7

BUDGET GUIDELINES FOR KHADI AND POLYVASTRA

INDICATIVE PRODUCTIVITY WORKING ECONOMICS FOR CALCULATION OF KHADI AND POLYVASTRA PRODUCTION

Spinning Productivity

Productivity of a Charkha depends upon the type of fiber used for producing yarn, pre spinning processes, condition of the charkha, the skill and the age of the spinner, the atmospheric condition etc. The productivity is usually in terms of number of hanks produced per charkha in 8 hours.

Weaving Productivity

The weaving productivity will depend on the quality of the yarn used for weaving, type and mechanical condition of the loom, operating skill of the weaver and atmospheric conditions etc. Generally in Khadi 70 Cm. (28 inches), 90 Cm. (36 inches), 115 Cm. (45 inches) and 130 Cm. (52 inches) width fabrics is woven.

Note: 1. The productivity norms worked out below both for spinning and weaving are based on optimum productivity (i.e. 100% efficiency). The field offices can work out the actual productivity to the tune of 75% to 80% efficiency based on available infrastructure with the institution while fixing the production target for Khadi and Polyvastra Programme.

2. The number of working days is taken as 299 days (52 Sundays and 14 National & Local holidays as non working days).

3. As the local holiday varies from State to State the field offices may calculate the number of working days accordingly.

4. The following working economics are indicative only, based on the information gathered from field. The field offices need to work out the actual figure based on the infrastructure and field realities.

5. Man power shown is the minimum requirement for a unit. This may depends on the capacity of unit.

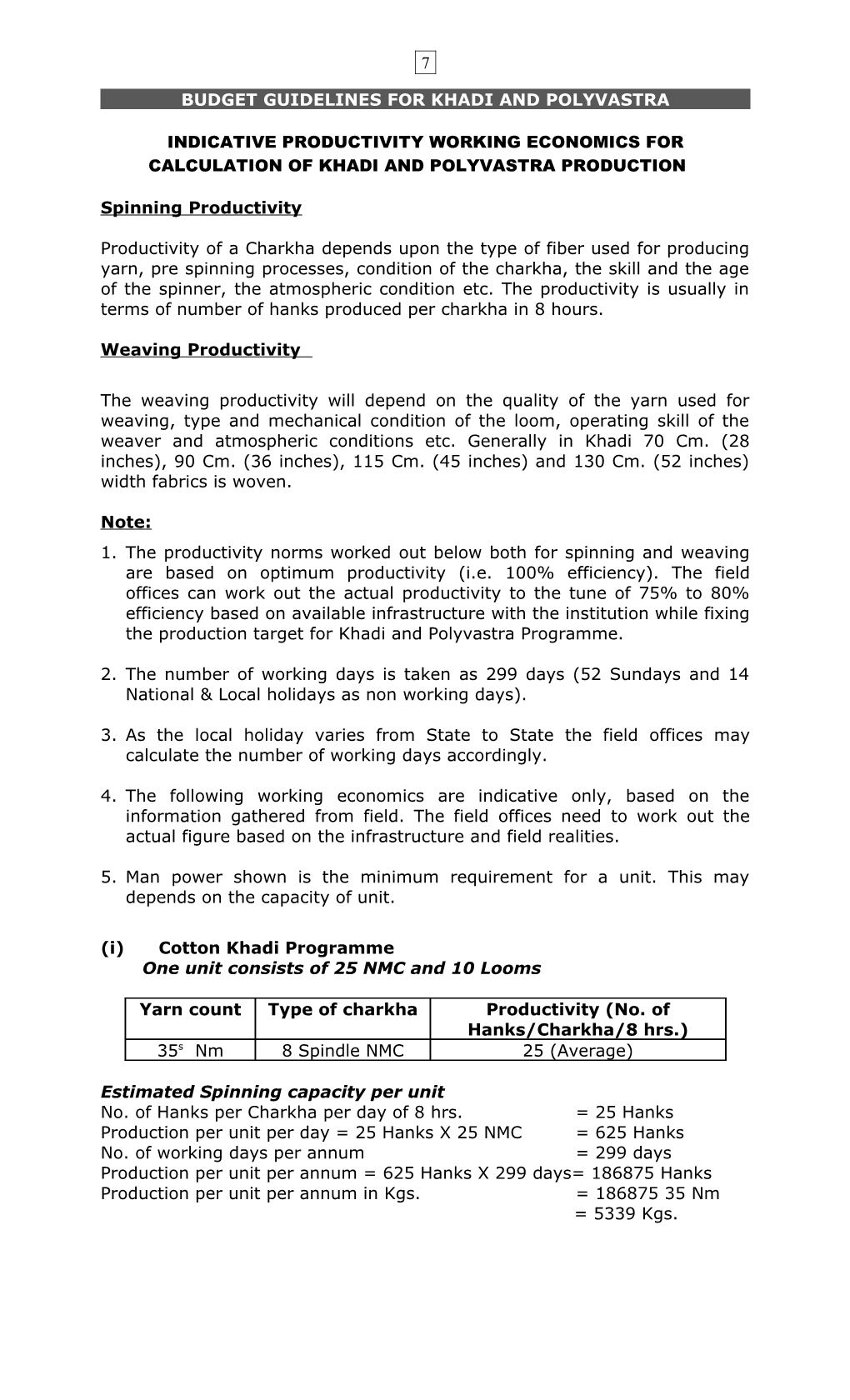

(i) Cotton Khadi Programme One unit consists of 25 NMC and 10 Looms

Yarn count Type of charkha Productivity (No. of Hanks/Charkha/8 hrs.) 35s Nm 8 Spindle NMC 25 (Average)

Estimated Spinning capacity per unit No. of Hanks per Charkha per day of 8 hrs. = 25 Hanks Production per unit per day = 25 Hanks X 25 NMC = 625 Hanks No. of working days per annum = 299 days Production per unit per annum = 625 Hanks X 299 days= 186875 Hanks Production per unit per annum in Kgs. = 186875 35 Nm = 5339 Kgs. 8

Cost of yarn per Kg. (@ Rs. 5.43 Per Hank)* = Rs. 5.43 X 35 Nm = Rs. 190.05 Total production value per unit per annum = 5339 Kgs. X Rs. 190.05 = Rs. 1014677/- Say = Rs. 10.00 Lakhs

Estimated Weaving capacity per unit No. of meters per loom per day of 8 hrs. = 8 mtrs. Production per unit per day = 8 mtrs. X 10 looms = 80 mtrs. No. of working days per annum = 299 days Production per unit per annum = 80 mtrs.X299 days = 23920 mtrs. Cost of Khadi cloth-Average rate per mtr. = Rs. 65/- Total production value per unit per annum = 23920 mtrs. X Rs. 65/- = Rs. 1554800/- Say = Rs. 15.00 Lakhs

Man Power Spinners : 25 Weavers : 10 Other artisans : 05 (warping & winding) Salaried Staff : 02 (instructors) Total : 42

(ii) Muslin Khadi Programme

One unit consists of 50 Charkhas and 10 Looms Yarn count Type of charkha Productivity (No. of Hanks/Charkha/8 hrs.) 100-120 Nm 7 Spindle NMC 20 ( Average)

Estimated Spinning capacity per unit

No. of Hanks per Charkha per day of 8 hrs. = 20 Hanks Production per unit per day = 20 Hanks X 50 NMC = 1000 Hanks No. of working days per annum = 299 days Production per unit per annum = 1000 Hanks X 299 days= 299000 Hanks Production per unit per annum in Kgs. = 299000 100 Nm = 2990Kgs. Cost of yarn per Kg. (@ Rs. 5.67 Per Hank)* = Rs. 5.43 X 100 Nm = Rs. 543 Total production value per unit per annum = 2990 Kgs. X Rs.543 = Rs. 1623570/- Say = Rs. 16.00 Lakhs

Estimated Weaving capacity per unit

No. of meters per loom per day of 8 hrs. = 6 mtrs. Production per unit per day = 6 mtrs. X 10 looms = 60 mtrs. No. of working days per annum = 299 days Production per unit per annum = 60 mtrs.X299 days = 17940 mtrs. Cost of Muslin Khadi cloth-Average rate per mtr. = Rs.110/- Total production value per unit per annum = 17940 mtrs. X Rs.110/- = Rs.1973400/- Say = Rs.20.00 Lakhs 9

Man Power

Spinners : 50 Weavers : 10 Other artisans : 10 (warping & winding) Salaried Staff : 02 (instructors) Total : 72

(iii) Silk Khadi Programme

One unit consists of 10 Basins and 20 Looms

Estimated Reeling capacity per unit Average production per basin per day of 8 hrs. = 900 Gms Production per unit per day = 900 Gms X 10 Basins = 9000 Gms i.e 9 Kgs No. of working days per annum = 299 days Production per unit per annum = 9 Kgs X 299 days = 2691 Kgs. (Cost of yarn per Kg )** = Rs.1550

Total production value per unit per annum = 2691 Kgs. X Rs.1550 = Rs.4171050/- Say = Rs.42.00.Lakhs

Estimated Weaving capacity per unit No. of meters per loom per day of 8 hrs ( Plain Shirting ) = 5mtrs. Production per unit per day = 5 mtrs. X 20 looms = 100 mtrs. No. of working days per annum = 299 days Production per unit per annum = 100 mtrs.X299 days = 29900 mtrs. Cost of Silk Khadi cloth-Average rate per mtr. = Rs.210/- Total production value per unit per annum = 29900mtrs. X Rs.210/- = Rs.6279000/- Say = Rs.63.00 Lakhs

Man Power Reelers : 10 Weavers : 20 Other artisans Reeling : 9 (Cookers, re-winders & winding) Twisting : 8 (Winding, Doubling, Twisting) Warping : 2 Jari work : 2 Weaving : 10 (Warping/Winding, Warp piecing & Pirn winding) Salaried Staff : 02 (instructors) Total : 53

(iv) Woollen Khadi Programme

One unit consists of 20 Charkhas ( 4 spindle ) and 10 Looms There are various Charkhas like Medleri and traditional etc… are existing in Karnataka, Rajasthan, Gujarat States and varities like Kambles, Kamblies, Shawls etc… are produced by using different types of Wool like Merino, Carded Wool etc…the working economics for spinning and weaving of Woollen varieties may be exercised by the concerned field offices based infrastructure available. 10

(v) Polyvastra Programme

One unit consists of 25 NMC and 10 Looms Yarn count Type of charkha Productivity (No. of Hanks/Charkha/8 hrs.) 65 Nm 8 Spindle NMC 30 ( Average )

Estimated Spinning capacity per unit No. of Hanks per Charkha per day of 8 hrs. = 30 Hanks Production per unit per day = 30 Hanks X 25 NMC = 750 Hanks No. of working days per annum = 299 days Production per unit per annum = 750 Hanks X 299 days= 224250 Hanks Production per unit per annum in Kgs. = 224250 65 Nm = 3450 Kgs. Cost of yarn per Kg. (@ Rs. 3.71 Per Hank)* = Rs. 3.71 X 65 Nm = Rs. 241.15

Total production value per unit per annum = 3450 Kgs. X Rs. 241.15 = Rs. 831968/- Say = Rs. 8.00 Lakhs

Estimated Weaving capacity per unit

No. of meters per loom per day of 8 hrs. = 8 mtrs. Production per unit per day = 8 mtrs. X 10 looms = 80 mtrs. No. of working days per annum = 299 days Production per unit per annum = 80 mtrs.X299 days = 23920 mtrs. (Cost of Khadi cloth-Average rate per mtr.)*** = Rs. 75/- Total production value per unit per annum = 23920 mtrs. X Rs. 75/- = Rs. 1794000/- Say = Rs. 18.00 Lakhs Man Power Spinners : 25 Weavers : 10 Other artisans : 05 (warping & winding) Salaried Staff : 02 (instructors) Total : 42

Source: *, **, *** Cost Chart rate of Tamil Nadu , Karnataka & Andhra Pradesh, respectively, which was existing earlier. However, the cost can be taken as per prevailing rate of concerned State.

Requirement of Raw Material

Cotton/Muslin @25% and Polyvastra @15%

(Qty. in Kgs. Value Rs. Lakhs) S. Varieties Production Estimated From own From No. (count- target for requirement sources C.S.Ps wise) 2011-12 of R.M.@ 25%/15% on Prodn. Target of 2011-12 Qty. Value Qty. Value Qty. Value 11

Silk Khadi

The raw material i.e. cocoon shall be purchased from the Govt. regulated cocoon markets and the yarn from the certified khadi institutions.

*it may also be noted that where there is a conflict on any point, between the cost chart and working economics, the cost chart or more appropriately the inputs as derived under cost chart will prevail over the Productivity/Working Economics as placed under – Annexure-A. In that case, SLBT, will record such recommendation for approval.

12

BUDGET GUIDELINES FOR KHADI AND POLYVASTRA

INTRODUCTION The Commission formulates budget guidelines every year. These guidelines served as basic tool for the budget team to discuss and review the KVI Programme implemented by the institutions during previous years, read with their progress in the current financial year and plan of action for the next financial year i.e. budgeting year. The Commission has decided to slightly modify the system of budget discussion linking the same with the system adopted by the Ministry i.e. outcome budgeting and the guidelines have been prepared to enable implementation of Programme in the most effective manner.

1) PERFORMANCE APPRAISAL AND TARGET FIXING / SETTING: - a) Production Targets :- The annual targets are to be fixed up to 20% on the best performance during the last three years but it will be no limitation to enhance the budget to an appropriate level to such institution wherein some significant infrastructure has been added or major increase in working capital has occurred or overall sudden jump in the prices of cotton/sliver have been reported from competent sources. Production targets for the purpose of Budget need to be primarily based on infrastructure capacity and constart with special programmes like SFURTI, Enhancing Productivity and Competitiveness of Khadi Industries and Artisans, etc. provided to the Institutions, which has boosted the production capacity of the Institutions.

Production target will be determined by SLBT based on the infrastructure available taking into account number of traditional Charkhas, number of NMC and Looms working with the Institutions and as per the format laid down in the Budget Guidelines which has to be clearly indicated by the SLBT in its Budget recommendation.

The recommendation of SLBT will also be technically verified by Dte. Of KPM with respect to the Production capacity as per working Charkhas and Looms for purpose of sanction.

The Institution should confirm during the Budget discussion that it has provided full coverage to its working artisans under JBY and AWFT, without which Budget discussion should not be entertained. Institution should also confirm that they are providing minimum of Rs.2.00 per hank to its Spinners as well as wage enhancement as decided by the Commission which was effected from 01.07.2007. b) Retail Sales and Wholesales :

Retail Sales and Wholesales are the two channels for effecting disposal of the Production of any Institution.

SLBT should assess that Retail Sales and Wholesales are not more than the sum of the Closing stock, Purchase, Production of assessment year ie.(Cl. Stock + Purchases + Production of assessment year). 13

Purchases should be from certified institutions with supportive documents as specified in the CCC Rules.

[ Since MDA Scheme in lieu of Rebate has been introduced with effect from 1.04.2010 on Production and not on Retail Sales, it is proposed that Retail Sales should be encouraged to liquidate stock. In cases where the Institution is enlisted with Dte. Of Government Supplies, KVIC, wholesales target can be extended upto 100% of the Production target, based on the recommendation of the Director (Marketing) and SLBT against Production target agreed. c) Economically viable target

Target of small institutions (usually assigned meager target of Rs.1.00 lakh or Rs.2.00 lakhs etc.) may be fixed taken into account the economics of Khadi so that the margin earned by achieving the assigned production and sale will enable institutions to meet their expenditure. Hence, even small institutions have to work on a scale, which is above their Break Even Point (B.E.P.).

2) CALCULATION OF GROSS AND NET ELIGIBILITY FOR WORKING CAPITAL: Formula for calculation of gross eligibility and net eligibility: - Gross Eligibility= Approved target (in value) X as per Pattern of Assistance Net Eligibility = Gross eligibility (-) Available Working fund (KVIC/CBC/BF/Own fund under Khadi) Further, as per the prescribed pattern of assistance financing is done based on DER (Debt Equity Ratio) of 10: 1.

i) Surplus Working Capital: - While calculating the Working capital available with the institutions all sources of fund should be taken into consideration in order to identify Net Eligibility and surplus, if any with the institution. Surplus fund first may be identified in CBC fund then KVIC fund and even after that if the fund are not sufficient it will be shown under Bank Finance. As ISEC is granted year to year basis on the approved budget taking into account of the net eligibility, surplus fund etc., wherever reduction noticed on the performance of the institutions and subsequent sanction of less budget then the previous year the ISEC should not be allowed to be continued to retain by the institution. Actual requirement of W.C. on the basis of net eligibility arrived at and ISEC shall be issued to that extent only.

Further, it is requested to refer Circular No:-DKC/Policy- General/2011-12/dated:- 26.12.2011, conveying Commission’s decision of its Meeting dated 19.12.2011 regarding retention of Bank Finance

ii) Under Khadi & Polyvastra, agreed budget for 2012-13 should be finalized and working capital gap should be proposed to meet out of Bank Finance under Comprehensive Interest Subsidy Scheme approved by the Govt. of India vide No. 4(47)75-KVI(I) dated 17.05.1977. However, for N. E. Region including Sikkim this demand of working capital gap will be met out of KVIC resources within 10% allocation limit for N. E. Region. 14

ii) Appropriation of own working fund:

In order to work out the Net Eligibility of Working fund it will be necessary to identify aggregate of working fund available with the institutions and Boards as per the accepted formula i.e. "current Assets minus current liabilities". The own fund of the institutions/Boards must be ascertained after deducting Commission's fund, Consortium Bank Credit and Bank Finance available from the aggregate of working funds. While calculating own funds the instruction laid down in the Circular No. DKC/RF/New/97-98 dated 11.012.1997 of Dy. CEO (Khadi), KVIC, Mumbai, must be scrupulously followed.

Many Khadi institutions implement Village Industrial activities beside their Khadi Programme. Now, Commission has stopped extending V.I. loan and also put a cap on C.B.C., no fresh loan is sanctioned to such institutions. Since, V.I. loans are recoverable, most of the institutions have already repaid the V.I. loan. With their continued association in the Village Industrial activity, they have generated their own resources, which is utilized for implementation of V.I. Programme.

It is observed that in the absence of specific guidelines for assessing own fund for V.I. Programme, such funds are amalgamated at one place and reckoned with Khadi schemes and as a result huge surplus is shown in case of Khadi institutions implementing sizeable V.I. Programme. Therefore, realistic working capital assessment should be done clearly earmarking the working capital for V.I. activities implemented by the institutions clearly in tune with the approved pattern of KVIC for the respective V.I. activity. For that purpose, drawl of separate set of Accounts for Khadi as well as Village Industrial activities would help to overcome this problem. Till then, a notional working capital as per Pattern of Assistance eligible for major V.I. activities carried out by the institutions may be subtracted (instead of subtracting V.I. stocks – being followed at present) from general working fund.

3) Raw Material Provision:

For production purpose, the procurement of raw material should be made on the basis of the latest policy and guidelines issued by the Commission from time to time. As per the existing policy, there is a mandatory requirement for procurement of cotton by the CSPs and all other Khadi/Polyvastra institutions from the Cotton Corporation of India only in order to maintain the uniformity in the Cotton Khadi cost chart, vide Circular No. DKRM/CSPs/Cotton Purchase–CCI/2009-10 dated 24.12.2009.

However, in case a specific variety of cotton is not available with CCI and being supplied by CCI, the CSPs, and Khadi institutions are permitted to purchase those varieties of cotton from open market including Govt. agencies such as State Level Marketing Federations, local regulated markets, agricultural producers marketing committee and National agricultural Federations etc. by following due procedure as envisaged in the circular No. DKRM/CSPs/Cotton Purchase- CCI/2009-10 dated 24.12.2009. 15

1. State/Divisional Office Directors may revised cost charts and targets considering of variable costs Khadi production in consultation with Cost Chart Committee at State Level.

2. The variation in the price of raw material up to 5% should be ignored. However, increase beyond 5% should only be considered for revision of the cost chart and proportionate increase in the production cost for regulation of MDA.

3. Every institution normally have price fluctuation reserve. Increased cost of raw material upto 5% may be met out of such price fluctuation reserve.

4. Any revision in the cost chart and corresponding production target should be made only by the respective Cost Chart Committee at State Level.

5. Further, for quarterly revision of the cost chart suitable software should be developed so that the revised cost chart is easily prepared with the revised cost of raw material. Otherwise for manual revision of the cost chart every quarter will be time taking process and any delay may defeat the purpose.

4) Artisan Welfare Measure (Janashree Bima Yojana):

Insurance to artisan under Janashree Bima Yojana Scheme @ Rs.100/- per annum per artisan with the break up of:-

(i) Contribution from Social security fund : Rs.50/- (Government of India) (ii) Institutions contribution : Rs.25/- (iii) KVIC : Rs.12.50 (iv) Artisan : Rs.12.50

Directorate of KC has suggested in view of the limitations in JBY/AWFT involving coverage of Artisans in the age of group of 18 to 59, SLBT may have to go by actual utilization of infrastructural facilities, without only going by the availability of infrastructure. This aspect may be taken care of by SLBT while considering budget proposals for 2012-13.

5) Target & purchase of V.I. by Departmental Bhavans & institutions:

Large No (s) of REGP/PMEGP and V.I. units have been set up in the country. To extend marketing facility to these units Departmental Bhavans/Khadi Institutions shall be encouraged for sale of V.I. items. At least 30% of total sales turnover should be achieved by V.I. sales. Acquisition of V.I. goods by the Departmental Bhavans shall be made on consignment basis only or as directed by Directorate of Marketing. For Departmental Bhavan no purchase targets to be agreed by budget team. To achieve the sale target judicious Purchase/Acquisition of goods on consignment shall be made as per guidelines issued from Directorate of Marketing so as to reduce old accumulated stock. 6) C S P Budget:

i) While discussing budget with the institution and Board, the budget team should compile side by side the requirement of raw material/sliver of such institution and Board for the use of the CSPs 16

and subsequent follow up action to be taken by Project Manager. To facilitate the compilation, CSP manager may be drafted as member of SLBT of the State in which State CSP is in operation. Project Managers may also arrange to depute his representative to other states where the institutions procure a handsome quantity of sliver /roving from their plant. While agreeing the production and sale target for CSP, total requirement of the institution, old accumulated stock with the CSP should be taken into consideration so as to keep the closing stock to the minimum level.

ii) Budget proposals for CSP's also to be finalized by the State Level Budget Team and send to Director (KRM) based on their past performance and demand. The project Managers should submit latest list of Sundry Debtors to the respective State/Divisional Directors so that this aspect can be discussed with the concerned institution and recovery plan is decided and recorded in the minutes of budget discussion. Simultaneously, if any institution has any specific issue pertaining to CSP, this may also be attended by budget team passing suitable advise to the CSP concerned for speedy redress.

7) M.D.A.

MDA on Production is an Assistance to be provided on cost of production of Khadi and Polyvastra achieved by the certified Khadi institutions. The Khadi institutions, having valid Khadi certificate and categorized as A+, A, B and C, are only eligible to avail MDA grant from KVIC.

Rate of MDA

MDA shall be calculated @ 20% on cost of production of Khadi (Cotton, Silk, Woollen) and Polyvastra to the extent of production target approved by the Standing Finance Committee (SFC) of KVIC for the year.

8) MISCELLANEOUS:

Compilation of budget at State/Divisional Office level is required to be made category-wise in respect of ‘A+’, 'A' 'B' & 'C' category of institution. As regards, revival of weak institutions, the Circular dt. 7.8.2009 of Directorate of RID&NS may please be taken note for considering and recommending the proposals of such weak institutions, on case to case basis, as per the merits of the proposals of such institutions. 17

BUDGET GUIDELINES FOR V.I. PROGRAMME

1. Continuation of old running programme only under Village Industries may be agreed for the year 2012-13 based on installed capacity of production, last year’s performance, availability of technical manpower and market potentiality of the product. Enhancement of targets may be made up to 20% over the last three years best performance and availability of W.C. 2. V.I. Budget exercise may be restricted to only those V.I. Activities which are carried by KVIC/KVIB Aided Institutions & Departmental Activity.

3. a) Targets of Production & Sales are to be in accordance with installed capacity and the manpower.

b) The available working capital should match achievement of target and gross eligibility.

c) In case of higher targets, i.e. more than ₹.5.00 Crore the proposal should be thoroughly examined in accordance with the Circular No. Finance/Circular/2011-12 dated 25.05.2011, by physically verifying with reference to infrastructure available, number of persons working as per wage bills/registers, source of procurement of raw materials, supply of finished goods, availability of finance and its source etc. and the same is to be incorporated in Form No. VI. 4. Since the Ministry has discontinued the V.I. Loan scheme, targets may be achieved with the available fund. If any surplus fund is identified it should be refunded immediately. Khadi and V.I. Boards should furnish the institution-wise details of old running continuation programme in the prescribed Form, which is essential to justify the retention of available working capital, and renewal of ISEC for Bank Finance availed. This exercise of budgeting is required to be done every year till the fund is fully repaid in order to ensure that the fund is being properly utilized for the purpose for which it was paid. Hence, without institution-wise details V.I. Budget of old continuation programme will not be agreed and no ISEC will be issued and the entire outstanding V.I. Loan amount paid out of KVIC/CBC resource has to be refunded by the Board with penal interest. 5. While considering the demand for renewal of Bank Finance under continuation programme the Budget team has to see that Institution/Board furnishes the details of repayment schedule in respect of C.E. Loan component and only the reduced balance is agreed for renewal of ISEC. Since the ISEC Scheme for V.I. Programme has been discontinued, the budget team has to ensure that any Bank Finance availed by the beneficiary after 01.04.1995 for new programme is not considered for renewal of ISEC. 18

6. Budget shall be discussed in respect of working units only. For the units where production activities have been stopped, the Institutions and the Boards are to be asked to refund the available fund obtained from KVIC/CBC/Bank Finance resources. Such fact should be mentioned in the record note of discussion.

7. Submission of quarterly Report by the V.I. Units are to be recorded in record note as one of the essential condition.

8. Under V.I. Programme, V.I. Grant provision may be made for Interest Subsidy, cluster development, Promotional activities, RISC etc. and sent to respective V.I. Director. In the Central Office V.I. Directorate shall compile the requirement of Promotional Budget while Director (VIC) has to prepare the requirement of budget for RISC.

9. PUBLICITY/MARKET PROMOTION : Provision for 2012-13 for ongoing and new programme on various items of Publicity and Market promotion activities should be made and forwarded to Director (Publicity/Market promotion) by due date.

10. MARKETING: Provision for 2012-13 for ongoing and new programme on various items of Marketing Expenditure including Annual budget of Departmental Bhavan/Vastragar may be forwarded to Directorate of Marketing by due date.

11. HRD : Fixing target and realistic requirement of fund of all the training Centres may be made based on in take capacity and concrete programme for each Centre may be sent to Director HRD by due date. Guidelines issued by the Directorate of HRD time to time may be followed

12. ACCOUNTS : Institution has to confirm the Khadi & V.I. Loan outstanding position and also fund received and refunded position in the format prescribed by the Directorate of Accounts (Copy enclosed). State Director may ensure to collect the loan confirmation statement as well as fund received and refunded statement duly signed by the secretary and chairman of the Institution and forward to Directorate of Accounts. 19

GENERAL GUIDELINES 1. The budget proposal of the institution/Board must be supported with the copy of the resolution to the effect that the said budget proposal has been considered and passed by the managing committee of the institution/Board. Apart from this the budget discussion should be held with the President and Secretary of the Institution/authorized representatives of the Institution/Board. 2. State/Divisional Directors must verify the following documents in respect of all the institutions and the facts may be recorded in the Note of discussion.

a. Registration Certificate and its date of issue in original. b. The date of issuance of Direct listing Certificate by KVIC c. The validity of Khadi/Polyvastra Certificate d. Position of creation of Equitable Mortgage Hypothecation Deed and Surety with value. The institution should furnish comprehensive statement in the prescribed form enclosed. 3. One of the basic requirements for finalization of ‘agreed programme’ is scrutiny of audited balance sheet and supporting statements of accounts. In view of this, it is imperative that the audited accounts of the institutions/Board for the latest period viz. 2010-11 are available at the time of the budget discussion. The State/Divisional Directors will therefore ensure its availability sufficiently in advance so that its analysis could be done before hand by the Internal Audit Party attached to it. It may be made clear to the institutions that failure to comply with this essential requirement would entail disqualification for budget discussion.

4. It may be ensured by the budget team that in agreed programme of the institutions sufficient participation of SC/ST, Women, and Minority has been taken into account both in terms of physical contents as well as monetary allocations under different industries and programme. Emphasis should be given to the need of furnishing reports of such participation of the SC/ST people to the State/Divisional Director, who in turn, will compile and furnish the information to the Directorate of Ec.R. as well as to the respective Industry and Programme Directors.

5. Preparation of Budget Record Note

The Record Note of Budget Discussion of 2012-13 should cover the points as mentioned in the Annexure-II. The budget record note should start with a broad but concise statement about the compliance of the observations raised in the Record Note of Budget Discussion of the previous year by the institution.

Further, it may also be ensured that the norms for revaluation of immovable properties issued vide Circular dated 28.5.1998 is strictly adhered to and wherever revaluation has taken place a separate para on the same may be mentioned in Budget Record Note.

While analyzing of the balance sheet of the institutions assessment of own fund for khadi as well as V.I. has to be calculated or reckoned in the pragmatic manner as mentioned in the para 2 (iii) of khadi & polyvastra budget guidelines. 20

6. Budget discussion for Directly Aided institutions and KVI Board Aided Institution is responsibility of concern State/Divisional and KVI Boards respectively.

Total budget for 2012-13 should be furnished in Outcome Budget Summary sheet, along-with balance sheet analysis and other forms. The details of Annexure and forms enclosed with budget guidelines are furnished below.

Sr Details of form enclosed Form No. Whom to be sent . N o. 1 Top Sheet for Khadi Institutions Annexure - Programme Director . 1

2 Budget Record Note Annexure - Programme Director . 2

3 Institution's Bio-Data Form No. I Director S.O./D.O. .

4 Khadi / Polyvastra Budget Form No. II Director S.O./D.O. .

5 Khadi Polyvastra Budget Form No. III Director S.O./D.O. .

6 Details of Production Centres/Retail Form No. IV To be retained with . Outlets S.O./D.O.

7 Janashree Bima Yojana Form No. V To be retained with . S.O./D.O.

8 V.I. Budget for ongoing activities Form No .VI Programme Director .

9 Quarterly Production Plan 2011-12 Form No. Director S.O./D.O. . VII

1 Outcome budget summary sheet Form No. Programme Director 0 2011-12 VIII .

1 Summary sheet of Khadi /Polyvastra Form No. IX Programme Director 1 .

1 Details of Bank Finance Consolidated Form No. X Programme Director 2 .

1 Budget Proposal in respect of Form No. XI Programme Director 3 Departmental Bhavans/Vastragar .

1 Budget Proposal in respect of CSP & Form No. Programme Director 4 Other Departmental Trading Units XII .

1 Construction of Infrastructural From No. Director S.O./D.O. 21

Development XIII 1 Bio Technology Budget Form No. Programme Director 6 XIV .

1 Details of immovable properties of Form No. Director S.O./D.O. 7 the institutions XV .

1 Details of fund received and Form No. Director Accounts 8 refunded to KVIC XVI .

1 Details of Utilization of MDA Form No. Director S.O./D.O. 9 XVII . 22

DIRECTOATE OFBUDGET KHADI AND VILLAGE INDUSTRIES COMMISSION IRLA ROAD, VILE PARLE (WEST), MUMBAI-400 056

No:-BGT/Guidelines/2011-12/ Date:- 26.12.2011

CIRCULAR

Sub:- Modification in Budget Guidelines 2011-12 regarding issuance of ISEC on the basis of approved target of performance.

In the Budget Guidelines 2011-12, as per decision taken in the Commission’s Meeting No:-581 held on 25.05.2010, the Para No.2 and sub-para of Para No.1 was changed as under:-

“As ISEC is granted year to year basis on the approved budget taking into account of the net eligibility, surplus fund etc., wherever reduction noticed on the performance of the institutions and subsequent sanction of less budget then the previous year the ISEC should not be allowed to be continued to retain by the institution. Actual requirement of W.C. on the basis of net eligibility arrived at and ISEC shall be issued to that extent only”. Many of the institutions with lesser performance has reduced their net eligibility and landed in the surplus, accordingly ISEC of these institutions has also been reduced. In order to handle the situation, in the Commission’s Meeting No.596 dated:- 19.12.2011, Commission directed as under:- “ As regards to reduction of the availment of Bank Finance based on the performance, the Commission reviewed the financial difficulties faced by the Khadi institutions who availed Bank Finance earlier and possibilities of declaring their Account as NPA by Bank, for those institutions which could not maintain physical performance at the same level. Further, considering the recommendation made by Commission to the Govt. of India for waiver of CBC loan as per directives of the Ministry and the intricacy/ sensitivity of the issue, it was decided by the Commission to restore the target of such Khadi institutions to the last year’s budget i.e. 2010-11 for the purpose of retaining Bank Finance and extend the benefit of ISEC to the institutions for the period up to September 2012. By this time the above institutions are expected to enhance their performance level for which practical and effective action plan and strategies should be chalked out by each such institution immediately. Commission while appreciating the decision taken by the earlier Commission for postponement of recovery of surplus funds from the Khadi institutions till June 2011 and decided that this relief should be extended upto September 2012. Commission further directed that direction to the above effect be issued immediately”.

FINANCIAL ADVISOR

To, 1. All State/Divisional Directors. 2. All the Industry/Programme Directors 3. All State/UT KVI Boards

Copy to:- 1. Commission Cell 2. OSD to C.E.O. 3. A.O. to F.A. Cell 4. Jt.C.E.O. Cell 5. Dy.C.E.Os. in the respective State/Zonal Office.