SALARY TRANSFER VOUCHER FORM

The Salary Transfer Voucher Form should be used for the following purposes only:

(1) Base Pay—Cost Center to Cost Center (Wage Type 6STB): To transfer pay between cost centers (effort certification provides transfer of regular pay and agency pay between cost centers and WBS elements, but not cost center to cost center). (2) Base Pay—Differential for 9-month positions (Wage Type 6STB): Through July 31, 2002 only, to transfer the difference between the 12-month monthly payment and 9-month accrual for 9-month positions. (The effort certification process transferred the 12-month monthly payment amount. For more details, see Appendix A in the effort certification manual for departments on the IRIS Web site.) (3) Longevity Pay (Wage Type 6STL): To transfer longevity pay between cost centers and/or WBS elements. (4) Overtime Pay (Wage Type 6STO): To transfer overtime pay between cost centers and/or WBS elements. (5) Summer School Pay (Wage Type 6STS): To transfer summer school pay between cost centers and/or WBS elements. (6) Other Non-Wage Pay (Wage Type 6STX): To transfer non-wage pay (such as stipends, fellowships, etc.) between cost centers and/or WBS elements.

The Salary Transfer Voucher Form should NOT be used to transfer regular (REG) or agency (AGY) pay between cost centers and WBS elements (temporary exception in #2 below). The effort certification process must be used for these transfers. See the effort certification documentation on the IRIS Web site (http://admin.tennessee.edu/iris).

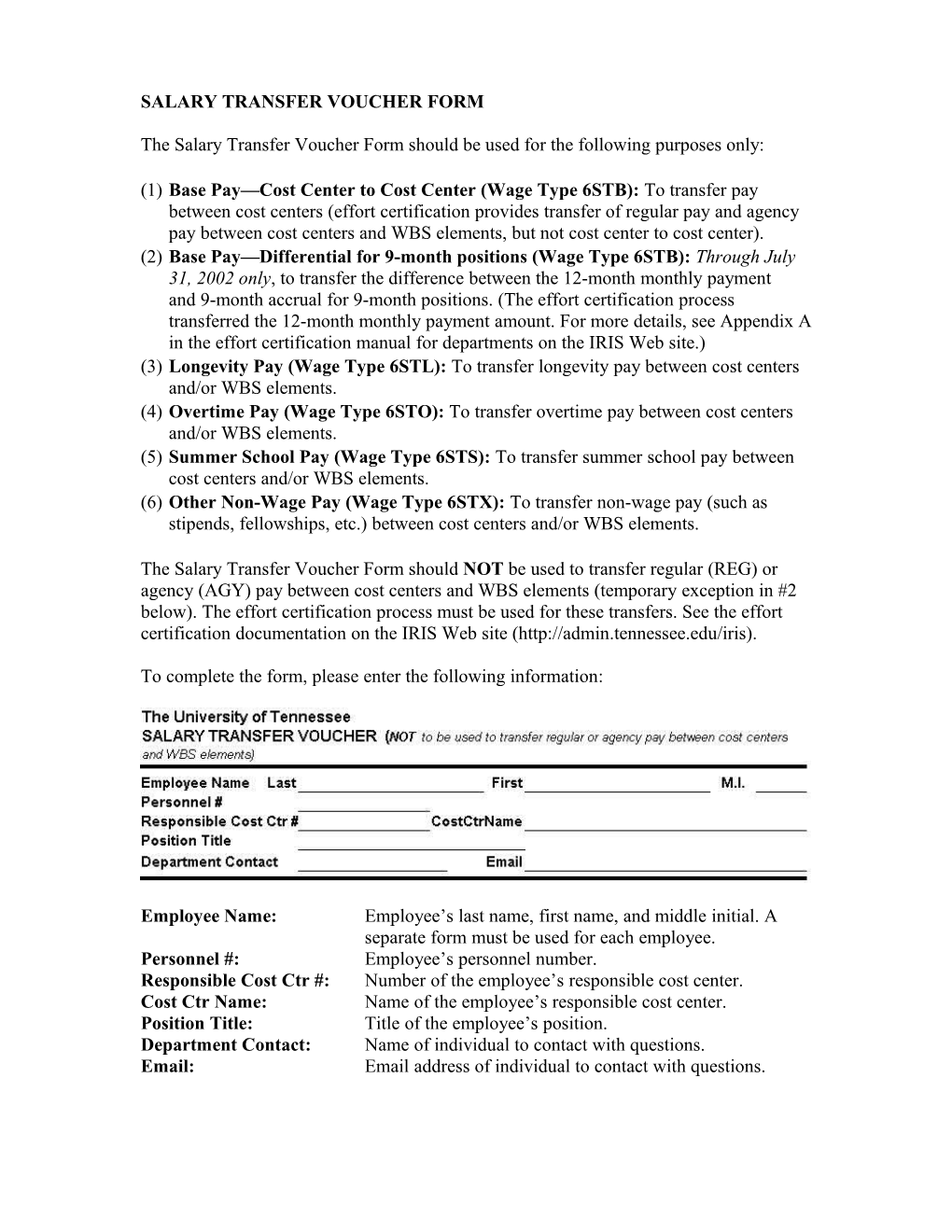

To complete the form, please enter the following information:

Employee Name: Employee’s last name, first name, and middle initial. A separate form must be used for each employee. Personnel #: Employee’s personnel number. Responsible Cost Ctr #: Number of the employee’s responsible cost center. Cost Ctr Name: Name of the employee’s responsible cost center. Position Title: Title of the employee’s position. Department Contact: Name of individual to contact with questions. Email: Email address of individual to contact with questions. Pay Cycle: Check whether the employee is paid on the monthly or the biweekly payroll.

Pay Period Ending Date: End of pay period covered by the transfer. A different form must be used for each pay period. Also, transfers CANNOT be done for more than 6 months prior to the ending date of the current pay period.

Type of Pay: Check the type of pay that is to be transferred. You should complete a separate form for each type of pay. Note: benefits do NOT need to be transferred.

TO BE CHARGED-Cost Center/WBS Element: Number of the cost center/WBS element to be charged. The form contains 10 lines; if additional lines are needed, attach a separate form. TO BE CHARGED-Cost Center/WBS Element Name: Name of the cost center/WBS element to be charged. Amount: Dollar amount of the salary to be charged to the designated cost center/WBS element. Total: Total dollar amount of salary charges covered by this form. TO BE CREDITED-Cost Center/WBS Element: Number of the cost center/WBS element to be credited. The form contains 5 lines; if additional lines are needed, attach a separate form. TO BE CREDITED-Cost Center/WBS Element Name: Name of the cost center/WBS element to be credited. Amount: Dollar amount of the salary to be credited to the designated cost center/WBS element. Total: Total dollar amount of salary credits covered by this form.

Calculation of amounts transferred: Show how the amounts to be transferred were calculated.

Approval Signatures/Dates: Both the department charged and the department credited must approve/sign and date the form.

Routing: When both departments have approved the form, the form should be routed to the campus HR/Payroll Office.

Timeframe for Submission: The completed form should be received by the campus HR/Payroll Office by the 15th of the month following the end of the pay period covered by this form.