August 08, 2012

Tractor Supply Company (TSCO-NASDAQ)

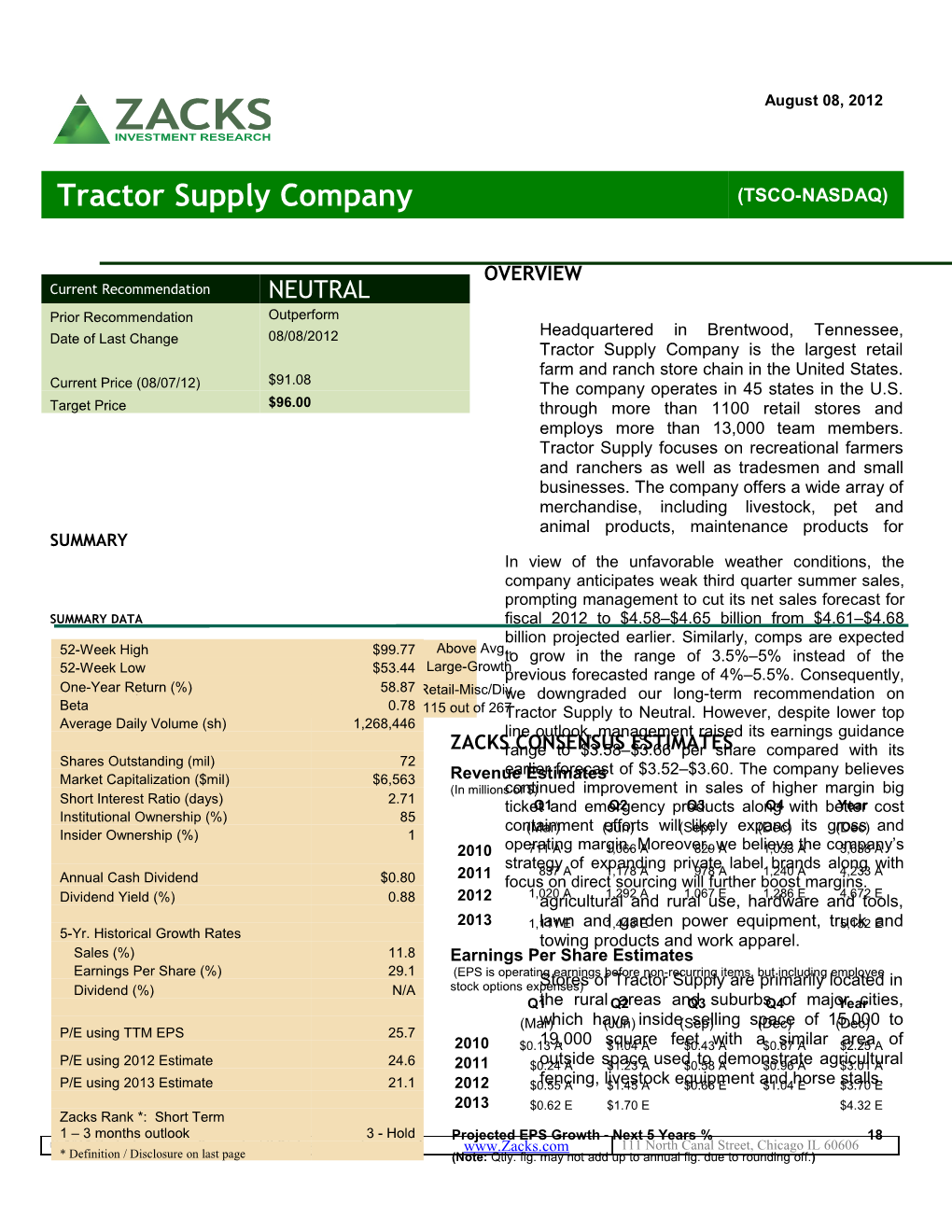

OVERVIEW Current Recommendation NEUTRAL Prior Recommendation Outperform Headquartered in Brentwood, Tennessee, Date of Last Change 08/08/2012 Tractor Supply Company is the largest retail farm and ranch store chain in the United States. $91.08 Current Price (08/07/12) The company operates in 45 states in the U.S. Target Price $96.00 through more than 1100 retail stores and employs more than 13,000 team members. Tractor Supply focuses on recreational farmers and ranchers as well as tradesmen and small businesses. The company offers a wide array of merchandise, including livestock, pet and animal products, maintenance products for SUMMARY In view of the unfavorable weather conditions, the company anticipates weak third quarter summer sales, prompting management to cut its net sales forecast for SUMMARY DATA fiscal 2012 to $4.58–$4.65 billion from $4.61–$4.68 billion projected earlier. Similarly, comps are expected 52-WeekRisk HighLevel * $99.77 Above Avg.,to grow in the range of 3.5%–5% instead of the Type of Stock Large-Growth 52-Week Low $53.44 previous forecasted range of 4%–5.5%. Consequently, One-YearIndustry Return (%) 58.87 Retail-Misc/Divwe downgraded our long-term recommendation on Beta Zacks Industry Rank * 0.78 115 out of 267Tractor Supply to Neutral. However, despite lower top Average Daily Volume (sh) 1,268,446 line outlook, management raised its earnings guidance ZACKSrange CONSENSUS to $3.58–$3.66 ESTIMATES per share compared with its Shares Outstanding (mil) 72 earlier forecast of $3.52–$3.60. The company believes Market Capitalization ($mil) $6,563 Revenue Estimates (In millionscontinued of $) improvement in sales of higher margin big Short Interest Ratio (days) 2.71 ticketQ1 and emergencyQ2 productsQ3 alongQ4 with betterYear cost Institutional Ownership (%) 85 containment(Mar) (Jun) efforts will(Sep) likely expand(Dec) its gross(Dec) and Insider Ownership (%) 1 2010 operating711 A margin.1,066 Moreover,A 829 weA believe1,033 Athe company’s3,638 A strategy of expanding private label brands along with 2011 837 A 1,178 A 978 A 1,240 A 4,233 A Annual Cash Dividend $0.80 focus on direct sourcing will further boost margins. Dividend Yield (%) 0.88 2012 1,020agricultural A 1,292 and A rural1,067 use, E hardware1,286 E and4,672 tools, E 2013 1,111lawn E and1,443 garden E power equipment, truck5,152 Eand 5-Yr. Historical Growth Rates towing products and work apparel. Sales (%) 11.8 Earnings Per Share Estimates Earnings Per Share (%) 29.1 (EPS is operatingStores earnings of before Tractor non-recurring Supply items, are butprimarily including locatedemployee in Dividend (%) N/A stock options expenses) Q1the ruralQ2 areas andQ3 suburbsQ4 of majorYear cities, (Mar)which have(Jun) inside(Sep) selling space(Dec) of 15,000(Dec) to P/E using TTM EPS 25.7 2010 $0.1319,000 A square$1.04 A feet$0.43 with A a$0.67 similar A $2.25 area A of P/E using 2012 Estimate 24.6 2011 $0.24outside A space$1.23 A used$0.58 to demonstrateA $0.96 A agricultural$3.01 A P/E using 2013 Estimate 21.1 2012 $0.55fencing, A livestock$1.45 A equipment$0.66 E and$1.04 horse E $3.70stalls. E 2013 $0.62 E $1.70 E $4.32 E Zacks Rank *: Short Term 1 – 3 months outlook 3 - Hold Projected EPS Growth - Next 5 Years % 18 © 2012 Zacks Investment Research, All Rights reserved. www.Zacks.com 111 North Canal Street, Chicago IL 60606 * Definition / Disclosure on last page (Note: Qtly. fig. may not add up to annual fig. due to rounding off.) Tractor Supply’s broad assortment of products merchandise such as outdoor power is tailored to meet the regional and geographic equipment. needs of its markets. Moreover, the retailer’s full line of product offerings is supported by a In an effort to boost margins, Tractor strong in-stock inventory position with an Supply is expanding its portfolio of private average of 16,000 to 19,500 unique products label brands and is also focusing on direct per store. Apart from selling nationally sourcing. The company has set a long- recognized, branded merchandise, the term target of generating 25% of sales company also markets a growing list of from private label brands and 13% from products under its “private-label programs,” strategic direct sourcing. This provides a which include: Masterhand and Job Smart strong upside potential to the company. (tools and tool chests), Dumor and Producers Pride (livestock feed) and Retriever and Paws ‘n Claws (pet foods).

REASONS TO BUY REASONS TO SELL

Tractor Supply is the largest operator of The company operates in a highly farm and ranch stores in the U.S., a unique fragmented industry and faces competition market niche that serve the lifestyle needs from larger retailers, such as Home Depot of recreational farmers and ranchers The and Lowe’s as well as from independently- company’s stores are strategically located owned retail farm and ranch stores, in small towns, close to its target privately-held regional farm store chains customers, which provide it with a and cooperatives. Being in such a high competitive edge over its rivals. competitive industry, Tractor Supply may find it difficult to execute and implement Tractor Supply reported yet another new business strategies, which in turn, will encouraging quarter, with earnings surging impact its operations adversely. nearly 18% to $1.45 per share in the second quarter of 2012, surpassing the Heavy job losses and reduced access to Zacks Consensus Estimate of $1.39. credit have led to a sharp fall in consumer Tractor Supply’s second-quarter results discretionary spending on big-ticket items. benefited mainly from strong top-line Although the economy is showing signs of performance and improved margins. Net revival, we believe that spending on big sales in the quarter surged 9.6% to remodeling projects will likely remain under $1,291.9 million from $1,178.4 million in pressure until the housing market stabilizes the prior-year quarter. However, total and consumer-spending rebounds. revenue missed the Zacks Consensus Estimate of $1,302 million. Encouraged by Tractor Supply's business is highly strong second-quarter results, the seasonal, with sales and profits the highest company raised its fiscal 2012 earnings in the spring and winter selling seasons guidance range to $3.58–$3.66 per share due to demand seasonality of its compared with its earlier forecast of $3.52– merchandise offering. Unseasonable $3.60 per share. weather, heavy precipitation, drought conditions, and early or late frosts may Tractor Supply has successfully tweaked have material impact on the company’s merchandise assortment across its stores financial condition and result of operation. in line with the prolonged economic downturn. The company has increased the proportion of less discretionary items such RECENT NEWS as animal and pet-related products, while reducing shelf space for certain big-ticket

Equity Research TSCO | Page 2 Tractor Supply Beats on Bottom Line – July percentage of sales, which came in at 21.8% 25, 2012 versus 21.9% in the prior-year quarter. Consequently, operating margin during the Tractor Supply reported yet another quarter improved 90 bps to 13.1% versus encouraging quarter with earnings surging 12.2% in the prior-year quarter. nearly 18% to $1.45 per share in the second quarter of 2012, surpassing the Zacks Financial Position Consensus Estimate of $1.39. Tractor Supply’s second-quarter results benefited mainly from Tractor Supply ended the quarter with cash and strong top-line performance and improved cash equivalents, including restricted cash of margins. $187.9 million compared with $207.4 million at the end of the prior-year quarter. Stockholders’ Tractor Supply has been witnessing increasing equity came in at $1,067.1 million compared trends in same-store sales. The reported with $940.7 million at the end of the second quarter was no exception as robust quarter of 2011. performance in core consumable, usable and edible products − for instance, pet food and Store Update animal feed − acted as a catalyst for an increase of 3.2% in same-store sales. In the quarter under review, Tractor Supply opened 18 new stores compared with 16 new During the recession, Tractor Supply had stores opened in the prior-year period. The suffered setbacks as buyers avoided big-ticket company currently runs as many as 1,135 purchases, such as mowers, but recent stores in 45 states. quarters have seen an uptick in results. The company’s impressive merchandising Management Guidance improvement strategy along with solid same- store sales trend resulted in high single-digit Looking into 2012, the company expects its top-line growth in revenues. profits to grow continually, given the right mix of products and marketing plans to maintain Net sales in the quarter surged 9.6% to customer footfall. Encouraged by strong $1,291.9 million from $1,178.4 million in the second-quarter operating performance, the prior-year quarter. However, total revenue company raised its 2012 earnings guidance missed the Zacks Consensus Estimate of range to $3.58 to $3.66 per share compared $1,302 million. The company witnessed a sales with its earlier forecast of $3.52 to $3.60 per increase of approximately $38 million in the first share. The Zacks Consensus Estimate for full- quarter of 2011 that was carried forward from year 2012 stands at $3.68, well above the the second quarter because of an early spring. higher-end of the company’s revised fiscal year The increase was at the high end of guidance. management's projection. However, looking at the unfavorable weather Gross profit during the quarter surged 12.2% to condition, the company anticipates weak third $451.5 million compared with $402.5 million in quarter summer sales. Therefore, Tractor the prior-year quarter. Moreover, gross margin Supply has lowered its net sales and comps expanded 80 basis points (bps) to 34.9%, as guidance range for full-year 2012. The the company benefited from improved big ticket company now expects net sales to be in seasonal and emergency products along with between $4.58 billion and $4.65 billion positive impact from lower sales of low margin compared with $4.61 - $4.68 billion forecasted products. earlier. Similarly, comps are expected to grow in the range of 3.5% - 5% instead of the Better cost containment related to store previous forecasted range of 4% - 5.5%. personnel and other operating expenses Further, the company has planned to open 90 resulted in a 10 bps improvement in selling, to 95 new stores during fiscal 2012. general and administrative expenses, as a

Equity Research TSCO | Page 3 VALUATION

Tractor Supply’s current trailing 12-month earnings multiple is 25.7x, compared with the 19.9x industry average and 14.5x for the S&P 500. Over the last five years, Tractor Supply’s shares have traded in a range of 12.0x to 29.6x trailing 12-month earnings. The stock is trading at a premium to the industry average, based on forward earnings estimates. Our long-term P/E P/E Neutral recommendation on the stock indicates 5-Yr 5-Yr that it would perform in line with the broaderP/E P/E Est. 5-Yr P/CF P/E High Low F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) marketTractor. Our Supply target Company price of(TSCO) $96.00, 25.9x 24.62012 21.1 18.3 21.1 25.7 29.6 12.0 EPS, reflects this view. Industry Average 20.8 13.5 14.4 9.0 19.9 61.2 8.8 S&P 500 13.7 12.8 10.7 12.2 14.5 27.7 12.0

Key IndicatorsDick’s Sporting Goods Inc. (DKS) 20.2 17.7 16.1 16.6 23.5 26.3 9.3 PetSmart Inc. (PETM) 20.3 18.3 16.3 14.2 23.9 24.4 11.7 Sally Beauty Holdings Inc. (SBH) 19.3 16.4 19.7 18.4 20.4 30.2 8.8 Cabela’s Inc. (CAB) 17.3 15.1 15.0 14.6 19.2 18.9 4.9 TTM is trailing 12 months; F1 is 2012 and F2 is 2013, CF is operating cash flow

P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Tractor Supply Company (TSCO) 6.2 6.7 1.8 25.6 0.0 0.9 14.6

Industry Average 2.5 2.5 2.5 9.4 0.3 0.5 6.9 S&P 500 9.8 9.8 Equity Research2.9 49.1 N/A 0.0 TSCO | PageN/A 4 Earnings Surprise and Estimate Revision History

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Tractor Supply Company (TSCO) at StockResearchWiki.com:

http://www.stockresearchwiki.com/tiki- index.php?page=TSCO/Ticker

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of TSCO. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will underperform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1035 companies covered: Outperform - 15.8%, Neutral - 77.1%, Underperform – 6.5%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better.

Equity Research TSCO | Page 5 Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research TSCO | Page 6