Annual Edition – WA Housing Loan Demand Trends Over 2008 … And what to expect now 2008 was certainly a stand-out year in terms of changes in consumer demand for different mortgage products. The interest rate rises in early 2008 saw fixed rate loan demand hit highs not seen for years, and then as interest rates began to decrease that trend quickly turned 180°, resulting in fixed rate demand hitting historical lows.

According to Mortgage Choice loan book data, at its peak in February 2008 fixed rate loan demand in Western Australia hit 34% after making a huge jump from 17% in January. At its trough, in September/November, only 2% of all loan approvals were for fixed loans. The latest data, for January 2009, shows fixed rate loan demand is still falling, though from a very low base. It now stands at just over 3%.

Mortgage Choice Senior Corporate Affairs Manager, Kristy Sheppard, said, “I will be surprised if fixed loan demand fell significantly over 2009, given the majority of economists are predicting only a relatively small additional cash rate decrease – to 2% by the end of 2009 – and a couple of major lenders have already warned Australians not to expect further cuts passed on in full. Hence, interest rates on mortgages will probably move only slightly further south”.

“Customers choose fixed rate loans for three main reasons: they want peace of mind resulting from a fixed repayment amount and/or there is speculation about rates increasing and/or a lender is offering an attractive fixed rate deal. Hence, first homebuyers and investors in particular are fans of fixed rate loans, both fully fixed and split fixed/variable loans”.

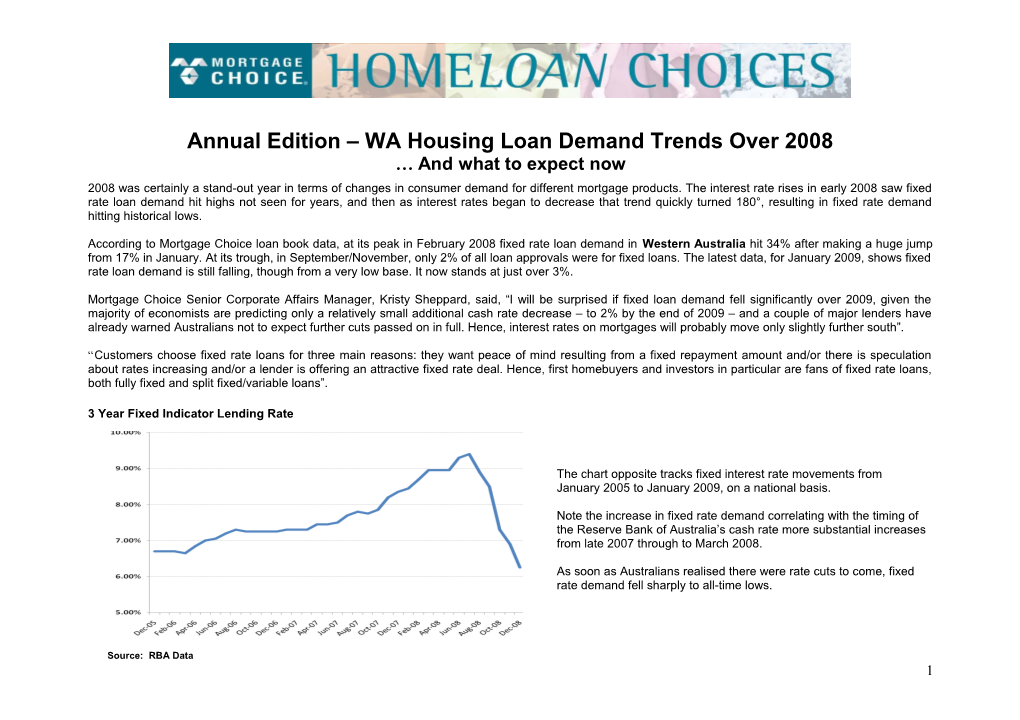

3 Year Fixed Indicator Lending Rate

The chart opposite tracks fixed interest rate movements from January 2005 to January 2009, on a national basis.

Note the increase in fixed rate demand correlating with the timing of the Reserve Bank of Australia’s cash rate more substantial increases from late 2007 through to March 2008.

As soon as Australians realised there were rate cuts to come, fixed rate demand fell sharply to all-time lows.

Source: RBA Data 1 Variable Rate Loans Skyrocket In contrast to the strong downward path of fixed loan demand over 2008, variable rate product demand rose to levels not seen for some years. Throughout the 12 months, the popularity of both standard and basic variable products rose mightily. At the beginning of 2008, variable loans as a percentage of all loan approvals stood at 66% (36% standard, 30% basic), with fixed rate loans at 17%. Variable demand picked up pace in April as talk of rate cuts began to filter through to the general public and by the end of the year it had reached 83%. In January 2009 that figure had risen even further, reaching 84%, which was also the first time in years that Australians’ enthusiasm for basic variable loans has leapt ahead to such an extent of that for standard variable.

“The rise in variable loan popularity is obvious – its flexible nature is attractive in an environment of decreasing rates. The take up of basic variable loans in particular demonstrates the increasingly conservative nature of the borrowing public in an uncertain economic climate. Borrowers are less concerned about loan features and are concentrating on overall cost, ensuring they are repaying as little as possible to finance their property dreams,” said Ms Sheppard.

Line of credit demand did not vary widely over 2008, ranging between 10% and 19%. Western Australia and South Australia were the states whose borrowers called the loudest for this type of loan, at times reaching 19% of all approvals in each; unsurprising given this product’s popularity with property investors.

Consumer Perspective Mortgage Choice’s annual Consumer Sentiment Survey (completed in November) delved into Australians’ thoughts on 2009 and found 83% of respondents anticipated rates falling between December 2008 and December 2009. This proved to be accurate with the Reserve Bank of Australia decreasing the cash rate in December and again in February 2009, for the fifth time this financial year. It is interesting to note, given further cuts are expected in 2009, that of those respondents expecting a rate decrease, only 6% said the drop would be between 2% and 3% and 1% said between 3% and 5%. The most popular prediction was a drop of between 0.5% and 1%, chosen by 30% of respondents. A drop between 1 and 1.5% came in second, with 23% of respondents.

In 2008, the unsettling global financial crisis fed a drop in consumer confidence, primarily driven by uncertainty over the direction of the economy and its effect on people’s finances. At the same time, concern about mortgage stress emerged as two further rate rises were announced by the Reserve Bank of Australia

2 in February and March. This concern began to abate later in 2008, to the point where, now, most Australians are rather positive about their short term future but not so sure about the long-term. Also, costs such as credit cards, personal loans, utility bills and food are weighing more heavily on borrowers’ minds.

Of course, fixed loan borrowers who committed in early 2008 and in the couple of years before, amidst steadily rising rates, have been dismayed to find the break and switching costs to move to a variable loan may not outweigh the benefits of doing so. Variable rate loan borrowers on the other hand would have seen their loan repayments drop by hundreds of dollars (close to $700 for the average borrower).

House Price Index The Property Market, according to the Real Estate Institute of Australia: Inflated property prices and successive rate rises in early 2008 pushed home ownership out of reach for many. As a result, market activity decreased and median prices began to fall in Melbourne, Canberra, and Perth, and to an increasing extent in Sydney, over the first half. Property prices in Brisbane, Adelaide, and Darwin continued to increase, driven by a shortage of suitable accommodation and the resources boom prominent in those states. The global financial crisis completely transformed the world economy and subsequently, the Australian housing market. The Rudd Government has since introduced the First Home Owner Boost (FHOB), while the Reserve Bank has cut the official interest rate by 4.0% in an effort to help stave off recession. So far these measures appear successful with falling property prices beginning to stabilise, propped up by first home buyer activity at the lower end of the market. The top end, so-called ‘blue-ribbon’ areas, is seeing a lack of demand and property prices continuing to fall. This is certainly the case for most capital cities. The only exceptions appear to be Darwin, where prices have continued to increase unabated, and Perth where prices continue to fall. The outlook for 2009 depends heavily on the global economy. The undersupply of housing in many capital cities means we are likely to avoid a severe decrease in values. There is likely to be increased activity right across Australia as the 30 June FHOB deadline approaches. After that, an underlying demand for housing will support the market once economic conditions begin to settle.

Source: ABS Data

Outlook Housing market fundamentals remain solid. Higher household incomes along with falling interest rates and relatively stable housing prices have driven housing affordability to a long-term low that should continue for some time yet. The market continues to tighten as new dwelling supply remains at insufficient levels to satisfy demand, and so already-increasing rents could be expected to rise higher. Growth in population and the reduction in the number of people per household should also provide a boost for housing demand, as will Government stimulus and incentives such as the First Home Owner Boost.

3 With rental vacancies and interest rates at historically low levels, and the continued uncertainty surrounding equity markets, the potential for sustained demand for residential investment property is anticipated. In fact, 63% of Consumer Sentiment Survey respondents said the credit crunch has made property seem safer than shares. Increased returns will generate stronger interest from property investors and developers.

The increasing interest in housing is evident in the late 2008 ABS housing finance data. October, November and December each showed an improvement in the residential loan sector, with December figures showing an impressive jump both demand and value. That month, the value of housing finance commitments for all dwellings increased by 5.9%, including a considerable rise in the number and value of loans for owner occupied housing and investment housing–fixed loans, plus a steep jump in the number of first homebuyers and first homebuyer commitments as a percentage of total owner occupied housing finance commitments. The number of loans for the purchase of new and established dwellings plus construction of dwellings also showed a substantial lift.

The number of owner occupied dwellings financed rose by 6.4% and the value of such loans rose 7.1% - a big jump from the amount of growth in November. The number of first homebuyers moved to 14,154 approvals in December - a big increase from 11,665 approvals in November and 9,901 in October. First homebuyers as a percentage of all housing finance commitments also increased once again, to 25.4% in December, from 23.6% in November.

This positive performance across every category is indicative of the direction of 2009. We should be looking at a much stronger year for Australians’ investment in housing. The two main issues holding some people back will be availability of finance and job security, the latter of which was rated by Mortgage Choice Consumer Sentiment Survey respondents as the biggest concern. Those in a more sound position in these respects may find this year allows them the opportunity to finally achieve the ‘Great Australian Dream’ of home ownership or to make the transition to property investor.

Notwithstanding, in these uncertain times, borrowers look to well-known specialist organisations like Mortgage Choice for knowledgeable advice on choosing suitable property loan solutions. In this kind of climate the ability to make a choice from a wide range of lenders and loan products, before being carefully led through the mortgage process, should appeal to even more Australians.

Note: Australia’s leading mortgage broker, Mortgage Choice’s annual loan approvals exceed 40,000 nationally, providing a clear insight into the product preferences of housing loan borrowers generally.

Glossary of Terms Basic Variable Rate - A variable rate home loan with a low interest rate but generally with fewer features than a standard variable rate loan. Standard Variable Rate - A variable rate home loan with comprehensive features. Fixed interest rate loans generally convert to standard variable rate loans at the end of their term. Fixed Interest - An interest rate set for a fixed term. Break costs usually apply if the loan is paid out before the term expires. Line of Credit - A credit facility from which the borrower can draw (usually for any reason or purpose) and pay back as they choose. As long as the interest and fees are paid and the balance does not exceed an approved limit, the facility will remain available. Lines of credit may be secured or unsecured (such as a credit card).

For further information or to arrange an interview, please contact: Kristy Sheppard, Mortgage Choice , 02 8907 0502 / [email protected] OR Ben Hornbrook, Reputation Pty Ltd, 02 8252 7005 4