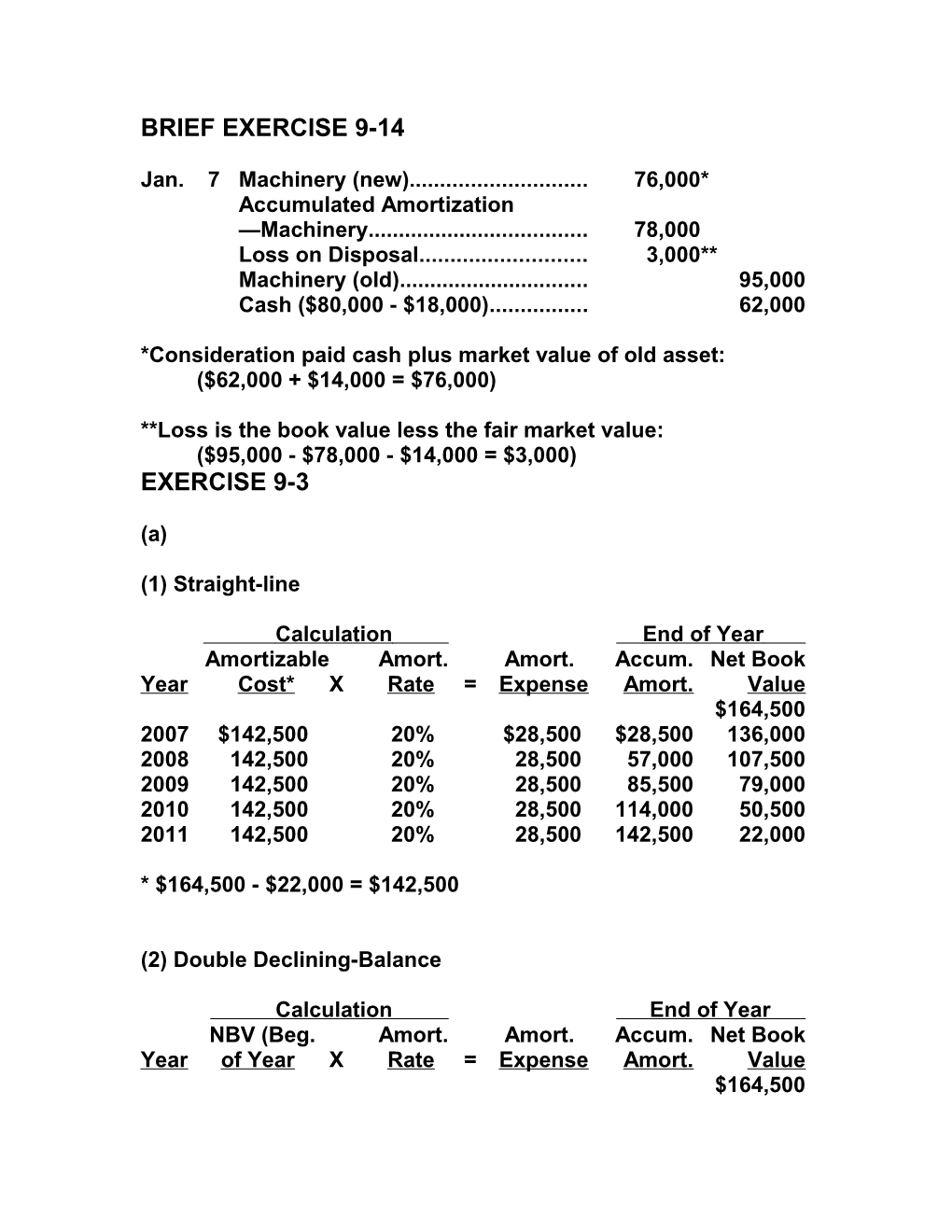

BRIEF EXERCISE 9-14

Jan. 7 Machinery (new)...... 76,000* Accumulated Amortization —Machinery...... 78,000 Loss on Disposal...... 3,000** Machinery (old)...... 95,000 Cash ($80,000 - $18,000)...... 62,000

*Consideration paid cash plus market value of old asset: ($62,000 + $14,000 = $76,000)

**Loss is the book value less the fair market value: ($95,000 - $78,000 - $14,000 = $3,000) EXERCISE 9-3

(a)

(1) Straight-line

Calculation End of Year Amortizable Amort. Amort. Accum. Net Book Year Cost* X Rate = Expense Amort. Value $164,500 2007 $142,500 20% $28,500 $28,500 136,000 2008 142,500 20% 28,500 57,000 107,500 2009 142,500 20% 28,500 85,500 79,000 2010 142,500 20% 28,500 114,000 50,500 2011 142,500 20% 28,500 142,500 22,000

* $164,500 - $22,000 = $142,500

(2) Double Declining-Balance

Calculation End of Year NBV (Beg. Amort. Amort. Accum. Net Book Year of Year X Rate = Expense Amort. Value $164,500 2007 $164,500 40% $65,800 $65,800 98,700 2008 98,700 40% 39,480 105,280 59,220 2009 59,220 40% 23,688 128,968 35,532 2010 35,532 40% 13,532¹ 142,500 22,000 2011 22,000 40% 0 142,500 22,000

¹ Limited to the amount to bring net book value to the residual value of $22,000 EXERCISE 9-3 (Continued)

(a) (Continued)

(3) Units-of-Activity

Calculation End of Year Units of Amort. Amort. Accum. Net Book Year Activity X Cost/Unit* = Expense Amort. Value $164,500 2007 78,000 $0.38 $29,640 $29,640 134,860 2008 76,000 0.38 28,880 58,520 105,980 2009 72,000 0.38 27,360 85,880 78,620 2010 74,000 0.38 28,120 114,000 50,500 2011 75,000 0.38 28,500 142,500 22,000

*Amortizable cost per unit is $0.38 per kilometre: [($164,500 – $22,000) 375,000 = $0.38]

(b) I recommend it use the units-of-activity method as it results in the best matching of expense with revenue. EXERCISE 9-4

(a)

(1) Straight-line

Calculation End of Year Amortizable Amort. Amort. Accum. Net Book Year Cost* X Rate = Expense Amort. Value $86,000 2007 $78,000 25% $4,875** $4,875 81,125 2008 78,000 25% 19,500 24,375 61,625 2009 78,000 25% 19,500 43,875 42,125 2010 78,000 25% 19,500 63,375 22,625 2011 78,000 25% 14,625*** 78,000 8,000

*$86,000 - $8,000 = $78,000 **$19,500 x 3/12 = $4,875 ***$19,500 x 9/12 = $14,625

(2) Double Declining-Balance

Calculation End of Year NBV (Beg. Amort. Amort. Accum. Net Book Year of Year X Rate = Expense Amort. Value $86,000 2007 $86,000 50% $10,750* $10,750 75,250 2008 75,250 50% 37,625 48,375 37,625 2009 37,625 50% 18,813 67,188 18,812 2010 18,812 50% 9,406 76,594 9,406 2011 9,406 50% 1,406** 78,000 8,000

*$86,000 x 50% x 3/12 = $10,750 **Limited to the amount to bring net book value to the residual value of $8,000 EXERCISE 9-4 (Continued)

(a) (Continued)

(3) Units-of-Activity

Calculation End of Year Units of Amort. Amort. Accum. Net Book Year Activity X Cost/Unit* = Expense Amort. Value $86,000 2007 500 $7.80 $3,900 $3,900 82,100 2008 2,800 7.80 21,840 25,740 60,260 2009 2,900 7.80 22,620 48,360 37,640 2010 2,600 7.80 20,280 68,640 17,360 2011 1,300 7.80 9,360** 78,000 8,000

*Amortizable cost per unit is $7.80/hour [($86,000 – $8,000) 10,000 = $7.80] **Limited to the amount to bring net book value to the residual value of $8,000.

(b) Over the life of the asset, amortization expense will be the same for all three methods.

(c) Cash flow is the same under all three methods. Amortization is an allocation of the cost of a long-lived asset and not a cash expenditure. PROBLEM 14-6A

(a) GENERAL JOURNAL J1 Date Account Titles and Explanation Debit Credit

Aug. 01 Income Tax Payable (Recoverable)...... 13,500 Retained Earnings...... 31,500 Accumulated Amortization...... 45,000

Oct. 015 Stock Dividends—Common...... 450,000 Common Stock Dividends Distributable...... 450,000 (250,000 X 10% X $18)

Nov. 10 Common Stock Dividends Distributable...... 450,000 Common Shares...... 450,000

Dec. 15 Cash Dividends—Preferred ...... 48,000 Dividends Payable—Preferred...... 48,000 (12,000 X $4)

31 Income Summary...... 395,000 Retained Earnings...... 395,000

31 Retained Earnings...... 498,000 Cash Dividends—Preferred...... 48,000 Stock Dividends—Common...... 450,000 (c) FRYMAN LTD. Statement of Retained Earnings Year Ended December 31, 2008

Balance, January 1, as previously reported...... $900,000 Less: Correction for understatement of amortization in 2007, net of income tax savings of $13,500...... ( 31,500 Balance, January 1, as adjusted...... 868,500 Add: Net income...... 395,000 1,263,500 Less: Cash dividends—preferred...... $ 48,000 Stock dividends—common...... 450,000 498,000 Balance, December 31 ...... $765,500 PROBLEM 14-6A (Continued)

(d) FRYMAN LTD. Partial Balance Sheet December 31, 2008

Shareholders' equity Contributed capital Share capital Preferred shares, $4-noncumulative, no par value, unlimited number authorized, 12,000 shares issued...... $ 800,000 Common shares, no par value, unlimited number authorized, 275,000 shares issued...... 950,000 Total share capital...... 1,750,000 Additional contributed capital Contributed capital—reacquired common shares...... 100,000 Total contributed capital...... 1,850,000 Retained earnings (See Note B)...... 765,500 Accumulated other comprehensive loss...... (50,000) Total shareholders' equity...... $2,565,500

Note B: Retained earnings is restricted for plant expansion, in the amount of $200,000. PROBLEM 17-8B

(a) (1) Indirect method

WETASKIWIN LTD. Cash Flow Statement Year Ended December 31, 2008

Operating activities Net income...... $36,000 Adjustments to reconcile net income to net cash provided by operating activities: Amortization expense...... $11,000 (1) Loss on sale of equipment...... 2,000 Increase in accounts receivable...... (14,000) Increase in merchandise inventory...... (13,000) Decrease in accounts payable...... (14,000) Decrease in income tax payable...... (5,000) (33,000) Net cash provided by operating activities...... 3,000

Investing activities Sale of equipment...... $8,000 Net cash provided by investing activities...... 8,000

Financing activities Payment of cash dividends...... $(21,000) (2) Net cash used by financing activities...... (21,000)

Net decrease in cash and cash equivalents...... (10,000) Cash and cash equivalents, January 1...... 0 33,000 Cash and cash equivalents, December 31...... $23,000

Note Equipment costing $10,000 was purchased by issuing a note payable. Calculations:

(1) Amortization expense Accumulated amortization, beginning of year...... $24,000 Less: Accumulated amortization of equipment sold ($15,000 - $10,000)...... (5,000) Accumulated amortization, end of year...... (30,000) Amortization expense...... $11,000

(2) Cash dividends Retained earnings, beginning of year...... $28,000 Add: Net income...... 36,000 64,000 Less: Dividends (calculated)...... (21,000) Retained earnings, end of year...... $43,000