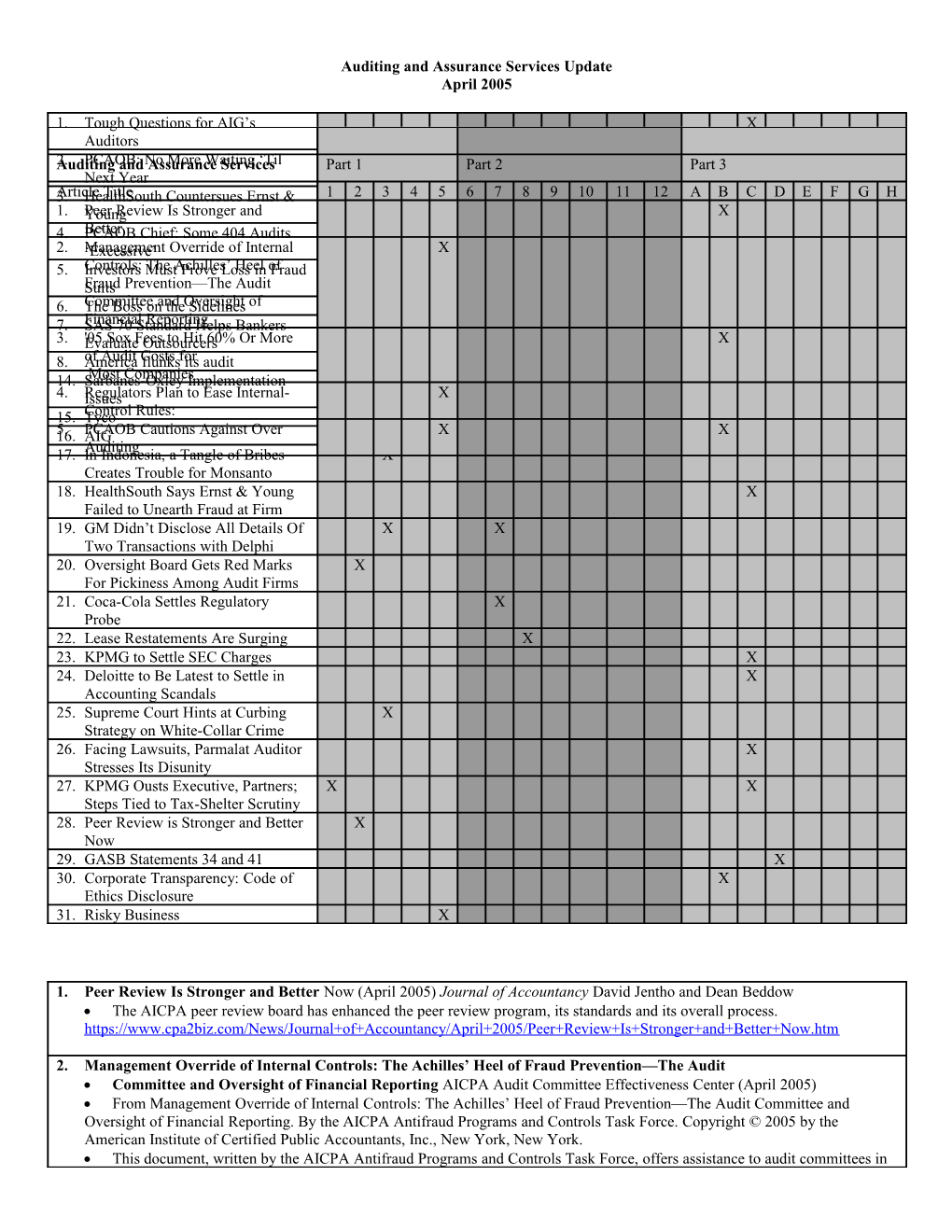

Auditing and Assurance Services Update April 2005

1. Tough Questions for AIG’s X Auditors Auditing2. PCAOB: and NoAssurance More Waiting Services ‘Til Part 1 X Part 2 Part 3 Next Year 3.ArticleHealthSouth Title Countersues Ernst & 1 2 3 4 5 6 7 8 9 10 11 12 A B XC D E F G H 1. YoungPeer Review Is Stronger and X 4. PCAOBBetter Chief: Some 404 Audits X 2. ‘Excessive’Management Override of Internal X 5. InvestorsControls: MustThe Achilles’ Prove Loss Heel in ofFraud X SuitsFraud Prevention—The Audit 6. TheCommittee Boss on and the Oversight Sidelines of X X 7. SASFinancial 70 Standard Reporting Helps Bankers X 3. Evaluate'05 Sox Fees Outsourcers to Hit 60% Or More X 8. Americaof Audit Costsflunks for its audit X 14. Sarbanes-Oxley Most Companies Implementation X X 4. IssuesRegulators Plan to Ease Internal- X 15. TycoControl Rules: X 16.5. AIGPCAOB Cautions Against Over X X X X X 17. InAuditing Indonesia, a Tangle of Bribes X Creates Trouble for Monsanto 18. HealthSouth Says Ernst & Young X Failed to Unearth Fraud at Firm 19. GM Didn’t Disclose All Details Of X X Two Transactions with Delphi 20. Oversight Board Gets Red Marks X For Pickiness Among Audit Firms 21. Coca-Cola Settles Regulatory X Probe 22. Lease Restatements Are Surging X 23. KPMG to Settle SEC Charges X 24. Deloitte to Be Latest to Settle in X Accounting Scandals 25. Supreme Court Hints at Curbing X Strategy on White-Collar Crime 26. Facing Lawsuits, Parmalat Auditor X Stresses Its Disunity 27. KPMG Ousts Executive, Partners; X X Steps Tied to Tax-Shelter Scrutiny 28. Peer Review is Stronger and Better X Now 29. GASB Statements 34 and 41 X 30. Corporate Transparency: Code of X Ethics Disclosure 31. Risky Business X

1. Peer Review Is Stronger and Better Now (April 2005) Journal of Accountancy David Jentho and Dean Beddow The AICPA peer review board has enhanced the peer review program, its standards and its overall process. https://www.cpa2biz.com/News/Journal+of+Accountancy/April+2005/Peer+Review+Is+Stronger+and+Better+Now.htm

2. Management Override of Internal Controls: The Achilles’ Heel of Fraud Prevention—The Audit Committee and Oversight of Financial Reporting AICPA Audit Committee Effectiveness Center (April 2005) From Management Override of Internal Controls: The Achilles’ Heel of Fraud Prevention—The Audit Committee and Oversight of Financial Reporting. By the AICPA Antifraud Programs and Controls Task Force. Copyright © 2005 by the American Institute of Certified Public Accountants, Inc., New York, New York. This document, written by the AICPA Antifraud Programs and Controls Task Force, offers assistance to audit committees in addressing the risk of fraud through management override of internal control over financial reporting. http://www.aicpa.org/audcommctr/spotlight/achilles_heel.htm

3. '05 Sox Fees to Hit 60% Or More of Audit Costs for Most Companies The Controller's Report 5-April-2005 Sarbanes-Oxley compliance was a budget buster at large companies in 2004.

4. Regulators Plan to Ease Internal-Control Rules: Dow Jones Business News 14-Apr-2005 Securities and accounting regulators, responding to business concerns about the costs of complying with provisions in the 2002 Sarbanes-Oxley Act, said they plan rule changes that could ease the burdens on corporations. 5. PCAOB Cautions Against Over Auditing accountingweb(April 21, 2005) At the same time the Public Company Accounting Oversight Board (PCAOB) is warning auditors not to overdo internal controls testing, the government is revamping portions of the law that required the testing in the first place. PCAOB Chairman William McDonough told auditors to expect a “severe conversation” if the board thinks they are gouging clients to run up fees, CFO.com reported. http://www.accountingweb.com/cgi-bin/item.cgi?id=100795&d=659&h=660&f=661

6. Tough Questions for AIG’s Auditors BusinessWeek (April 11, 2005), 36. Discusses the possible liability of AIG’s auditors (PricewaterhouseCoopers) for not detecting some of the recent accounting improprieties at AIG.

7. PCAOB: No More Waiting ‘Til Next Year CFO.com (April 1, 2005), Stephen Taub. A new proposal by the PCAOB would allow companies to engage auditors to test specific controls as opposed to the entire control environment. This proposal would also allow these tests to occur throughout the year instead of at year-end, as is required under the current rule 404.

8. HealthSouth Countersues Ernst & Young CFO.com (April 7, 2005), Stephen Taub HealthSouth is suing Ernst & Young for breach of contract and failure to detect the $2.7 billion accounting fraud. HealthSouth’s ability to prevail is questionable, since a number of finance executives have testified that they took significant steps to hide the fraud from E&Y. In addition, the fact that many former executives at HealthSouth were once employed by E&Y allowed them to manipulate the reports to make the fraud more difficult to detect. http://www.cfo.com/printable/article.cfm/3840063?f=options

9. PCAOB Chief: Some 404 Audits ‘Excessive’ CFO.com (April 14, 2005), Stephen Taub. PCAOB Chairman William McDonough indicated that some 404 audits were characterized by excessive work and that the PCAOB would discuss some of these circumstances with the accounting firms’ management. Thus far, 7.7 percent of all Section 404 reports have been adverse opinions.

10. Investors Must Prove Loss in Fraud Suits CFO.com (April 20, 2005), Stephen Taub. A recent Supreme Court ruling affirmed that investors accusing a company of securities fraud must be able to demonstrate that the fraud was related to a decline in that company’s share prices. This ruling was in response to an earlier ruling on behalf of shareholders of Dura Pharmaceuticals. http://www.cfo.com/printable/article.cfm/3885009?f=options

11. The Boss on the Sideline BusinessWeek (April 25, 2005). Discusses how changes in the audit environment brought by Sarbanes-Oxley have affected directors, auditors and attorneys. Based on discussion with partners, it has become much easier for auditors to convince companies to restate financial statements. However, there is concern that auditors may become too insistent on immaterial items, making the financial statements less useful to investors.

12. SAS 70 Standard Helps Bankers Evaluate Outsourcers Lucas Mearian Computerworld (Apr 11, 2005) . Corporate IT organizations are increasingly turning to the SAS 70 auditing standard to ensure that outsourcers comply with various government IT regulations. Chicago-based Northern Trust Corp. uses the SAS 70 format to evaluate whether large outsourcing vendors are compliant with various government regulations, such as the Sarbanes-Oxley Act and the Gramm-LeachBliley Act, said Katy Hurst, global disaster recovery director at the bank. 13. America flunks its audit Glenn Cheney. Intheblack. (Apr 2005) According to a report by US comptroller general David M Walker, material weaknesses in internal control and in selected and financial reporting and accounting practices have prevented the Government Accountability Office from providing an opinion on the federal government's consolidated financial statements - not just this year, but the past seven years. 14. The Sarbanes Oxley Act of 2002 Implementation Issues

Call It Sarbanes-Oxley Burnout: Finance-Chief Turnover Is Rising, Wall Street Journal, April 5, 2005, B4. A recent study found that CFO turnover in Fortune 500 companies rose from 13% to 16% (a 23% increase) in 2004. Given the focus on internal controls, one expert stated that he thought “the position has lost a lot of its fun.” Turnover increased in the controller ranks as well, with many financial experts leaving public companies to work for private ones that were not subject to the rigorous Sarbanes-Oxley requirements.

More Companies Are Filing Late, Wall Street Journal, April 11, 2005, C3. Sarbanes-Oxley’s “onerous new compliance requirements” are being blamed for the increase (from 12 to 32 of NASDAQ companies; from 16 to 32 of NYSE companies) in SEC late filers. Late filers face possible delisting by the stock market exchanges.

Regulators Plan to Ease Internal Control Rules, Wall Street Journal, April 14, 2005, C3. At a recent summit addressing the pitfalls of Section 404 of the Sarbanes-Oxley Act, regulators agreed that the section has proved more costly than anticipated. While strengthening internal controls is an admirable objective, the burden has just been too heavy. Part of the problem appears to be caused by audit firms that are “afraid” and are therefore too rigorous in their internal control evaluations.

Software for Sarbanes, Wall Street Journal, April 25, 2005, R8. R9. To help address the myriad Sarbanes Oxley requirements, companies are turning to software solutions. One expert estimates that large companies will spend in excess of $500,000 on Sarbanes Oxley compliance software.

15. Tyco Former Tyco Auditor Disagreed With Treatment of Transaction, Wall Street Journal, April 5, 2005, C3. Although he disagreed with Tyco’s accounting for bonuses related to an acquisition, the PwC engagement partner allowed it because “the bonus was not considered material.” Although not a direct expense related to the transaction, Tyco officials were able to “hide” the amount of the bonuses by offsetting them against the gain on the transaction.

Tyco Ex-Auditor Says Access To Books Was Not Restricted, Wall Street Journal, April 6, 2005, C4. PwC auditors had full access to all Tyco records as well as unrestricted access to Tyco’s audit committee to answer any questions that the committee members might have. Despite this access, the PwC audit partner on the engagement testified, “No one asked me any questions,” especially about what has been termed excess compensation to Tyco CEO Dennis Kozlowski.

16. AIG Probe of AIG Hits on More Potential Problems, Wall Street Journal, April 1, 2005, C1, C3. Authorities continue to investigate insurance giant AIG’s questionable accounting transactions. After an internal investigation, AIG disclosed a number of different potential accounting “errors.”

Insurer’s Filings Had Accounting Clues, Wall Street Journal, April 11, 2005, C1, C6. Insurance giant AIG faces investigation over the failure to expense employee stock compensation. One analyst noted, “I don’t see how the auditor on the job missed it.”

AIG Received Warning in ’92 On Accounting, Wall Street Journal, April 27, 2005, C1, C5. In house counsel warned CEO Hank Greenberg that some accounting policies regarding revenue recognition were “permeated with illegality.” Despite this warning, AIG continued the practices.

AIG Will Delay Filing As Questions Mount on Accounting, Wall Street Journal, April 30, 2005, C1, C4. Facing an impending SEC investigation of its accounting practices, insurance giant AIG announced that it is pushing back the filing of its annual report. At issue is over $2.5 billion in accounting “errors.” As the company’s internal investigation continues, more accounting irregularities are being discovered, including the movement of funds in and out of hedge funds intended to increase quarterly results for down periods. 17. In Indonesia, a Tangle of Bribes Creates Trouble for Monsanto, Wall Street Journal, April 5, 2005, A1, A6. Agricultural giant Monsanto agreed to pay $1.5 million in order to settle charges that it bribed Indonesian officials in violation of the Foreign Corrupt Practices Act. Over $750,000 was spent in cash payments, goods, and services in an attempt to get the Indonesian government to allow genetically modified seeds to be introduced to the country. This case is an example of an indirect effect illegal act. 18. HealthSouth Says Ernst & Young Failed to Unearth Fraud at Firm, Wall Street Journal, April 6, 2005, C4. HealthSouth is suing Ernst & Young for failing to uncover a massive fraud perpetrated by the company’s key executives, including its founder Richard Scrushy. 19. GM Didn’t Disclose All Details Of Two Transactions with Delphi, Wall Street Journal, April 13, 2005, A1, A16. General Motors came under scrutiny for a related party transaction with its former subsidiary, auto parts manufacturers Delphi, which allowed GM to meet analysts profit estimates in 2000. General Motors said that the $237 million transaction was not disclosed because it was “not material,” although it represented 19% of the company’s 3rd quarter profits.

Delphi and GM Accounts Seem at Odds, Wall Street Journal, April 28, 2005, A3. Explanations for a questioned $85 million transaction between General Motors and auto parts manufacturer Delphi, a former GM subsidiary, differ. General Motors says that the transaction was part of the final divestiture of Delphi, and treated the transaction as a balance sheet only transaction, thereby not negatively affecting net income. Delphi explains the transaction as a post- divestiture settlement of a warranty expense dispute between the two companies, and therefore should have been expensed by GM. The dispute related to a recall of GM cars that had faulty Delphi parts. Delphi paid $235 million to pay its share of the recall expenses, but a mediator later reduced the settlement by $85 million, the amount of the questioned transaction. While GM recorded the $235 as income, it did not record the $85 million rebate as an expense.

20. Oversight Board Gets Red Marks For Pickiness Among Audit Firms, Wall Street Journal, April 14, 2005, C3. The PCAOB continues to generate criticism for its inspections of firms conducting audits of public companies. A recent inspection targeted a California CPA firm that had only one public client. The review uncovered a lack of documentation involving stock transactions for a computer software company that had generated a total of only $108,000 over an 8-year period. Susan Coffey, a senior vice president at the AICPA, stated that the PCAOB has “spent a little more time than may have been necessary conducting inspections.” The PCAOB’s review staff has grown from 60 inspectors to 130 this past year and expects to reach 220 this year. It plans to inspect firms auditing more than 100 clients on an annual basis and all other firms on a three-year basis.

21. Coca-Cola Settles Regulatory Probe, Wall Street Journal, April 19, 2005, A3, A10. Coca-Cola, under SEC investigation for “channel stuffing,” agreed to a settlement without admitting or denying the SEC’s findings. “Channel stuffing” or more appropriately “gallon pushing” in Coca-Cola’s case involves forcing unwanted shipments to bottlers (who in this case are related parties) to inflate earnings in down periods.

22. Lease Restatements Are Surging, Wall Street Journal, April 20, 2005, C4. SEC clarification of lease accounting regulations has resulted in a number of income statement and balance sheet restatements. To date, over 200 companies have announced restatements. Many of the companies reporting restatements have also reported material weaknesses in their internal controls. 23. KPMG to Settle SEC Charges, Wall Street Journal, April 20, 2005, C4. Without admitting or denying the charges, the Big 4 firm agreed to pay $22.5 million to settle SEC charges relating to the firm’s audit of Xerox. Allegations leveled against the firm included removing a partner from the engagement who disagreed with Xerox’s accounting practices (Xerox overstated in revenues and net income by $3 billion and $1.5 billion, respectively, in order to meet analysts’ earnings estimates), ignoring warnings from other KPMG partners, and failing to inform Xerox’s audit committee about the accounting concerns raised. 24. Deloitte to Be Latest to Settle in Accounting Scandals, Wall Street Journal, April 26, 2005, A2. Without admitting or denying the charges, the Big 4 firm agreed to pay $50 million to settle SEC charges relating to the firm’s audit of cable giant Adelphia. In another settlement, Arthur Andersen agreed to pay $65 million relating to its audit of WorldCom. In fact, since January, all of the Big 5 firms (counting Andersen) have paid large settlements relating to so-called “audit failures.”

Deloitte Statement About Adelphia Raises SEC’s Ire, Wall Street Journal, April 27, 2005, C3. Although the Big 4 firm agreed to pay $50 million to settle SEC charges relating to the firm’s audit of cable giant Adelphia, Deloitte & Touche angered the SEC by shifting the blame back to Adelphia saying in its press release that the company and its executives “deliberately misled” the auditors. The SEC responded quickly, demanding that the firm retract its statement. A spokesman for the SEC stated, “Deloitte’s characterization of the case is simply wrong. Deloitte was not deceived. They didn’t just miss red flags; they pulled the flag over their head and then claimed they couldn’t see.” 25. Supreme Court Hints at Curbing Strategy on White-Collar Crime, Wall Street Journal, April 28, 2005, C3. The U.S. Supreme Court is hearing testimony regarding Arthur Andersen and its “document retention policy.” At issue is whether Andersen inside counsel’s reminder to follow the document retention policy was actually a hidden message to shred all potentially incriminating documents before the documents could be subpoenaed by prosecutors. Prosecutors are arguing that this action was an obstruction of justice. 26. Facing Lawsuits, Parmalat Auditor Stresses Its Disunity, Wall Street Journal, April 28, 2005, A1, A11. As the massive Parmalat fraud in Italy unfolds in litigation, Deloitte & Touch, the company’s auditor, is arguing that the firm’s worldwide operations are composed of separate, legal entities, and only the Italian branch of the firm (Deloitte & Touche SpA) is subject to legal remedies if found negligent, not the entire firm. Parmalat’s Italian auditors, however, relied on the work of firm auditors in 30 other countries, including the U.S. 27. KPMG Ousts Executive, Partners; Steps Tied to Tax-Shelter Scrutiny, Wall Street Journal, April 28, 2005, C2. The Big 4 accounting firm fired three partners, including the head of its tax shelter services division. The firm has been under criminal investigation by the Department of Justice for its sales of abusive or illegal tax shelters since February 2004. 28. Peer Review is Stronger and Better Now, Journal of Accountancy, April 2005, PP. 44-46. Article provides some additional information for students regarding the peer review process. Article includes discussions of the benefits of peer review; types of peer review, issues in determining appropriate peer reviews; and reports issues. 29. GASB Statements 34 and 41, The CPA Journal, March 2005, pp. 20-25 Students who are interested in government auditing may not have a background in government accounting. This article provides students with additional information concerning governmental accounting such that issues for government auditing may be better understood. Presentation of financial information, the need for budgets and budget reconciliations, MD & A requirements, and other government topics are presented. 30. Corporate Transparency: Code of Ethics Disclosure, The CPA Journal, April 2005, pp. 34-37 One of the methods for restoring public confidence in corporations is the use of a code of conduct. This article presents research conducted on 97 of the fortune 500 companies concerning the disclosure of codes of conduct. 31. Risky Business, Fraud Magazine, March/April 2005, pp. 41 – 43, 62 Article presents a methodology for conducting an internal fraud assessment. Includes a discussion of risk analysis; Assessment of controls; addressing vulnerabilities; and the benefits of performing a risk anlalysis.