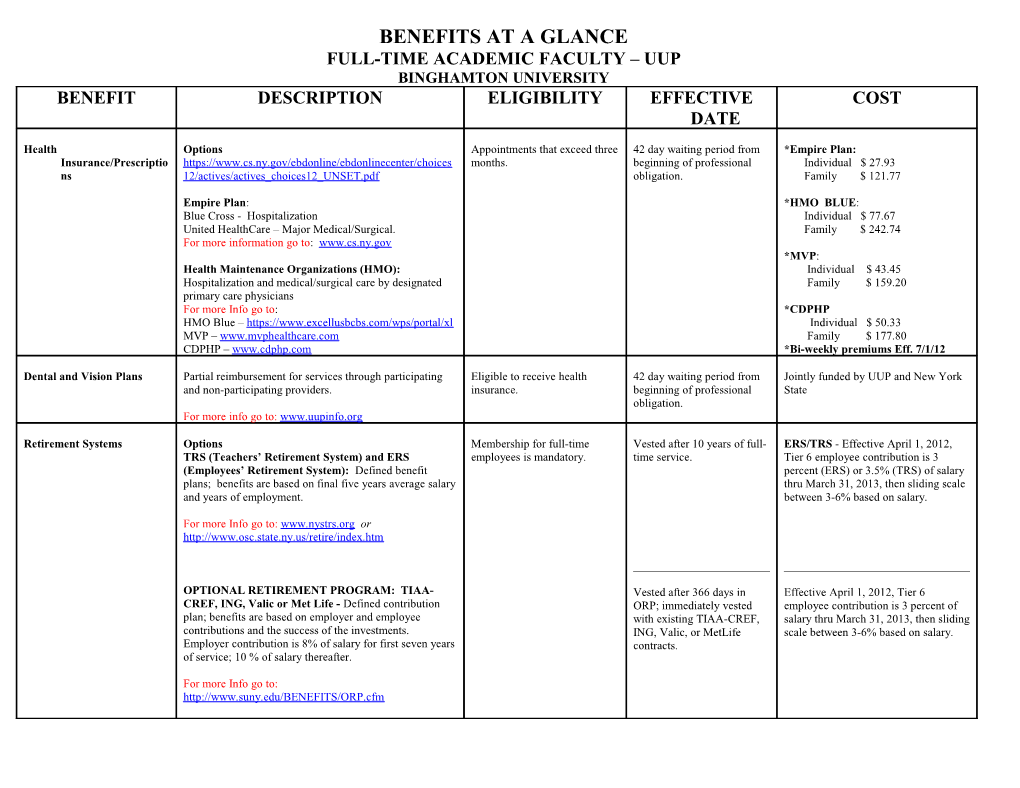

BENEFITS AT A GLANCE FULL-TIME ACADEMIC FACULTY – UUP BINGHAMTON UNIVERSITY BENEFIT DESCRIPTION ELIGIBILITY EFFECTIVE COST DATE

Health Options Appointments that exceed three 42 day waiting period from *Empire Plan: Insurance/Prescriptio https://www.cs.ny.gov/ebdonline/ebdonlinecenter/choices months. beginning of professional Individual $ 27.93 ns 12/actives/actives_choices12_UNSET.pdf obligation. Family $ 121.77

Empire Plan: *HMO BLUE: Blue Cross - Hospitalization Individual $ 77.67 United HealthCare – Major Medical/Surgical. Family $ 242.74 For more information go to: www.cs.ny.gov *MVP: Health Maintenance Organizations (HMO): Individual $ 43.45 Hospitalization and medical/surgical care by designated Family $ 159.20 primary care physicians For more Info go to: *CDPHP HMO Blue – https://www.excellusbcbs.com/wps/portal/xl Individual $ 50.33 MVP – www.mvphealthcare.com Family $ 177.80 CDPHP – www.cdphp.com *Bi-weekly premiums Eff. 7/1/12

Dental and Vision Plans Partial reimbursement for services through participating Eligible to receive health 42 day waiting period from Jointly funded by UUP and New York and non-participating providers. insurance. beginning of professional State obligation. For more info go to: www.uupinfo.org

Retirement Systems Options Membership for full-time Vested after 10 years of full- ERS/TRS - Effective April 1, 2012, TRS (Teachers’ Retirement System) and ERS employees is mandatory. time service. Tier 6 employee contribution is 3 (Employees’ Retirement System): Defined benefit percent (ERS) or 3.5% (TRS) of salary plans; benefits are based on final five years average salary thru March 31, 2013, then sliding scale and years of employment. between 3-6% based on salary.

For more Info go to: www.nystrs.org or http://www.osc.state.ny.us/retire/index.htm

OPTIONAL RETIREMENT PROGRAM: TIAA- Vested after 366 days in Effective April 1, 2012, Tier 6 CREF, ING, Valic or Met Life - Defined contribution ORP; immediately vested employee contribution is 3 percent of plan; benefits are based on employer and employee with existing TIAA-CREF, salary thru March 31, 2013, then sliding contributions and the success of the investments. ING, Valic, or MetLife scale between 3-6% based on salary. Employer contribution is 8% of salary for first seven years contracts. of service; 10 % of salary thereafter.

For more Info go to: http://www.suny.edu/BENEFITS/ORP.cfm BENEFIT DESCRIPTION ELIGIBILITY EFFECTIVE COST DATE

Life Insurance $6,000 group life insurance plan. Employees represented by Date employee is placed on No cost to employee. UUP. payroll. For more Info go to: www.uupinfo.org Must enroll within 60 days Long-Term Care Insurance NYPERL (NYS Public Employee and Retiree Long-Term Eligible to receive health of hire date in order to avoid Varies dependent upon option Care Plan) insurance. medical underwriting. Can selection. For more info or to enroll go to: enroll anytime subject to www.NYPERL.net medical underwriting. FLEX SPENDING ACCOUNTS Must be receiving regular New employees must enroll Dependent Care Advantage A portion of salary is designated by employee to cover bi-weekly paychecks. within 60 days of their hire The employee determines the amount Account child, elder and dependent care expenses with tax-free date or during open to be deducted (maximum $5,000). dollars. enrollment period.

New employees become A portion of salary is designated by employee to cover Must be annual salaried eligible after completion of The employee may contribute a HealthCare Spending unreimbursed health-related expenses with tax-free employee and eligible for 60 consecutive days of state minimum of $150 up to a maximum of Account dollars. health insurance. service, and must enroll $3,000 annually. within 60 days of hire date or For more detailed information on both programs go to: during open enrollment http://flexspend.state.ny.us period.

Tax Deferred Annuities Retirement savings/investment plan. Defers taxation on Upon employment. Choice of employee. Employee contributions through salary percentage of earnings and interest. reduction subject to IRS limitations.

Contact HR for options available to you

New York State Deferred Voluntary tax-deferred savings program designed to Upon employment. Choice of employee. Employee contributions through salary Compensation provide funds in retirement. reduction subject to IRS limitations.

For more information or to enroll go to: www.nysdcp.com or call 1-800-422-8463

Long Term Disability Monthly income benefit equal to 60 percent of covered Full-time faculty who are First of the month following No cost to employee. Coverage monthly salary, not to exceed $7,500 a month; also disabled for six consecutive one year anniversary. provides a monthly annuity premium benefit. months. If you were covered by a previous employer within the For more Info go to: last 3 months with a similar http://www.suny.edu/BENEFITS/LTD.cfm plan, the waiting period may be waived.

Tuition Assistance Partial assistance is available through the Tuition Waiver Appointment must cover period Upon employment. No cost to the employee for this (based on funding) and Space Available programs. of support. benefit. Fees are not covered by Tuition Assistance. Contact Jon Roma/HR for more information BENEFIT DESCRIPTION ELIGIBILITY Sick Leave Years of service* Days Earned Semester Total Fall Spring 0-1 1.25 days per month 5.0 6.25 days 2 1.33 days per month 5.3 6.70 days 3, 4, 5 1.50 days per month 6.0 7.50 days 6 1.66 days per month 6.7 8.30 days 7 1.75 days per month 7.0 8.75 days *Refer to UUP contract for rates prior to July 1, 1982.

New employees cannot be placed on the payroll or issued parking permits or ID cards until they have completed their I-9’s and the required personnel/payroll forms indicated in their offer letter. Updated 06/2012