1

May Tai

255 Warren St

Jersey City, NJ, 07302

857-636-8225

Professional Profile:

Senior consultant with primary focus in the banking and financial industry. Extensive experience in driving and delivering global enterprise level projects that including Trading Systems Implementation, Risk Management, Process Improvement, Compliance & Regulations. Hands on with the Trade Lifecycle and the System Development Lifecycle. Well versed in OTC Derivatives, Securitization and the Trading Operations. A team player with excellent cross-functional communication, and negotiation skills. Currently working on the CFA

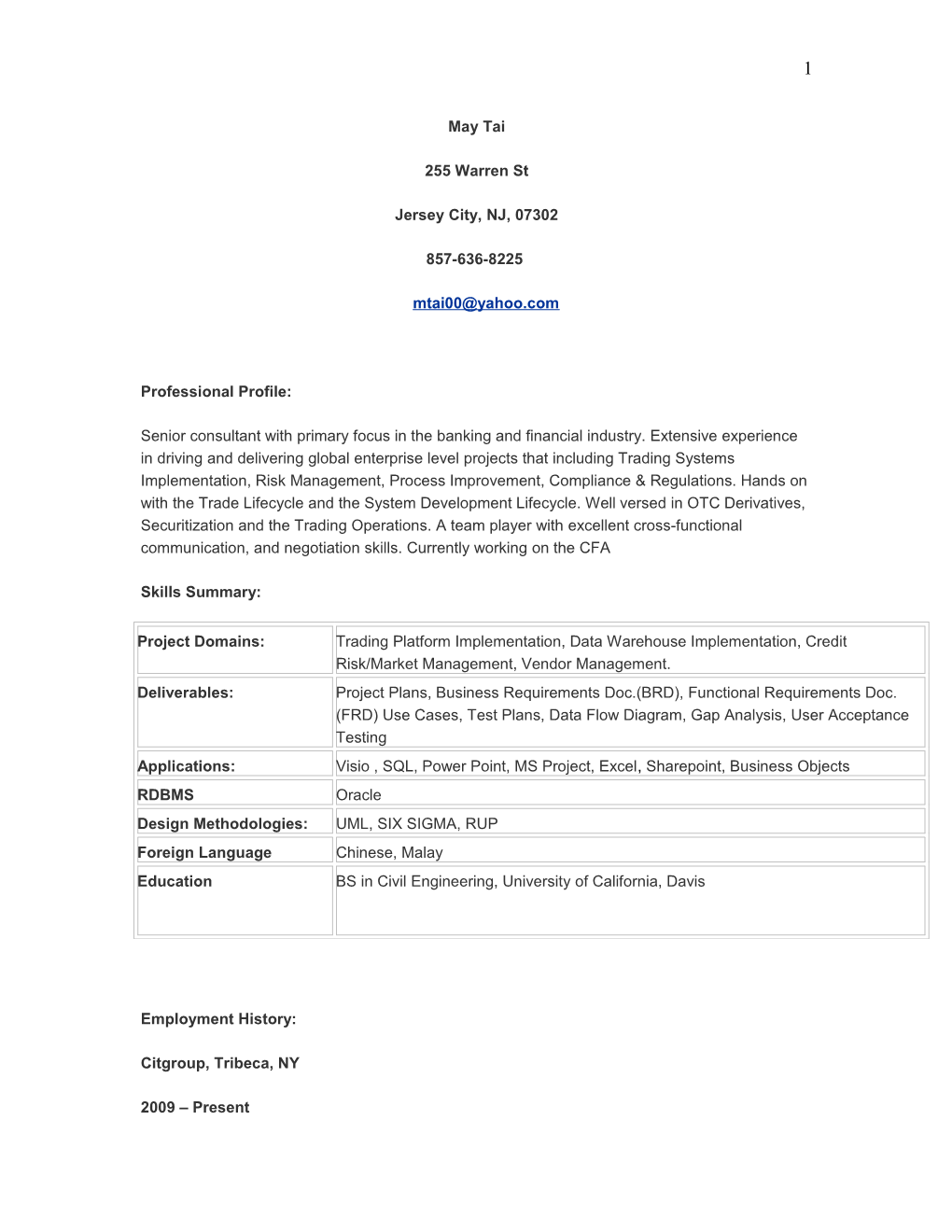

Skills Summary:

Project Domains: Trading Platform Implementation, Data Warehouse Implementation, Credit Risk/Market Management, Vendor Management. Deliverables: Project Plans, Business Requirements Doc.(BRD), Functional Requirements Doc. (FRD) Use Cases, Test Plans, Data Flow Diagram, Gap Analysis, User Acceptance Testing Applications: Visio , SQL, Power Point, MS Project, Excel, Sharepoint, Business Objects RDBMS Oracle Design Methodologies: UML, SIX SIGMA, RUP Foreign Language Chinese, Malay Education BS in Civil Engineering, University of California, Davis

Employment History:

Citgroup, Tribeca, NY

2009 – Present 2

Consultant – Sr. Business Analyst

Drived and delivered multiple process re-engineering initiatives that automated current trade settlement procedures with a STP end to end process. Project domain including Front office Data Capture, Securities Settlement, and Collateral Management for capital markets products. Responsibilities including conducting JAD sessions, business analysis, gap analysis, impact analysis, process/data flow diagram implementation, management of project milestones and deliveries.

Bank of New York-Mellon, Wall Street, NY 2008- 2009 Consultant – Sr. Business Analyst

Served as a Sr. Business Analyst for Bank of New York Basel II implementation initiative. Major responsibilities including: Conducted business requirements sessions and successfully capturing the Basel regulatory capital calculation and reporting requirements for cross asset class securities including FX and CDS. Responsible for Functional Specifications, Data Analysis, and Test Plans Development, tracking project risks and issues logs. Assisted Internal Audit in the review and validation of Credit Risk Assessment, PD, LGD, EAD estimates and credit risk architecture Supported the bank’s data quality and governance framework for the completeness of data used in the risk-based capital calculation and reporting Create and execute SQL, data mapping and conversion from source systems to FinArch/FinStudio

UBS Investment Bank, Stamford, CT 2007 – 2007 Project Manager/ Sr. Business Analyst

Managed a global, cross functional team in the delivery of a trading, risk management platform that supported the Front office and Back office operations including pricing, risk management and analytics of cross-asset class securities. The resulting systems successfully captured the valuation, pricing, Greek sensitivities measurement( Delta, Vega and Beta), and regulatory reporting requirements of capital markets products including CDS, Interest Rate Swaps, Exotic Options and FX.

Responsible for business requirements, tracking deliverables milestones, resource management, test plan development and UAT testing. Implemented the workflow that managed the daily trading operations including front office trade capture, back office securities settlement, and risk management processes that monitored market risks and portfolio performance measurement of VaR. Collaborated with the Front Office Trading Desk, IT, Operations, and Risk Control groups in London, and Zurich in the migration of Munis and Convertible Bond accounts to a new system that improved trading exposure control, pricing, valuation and P&L performance. 3

IBM Global Services, Boston, MA 2005 – 2006 Consultant – Project Manager/ Sr. Business Analyst

Implemented numerous enterprise level projects with top-tiered US banks that included Basel II implementation, Market/Credit/Operational risk management, Regulatory & Compliance.

Responsible for business case proposals, business requirements, test plans and test strategy development, liaised with PMO in project tracking, financial and resource planning, management of offshore vendors and developers Implemented standards and guidelines in risk assessment, risk mitigation, controls and measurement processes Established enterprise level data governance that resulted in improved data quality and consistency for the credit risk calculations.

The clients included Citigroup, ABN AMRO, Royal Bank of Canada, Wachovia Bank, Wells Fargo

JPMorgan Invest, Boston, MA 2005 – 2005 Consultant – Sr. Business Analyst

Implemented an end to end, straight through process, trading and portfolio accounting platform that enhanced real time trading experience for investors. The application supported portfolio management, trade capture, trade reconciliation and settlement for Fixed Income, Equity derivatives products.

Collaborated with third party vendors to define the trading platform architecture and system requirements. Developed graphical user interface, business requirements and functional specifications Implemented workflow for post trade operation, margin account set up, market data feed, and application testing

State Street Corporation, Boston, MA 2004 – 2005 Consultant – Basel II Sr. Business Analyst

Played a key role in assisting the client in achieving its business goal of Basel II compliance and supporting the client’s risk management systems that fully captured the Credit Risk, Operation Risk and Regulatory reporting requirements. 4

Responsible for systems assessment and selection, use cases, test plans development and developed processes that met the Basel II Accord and US Supervisory Guidelines.

Bank of America, Charlotte, NC 2003 – 2004 Consultant – Sr. Business Analyst

Supported the bank’s online trading platform and portfolio management system for CDS, CDOs, Fixed Income, Interest Rate Swaps, Mortgage Backed Securities, and other capital markets products.

Served as a subject matter expert for the bank’s cash management and data warehouse initiatives that resulted in increased revenues, cost saving and improved data quality. Implemented a comprehensive business continuity and disaster recovery plan for the bank’s business operations. Assisted the bank with its post merger consolidation and integration efforts.

Wachovia Bank, Charlotte, NC 2002 – 2003 Consultant- Sr. Business Analyst

Implemented the workflow that managed the bank’s post merger integration of applications, systems and business processes.

Assisted the bank in converting a legacy financial center application into a web base graphical user interface, GUI, platform that improved process efficiency, customer satisfaction and added cross sales opportunities.

MedImpact, San Diego, CA 2000 – 2001 Consultant- Project Manager

Managed an enterprise data warehouse re-engineering initiative that consolidated despairing data sources into a well structured, high quality data repository that was accessible to business units for analytics, reporting and timely executive decision making.

Responsibilities included project risk management and mitigation, budget planning, architecture review, and vendor management. Provided status reports to stakeholders and executive management. Performed data conversion, data warehousing tools selection including the assessment and evaluation of Informatica ETL tools.

Union Bank of California, CA 1999 – 2000 5

Consultant - System Specialist

A key member of a team that implemented the bank’s post merger system consolidation and integration effort.

Assisted the bank’s top management in identifying its business, technical and training needs as well as mitigating business operation risks. The strategic approach resulted in a seamless integration of multiple systems from the union of two high profile banks. Responsibilities included the evaluation and assessment of existing business/IT processes, IT architecture, applications reengineering, and application testing.

Advance Commercial Banking Systems, CA 1998 – 1999 Consultant - Software Engineer

A technical lead for a team that developed a suite of banking lending and servicing solutions that included Relationship & Prospecting Management, Loan Origination & Syndication, Deal Closing, Servicing, Credit Portfolio Management, and Trading. Responsible for workflow management, new technology research, product development, and third party product integration and testing.