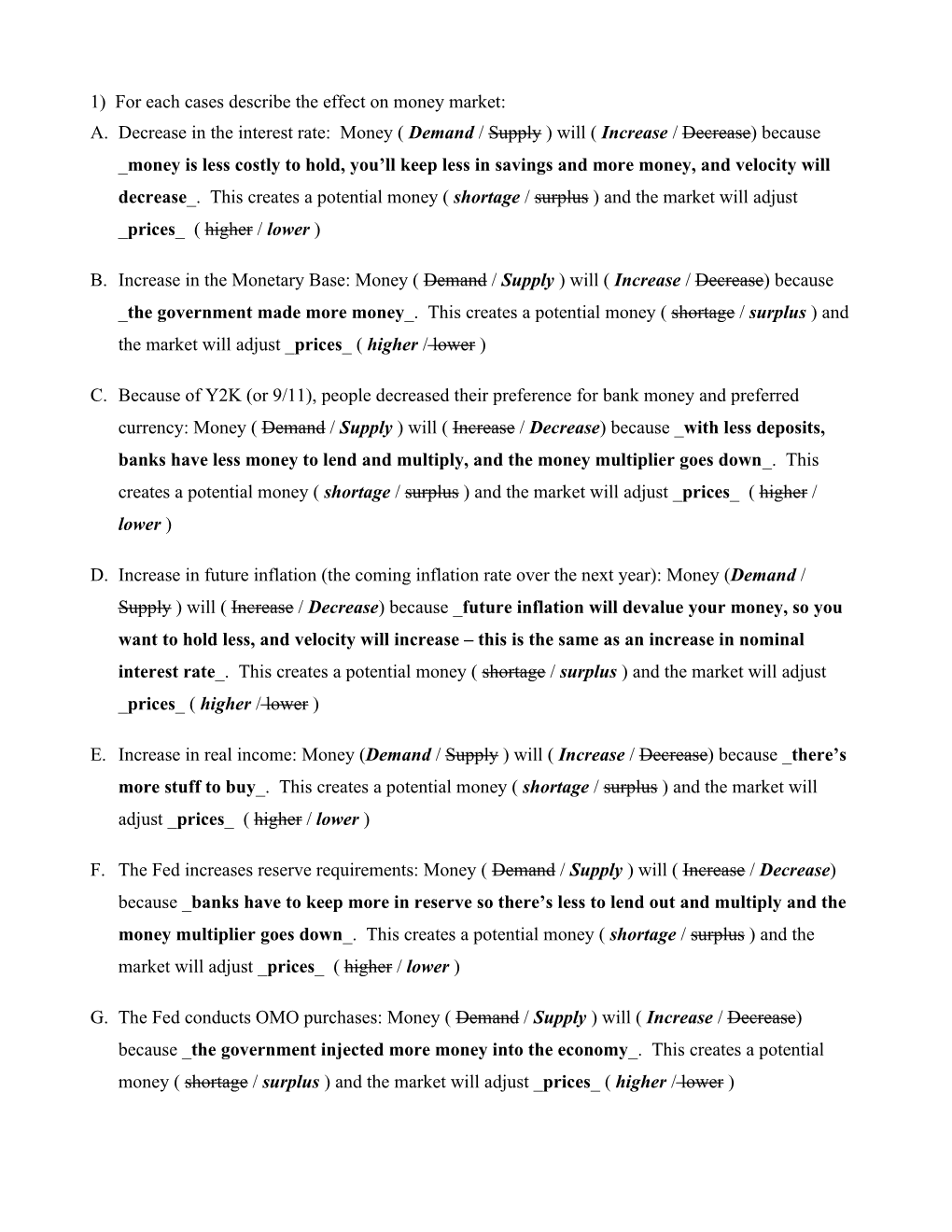

1) For each cases describe the effect on money market: A. Decrease in the interest rate: Money ( Demand / Supply ) will ( Increase / Decrease) because _money is less costly to hold, you’ll keep less in savings and more money, and velocity will decrease_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower )

B. Increase in the Monetary Base: Money ( Demand / Supply ) will ( Increase / Decrease) because _the government made more money_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower )

C. Because of Y2K (or 9/11), people decreased their preference for bank money and preferred currency: Money ( Demand / Supply ) will ( Increase / Decrease) because _with less deposits, banks have less money to lend and multiply, and the money multiplier goes down_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower )

D. Increase in future inflation (the coming inflation rate over the next year): Money (Demand / Supply ) will ( Increase / Decrease) because _future inflation will devalue your money, so you want to hold less, and velocity will increase – this is the same as an increase in nominal interest rate_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower )

E. Increase in real income: Money (Demand / Supply ) will ( Increase / Decrease) because _there’s more stuff to buy_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower )

F. The Fed increases reserve requirements: Money ( Demand / Supply ) will ( Increase / Decrease) because _banks have to keep more in reserve so there’s less to lend out and multiply and the money multiplier goes down_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower )

G. The Fed conducts OMO purchases: Money ( Demand / Supply ) will ( Increase / Decrease) because _the government injected more money into the economy_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower ) H. The government changes the currency, replacing 1 new bill for every old 1000 bills: Money ( Demand / Supply ) will ( Increase / Decrease – by a factor of 1000 ) because _the government decreased the monetary base by changing the money_. This creates a potential money ( shortage / surplus ) and the market will adjust _prices_ ( higher / lower – by a factor of 1000 ) 2) List all of the factors that would cause an increase in money demand: Increase in Income Decrease in Velocity, which would be caused by: Decrease in the nominal interest rate (lower real rate or lower inflation rate) Increase in the cost of banking

3) List all of the factors that would cause an increase in the money supply: Increase in Monetary Base which the Fed could cause by: More OMO purchases Lowering the Discount Rate Increase in the Money Multiplier which would be caused by: Decrease in reserves (either required or excess) Increase in preference for checking as opposed to currency

4) List all of the reasons the price level would rise A money surplus caused by: An increase in the Money Supply Increase in Monetary Base which the Fed could cause by: More OMO purchases Lowering the Discount Rate Increase in the Money Multiplier which would be caused by: Decrease in reserves (either required or excess) Increase in preference for checking as opposed to currency A decrease in Money Demand Decrease in Income Increase in Velocity, which would be caused by: Increase in the nominal interest rate (lower real rate or lower inflation rate) Decrease in the cost of banking

5) List all of the reasons the price level would fall See #4, reverse