The University of Texas at El Paso College of Business Administration, Department of Accounting ACCT 3321-Intermediate Accounting I ICC5a, Fall Semester 2005

Installment Sales

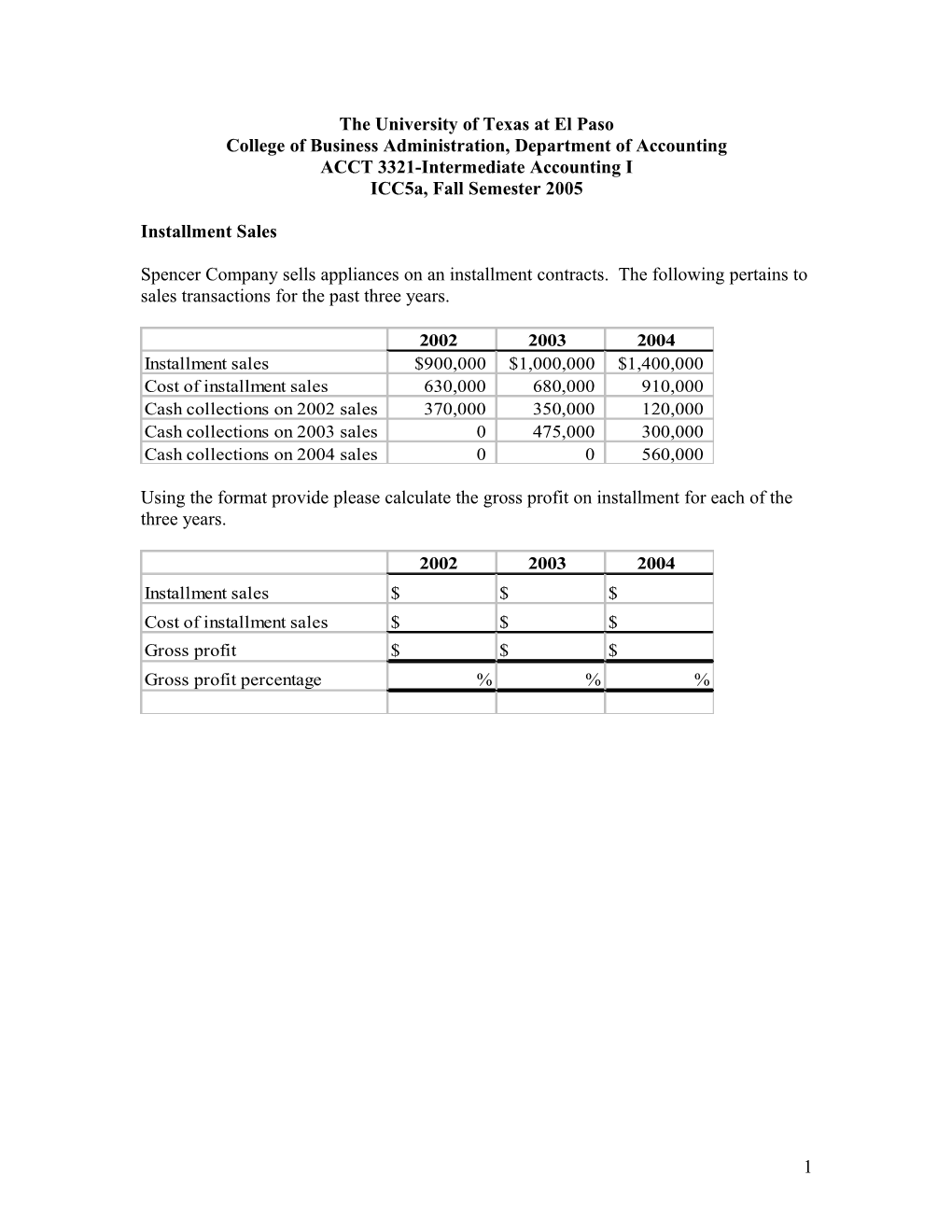

Spencer Company sells appliances on an installment contracts. The following pertains to sales transactions for the past three years.

2002 2003 2004 Installment sales $900,000 $1,000,000 $1,400,000 Cost of installment sales 630,000 680,000 910,000 Cash collections on 2002 sales 370,000 350,000 120,000 Cash collections on 2003 sales 0 475,000 300,000 Cash collections on 2004 sales 0 0 560,000

Using the format provide please calculate the gross profit on installment for each of the three years.

2002 2003 2004 Installment sales $ $ $ Cost of installment sales $ $ $ Gross profit $ $ $ Gross profit percentage % % %

1 Using the format provided please complete the journal entries to record the transactions and the year-end adjusting journal entries to record deferred gross profit for the year of 2002 and the realization of gross profit on 2002 collections.

DATE ACCOUNT DEBIT CREDIT 2002 Installment receivables Inventory Deferred gross profit, 2002 To record installment sales for 2002

2002 Cash Installment receivables To record collections on installment receivables

2002 Deferred gross profit, 2002 Realized gross profit on installment sales To recognize gross profit from installment collections

Analysis of realized gross profit Collection on installment sales, 2002 $ Gross profit percentage % Realized gross profit on installment collections $

Using the format provided please complete the journal entries to record the transactions and the year-end adjusting journal entries to record deferred gross profit for the year of 2003 and the realization of gross profit on 2003 collections.

2 DATE ACCOUNT DEBIT CREDIT 2003 Installment receivables Inventory Deferred gross profit, 2003 To record installment sales for 2003

2003 Cash Installment receivables To record collections on installment receivables

2003 Deferred gross profit, 2002 Deferred gross profit, 2003 Realized gross profit on installment sales To recognize gross profit from installment collections

Analysis of realized gross profit Collection on installment sales, 2002 $ Gross profit percentage % Realized gross profit on installment collections $

Analysis of realized gross profit Collection on installment sales, 2003 $ Gross profit percentage % Realized gross profit on installment collections $

3 In January 1, 2004 Spencer Company had to repossess merchandise that was sold in 2002 for $8,000. The company had collected $6,000 on the account and the fair market value of the merchandise at the time of repossession was $1,000. After repossession the company had to spend $250 to recondition the merchandise so that it could be resold. Using the format provided prepare the adjusting journal entries to record the repossession of the merchandise and the reconditioning costs.

DATE ACCOUNT DEBIT CREDIT 1/1/04 Deferred gross profit $ Repossessed merchandise $ Loss on repossession $ Installment receivables $ To record repossession of merchandise

Analysis of loss on repossession Original installment receivable $ Collections to date $ Remaining balance $ Gross profit percentage % Gross profit on balance of installment receivalbe $ Cost basis of merchandise repossessed $ FV of merchandise at date of repossession $ Loss on repossession $

1/1/04 Repossessed merchandise $ Cash $ To record the cost of reconditioning repossessed merchandise

4 After recording the repossession prepare the journal entries for 2004.

DATE ACCOUNT DEBIT CREDIT 2004 Installment receivables Inventory Deferred gross profit, 2004 To record installment sales for 2004

2004 Cash Installment receivables To record collections on installment receivables

2004 Deferred gross profit, 2002 Deferred gross profit, 2003 Deferred gross profit, 2004 Realized gross profit on installment sales To recognize gross profit from installment collections

Analysis of realized gross profit Collection on installment sales, 2002 $ Gross profit percentage % Realized gross profit on installment collections $

Analysis of realized gross profit Collection on installment sales, 2003 $ Gross profit percentage % Realized gross profit on installment collections $

Analysis of realized gross profit Collection on installment sales, 2004 $ Gross profit percentage % Realized gross profit on installment collections $

5