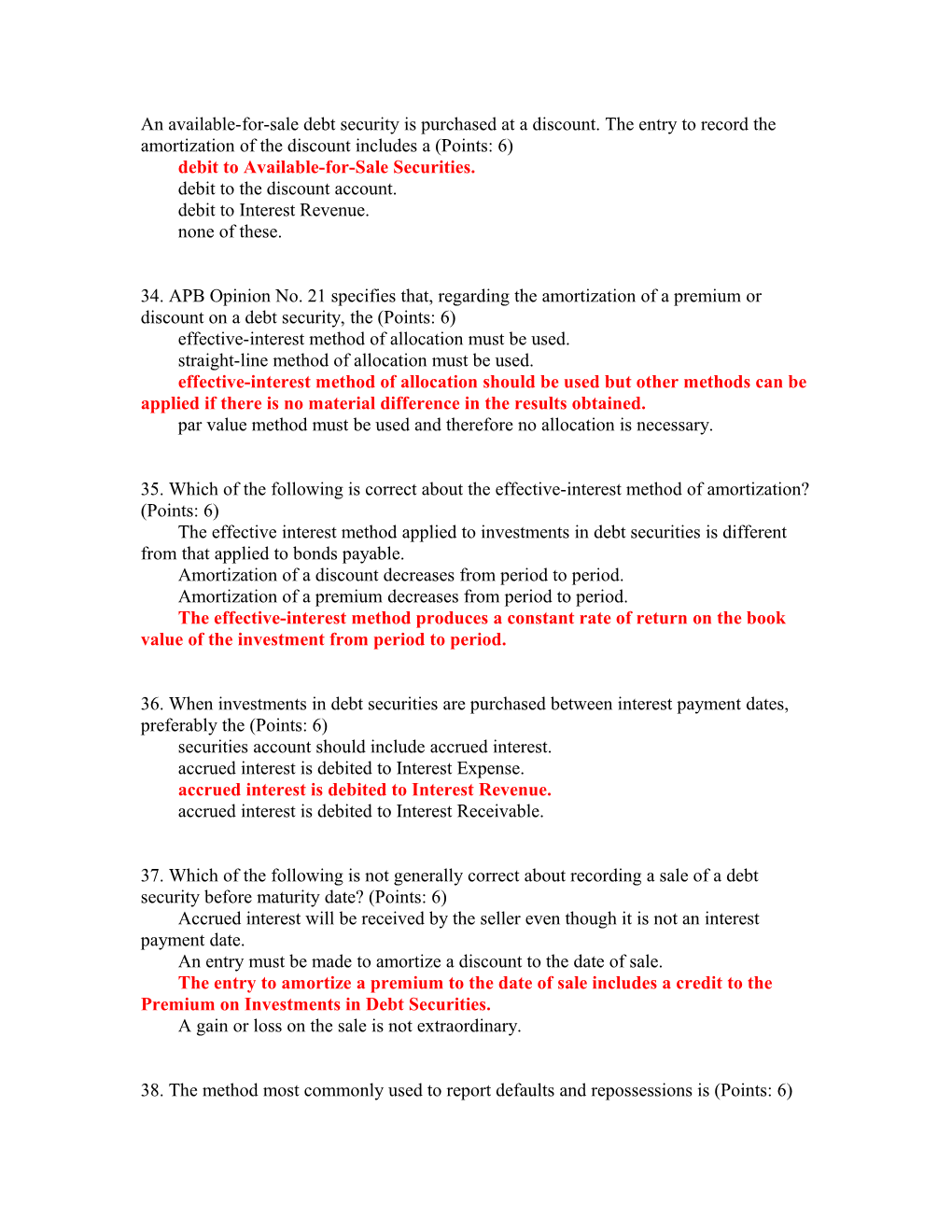

An available-for-sale debt security is purchased at a discount. The entry to record the amortization of the discount includes a (Points: 6) debit to Available-for-Sale Securities. debit to the discount account. debit to Interest Revenue. none of these.

34. APB Opinion No. 21 specifies that, regarding the amortization of a premium or discount on a debt security, the (Points: 6) effective-interest method of allocation must be used. straight-line method of allocation must be used. effective-interest method of allocation should be used but other methods can be applied if there is no material difference in the results obtained. par value method must be used and therefore no allocation is necessary.

35. Which of the following is correct about the effective-interest method of amortization? (Points: 6) The effective interest method applied to investments in debt securities is different from that applied to bonds payable. Amortization of a discount decreases from period to period. Amortization of a premium decreases from period to period. The effective-interest method produces a constant rate of return on the book value of the investment from period to period.

36. When investments in debt securities are purchased between interest payment dates, preferably the (Points: 6) securities account should include accrued interest. accrued interest is debited to Interest Expense. accrued interest is debited to Interest Revenue. accrued interest is debited to Interest Receivable.

37. Which of the following is not generally correct about recording a sale of a debt security before maturity date? (Points: 6) Accrued interest will be received by the seller even though it is not an interest payment date. An entry must be made to amortize a discount to the date of sale. The entry to amortize a premium to the date of sale includes a credit to the Premium on Investments in Debt Securities. A gain or loss on the sale is not extraordinary.

38. The method most commonly used to report defaults and repossessions is (Points: 6) provide no basis for the repossessed asset thereby recognizing a loss. record the repossessed merchandise at fair value, recording a gain or loss if appropriate. record the repossessed merchandise at book value, recording no gain or loss. none of these.

39. Under the installment-sales method, (Points: 6) revenue, costs, and gross profit are recognized proportionate to the cash that is received from the sale of the product. gross profit is deferred proportionate to cash uncollected from sale of the product, but total revenues and costs are recognized at the point of sale. gross profit is not recognized until the amount of cash received exceeds the cost of the item sold. revenues and costs are recognized proportionate to the cash received from the sale of the product, but gross profit is deferred until all cash is received.

40. The realization of income on installment sales transactions involves (Points: 6) recognition of the difference between the cash collected on installment sales and the cash expenses incurred. deferring the net income related to installment sales and recognizing the income as cash is collected. deferring gross profit while recognizing operating or financial expenses in the period incurred. deferring gross profit and all additional expenses related to installment sales until cash is ultimately collected.

41. A manufacturer of large equipment sells on an installment basis to customers with questionable credit ratings. Which of the following methods of revenue recognition is least likely to overstate the amount of gross profit reported? (Points: 6) At the time of completion of the equipment (completion of production method) At the date of delivery (sales method) The installment-sales method The cost-recovery method

42. A seller is properly using the cost-recovery method for a sale. Interest will be earned on the future payments. Which of the following statements is not correct? (Points: 6) After all costs have been recovered, any additional cash collections are included in income. Interest revenue may be recognized before all costs have been recovered. The deferred gross profit is offset against the related receivable on the balance sheet. Subsequent income statements report the gross profit as a separate item of revenue when it is recognized as earned.

43. According to the FASB, immediate recognition of a liability (referred to as the minimum liability) is required when the accumulated benefit obligation exceeds the fair value of plan assets. Conversely, when the fair value of plan assets exceeds the accumulated benefit obligation, the Board (Points: 6) requires recognition of an asset. requires recognition of an asset if the excess fair value of plan assets exceeds the corridor amount. recommends recognition of an asset but does not require such recognition. does not permit recognition of an asset.

44. Which of the following disclosures of pension plan information would not normally be required by Statement of Financial Accounting Standards No. 132, "Employers' Disclosure about Pensions and Other Postretirement Benefits"? (Points: 6) The major components of pension expense The amount paid from the pension fund to retirees during the period The funded status of the plan and the amounts recognized in the financial statements

The rates used in measuring the benefit amounts

45. A lessee with a capital lease containing a bargain purchase option should depreciate the leased asset over the (Points: 6) asset's remaining economic life. term of the lease. life of the asset or the term of the lease, whichever is shorter. life of the asset or the term of the lease, whichever is longer.

46. On December 31, 2007, Pool Corporation leased a ship from Renn Company for an eight-year period expiring December 30, 2015. Equal annual payments of $200,000 are due on December 31 of each year, beginning with December 31, 2007. The lease is properly classified as a capital lease on Pool's books. The present value at December 31, 2007 of the eight lease payments over the lease term discounted at 10% is $1,173,685. Assuming all payments are made on time, the amount that should be reported by Pool Corporation as the total obligation under capital leases on its December 31, 2008 balance sheet is (Points: 6) $1,091,054. $1,000,159. $871,054. $1,200,000. 47. Which type of accounting change should always be accounted for in current and future periods? (Points: 6) Change in accounting principle Change in reporting entity Change in accounting estimate Correction of an error

48. Which of the following is (are) the proper time period(s) to record the effects of a change in accounting estimate? (Points: 6) Current period and prospectively Current period and retrospectively Retrospectively only Current period only

49. The estimated life of a building that has been depreciated 30 years of an originally estimated life of 50 years has been revised to a remaining life of 10 years. Based on this information, the accountant should ______. (Points: 6) continue to depreciate the building over the original 50-year life depreciate the remaining book value over the remaining life of the asset adjust accumulated depreciation to its appropriate balance, through net income, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years adjust accumulated depreciation to its appropriate balance through retained earnings, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years

50. Which of the following statements is correct? (Points: 6) Changes in accounting principle are always handled in the current or prospective period Prior statements should be restated for changes in accounting estimates A change from expensing certain costs to capitalizing these costs due to a change in the period benefited should be handled as a change in accounting estimate. Correction of an error related to a prior period should be considered as an adjustment to current year net income.