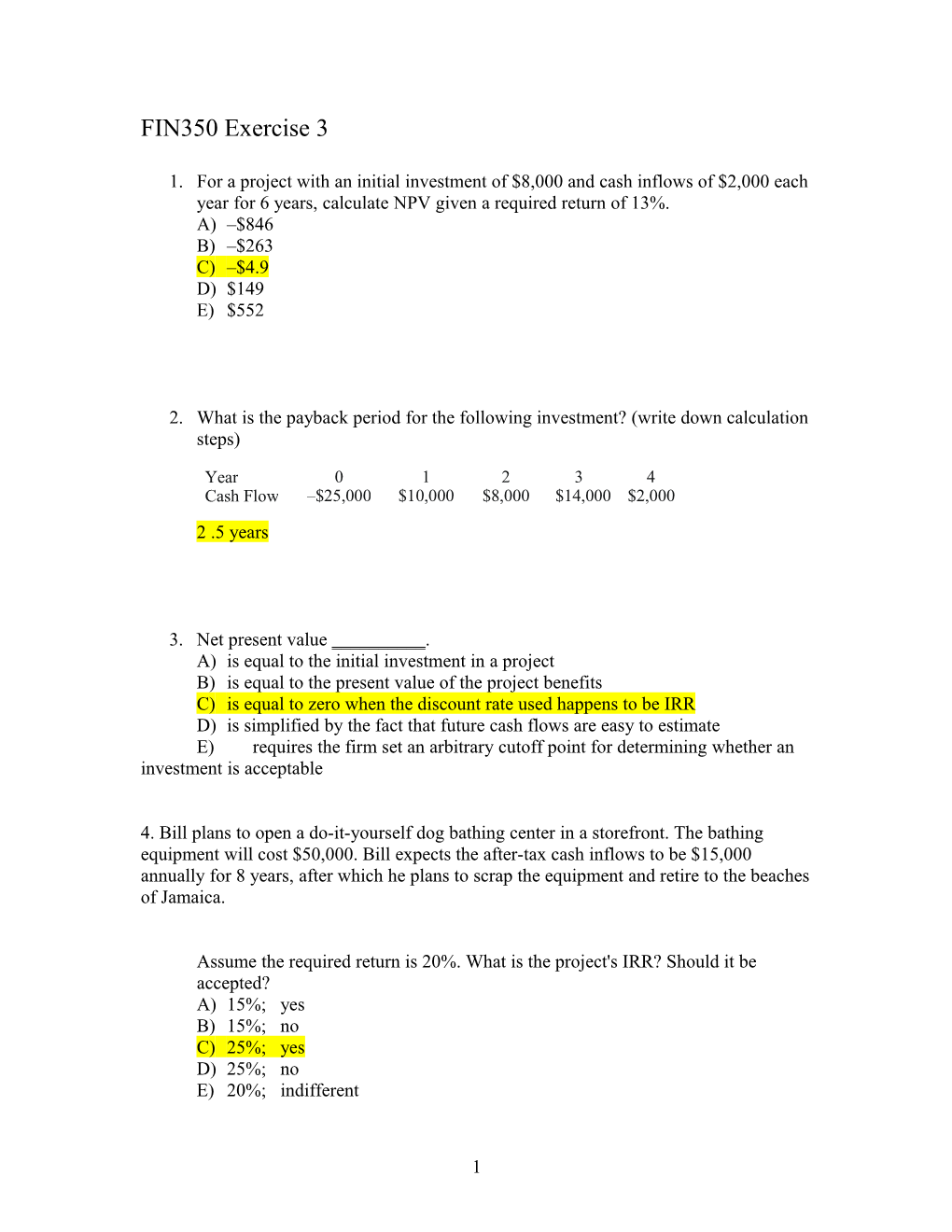

FIN350 Exercise 3

1. For a project with an initial investment of $8,000 and cash inflows of $2,000 each year for 6 years, calculate NPV given a required return of 13%. A) –$846 B) –$263 C) –$4.9 D) $149 E) $552

2. What is the payback period for the following investment? (write down calculation steps)

Year 0 1 2 3 4 Cash Flow –$25,000 $10,000 $8,000 $14,000 $2,000

2 .5 years

3. Net present value ______. A) is equal to the initial investment in a project B) is equal to the present value of the project benefits C) is equal to zero when the discount rate used happens to be IRR D) is simplified by the fact that future cash flows are easy to estimate E) requires the firm set an arbitrary cutoff point for determining whether an investment is acceptable

4. Bill plans to open a do-it-yourself dog bathing center in a storefront. The bathing equipment will cost $50,000. Bill expects the after-tax cash inflows to be $15,000 annually for 8 years, after which he plans to scrap the equipment and retire to the beaches of Jamaica.

Assume the required return is 20%. What is the project's IRR? Should it be accepted? A) 15%; yes B) 15%; no C) 25%; yes D) 25%; no E) 20%; indifferent

1 5. A cost that has already been paid, or the liability to pay has already been incurred, is a(n): a. Salvage value expense. b. Net working capital expense. c. Sunk cost. d. Opportunity cost.

6. The most valuable investment given up if an alternative investment is chosen is a(n): a. Salvage value expense. b. Sunk cost. c. Opportunity cost. d. Erosion cost.

7. Your plant is generating a net $3 million dollar cash inflow each year. If you add another production line, you would receive an additional $1 million (so a total of $4 million) cash flow each year. The production line will cost initial cash outlay of $7million. In deciding the NPV of investing in this additional production line, the relevant cash outflow is $7m at year 0. The relevant (incremental) cash inflow is______$1million__ each year.

8. A company estimates that its weighted average cost of capital (WACC) is 10 percent. Which of the following independent projects should the company accept? (The projects have the same risk as the firm’s existing assets. Also assume these projects are normal projects. ) a. Project A requires an up-front expenditure of $3,000,000 and generates a net present value of $3,200. b. Project B has an internal rate of return of 9.5 percent. c. Project C requires an up-front expenditure of $5,000,000 and generates a positive internal rate of return of 9.7 percent. d. Project D has an internal rate of return of 9 % and generates a net present value of - $6, 000. e. None of the projects above should be accepted.

2