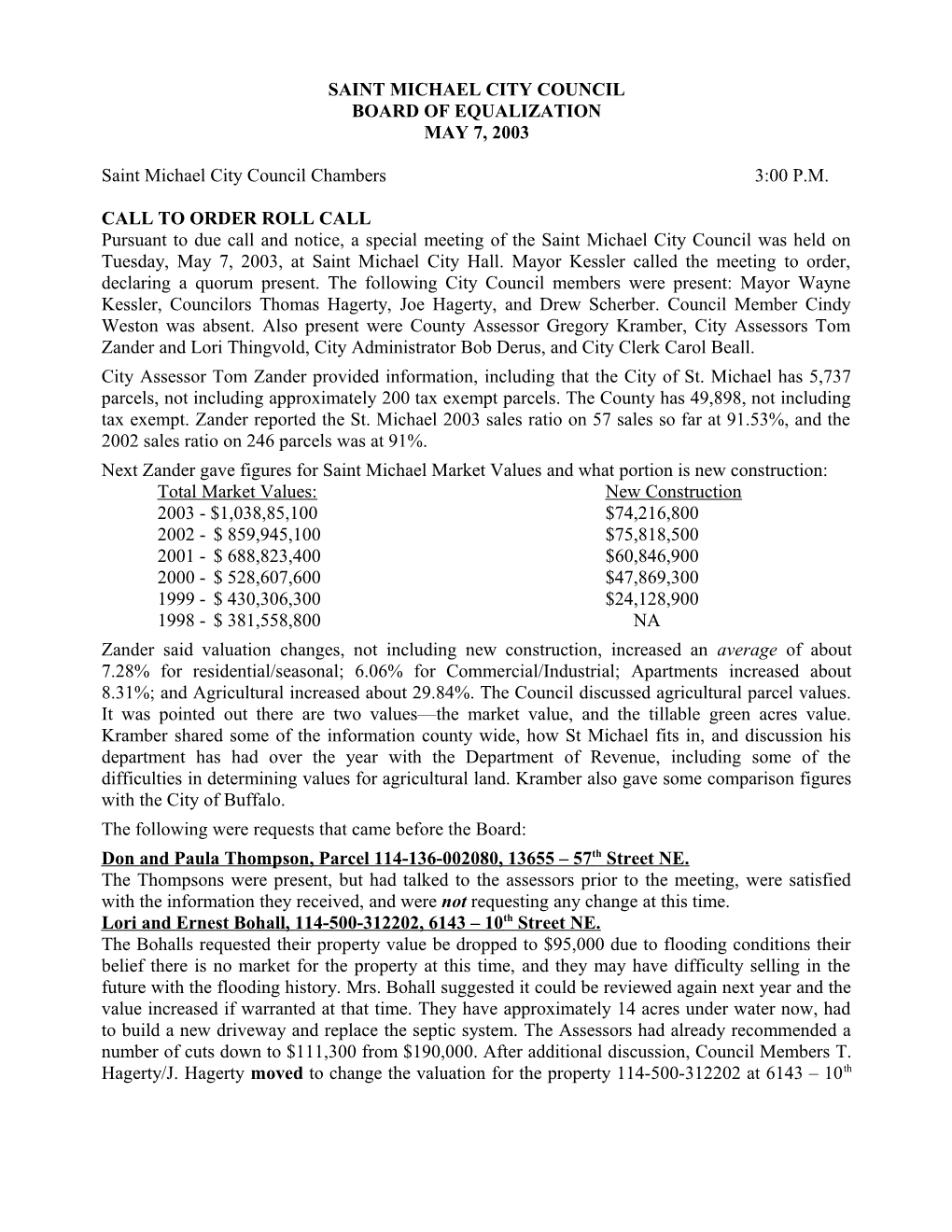

SAINT MICHAEL CITY COUNCIL BOARD OF EQUALIZATION MAY 7, 2003

Saint Michael City Council Chambers 3:00 P.M.

CALL TO ORDER ROLL CALL Pursuant to due call and notice, a special meeting of the Saint Michael City Council was held on Tuesday, May 7, 2003, at Saint Michael City Hall. Mayor Kessler called the meeting to order, declaring a quorum present. The following City Council members were present: Mayor Wayne Kessler, Councilors Thomas Hagerty, Joe Hagerty, and Drew Scherber. Council Member Cindy Weston was absent. Also present were County Assessor Gregory Kramber, City Assessors Tom Zander and Lori Thingvold, City Administrator Bob Derus, and City Clerk Carol Beall. City Assessor Tom Zander provided information, including that the City of St. Michael has 5,737 parcels, not including approximately 200 tax exempt parcels. The County has 49,898, not including tax exempt. Zander reported the St. Michael 2003 sales ratio on 57 sales so far at 91.53%, and the 2002 sales ratio on 246 parcels was at 91%. Next Zander gave figures for Saint Michael Market Values and what portion is new construction: Total Market Values: New Construction 2003 - $1,038,85,100 $74,216,800 2002 - $ 859,945,100 $75,818,500 2001 - $ 688,823,400 $60,846,900 2000 - $ 528,607,600 $47,869,300 1999 - $ 430,306,300 $24,128,900 1998 - $ 381,558,800 NA Zander said valuation changes, not including new construction, increased an average of about 7.28% for residential/seasonal; 6.06% for Commercial/Industrial; Apartments increased about 8.31%; and Agricultural increased about 29.84%. The Council discussed agricultural parcel values. It was pointed out there are two values—the market value, and the tillable green acres value. Kramber shared some of the information county wide, how St Michael fits in, and discussion his department has had over the year with the Department of Revenue, including some of the difficulties in determining values for agricultural land. Kramber also gave some comparison figures with the City of Buffalo. The following were requests that came before the Board: Don and Paula Thompson, Parcel 114-136-002080, 13655 – 57 th Street NE. The Thompsons were present, but had talked to the assessors prior to the meeting, were satisfied with the information they received, and were not requesting any change at this time. Lori and Ernest Bohall, 114-500-312202, 6143 – 10 th Street NE. The Bohalls requested their property value be dropped to $95,000 due to flooding conditions their belief there is no market for the property at this time, and they may have difficulty selling in the future with the flooding history. Mrs. Bohall suggested it could be reviewed again next year and the value increased if warranted at that time. They have approximately 14 acres under water now, had to build a new driveway and replace the septic system. The Assessors had already recommended a number of cuts down to $111,300 from $190,000. After additional discussion, Council Members T. Hagerty/J. Hagerty moved to change the valuation for the property 114-500-312202 at 6143 – 10th Board of Equalization (Review) – 05-07-03 - 2

Street NE, to $95,000, with $46,000 on the land and the reduction made to the building. All voted aye.

Larry C. Van Hall, Parcel 114-218-000380, 1555 Hansack Avenue NE. Van Hall was present to ask for consideration of a reduction in the value of his property due to hardship with ten months of disaster conditions. He did receive an appraisal on his property for refinancing purposes, which was higher than the value the assessors had on the property. It was also pointed out there was a 30% increase in land value across the board in the city. There was some discussion on sales in the Beebe Lake area. Municipal Sanitary Sewer had been installed in the neighborhood as well, which was helpful for the homeowners. The board took no action.

Mike and Rita Bruner, Parcel 114-013-002160. Mike Bruner was present but was not asking for a reduction at this time. He asked several questions about the percentage of increases, how agriculture land is valued, and how values compare on ramblers, splits and two-story houses. The assessors answered his questions. The Board took no action.

Norman Dehmer, Parcel 114-800-302301, 12013 - 17 th Street NE. Norman Dehmer asked where all the increase came in. His property is a split class. Zander reviewed each classification and the value placed on the residential portion, as well as the commercial classification. The increase in valuation of land across the board was also explained, as well as a review of each of the buildings on the property and the value on each. Dehmer believed one building was classified as commercial, which should be classified as personal use. The assessors agreed they could visit the property to view the building, and if it has been misclassified, that could be changed. It was recommended the meeting be continued to allow the assessors to make a further recommendation on the property. The assessors will view the property this afternoon if Dehmer is available. Richard Mason, Parcel 114-500-173401, 7280 30 th Street NE Lori Thingvold worked with Mason who called about a discrepancy in road frontage for his property. Based on the half section map, Thingvold found that Mason was correct in his belief his road frontage should be .55 acres. Based on the discrepancy, Assessor Zander recommended changing the land valuation from $77,000 to $74,600. Council Members T. Hagerty/Scherber moved to approve reduction in the 2003 valuation for Parcel 114-500-17302, at 7280 – 30th Street NE, from the current 2003 valuation of $192,500 to $190,100. All voted aye. Lynn Ostrem, Parcel 114-500-234400, 4439 McAllister Avenue NE. Ms. Ostrem telephoned to ask about the amount of new construction for her basement finish. Thingvold reviewed the property and recommended changing the basement finish quality from good to average, with the recommendation to change current 2003 valuation form $245,700 to $231,200, with new construction at $26,100. Council Members Scherber/J. Hagerty moved to change the current 2003 valuation for Parcel 114-161-003120, at 4439 McAllister Avenue NE, from $245,700 to $231,200, as recommended by the assessors. All voted aye. Maplewood Development, Parcel 114-500-234400. Assessor Zander said there were three parcels involved in the property questioned by Mario Cocchiarella. Cocchiarella submitted a survey for Parcel #114-500-234400, which showed the acreage to be 59.98 acres, while the assessor’s book showed 72.30 acres, and GIS showed 64.592 acres. Zander said Thingvold measured from the half section map, which appeared to be fairly consistent with the survey submitted. Therefore, the land was recalculated using the survey as a guideline. No change was recommended for the other two parcels. Councilors T. Hagerty/Scherber Board of Equalization (Review) – 05-07-03 - 3 moved to change the current 2003 valuation on Parcel 114-500-234400 from $1,154,879 to $1,049,224, as recommended by the assessors. All voted aye. Charles Van Heel, Parcel 114-145-000010, 15440 45 th Street NE. Administrator Derus reported Charles Van Heel called and withdrew his request for consideration of a change in the split classification of his property. No action was taken. Stellar Health Care Center, Parcel 114-028-002031, 701 Thielen Drive SE. The property owner questioned the 2003 valuation, claiming he bought the property in January for $329,000. Thingvold had checked the deed tax, and a reduction was recommended. After some discussion, the Council consensus was to keep the property valued at the 2002 valuation, with no increase in valuation for 2003. Council Members T. Hagerty/Scherber moved to keep parcel 114-028-002031, 701 Thielen Drive SE, at the 2002 assessed valuation of $345,600, bringing it down from the current 2003 value of $372,700. All voted aye. Dusk Cantrell, Parcel 114-091-004120, 207 Cherrywood Avenue NW. After sales analysis of the area and review of the property at 207 Cherrywood Avenue NW, the assessors were recommending a change in value. The Council was informed the entire area would be reviewed this summer. Council Members Scherber/T. Hagerty moved to approve a change from current 2003 valuation of $228,000 to $217,400 for parcel 114-091-004120 at 207 Cherrywood Avenue NW as recommended. All voted aye. Connie Eytad, Parcel 114-139-002090, 5760 Needham Avenue NE . Ms Eytad telephoned with a concern about her property being valued higher than others in the neighborhood. Thingvold reviewed the property and recommended lowering the value at this time. It is planned to reassess the entire neighborhood this year, as some of the properties appear to be undervalued. Council Members J. Hagerty/Scherber moved to reduce the value of Parcel 114-139-003010 at 5760 Needham Avenue NE, from current 2003 valuation of $243,100 to $231,300. All voted aye. Chris Rodgers, Parcel 114-129-001030, 5760 Quam Avenue NE. The lot size for the Chris Rodgers parcel was changed from 49,075 square feet to 48,707 square feet as shown on the County GIS. In addition part of the office space was changed to showroom value, changing the new construction amount from $67,200 to $56,900. Council Members Scherber/T. Hagerty moved to change the current 2003 valuation on Parcel 114-129-001030 at 5760 Quam Avenue NE from $274,900 to $254,200. All voted aye. In addition to the above, both Zander and Thingvold had talked to a number of property owners and answered questions to their satisfaction prior to this meeting. There was further discussion among the Council and the assessors on a number of issues. Zander thanked the Council for the opportunity to hire Lori Thingvold and commended the good work she has done, making her a real asset to the Department. Kramber told the Council the St. Michael assessors are doing an excellent job. There was brief discussion on rates the County will pay for assessing next year, including a higher rate on new homes, with the additional fees collected through the permitting process. Councilmen T. Hagerty/J. Hagerty moved to continue the Local Board of Equalization (Review) to 7:00 p.m. on Tuesday, May 13, 2003 (Regular Council Meeting date). All voted aye. Attest:

______Board of Equalization (Review) – 05-07-03 - 4

Carol Beall, City Clerk Wayne Kessler, Mayor