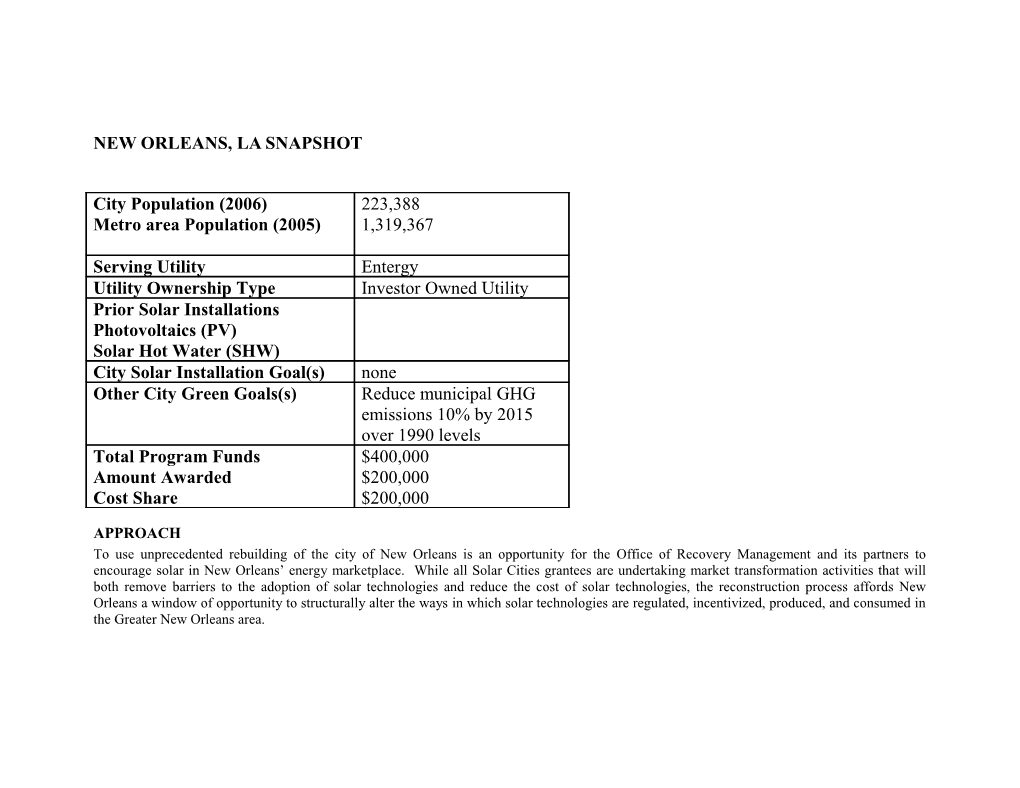

NEW ORLEANS, LA SNAPSHOT

City Population (2006) 223,388 Metro area Population (2005) 1,319,367

Serving Utility Entergy Utility Ownership Type Investor Owned Utility Prior Solar Installations Photovoltaics (PV) Solar Hot Water (SHW) City Solar Installation Goal(s) none Other City Green Goals(s) Reduce municipal GHG emissions 10% by 2015 over 1990 levels Total Program Funds $400,000 Amount Awarded $200,000 Cost Share $200,000

APPROACH To use unprecedented rebuilding of the city of New Orleans is an opportunity for the Office of Recovery Management and its partners to encourage solar in New Orleans’ energy marketplace. While all Solar Cities grantees are undertaking market transformation activities that will both remove barriers to the adoption of solar technologies and reduce the cost of solar technologies, the reconstruction process affords New Orleans a window of opportunity to structurally alter the ways in which solar technologies are regulated, incentivized, produced, and consumed in the Greater New Orleans area. Partners Alliance for Affordable Energy City of New Orleans LA Clean Tech Future Proof Global Green New Orleans, LA “SOLAR ENVIRONMENT” BENCHMARKING & TRACKING MATRIX The Benchmarking & Tracking Matrix provides a quarterly overview of the City’s status with regard to policies and activities that affect solar deployment. For cities awarded in 2007, benchmarking was completed July 1 – September 30, 2007; for cities awarded in 2008, benchmarking was completed April 1 – June 30, 2008. For each policy or activity marked as “YES,” the listed status is hyperlinked to a more detailed description in the below “Benchmarking & Tracking Description.” For some policies or activities there are multiple providers listed. If no status is listed for a certain policy or action, it means DOE staff has not yet confirmed the status.

Solar Environment Benchmark: 2007 2008 2008 2008 2008 2009 2009 2009 Jul 1 – Oct 1 – Jan 1 – Apr 1 – July 1 – Oct 1 – Jan 1 – Apr 1 – July 1 – Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Rules, Regulations, and Policies Interconnection Standards City NO NO NO NO NO NO State YES YES YES YES YES YES

Net Metering City YES YES YES YES U YES YES State YES YES YES YES YES YES Solar Set-Asides in RPS City NO NO NO NO NO NO State NO NO NO NO NO NO Public Benefits Funds City NO NO NO NO NO NO State NO NO NO NO NO NO Solar Access Laws City NO NO NO NO NO NO State NO NO NO NO NO NO Solar Mandates in Building Standards City NO NO NO NO NO NO State NO NO NO NO NO NO Expedited Solar System Permitting / Zoning City NO NO NO NO NO NO State NO NO NO NO NO NO Solar in Emergency Preparedness Plan City NO NO NO NO NO NO State NO NO NO NO NO NO Financial Incentives Direct Incentives City NO NO NO NO NO NO State NO NO NO NO NO NO Low-Interest Loans/Innovative Financing Packages City NO NO NO NO NO NO State YES YES YES YES YES YES Income/Investment Tax Credits City NO NO NO NO NO NO State YES YES YES YES YES YES Property Tax Incentives City NO NO NO NO NO NO State YES YES YES YES YES YES Sales Tax Incentives City NO NO NO NO NO NO State NO NO NO NO NO NO Permit Fee Discounts/Waivers City NO NO NO NO NO NO State NO NO NO NO NO NO Property Tax Assessment Financing City NO NO NO NO NO NO State NO NO NO NO NO NO Industry Development Incentives City NO NO NO NO NO NO State NO NO NO NO NO NO Utility Programs

Other Notable City Items Benchmarking Matrix Details and Description

RULES, REGULATIONS, AND POLICIES

Interconnection Standards Benchmark: September 30, 2007 City: (NO)

State: (YES) In November 2005, the Louisiana Public Service Commission (PSC) issued rules for net metering and the interconnection of net- metered systems. Louisiana's rules, based on those in place in Arkansas, require publicly-owned utilities and rural electric cooperatives to offer net metering to customers with systems that generate electricity using solar, wind, hydropower, geothermal or biomass resources. (Fuel cells and microturbines that generate electricity entirely derived from renewable resources are eligible.) The rules apply to residential facilities with a maximum capacity of 25 kilowatts (kW) and commercial systems with a maximum capacity of 100 kW.

Utilities must provide customer-generators with a meter capable of measuring the flow of electricity in both directions. Although utilities must pay for the cost of the meter itself, customer-generators must pay a one-time charge to cover the installation cost of the meter. Interconnected systems must meet all safety and performance standards established by local and national electric codes, including the National Electric Code (NEC), the Institute of Electrical and Electronics Engineers (IEEE), the National Electrical Safety Code (NESC), and Underwriters Laboratories (UL). A manual external disconnect switch is required for all interconnected systems.

Customer-generators seeking to interconnect and net meter must submit an interconnection agreement to a utility 45 days prior to interconnection. Utilities must use a PSC-approved standard interconnection agreement for interconnected facilities. Customers must pay for "interconnection costs," defined as "the reasonable costs of connection, switching, metering, transmission, distribution, safety provisions and administrative costs incurred by the electric utility directly related to the installation and maintenance of the physical facilities necessary to permit interconnected operations with a net-metering facility, to the extent the costs are in excess of the corresponding costs which the electric utility would have incurred if it had not engaged in interconnected operations, but instead generated an equivalent amount of electric energy itself or purchased in equivalent amount of electric energy or capacity from other sources." Furthermore, following notice and opportunity for public comment, the PSC may authorize a utility to assess customer-generators "a greater fee or customer charge, of any type, if the electric utility's direct costs of interconnection and administration of net metering outweigh the distribution system, environmental and public-policy benefits of allocating the costs among the electric utility's entire customer base." For more information, go to http://dsireusa.org/library/includes/incentive2.cfm? Incentive_Code=LA03R&state=LA&CurrentPageID=1&RE=1&EE=0 Net Metering Benchmark: September 30, 2007 City: (YES) In May 2007, the New Orleans City Council adopted net-metering rules that are similar to rules adopted by the Louisiana Public Service Commission (PSC) in November 2005. The system size limit was further enhanced by SB 359, enacted in June 2008. The City Council's rules require jurisdictional utilities -- namely Entergy New Orleans, an investor-owned utility regulated by the city -- to offer net metering to customers with systems that generate electricity using solar energy, wind energy, hydropower, geothermal or biomass resources. Fuel cells and microturbines that generate electricity entirely derived from eligible renewable resources are also eligible. The City Council's rules apply to residential facilities with a maximum capacity of 25 kilowatts (kW) and commercial and agricultural systems with a maximum capacity of 300 kW. These capacity limits and certain other conditions are specified in Louisiana’s net-metering statute, which applies to all utilities in the state. Utilities must provide customer-generators with a meter capable of measuring the flow of electricity in both directions, or -- if the existing meter is incapable of registering bi-directional electricity flow -- an additional meter or meters capable of registering bi-directional electricity flow. Utilities must pay for the cost of the meter itself, but utilities may assess a “one-time customer charge” to cover the installation costs. The “customer charge” may include the cost of a mandatory accuracy test of the customer's meter or meters, performed by the utility.

Customers must pay for “interconnection costs,” which are defined as “the reasonable costs of connection, switching, metering, transmission, distribution, safety provisions and administrative costs incurred by the [utility] directly related to the installation and maintenance of the physical facilities necessary to permit interconnected operations” with a net-metered system, “to the extent the costs are in excess of the corresponding costs which the [utility] would have incurred if it had not engaged in interconnected operations, but instead generated an equivalent amount of electric energy itself or purchased an equivalent amount of electric energy or capacity from other sources.” In addition, the City Council may authorize the utility to assess a customer “a greater fee or customer charge, of any type,” if the utility's “direct costs of interconnection and administration of net metering outweigh the distribution system, environmental and public policy benefits of allocating the costs among the ... utility’s entire customer base.”

Net excess generation (NEG) is credited at the utility's retail rated and carried over to the customer’s next bill indefinitely. For the final month in which the customer takes service from the utility, the utility will pay the customer for the balance of any credit at the utility’s avoided-cost rate. Customers who wish to net meter must notify the utility at least 90 days prior to the date of interconnection. The utility must develop a standard interconnection agreement approved by the City Council. Systems must meet all safety and performance standards established by local and national electric codes and performance standards, including the NEC, IEEE, UL, NESC and any other relevant codes specified by the City Council. An external disconnect switch is required. For more information, visit: http://www.dsireusa.org/library/includes/incentive2.cfm? Incentive_Code=LA05R&state=LA&CurrentPageID=1&RE=1&EE=1

State: (YES) Legislation enacted in 2003 established net metering in Louisiana. Louisiana's statute, based largely on Arkansas’s statute, requires investor-owned utilities, municipal utilities and electric cooperatives to offer net metering to customers that generate electricity using solar, wind, hydropower, geothermal or biomass resources. Fuel cells and microturbines that generate electricity entirely derived from renewable resources are also eligible. The original legislation establishes that residential systems up to 25 kilowatts (kW) in capacity, and commercial and agricultural systems up to 100 kW, are eligible for net metering. The original legislation also directed the Louisiana Public Service Commission (PSC) to establish rates, terms and conditions for net metering contracts for utilities under its jurisdiction. It should be noted that the Louisiana PSC regulates investor-owned utilities and electric cooperatives; however, it does not regulate municipal-owned utilities, and its rules thereby do not apply to municipal utilities. (Municipal utilities must develop their own programs based on the statute.)

The Louisiana PSC issued rules for net metering and interconnection in November 2005. The PSC’s rules are described below. Utilities must provide customer-generators with a meter capable of measuring the flow of electricity in both directions. Utilities must pay for the cost of the meter itself, but customer-generators must pay a one-time charge to cover the installation cost of the meter. Net excess generation (NEG) is credited to the customer's next bill indefinitely. For the final month in which the customer takes service from the utility, the utility will pay the customer for the balance of any credit at the utility's avoided-cost rate. Customer-generators seeking to net meter must notify the utility at least 90 days prior to the date of interconnection. Utilities must use a PSC- approved standard interconnection agreement for net-metered facilities. Customers must pay for "interconnection costs," which are defined in the PSC's rules.*

By the end of each calendar year, utilities must file with the PSC a report listing all existing net-metered systems and their capacities, and, where applicable, the inverter rating for each facility. Regarding renewable-energy credits (RECs), the PSC will review the feasibility of a REC-trading program as part of the commission’s ongoing renewable portfolio standard (RPS) rulemaking process.

June 30, 2008: U State: In June 2008, Louisiana SB 359 increased the maximum capacity of commercial and agricultural systems to 300 kW. The New Orleans City Council must still formally adopt this change before it becomes effective for customers of Entergy New Orleans. For more information, visit http://dsireusa.org/library/includes/incentive2.cfm? Incentive_Code=LA02R&state=LA&CurrentPageID=1&RE=1&EE=0

Solar Set-Aside in RPS City: (NO)

State: (NO) Public Benefits Fund City: (NO)

State: (NO)

Solar Access Laws City: (NO)

State: (NO)

Solar Mandates in Building Standards City: (NO)

State: (NO)

Expedited Solar System Permitting / Zoning City: (NO)

State: (NO)

Solar in Emergency Preparedness Plan City: (NO)

State: (NO) FINANCIAL INCENTIVES

Direct Incentives City: (NO)

State: (NO)

Low-Interest Loans / Innovative Financing Packages Benchmark: June 30, 2008 City: (NO)

State: (YES)

Home Energy Loan Program - Through the HELP program, administered by the Louisiana Department of Natural Resources, homeowners can get a five-year loan to improve the energy efficiencies of their existing homes. This is accomplished by DNR subsidizing one half of the financing for energy efficiency improvements at a two percent rate to participating lenders, up to a maximum DNR participation of $6,000. Each participating lender sets its own maximum loan amount of participation, along with the interest rate that is charged to the homeowner. A homeowner may qualify for an energy improvement loan in two ways – either through an energy audit in which an Energy Home Rater makes recommendations, or by choosing pre-approved home improvements as designated by the program.

In order to participate, a homeowner must contact one of the two participating lenders directly to complete a credit application. The HELP home improvement loans may be consumer loans or second mortgages at the discretion of the participating lender. For more information, see: http://dsireusa.org/library/includes/incentive2.cfm?Incentive_Code=LA06F&state=LA&CurrentPageID=1&RE=1&EE=0.

Income/Investment Tax Credits Benchmark: June 30, 2008 City: (NO)

State: (YES) Tax Credit for Solar and Wind Energy Systems on Residential Property (Personal and Corporate) - Louisiana provides a tax credit for the purchase and installation of solar and wind energy systems purchased and installed on or after January 1, 2008. In September 2007 the Louisiana Department of Revenue issued an Emergency Rule provide clarification until final rules can be issued. The credit may be applied to personal, corporate or franchise taxes, depending on the entity which owns the property, but the system must be installed at either a residence or a residential rental apartment complex to be eligible. The tax credit may be applied both to solar-electric systems (PV systems) and solar-thermal systems, when the energy is used for space heating, space cooling or water heating. The amount of the credit is equal to 50% of the first $25,000 of the cost of the system, including installation costs (unless the taxpayer is installing the system). The credit must be fully claimed in the taxable year in which the system is installed and placed in service. Any excess credit which exceeds the taxpayer's liabilities for that year shall be treated as an overpayment, and the Louisiana Department of Revenue will issue a refund for the remaining amount within one year of receiving the claim.

For PV, the tax credit applies to AC or DC generation systems which are grid-connected net metered systems (with or without battery backup) or stand alone systems. Eligible wind energy systems include AC or DC electric generation and mechanical wind systems. Solar thermal systems include those used for solar hot water, heating and cooling thermal energy and pool heating. Electrical equipment must be UL certified and installed in compliance with all applicable building and electrical codes. Solar thermal equipment must be SRCC certified and installed in compliance with all applicable building and plumbing codes. Installations must be performed by a licensed contractor, the owner of the residence, or by a person who has received certification by a technical college in the installation of such systems. In order to claim a tax credit for a wind or solar energy system all components must be installed at the same time as the system. This tax credit may be combined with any federal tax incentive, but it may not be combined with any other state tax incentive. Whenever additional incentives such as cash rebates, prizes or gift certificates are offered in addition to the tax credit, the eligible cost must be reduced by the value of the incentive received.

Personal: http://dsireusa.org/library/includes/incentive2.cfm?Incentive_Code=LA11F&state=LA&CurrentPageID=1&RE=1&EE=0

Corporate: http://www.dsireusa.org/library/includes/incentive2.cfm?Incentive_Code=LA12F&state=LA&CurrentPageID=1&RE=1&EE=1

Property Tax Incentives Benchmark: June 30, 2008 City: (NO)

State: (YES) Solar Energy System Exemption - In Louisiana, any equipment attached to an owner-occupied residential building or swimming pool as part of a solar energy system is considered personal property that is exempt from ad valorem taxation. The value of a solar energy system will not be included in the assessment of such buildings or swimming pools.

A solar energy system is defined as "any device that uses the heat of the sun as its primary energy source and is used to heat or cool the interior of a structure or swimming pool, or to heat water for use within a structure or swimming pool." Solar energy systems include but are not limited to systems utilizing solar collectors, solar cells and passive roof ponds. http://dsireusa.org/library/includes/incentive2.cfm?Incentive_Code=LA01F&state=LA&CurrentPageID=1&RE=1&EE=0

Sales Tax Incentives City: (NO)

State: (NO)

Permit Fee Discounts/Waivers City: (NO)

State: (NO)

Property Tax Assessment financing City: (NO)

State: (NO)

Industry Development Incentives City: (NO)

State: (NO) UTILITY PROGRAMS

None

OTHER NOTABLE CITY PROGRAMS

None