HEW DALRYMPLE ma, mphil, msc strategy, business development & turnaround Blackdykes North Berwick East Lothian EH39 5PQ Tel: h-01620 894019, m-07799 475183 E-mail: [email protected]

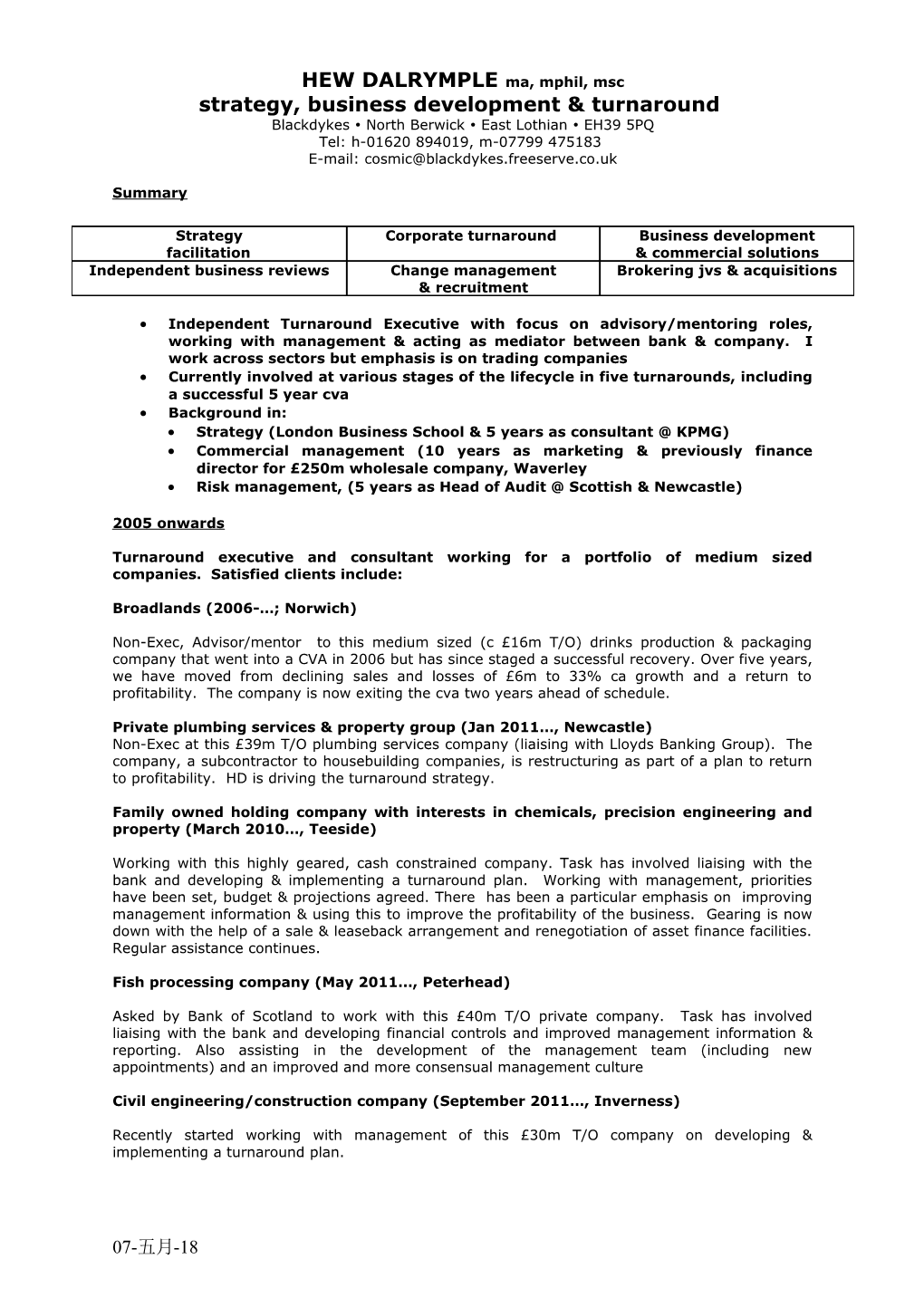

Summary

Strategy Corporate turnaround Business development facilitation & commercial solutions Independent business reviews Change management Brokering jvs & acquisitions & recruitment

Independent Turnaround Executive with focus on advisory/mentoring roles, working with management & acting as mediator between bank & company. I work across sectors but emphasis is on trading companies Currently involved at various stages of the lifecycle in five turnarounds, including a successful 5 year cva Background in: Strategy (London Business School & 5 years as consultant @ KPMG) Commercial management (10 years as marketing & previously finance director for £250m wholesale company, Waverley Risk management, (5 years as Head of Audit @ Scottish & Newcastle)

2005 onwards

Turnaround executive and consultant working for a portfolio of medium sized companies. Satisfied clients include:

Broadlands (2006-…; Norwich)

Non-Exec, Advisor/mentor to this medium sized (c £16m T/O) drinks production & packaging company that went into a CVA in 2006 but has since staged a successful recovery. Over five years, we have moved from declining sales and losses of £6m to 33% ca growth and a return to profitability. The company is now exiting the cva two years ahead of schedule.

Private plumbing services & property group (Jan 2011…, Newcastle) Non-Exec at this £39m T/O plumbing services company (liaising with Lloyds Banking Group). The company, a subcontractor to housebuilding companies, is restructuring as part of a plan to return to profitability. HD is driving the turnaround strategy.

Family owned holding company with interests in chemicals, precision engineering and property (March 2010…, Teeside)

Working with this highly geared, cash constrained company. Task has involved liaising with the bank and developing & implementing a turnaround plan. Working with management, priorities have been set, budget & projections agreed. There has been a particular emphasis on improving management information & using this to improve the profitability of the business. Gearing is now down with the help of a sale & leaseback arrangement and renegotiation of asset finance facilities. Regular assistance continues.

Fish processing company (May 2011…, Peterhead)

Asked by Bank of Scotland to work with this £40m T/O private company. Task has involved liaising with the bank and developing financial controls and improved management information & reporting. Also assisting in the development of the management team (including new appointments) and an improved and more consensual management culture

Civil engineering/construction company (September 2011…, Inverness)

Recently started working with management of this £30m T/O company on developing & implementing a turnaround plan.

07-五月-18 Independent car dealership ( Jan 2011- April, Glasgow)

Asked by Bank of Scotland to follow up an IBR of this leading £150m turnover, 16 branch car dealership; the assignment involved a review of strategy, budgets and management structure. The outcome was a better understanding of key business drivers and a change of strategy by management; this resulted in management securing renewed facilities from the bank.

UK subsidiary of French haulage company (2009-10;Stirling)

Asked by Royal Bank of Scotland to conduct an IBR of this loss-making subsidiary; the review also involved an assessment of the French Private Equity owned parent company’s strategy and financial situation. The review validated projections and highlighted risks to the bank. Then spent 12 months working with management on strategic direction and liaison with the bank; the work ended with successful sale of company to a subsidiary of SNCF

Family owned haulage company (July – October 2010; Middlesbrough) Asked by Barclays Bank to conduct an IBR for this £6m T/O family haulage company. Review involved: preparing forecasts assessing strategic direction & financial controls Result was more realistic forecasts and management having a more commercial approach to its customer base (including improved debt collection).

Sale of drinks distribution company (Jan – June 2011; Scotland) Asked by Clydesdale Bank to conduct an IBR for this £6m T/O company. Review involved: preparing forecasts assessing strategic direction & financial controls Then worked with management to sell the company. HD prepared the sale prospectus, contacted a shortlist of trade buyers and helped negotiate the successful sale.

Enotria (2006-2008)

Retained for two years by the Chairman of this £50m T/O ISIS (private equity) backed distribution company. Worked closely with the Chairman & his board as strategic advisor & troubleshooter for 2 years, including: Masterminding the company’s vision & strategic plan (aimed at doubling profit in 2 years) & using this to reposition the company in the market (including new corporate identity and PR initiatives)

Other assignments since 2006 Two successful projects for Pernod Ricard including acquisition integration of Allied Domecq & channel strategy for wholesalers Created virtual drinks company for client resulting in new spirits brand – achieved launch listings with Tesco, Sainsbury & Waitrose; voted Best Launch 2009 by Drinks Business Procurement strategy for a trading company Acquisition review for drinks distribution company Strategic review for an investment of Charlotte Capital Expert witness for agency compensation

Other responsibilities have included Director of the award winning Scottish Seabird Centre since its inception in 1998 o One of three who raised £3m (inc £1m from the Millennium Commission) and put together and then implemented this highly successful Millennium project which opened in April 2000; chaired the Trading Committee which oversaw construction and initial trading. Recently awarded Queens Award for Innovation MD of family property company Director & shareholder of Edinburgh boutique, Arkangel Ltd 2001-2010 when the business was sold

Previous experience 1991 – 2005: Scottish & Newcastle plc 1996 - 2001: Finance Director then 2001 - 2004: Marketing & Strategy Director, Waverley Group Appointed to Waverley (drinks distribution company, turnover £250m ending up at £500m) as part of a turnaround team which transformed the company from being a loss making wholesaler to become 07-五月-18 the market leading on and off-trade drinks distributor. As Finance Director, I pulled together the recovery plan which was based on improved management information resulting, for the first time, in a real understanding of where value was and was not being created. In 2001, tasked by MD with developing a marketing function & brands portfolio; also responsible for corporate strategy and purchasing. With the merger of Waverley and The Beer Seller in 2003, Hew oversaw the integration of the newly merged company.

Previously: Head of Group Review & Audit, Scottish & Newcastle plc (1992-1996) Ran the internal audit team of 16 reporting directly to the Plc Audit Committee. Responsibilities covered risk management across the whole group, i.e. beer, pub retailing and leisure (Center Parcs & Pontins) interests in the UK & the Continent. Resources were focused on underperforming areas of the group and practical solutions were implemented in conjunction with local management.

Strategic mentor to the Managing Director, Microsoft UK (1988-1993) Retained by the MD to advise on strategy, ad hoc projects and run bi-annual retreats for the Executive. These retreats reviewed performance, organisation and progress and were the key mechanism for setting strategy and managing rapid expansion of the company; during this period, company turnover rose from £15m to over £200m.

Strategy and finance managing consultant, Peat Marwick McLintock, London - now KPMG (1984-1991) Helped set up KPMG’s strategic consultancy business, managing 20 consultants and selling over £1m of consultancy in 1990. Based in the City, engagements covered corporate strategy & finance and turnaround for listed & unlisted companies, particularly in manufacturing, wholesaling and retailing.

Most successful turnaround assignment was in 1990 for the £60m T/O Northern Fed Brewery at the request of the Coop bank; over six months, identified the weaknesses in the company & worked with the management to restore the company to profitability.

Qualifications & early career Sloan Fellowship, London Business School (1986-1987) o A year’s sabbatical at LBS; distinction in Business Strategy Overseas Development Institute Fellowship at the Ministry of Works, Power and Communication, Swaziland (1982-1984) o Planning Officer responsible for planning in the water, power and construction divisions and for negotiating and managing World Bank projects. Cambridge & London(Birkbeck) universities (1980 &1981) MPhil & MSC in Economics Volunteer in Kenya (1977-1980) Oxford University (1974-1977) History scholar, MA History Married, 4 children (21,20,18,15). Born 1955

07-五月-18