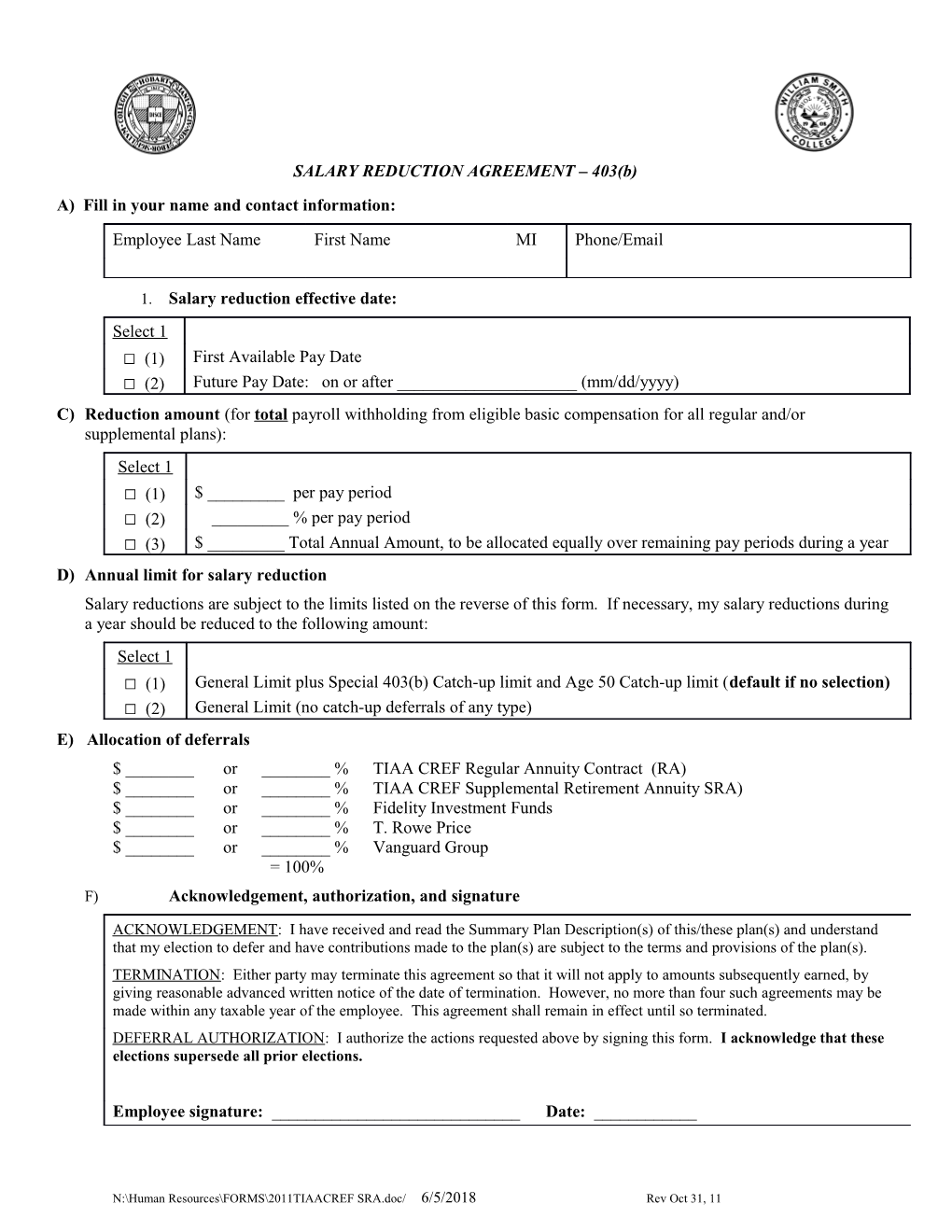

SALARY REDUCTION AGREEMENT – 403(b) A) Fill in your name and contact information:

Employee Last Name First Name MI Phone/Email

1. Salary reduction effective date: Select 1 □ (1) First Available Pay Date □ (2) Future Pay Date: on or after ______(mm/dd/yyyy) C) Reduction amount (for total payroll withholding from eligible basic compensation for all regular and/or supplemental plans): Select 1 □ (1) $ ______per pay period □ (2) ______% per pay period □ (3) $ ______Total Annual Amount, to be allocated equally over remaining pay periods during a year D) Annual limit for salary reduction Salary reductions are subject to the limits listed on the reverse of this form. If necessary, my salary reductions during a year should be reduced to the following amount: Select 1 □ (1) General Limit plus Special 403(b) Catch-up limit and Age 50 Catch-up limit (default if no selection) □ (2) General Limit (no catch-up deferrals of any type) E) Allocation of deferrals $ ______or ______% TIAA CREF Regular Annuity Contract (RA) $ ______or ______% TIAA CREF Supplemental Retirement Annuity SRA) $ ______or ______% Fidelity Investment Funds $ ______or ______% T. Rowe Price $ ______or ______% Vanguard Group = 100% F) Acknowledgement, authorization, and signature

ACKNOWLEDGEMENT: I have received and read the Summary Plan Description(s) of this/these plan(s) and understand that my election to defer and have contributions made to the plan(s) are subject to the terms and provisions of the plan(s). TERMINATION: Either party may terminate this agreement so that it will not apply to amounts subsequently earned, by giving reasonable advanced written notice of the date of termination. However, no more than four such agreements may be made within any taxable year of the employee. This agreement shall remain in effect until so terminated. DEFERRAL AUTHORIZATION: I authorize the actions requested above by signing this form. I acknowledge that these elections supersede all prior elections.

Employee signature: ______Date: ______

N:\Human Resources\FORMS\2011TIAACREF SRA.doc/ 6/5/2018 Rev Oct 31, 11 Information on Annual Salary Reduction Limits

The total amount of salary reductions during a year is limited by law. In general, salary reductions may not exceed the General Limit. However, if the eligibility requirements are satisfied, the General Limit may be exceeded by the use of Special 403(b) Catch-up deferrals and Age 50 Catch-up deferrals. For 2016, the General Limit is $18,000 and the Age-50 Catch-up limit is an additional $6,000. The amount of the General Limit and the Age 50 Catch-up limit are adjusted each year for inflation.

Part D on the salary reduction agreement allows you to maximize the amount of your deferrals if you desire. The first option allows you to make full use of any available catch-up deferrals. If you check this box and either the Special 403(b) Catch-up limit, the Age 50 Catch-up limit, or both are not available, those catch-up limits that are not available will be disregarded. The second option allows you to make full use of the General Limit without making any catch-up contributions. If you do not select an option in Part D, your deferrals will be reduced, if necessary, only to the maximum legal limit, that is the General Limit plus the available Special 403(b) Catch-up limit plus the available Age 50 Catch-up limit.

General Limit: The total payroll withholding for all regular and supplemental plans may not exceed the General Limit under IRC 402(g) for a year, except for the catch-up amounts described below. Special 403(b) Catch-up: An employee with at least the equivalent of 15 years of full time service with the Colleges may “catch up” by contributing up to $3,000 each year above the General Limit towards the Life Time Catch-Up Limit of $15,000. Proof of eligibility from TIAA-CREF will be required. Age 50 Catch-up: In addition to the General Limit, there is a catch-up contribution available during a year for those employees who are at least 50 years of age by the end of that year. This catch-up contribution allows you to defer up to an additional amount under IRC 414(v). This additional amount may be deferred over the General Limit in addition to any Special 403(b) Catch-up deferrals.

Please contact Human Resources if you would like more information on the salary reduction limits for the current year.

N:\Human Resources\FORMS\2011TIAACREF SRA.doc/ 6/5/2018 Rev Oct 31, 11