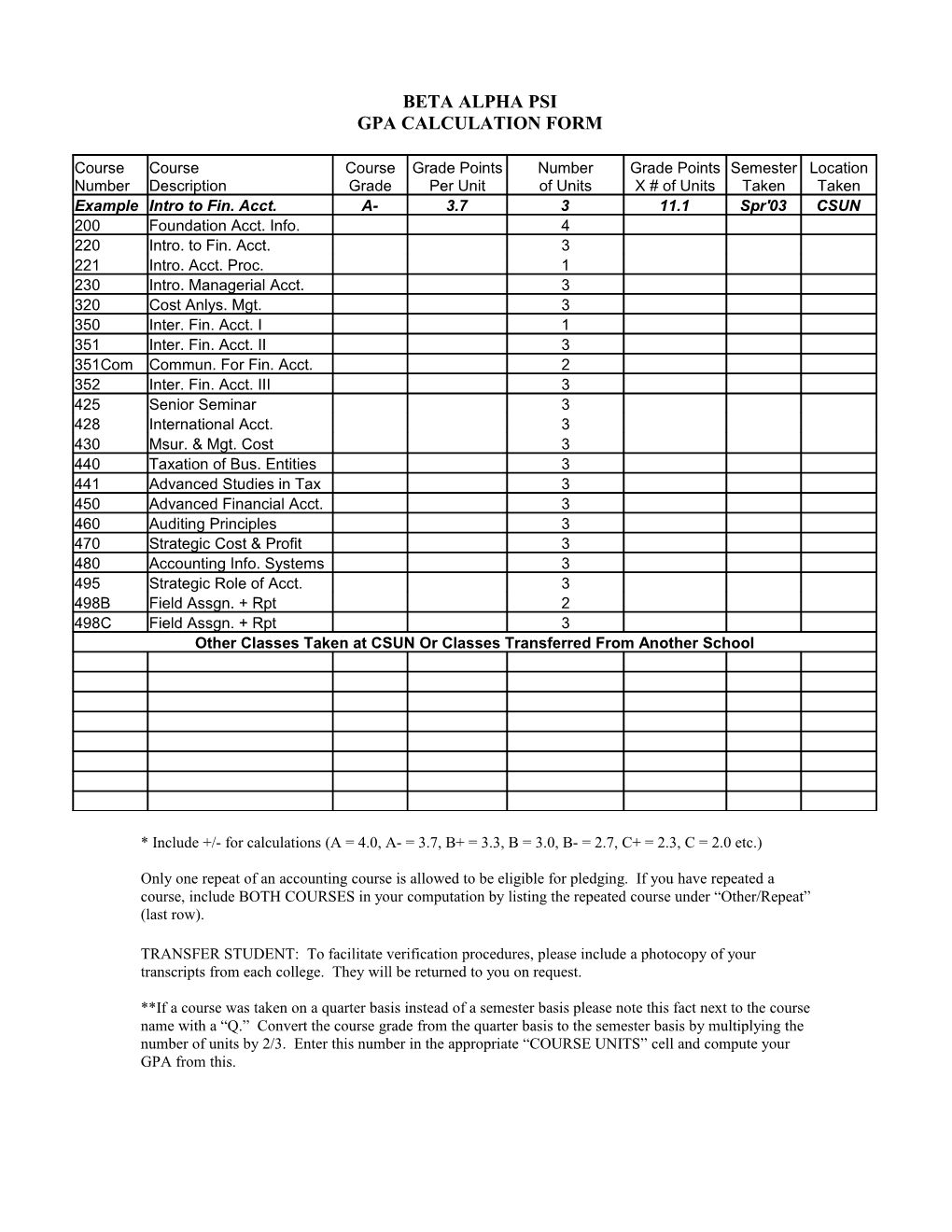

BETA ALPHA PSI GPA CALCULATION FORM

Course Course Course Grade Points Number Grade Points Semester Location Number Description Grade Per Unit of Units X # of Units Taken Taken Example Intro to Fin. Acct. A- 3.7 3 11.1 Spr'03 CSUN 200 Foundation Acct. Info. 4 220 Intro. to Fin. Acct. 3 221 Intro. Acct. Proc. 1 230 Intro. Managerial Acct. 3 320 Cost Anlys. Mgt. 3 350 Inter. Fin. Acct. I 1 351 Inter. Fin. Acct. II 3 351Com Commun. For Fin. Acct. 2 352 Inter. Fin. Acct. III 3 425 Senior Seminar 3 428 International Acct. 3 430 Msur. & Mgt. Cost 3 440 Taxation of Bus. Entities 3 441 Advanced Studies in Tax 3 450 Advanced Financial Acct. 3 460 Auditing Principles 3 470 Strategic Cost & Profit 3 480 Accounting Info. Systems 3 495 Strategic Role of Acct. 3 498B Field Assgn. + Rpt 2 498C Field Assgn. + Rpt 3 Other Classes Taken at CSUN Or Classes Transferred From Another School

* Include +/- for calculations (A = 4.0, A- = 3.7, B+ = 3.3, B = 3.0, B- = 2.7, C+ = 2.3, C = 2.0 etc.)

Only one repeat of an accounting course is allowed to be eligible for pledging. If you have repeated a course, include BOTH COURSES in your computation by listing the repeated course under “Other/Repeat” (last row).

TRANSFER STUDENT: To facilitate verification procedures, please include a photocopy of your transcripts from each college. They will be returned to you on request.

**If a course was taken on a quarter basis instead of a semester basis please note this fact next to the course name with a “Q.” Convert the course grade from the quarter basis to the semester basis by multiplying the number of units by 2/3. Enter this number in the appropriate “COURSE UNITS” cell and compute your GPA from this.