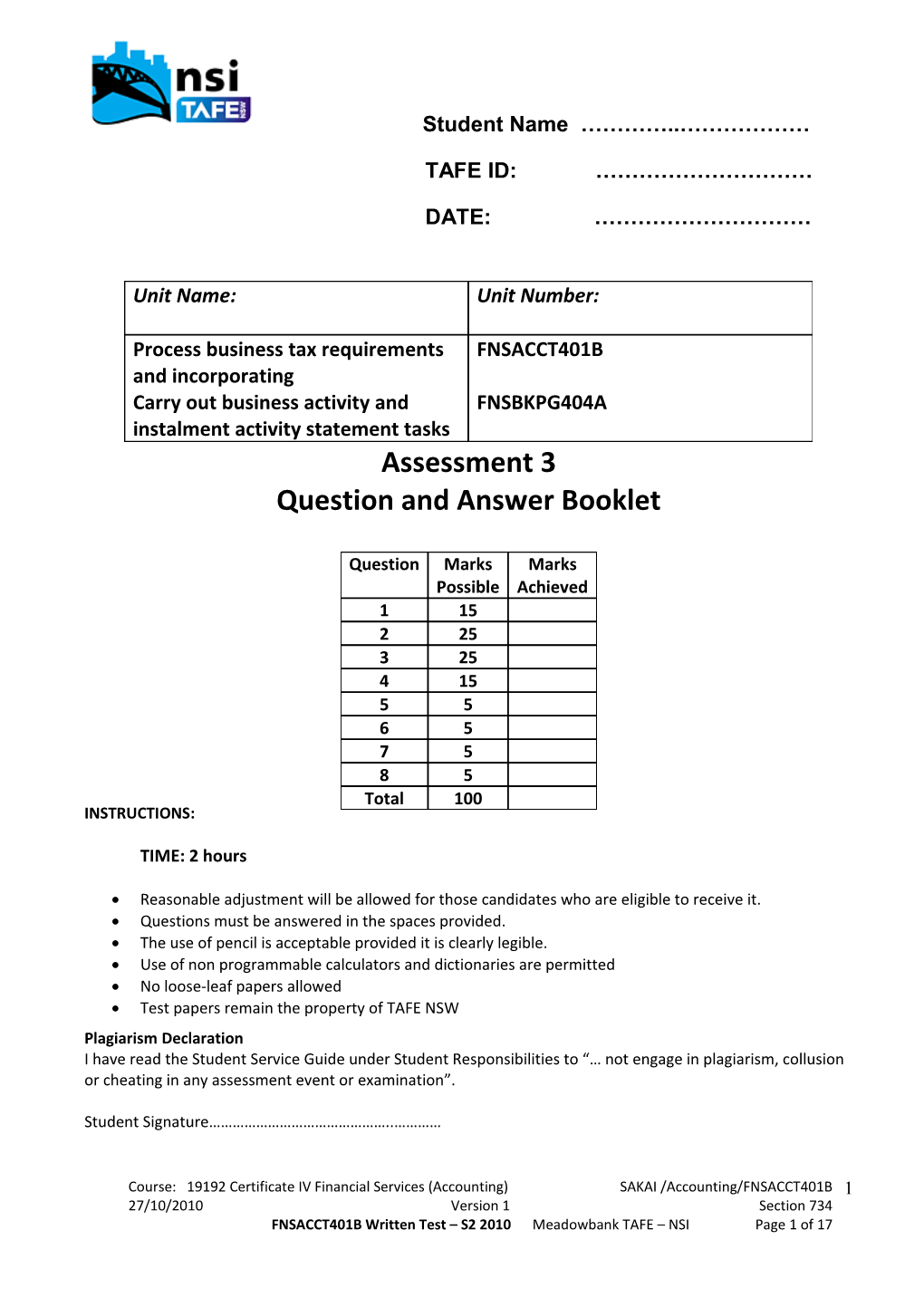

Student Name …………..………………

TAFE ID: …………………………

DATE: …………………………

Unit Name: Unit Number:

Process business tax requirements FNSACCT401B and incorporating Carry out business activity and FNSBKPG404A instalment activity statement tasks Assessment 3 Question and Answer Booklet

Question Marks Marks Possible Achieved 1 15 2 25 3 25 4 15 5 5 6 5 7 5 8 5 Total 100 INSTRUCTIONS:

TIME: 2 hours

Reasonable adjustment will be allowed for those candidates who are eligible to receive it. Questions must be answered in the spaces provided. The use of pencil is acceptable provided it is clearly legible. Use of non programmable calculators and dictionaries are permitted No loose-leaf papers allowed Test papers remain the property of TAFE NSW Plagiarism Declaration I have read the Student Service Guide under Student Responsibilities to “… not engage in plagiarism, collusion or cheating in any assessment event or examination”.

Student Signature………………………………………..…………

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 1 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 1 of 17 Student Name …………..………………

Question 1 – (15 marks)

The following tables summarise Smashed In Pty Limited’s panel beating business sales and purchases for the quarter ended 30 June 2011. Required:

a) Using the tables provided, determine the amounts of GST for the quarter ended 30 June 2011 if the business uses:

i) Cash method of reporting for GST; or (6 marks)

ii) Accrual method of reporting for GST (7 marks)

b) Calculate the net GST payable / (refundable) for the quarter ended 30 June 2011 if the business uses:

i) Cash method of reporting for GST; or (1 mark)

ii) Accrual method of reporting for GST (1 mark)

Sales: Invoice date Payment Customer Amount Cash Basis Accrual received (GST Basis Inclusive) 24 April 2 June 2011 A Jacks $8,800 2011

5 May 2011 31 July 2011 P Lang $7,700

30 June 2011 20 July 2011 D Jay $5,500

Purchases: Invoice date Payment date Supplier Amount Cash Basis Accrual (GST Basis inclusive) 25 April 2011 4 May 2011 Spray Paint 3,300 World P/L 2 May 2011 25 May 2011 Putty Land 4,400 P/L 1 June 2011 30 July 2011 Car Pieces 1,100 P/L

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 2 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 2 of 17 Student Name …………..………………

Net GST Payable (Refundable) for the quarter ended 30 June 2011

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 3 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 3 of 17 Student Name …………..………………

Question 2 – (25 marks)

Very Profitable Pty Limited is registered for GST as a cash payer and has chosen to report and calculate its GST every quarter. As the bookkeeper, part of your job description is to complete the quarterly BAS (under the direction of your client’s tax agent). Note: The following raw data values for the quarter ended 30 June 2011 are GST inclusive (where applicable)

Account Details $ Sale of goods and services 440,000 Export sales 7,700 Other GST-free sales 6,600 Commercial Rent 99,000 Residential Rent 22,000 Sale of Assets 5,500 Business Expenses (all incl GST) 220,000 Business Council & Water Rates 2,200 Depreciation 4,400 Commercial Rent Expenses 9,900 Residential Rent Expenses 4,400 Purchase of Laptop 2,200 Gross Wages & Salaries 88,000 PAYG tax withheld 22,200 Superannuation 7,920

Required: Prepare the following for the quarter ended 30 June 2011:

a) The GST Classification Worksheet (15 marks) b) The GST Calculation Worksheet (10 marks)

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 4 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 4 of 17 Student Name …………..………………

a) The GST Classification Worksheet for the quarter ended 30 June 2011 Account Amount Sale GST GST Input Taxable Capital Non- Input GST Taxable Gross PAYG Excluded Details Free Free Taxed Supply Purchases Capital Taxed Free Supply Wages Export Purchases Sale of goods 440,000 and services Export sales 7,700 Other GST- 6,600 free sales Commercial 99,000 Rent Residential 22,000 Rent Sale of Assets 5,500 Business 220,000 Expenses Business 2,200 Council & Water Rates Depreciation 4,400 Commercial 9,900 Rent Expenses Residential 4,400 Rent Expenses Purchase of 2,200 Laptop Gross Wages 88,000 & Salaries PAYG tax 22,200 withheld Superannuation 7,920

G1 G2 G3 G4 G6 G10 G11 G13 G14 G17 W1 W2

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 5 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 5 of 17 Student Name …………..……………… b) The GST Calculation Worksheet for the quarter ended 30 June 2011

G1 Total Sales (incl any GST) G10 Capital Purchases (incl any GST)

G2 Export sales G11 Non-Capital Purchases (incl any GST)

G3 Other GST –Free Sales G12 G10 + G11

G4 Input Taxed Sales G13 Purchases for making Input Taxed Sales

G5 G2 + G3 + G4 G14 Purchases without GST in the price

G6 Total Sales subject to GST G15 Estimated Purchases for (G1 minus G5) Private Use or not Income Tax Deductible

G7 Adjustments (if G16 G13 + G14 + G15 applicable)

G8 Total Sales subject to GST G17 Total Purchases subject after Adjustments (G6 to GST (G12 minus G16) +G7)

G9 GST on Sales (G8 divided G18 Adjustments (if by eleven) applicable)

G19 Total Purchases subject to GST after Adjustments (G17 + G18)

G20 GST on Purchases (G19 divided by eleven)

NET GST PAYABLE (G9 minus G20)

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 6 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 6 of 17 Student Name …………..………………

Question 3 – (25 marks)

Glass Fitters Pty Limited maintains a computerised accounting system for its glass business which accounts for GST on an accrual basis and reports quarterly to the ATO for its Business Activity Statement obligations. Below is the company’s quarterly Profit & Loss Account and applicable general ledgers for movements in the asset accounts to highlight any capital acquisitions made during the quarter. Required: Using the reports provided below, complete the (partially completed) Business Activity Statement (BAS) for the quarter ended 30 September 2011 using the accounts method.

Glass Fitters Pty Limited Profit and Loss Account for the 3 months ended 30 September 2011

Income from Service(s): Glazing Services 92,800.00 Total Income from Services 92,800.00 Other Income: Interest Income 200.00 Total Income 93,000.00 Expenses: Advertising 1,760.00 Bank Fees 180.00 Depreciation 2,784.00 Insurance 2,060.00 Motor Vehicle Expenses 1,020.00 Glass Supplies and Materials 25,500.00 Stationery 530.00 Superannuation 3,780.00 Telephone 1,450.00 Wages – Casual (Gross) 27,576.00 Total Expenses 66,640.00 Net Profit 26,360.00

Glass Fitters Pty Limited General Ledger As at 30 September 2011 Motor Vehicles

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 7 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 7 of 17 Student Name …………..………………

Debit Credit Balance 01//07/2011 Opening Balance 60,000.00 60,000.00 dr 30/09/2011 Motor vehicle 15,000.00 75,000.00 dr purchased 30/09/2011 Closing Balance 75,000.00 dr

Question 3 (25 Marks)

G1 =

G10 =

G11 =

1A =

1B =

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 8 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 8 of 17 Student Name …………..………………

Glass Fitters Pty Limited ABN 11 222 333 444 Summary Option 1 Calculated GST and report Amounts you owe the Tax quarterly Office

GST on sales or GST Total sales G1 instalment 1A

Does the amount shown at G1 include GST? Yes/No YES Export sales G2 PAYG tax withheld 4 14,424 Other GST-free sales G3 PAYG income tax instalment 5A 5,301

Capital purchases G10 Non-capital purchases G11 1A + 4 + 5A 8A

Amounts the Tax Office owes you GST on purchases 1B

These boxes represent the various boxes on the BAS form

1B 8B

Payment or refund? Is 8A more than 8B? (indicate with an X) Yes, then write the result of 8A minus 8B at 9. This is the amount payable to the ATO.

No, then write the result of 8B minus 8A at 9. This amount is refundable to you (or offset against any other tax debt you have). Payment due 9

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 9 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 9 of 17 Student Name …………..………………

Question 4 – (15 marks) Melitta operates a small business and receives investment income. She accounts for GST on a cash basis, reports GST annually and PAYG instalment income quarterly.

This is a list of revenue (GST inclusive where applicable) received for the quarter ended 31 March 2011.

Sales 55,000

Commercial rent received 22,000

Residential rent received 8,800

Interest received 1,200

Dividend income 3,300

Sale of business printer 2,200

Proceeds from sale of BHP shares 4,400

Total Revenue $96,900

Required: a) Calculate the PAYG instalment income amount (11 marks) b) Calculate the PAYG income tax instalment assuming a PAYG income tax instalment rate of 4.10% (2 marks) c) Complete the extract of the Instalment Activity Statement for the quarter ended 31 March 2011 using option 2. (2 marks)

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B 10 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 10 of 17 Student Name …………..………………

Question 4 (15 Marks) a)

b)

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B11 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 11 of 17 Student Name …………..………………

c) Extract of the Instalment Activity Statement for the quarter ended 31 March 2011

Option 2: Calculate PAYG instalment using income X rate

PAYG Instalment income T1 $

T2 %

T1 X T2 T11 $

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B12 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 12 of 17 Student Name …………..………………

Question 5 – (5 marks) Fancy Cars Pty Limited recently commenced its business of selling luxury motor vehicles. The company’s first BMW will be initially priced at $88,000 (including GST). Based on the 2009/2010 luxury car tax threshold $57,180 and LCT rate of 33%:

Required: Calculate the Luxury Car Tax (LCT) amount and total retail selling price of the BMW to a potential customer.

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B13 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 13 of 17 Student Name …………..………………

Question 6 – (5 marks) Cleanskin Wine Wholesalers derived ‘assessable dealings’ from the sale of its taxable wine supplies amounting to $440,000 (GST-inclusive) for the quarter ended 30 September 2010.

Required: a) Calculate the GST payable.

b) Calculate the Wine Equalisation Tax (WET) payable.

a)

b)

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B14 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 14 of 17 Student Name …………..………………

Question 7 – (5 marks) The current fuel tax credit rate for fuels used in general business activities is 19.0715 cents per litre. Your client’s records show that they used $754.00 of diesel at $1.45 per litre and $762.00 of unleaded petrol at $1.27 per litre in his equipment (excavators, dumpers and loaders) for rail line maintenance in the quarter ended 31 December 2010. Required: Calculate the fuel tax credit they may claim by first working out the eligible litres using the basic ‘constructive method’ calculation.

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B15 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 15 of 17 Student Name …………..………………

Question 8 – (5 marks)

Below is an extract from the weekly tax tables for payments made on or after 1 July 2009, in respect of the year ended 30 June 2010.

Weekly earnings With tax-free With tax-free No tax-free threshold threshold with leave threshold no leave loading loading

1 2 3 4 ($) ($) ($) ($)

406 38.00 37.00 83.00

407 38.00 38.00 83.00

408 38.00 38.00 83.00

409 39.00 38.00 84.00

410 39.00 38.00 84.00

Required: a) The correct amount of tax to withhold (if any) from a resident employee earning $409 per week, who has not quoted a TFN but has requested the tax-free threshold with leave loading is?

b) The correct amount of tax to withhold (if any) from a resident employee earning $406.80 per week, who has quoted a TFN and requested the tax-free threshold with no leave loading is?

c) The correct amount of tax to withhold (if any) from a resident employee earning $408.90 per week, who has quoted a TFN and requested the tax-free threshold with no leave loading is?

d) The correct amount of tax to withhold (if any) from a contracting supplier charging $407 who has correctly supplied an ABN is ?

e) The correct amount of tax to withhold (if any) from a contracting supplier charging $410 who has incorrectly supplied an ABN is?

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B16 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 16 of 17 Student Name …………..………………

Working out paper if required

Course: 19192 Certificate IV Financial Services (Accounting) SAKAI /Accounting/FNSACCT401B17 27/10/2010 Version 1 Section 734 FNSACCT401B Written Test – S2 2010 Meadowbank TAFE – NSI Page 17 of 17