Title: Purpose and Impact of the 4332 AAI

Abstract: The purpose of the 4332 AAI is to produce the proper G/L distribution (journal entries) when a cost variance occurs at voucher match.

AAI Table 4332

The purpose of the 4332 AAI is to produce the proper G/L distribution (journal entries) when a cost variance occurs at voucher match. The AAI is used to correct the accounting between inventory and cost of goods sold (COGS). It is helpful to understand the accounting implications of a cost variance. An explanation of how it works is best represented by example.

If the 4332 AAI table did not exist

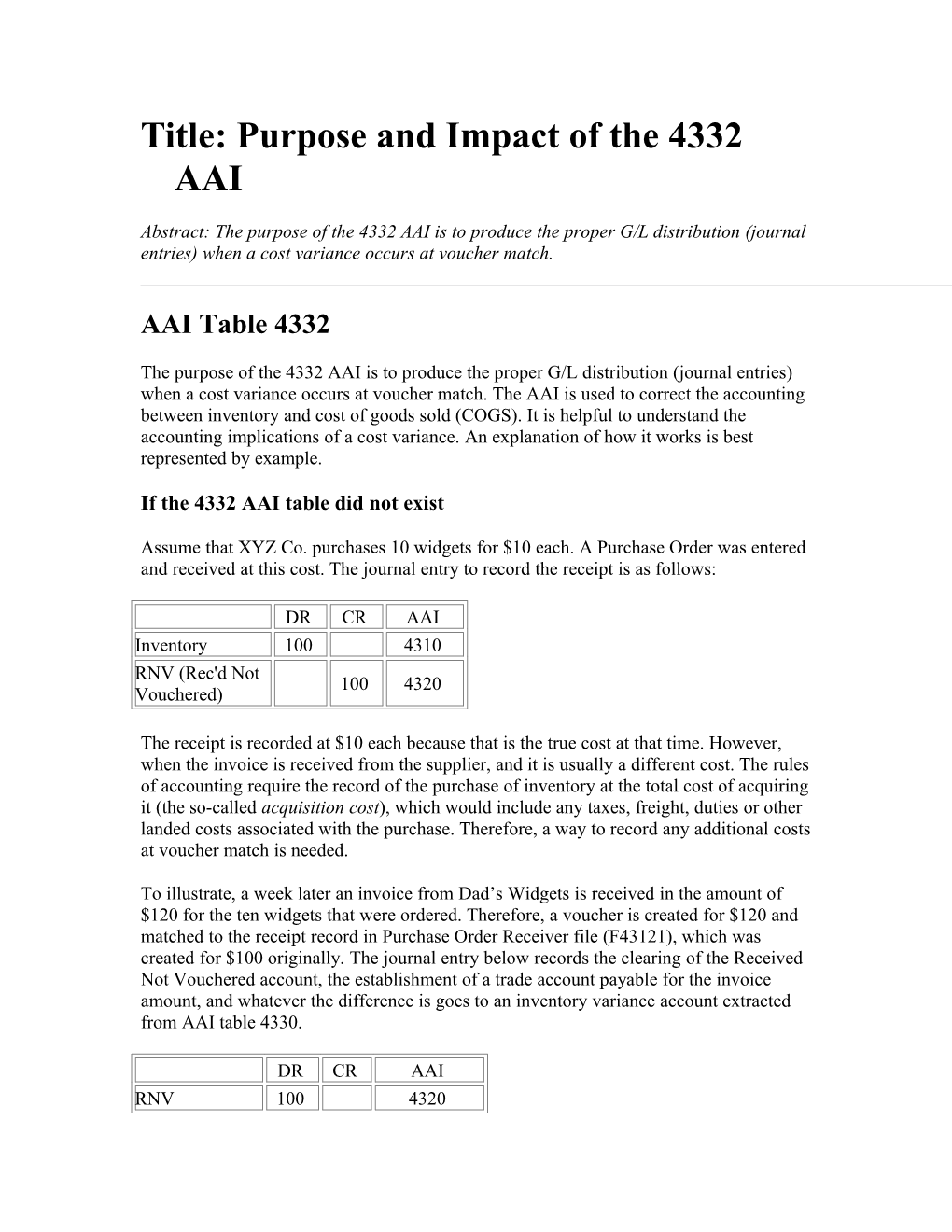

Assume that XYZ Co. purchases 10 widgets for $10 each. A Purchase Order was entered and received at this cost. The journal entry to record the receipt is as follows:

DR CR AAI Inventory 100 4310 RNV (Rec'd Not 100 4320 Vouchered)

The receipt is recorded at $10 each because that is the true cost at that time. However, when the invoice is received from the supplier, and it is usually a different cost. The rules of accounting require the record of the purchase of inventory at the total cost of acquiring it (the so-called acquisition cost), which would include any taxes, freight, duties or other landed costs associated with the purchase. Therefore, a way to record any additional costs at voucher match is needed.

To illustrate, a week later an invoice from Dad’s Widgets is received in the amount of $120 for the ten widgets that were ordered. Therefore, a voucher is created for $120 and matched to the receipt record in Purchase Order Receiver file (F43121), which was created for $100 originally. The journal entry below records the clearing of the Received Not Vouchered account, the establishment of a trade account payable for the invoice amount, and whatever the difference is goes to an inventory variance account extracted from AAI table 4330.

DR CR AAI RNV 100 4320 Inventory 20 4330 Variance Trade A/P 120 PCxx

The variance account specified in AAI 4330 can be thought of as an addendum to the regular inventory account, because it represents the additional cost not already captured in the receipt entry above. When XYZ Co. prepares its financial statements at the end of the period, this variance account will be lumped in with inventory. So why not just hit inventory again for $20 instead of charging it to a variance account? Because the use of the variance account provides management with useful information in analyzing their operations (in fact, that is precisely why accounting was invented to begin with).

Note: Generally speaking, the 4330 AAI will be setup to hit the regular inventory account instead of a variance, unless standard cost is being used for items. In that case, the use of a variance account makes the most sense. The use of the separate inventory variance account in these examples is done to avoid confusion between the inventory account in 4310 AAI and the same account in 4330 AAI.

What happens if some of the goods are sold prior to paying for them?

Assume the same situation as above with regard to the receipt of the 10 widgets. The journal entry at receipt will be the same. But before the invoice from Dad's is received, customer ABC buys 5 of the widgets and they are shipped immediately. Once sales update is run, journal entries are created to record the sale, which includes accounts for revenue, A/R or cash, inventory, and COGS. The sales and A/R portion will be ignored for purposes of this discussion. The rest of the J/E looks like this:

DR CR AAI COGS 50 4220 Inventory 50 4210

Remember, the cost on the books at the time of the sale is $10 each, and we sold 5. Now 5 widgets, or $50, are left in inventory. The sale is complete.

Now here comes Dad’s invoice for $120. A voucher is created and the same journal entries, reproduced again here:

DR CR AAI RNV 100 4320 Inventory 20 4330 Variance Trade A/P 120 PCxx At first glance, this seems fine. But wait a minute. If $120 was paid for 10 widgets, then the true cost must be $12 each, not $10. And how many widgets are currently in inventory? 5. That means that when all is said and done, $60 (5 x $12) needs to be shown for the total in inventory, which includes the inventory account plus the variance account. But the variance account just got hit for $20 in the above journal entry, and $50 already exists in the inventory account, so the total is $70. That means our inventory is overstated by $10. Furthermore, COGS only got hit for $50 at sales update when it really should have gotten $60, because 5 widgets were sold at the actual cost of $60. The accounting for both the purchase and sale is done, and everything balances nicely, but COGS and inventory are not correct due to the fact that the entire variance amount got booked to inventory variance.

How the 4332 AAI table solves this issue:

The 4332 solves this problem by directing the correct portion of the total variance to a cost of sales account, which may or may not be the same account as COGS in AAI 4220, depending on the information needed. Cost of sales should receive part of the variance because half of the widgets made their way from inventory to COGS and the cost of them must follow. This time, upon voucher match, the following journal entries are created:

DR CR AAI RNV 100 4320 Inventory 10 4330 Variance COGS 10 4332 Trade A/P 120 PCxx

In this case, the system checks the on-hand quantity for the item and compares it to the quantity involved in the voucher match. If the on-hand quantity is LESS THAN that being matched, the 4332 AAI is invoked and a computation is done to determine the distribution of the total variance amount between the inventory variance and COGS. The system does this by computing the variance PER UNIT, which in our example is $2, and multiplying this by the on-hand quantity (5 in our case). The result is $10, which the system books to the inventory variance AAI 4330. The system is smart enough to know that whatever remains (the other $10) must belong to goods that have been sold (or written off, or otherwise disposed of) and should properly be booked to a cost of sales account. The 4332 AAI provides this account.