PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina

FOREIGN MARKET ANALYSIS

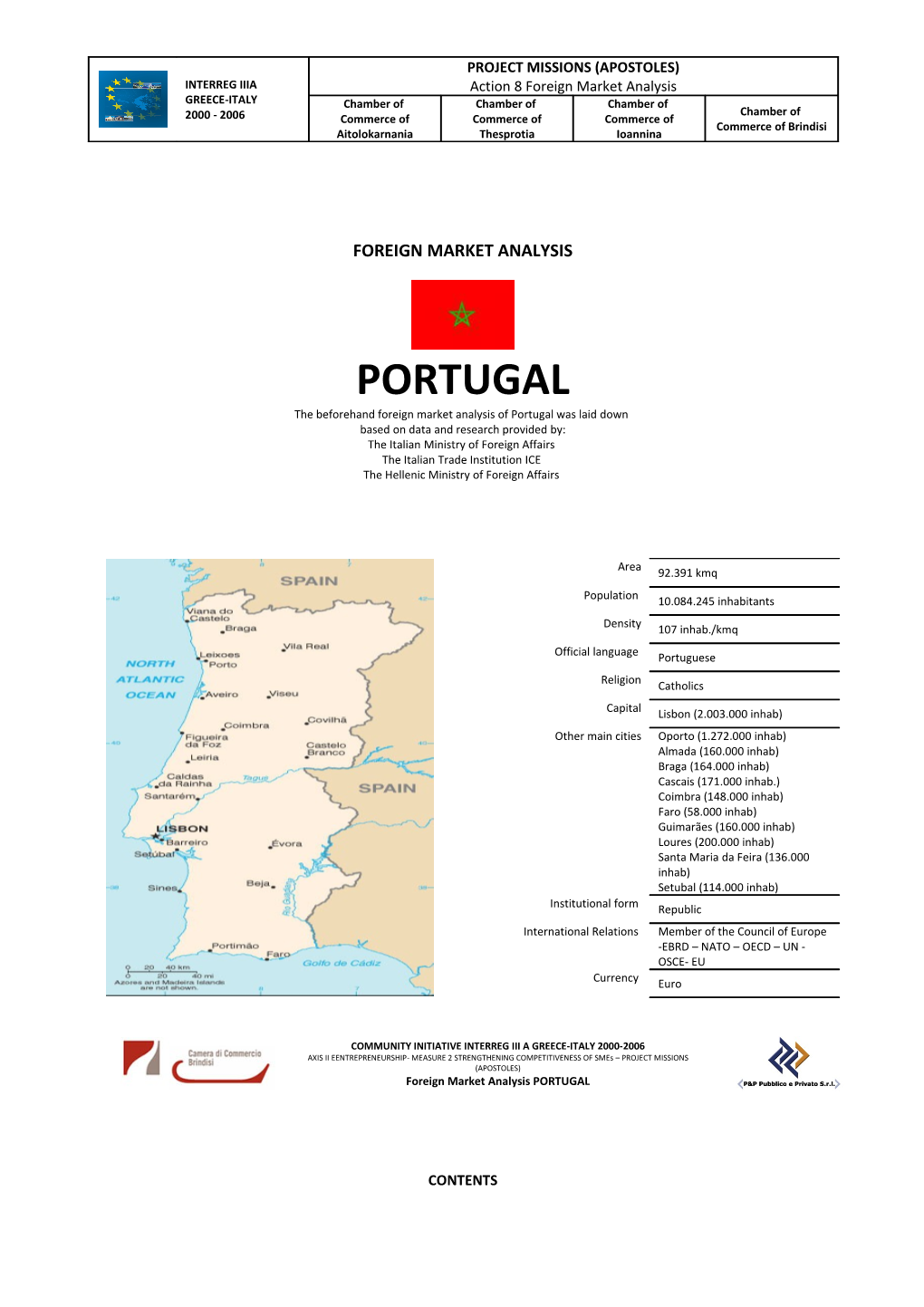

PORTUGAL The beforehand foreign market analysis of Portugal was laid down based on data and research provided by: The Italian Ministry of Foreign Affairs The Italian Trade Institution ICE The Hellenic Ministry of Foreign Affairs

Area 92.391 kmq

Population 10.084.245 inhabitants

Density 107 inhab./kmq

Official language Portuguese

Religion Catholics

Capital Lisbon (2.003.000 inhab) Other main cities Oporto (1.272.000 inhab) Almada (160.000 inhab) Braga (164.000 inhab) Cascais (171.000 inhab.) Coimbra (148.000 inhab) Faro (58.000 inhab) Guimarães (160.000 inhab) Loures (200.000 inhab) Santa Maria da Feira (136.000 inhab) Setubal (114.000 inhab) Institutional form Republic International Relations Member of the Council of Europe -EBRD – NATO – OECD – UN - OSCE- ΕU Currency Euro

COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) Foreign Market Analysis PORTUGAL

CONTENTS PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina

1. ECONOMIC SITUATION ANALYSIS...... 3 1.1 Financial Course...... 3 1.2 Governmental economic policy...... 4 1.3 Plan for the privatizations and the economic growth...... 5 1.4 Policy for the SMEs...... 6 2. REFERENCE COUNTRY PORTUGAL...... 6 2.1 Macroeconomic framework...... 6 a) Economic growth and country risk...... 6 b) Foreign market and foreign investment opening...... 9 b.1 International Trade...... 9 b.2 Foreign Direct Investments in Portugal...... 11 c) Trade performance regarding Italy and bilateral direct foreign investments performance...... 12 d) Trade performance regarding Greece and bilateral direct foreign investments performance …...... 13 2. 2 Intervention fields...... 13 a) Assessment of commercial penetration of Italian products in the domestic market...... 13 b) Assessment of the Italian direct investments...... 15 c) Assessment of the trade and industrial cooperation in the high tech fields...... 15 d) Suggestions on granting public financing and security in line with SACE and SIMEST…………………………………………………………………………………………………………………16 e) Investments regulation...... 16 f) Transport abroad of profits and capitals ...... 17 g) Double taxation...... 17 2.3 Trade and market access policy...... 17 a)Barriers respecting the free circulation of goods...... 17 b)Barriers respecting the free circulation of services, capital and free establishment of enterprises...... 17 3. MAIN TRADE FLOWS ……………………………………………………………………………………………....19 4. FINANCIAL EVENTS IN PORTUGAL...... 21 4.1 Exhibitions in Lisbon...... 21 4.2 Exhibitions in Porto...... 21 4.3Exhibitions in Batalha...... 22 5. USEFUL LINKS AND INFORMATION …………………………………………………………………………...... 23 5.1 In Italy...... 23 5.2 In Greece...... 23 5.3 In Portugal...... 24 a. Italian representation...... 24 b.Greek representation...... 25 6. USEFUL WEBSITES ………………………………………………………………………………………………….. 25 7. USEFUL INFORMATION...... 28 7.1 International calling codes...... 28 7.2 Time-zone...... 28 7.3 Documentation...... 28 7.4 Working Days...... 28 7.5 Official holidays...... 28

2 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina

1. ECONOMIC SITUATION ANALYSIS 1.1 Financial Course 2006 for Portugal was a year of low economic growth, in relation to the difficult situation that characterized 2005 (with a growth of just 0,4% of the GDP) and the last five years. The growth rate reached 1,3% of the GDP, confirming the provision of OSCE (1,2 for the European Commission), a result slightly lower than the expectations of the government. The exports constituted the motivation power of the economic growth (12,4% according to the data of the National Statistic Service), surpassing in a high degree the expectations of the international Institutions (equal to 8%) and the Bank of Portugal itself (9,3%). In addition, the imports registered a pure stable growth (+8%, based on the National Statistic Service data). The external credit fell to 7,6% of the GDP (in relation to 8,1% of the GDP). On the contrary, less good was the performance of the private consumption, which raised, but only to 1% according to the international and national institutes-and investments, still with negative values (-2,6% for the European Commission and -3,1% for the Bank of Portugal). Alarming are also the data for the growth of the unemployment to 7,6% (European Commission) with the presence of an inflation about 3% (Bank of Portugal, European Commission, OSCE). According to the quarterly data of the National Statistic Service, results a slightly discouraging tendency: the fourth trimester of 2006 the rate of unemployment touched 8,2%, with a raise of the female unemployment (4,8%) in relation to the unemployment of men, which presented an almost zero variation. Always in the fourth trimester of 2006 the total employment registered a slight growth 0,2% in relation to the same period of the last year (1,1%). The male employment was raised to 1,4% while the female remained stagnant. In total values the National Statistic Service registered in 2006 an unemployment rate 7,7% with an increase of 0,1% in relation to 2005. The unemployed population reached 427,8 thousand people (+1,3%) in relation to the previous year. The inflations growth (which in 2005 fell to 2,1%), due to a restrained growth, depends mainly on the intensive fuel use of Portugal, the deficient competitiveness of the economy’s key sectors and the policies for the wages increases over the labour productivity. The inflationist pressures are connected to the high cost of labour, rendering the country less competitive. This tendency begun to be inverted during the last trimester of the year, also due to the efforts of the wages limitation. The consolidation of the public finances according to the last data of the National Statistic Service was realized in 2006 and the government, reducing the deficit to 3,9% of the GDP, surpassed the determined objective of 4,6% of the process for the regulation of the increased deficit started in 2005. The good results are an essential result of the increase of the fiscal revenues, which have reached 7,2%. Less drastic was the limitation of the public expenses, which have registered a small increase (1,4%). However, the pure numbers of the public investments reached (-15%) and the public expenses for the personnel were reduced to 2,7%. In general, the public investment burdened the GDP only with 2,3%, a lower value during the last thirty years, while the public consumption fell to 0,3%. The higher saving was realised in the central administration and the Social Security. The limitation included the regional and local administrations. The public debt reached 67,4%. The framework, without a doubt better than the past years, continues to present fragile sides, in such a degree that the Commission itself, to re-enforce the proposed strategy for stability of the Portuguese government, provides a stable regulation and underlines that the goals-without the adoption of more measures from the aspect of the expenses and the fiscal incomes-could not be feasible. The last provisions of the European Commission, in Fall 2006, in fact indicate a deficit of 4% for 2007 and 3,9% for 2008. On the contrary, more optimistic remains OSCE, in compliance to the government’s provisions. Moreover, the public debt according to the Commission endangers to continue being increased to 68% (with a need of state funding equal to 7,1 billion Euros) and will continue to decline only in 2008. Portugal essentially remains in a high risk status as far as the stability of public finances and the perspectives of economic growth are concerned. According to estimations of the European Commission and other international institutions, the keys are three: the performance in the context of growth, the stabilizations of the fiscal incomes and finally the completion and the positive results of the structural reforms.

1.2 Governmental economic policy In the Fall of 2006, the government planned a funding based on a careful macroeconomic scenario, maintained the strict management of the finances which has characterized the entire 2006, together with the start of the co- operations with the private sector and the occupation with the technology and the structural reforms.

3 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina The government confronts the stabilization of the public finances with a new approach, passing from the “ obsession with the deficit” to policies less politically strict, which favour the reform of the Stability Agreement, as well as do not submit the state in sacrifices during a financially and socially difficult status. The political choices of the Government, in order to confront this need, reject the extreme measures and are based on a series of structural interventions. Without betraying the objective of the social state, they intend to eliminate the injustices, briberies and privileges characterizing the public administration of the country. In difficult stagnant period, from March 2005, the government started a strict plan for the stabilization of the public finances, which is provided by the Stability and Development Plan presented in June 2005, revised in December 2005 and with a last revision in 2010. The guidelines for the support of this programme are five: 1. reform of the public administration and management of the human resources 2. promotion of the social security’s viability 3. improvement of the public expenses quality and the infrastructures use 4. simplification of the fiscal system, confrontation of the tax evasion and the fraud respecting the deposit of taxes 5. privatizations It is provisioned the reduce of the public expenses burden respecting GDP, in fact in order to be set a stable basis for an economic growth, without being affected the social cohesion and stability. The numbers that the government presented in Brussels, respecting the renewed publication for 2006-2010 of the Programme for Stability and Development, derived from a purely optimistic attitude and were confirmed as far as the stabilization of the public finances is concerned by the data of the National Statistic Service, which certified the reduce of the deficit in 3,9% respecting the relation deficit/ GDP in 2006 (from 6% in 2005), surpassing the initial objective of 4,6%. Among the provisions of the government which allowed the achievement of the highest result are also the fiscal measures such as the VAT’s increase from 19 to 21%, the introduction of a new taxation scale of 42% respecting the incomes over 60 thousand euros, measures for the confrontation of the tax evasion, revision of various exemptions, fiscal facilities and privileges, increase of the oil taxes. As far as the public investments are concerned a strict control was introduced under the supervision of the Finance Ministry. Moreover, the promotions concerning the professional development in the public sector froze. It is recognised, that the Government has developed a wide programme of structural reforms, intervening in certain sectors which for a long time had the need of a profound restructure, such as the Social Welfare, the Public Administration and the National Health System. Respecting the reform of the public administration, the executive organ has made a remarkable effort. Some already approved acts have contributed to an essential restructure (Act about the regional economies, organic law of the Ministries and the articles of association of the instructors’ professional development). Under implementation are already being some other programmes, such as Simplex and PRACE (Programme for the Restructure of the Central Administration of the State), for the improvement, acceleration and simplification of various procedures, mainly enforcing the possibility of interaction with the administrative services through the internet. The act of the organic reform of the Ministries reduces the structures of the public administration in 25,6% through the abridgement logic. In addition, the managerial structures will be redetermined: the working places were reduced from 761 to 544, while the 100 public services were reduced to 56, and to each one were given administrative and financial autonomy. This restructure concerns all the ministries, among which the Ministry of instruction, the Ministry of Defence and the Ministry of Health, with the reform of some structures from public to private. At the end of 2007, it is also provisioned, a reform of the assessment system of the human resources and public services. The objective is the decrease of the expenses and mainly the expenses that are destined for briberies and particularly respecting the municipalities’ level. Relevant modifications also concern the organizing of the employment and mainly the social Welfare and the protection of unemployed people. The government has created a web portal in order to fulfill the needs of the employment’s offer/ demand (Netemprego), publishing the new law about unemployment and the law about the Social Security, as well as new regulations for the confrontation of the unemployment with the cooperation of the trade unions. The minimum wage guaranteed (which will be increased this year in about 400 euros), new programmes of professional formation and new rules for the organizing of the current status of labour are waiting for their approval. The reforms respecting the social security allowed the saving of 600 million euros, mainly due to the stabilization of the pensions.

4 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina Another sector which is susceptible of essential reforms is the sector of Health. Despite the strict limitations imposed by the National Union of Medicines, the Ministry of Health has improved the access in the medicines’ market, increasing those that can be sold outside chemist’s stores. The selling values of the medicines were reduced in average to 6%.

1.3 Plan for privatizations and economic growth The government is also oriented towards the privatizations in order to contribute to the public debt: the privatizations programme approved by the Council of Ministers by February 2006 has a biennial duration. In 2006 has brought 1.670 million euros profit in the country. As far as the recovery of the economy is concerned, the government has started a programme based on the needs for the support of the implementation of the Lisbon Strategy and the goals of social development and innovation, focusing constantly in the goal for the stabilization of the public finances. From this was also born the Programme by the name “technologic shock”, which represents the best argument for the confirmation of a less strict social policy, to which the Government has given important attention. By the summer of 2006, the executive Council has announced that the 79% of 112 provisioned measures has been completed. The project was born in order to give the country the opportunity to develop a new competitive model based on technology, information and instruction for covering the delay with respect to the other EU member states and giving incentives for the development of innovation to the Portuguese enterprises with the increase of competitiveness and productivity and the improve of the human resources’ qualifications. The Government intends to place Portugal in an innovative information system of wide access, by the improvement of the services towards citizens and enterprises through the e-government and by developing a digital culture. Another goal is the enlargement of the internet access (for instructional activities too) in competitive prices in relation to the more developed countries of the EU and the development of information and communication technologies. Based on the plan, are being implemented the following initiatives for: the enforcement of the research and development sector promoting the co-operation and development of national and international networks through the increase of public and private investments the improvement of the competitiveness promoting technology and internationalization of the national scientific system conducting co-operations between significant foreign institutes and Universities of Portugal. the support of the innovative enterprises revising the priorities respecting the existing systems of incentives’ modernization and simplification of the public administration

1.4 Policy for the SMEs Special attention has been given to the Small and Medium Enterprises (SMEs), which are in a great difficulty because of the foreign competition, the economic decrease and the development of the international trade. The Government has signed a total of investment contracts with more than 130 SMEs, which will lead to the creation of 1400 employment places, through IAPMEI (Institute for the Support of the SMEs respecting the investments). The contracts shall be placed within the scope of PRIME (Programme of Incentives for the modernization of Economy). The enterprises which will be benefited by this support operate mainly in the industrial fields such as energy, metallurgy, decoration, textile, wine and paper. Through PRIME during the last two years have been already funded 3.100 projects and the largest part of the SMEs creating 11 thousand employment places. In April 2007, IAPMEI has signed with the main bank institutes a Cooperation Protocol, destined to develop the programme FINCRESCE in order to be created for the SMEs mare favourable financing conditions. Within the scope of the Technological Plan has been created the programme “INOV-JOVEM” for the assistance of the SMEs, which young people until 35 years old intend to start, in order to develop the innovation and the growth of the SMEs. The composition of the Portuguese entrepreneurship is characterised by an increased number of SMEs which are of important significance for the economy of the country greater than in the other European countries. Among an active population of 5 million people the SMEs provide employment to the 75% of the work force (54% concerns the employment in SMEs and 21% in medium enterprises). These operate in the field of services27,4%), tourism (10,1%), trade (34,3%), constructions (12,3%), energy(0,1%), mining industry (0,3%) and manufacture industry (15,5%) and represent the 99,9% of the entrepreneurial composition of Portugal (83,1% micro, 14,4% small and 4% medium enterprises). The excessive division of the capitals does not allow the development. The stock exchange of Portugal Euronext Lisboa, intends to create a stock exchange for the SMEs’ in 2007, through a European plan for the activation through

5 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina Alternext (market of Euronext for the capitalization of the SMEs and which already exists in the stock exchanges of three countries: Amsterdam, Brussels and Paris.

2. REFERENCE COUNTRY PORTUGAL

2.1 Macroeconomic Framework a) Economic growth and country risk 2006 for Portugal was a year of low economic growth, in relation to the difficult situation that characterized 2005 (with a growth of just 0,4% of the GDP) and the last five years. The growth rate reached 1,3% of the GDP, confirming the provision of OSCE (1,2 for the European Commission), a result slightly lower than the expectations of the government. The exports constituted the motivation power of the economic growth (12,4% according to the data of the National Statistic Service), surpassing in a high degree the expectations of the international Institutions (equal to 8%) and the Bank of Portugal itself (9,3%). In addition, the imports registered a pure stable growth (+8%, based on the National Statistic Service data). The external credit fell to 7,6% of the GDP (in relation to 8,1% of the GDP). On the contrary, less good was the performance of the private consumption, which raised, but only to 1% according to the international and national institutes-and investments, still with negative values (-2,6% for the European Commission and -3,1% for the Bank of Portugal). Alarming are also the data for the growth of the unemployment to 7,6% (European Commission) with the presence of an inflation about 3% (Bank of Portugal, European Commission, OSCE). According to the quarterly data of the National Statistic Service, results a slightly discouraging tendency: the fourth trimester of 2006 the rate of unemployment touched 8,2%, with a raise of the female unemployment (4,8%) in relation to the unemployment of men, which presented an almost zero variation. Always in the fourth trimester of 2006 the total employment registered a slight growth 0,2% in relation to the same period of the last year (1,1%). The male employment was raised to 1,4% while the female remained stagnant. In total values the National Statistic Service registered in 2006 an unemployment rate 7,7% with an increase of 0,1% in relation to 2005. The unemployed population reached 427,8 thousand people (+1,3%) in relation to the previous year. The inflations growth (which in 2005 fell to 2,1%), due to a restrained growth, depends mainly on the intensive fuel use of Portugal, the deficient competitiveness of the economy’s key sectors and the policies for the wages increases over the labour productivity. The inflationist pressures are connected to the high cost of labour, rendering the country less competitive. This tendency begun to be inverted during the last trimester of the year, mainly due to the efforts of the wages limitation. The good results are an essential result of the increase of the fiscal revenues, which have reached 7,2%. Less drastic was the limitation of the public expenses, which have registered a small increase (1,4%). However, the pure numbers of the public investments reached (-15%) and the public expenses for the personnel were reduced to 2,7%. In general, the public investment burdened the GDP only with 2,3%, a lower value during the last thirty years, while the public consumption fell to 0,3%. The higher saving was realised in the central administration and the Social Security. The limitation included the regional and local administrations. The public debt reached 67,4%. The framework, without a doubt better than the past years, continues to present fragile sides, in such a degree that the Commission itself, to re-enforce the proposed strategy for stability of the Portuguese government, provides a stable regulation and underlines that the goals-without the adoption of more measures from the aspect of the expenses and the fiscal incomes-could not be feasible. The last provisions of the European Commission, in Fall 2006, in fact indicate a deficit of 4% for 2007 and 3,9% for 2008. On the contrary, more optimistic remains OSCE, in compliance to the government’s provisions. Moreover, the public debt according to the Commission endangers to continue being increased to 68% (with a need of state funding equal to 7,1 billion Euros) and will continue to decline only in 2008. Despite the consistent attitude of the Government, which for 2007 has set as target the relation deficit/ GDP to reach the quota of 3,7% and announced (March 2007) a new provision for the reduce of the deficit until 3,3% without extreme measures, Portugal remains still in a situation of high risk respecting the stability of the public finances and the perspectives of economic growth. According to estimations of the European commission and other international organizations, the keys are three: a) the performance in the context of growth b) the stabilizations of the fiscal incomes c) the completion and the positive results of the structural reforms

6 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina In 2006 the deficit to the balance of current transactions and capitals increased to 595,2 million euros respecting the same period of the previous year, reaching 13.338,8 million euros. This charge is owed to the results of the current transactions balance, with an increase of the deficit of the trade balance and a decrease of the surplus of the capital balance. As far as the development of the other parts of the current transactions balance is concerned, an increase has been registered respecting the surplus of the services balance. The market of Portugal has on the other hand manifested some important indications of mobility. The mobility in the stock market in 2006 has registered an increase and Portugal was placed in the classification of the countries with the highest volume of mergers and take overs in Europe. In fact, already 12 OPA have motivated the Portuguese market, offering surely a breath to a country still little used to the culture of risk and to the undertaking of business responsibilities. However, the bankruptcy of OPA over Portugal Telecom underlines the lack of maturity and flexibility of the Portuguese market, where the obvious dynamism opposes to the protectionism of the major financial Groups and gets the worst of this confrontation. The focusing points for the economic improvement are three: a development which will synchronize the country with the European circle a process for the stabilization of the public finances a series of structural reforms with a certain result in the short term. In relation to the development expectations for 2007, the country suffers from some disabilities of internal character. Due to limitations on the balance it is impossible for the state to contribute to the development of the investments (the great effort for the stabilization of the balance has prevented Portugal deducting from the growth of the GDP the 0,6%), while the internal consumption (which together with investments could lead to a sustainable development), in order to allow its the anodic course, remains limited by the need of the public saving and the high levels of the families’ debt. The growth perspectives, given the constant occupation of the state following a more strict policy, continue to depend on the employment of the private sector. In fact, the greatest hopes of the Bank of Portugal are focusing to the performance of the enterprises which will have to be motivated by numerous plans announced in the fields of interest, such as the wind power, tourism and infrastructure. Regarding the relations with abroad, the exports were significantly reduced reaching 5%. Despite the provisioned improvement by the Bank of Portugal (from 8,1% to 7,3% of the GDP), the external debt (8,7% of the GDP for the European Commission and 9,2 for OSCE) will continue to affect the national economy. The exports could return in high levels with the appreciation of euro and the reduction of the demand by the countries that import in Portugal (such as Spain and Germany). Further uncertainties are connected to the provisions for the general consolidation of the economic situation and the increase of the oil’s prices which are taken into consideration in the governmental plan. It should be also underlined that Portugal is the country that is more dependend on oil and fossil fuels (54% and 80% respectively of the total of the energy demand for 2006) than any other European country and this situation will be continued until 2010, according to the last estimations of the European Energy Service. Imports continue to get increased (about 3,5%), in sight of these consideration, the European Commission and OSCE estimate that there will be an increase equal to 1,5%, lower enough than the average increase in the euro-zone (which should fall only to 1,9%). To a growth in danger, the deficient fiscal revenues could be also added: the variation between the estimations of the government-which sees the incomes increasing to 5,8% in 2007- and the European Commission is clear: for the Commission the estimations are more moderate (4,7%) The credit assessment service Moody’s, maintains the rating of Portugal in ΑΑ2, with stable outlook. The credit assessment service, which intends to assess the long-term period and does not foresee a revision of a lower level for Portugal, has appreciated the functions of the government, which did not use extreme measures and has recognised as positive the increase of the taxes and the target of the expenses’ reduce with the purpose of the control and the improvement of the public finances. The credit assessment services Standard &Poor’s and Fitch maintained the rating of the long term payments of Portugal, which was decided in the first semester of 2006, from AA with positive perspectives to AA with negative outlook. S&P threatens with a greater downgrading in its scale as far as the deficient measures determined by the Balance Act for the guarantee of the structural decrease of the external debt and has inflicted a penalty regarding the international competitiveness. The public debt of Portugal- with expenses for interests about 65,4% of the GDP- is considered less certain than in the

7 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina past, with indications for the liability decrease of the state’s finances, which maintain an intense ability of payment and a moderate trust of the investors. These modifications draw the government’s attention, which should continue to confront with determination the economic policies in order to restore the system’s liability. The delay of the economic growth of 2001, the reduce of the income per capita, an industrial structure that is judged as deficient, the inability of the country to reach to a higher foreign competitiveness, the inflationist pressures and the high cost of labour are the factors which burden the most the assessment of the country’s risk. As far as the Eu is concerned, Portugal in the context of the enlargement, is punished even more by the fall of the competitiveness and productivity registered, than in the 90s. Regarding the international competition, Portugal, according to the assessment realized by the World Economic Forum for 2006/2007, continues to loose places passing from 31st place to 34th place concerning the classification among the most competitive countries. The quota of the Portuguese GDP’s real growth does not correspond to the possibilities of the country. According to the data of the European Commission, is the lowest in the euro-zone and remains for the fifth year lower than the average in the euro-zone (2,6%, 2,7% for Eurostat), as well in the EU 25 (2,8%). In relation to the average of the EU 25, the GDP per capita fell to 71% and the income per capita to 63,5%. The labour productivity between 2000 and 2005 was increased with more slow rates in 30 countries of the OSCE, while in 2006 was increased only to 0,6% in relation to the 1,3% of the EU 25 average (equal to 2,2%). On the contrary, encouraging is the fact that in relation to the public expenses which in a GDP quota are still within the euro-zone levels: 21,1% in relation to the average 20,5%. Regarding the Lisbon Strategy, in 2006 Portugal was in the 16th place among the European partners, rising two places respecting 2005. Crucial indexes for the country are mainly those that have to do with the employment and the social convergence (in particular, labour market, instruction and personnel formation, social welfare). European Commission and the financial entrepreneurs agree that they should distinguish among the internal causes the stagnancy of the economic dynamism over the last four years (in a twenty year distance from the growth promotion caused by the accession in the EU). It is worth to be mentioned that a series of key factors, in relation to which the reforms realised and the efforts made, although they were positive (mainly in the sectors of health, social insurance, education and incentives for entrepreneurship) still remain deficient: deficient productivity caused by the stagnancy of the technological innovation limited ability of the educative and formation system imbalance respecting the public finances, which are charged with the increased external deficit a still deficient modernisation level of the country and the public administration, as well as deficient liberation of the energy market.

Macroeconomic data of the Programme for Stability and Development 2006/2010 (realisation January 2007) 2006 2007 2008 2009 2010 GDP 1,4 1,8 2,4 3 3 Private Consumption 1 1,3 2 2,3 2,4 Public Consumption -0,2 -1,3 -1,5 -129 -1,1 Investments -2,6 1,9 4 6,8 7 Exports 8,6 7,2 6,8 7 7,2 Imports 2,8 3,7 4,3 5,4 6,1 Inflation 2,9 2,1 2,1 2,1 2,1 Unemployment 7,6 7,5 7,2 6,6 6,3 Deficit/ GDP -3,4 -2,6 -1,8 -1,3 -0,5 Public Debt/ GDP 67,4 68 67,3 65,2 62,2 Source: Ministry of Finance b) Foreign market and foreign investment opening b.1 International trade In 2006 according to the preliminary data of the National Statistic Service of Portugal, the world exports (+12,4%), were the motivation power of the economic growth, during the long period of the last twelve years. The data of the National Statistic Service surpass the provisions of the Bank of Portugal (restrained, however optimistic respecting the

8 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina international organisations), which indicated a growth equal to 9,3% for 2006. During the examined period, the variation of the deficit of the trade balance reached 0,7%. The coverage quota reached the 65%, with improvement of 2,5 percentage points in relation to the previous year. The intercommunity trade has been increased to 8,7% for the exports and to 6,8% for the imports. Respecting the extra-community trade the exports registered an increase to 26,8% and the imports to 11,9%. World imports registered an increase of 8% (fuels and lubricants 13,2%, industrial supplies 10,1%, food products and drinks 9,1%). As supplier countries of Portugal are presented Spain, Germany, United Kingdom and Italy. The first factor of the increase was without a doubt the approach of the European demand, more specifically of Germany and Spain, with which always existed a traditional interdependence. In 2006 Germany and Spain were the first clients concerning the Portuguese exports. The main exporting products towards Germany are vehicles and other transport materials coming from the Volkswagen industry in Palmela “Auto Europa”, where the monocylinder Sharan are produced and the IEOS industry. The main products that are exported towards the Spanish market, in treble volume during the last ten years, are fossil fuels, machines and appliances. Despite the prediction for stagnancy of the Spanish economy in 2007 with an inevitable fall in the Portuguese market, the specialists announced an improvement of the exports in the sector of textile industry by the return of the demand from the side of the Spanish entrepreneurs that had preferred the Asian markets from Portugal. On the other hand the diversification of the destination countries of Portugal rendered Portugal less sensitive regarding the international turbulences. In 2006 the main innovation was in fact the decisive growth of the exports towards the extra-communitarian countries (+26,8%) among which USA (+27,3%), Angola (+50,7%) and China (+ 25,4%). Towards USA exports of oil (from the refineries of Sines) and vehicles (EOS) had the first word, towards Angola the main exported products were machines, appliances, refreshments and vehicles. In the third position as an outside EU client is China, which imports from Portugal mainly machines and appliances. Remarkable are also the purchases of Portuguese wine: only the area of Alentejo has exported 394,7 thousand liters (+27%) in 2006. For 2007 it is provisioned a further improvement of the trade relations with this country due to the recent visitation of the Prime Minister Socrates, accompanied by entrepreneurs that have signed trade Agreements with the local enterprises. On this occasion was also announced the creation of a series of loans of a 300 million euros total for the support of the Portuguese exports from China. With the same intention was also agreed the creation of a company which will manage the “Centre of Distribution of Portuguese products for China”, with premises in Zhuai. In Portugal has been also registered the start of a modernization process of the industrial composition, while new products will replace the traditional exports. The sectors of the world exports of Portugal which during the examined period have reached their highest growth are the sectors of fossil fuels and lubricants (47,7%), machines and other goods (22,2%)and industrial supplies (15,6%). According to the Council of Strategy and Studies of the Ministry of Economy the exports of technology and industrial products transformed through high technology were increased as a result of the research and development and as a source of the development of the national production. In this category distinguish the machines and the electrical appliances, a production that until 1997 was destined to the local market. Gradually have been increased the exports of these products towards the community’s states and over the last years towards the developing markets. Today but also in the future, Portugal looks to Algeria, Argentina, Chile, Mozambique, Angola, Green Cape, Slovakia, Hungary and Kazakhstan. The main countries, which at this moment supply Portugal with machinery and appliances, are Germany, Spain, France, USA and Singapore. The economic policy of Portugal for 2007 provides the same policy of 2006; it is worth mentioning the conquest of new markets and the increase of the quota in the traditional markets. China, India, Russia and UAE are considered as priority markets for the development of the Portuguese exports. Special attention is being given, except China, also in India where the president Cavalco Silva in February 2007 made a visitation, accompanied by a delegation of entrepreneurs. The sectors derived as particularly interesting are the sectors of wine exports, tourism, information technology and constructions (Goa airport). In Europe the main countries where the Portuguese exports are destined, remain Spain, United Kingdom and Germany. Among the states with Portuguese as their official language the two priorities are Angola and Brazil, this last country is in the fifth place among the extra-communitarian clients. The targeted increase of the exports in 2006 lurks however certain risks and uncertainties for the future development. More than the competitiveness the economic growth continues to be occupied with the enlargement of the

9 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina destination markets (which highly depends on the growth rate in Europe) and is subjected to the instability of the purchases (connected for example to the variations of the energy prices) and the demand of the developing markets. According to a recent study of the Bank of Portugal, between 2000 and 2005, Portugal has lost quotas in the destination markets, a fact that creates thoughts as far as a more coordinated determination of the competitiveness of the national exports is concerned. According to the Monetary Authority of Portugal, to this phenomenon has also contributed the composition of the exports’ products structure. The exports have presented a particularity in goods the markets of which were increased under the average of the international trade’s total. A fact that is observed more intensively in the traditional sectors such as textile industry, clothing and footwear. However, the geographical particularity of Portugal has contributed positively to the strong bonds of Portugal with Spain, which were increased over the world average. The study also confirmed that the loss of quotas of the Portuguese exports leaded respectively to profits for the developing economies of Asia and Central and East Europe. b.2 Foreign Direct Investments in Portugal According to the data of the Bank of Portugal, the balance of the Foreign Directs Investments in Portugal raised to 84,3% between 2005 and 2006, a raise caused mainly by the reduce of the disinvestments to 10,8%. After the increase registered in the beginning of the 9s with the activation of the “AutoEuropa” project (the greatest foreign investment that has ever happened in the country), the foreign direct investments in Portugal (FDIP) registered a decline during the second half of the decade and recover in 2000-2001, with peak the international mergers and acquisitions. The difficulties in the global economy had an especially negative impact during 2002-2005. For the promotion of the competitiveness and productivity of the Portuguese economy there is a package of measures which provides the state as a partner and supports transparency. The Portuguese Service for Investments has been assigned with the duty for the promotion of the competitiveness and productivity of the economy and for the investments of great dimensions. It is also its duty to find the investment opportunities which are relevant to the country, present them and contribute to the negotiations procedures. The new areas that have been defined by the Portuguese Service for Investments and where the country could attract investments are, except tourism, health and Wellbeing, payment means and services and Service Centres. Portugal climbed over 36 places in the classification respecting investments attraction. According to a study conducted by A.T. Kearney, Portugal passed from the 53rd place to the 17th due to the promotion model of the Investments Service. In March 2007, the Service has been awarded with the premium “WAIPA” as the best Service for the promotion of Investments in world level respecting the activity of clients’ support. In the Service for the Investments participate “API Capital” which at this moment has in its disposal 43 million euros to invest in new entrepreneurial participations and API Parques” with 7,5 million q.m in its disposal in four Industrial parks for the establishment of facilities there. However, still remain sensible the objective difficulties for Portugal that are connected to the more favourable conditions that offer the enlargement countries, as far as the incentives for the establishment of companies in these markets are concerned and to the pressure by the neighbouring Spanish market. In 2005, as well as in 2006 EU was the main investor in Portugal with 25.186 million euros. The main investors countries are Germany (raise9,1%), which precedes UK and Holland. France, Spain, Belgium and Finland follow. In the context of the EU, only Germany , UK, Holland and Ireland have presented a positive tendency during the examined period, while among the markets with a significant fall are registered Belgium (-240,06%), Finland (-24,46%), Italy (-15,36%) and Spain (-12,78%). Regarding the FDIs that entered the country, in a high place is presented Brazil, which with recent and constant investments (end 2005-beginning 2006) confirms a very positive variation (55,07%), as well as Switzerland (101%). In 2006 the manufacture industry was the first sector of investments, with a value of 8.373 million euros and a quota equal to 30,56%. The sector that concerns real estate possesses the second place with quotas equal to 21,27% and investment value of 5.829 million euros. The third place is taken by the financial activities, with a quota of 9,53%, 2.610 million euros value, from which 371 correspond to currency financial activities. Wholesale trade and retail trade have a 0,94% quota that corresponds to a value of 258 million euros. Building constructions (171 million), mining industry (149 millions) and agricultural production (57 million euros) follow.

c) Trade performance regarding Italy and bilateral foreign direct investments performance

Trade Transactions Italy-Portugal

10 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina (values expressed in Euros) 2003 2004 2005 2006(*) Transactions Total 4.752.686.766 4.698.849.679 5.139.604.786 4.478.627.154 Exports 3.419.232.960 3.315.851.466 3.601.489.866 3.065.423.749 Imports 1.333.453.806 1.382.998.213 1.538.114.920 1.413.203.405 Balance 2.085.779.154 1.932.853.253 2.063.374.946 1.652.220.344 Source: Istat

During the first ten months of 2006, according to the data of the National Statistic Service of Portugal, the trade balance between Italy and Portugal registered transactions equal to 4.478 million euros (4.031 million € during the relevant period of 2005) and a surplus on Italy’ s behalf equal to 1.652 million € (1.340 million € over the first ten months of 2005). The exports have been increased to 14,1% (3,06 billion euros) and the imports to 5,3% (1,41 billion euros). Italy maintains among the EU countries the fourth place as a supplier country after Spain, Germany, and France, and the sixth place as a client country after Spain, Germany, France, UK and USA. Italy continues to be a reference partner for Portugal. Τthe main products that Italy exports towards Portugal are machinery and appliances, common metals, vehicles and means of transport, clothing, chemical products, plastic products, leather and textile products. The main products that Italy imports from Portugal are machinery and appliances, agricultural products, clothing products, vehicles and means of transport, wood, paper pulp, plastic products, food products. It is also reminded that the transactions, besides the stagnancy of the Portuguese economy, are also charged with the lack of registration in the statistics of the imports from Italian enterprises which have established their entrepreneurial centre in Spain. As far as the commodities are concerned, the transactions between Italy and Portugal have remained almost in the same sectors (the Italian imports for example have been always focused in the traditional products such as fruits, sea food, marble, tins, cellulose and cork). At this moment the exchange of knowledge between Italian and Portuguese trade entrepreneurs in the fields of nutrition and innovation does not seem developed enough, although it is a necessary procedure for the development of continuous relations between local regional industries and Italian regional institutes, contributing also to the best promotion of the Italian System. In 2006, a decrease has been registered regarding the Italian investments in Portugal, which passed from 427 to 371 million euros, with a 15,22% decrease, equal to more than 56 million euros, while the FDI of Portugal in Italy had registered a raise up to 9,16% passing from 57,6 in 2005 to 62,9 million euros in 2006. The sectors where the Italian investments are concentrated are manufacture industry, wholesale trade, financial activities and real estate activities. d) Trade performance regarding Greece and bilateral foreign direct investments performance

Trade Transactions Greece-Portugal (values expressed in Euros) 2003 2004 2005 2006 Transactions Total 183.314.988 201.611.903 195.998.496 206.415.906 Exports 79.163.479 87.936.978 82.178.399 94.338.155 Imports 104.151.509 113.674.925 113.820.097 112.077.751 Balance - 24.988.030 - 25.737.947 - 31.641.698 - 17.739.596 Source: EUROSTAT

2.2 Intervention fields a) Assessment of commercial penetration of Italian products in the domestic market Machines for the metals’ processing The imports of machines for the processing of metals represent a market that has exceeded the 8 million euros in 11 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina 2005. The imports during the first ten months of 2006 were equal about 4 million euros. This market was traditionally dominated by two main countries, Germany and Italy, which during the last years were surpassed by Austria, which has been turned into a leader in Portugal with a quota of 17,05% in the market, during period January-October 2006. USA with 14,74%, Germany with 10,41%, Italy with 8,21%, Brazil with 6,51% and Spain with 5,43% follow. Machines for the industry of tiles and bricks A dynamic sector of the Portuguese economy with important investments in infrastructures, which have characterized Portugal and continue to do so. However, in 2005, the sector has registered a decrease in the imports with respect to the previous year with a quota loss from Italy’s side, which still remains in the first with difference as a supplier country, with a quota in the market, which during the first months of 2006 has been equal to 29,5%. Dividing the sector into three product sub-categories: cutting machines, polishing machines, smoothing machines and other machinery, it seems that Italy is a leader country in all three of them. Analyzing the quota values of the other supplier countries during the first ten months of 2006, it results that France and Spain have analogous shares in the market 21,4% and 12,44%, while Germany (11,03%) is closer to the quotas of France. Machines of wood processing The wood processing machines imported mainly in Portugal are those used for the second processing, especially in the furniture production (75% of the sector’s enterprises produce wooden furniture). It is clear that the biggest part of the enterprises of this sector operate with machinery of obsolete technology and for this reason there is the need of their replacement. During the first ten months of 2006, Italy was the first supplier country of Portugal, even though the percentage in the local market (33,95%) has registered a decrease, due to the reduction of the imports total, as well as due to the growth of imports from Germany (29,52%). Enology machines Italy with a quota of 50,2% in the market in 2005, is the main supplier of Portugal in enology mechanisms. Over the last years this quota has been raised and by 2005, has surpassed the 50% of the Portuguese imports in this sector. However, this tendency is not being confirmed by the available data for 2006, which till October have registered a quota of 41,48%. The value of the imports’ total in enology machines has been raised over the last years together with the preference for Made in Italy products. However, during the first ten months of 2006, this value has been reduced, reaching the total amount of 1,263 million euros from the initial 1,908 millions. The quotas registered by the competitive countries are in a much greater distance than those of Italy. However, based on the available data for 2006, an increase has been registered respecting the quotas of Germany (17,63%), which in 2005 has lost the second place, but most likely it will take it back, returning as the main competitor of Italy. On the contrary, Spain and France during the past years continued to lose places. Indeed, their share in the market was reduced passing from 2004 to 2005, from 18,8% to 14,6% respectively. Over the first ten months of 2006, the loss of the those countries’ quotas was even greater with respect to the relevant period of 2005, given that Spain has a quota of 10,6% and France a 10,3% quota. Ornaments and jeweller ’ s trade The economic growth of Portugal in the 90s, has brought an important increase for the imports in this sector. Italy due to an image connected to design and quality, knew how to take advantage this growth reaching in the first place as a supplier country of Portugal with a rate of 39,32% during the period of January-October 2006. However, its quotas have been decreased since 2003, a year in which they have reached a quota of 50%. Crucial competitor of Italy is Spain, which even with a quota in decrease respecting 2004, has been remained about 20%. Textiles ( threads ) In 2005, Portuguese imports in threads reached the amount of 231,7 million euros, an amount which corresponds to a 15,33% decrease in relation to 2004, a year in which the value reached 267,2 million euros. Italy possesses the first place as a supplier country of threads for the Portuguese industry, with a quota equal to 15,91% in 2005 and an exports value equal to 36,9 million euros. Over the first ten months of 2006, the Italian quota was equal to 15,1% with a value of 31,5 million euros, which is being reflected to a slight reduction in relation to the relevant period of 2005. Germany follows as the main competitor of Italy with similar quotas (15,0%), then come Spain (10%) and China (4,3%). The first place regarding imports take the synthetic textiles, with a 118 million euros value during the first ten months of 2006, followed by threads with a 41 millions value, woollen threads (24 millions), linen threads (3 millions) and silk threads (438 thousand euros). Italy is a leader regarding the woolen threads, with an imports’ value of 11,98 million euros, which corresponds to the 49,93%, followed by the synthetic threads with a value of 9,56 million and a 8,11% quota and the synthetic fibres (8,49 millions) with a quota of 20,71%. Linen and silk threads have a reduced value of imports: 1,44 millions and 173 thousand euros respectively, amounts that correspond to the 47,9% and 39,43% for the deficient Portuguese imports

12 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina of this products’ type. Security Despite the increase of 2006, the value of the exports towards Portugal (34,991 million euros compared to the 32,28 million euros in 2005), Italy has saw its quotas being reduced, passing from 19,3% in 2005 to 17,77% in 2006 and has lost the second place, which at this moment is taken by Germany (18,77%). Spain dominates in the market with a quota of 33,03%, in decrease in 2003, which in the previous year was equal to 41,3%. The fourth place has been taken by France (6,68%). In the context of security, is also included the sub sector of the house equipment of steel plated doors and security cameras, in which Italy with a quota of 47,19% and a 6 million euros value during the period January-October 2006, is the first place. Spain with a percentage of 36,04%, France (4,61%) and Germany (3,32%) follow. Footwear The exported footwear from the Portuguese industry reach 80 millions each year (1,3 million euros the value of the Portuguese exports annually) and 35 millions are the footwear sold in the internal market, from which 20 millions are imported products. Based on a survey of the Portuguese Footwear and Leather Products Industry Association (APICCAPS) the productivity of the sector’s industry has been raised to 15% over the last decade and is still being increased over than the average of the EU. Portuguese footwear exports recovered over the second half of 2005, closing with 1.288 million euros, which correspond to a value of exports very similar to the one registered in 2004 (1.330 millions, fall 3,3%). The good performance of the Portuguese industry results from the rational productive process, the investments realized and the new imported methods of production. During the period of January-October 2006, the Portuguese industry has exported footwear of an about 1.101 million euros, that is 66 million pairs, while the relevant period of 2005 the exports reached 1.113 million euros. Αthis corresponds to a 1,1% reduction. The exports were raised in markets such as Belgium (3%), Spain (2%) and Greece (7%), while they have been reduced in Germany and UK with falls about 20% due to the phenomenon of the disinvestments. The imports in 2005, have surpassed 414 million euros and during the period of January-October 2006 have reached over 381 million euros. Italy with a quota of 7,64% is the third exporter in Portugal after Spain (33,41%), which dominates in the market and Germany (8,02%). Medical Products In this sector Portugal has imported about 1.493 million € over the first ten months of 2006, while during the same period of 2005 the imports reached 1.334 million euros. The main supplier of Portugal is France with a quota of 15,68% in a far distance are being found Germany (12,74%) and Spain (9,13%). Italy has registered a quota of 6,28%. Chemical Products The value of the chemical products’ import is increased with about 891 million € during the period of January-October 2006, while in the same period of 2005 had registered 751 millions. The first supplier country is Spain with a quota in the market equal to 23,8%, followed by France (12,74%) and Germany (7,91%). Italy possesses only the 3,28%. Agricultural and food products The trade balance of Portugal in the sector of agricultural products is presented passive in times. The Portuguese imports in 2005 have surpassed the amount of 5,8 billion euros (5,7 in 2004). During the period of January-October of 2006 have surpassed 5,7 billion euros, while during the same period of 2005 have reached 4,78 billions. The exports reached 2,5 billion euros (2,2 in 2004). The EU represents the 70% of the sales abroad. Spain is the main supplier with a quota equal to 40,4%. In the second place is France, which during the last three years is being remained in the market with a quota equal to 10%. With lower quotas follow Germany (6,7%), Holland (4,88%), Brazil (4,83%) and UK (2,64%). Italy’s percentage is lower (2 %). As far as the main products are concerned, those are coffee, meat, cacao, noodles and fruits, which represent the 43% of the imports total. Italian exports for the period of January-October 2006 concerned mainly coffee (9 million euros), meat (8 millions), cacao based products (7 million euros), noodles (6,3 million euros), fruits (6 million euros), sea food (4,5 million euros) and cereals (3,7 million euros). b) Assessment of the direct investments from and to Italy It is underlined that the Portuguese investors consider as difficult the penetration in the Italian market. Italian investors on the other hand-although in the present study we aim to present the more modern side of the country and the opportunities characterizing it- continue to know Portugal, mainly through the products reaching the Italian market. It concerns traditional products (fruits, fish, tins, Porto wine, marble, cork and paper pulp) which do not contribute

13 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina enough in order to render the country’s image as more dynamic and attractive. Among the promising sectors for investments in Portugal, including those of high tech, are also the spare parts of vehicles, chemicals, hospital equipment, matrixes, electric and electronic products, Computer Science products and telecommunications. More specifically, there are some other sectors which present an interest and where it would be possible the intervention of Italian entrepreneurs-at this time completely absent- as well as in the major infrastructures’ projects, which constitute the most promising and active sector respecting the use of fundings from the EU. c) Assessment of the trade and industrial cooperation in the high tech fields Among the sectors of interest for investments in Portugal, as mentioned above, are without a doubt the sectors of electric and electronic products, products of Computer Science, telecommunications (mainly for radio networks and mobile telephony networks) and air navigation products. In addition to the perspective of the major infrastructure projects there are also increased possibilities for technological investments. The delay of the technological innovation and the stagnancy in the sector of Research and Development create concerns of absolute priority for Portugal. Among the objectives of greatest importance are the confrontation of the energy dependence (99,4% of the country’s consumption in energy depends on imported sources, 80% from oil, according to the data of the European Energy Service). Within this scope there are, as results, investment opportunities in the sector of the renewable energy sources (wind power, biomass, sea energy, central or of combined circle). d) Suggestions on granting public financing and security in line with SACE and SIMEST Between Italy and Portugal is valid a Pact within the framework of insurances between SACE and COSEC (Companhia de Seguro de Créditos S.A) with the purpose to give incentives to the national enterprises. Within the Pact, approved on 24th May 2002 by the Executive Council of SACE, are being defined the obligations of the contracting parties. More specifically the main Insurer has the duty to transfer to the Insured a quota of the amount which received relevant to the amount of the insurance, from which is withhold a commission of 10% for the management expenses of the insurance contract. The Pact, within the scope of the insurances, with COSEC is destined to cover the insurance of the Italian products and services integrated to the orders from the Portuguese companies as far as third client countries are concerned. The process is realized in mutual basis: the Italian exporter that does not have a direct contractual relation with the final order party, could be covered by an insurance coverage. the acquisitions in Italy from the Portuguese enterprises side have many incentives, as SACE will cover the risk of the Portuguese order in relation to the Italian percentage. By 2002 the functions of the Executive Council of SACE towards Portugal concerned supplies for the facilities: for the production of stone products for the production of ceramic products finishing machines machines for the production of hoses Portugal is in the category SACE 1 and in the category OSCE 0, with lower risk. Respecting the provisioned insurance conditions by SACE regarding Portugal, there are no restrictions and this contributes to the opening towards all the enterprises’ types. SACE could also support a possible intervention in relation to the implementation of major infrastructure projects in Portugal. SIMEST intervenes in Portugal as far as the trade transactions are concerned and in particular interferes to the support of credits in exports. e) Investments’ regulation After the entry into force of the 409/99 legislative Decree of 15th October, which modified the legislation about the contractual fiscal benefits, has been published the 4/2000 regulative Decree of 24th March, which modifies the contractual status of the foreign investments, which is applied to the projects that are of special interest for the Portuguese economy (2/ 96 Regulative Decree of 16th May). This regulation considers as projects of special interest for the Portuguese economy all those that present an investment value equal to or higher than five million euros, which include investments in structural level, supporting and following the sectional national policies and contribute with relevant way to the development and internationalization of the national economy. The investment plans that could favour the incentives should be direct respecting the following sectors of economic

14 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina activity: manufacture and mining industry Tourist activity Information and similar activities Agricultural activities, pisciculture, animal breeding, forestry Activities of research and development and high tech. Computer science technologies and production of audiovisual media and multimedia. The foreign enterprises of investments promotion should submit in the Portuguese Investments Service a candidature application, which describes the action plan for a period from 5 to 10 years, the determination of the commercial objectives and an internal and external analysis of the company. During the candidature phase the Portuguese Investments Service can request from those who promote the project more clarifications, which should be presented within 60 days and needs a period of 60 days in order to announce the compliance of the project with the contractual status of the foreign investments. Ministries and other contractual institutes with the Service of the issuance of the final permissions or consultations are obliged to respond within a 30 days period. According to the investments Service, as far as the cancellation of the investment contract is concerned in case of the non fulfillment of the objectives and actions defined within the determined framework, the regulation provides that it should be taken under consideration the implementation degree of the contractual objectives. f) Transport abroad of profits and capitals The incomes from the shares for the country of origin of the capitals that have been invested in Portugal are not being subject under any limitation nor demand the slightest connection with the Bank of Portugal. There are no restrictions for the payment and the credits deposit granted by foreign investors or for the revenues from the relevant interests. g) Double taxation Portugal has concluded an Agreement against double taxation with certain countries. The method which is generally applied in order for the double taxation to be avoided within the Agreements with Portugal is the method of the fiscal credit, which is used also for the Agreement with Italy. Between Italy and Portugal there is an Agreement of 1982 against the double taxation.

2.3 Trade and market access policy a) Barriers respecting the free circulation of goods In Portugal there are not any difficulties for the import of products coming from other markets and in particular from the EU. Moreover, there are not any technical barriers not complied with the community levels. b) Barriers respecting the free circulation of services, capital and free establishment of enterprises As mentioned above there are no barriers for the operation in the ground of Portugal. The only difficulty seems to exist concerning the mistrust from the public administration’s side, which exists, mainly, due to from the experiences of the past years with projects that have started, but have not been completed. On the other hand, it seems that the barriers in the country respecting the liberal competition are still remaining. The issue has been arisen since a long time and causes conflicts in the country concerning mainly the sectors of energy, water and telecommunications. The protection of the competition and the regulation of the market is a duty not only of the Central Competition Authority (under the presidency of Abel Mateus) and the Central Bank (Bank of Portugal, under the presidency of Victor Constâncio), but also of a series of sectorial institutes, all of them recently founded: ANACOM (communications), President: José Manuel A. Da Silva; CMVM (real estate values market), President: Carlos Tavares; ER Serviços Energeticos (energy sector), President: Jorge Vasconcelos; Instituto de Seguros de Portugal (insurances), President: Rui Manuel Martinho; INFARMED (medical products), President: Vasco Maria; ER da Sáude (health sector), President: Álvaro Almeida; Instituto Regulador das Águas e Residuos (water sector), President: Jaime Baptista; Autoridade da Segurança Alimentar e Económica (nutrition sector), President: António Nunes; Instituto Nacional de Aviaçao Civil (air-navigation), President: Luís Fonseca de Almeida;

15 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina Instituto Nacional dos Transportes Ferroviários (railway sector), President: António Brito da Silva; Instituto do Mercado de Obras Públicas e Particulares do Imobiliario (public works and real estate market), President: Hipólito Ponce de Leão. Although there are not any national regulations that set barriers respecting the liberal circulation of capitals or the free establishment of foreign enterprises in Portugal, barriers (for the national enterprise too) regarding the access in certain activities still remain: . In the sector of national defence and commercial security . In the collection, management and distribution of water for public use and in the collection, management and disposal of the infected urban waters and solid urban wastes. . In the postal services, which belong to the public sector . In the railway transports of public character . In the management of the maritime ports Moreover, the Portuguese market is still protected, little competitive and is characterized by an intense state interventionism. The growth of the Portuguese stock exchange suffers from a double protectionism: on the one hand the gold share of the State and on the other hand a structure of stocks of the major enterprises and banks controlled by a unique stakeholder (usually a great family) or by a closed shares Group and protected concerning OPA by limits imposed by the articles of association for the shareholders’ vote right. The privatizations in process, according to what has been announced regarding the new plan presented in February 2006, will be realized with a guaranteed result; while under consideration is also the strategy for the public service of the enterprises.

16 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina

3. MAIN TRADE FLOWS

Reference country: PORTUGAL Flow : Exports (values in million US Dollars) Countries 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Spain 3.426 3.434 3.756 4.431 4.702 4.656 5.426 7.576 8.907 9.834 France 3.372 3.325 3.485 3.415 3.087 3.063 3.493 4.196 4.985 4.950 Germany 4.414 4.665 4.788 4.838 4.397 4.574 4.564 4.704 4.804 4.439 United Kingdom 2.568 2.860 2.926 2.950 2.649 2.460 2.681 3.272 3.424 3.006 USA 1.087 1.100 1.191 1.213 1.409 1.377 1.481 1.813 2.162 2.048 Other European Countries ...... 1.761 Italy 886 921 982 1.022 968 1.070 1.182 1.523 1.534 1.610 Belgium . . . 1.156 1.446 1.280 1.115 1.410 1.424 1.402 Netherlands 1.164 1.168 1.172 1.080 1.031 979 992 1.197 1.428 1.231 Angola 397 443 411 294 343 451 537 739 835 996 Singapore 125 87 55 28 85 77 115 262 302 473 Sweden 489 499 476 444 404 368 383 424 410 409 Switzerland 402 300 302 272 249 246 279 335 342 310 Denmark 423 427 373 355 296 261 258 282 292 295 Finland 185 184 161 147 125 118 114 145 245 269 Turkey 69 98 75 59 96 69 102 169 216 256 Brazil 249 229 226 145 182 201 155 146 192 220 China 32 47 20 32 49 54 76 170 126 210 Austria 288 269 239 251 201 200 161 193 202 205 Ireland 107 105 114 135 128 129 151 169 212 198 WORLD 23.186 23.525 24.218 24.494 24.365 24.086 25.839 31.829 35.712 38.086 Source: elaborazioni ICE su dati ONU-COMTRADE

17 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina

Reference country: PORTUGAL Flow : Imports (values in million US Dollars) Countries 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 ΕU 25 76,10 76,67 77,81 78,77 76,34 76,63 79,71 79,25 77,06 73,12 Spain 22,47 23,58 24,05 25,26 25,90 27,37 28,85 29,96 29,29 28,93 Germany 15,49 14,87 14,88 14,72 13,73 13,78 14,97 14,59 14,30 13,42 France 11,08 10,76 11,15 11,42 10,62 10,21 10,24 9,82 9,34 8,46 Italy 8,28 8,11 7,94 7,75 7,14 6,85 6,73 6,42 6,09 5,19 Netherlands 4,43 4,74 4,87 4,78 4,59 4,82 4,57 4,69 4,60 4,27 United Kingdom 6,73 7,28 6,64 6,81 5,99 5,04 5,20 4,89 4,61 4,21 Belgium . . . 3,13 3,05 3,03 3,06 2,90 2,79 2,83 Sweden 1,18 1,13 1,49 1,35 1,25 1,11 1,16 1,17 1,29 1,09 Ireland 0,55 0,66 0,68 0,69 0,61 0,61 0,68 0,74 0,79 0,93 CENTRAL AND EAST EUROPE 1,07 1,03 0,75 0,74 0,82 1,25 1,16 1,51 1,75 1,03 Russia 0,90 0,83 0,49 0,50 0,57 0,99 0,84 1,24 1,39 0,76 OTHER EUROPEAN COUNTRIES 2,60 2,46 2,84 3,12 3,30 3,72 2,79 2,96 2,78 2,50 Norway 0,81 0,73 1,08 1,41 1,76 1,88 1,12 1,31 1,20 1,04 Turkey 0,22 0,32 0,45 0,49 0,45 0,63 0,61 0,68 0,79 0,73 NORTH AFRICA 1,60 1,15 0,65 0,64 0,92 0,90 0,97 1,76 2,22 3,07 Algeria 0,37 0,19 0,10 0,08 0,16 0,33 0,46 0,52 1,11 2,23 OTHER AFRICAN COUNTRIES 3,82 3,38 2,89 2,36 3,54 3,43 2,87 2,88 2,95 3,82 Nigeria 1,71 1,42 0,74 0,82 2,04 1,84 1,31 1,60 1,55 1,97 NORTH AMERICA 3,51 3,45 3,20 3,06 3,23 3,86 2,28 2,34 2,61 2,38 USA 3,17 3,15 2,85 2,82 2,96 3,63 2,08 1,89 2,37 2,17 CENTRAL AND SOUTH AMERICA 2,88 3,15 3,07 2,63 2,72 3,13 3,37 3,13 3,58 3,57 Brazil 1,38 1,68 1,41 0,98 1,11 1,26 1,55 1,58 1,94 1,99 MIDDLE EAST 1,99 2,31 1,91 2,03 2,69 1,68 1,72 1,21 1,56 1,88 Saudi Arabia 1,04 1,10 0,65 0,62 0,98 0,94 0,82 0,76 0,69 0,86 CENTRAL ASIA 0,83 0,80 0,76 0,62 0,73 0,73 0,73 0,71 1,23 1,15 EAST ASIA 5,36 5,33 5,92 5,76 5,57 4,50 4,19 4,07 4,14 3,87 Japan 2,23 2,40 2,85 2,70 2,45 1,85 1,70 1,61 1,48 1,18 China 0,68 0,71 0,81 0,75 0,88 0,80 0,81 0,89 1,04 1,15 OCEANIA 0,21 0,21 0,15 0,21 0,13 0,17 0,21 0,19 0,11 0,09 OTHER REGIONS ...... 3,28 WORLD 100,00 100,00 100,00 100,00 100,00 100,00 100,00 100,00 100,00 100,00 Source: elaborazioni ICE su dati ONU-COMTRADE

18 COMMUNITY INITIATIVE ΙNTERREG III A GREECE-ΙΤΑLY 2000-2006 Revision 00 AXIS II ΕENTREPRENEURSHIP- MEASURE 2 STRENGTHENING COMPETITIVENESS OF SMEs – PROJECT MISSIONS (APOSTOLES) 30.09.2007 Foreign Market Analysis PORTUGAL PROJECT MISSIONS (APOSTOLES) INTERREG IIIA Action 8 Foreign Market Analysis GREECE-ΙΤΑLY Chamber of Chamber of Chamber of Chamber of 2000 - 2006 Commerce of Commerce of Commerce of Commerce of Brindisi Aitolokarnania Thesprotia Ioannina

4. FINANCIAL EVENTS IN PORTUGAL

4.1 Exhibitions in Lisbon Organizer: AIP – Associação Industrial Portuguesa Rua Do Bojador – Parque Das Nações 1998-010 Lisboa Tel. 00351 218 921500 Fax: 00351 218 921500 Website: ww.fil.pt