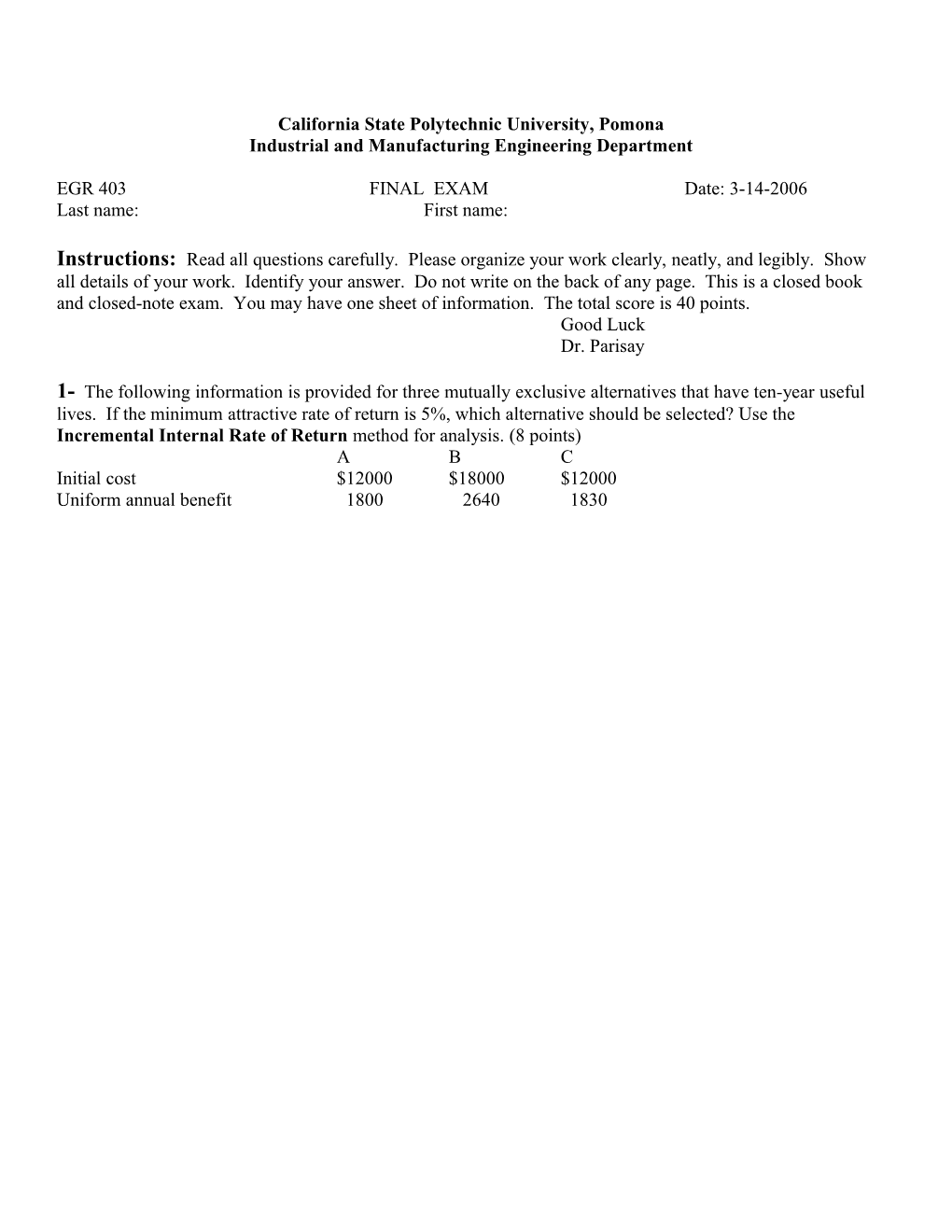

California State Polytechnic University, Pomona Industrial and Manufacturing Engineering Department

EGR 403 FINAL EXAM Date: 3-14-2006 Last name: First name:

Instructions: Read all questions carefully. Please organize your work clearly, neatly, and legibly. Show all details of your work. Identify your answer. Do not write on the back of any page. This is a closed book and closed-note exam. You may have one sheet of information. The total score is 40 points. Good Luck Dr. Parisay

1- The following information is provided for three mutually exclusive alternatives that have ten-year useful lives. If the minimum attractive rate of return is 5%, which alternative should be selected? Use the Incremental Internal Rate of Return method for analysis. (8 points) A B C Initial cost $12000 $18000 $12000 Uniform annual benefit 1800 2640 1830 2- Please refer to the graph below and answer these questions. (4 points) a) How much is the average cost at 7 units of production? Show details of calculation.

b) How much is the marginal cost at 10 units of production? Show details of calculation.

c) Where and how has the Learning Curve affected this graph? Explain.

3- An unmarried individual has a taxable income of $80,000. Assume that the state tax rate is 10%. How much would he pay on state and federal taxes? What is his combined incremental tax rate? (3 points) 4- A profitable company making earth moving equipment is considering an investment of $600,000 on equipment which will have 3 year useful life and a $120,000 salvage value. (4 points) a) Calculate its deprecation using Sum-of-years digit method. (use table below) b) What is the book value at the end of second year?

5- Calculate the Modified Payback period for the following investment: Initial cost is $8000, zero salvage value, and the net return for each year is in the table below. MARR = 10% (4 points)

Year CASH 1 4200 2 3680 3 3040 4 2800 5 2600 6 2600 6- A firm is considering the following investment project:

Year 0 1 2 3 4 5 . Before-tax cash flow -4000 +2000 +1360 +976 +400 +400

Salvage value will be $500. The project has a five-year life. MACRS depreciation with Three-Years class will be used. The income tax rate is 34%. If the firm requires a 10% after-tax rate of return, should the project be undertaken? (11 points)

Yr

0

1

2

3

4

5 7- The following data is the calculated EUAC (not cash flow) of a defender and a challenger in order to find their minimum cost life. (6 points)

Year 1 2 3 4 5 6 EUAC(challenger) $6000 $4800 $5000 $5300 $7300 $8500 EUAC(defender) $7500 $5800 $5600 $4900 $8700 $9000

a) What is the minimum cost life of defender? What does that mean?

b) What is the minimum cost life of challenger? What does that mean?

c) Write a report to a manager on your conclusion, based on these data, for a replacement analysis. Explain your reason in details.