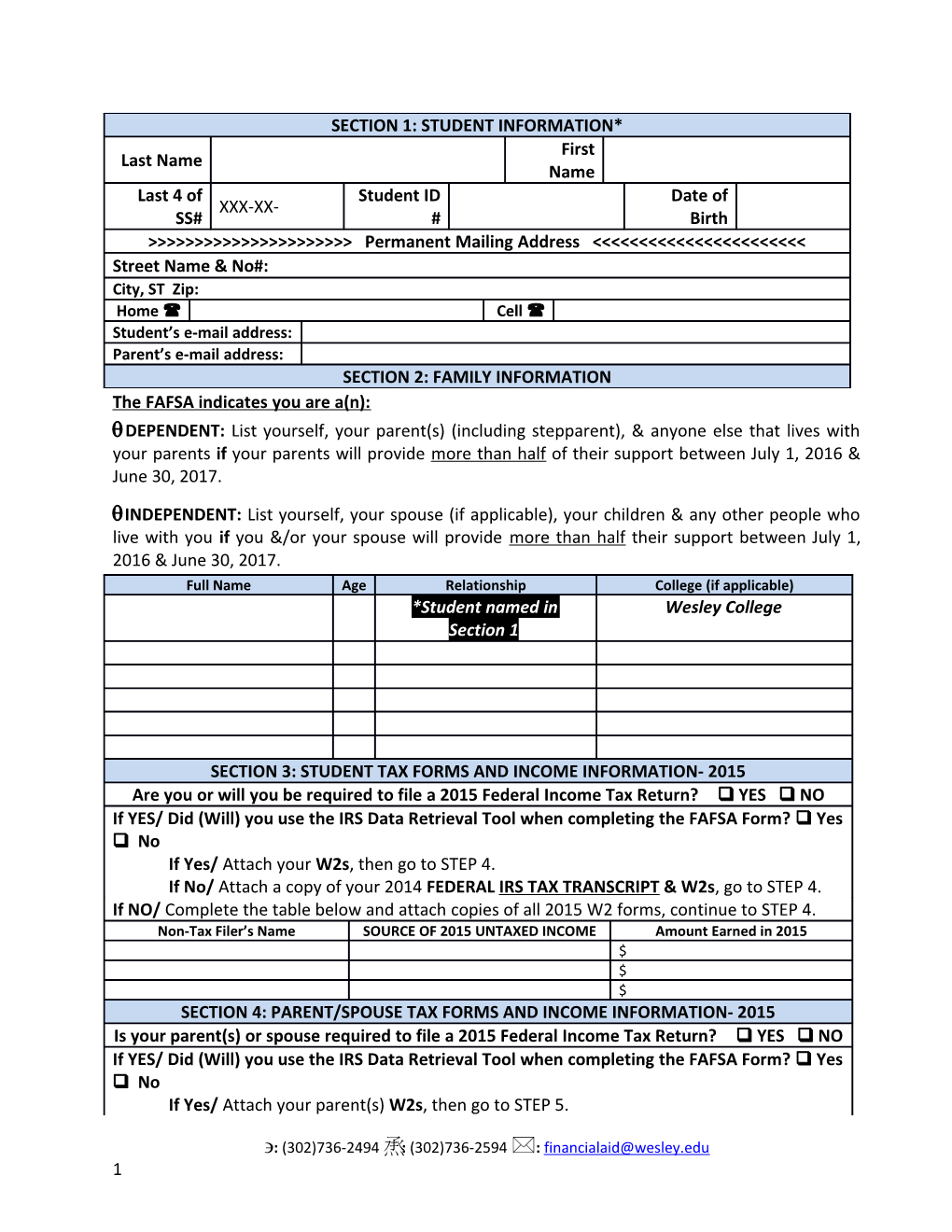

SECTION 1: STUDENT INFORMATION* First Last Name Name Last 4 of Student ID Date of XXX-XX- SS# # Birth >>>>>>>>>>>>>>>>>>>>>> Permanent Mailing Address <<<<<<<<<<<<<<<<<<<<<<< Street Name & No#: City, ST Zip: Home Cell Student’s e-mail address: Parent’s e-mail address: SECTION 2: FAMILY INFORMATION The FAFSA indicates you are a(n): DEPENDENT: List yourself, your parent(s) (including stepparent), & anyone else that lives with your parents if your parents will provide more than half of their support between July 1, 2016 & June 30, 2017.

INDEPENDENT: List yourself, your spouse (if applicable), your children & any other people who live with you if you &/or your spouse will provide more than half their support between July 1, 2016 & June 30, 2017. Full Name Age Relationship College (if applicable) *Student named in Wesley College Section 1

SECTION 3: STUDENT TAX FORMS AND INCOME INFORMATION- 2015 Are you or will you be required to file a 2015 Federal Income Tax Return? YES NO If YES/ Did (Will) you use the IRS Data Retrieval Tool when completing the FAFSA Form? Yes No If Yes/ Attach your W2s, then go to STEP 4. If No/ Attach a copy of your 2014 FEDERAL IRS TAX TRANSCRIPT & W2s, go to STEP 4. If NO/ Complete the table below and attach copies of all 2015 W2 forms, continue to STEP 4. Non-Tax Filer’s Name SOURCE OF 2015 UNTAXED INCOME Amount Earned in 2015 $ $ $ SECTION 4: PARENT/SPOUSE TAX FORMS AND INCOME INFORMATION- 2015 Is your parent(s) or spouse required to file a 2015 Federal Income Tax Return? YES NO If YES/ Did (Will) you use the IRS Data Retrieval Tool when completing the FAFSA Form? Yes No If Yes/ Attach your parent(s) W2s, then go to STEP 5.

: (302)736-2494 : (302)736-2594 : [email protected] 1 If No/ Attach a copy of your parent 2015 FEDERAL IRS TAX TRANSCRIPT & W2s, go to STEP 5. If NO/ Complete the table below and attach copies of all 2015 W2 forms, continue to STEP 5. Non-Tax Filer’s Name SOURCE OF 2015 UNTAXED INCOME Amount Earned in 2015 $ $ Section 5: FOOD STAMPS (Supplemental Nutrition Assistance Program) In 2015 &/or 2016, did you, your parents or anyone in your parents’ home receive Supplemental Nutrition Assistance Program (SNAP)/Food Stamps? Yes No

SECTION 6: 2015 CHILD SUPPORT PAID Complete this section ONLY IF you, your spouse (if married) or parents (if dependent) PAID child support in 2015. Please provide the following information below (use an extra sheet if necessary). Individual paying child Amount Name of the child (children) Child support recipient support paid for whom support was paid

SECTION 7: 2015 UNTAXED INCOME List any untaxed income for ANY household member. If an item does not apply enter “0” in the appropriate space Student/ 2015 Untaxed Income Parent Spouse Payments to tax-deferred pension & retirement savings: (direct or withheld from wages) to tax-deferred pension & retirement savings plans (ie. 40i(k) or 403 (b) plans) $ $ including, but not limited to, amounts on W-2s in Boxes 12a-12d, coded D, E, F, G, H &/or S (double letters may be omitted, ie. DD, AA, etc.). Child Support Received: List actual amounts of child support received in 2015 for any $ children in the home. Don’t include: foster care, adoption payments or any $ amounts that were court-ordered but NOT paid. Housing, Food & other living allowances paid to military, clergy etal: include cash $ payments &/or the cash value of benefits received Don’t include: the value of on- $ base housing or basic military housing allowance. Veteran’s non-education benefits: List total amounts of VA non-education benefits $ received in 2015 include Disability, Death Pension or Dependency & Indemnity $ Compensation (DIC) and/or VA Educational Work-Study allowances. Other Untaxed Income: List the amounts of other untaxed income not reported & not excluded elsewhere on this form. Include untaxed income such as workers’ compensation, disability, Black Lung Benefits, untaxed portions of health savings accts from IRS Form 1040 line 25, Railroad Retirement Benefits etc. Don’t include: any items reported or excluded from the 4 other options listed above. ALSO OMIT $ $ student aid, Earned Income Credit, Additional Child Tax Credit, Temporary Assistance to Needy Families (TANF), Untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, benefits from flexible spending arraignments (e.g., cafeteria plans), foreign income exclusion or credit for federal tax on special fuels. Money received or paid on the student’s behalf: if anyone helps the student or $ parent(s) by paying or helping to pay bills or expenses please list the total yearly $ amount.

: (302)736-2494 : (302)736-2594 : [email protected] 2 SECTION 8: SIGN THIS WORKSHEET By signing this worksheet, I (we) certify that all the information reported on it is complete and correct. If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both.

Dependent Students: at least ONE parent must sign. / Independent Students: Spouse’s Signature is Optional

Student Signature ______Date ______

Parent Signature ______Date ______

: (302)736-2494 : (302)736-2594 : [email protected] 3