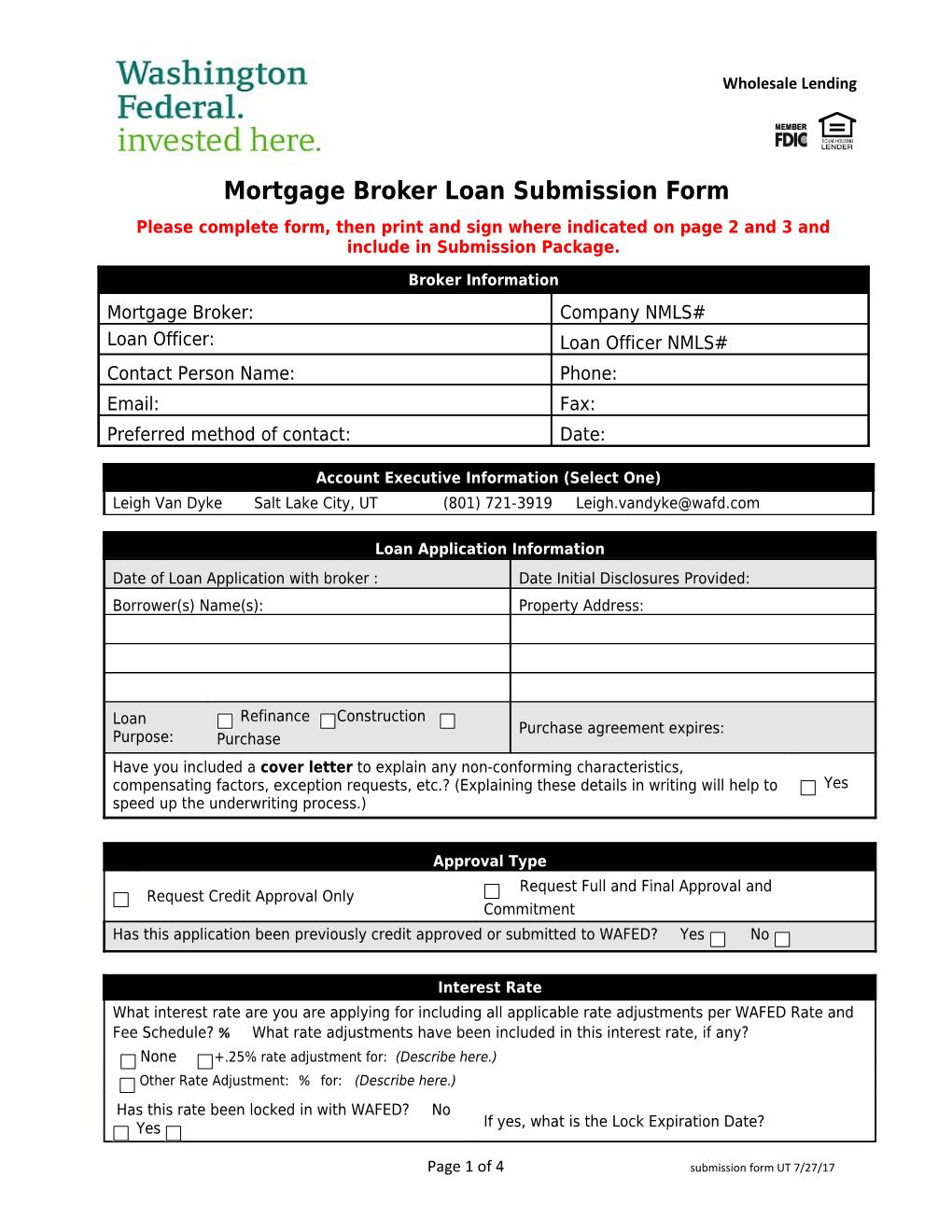

Wholesale Lending

Mortgage Broker Loan Submission Form Please complete form, then print and sign where indicated on page 2 and 3 and include in Submission Package.

Broker Information

Mortgage Broker: Company NMLS# Loan Officer: Loan Officer NMLS# Contact Person Name: Phone: Email: Fax: Preferred method of contact: Date:

Account Executive Information (Select One) Leigh Van Dyke Salt Lake City, UT (801) 721-3919 [email protected]

Loan Application Information Date of Loan Application with broker : Date Initial Disclosures Provided: Borrower(s) Name(s): Property Address:

Loan Refinance Construction Purchase agreement expires: Purpose: Purchase Have you included a cover letter to explain any non-conforming characteristics, compensating factors, exception requests, etc.? (Explaining these details in writing will help to Yes speed up the underwriting process.)

Approval Type Request Full and Final Approval and Request Credit Approval Only Commitment Has this application been previously credit approved or submitted to WAFED? Yes No

Interest Rate What interest rate are you are applying for including all applicable rate adjustments per WAFED Rate and Fee Schedule? % What rate adjustments have been included in this interest rate, if any? None +.25% rate adjustment for: (Describe here.) Other Rate Adjustment: % for: (Describe here.) Has this rate been locked in with WAFED? No Yes If yes, what is the Lock Expiration Date?

Page 1 of 4 submission form UT 7/27/17 Broker Compensation: Cannot Exceed a Total of 2% per WAFED Policy: Source of Broker Compensation (Select one option only): Lender-Paid (LPO) Borrower-Paid (BPO) Important Note: Lender Paid Comp is required to match your company’s current compensation agreement with WAFED. Compensation to Broker (List % $ percentage of loan amount and corresponding dollar amount.) Processing Fee to Broker $ (Cannot charge if comp. is Lender-Paid.) Misc. Origination Fees to $ Broker (Cannot charge if comp. is Lender-Paid):

Broker’s Certification Acknowledgement and Agreement

I certify, acknowledge and agree to the following:

1. I am an authorized representative of the named mortgage broker company listed below.

2. The Loan Officer who accepted the loan application has a current Loan Originator’s license as required by state law and is properly registered with the NMLS.

3. If the loan application is considered complete as defined by RESPA, which includes the identification of a property address, the Borrower(s) have been provided all applicable mortgage lending disclosures as required by law1.

4. If a Loan Estimate is required and has been provided, I have confirmed the Borrower(s) has (have) received it and intends to proceed with the transaction as submitted to Washington Federal.

5. On all Borrower-Paid Compensation transactions subject to RESPA, I agree to credit the borrower(s) at settlement the total dollar amount required to cure any out of tolerance RESPA violations based on a comparison of the final LE to the Closing Disclosure.

6. For all incomplete applications that did not identify all six pieces of information I did not “Require” income or asset documentation as part of the application.

1 If a property address has not yet been identified, the application is not considered complete as defined by RESPA and disclosures are not required. In this situation, the application will be considered complete as of the date a property address is identified to broker. The broker is then required to document for WAFED that all initial disclosures, including an acceptable LE, were provided to borrower within 3 business days of that date. (WAFED does not require disclosures be provided on N/O/O loan applications.)

Page 2 of 4 submission form UT 7/27/17 The signature below indicates my certification, acknowledgment, and agreement to all of the above: ______Signature of authorized representative of company. Title Date

______Print Name of Authorized Representative Print Name of Mortgage Broker Company

Please send Submission Package to: Washington Federal Attention Wholesale Lending

Salt Lake City Office 405 S Main, Suite 100, Salt Lake City, UT 84111 (801) 366-2265

Submissions can be emailed to: [email protected]

Reminder: Have pages 2 and 3 been signed where indicated?

Wholesale Lending

Submission package will not be accepted until Loan Officer has completed and signed this certification.

Broker’s Regulation Z Certification Re: Borrower(s) Name(s):

Property Address: (If one has been determined.)

On behalf of the named Mortgage Broker Company listed below, I hereby certify the following to be true: 1. I have fully complied with all applicable state and federal regulatory requirements in originating the loan referenced above including, but not limited to, the federal Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and Fair and Accurate Credit Transactions Act (FACT Act).

Page 3 of 4 submission form UT 7/27/17 2. I am only receiving compensation from one (single) source; be that the borrower, lender, or third party, for the loan referenced above. 3. I have complied with all anti-steering requirements including, but not limited to, providing the borrower at least three loan options for each loan type for which the borrower has expressed interest. These three options must include at a minimum: a. A loan with the lowest interest rate; b. A loan with the lowest total origination fees and discount points; c. A loan with the lowest rate with no high-risk features, such as a prepayment penalty or negative amortization. 4. I can and will provide documented proof of the financing options provided to the borrower to Washington Federal upon request. 5. Broker is receiving compensation for providing both mortgage banker/broker services and real estate broker/real estate agent services. _____Yes or _____No. 6. I further agree to hold Washington Federal harmless for any liability that may arise for any potential liability I may have under the applicable regulation, and understand that Washington Federal is not giving any legal advice regarding my compliance with applicable regulations.

Mortgage Broker Company: ______Date: ______

Loan Officer (Print Name): ______Loan Officer Signature: ______

Page 4 of 4 submission form UT 7/27/17