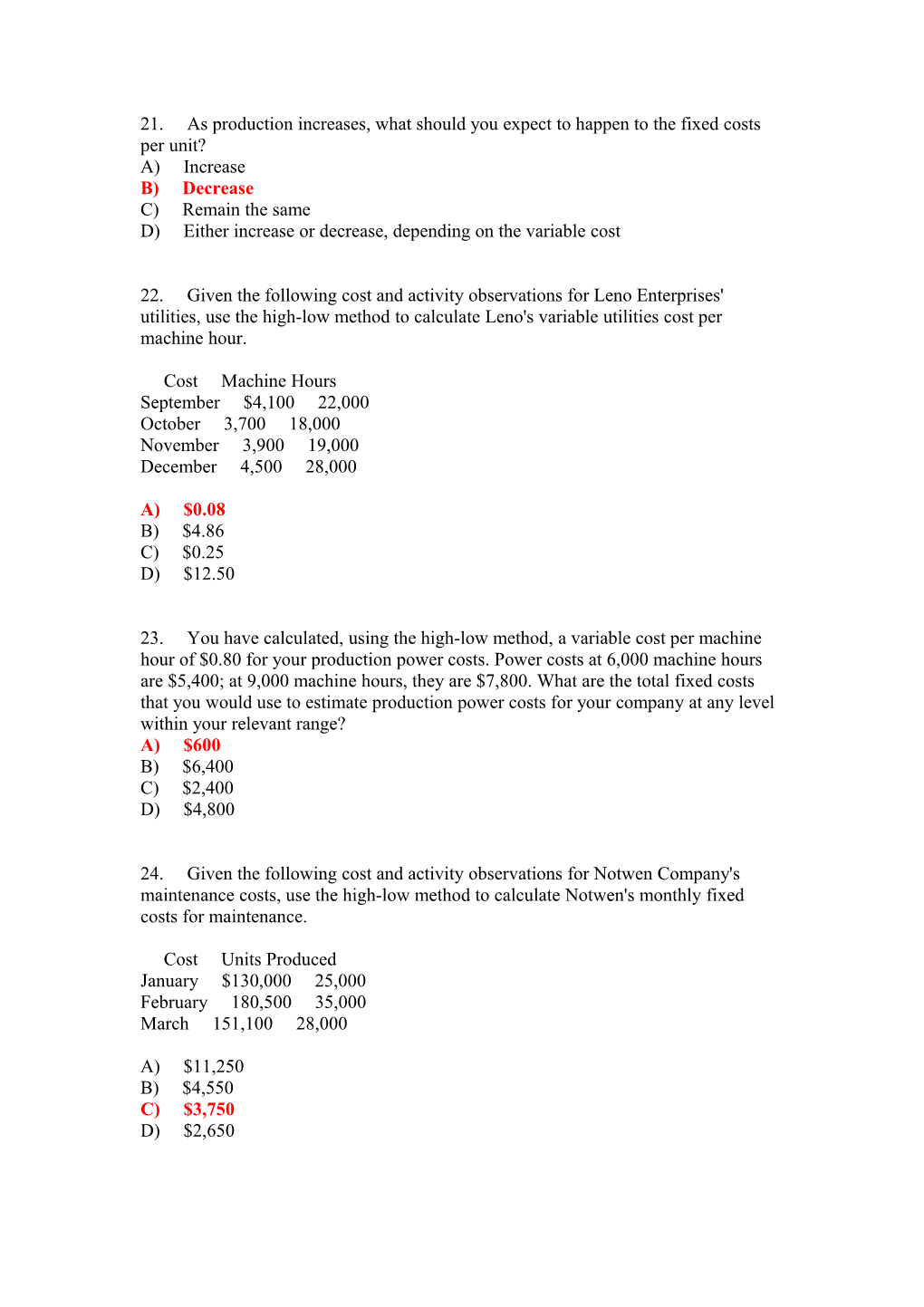

21. As production increases, what should you expect to happen to the fixed costs per unit? A) Increase B) Decrease C) Remain the same D) Either increase or decrease, depending on the variable cost

22. Given the following cost and activity observations for Leno Enterprises' utilities, use the high-low method to calculate Leno's variable utilities cost per machine hour.

Cost Machine Hours September $4,100 22,000 October 3,700 18,000 November 3,900 19,000 December 4,500 28,000

A) $0.08 B) $4.86 C) $0.25 D) $12.50

23. You have calculated, using the high-low method, a variable cost per machine hour of $0.80 for your production power costs. Power costs at 6,000 machine hours are $5,400; at 9,000 machine hours, they are $7,800. What are the total fixed costs that you would use to estimate production power costs for your company at any level within your relevant range? A) $600 B) $6,400 C) $2,400 D) $4,800

24. Given the following cost and activity observations for Notwen Company's maintenance costs, use the high-low method to calculate Notwen's monthly fixed costs for maintenance.

Cost Units Produced January $130,000 25,000 February 180,500 35,000 March 151,100 28,000

A) $11,250 B) $4,550 C) $3,750 D) $2,650 25. Dapper Hat Makers is in the business of designing and producing specialty hats. The material used for derbies costs $4.50 per unit, and Dapper pays each of its two full-time employees $250 per week. If the employees make 50 derbies in one week, what is the fixed cost per derby? (Round to two decimal places where necessary.) A) $4.50 B) $5.00 C) $10.00 D) $14.50

26. Which of the following is a fixed cost? A) Direct materials B) Personnel manager's salary C) Operating supplies D) Telephone expense E) Direct labor

27. Retleb Manufacturing Company noticed that, during its busiest month of 20xx, maintenance costs totaled $15,400, resulting from the production of 32,000 units. During its slowest month, $12,600 in maintenance costs were incurred, resulting from the production of 24,000 units. Using the high-low method, what maintenance cost would the company expect to incur at a volume of 20,000 units? A) $7,000 B) $11,200 C) $8,400 D) $2,800

28. During this past year, a small publishing company sold 60,000 copies of Super Travel paperbacks (its only product) at $5 per book; total fixed costs were $21,000; and total variable costs were $3 per book. What is this company's breakeven point in units? A) 14,700 units B) 10,500 units C) 42,000 units D) 21,000 units

29. How many total dollars of sales must BAC Company sell to break even if the selling price per unit is $8.50, variable costs are $4.00 per unit, and fixed costs are $9,000? A) $4,000 B) $8,500 C) $9,000 D) $17,000 E) $20,000 30. How many units must BAC Company sell to break even if the selling price per unit is $8.50, variable costs are $4.00 per unit, and fixed costs are $9,000? A) 1,000 B) 1,059 C) 2,000 D) 2,250

31. Field Legal Services is trying to determine the variable and fixed elements of its service overhead. The following data have been collected from recent activity:

Total Service Overhead Cases Worked March $22,900 112 April 20,800 98 May 26,400 138

The formula for total service overhead costs is A) $5,600 + $140 per case. B) $5,600 + $40 per case. C) $7,823 + $134.62 per case. D) $7,080 + $140 per case.

32. Dilly LLC, wants to make a profit of $30,000. It has variable costs of $85 per unit and fixed costs of $20,000. How much must it charge per unit if 5,000 units are sold? A) $70 B) $55 C) $85 D) $95 E) $100

33. Walton's Warehouse reported sales of $640,000, a contribution margin of $8 per unit, fixed costs of $314,000, and a profit of $70,000. How many units did Walton's Warehouse sell? A) 8,750 units B) 28,375 units C) 48,000 units D) 67,625 units

34. For every unit that a company produces and sells above the breakeven point, its profitability is improved (ignoring taxes) by the unit's A) gross margin. B) selling price minus fixed cost. C) variable cost. D) contribution margin. 35. Excerpts from a cost-volume-profit analysis indicate fixed costs of $50,000, a contribution margin per unit of $35, a selling price of $90, and a sales level of 4,000 units. What must be the targeted level of profit? A) $80,000 B) $105,000 C) $140,000 D) $90,000

36. Dick Sports, Inc.'s, income statement data for last year is as follows:

Sales revenue $200,000 Variable costs 140,000 Fixed costs 30,000 Operating income 18,000

What is Dick's breakeven point in dollars? A) $100,000 B) $18,000 C) $142,000 D) $48,000

Use the following to answer questions 37-38:

SHARE is trying to determine how many clients must be serviced in order to cover its monthly service overhead. Using the high-low method, it has determined that the variable cost per client is $800 and that the monthly fixed overhead is $28,000.

37. Assuming an average fee of $1,200 per client, the breakeven point per month is A) 35 clients. B) 80 clients. C) 70 clients. D) 55 clients.

38. Assuming an average fee of $1,400 per client and a targeted profit of $26,000, the number of clients to be serviced is A) 80 clients. B) 120 clients. C) 47 clients. D) 90 clients.

39. Excerpts from a cost-volume-profit analysis indicate fixed costs of $30,000, a variable cost per unit of $36, a selling price of $60, and a sales level of $125,000. The targeted level of profit must be A) $20,000. B) $50,000. C) $95,000. D) $75,000.

40. If fixed costs are $80,000, the contribution margin is $25 per unit, and the targeted profit is $30,000, then the required unit sales are A) 4,400 units. B) 2,000 units. C) 4,500 units. D) 2,500 units