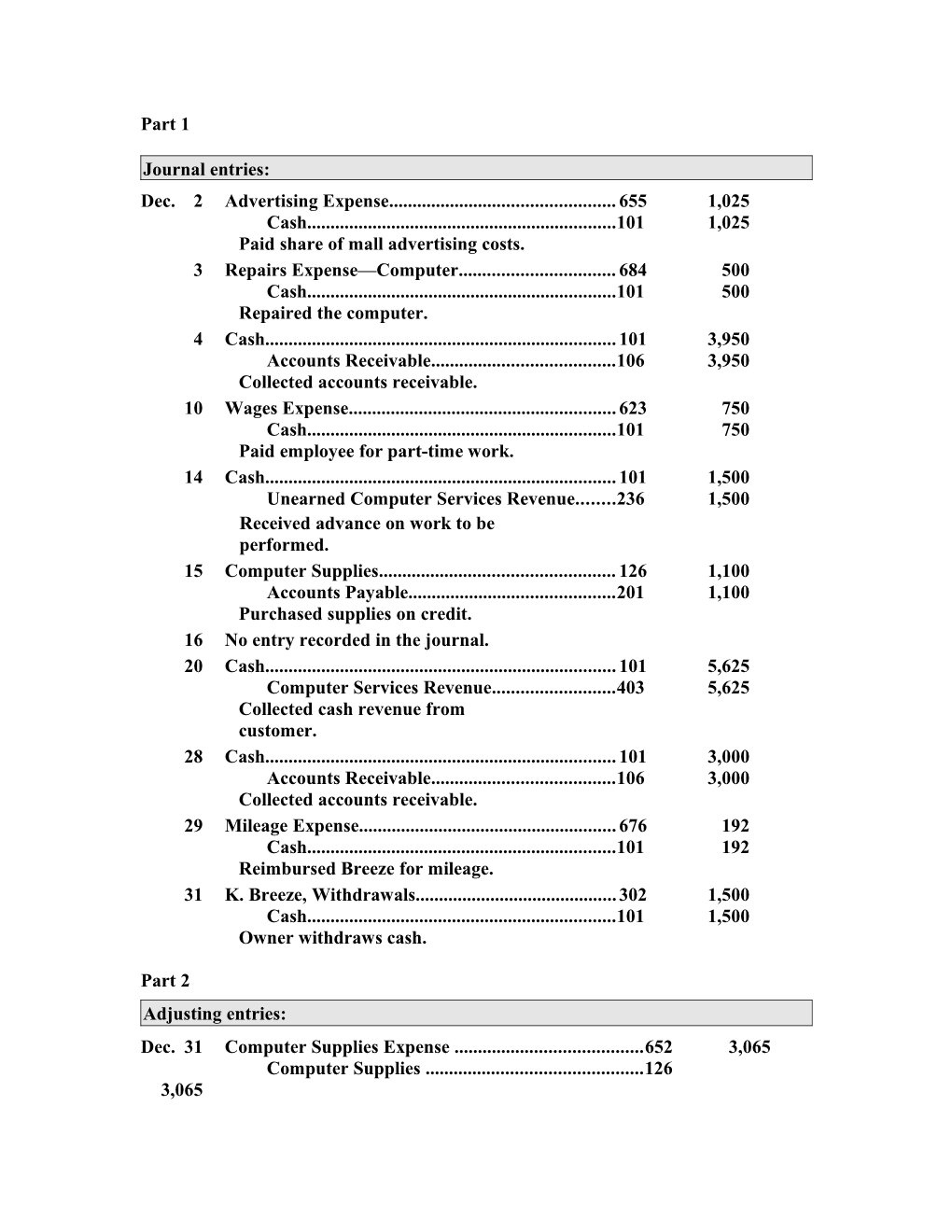

Part 1

Journal entries: Dec. 2 Advertising Expense...... 655 1,025 Cash...... 101 1,025 Paid share of mall advertising costs. 3 Repairs Expense—Computer...... 684 500 Cash...... 101 500 Repaired the computer. 4 Cash...... 101 3,950 Accounts Receivable...... 106 3,950 Collected accounts receivable. 10 Wages Expense...... 623 750 Cash...... 101 750 Paid employee for part-time work. 14 Cash...... 101 1,500 Unearned Computer Services Revenue...... 236 1,500 Received advance on work to be performed. 15 Computer Supplies...... 126 1,100 Accounts Payable...... 201 1,100 Purchased supplies on credit. 16 No entry recorded in the journal. 20 Cash...... 101 5,625 Computer Services Revenue...... 403 5,625 Collected cash revenue from customer. 28 Cash...... 101 3,000 Accounts Receivable...... 106 3,000 Collected accounts receivable. 29 Mileage Expense...... 676 192 Cash...... 101 192 Reimbursed Breeze for mileage. 31 K. Breeze, Withdrawals...... 302 1,500 Cash...... 101 1,500 Owner withdraws cash.

Part 2 Adjusting entries: Dec. 31 Computer Supplies Expense ...... 652 3,065 Computer Supplies ...... 126 3,065 Adjustment for supplies used (supplies balance less cost of supplies available).

31 Insurance Expense ...... 637 555 Prepaid Insurance ...... 128 555 Adjustment for expired insurance (1/4 of original prepaid amount).

31 Wages Expense ...... 623 500 Wages Payable ...... 210 500 Adjustment for accrued wages.

31 Depreciation Exp—Computer Equip...... 613 1,250 Accumulated Depreciation— Computer Equipment...... 168 1,250

Adjustment for computer equipment depreciation: Cost...... $20,000 Predicted life...... 4 years Annual depreciation (cost/life)...... $5,000 Expense for three months...... $1,250

31 Depreciation Expense—Office Equip...... 612 400 Accumulated Depreciation— Office Equipment ...... 164 400

Adjustment for office equipment depreciation: Cost...... $8,000 Predicted life...... 5 years Annual depreciation (cost/life)...... $1,600 Expense for three months...... $400

31 Rent Expense ...... 640 2,475 Prepaid Rent ...... 131 2,475 Adjustment for expired rent (3/4 of original prepaid amount).

Parts 1 and 2

Posting to the accounts: Cash Acct. No. 101 Date Explanation PR Debit Credit Balance Oct. 1 55,000 55,000 2 3,300 51,700 5 2,220 49,480 8 1,420 48,060 15 4,800 52,860 17 805 52,055 20 1,940 50,115 22 1,400 51,515 31 875 50,640 31 3,600 47,040 Nov. 1 320 46,720 2 4,633 51,353 5 1,125 50,228 18 2,208 52,436 22 250 52,186 28 384 51,802 30 1,750 50,052 30 2,000 48,052 Dec. 2 1,025 47,027 3 500 46,527 4 3,950 50,477 10 750 49,727 14 1,500 51,227 20 5,625 56,852 28 3,000 59,852 29 192 59,660 31 1,500 58,160

Parts 1 and 2

Accounts Receivable Acct. No. 106 Date Explanation PR Debit Credit Balance Oct. 6 4,800 4,800 12 1,400 6,200 15 4,800 1,400 22 1,400 0 28 5,208 5,208 Nov. 8 5,668 10,876 18 2,208 8,668 24 3,950 12,618 Dec. 4 3,950 8,668 28 3,000 5,668 Computer Supplies Acct. No. 126 Date Explanation PR Debit Credit Balance Oct. 3 1,420 1,420 Nov. 5 1,125 2,545 Dec. 15 1,100 3,645 31 3,065 580

Prepaid Insurance Acct. No. 128 Date Explanation PR Debit Credit Balance Oct. 5 2,220 2,220 Dec. 31 555 1,665

Prepaid Rent Acct. No. 131 Date Explanation PR Debit Credit Balance Oct. 2 3,300 3,300 Dec. 31 2,475 825

Office Equipment Acct. No. 163 Date Explanation PR Debit Credit Balance Oct. 1 8,000 8,000

Accumulated Depreciation—Office Equipment Acct. No. 164 Date Explanation PR Debit Credit Balance Dec. 31 400 400

Parts 1 and 2

Computer Equipment Acct. No. 167 Date Explanation PR Debit Credit Balance Oct. 1 20,000 20,000

Accumulated Depreciation—Computer Equipment Acct. No. 168 Date Explanation PR Debit Credit Balance Dec. 31 1,250 1,250

Accounts Payable Acct. No. 201 Date Explanation PR Debit Credit Balance Oct. 3 1,420 1,420 8 1,420 0 Dec. 15 1,100 1,100 Wages Payable Acct. No. 210 Date Explanation PR Debit Credit Balance Dec. 31 500 500

Unearned Computer Services Revenue Acct. No. 236 Date Explanation PR Debit Credit Balance Dec. 14 1,500 1,500

K. Breeze, Capital Acct. No. 301 Date Explanation PR Debit Credit Balance Oct. 1 83,000 83,000

K. Breeze, Withdrawals Acct. No. 302 Date Explanation PR Debit Credit Balance Oct. 31 3,600 3,600 Nov. 30 2,000 5,600 Dec. 31 1,500 7,100

Parts 1 and 2

Computer Services Revenue Acct. No. 403 Date Explanation PR Debit Credit Balance Oct. 6 4,800 4,800 12 1,400 6,200 28 5,208 11,408 Nov. 2 4,633 16,041 8 5,668 21,709 24 3,950 25,659 Dec. 20 5,625 31,284

Depreciation Expense—Office Equipment Acct. No. 612 Date Explanation PR Debit Credit Balance Dec. 31 400 400

Depreciation Expense—Computer Equipment Acct. No. 613 Date Explanation PR Debit Credit Balance Dec. 31 1,250 1,250

Wages Expense Acct. No. 623 Date Explanation PR Debit Credit Balance Oct. 31 875 875 Nov. 30 1,750 2,625 Dec. 10 750 3,375 31 500 3,875

Insurance Expense Acct. No. 637 Date Explanation PR Debit Credit Balance Dec. 31 555 555

Rent Expense Acct. No. 640 Date Explanation PR Debit Credit Balance Dec. 31 2,475 2,475

Parts 1 and 2

Computer Supplies Expense Acct. No. 652 Date Explanation PR Debit Credit Balance Dec. 31 3,065 3,065

Advertising Expense Acct. No. 655 Date Explanation PR Debit Credit Balance Oct. 20 1,940 1,940 Dec. 2 1,025 2,965

Mileage Expense Acct. No. 676 Date Explanation PR Debit Credit Balance Nov. 1 320 320 28 384 704 Dec. 29 192 896

Miscellaneous Expenses Acct. No. 677 Date Explanation PR Debit Credit Balance Nov. 22 250 250

Repairs Expense—Computer Acct. No. 684 Date Explanation PR Debit Credit Balance Oct. 17 805 805 Dec. 3 500 1,305

Part 3 SUCCESS SYSTEMS Adjusted Trial Balance December 31, 2004 Debit Credit

Cash ...... $ 58,160 Accounts receivable ...... 5,668 Computer supplies ...... 580 Prepaid insurance ...... 1,665 Prepaid rent ...... 825 Office equipment ...... 8,000 Accumulated depreciation—Office equipment...... $ 400 Computer equipment ...... 20,000 Accumulated depreciation—Computer equipment...... 1,250 Accounts payable ...... 1,100 Wages payable ...... 500 Unearned computer services revenue ...... 1,500 K. Breeze, Capital...... 83,000 K. Breeze, Withdrawals...... 7,100 Computer services revenue ...... 31,284 Depreciation expense—Office equipment ...... 400 Depreciation expense—Computer equipment...... 1,250 Wages expense ...... 3,875 Insurance expense ...... 555 Rent expense ...... 2,475 Computer supplies expense ...... 3,065 Advertising expense...... 2,965 Mileage expense ...... 896 Miscellaneous expenses ...... 250 Repairs expense—Computer ...... 1,305 ______Totals...... $119,034 $119,034

Part 4

SUCCESS SYSTEMS Income Statement For Three Months Ended December 31, 2004

Revenue Computer services revenue...... $31,284 Expenses Depreciation expense—Office equipment...... $ 400 Depreciation expense—Computer equipment...... 1,250 Wages expense...... 3,875 Insurance expense...... 555 Rent expense...... 2,475 Computer supplies expense...... 3,065 Advertising expense...... 2,965 Mileage expense...... 896 Miscellaneous expenses...... 250 Repairs expense—Computer...... 1,305 Total expenses...... 17,036 Net income...... $14,248

Part 5

SUCCESS SYSTEMS Statement of Owner’s Equity For Three Months Ended December 31, 2004

K. Breeze, Capital, October 1, 2004...... $ 0 Plus: Owner investment...... 83,000 Net income...... 14,248 97,248 Less: Owner withdrawals...... 7,100 K. Breeze, Capital, December 31, 2004...... $90,148

Part 6

SUCCESS SYSTEMS Balance Sheet December 31, 2004

Assets Cash ...... $58,160 Accounts receivable ...... 5,668 Computer supplies ...... 580 Prepaid insurance ...... 1,665 Prepaid rent ...... 825 Office equipment ...... $ 8,000 Accumulated depreciation—Office equipment...... (400) 7,600 Computer equipment...... 20,000 Accumulated depreciation—Computer equipment...... (1,250) 18,750 Total assets...... $93,248

Liabilities Accounts payable...... $ 1,100 Wages payable...... 500 Unearned computer services revenue...... 1,500 Total liabilities...... 3,100

Equity K. Breeze, Capital...... 90,148 Total liabilities and equity...... $93,248