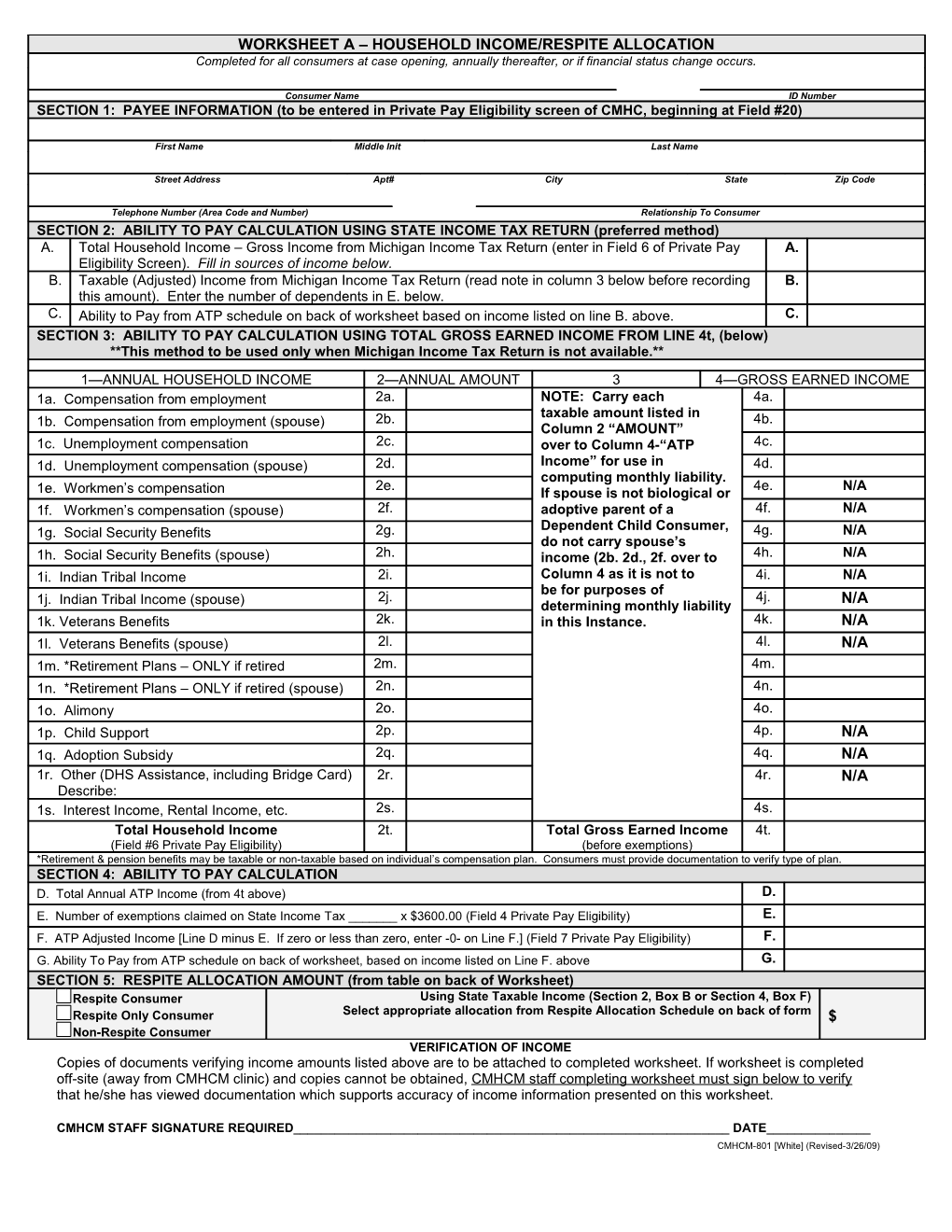

WORKSHEET A – HOUSEHOLD INCOME/RESPITE ALLOCATION Completed for all consumers at case opening, annually thereafter, or if financial status change occurs.

Consumer Name ID Number SECTION 1: PAYEE INFORMATION (to be entered in Private Pay Eligibility screen of CMHC, beginning at Field #20)

First Name Middle Init Last Name

Street Address Apt# City State Zip Code

Telephone Number (Area Code and Number) Relationship To Consumer SECTION 2: ABILITY TO PAY CALCULATION USING STATE INCOME TAX RETURN (preferred method) A. Total Household Income – Gross Income from Michigan Income Tax Return (enter in Field 6 of Private Pay A. Eligibility Screen). Fill in sources of income below. B. Taxable (Adjusted) Income from Michigan Income Tax Return (read note in column 3 below before recording B. this amount). Enter the number of dependents in E. below. C. Ability to Pay from ATP schedule on back of worksheet based on income listed on line B. above. C. SECTION 3: ABILITY TO PAY CALCULATION USING TOTAL GROSS EARNED INCOME FROM LINE 4t, (below) **This method to be used only when Michigan Income Tax Return is not available.**

1—ANNUAL HOUSEHOLD INCOME 2—ANNUAL AMOUNT 3 4—GROSS EARNED INCOME 1a. Compensation from employment 2a. NOTE: Carry each 4a. taxable amount listed in 1b. Compensation from employment (spouse) 2b. 4b. Column 2 “AMOUNT” 1c. Unemployment compensation 2c. over to Column 4-“ATP 4c. 1d. Unemployment compensation (spouse) 2d. Income” for use in 4d. computing monthly liability. 2e. 4e. N/A 1e. Workmen’s compensation If spouse is not biological or 1f. Workmen’s compensation (spouse) 2f. adoptive parent of a 4f. N/A Dependent Child Consumer, 1g. Social Security Benefits 2g. 4g. N/A do not carry spouse’s 1h. Social Security Benefits (spouse) 2h. income (2b. 2d., 2f. over to 4h. N/A 1i. Indian Tribal Income 2i. Column 4 as it is not to 4i. N/A be for purposes of 2j. 4j. N/A 1j. Indian Tribal Income (spouse) determining monthly liability 1k. Veterans Benefits 2k. in this Instance. 4k. N/A 1l. Veterans Benefits (spouse) 2l. 4l. N/A 1m. *Retirement Plans – ONLY if retired 2m. 4m. 1n. *Retirement Plans – ONLY if retired (spouse) 2n. 4n. 1o. Alimony 2o. 4o. 1p. Child Support 2p. 4p. N/A 1q. Adoption Subsidy 2q. 4q. N/A 1r. Other (DHS Assistance, including Bridge Card) 2r. 4r. N/A Describe: 1s. Interest Income, Rental Income, etc. 2s. 4s. Total Household Income 2t. Total Gross Earned Income 4t. (Field #6 Private Pay Eligibility) (before exemptions) *Retirement & pension benefits may be taxable or non-taxable based on individual’s compensation plan. Consumers must provide documentation to verify type of plan. SECTION 4: ABILITY TO PAY CALCULATION D. Total Annual ATP Income (from 4t above) D. E. Number of exemptions claimed on State Income Tax ______x $3600.00 (Field 4 Private Pay Eligibility) E. F. ATP Adjusted Income [Line D minus E. If zero or less than zero, enter -0- on Line F.] (Field 7 Private Pay Eligibility) F. G. Ability To Pay from ATP schedule on back of worksheet, based on income listed on Line F. above G. SECTION 5: RESPITE ALLOCATION AMOUNT (from table on back of Worksheet) Respite Consumer Using State Taxable Income (Section 2, Box B or Section 4, Box F) Respite Only Consumer Select appropriate allocation from Respite Allocation Schedule on back of form $ Non-Respite Consumer VERIFICATION OF INCOME Copies of documents verifying income amounts listed above are to be attached to completed worksheet. If worksheet is completed off-site (away from CMHCM clinic) and copies cannot be obtained, CMHCM staff completing worksheet must sign below to verify that he/she has viewed documentation which supports accuracy of income information presented on this worksheet.

CMHCM STAFF SIGNATURE REQUIRED______DATE______CMHCM-801 [White] (Revised-3/26/09)

FINANCIAL LIABILITY SCALE FOR CLINICAL SERVICES

STATE TAXABLE ABILITY-TO-PAY STATE TAXABLE ABILITY-TO-PAY (ADJUSTED) INCOME MONTHLY (ADJUSTED) INCOME MONTHLY $ 10,000 TO $ 11,000 $11 $ 30,001 TO $ 31,000 $225 $ 11,001 TO $ 12,000 $ 14 $ 31,001 TO $ 32,000 $244 $ 12,001 TO $ 13,000 $ 18 $ 32,001 TO $ 33,000 $ 264 $ 13,001 TO $ 14,000 $ 22 $ 33,001 TO $ 34,000 $ 284 $ 14,001 TO $ 15,000 $ 27 $ 34,001 TO $ 35,000 $ 304 $ 15,001 TO $ 16,000 $ 32 $ 35,001 TO $ 36,000 $ 324 $ 16,001 TO $ 17,000 $ 38 $ 36,001 TO $ 37,000 $ 344 $ 17,001 TO $ 18,000 $ 45 $ 37,001 TO $ 38,000 $ 364 $ 18, 001 TO $ 19,000 $ 53 $ 38,001 TO $ 39,000 $ 384 $ 19,001 TO $ 20,000 $ 62 $ 39,001 TO $ 40,000 $ 405 $ 20,001 TO $ 21,000 $ 72 $ 40,001 TO $ 41,000 $ 426 $ 21,001 TO $ 22,000 $ 83 $ 41,001 TO $ 42,000 $ 447 $ 22,001 TO $ 23,000 $ 95 $ 42,001 TO $ 43,000 $ 468 $ 23,001 TO $ 24,000 $ 108 $ 43,001 TO $ 44,000 $ 489 $ 24,001 TO $ 25,000 $ 122 $ 44,001 TO $ 45,000 $ 510 $ 25,001 TO $ 26,000 $ 137 $ 45,001 TO $ 46,000 $ 531 $ 26,001 TO $ 27,000 $ 153 $ 46,001 TO $ 47,000 $ 552 $ 27,001 TO $ 28,000 $ 170 $ 47,001 TO $ 48,000 $ 573 $ 28,001 TO $ 29,000 $ 188 $ 48,001 TO $ 49,000 $ 594 $ 29,001 TO $ 30,000 $ 206 $ 49,001 TO $ 50,000 $ 615

FOR STATE TAXABLE INCOME OVER $50,000 ABILITY TO PAY SHALL BE .15 OF THAT INCOME

RESPITE ALLOCATIONS BASED ON INCOME AND MEDICAID ELIGIBILITY Suggested Maximum STATE TAXABLE (ADJUSTED) INCOME ANNUAL RESPITE ALLOCATION $12,500 … or Medicaid Eligibility $1000 $12,501 TO $15,000 $990 $15,001 TO $20,000 $980 $20,001 TO $23,000 $970 $23,001 TO $27,000 $960 $27,001 TO $30,000 $950 $30,001 TO $35,000 $940 $35,001 TO $45,000 $930 $45,001 TO $55,000 $920 $55,001 TO $65,000 $910 $65,001 TO $75,000 $900 $75,001 TO $85,000 $880 $85,001 TO $100,000 $860

Annual Respite Allocation may be increased regardless of the consumer/family’s income Based on Medical Necessity of the consumer and documented in the Person Centered Plan Supervisor’s signature is required. Program Director’s signature is required if over $1,000.

Supervisor’s Signature:______Amount:______Date:______

Program Director’s Signature:______Amount:______Date:______