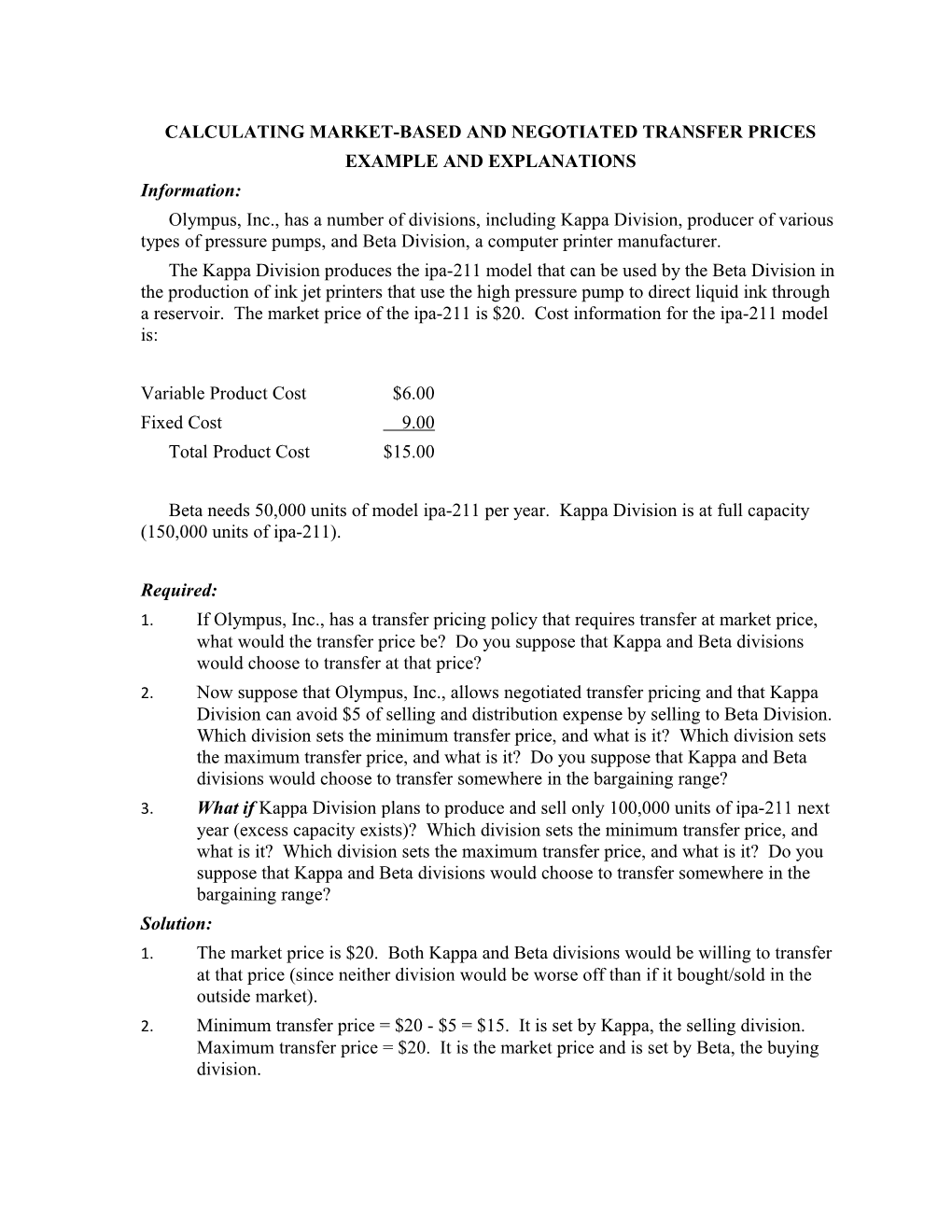

CALCULATING MARKET-BASED AND NEGOTIATED TRANSFER PRICES EXAMPLE AND EXPLANATIONS Information: Olympus, Inc., has a number of divisions, including Kappa Division, producer of various types of pressure pumps, and Beta Division, a computer printer manufacturer. The Kappa Division produces the ipa-211 model that can be used by the Beta Division in the production of ink jet printers that use the high pressure pump to direct liquid ink through a reservoir. The market price of the ipa-211 is $20. Cost information for the ipa-211 model is:

Variable Product Cost $6.00 Fixed Cost 9.00 Total Product Cost $15.00

Beta needs 50,000 units of model ipa-211 per year. Kappa Division is at full capacity (150,000 units of ipa-211).

Required: 1. If Olympus, Inc., has a transfer pricing policy that requires transfer at market price, what would the transfer price be? Do you suppose that Kappa and Beta divisions would choose to transfer at that price? 2. Now suppose that Olympus, Inc., allows negotiated transfer pricing and that Kappa Division can avoid $5 of selling and distribution expense by selling to Beta Division. Which division sets the minimum transfer price, and what is it? Which division sets the maximum transfer price, and what is it? Do you suppose that Kappa and Beta divisions would choose to transfer somewhere in the bargaining range? 3. What if Kappa Division plans to produce and sell only 100,000 units of ipa-211 next year (excess capacity exists)? Which division sets the minimum transfer price, and what is it? Which division sets the maximum transfer price, and what is it? Do you suppose that Kappa and Beta divisions would choose to transfer somewhere in the bargaining range? Solution: 1. The market price is $20. Both Kappa and Beta divisions would be willing to transfer at that price (since neither division would be worse off than if it bought/sold in the outside market). 2. Minimum transfer price = $20 - $5 = $15. It is set by Kappa, the selling division. Maximum transfer price = $20. It is the market price and is set by Beta, the buying division. Yes, both divisions would be willing to accept a transfer price within the bargaining range. The actual transfer price set depends on the negotiating skills of the Kappa and Beta division managers. 3. Minimum transfer price = $6.00 (the variable cost of production). This price is set by Kappa, the selling division. Maximum transfer price = $20. This is the market price and is set by Beta, the buying division.

Both divisions would be willing to accept a transfer price within the bargaining range. The actual transfer price depends on the negotiating skills of the Kappa and Beta division managers. (Notice that the fixed product costs are not included in the minimum transfer price because Kappa will have to pay total fixed cost no matter how many units are produced.) Explanations: Market-Based Pricing occurs when a perfectly competitive market exists in the outside market. This means that the transfer price and the market price for the good being transferred are equal. This type of market is extremely rare; prices are almost always influenced by producers. Negotiated transfer prices are used when the outside market is not perfectly competitive. Negotiated transfer prices are determined using the opportunity cost approach. This approach identifies the minimum and maximum prices accepted by each division when transferring internally. 1. Market-Based Price: When the transfer price and market price are equal, the actions within Kappa and Beta divisions optimize profits for both divisions and Olympus, Inc. as a whole. Kappa and Beta divisions cannot benefit at the expense of the one another. Because Kappa Division can sell all that it produces at the market price, transferring with Beta Division at a lower price would make Kappa Division worse off. The same concept applies to Beta Division. Beta Division would not want to pay more than the market price when transferring goods with Kappa Division. 2. Negotiated Transfer Price: Minimum and maximum transfer prices outline the bargaining range and can be identified by the opportunity costs of transferring between Kappa and Beta divisions. The minimum transfer price is the absolute lowest price that Kappa Division can sell the ipa-211 without being worse off. The absolute highest price that Beta Division is willing to pay for the ipa-211 model without being worse off is the maximum transfer price. The ipa-211 should be transferred between the two divisions whenever the minimum price is of Kappa Division is less than the maximum price of Beta Division. 3. Negotiated Transfer Price: When the selling division has excess capacity, only variable costs are of importance when determining the minimum transfer price. The total profits of the Kappa Division will not change if the variable costs are covered. This means the division will be no worse off. The maximum transfer price for Beta division remains at market price. Reference: Hansen, D.R. & Mowen, M.M. (2011). Cornerstones of Cost Accounting. Mason, OH: South-Western, Cengage Learning