Using the Paycheck Calculator

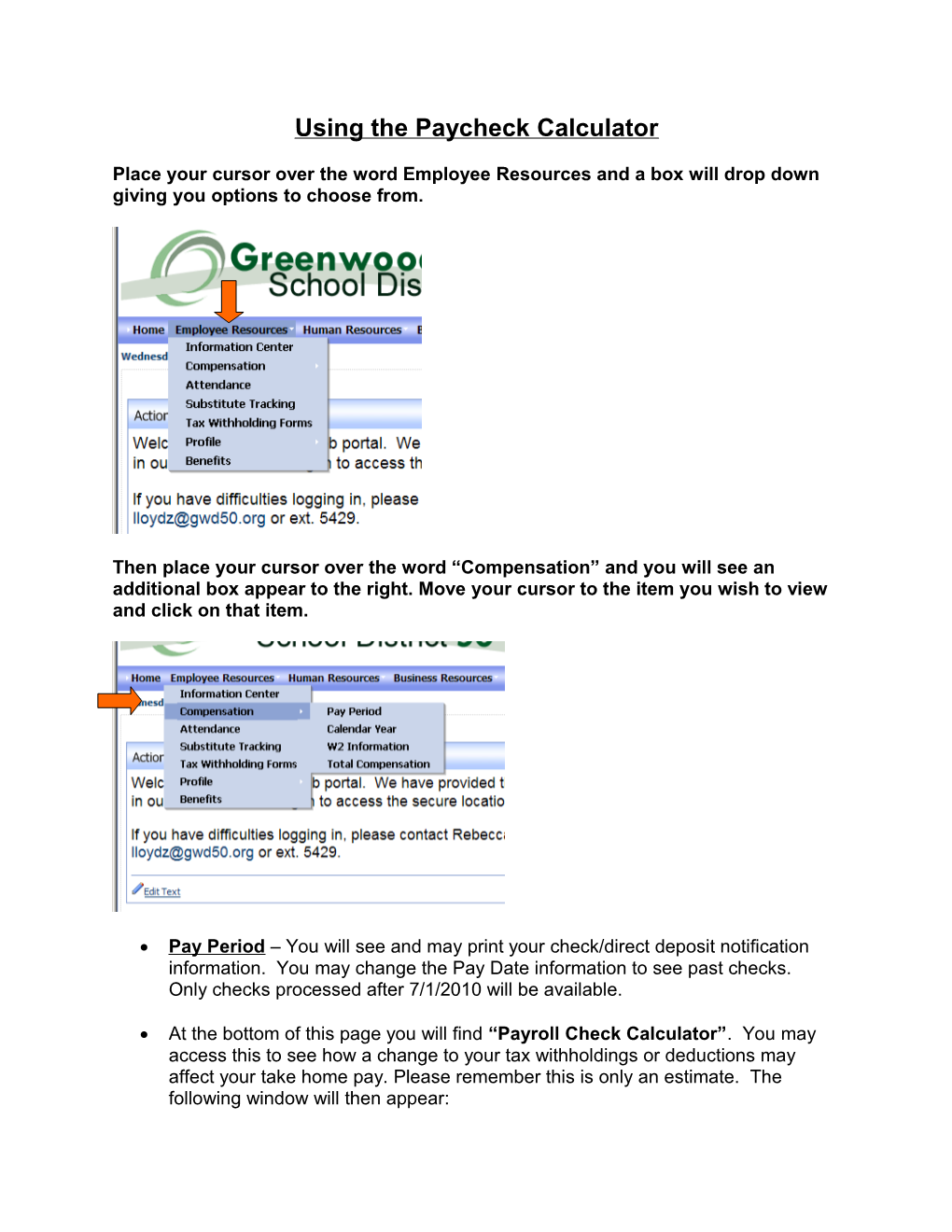

Place your cursor over the word Employee Resources and a box will drop down giving you options to choose from.

Then place your cursor over the word “Compensation” and you will see an additional box appear to the right. Move your cursor to the item you wish to view and click on that item.

Pay Period – You will see and may print your check/direct deposit notification information. You may change the Pay Date information to see past checks. Only checks processed after 7/1/2010 will be available.

At the bottom of this page you will find “Payroll Check Calculator”. You may access this to see how a change to your tax withholdings or deductions may affect your take home pay. Please remember this is only an estimate. The following window will then appear: Click the Submit button to proceed and you will see a new window appear with your salary information and deductions listed. You can change any of the information in that window and tell the system to recalculate to obtain an estimate of your new net pay.

Example I: Let’s say I earn $1500 per month, I claim Married and zero exemptions on my State and Federal Taxes:

I also have SCRS (retirement) come out of my check: If I click the “calculate” button, I will see the following information which shows my net pay:

Example II: Now let’s pretend that I get hired on full-time and I want to see what my check would look like with health and dental insurance coming out (you must know the cost of these deductions…they are also online). I will add in health insurance for me which is $93.46 and Dental Plus which is $20.60. Both of these deductions are Pre-tax, so I need to make sure I indicate that! I can click calculate now and see what my check would be if I elected insurance:

If you are not sure what deductions cost, you may visit the Employee Insurance Program website at: http://www.eip.sc.gov/category/index.aspx?cat=1&p=3

To determine what deductions are exempt from taxes, please contact the payroll department at 941-5401 or 941-5408.