BUSINESS SERVICES PROCEDURES FISCAL YEAR END GUIDELINES 2011-2012

FISCAL YEAR END GUIDELINES - 2012

Financial and Business Services office is required to prepare financial statements which properly reflect the expenditures for each fiscal year. These financial statements are prepared in accordance with generally accepted accounting principles and are audited by the Florida Auditor General’s Office. For accurate financial statement presentation, we must charge all materials and services received by June 30 to the current ending fiscal year.

A College-wide Year End Closing Calendar is published each year in April with notice of the pertinent dates for the fiscal year-end closing. The Calendar is located on the Business Services website on the Accounting page and is available for download. Please print it out and make note of the deadlines.

NEW for 2011-2012: If you have always waited until July to complete your year-end tasks, don’t wait this year - things are different! All year-end associated tasks for inclusion of expenses in the current fiscal year must be completed on or before Monday, July 2.

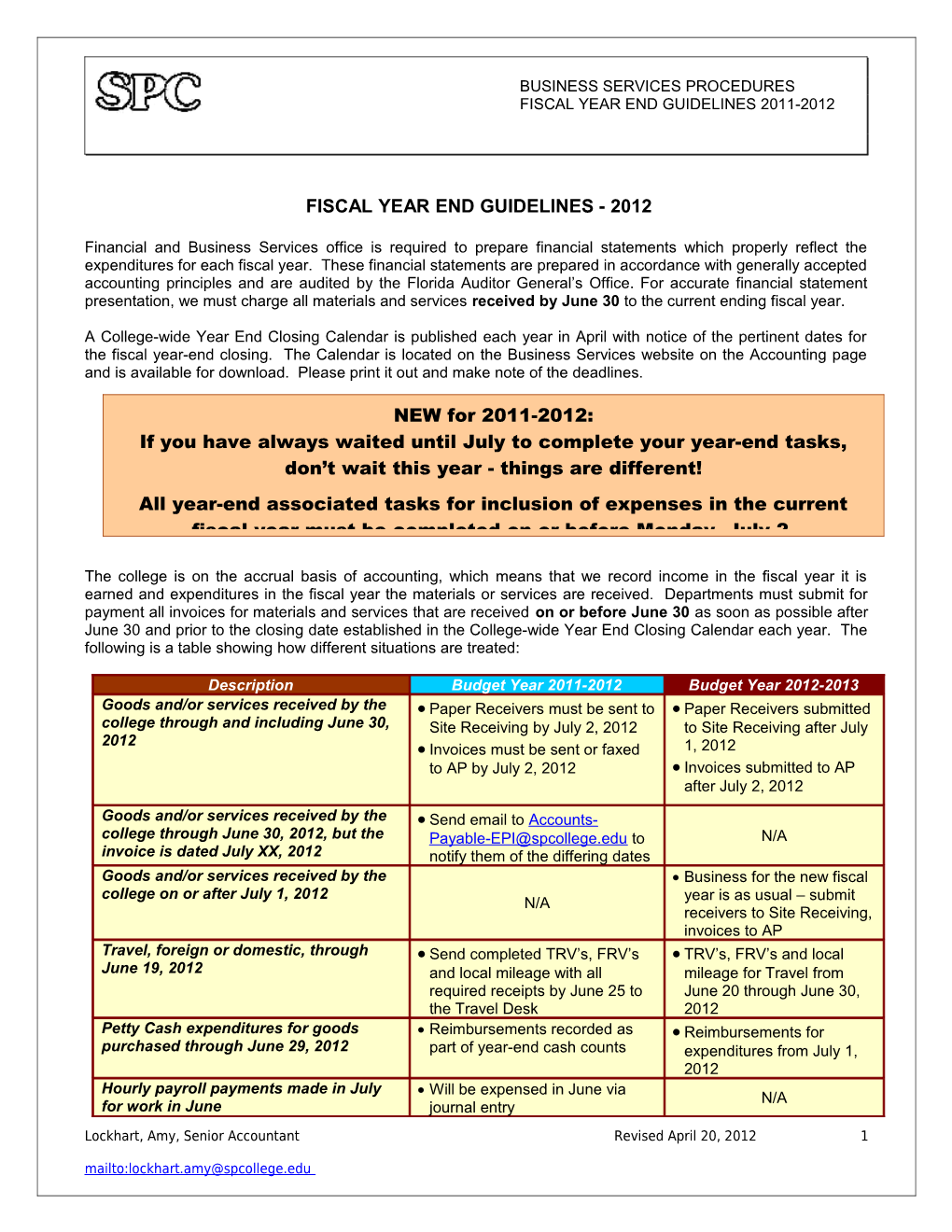

The college is on the accrual basis of accounting, which means that we record income in the fiscal year it is earned and expenditures in the fiscal year the materials or services are received. Departments must submit for payment all invoices for materials and services that are received on or before June 30 as soon as possible after June 30 and prior to the closing date established in the College-wide Year End Closing Calendar each year. The following is a table showing how different situations are treated:

Description Budget Year 2011-2012 Budget Year 2012-2013 Goods and/or services received by the Paper Receivers must be sent to Paper Receivers submitted college through and including June 30, Site Receiving by July 2, 2012 to Site Receiving after July 2012 Invoices must be sent or faxed 1, 2012 to AP by July 2, 2012 Invoices submitted to AP after July 2, 2012

Goods and/or services received by the Send email to Accounts- college through June 30, 2012, but the [email protected] to N/A invoice is dated July XX, 2012 notify them of the differing dates Goods and/or services received by the Business for the new fiscal college on or after July 1, 2012 year is as usual – submit N/A receivers to Site Receiving, invoices to AP Travel, foreign or domestic, through Send completed TRV’s, FRV’s TRV’s, FRV’s and local June 19, 2012 and local mileage with all mileage for Travel from required receipts by June 25 to June 20 through June 30, the Travel Desk 2012 Petty Cash expenditures for goods Reimbursements recorded as Reimbursements for purchased through June 29, 2012 part of year-end cash counts expenditures from July 1, 2012 Hourly payroll payments made in July Will be expensed in June via N/A for work in June journal entry

Lockhart, Amy, Senior Accountant Revised April 20, 2012 1 mailto:[email protected] BUSINESS SERVICES PROCEDURES FISCAL YEAR END GUIDELINES 2011-2012

HOW DO YOU HANDLE…2011-12 business?

NOTE: All College locations and departments are now “live” with utilizing the e-req system within PeopleSoft Financials. All new year (2012-2013) blanket PO requisition are to be completed in the system - no paper requisitions will be accepted. In order to ensure that the requisition and the accompanying budget are from the new year, you must enter the July 1, 2012 date for both the requisition date and the accounting date. Please pay careful attention to your data entry.

How do I know if I still have money left on a 2011-12 purchase order? Run the “All PO’s by Cost Center (New)” Crystal report S_POC58O for each of your cost centers individually. Please be sure to use 07/01/11 as the “PO Accounting Date From” prompt and 06/30/12 as the “PO Accounting Date To” to ensure that you are getting information on all purchase orders issued during this fiscal year. Do not leave any of the prompt fields blank. If a purchase order has zero dollars remaining, it is effectively closed – you cannot use it, you cannot process a change order against it.

Blanket (formally known as Open) purchase order payments? Blanket purchase orders are NOT eligible for rollover into the new fiscal year. Final orders against blanket purchase orders must be placed by April 27, 2012. Those orders must be received and invoiced by June 30. It is the department’s responsibility to notify the vendor that an invoice must be received in Accounts Payable no later than July 1 in order to be expensed in the correct budget year. Faxed invoices are acceptable (AP fax number is 727-341-3117).

Rollover purchase orders? Rollover purchase orders take budget with them from the current to the new fiscal year, but only certain types of purchase orders are eligible for rollover. For instance, purchase orders for 2011- 12 that contain the language “for the period of July 1, 2011 through June 30, 2012” are not eligible for rollover. Blanket purchase orders that were unused in 2011-12 are not eligible for rollover. Please work with Purchasing and with your Grants Accountant, where applicable, to “scrub” your purchase orders to determine which are eligible for rollover. Your list must be received no later than May 21, 2012. All purchase orders ineligible for rollover will be closed by June 30.

Petty Cash expenditures? Keep petty cash expenditures for June separate from those for July. The deadline for submitting Petty Cash reimbursements from 2012 budget is June 22, 2012. Petty Cash is to be counted and recorded on June 29. A request for replenishment should be done at the same time in order to keep June and July transactions separate. In mid-June, a reminder email will be sent to each Business Office Manager and/or custodian of cash containing a link to the Cash Count Form and instructions for preparation and timely submission.

Journal entry submission? With few exceptions (including grants and construction), Journal entries for transactions affecting the 2011-12 fiscal year should be submitted to Accounting as early as possible and no later than July 11, 2012. This will allow Accounting to meet established deadlines. Please do not combine entries for 2011-2012 and 2012-13 on one form; you must submit separate forms and be sure the Budget Year column indicates the correct Budget Year (“12” represents 2011-12; “13” represents

Lockhart, Amy, Senior Accountant Revised April 20, 2012 2 mailto:[email protected] BUSINESS SERVICES PROCEDURES FISCAL YEAR END GUIDELINES 2011-2012

2012-13). The 2012-13 journal entry form will be posted on the SPC website by May 21, 2012.

College checks that must be voided? Forward any college checks issued in the fiscal year ending June 30 which must be voided to Matthias Bates in Accounting at the Epicenter Services building. Please do not hold these checks, but return them to Accounting as soon as you are aware of the need to void. Be sure to note in the remittance portion of the check why it is to be voided and whether a replacement check is to be issued. Provide your name and a contact phone number so that you can be reached if necessary.

Tagging of Assets? All college-owned equipment, furnishings, and fixtures costing $1,000 or more must be tagged by Monday, June 25, 2012. If you have an untagged asset, please contact Karen Reynolds in Asset Management at 341-3234. Budget Supervisors must make every attempt to locate missing assets prior to June 30. On June 30, each Budget Supervisor is required to print a list of missing assets, sign and date the printout, and send to Karen Reynolds, Asset Management, EpiCenter Services Building.

Grant or Restricted Funded business? Please remember to obtain your Grants Accountant’s signature before submitting requisitions and/or check requests to Purchasing or AP. Since many Grant or Restricted Funded programs have differing rules and deadlines that may not be in synch with the College’s deadlines, please discuss with your Grant Accountant the deadlines that will impact you.

Budgets? If your remaining balance of budget is near zero and you will be processing additional 2011-12 expenses that were not previously encumbered, please contact Jim Nosewicz in the Budgets Office (341-3230) and make arrangements to provide an alternate funding source through a budget amendment for your journal entries or vouchers. The final day for submitting current expense budget amendments, for FY 2011-12 is June 11, 2012. The final day for submitting personnel or OPS budget amendments, for FY 2011-12 is June 22, 2012.

Any other questions? Contact any of the Team on the Contact Information sheet provided at the end of the SPC 2012 Year-End Closing Calendar. Please remember that College Policies and Procedures are not suspended during year end activities, even though the volume of details is intensified due to processing two fiscal years during the same time frame. To ensure that your business is processed timely and accurately, be sure that all required signatures are in place, that you have attached required supporting documentation, and supplied accurate and up-to-date information as to your vendor selection.

HOW DO YOU HANDLE…2012-13 business?

NOTE: All College locations and departments are now “live” with utilizing the e-req system within PeopleSoft Financials. All new year (’12-’13) blanket PO requisition are to be completed in the system- no paper requisitions will be accepted. In order to insure that the requisition and the accompanying budget are from the new year, you must enter the July 1, 2012 date for both the requisition date and the accounting date. Please pay careful attention to your data entry.

Lockhart, Amy, Senior Accountant Revised April 20, 2012 3 mailto:[email protected] BUSINESS SERVICES PROCEDURES FISCAL YEAR END GUIDELINES 2011-2012

Blanket (formally known as Open) Purchase Orders for 2012-13? Submit your requisitions for blanket purchase orders for 2012-13 beginning April 9, 2012 and no later than May 25, 2012; your blanket purchase order description text should read “for the fiscal year July 1, 2012 through June 30, 2013.” Blanket purchase orders should be in the hands of your vendors by July 1.

Payments due 7/1/12 and later? Please have your check requests clearly marked “2012-2013 budget” and submit them to Accounts Payable no later than June 22, 2012. The check requests will be processed and charged to your 2013 budget and a check will be mailed to the vendor on or after July 1.

Lockhart, Amy, Senior Accountant Revised April 20, 2012 4 mailto:[email protected] BUSINESS SERVICES PROCEDURES FISCAL YEAR END GUIDELINES 2011-2012

Handy Tips for processing Purchase Requisitions, Check Requests Topic Tip Grant or contract funded purchases Requires approval by the respective Grant or contract (Restricted Funds: 20 - 24) Accountant before being submitted to Purchasing Information Technology purchases Requires approval by Daya Pendharkar, Associate (Software, hardware, licenses, etc. Vice President Information Systems, before being over $750.00) submitted to Purchasing Furniture, cabinets, bulletin boards, Requires Interior Design approval. Vivian DeRussy signage, etc. or any purchases to be for South County and Charm Callahan for Clearwater attached to a building and North County. Advertising specialties (t-shirts, pens, Requires approval by Mike O’Keeffe, Director of etc.), printing (over 50 copies), all Marketing and Public Information print, radio, TV and internet marketing content (artwork, wording, College Logo, etc.) Continuing contracts for copiers, Be sure to specify terms covered (i.e. “months 12-24 printers of a 36 month contract”); also reference the 2011-12 purchase order to help ensure tracking of lease obligations. Vendor Quotations Be sure to include the name of the individual quoting, and the date; attach the quote if written, attach all renewal notices to the requisition. If more than one quote was obtained, please attach all. Blanket purchase orders (BL) State in the body of the requisition what you intend to purchase. Indicate on the requisition whether a BL2- way or a BL3-way match is required.

A BL2-way match does not require your authorization to pay – AP will pay any invoices received up to the amount of the purchase order. A BL3-way match requires the input of a receiver, which is your authorization to pay and your acknowledgement of receipt. Memberships and Subscriptions No purchase order is required; can be paid from a check request with documentation attached. Institutional Memberships must meet F.S. 119.01(3) requirements

Your assistance in making this a smooth fiscal year-end and a new fiscal year beginning is greatly appreciated by all of Financial and Business Services.

Lockhart, Amy, Senior Accountant Revised April 20, 2012 5 mailto:[email protected]