ChangeWave Research: Corporate IT Spending

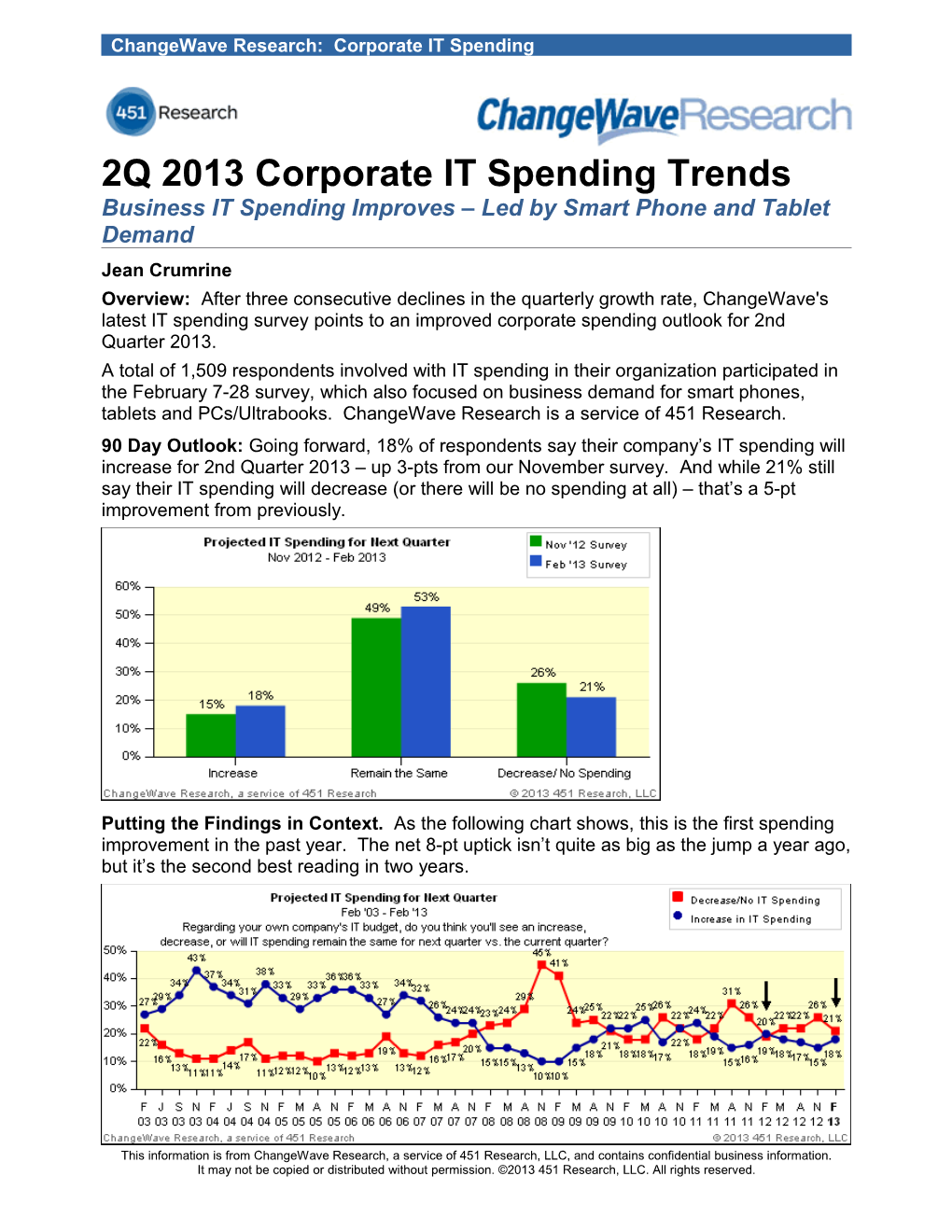

2Q 2013 Corporate IT Spending Trends Business IT Spending Improves – Led by Smart Phone and Tablet Demand Jean Crumrine Overview: After three consecutive declines in the quarterly growth rate, ChangeWave's latest IT spending survey points to an improved corporate spending outlook for 2nd Quarter 2013. A total of 1,509 respondents involved with IT spending in their organization participated in the February 7-28 survey, which also focused on business demand for smart phones, tablets and PCs/Ultrabooks. ChangeWave Research is a service of 451 Research. 90 Day Outlook: Going forward, 18% of respondents say their company’s IT spending will increase for 2nd Quarter 2013 – up 3-pts from our November survey. And while 21% still say their IT spending will decrease (or there will be no spending at all) – that’s a 5-pt improvement from previously.

Putting the Findings in Context. As the following chart shows, this is the first spending improvement in the past year. The net 8-pt uptick isn’t quite as big as the jump a year ago, but it’s the second best reading in two years.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. ChangeWave Research: Corporate IT Spending

2nd Half 2013: Looking further ahead to 2nd half 2013, we also see positive signs. Nearly one-in-five (19%) think their IT budget will be greater than the 1st half of 2013 compared to 22% who believe it will be less – a huge 12-pt improvement from previously.

Current Quarter: We also asked respondents if their IT spending was on track thus far in the 1st Quarter, and the results show unmistakable signs of improvement. A total of 14% say they’ve spent More than Planned so far in the quarter and 25% Less than Planned – a net 6-pts better than previously. Of the IT spending categories tracked in this survey, Servers (Change in Net Difference Score = +4) registered the biggest increase since last quarter. Security (+2), Software-as- a-Service (SaaS) (+2), Storage (+2) and Communications (+2) also show improvement. Impact of Government “Sequester” Cuts Previous ChangeWave surveys showed the fiscal cliff having a major negative impact on U.S. business IT spending. While the legislation passed to avert the fiscal cliff resolved tax issues, it only delayed “sequester” cuts mandated by the U.S. Government’s 2011 Budget Control Act. With $85 billion in forced federal spending cuts now occurring, we asked respondents whether these cuts and associated uncertainty were causing any adjustment to be made to their company’s 2Q IT spending budgets. Thinking about your company's overall IT budget for 2nd Quarter (Apr-Jun) 2013, are the scheduled government spending cuts and associated uncertainty causing your company to make any adjustments to your IT budget over the next 90 days? Current Survey Feb ‘13 Yes, We are Decreasing Our 2nd Quarter 2013 IT Budget Over the Next 90 Days 13% Because of the Scheduled Spending Cuts and Associated Uncertainty Yes, we are Increasing our 2nd Quarter 2013 IT Budget over the Next 90 Days 2% Because of the Scheduled Spending Cuts and Associated Uncertainty No, There Will be No Change in Our 2nd Quarter 2013 IT Budget Over the Next 67% 90 Days Because of the Scheduled Spending Cuts and Associated Uncertainty

2 ChangeWave Research: Corporate IT Spending Don't Know 18% The findings show there is an adverse impact on IT spending from the “sequester” issue – with 13% saying their company is Decreasing 2Q IT budgets because of the scheduled cuts and associated uncertainty. However, the impact is clearly less damaging than three months ago when three-in-ten (31%) reported their company’s IT budget had adjusted lower because of the fiscal cliff issue. Despite this tempering finding, we’re nonetheless seeing improvement in IT spending for the first time in the past year. Planned Corporate Smart Phone Buying Going forward, 43% of respondents report their company plans to buy smart phones next quarter – up 4-pts from previously and the highest level ever in a ChangeWave survey.

Apple vs. Blackberry. At the individual manufacturers’ level, Apple (64%) continues to dominate planned corporate smart phone purchases – 2-pts off its all-time high in our previous survey.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 3 ChangeWave Research: Corporate IT Spending A big story in business smart phones is demand for Blackberry. After hitting an all-time low in the previous survey, Blackberry (32%) has increased 3-pts - only its second improvement in the past five years. This is an encouraging sign that corporate interest for their latest models running the new Blackberry 10 OS (Z10 and Q10) may provide a much needed shot-in-the-arm for the once dominant manufacturer. Samsung. After surging to its highest level ever in terms of planned smart phone purchases, Samsung (29%) is down just 1-pt from last quarter. We note some companies may be holding off on Samsung purchases until the Galaxy S IV and Note III are available.

Motorola vs. HTC vs. Nokia. Motorola (14%) has fallen 2-pts since last quarter, while HTC (11%) is unchanged. Nokia (6%), on the other hand, is up 2-pts this quarter to a new ChangeWave high. Mobile Operating Systems. In terms of corporate mobile OS preferences, Apple’s iOS (61%) remains number one followed by Google’s Android OS (38%) – both down 3-pts from the previous survey.

Blackberry’s OS (32%) has registered a 2-pt increase since the previous survey – another positive finding in the aftermath of the Blackberry 10 launch. Moreover, when we asked about the impact of the new OS release on purchasing plans, 25% of current Blackberry users reported their company is now More Likely to buy Blackberry smart phones.

4 ChangeWave Research: Corporate IT Spending Another big momentum story is corporate interest in Windows Phone 8 (11%), which is up 2-pts this quarter, and a five-fold increase since our initial reading six months ago.

OS Customer Satisfaction. We took a close-up look at OS customer satisfaction. As we've seen in previous ChangeWave surveys, Apple is the clear leader with 60% of iPhone business users reporting they're Very Satisfied with iOS.

In further positive news for the Windows Phone 8 OS (46%), it is beating Android OS (37%) in terms of corporate customer satisfaction. The Blackberry OS (17%) trails by a wide margin, illustrating exactly how steep an uphill battle the company faces as it attempts to regain traction in the corporate market. Android OS Security Concerns. Some consider Google’s Android OS more vulnerable to security issues than its competitors because it runs on multiple devices from various manufacturers. The survey found Security Concerns (42%) ranks as the top reason why companies are not using Android, followed by Too Many Versions of Android OS Software (24%). When we asked all respondents about the Android security issue, 10% said their company is Very Concerned and 38% Somewhat Concerned. We note companies not using Android (18%) are four times more likely than Android users (4%) to say their company is Very Concerned with Android’s security.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 5 ChangeWave Research: Corporate IT Spending

6 ChangeWave Research: Corporate IT Spending Business Tablet Demand Going forward, 25% of corporate respondents say their companies will be purchasing tablets for their employees in 2nd Quarter 2013, 1-pt above the all-time high registered in last quarter’s survey.

Apple. The iPad remains the overwhelming frontrunner in the corporate tablet market, with better than three-in-four (77%) companies that plan to buy tablets saying they’ll purchase iPads – up 4-pts since November. The rest of the competition is still well behind Apple, but the battle for second place is intensifying.

Microsoft vs. Samsung. Following the surge of demand for its Surface tablet last quarter, Microsoft (14%) is down just 2-pts in corporate buying and remains tied for second place with Samsung (14%) – also down 2-pts from the all-time high in the previous survey. Corporate PCs After the uptick last quarter with the Windows 8 release, the survey now shows PC buying settling back to just above the levels of six months ago. A total of 68% of respondents say their company will buy laptops in the 2nd Quarter, down 2-pts from previously. Planned desktop purchasing (62%) is also down 2-pts.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 7 ChangeWave Research: Corporate IT Spending

Planned Buying By Manufacturer. The biggest momentum winner in PC buying is Lenovo which has hit their highest level of the past five years in planned laptop buying (12%) – up 2-pts since November. Lenovo is also registering an uptick in corporate desktops (6%; up 1-pt) for the first time in two years.

In terms of other manufacturers, Dell laptop demand (26%) is unchanged near its lowest level, while Apple (15%) and H-P (14%) are both down 1-pt. Desktop buying for Apple (9%) remains at its all-time high, even as Dell (25%; down 1-pt) and H-P (13%; down 2- pts) are both hitting new lows. Computer Operating Systems. We asked corporate respondents which operating systems will be installed on their new PCs next quarter. After the surge for Windows 8 in our previous survey, 22% say they’ll be installing the new Microsoft OS – just 2-pts less than previously. In comparison, 36% chose Windows 7 and 13% Mac OS X Mountain Lion. Now that several months have passed since the Windows 8 OS release, we asked several questions to measure corporate reactions to the new operating system. First, 15% of companies now say their company has a Windows 8 upgrade plan in place (3% Formal and 12% Informal/Tentative) – up 3-pts from previously. Another 9% say their company is Currently Working on a Windows 8 Upgrade Plan, but this is down 3-pts. Next we looked at corporate satisfaction with the Windows 8 OS, and found 16% saying their company is Very Satisfied. Another 48% say Somewhat Satisfied.

8 ChangeWave Research: Corporate IT Spending

As mentioned above, the smart phone satisfaction rating for Windows Phone 8 OS is positive news for Microsoft. One reason the computer satisfaction rating for Windows 8 OS isn’t as strong may have to do with how user friendly companies find it compared to Windows 7: Better than one-in-five (22%) say Windows 8 is More user friendly than Windows 7, while twice as many (50%) characterize it as Less user friendly. Corporate Ultrabook Demand Last quarter’s uptick in corporate PC buying was largely attributable to the Windows 8 release, but for over a year we’ve also been tracking business demand for Ultrabooks – slim, light-weight laptops – to see if it can help revive the sluggish growth that has been plaguing the industry. One-in-ten (10%) planning to buy laptops next quarter say their company will purchase Ultrabooks in 2nd Quarter – up 1-pt since previously and double the level a year ago.

Dell (42%; down 3-pts) remains the leader in the corporate Ultrabook market. But Lenovo (25%) is showing the greatest momentum – up 3-pts since November and now within striking distance of H-P (26%; unchanged) for second.

Bottom Line: The ChangeWave survey findings point to an improvement in corporate IT spending for 2nd Quarter 2013 – the second largest quarterly uptick in two years.

The survey shows enterprise demand for smart phones and tablets at the highest levels we’ve seen. Apple maintains a dominant position in both markets. Microsoft and Samsung are emerging as front runners for the number two spot in the tablet market.

After surging to a new high last quarter, Samsung is down just slightly in the smart phone market, but companies waiting for the Galaxy S IV and Note III releases may be a contributing factor. Blackberry is showing traction in business smart phones for the first time in a year with their recent new OS launch – though it remains an arduous climb to regain the position it once held.

The continued growth in business demand for smart phones and tablets is impressive, especially considering the rise in ‘Bring Your Own Device’ (BYOD) trends. Our survey

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 9 ChangeWave Research: Corporate IT Spending shows more than half of companies (55%) now allow employees to use their personal smart phones and/or tablets for business purposes, up 3-pts since November.

In the aftermath of the Windows 8 surge seen last quarter, PC buying plans have calmed. We’re still seeing solid interest in Windows 8, with Lenovo the biggest momentum winner in terms of PC buying plans.

In one cautionary finding, the ChangeWave survey shows the government “sequester” and associated uncertainty is having at least some tempering impact on U.S. business spending going forward. Nonetheless, the improvement we’re seeing is the first in a year and a positive sign for the business economy. Summary of Key Findings

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

10 ChangeWave Research: Corporate IT Spending Table of Contents

Summary of Key Findings...... 9

The Findings...... 11

2nd Quarter 2013 Visibility...... 11

...... Projected IT Spending: A Comparison ...... 11

...... Projected IT Spending For Next Quarter: Feb ’03 – Feb ‘13 ...... 11

...... Projected IT Spending By Company Size ...... 12

A Closer Look at 2nd Half 2013...... 12

...... Looking Ahead – IT Budget for Next Half ...... 12

Green Light Spending...... 13

...... Willingness to Spend on IT Products and Services ...... 13

1st Quarter IT Spending...... 13

...... IT Spending Thus Far in Current Quarter (1Q 2013) ...... 13

IT Spending Categories...... 14

Impact of Government “Sequester” Cuts ...... 16

Corporate Smart Phone, Tablet and PC Markets ...... 17

Corporate Smart Phones ...... 17

Corporate Tablets ...... 23

Corporate Ultrabooks and PCs ...... 30

ChangeWave Research Methodology ...... 36

About ChangeWave Research ...... 36

About The 451 Group ...... 36 This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 11 ChangeWave Research: Corporate IT Spending

12 ChangeWave Research: Corporate IT Spending I. The Findings

Introduction: After three consecutive declines in the quarterly growth rate, ChangeWave's latest IT spending survey points to an improved corporate spending outlook for 2nd Quarter 2013.

A total of 1,509 respondents involved with IT spending in their organization participated in the February 7-28 survey, which also focused on business demand for smart phones, tablets and PCs/Ultrabooks. ChangeWave Research is a service of 451 Research.

90 Day Outlook: Going forward, 18% of respondents say their company’s IT spending will increase for 2nd Quarter 2013 – up 3-pts from our November survey. And while 21% still say their IT spending will decrease (or there will be no spending at all) – that’s a 5-pt improvement from previously.

Putting the Findings in Context. As the following chart shows, this is the first spending improvement in the past year. The net 8-pt uptick isn’t quite as big as the jump a year ago, but it’s the second best reading in two years.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 13 ChangeWave Research: Corporate IT Spending Projected IT Spending for Next Quarter (2Q 2013) – By Company Size: The spending outlook is showing improvement across companies of all sizes – though it remains far weaker among smaller size companies (less than 10 employees).

2nd Half 2013: Looking further ahead to 2nd half 2013, we also see positive signs. Nearly one-in-five (19%) think their IT budget will be greater than the 1st half of 2013 compared to 22% who believe it will be less – a huge 12-pt improvement from previously.

14 ChangeWave Research: Corporate IT Spending Willingness to Spend: We asked respondents to rate the willingness of their company to spend money on IT products and services. One-in-three (34%) say their company is giving a “Green Light” to IT spending (i.e., spending is normal) – up 8-pts from the previous quarter.

While another 59% say their company has a “Yellow/Red Light” to spend on IT – this is a 6-pt improvement.

Current Quarter: We also asked respondents if their IT spending was on track thus far in the 1st Quarter, and the results show unmistakable signs of improvement. A total of 14% say they’ve spent More than Planned so far in the quarter and 25% Less than Planned – a net 6-pts better than previously.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 15 ChangeWave Research: Corporate IT Spending IT Spending Categories For which of the following main IT Spending categories - if any - have you spent more than planned thus far in the 1st Quarter? (Check All That Apply)

Curren Previous Previou Previous Previous t Survey s Survey Survey Survey Survey Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Feb ‘13 Servers 9% 7% 7% 8% 7% Security 9% 7% 8% 7% 8% PCs 9% 9% 9% 9% 10% Mobile Devices (e.g., Tablets, Smart Phones) 9% NA NA NA NA Storage 8% 7% 8% 7% 7% Networking 7% 7% 6% 7% 7% Software: Enterprise Applications 6% 6% 6% 7% 6% Application Development Software/Tools 5% 4% 5% 5% 4% Software: Platforms/Operating Systems 5% 5% 5% 5% 5% Software-as-a-Service (SaaS)/ Outsourced 4% 2% 3% 2% 2% Application Management Communications 4% 3% 4% 4% 3% Virtualization 4% 4% 4% 5% 4% Outsourced IT Services: Systems 4% 4% 3% 4% 3% Integration/Implementation Don't Know 21% 24% 21% 20% 24% Other 5% 6% 7% 6% 6%

And for which of the following main IT Spending categories - if any - have you spent less than planned thus far in the 1st Quarter? (Check All That Apply)

Curren Previous Previou Previous Previous t Survey s Survey Survey Survey Survey Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Feb ‘13 PCs 18% 19% 19% 16% 15% Servers 12% 14% 13% 12% 10% Mobile Devices (e.g., Tablets, Smart Phones) 9% NA NA NA NA Software: Enterprise Applications 9% 8% 8% 7% 6% Networking 9% 9% 10% 8% 8% Storage 9% 10% 9% 8% 8% Software: Platforms/Operating Systems 8% 9% 10% 8% 7% Application Development Software/Tools 7% 7% 7% 6% 6% Virtualization 6% 5% 5% 4% 5% Security 6% 6% 6% 5% 5% Communications 5% 6% 4% 5% 4% Outsourced IT Services: Systems Integration/ 5% 6% 6% 6% 6% Implementation Software-as-a-Service (SaaS)/ Outsourced 4% 4% 4% 4% 3% Application Management Don't Know 24% 26% 23% 23% 26% Other 4% 4% 3% 4% 5%

16 ChangeWave Research: Corporate IT Spending

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 17 ChangeWave Research: Corporate IT Spending Change in Net Difference Score: Current Survey (Feb ’13) vs. Previous Survey (Nov ’12) Current Previous Survey Survey Change Net Net in Net Overall IT Spending Categories Difference Difference Difference Score Score Score (Feb ’13) (Nov ‘12) Servers -3 -7 +4 Security +3 +1 +2 Software-as-a-Service (SaaS)/ Outsourced 0 -2 +2 Application Management Storage -1 -3 +2 Communications -1 -3 +2 Outsourced IT Services: Systems -1 -2 +1 Integration/Implementation Application Development Software/Tools -2 -3 +1 Software: Platforms/ Operating Systems -3 -4 +1 PCs -9 -10 +1 Networking -2 -2 0 Virtualization -2 -1 -1 Software: Enterprise Applications -3 -2 -1

Of the IT spending categories tracked in this survey, Servers (Change in Net Difference Score = +4) registered the biggest increase since last quarter. Security (+2), Software-as- a-Service (SaaS) (+2), Storage (+2) and Communications (+2) also show improvement.

18 ChangeWave Research: Corporate IT Spending Impact of Government “Sequester” Cuts

Previous ChangeWave surveys showed the fiscal cliff having a major negative impact on U.S. business IT spending. While the legislation passed to avert the fiscal cliff resolved tax issues, it only delayed “sequester” cuts mandated by the U.S. Government’s 2011 Budget Control Act.

With $85 billion in forced federal spending cuts now occurring, we asked respondents whether these cuts and associated uncertainty were causing any adjustment to be made to their company’s 2Q IT spending budgets.

Thinking about your company's overall IT budget for 2nd Quarter (Apr-Jun) 2013, are the scheduled government spending cuts and associated uncertainty causing your company to make any adjustments to your IT budget over the next 90 days?

Current Survey Feb ‘13 Yes, We are Decreasing Our 2nd Quarter 2013 IT Budget Over the Next 90 13% Days Because of the Scheduled Spending Cuts and Associated Uncertainty Yes, we are Increasing our 2nd Quarter 2013 IT Budget over the Next 90 2% Days Because of the Scheduled Spending Cuts and Associated Uncertainty No, There Will be No Change in Our 2nd Quarter 2013 IT Budget Over the 67% Next 90 Days Because of the Scheduled Spending Cuts and Associated Uncertainty Don't Know 18%

The findings show there is an adverse impact on IT spending from the “sequester” issue – with 13% saying their company is Decreasing 2Q IT budgets because of the scheduled cuts and associated uncertainty. However, the impact is clearly less damaging than three months ago when three-in-ten (31%) reported their company’s IT budget had adjusted lower because of the fiscal cliff issue.

Despite this tempering finding, we’re nonetheless seeing improvement in IT spending for the first time in the past year.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 19 ChangeWave Research: Corporate IT Spending II. Corporate Smart Phones, Tablets, and PCs

(A) Corporate Smart Phone Demand

Planned Corporate Smart Phone Buying. Going forward, 43% of respondents report their company plans to buy smart phones next quarter – up 4-pts from previously and the highest level ever in a ChangeWave survey.

Smart Phone Manufacturers

Apple vs. Blackberry. At the individual manufacturers’ level, Apple (64%) continues to dominate planned corporate smart phone purchases – 2-pts off its all-time high in our previous survey.

A big story in business smart phones is demand for Blackberry. After hitting an all-time low in the previous survey, Blackberry (32%) has increased 3-pts – only its second improvement in the past five years. This is an encouraging sign that corporate interest for their latest models running the new Blackberry 10 OS (Z10 and Q10) may provide a much needed shot-in-the-arm for the once dominant manufacturer.

20 ChangeWave Research: Corporate IT Spending Samsung. After surging to its highest level ever in terms of planned smart phone purchases, Samsung (29%) is down just 1-pt from last quarter. We note some companies may be holding off on Samsung purchases until the Galaxy S IV and Note III are available.

Motorola vs. HTC. Motorola (14%) has fallen 2-pts since last quarter, while HTC (11%) is unchanged.

Nokia. Nokia (6%), on the other hand, is up 2-pts this quarter to a new ChangeWave high.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 21 ChangeWave Research: Corporate IT Spending

(FOR THOSE COMPANIES BUYING SMART PHONES IN 2ND QUARTER 2013) Who is the manufacturer of the Smart Phones your company is planning on buying? (Check All That Apply)

Current Previou Previous Previou Previous Survey s Survey Survey s Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Apple (e.g., iPhone) 64% 66% 66% 61% 61% Blackberry (e.g., Q10, Z10) 32% 29% 33% 36% 35% Samsung (e.g., Galaxy S III, Galaxy 29% 30% 26% 20% 18% Note II, Galaxy Nexus) Motorola (e.g., Droid Razr Maxx HD, 14% 16% 18% 18% 20% Droid 4, Atrix HD, Photon Q) HTC (e.g., Windows Phone 8X, One X+, 11% 11% 12% 14% 12% Droid DNA) LG (e.g., Google Nexus 4, Optimus G, 7% 6% 4% 6% 5% Spectrum 2) Nokia (e.g., Lumia 920, Lumia 820) 6% 4% 4% 4% 3% Sony (e.g., Xperia TL, Xperia ion) 2% NA NA NA NA Lenovo (e.g., K900) 1% NA NA NA NA Sanyo (e.g., Milano, Rise) 1% NA NA NA NA Don't Know 1% 1% 0% 1% 1%

Mobile Operating Systems. In terms of corporate mobile OS preferences, Apple’s iOS (61%) remains number one followed by Google’s Android OS (38%) – both down 3-pts from the previous survey.

Blackberry’s OS (32%) has registered a 2-pt increase since the previous survey – another positive finding in the aftermath of the Blackberry 10 launch.

Another big momentum story is corporate interest in Windows Phone 8 (11%), which is up 2-pts this quarter, and a five-fold increase since our initial reading six months ago.

22 ChangeWave Research: Corporate IT Spending

(FOR THOSE COMPANIES BUYING SMART PHONES IN 2ND QUARTER 2013) Which of the following mobile Operating Systems will be installed on the Smart Phones your company is planning on buying? (Check All That Apply)

Curren Previous Previou Previous Previous t Survey s Survey Survey Survey Survey Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Feb ‘13 iOS (Apple) 61% 64% 63% 57% 55% Android (Google) 38% 41% 37% 36% 39% Blackberry OS (RIM) 32% 30% 34% 38% 37% Windows Phone 8 (Microsoft) 11% 9% 2% NA NA Windows Phone 7 (Microsoft) NA 3% 5% 7% 5% Don't Know 3% 3% 2% 3% 2% Other 0% 3% 3% 2% 0%

OS Customer Satisfaction. We took a close-up look at OS customer satisfaction. As we've seen in previous ChangeWave surveys, Apple is the clear leader with 60% of iPhone business users reporting they're Very Satisfied with iOS.

In further positive news for the Windows Phone 8 OS (46%), it is beating Android OS (37%) in terms of corporate customer satisfaction.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 23 ChangeWave Research: Corporate IT Spending

The Blackberry OS (17%) trails by a wide margin, illustrating exactly how steep an uphill battle the company faces as it attempts to regain traction in the corporate market.

The following are overall enterprise smart phone operating system satisfaction ratings: Windows Blackberry iOS Android Phone 8 OS (Apple) (Google) (Microsoft) (Blackberry) Very Satisfied 60% 46% 37% 17% Somewhat Satisfied 34% 43% 51% 55% Very Unsatisfied 3% 11% 9% 23% Somewhat Unsatisfied 3% 0% 3% 6%

A Closer Look at Impact of Blackberry 10 OS

To help gauge the potential impact of the Blackberry 10 OS release, we asked corporate respondents if the new release is making any differences in their company plans for purchasing Blackberry smart phones in the future. Blackberry recently released their Blackberry 10 mobile operating system with new features including a unified inbox that displays all notifications 'at-a-glance' and gesture-based navigation, among other things. Does this development make your company more likely to purchase Blackberry smart phones in the future, less likely, or does it have no effect on your company's Blackberry purchasing plans? Current Past Non- Blackberry Blackberry Blackberry Users Users Users Significantly More Likely to Buy 4% 3% 0% Blackberry Smart Phones in the Future Somewhat More Likely to Buy Blackberry 21% 13% 4% Smart Phones in the Future No Effect on Blackberry Smart Phones 54% 63% 61% Purchasing Plans in the Future Somewhat Less Likely to Buy Blackberry 1% 0% 1% Smart Phones in the Future Significantly Less Likely to Buy 1% 5% 4% Blackberry Smart Phones in the Future Don’t Know/ Not Applicable 19% 15% 30% One-in-four (25%) current users report their company is now More Likely to buy Blackberry smart phones in the future, compared with just 4% of Non-Blackberry users. Importantly, among respondents whose company previously used Blackberry smart phones but no longer uses them 16% say their company is More Likely to buy Blackberry smart phones now that the new OS is available.

24 ChangeWave Research: Corporate IT Spending Google Android OS Security Concerns

Some consider Google’s Android OS more vulnerable to security issues than its competitors because it runs on multiple devices from various manufacturers.

For those whose company does not support the Android OS, what is the most important reason why not? Current Survey Feb ‘13 Security Concerns 42% Too Many Versions of Android OS Software 22% Reliability 12% Selection of Apps 6% Cost 1% Other 17%

The survey found Security Concerns (42%) ranks as the top reason why companies are not using Android, followed by Too Many Versions of Android OS Software (24%).

Focusing on Google’s Android operating system, what is your company’s level of concern with the security of the Android OS? Current Survey Feb ‘13 Very Concerned 10% Somewhat Concerned 38% Not Very Concerned 43% Not at All Concerned 9%

When we asked all respondents about the Android security issue, 10% said their company is Very Concerned and 38% Somewhat Concerned. Breakdown of Current Android Users vs. Companies Not Using Android Current Companies Android Not Using Users Android Very Concerned 4% 18% Somewhat Concerned 41% 35% Not Very Concerned 51% 32% Not at All Concerned 4% 15%

We note companies not using Android (18%) are four times more likely than Android users (4%) to say their company is Very Concerned with Android’s security.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 25 ChangeWave Research: Corporate IT Spending (B) Business Tablet Demand

Planned Corporate Tablet Buying. Going forward, 25% of corporate respondents say their companies will be purchasing tablets for their employees in 2nd Quarter 2013, 1-pt above the all-time high registered in last quarter’s survey.

Apple. The iPad remains the overwhelming frontrunner in the corporate tablet market, with better than three-in-four (77%) companies that plan to buy tablets saying they’ll purchase iPads – up 4-pts since November. The rest of the competition is still well behind Apple, but the battle for second place is intensifying.

Microsoft vs. Samsung. Following the surge of demand for its Surface tablet last quarter, Microsoft (14%) is down just 2-pts in corporate buying and remains tied for second place with Samsung (14%) – also down 2-pts from the all-time high in the previous survey.

Other manufacturers that showed momentum in the previous survey but are down in next quarter buying include Dell (6%; down 2-pts) and Google (4%; down 2-pts).

We note Blackberry (3%) is registering a very slight 1-pt uptick – the first improvement in corporate tablet buying in over a year.

26 ChangeWave Research: Corporate IT Spending Here are the complete results for 2nd Quarter tablet buying: (FOR THOSE COMPANIES BUYING TABLETS IN 2ND QUARTER 2013) Who is the manufacturer of the Tablets your company is planning on buying? (Check All That Apply) Current Previou Previou Previous Previous Survey s Survey s Survey Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Apple (e.g., iPad with Retina display, iPad 77% 73% 82% 83% 84% mini, iPad 2) Microsoft (e.g., Surface) 14% 16% 5% NA NA Samsung (e.g., Galaxy Tab 2, Galaxy Note 14% 16% 13% 15% 8% III, Galaxy Note 10.1) Dell (e.g., XPS 10, Latitude 10) 6% 8% 6% 5% 3% H-P (e.g., ElitePad, TouchPad) 5% 5% 4% 4% 4% Amazon (e.g., Kindle Fire HD, Kindle Fire) 4% 3% 4% 6% 6% Asus (e.g., Transformer Pad, Vivo Tab) 4% 4% 3% 4% 3% Google (e.g., Nexus 10, Nexus 7) 4% 6% 3% NA NA RIM/BlackBerry (e.g., PlayBook) 3% 2% 2% 2% 3% Lenovo (e.g., IdeaTab, ThinkPad) 3% 3% 3% 4% 2% Acer (e.g., Iconia) 2% 1% 3% 2% 2% Toshiba (e.g., Thrive, Excite) 2% 1% 1% 2% 1% Barnes & Noble (e.g., Nook HD+, Nook HD) 1% 1% 1% 1% 1% LG (e.g., Optimus) 1% 1% 1% 1% 0% Motion (e.g., CL910, J3500) 1% 1% 1% 1% 1% Sony (e.g., Xperia) 1% 1% 1% 1% 0% HTC (e.g., Flyer) 1% 2% 1% 1% 1% Motorola (e.g., Xoom, Xyboard) 1% 2% 1% 2% 2% Don't Know 1% 0% 1% 1% 2% Other 1% 3% 2% 3% 2%

A Closer Look at Microsoft Surface Tablet Buying Plans

We took a closer look at corporate interest in both the ARM-based Windows RT and Intel- based Windows 8 versions of the Microsoft Surface tablet.

(FOR THOSE COMPANIES BUYING MICROSOFT SURFACE TABLETS) Which Microsoft Surface tablet(s) is your company most interested in buying? Current Survey Feb ‘13 Intel-based Windows 8 Pro Only 74% ARM-based Windows RT Only 10% Both Intel-based Windows 8 Pro 15% and ARM-based Windows RT

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 27 ChangeWave Research: Corporate IT Spending As we’ve seen in previous ChangeWave surveys, there is far greater corporate interest in purchasing the Intel-based Windows 8 Surface tablet (74%) than the ARM-based RT model (10%). A total of 15% say their company is interested in buying both versions.

Compatibility ranks as the number one reason for those interested in buying the Windows 8 Pro. Respondent ALQ25191 writes, "We like the features, ease of use and convenience of having the utility of a laptop but the convenience of a tablet – and the fact that it will have all the Office applications to make work easier." STE10335 adds Windows 8 Pro provides "full compatibility with the rest of the infrastructure."

Corporate Interest in 128GB 4th Generation iPad

Apple recently began offering their 4th generation iPad with 128GB of storage targeted for businesses. The Wi-Fi Only model costs $799 and the Wi-Fi + Cellular model costs $929.

To find out about market potential for this higher-priced, large capacity model we asked respondents how likely their company would be to buy one in the next quarter.

One-in-three (33%) respondents from companies currently using iPads say their company is likely to buy the 128GB model next quarter (7% Very Likely; 26% Somewhat Likely) 9% of non-iPad users say their company is likely to purchase the model next quarter (1% Very Likely; 8% Somewhat Likely)

How likely is your company to purchase the new 128GB iPad for business purposes in the next quarter? Curren Non- t iPad iPad Users Users Very Likely 7% 1% Somewhat Likely 26% 8% Unlikely 54% 73%

28 ChangeWave Research: Corporate IT Spending Don’t Know/ No Answer 12% 18%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 29 ChangeWave Research: Corporate IT Spending But as one of the more expensive tablets on the market, how much of a barrier is the price point of the 128GB iPad? We asked those unlikely to buy the following question:

How much of a barrier - if any - is the price point of the Apple 4th Generation 128GB iPad?

Companies Unlikely to Purchase 128GB iPad Next Quarter Significant Barrier 30% Moderate Barrier 20% Slight Barrier 13% Not a Barrier At All 18% Don’t Know/No Answer 18%

Three-in-ten (30%) unlikely corporate buyers of the 128GB iPad consider the cost a Significant barrier, and 20% say cost is a Moderate barrier.

How are Companies Making Use of Tablets? We presented corporate respondents with a list of business functions and asked them which ones their company uses tablets for.

Checking Email (75%), Internet Access (69%) and Working Away From the Office (66%) remain the three most popular uses.

In a reminder of the continued serious threat that corporate tablet demand is having on the laptop industry, better than one-in-three companies providing tablets to their employees now say they’re using them as Laptop Replacements (35%) – up 7-pts from previously and matching the highest level of the past year.

30 ChangeWave Research: Corporate IT Spending What business functions does your company/organization use Tablets for? (Check All That Apply)

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Checking Email 75% 75% 75% 81% 73% Internet Access 69% 70% 70% 76% 73% Working Away From the Office 66% 69% 68% 72% 67% Sales Support 47% 45% 39% 39% 41% Customer Presentations 46% 46% 46% 45% 38% Laptop Replacement 35% 28% 30% 35% 32% Netbook Replacement 13% 13% 10% 9% 8% GPS Navigation 12% 18% 15% 18% 13% Healthcare Applications 9% 7% 6% 7% 6% Desktop Replacement 9% 8% 8% 5% 6% Other 8% 6% 9% 7% 7%

Types of Tablet Apps. We also presented respondents with a list of tablet applications and asked them which ones their company is currently using.

Beyond Corporate Email (71%), Productivity Apps (40%) is the most popular type of tablet “App” being used by companies. Collaboration Tools (28%), Customer Relationship Management (28%), Instant Messaging (28%), and Business Intelligence (25%) are also highly popular corporate tablet Apps.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 31 ChangeWave Research: Corporate IT Spending And which of the following types of Tablet “Apps” does your company/organization currently use? (Check All That Apply)

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Corporate Email 71% 72% 73% 73% 74% Productivity Apps (e.g., Documents, 40% 43% 44% 44% 42% Spreadsheets) Collaboration Tools 28% 30% 27% 29% 23% Customer Relationship Management 28% 26% 22% 23% 21% (CRM) Apps Instant Messaging 28% 27% 25% 28% 23% Business Intelligence (e.g., Reporting, 25% 29% 27% 25% 22% Dashboards) GPS Navigation Apps 20% 22% 22% 25% 20% Expense Management 19% 20% 22% 22% 20% Field Service 16% 18% 18% 19% 16% Social Networking Apps 14% 21% 15% 19% 14% Customer Facing Apps (e.g., mobile 13% 17% 14% 16% 14% storefront, account access) IT Support Tools 13% 17% 14% 15% 12% Travel Management Apps 13% 19% 22% 19% 18% Time Tracking Apps 9% 15% 11% 13% 8% Point of Sale (POS) Apps (e.g., Credit 8% 6% 7% 7% 6% Cards) Enterprise Resource Planning (ERP) 5% 10% 9% 10% 8% Apps Don't Know 5% 5% 5% 5% 5% Other 5% 3% 6% 4% 6%

32 ChangeWave Research: Corporate IT Spending Other Findings on Smart Phones and Tablets

‘Bring Your Own Device’ Trends. The continued growth in business demand for smart phones and tablets is impressive, especially considering the rise in ‘Bring Your Own Device’ (BYOD) trends.

Some companies allow employees to use their personal smart phones and/or tablets for business purposes - such as company email, connecting to the corporate network, or using other IT resources. Other companies only allow access to email and other IT resources through approved, company-provided devices.

Does your company allow employees to use their personal smart phones and/or tablets for business purposes? Curren Previous Previous t Survey Survey Survey Nov ‘12 Nov ‘11 Feb ‘13 Yes - Both Smart Phones and Tablets 38% 36% 29% Yes - Smart Phones Only 15% 15% 16% Yes - Tablets Only 2% 1% 1% No - Personal Devices are Not Allowed/ 36% 40% 44% Company Has No Policy Regarding Personal Devices Don’t Know 8% 8% 11%

Our survey shows more than half of companies (55%) now allow employees to use their personal smart phones and/or tablets for business purposes, up 3-pts since November.

Which of the following activities does your company allow on personal smart phones and/or tablets? (Check All That Apply)

Current Previous Previous Survey Survey Survey Feb ‘13 Nov ‘12 Nov ‘11 Corporate Email Access 88% 88% 87% Access to Web-Based Tools/Applications 49% 49% 46% Access to Company Files (e.g., Documents, 38% 39% 35% Spreadsheets) VPN Access to Corporate Networks 30% 31% 32% Remote Access to Company-Owned Computers 24% 27% 27% Use of Company-Specific Apps 23% 25% NA Remote Access to Datacenter 12% 14% 11% Management/Monitoring Tools Don't Know 1% 4% 4% Other 1% 1% 1%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 33 ChangeWave Research: Corporate IT Spending (C) Corporate Ultrabook and PC Demand

PC Demand. After the uptick last quarter with the Windows 8 release, the survey now shows PC buying settling back to just above the levels of six months ago.

A total of 68% of respondents say their company will buy laptops in the 2nd Quarter, down 2-pts from previously. Planned desktop purchasing (62%) is also down 2-pts.

Planned Buying By Manufacturer. The biggest momentum winner in PC buying is Lenovo which has hit their highest level of the past five years in planned laptop buying (12%) – up 2-pts since November. Lenovo is also registering an uptick in corporate desktops (6%; up 1-pt) for the first time in two years.

In terms of other manufacturers, Dell laptop demand (26%) is unchanged near its lowest level, while Apple (15%) and H-P (14%) are both down 1-pt.

34 ChangeWave Research: Corporate IT Spending

Desktop buying for Apple (9%) remains at its all-time high, even as Dell (25%; down 1-pt) and H-P (13%; down 2-pts) are both hitting new lows.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 35 ChangeWave Research: Corporate IT Spending (FOR THOSE COMPANIES BUYING COMPUTERS IN 2ND QUARTER 2013) Who is the manufacturer and what computer type(s) is your company planning on buying? (Check All That Apply)

Laptops Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Dell - Laptop Computer 26% 26% 27% 25% 25% Apple - Laptop Computer 15% 16% 15% 16% 15% Hewlett-Packard (including Compaq) - 14% 15% 14% 16% 16% Laptop Computer Lenovo (formerly IBM) - Laptop 12% 10% 10% 11% 10% Computer Toshiba - Laptop Computer 4% 4% 5% 4% 4% Samsung - Laptop Computer 2% 1% 1% 1% NA Acer (including Gateway and 2% 1% 2% 2% 2% eMachines) - Laptop Computer ASUS - Laptop Computer 2% 2% 2% 2% 1% Sony - Laptop Computer 1% 2% 1% 2% 1% Other - Laptop Computer 1% 1% 1% 1% 1% Don't Know 7% 11% 7% 6% 7% Not Buying Laptops in 2nd Quarter 32% 30% 33% 31% 32%

Desktops Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Feb ‘12 Dell - Desktop Computer 25% 26% 27% 27% 28% Hewlett-Packard (including Compaq) - 13% 15% 14% 15% 15% Desktop Computer Apple - Desktop Computer 9% 9% 8% 8% 8% Lenovo (formerly IBM) - Desktop 6% 5% 5% 5% 5% Computer Acer (including Gateway and 2% 1% 2% 2% 2% eMachines) - Desktop Computer ASUS - Desktop Computer 1% 2% 1% 1% 1% Sony - Desktop Computer 0% 1% 0% 1% 0% Other - Desktop Computer 2% 1% 1% 2% 2% Don't Know 7% 11% 7% 7% 7% Not Buying Desktops in 2nd Quarter 38% 36% 39% 38% 35%

36 ChangeWave Research: Corporate IT Spending Computer Operating Systems. We asked corporate respondents which operating systems will be installed on their new PCs next quarter. After the surge for Windows 8 in our previous survey, 22% say they’ll be installing the new Microsoft OS – just 2-pts less than previously. In comparison, 36% chose Windows 7 and 13% Mac OS X Mountain Lion.

And for those companies buying computers in 2nd Quarter 2013, what operating system(s) will be installed on your new computers? (Check All That Apply) Current Previous Previous Previous Survey Survey Survey Survey Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Windows 7 36% 32% 36% 52% Windows 8 Pro 13% 13% 10% NA Windows 8 9% 11% 7% NA Windows Other 3% 6% 9% 8%

Mac OS X Mountain Lion * 13% 13% 16% 15%

Linux 5% 5% 6% 6%

Chrome OS 2% NA NA NA

Other OS /Don’t Know 8% 9% 5% 7% Not Buying Computers in 19% 18% 25% 22% 2nd Quarter

*In the previous August 2012 survey there were 2 response choices: ‘Mac OS X Mountain Lion’ (11%) and ‘Mac OS X Lion’ (5%), and in the previous May 2012 survey the response choice was ‘Mac OS X Lion’.

Now that several months have passed since the Windows 8 OS release, we asked several questions to measure corporate reactions to the new operating system.

First, 15% of companies now say their company has a Windows 8 upgrade plan in place (3% Formal and 12% Informal/Tentative) – up 3-pts from previously. Another 9% say their company is Currently Working on a Windows 8 Upgrade Plan, but this is down 3-pts.

Which of the following statements best describes your company's Windows 8 upgrade plan?

Curren Previous t Survey Survey Nov ‘12 Feb ‘13 We Have a Formal Windows 8 Upgrade Plan in Place 3% 2% We Have an Informal/Tentative Windows 8 Upgrade Plan 12% 10% We are Currently Working on a Windows 8 Upgrade Plan 9% 12% We Currently Have No Plans to Upgrade to Windows 8 58% 59% Don't Know /No Answer 19% 16%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 37 ChangeWave Research: Corporate IT Spending Next we looked at corporate satisfaction with the Windows 8 OS, and found 16% saying their company is Very Satisfied. Another 48% say Somewhat Satisfied.

(FOR THOSE COMPANIES CURRENTLY USING WINDOWS 8 IN ANY CAPACITY) Overall, how satisfied is your company with the Windows 8 Operating System?

Current Survey Feb ‘13 Very Satisfied 16% Somewhat Satisfied 48% Somewhat Unsatisfied 22% Very Unsatisfied 14%

As mentioned above, the smart phone satisfaction rating for Windows Phone 8 OS is positive news for Microsoft. One reason the computer satisfaction rating for Windows 8 OS isn’t as strong may have to do with how user friendly companies find it compared to Windows 7:

How "user friendly" would you say Windows 8 is compared to Windows 7?

Current Survey Feb ‘13 Windows 8 is More User Friendly Than Windows 7 22% Windows 8 is Less User Friendly Than Windows 7 50% Windows 8 is About As User Friendly As Windows 7 28%

Better than one-in-five (22%) say Windows 8 is More user friendly than Windows 7, but twice as many (50%) characterize it as Less user friendly.

Ultrabooks. Last quarter’s uptick in corporate PC buying was largely attributable to the Windows 8 release, but for over a year we’ve also been tracking business demand for Ultrabooks – slim, light-weight laptops – to see if it can help revive the sluggish growth that has been plaguing the industry.

38 ChangeWave Research: Corporate IT Spending One-in-ten (10%) respondents planning to buy laptops next quarter say their company will purchase Ultrabooks in 2nd Quarter – up 1-pt since previously and double the level a year ago.

Dell (42%; down 3-pts) remains the leader in the corporate Ultrabook market. But Lenovo (25%) is showing the greatest momentum – up 3-pts since November and now within striking distance of H-P (26%; unchanged) for second.

(FOR THOSE COMPANIES BUYING ULTRABOOKS IN 2ND QUARTER 2013) Who is the manufacturer of the Ultrabooks your company plans on buying? (Check All That Apply)

Curren Previou Previou Previous t s Survey s Survey Survey Survey Nov ‘12 Aug ‘12 May ‘12 Feb ‘13 Dell (e.g., Inspiron 15z, XPS 14) 42% 45% 50% 40% Hewlett-Packard (e.g., Envy 6-1000sg, Folio 13) 26% 26% 29% 28% Lenovo (e.g., Thinkpad X1 Carbon, IdeaPad U410) 25% 22% 23% 23% Samsung (e.g., Series 9, Series 5) 11% 14% 6% 13% ASUS (e.g., VivoBook S500CA, Zenbook Prime) 7% 15% 8% 10% Toshiba (e.g., Satellite U845W, Portégé Z935) 6% 12% 16% 20% Acer (e.g., Inspire S3, Aspire S5) 5% 9% 8% 5% Fujitsu (e.g., Lifebook UH572, U772) 1% 5% 0% NA Sony (e.g. VAIO T Series, Duo 11) 1% 9% NA NA LG (e.g., Xnote Z450, Z350) 0% 4% 2% NA Vizio (e.g., Thin + Light) 0% 4% NA NA Don't Know 8% 9% 6% 5% Other 3% 4% 3% 7%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 39 ChangeWave Research: Corporate IT Spending ChangeWave Research Methodology

The current findings are based on a survey of ChangeWave Research Network members involved with IT spending in their organization, conducted February 7-28, 2013. The goal of the survey was to get an up-to-date picture of IT spending for the 2nd Quarter of 2013. To this end, the survey was composed of a sample of 1,509 accredited members.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies, and consumer and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research

ChangeWave Research, a service of 451 Research, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

451 Research, LLC, including its ChangeWave Research service, does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

About 451 Research

451 Research, a division of The 451 Group, is a leading global analyst and data company focused on the business of enterprise IT innovation. Clients of 451 Research – at end-user, service- provider, vendor, and investor organizations – rely on 451 Research’s insight through a range of syndicated research and advisory services to support both strategic and tactical decision-making. For additional information on 451 Research, go to: 451research.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 240-200-3988 Suite 1301 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

40