Principles of Macroeconomics

Solutions to Sample Final Examination (Based on material in Chapters 5-17)

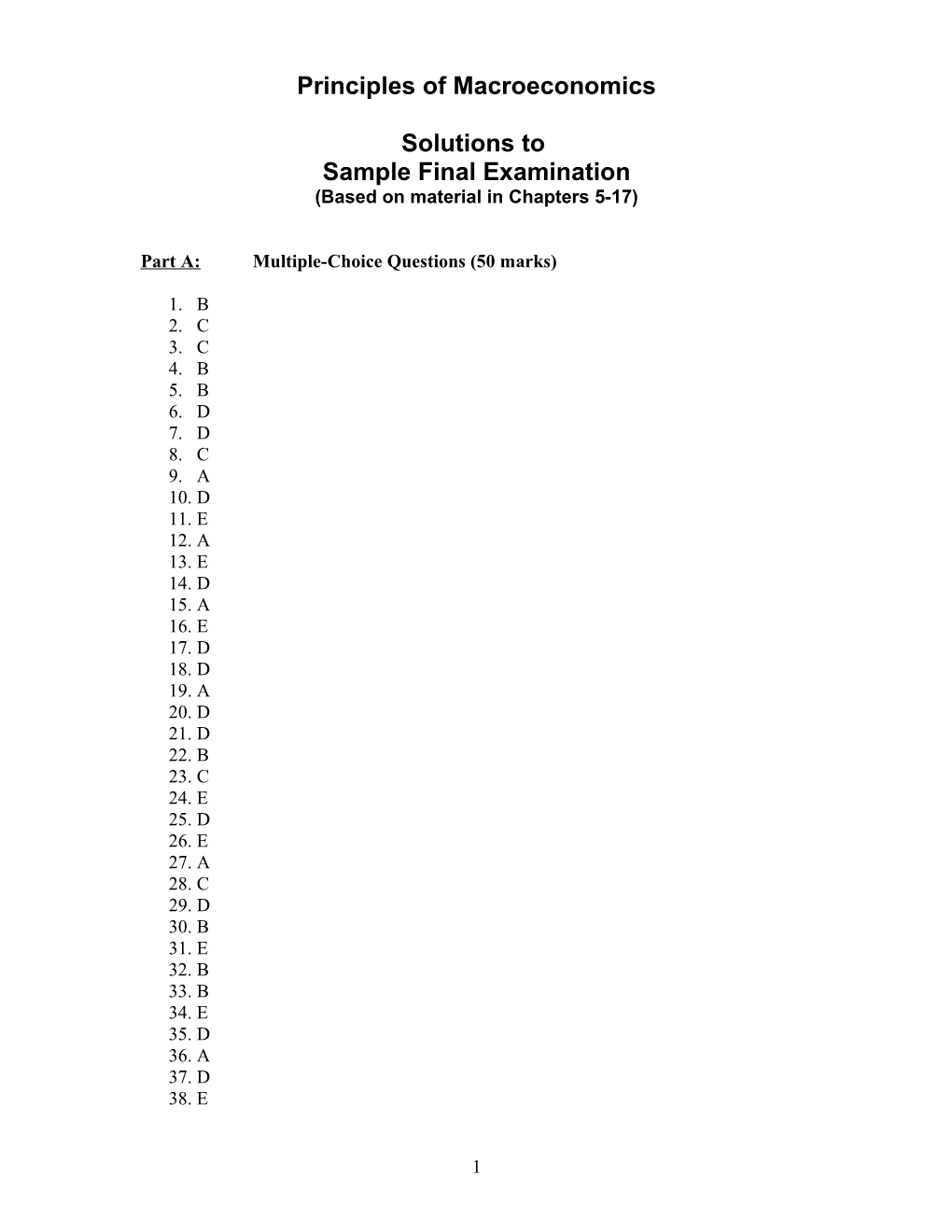

Part A: Multiple-Choice Questions (50 marks)

1. B 2. C 3. C 4. B 5. B 6. D 7. D 8. C 9. A 10. D 11. E 12. A 13. E 14. D 15. A 16. E 17. D 18. D 19. A 20. D 21. D 22. B 23. C 24. E 25. D 26. E 27. A 28. C 29. D 30. B 31. E 32. B 33. B 34. E 35. D 36. A 37. D 38. E

1 39. C 40. B 41. C 42. B 43. D 44. E 45. C 46. A 47. D 48. D 49. E 50. C

Part B: Short-Answer Questions (50 Marks)

1. A. AD = $ 570 billion + 0.80Y. Using the given information, substitute into the equation the numerical values for each component of aggregate demand. Y= $300 billion + 0.80 (Y – $ 150 billion) + $ 150 billion + $ 200 billion + $ 40 billion. Or after simplifying that equation yields the equation AD = $ 570 billion + 0.80Y.

B. Y = $ 2850 billion. The definition of short-run equilibrium output implies that Y = AD. Replacing AD with the AD equation yields Y = $ 570 billion + 0.80Y. Now solve for Y in Y – 0.80 Y = $ 570 billion, or Y = $ 2850 billion.

C. $ 2350 billion. If government purchases decrease by $100 billion the new short-run equilibrium output will equal $ 2350 billion. Equilibrium Y decreases by 5x $100 billion = $ 500 billion decrease.

D. $ 2450 billion. If the government decreased transfer payments by $100 billion, the new short-run equilibrium output would equal $ 2450 billion. The change in Y is = 5x[0.8x($100 billion)] = 5 x $ 80 billion = $ 400 billion.

E. Greater.

2. A. See table below.

Real GDP per Ave. Real GDP per Ave. Share of the Capita Annual Employed Person Annual Population Country (US$) Growth (US$) Growth Employed (%) (%) (%) 1998 1988 1988-98 1998 1988 1988-98 1998 1988 Canada 25,496 22,429 1.29 53,702 46,605 1.43 47.5 48.1 Japan 24,170 19,347 2.25 47,232 42,171 1.14 51.0 45.8 Korea 14,574 8,040 6.13 33,844 20,033 5.38 43.1 40.1 U.S.A. 32,413 26,649 1.98 65,885 55,727 1.69 49.2 47.8

2 B. Korea; real GDP per capita.

C. U.S.A.; real GDP per employed person.

D. The growth in real GDP per employed person of 1.43% a year reflects growth in average labour productivity. As the share of population employed can approximately be treated as constant over the years, the productivity growth can be attributed to technological progress and capital accumulation.

E. No, because Canada’s growth rate of 1.29% a year is lower than the 1.98% of the USA. Based on compounding, Canada’s real GDP per capita is approximately US$29,735 in 2010, i.e., US$25,496 x (1+ 0.0129)12 ,whereas that of the USA is about US$41,809, i.e., US$32,413 x (1+ 0.0198)12.

F. Yes, because Korea’s growth rate of 6.13% a year is higher than the 1.29% of Canada. Based on compounding, Korea’s real GDP per capita is approximately US$29,755 in 2010, i.e., US$14,574 x (1+ 0.0613)12 , slightly higher than or about the same as Canada’s US$29,735.

3. A. Substituting r =0.05 into the components and adding up to get AD = $750 billion + . 75(Y – $400 billion) – $300 billion (.05) + $400 billion – $600 billion (.05) + $550 billion + –$55 billion. Or AD =1,300 billion + 0.75Y.

B. The short run equilibrium output is $5,200 billion (i.e., Y = $1,300 billion + .75 Y, or .25Y = $1,300 billion, thus Y = $1,300 billion/.25).

C. Expansionary or inflationary gap; $150 billion (output gap = Y - Y* = $ (5,200 – 5,050) billion).

D. Contractionary

E. Increase; 9.167%. ($5,050 billion = $1,345 billion + .75($5,050 billion) – 900r, or $5,050 billion = $1,345 billion + $3,787.5 billion – 900r. Combining the constant values gives us –$82.5 billion = – 900r, or r = 0.09167).

4. A.

3 Inflation rate (%) LRAS

6

5

4 SRAS 3

2

1 AD

0 3500 3550 3600 3650 3700 3750 3800 Aggregate Demand ($ billion)

B. 3,550

C. recessionary; 100

D. Decrease

E. SRAS; downward

F. long-run; 3,650

5. A. The nominal exchange rate is defined as either the number of Canadian dollars needed to purchase one unit of the foreign currency or the amount of foreign currency needed to purchase one Canadian dollar.

B.

Nominal Exchange Rates for the Canadian Dollar (April 2, 2002) Country Foreign currency / Canadian Canadian Dollars / foreign dollar currency Britain (Pound) 0.4339 2.3046 US (Dollar) 0.6252 1.5994 Europe (Euro) 0.7099 1.4087 Switzerland (Franc) 1.038 0.9632 Japan (Yen) 83.33 0.012 Mexico (N Peso) 5.63 0.1775

4 C. The real exchange rate (for the automobile) equaled 1.1156 (round your answer to the nearest hundredth). [48000 x 0.6252 / 26,900 = 1.1156].

D. More; Canadian.

6. A. Consumption = 290 (i.e., by substituting P = 50 into the demand function); domestic production = 170 (i.e., by substituting P = 50 into the supply function), and Sunland would import 120 cellular phones, i.e., (290-170).

B. Decrease consumption by 8; Increase domestic production by 8; and decrease imports by 16. After the imposition of the tariff, consumption = 282 (i.e., by substituting P = 70 into the demand function); domestic production = 178 (i.e., by substituting P = 70 into the supply function), and Sunland would import 104 cellular phones, i.e., (282- 178).

C. The Sunland government would receive $2080 from the tariff. [104 units x $20].

5