We need to be financially responsible. What does this mean? (Levels 4-5) Context for learning We are engaged in ‘financial thinking’ daily, looking at spending opportunities and thinking about the money we have or do not have to make such purchases. But what does it mean to be financially responsible when we look at financial choices? The purpose of this activity is to explore the idea of what it means to be ‘financially responsible’. This investigation asks students ‘What were you thinking’ when you bought a recent purchase? Students record their thinking for further analysis and reflection. This investigation will help students understand key financial messages and encourage them to establish a set of guidelines that might help them make better financial choices in the future. NB: The teacher can extend students’ knowledge of the key financial messages by investigating each of them through this taster and starter approach.

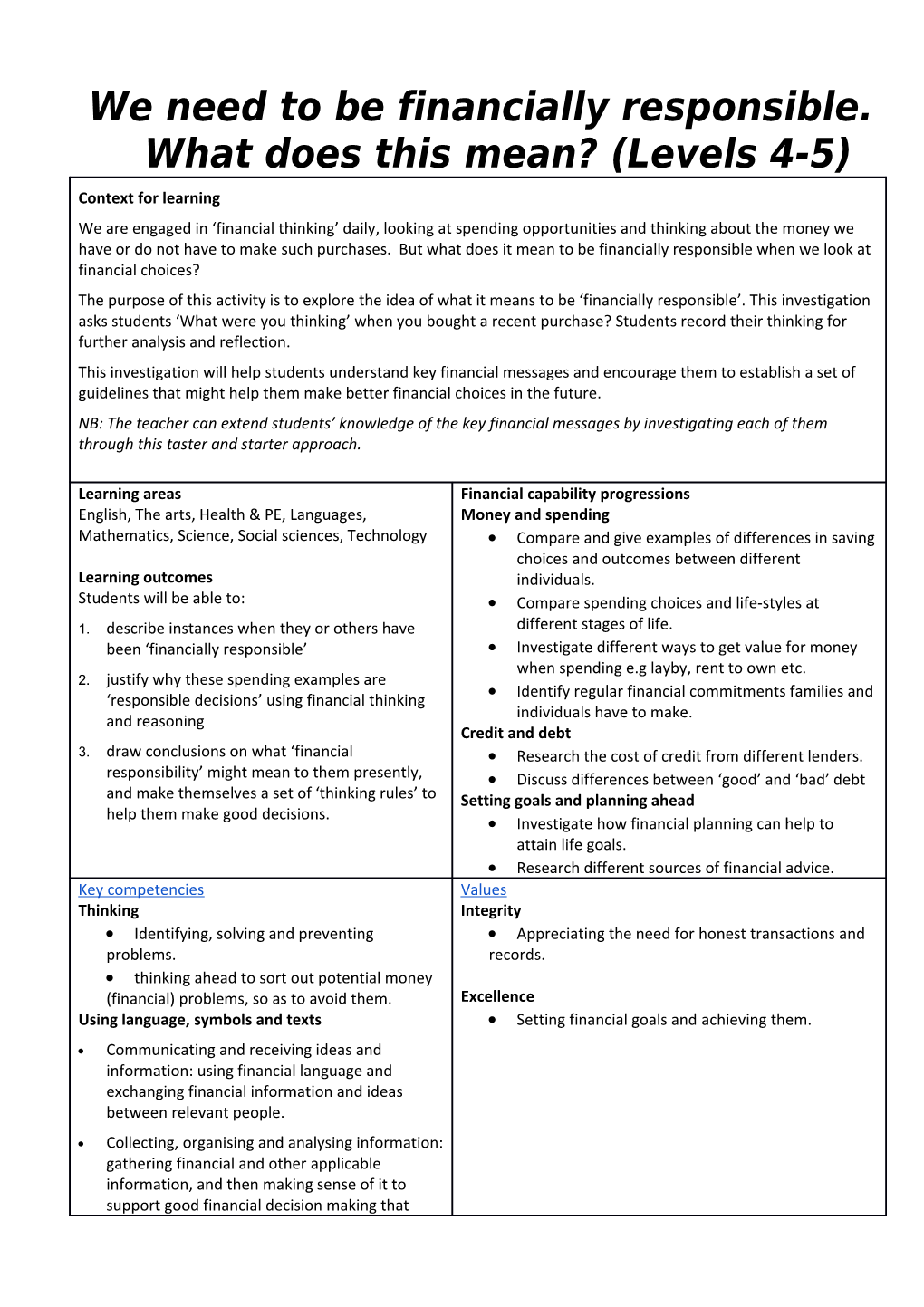

Learning areas Financial capability progressions English, The arts, Health & PE, Languages, Money and spending Mathematics, Science, Social sciences, Technology Compare and give examples of differences in saving choices and outcomes between different Learning outcomes individuals. Students will be able to: Compare spending choices and life-styles at 1. describe instances when they or others have different stages of life. been ‘financially responsible’ Investigate different ways to get value for money when spending e.g layby, rent to own etc. 2. justify why these spending examples are Identify regular financial commitments families and ‘responsible decisions’ using financial thinking individuals have to make. and reasoning Credit and debt 3. draw conclusions on what ‘financial Research the cost of credit from different lenders. responsibility’ might mean to them presently, Discuss differences between ‘good’ and ‘bad’ debt and make themselves a set of ‘thinking rules’ to Setting goals and planning ahead help them make good decisions. Investigate how financial planning can help to attain life goals. Research different sources of financial advice. Key competencies Values Thinking Integrity Identifying, solving and preventing Appreciating the need for honest transactions and problems. records. thinking ahead to sort out potential money (financial) problems, so as to avoid them. Excellence Using language, symbols and texts Setting financial goals and achieving them. Communicating and receiving ideas and information: using financial language and exchanging financial information and ideas between relevant people. Collecting, organising and analysing information: gathering financial and other applicable information, and then making sense of it to support good financial decision making that stands the test of time.

Suggested teaching and learning sequence 1. The teacher asks students what is meant by the statement, “We need to be financially responsible?” 2. The teacher records students’ ideas and explains the purpose of the activity which is to gain a better understanding of this key financial message and to establish a set of guidelines that might help them make better financial choices in the future. 3. Students are asked to list a set of their recent purchases. They are then asked “What were you thinking at the time?” and to record their thoughts, or lack of thoughts, for each of their purchases. 4. Students will then compare their ‘thinking’ with others, and consider the range of thinking to determine which thoughts could be classified as ‘financial thinking’. 5. The class analyses the thinking and determines any patterns or trends. Students’ thoughts may resemble the following statements: Do I really have the income (money)?; Is it something I really need or just want?; I could save this money instead; Will this purchase effect my future?; Should I save my money instead; This is an impulse buy but I will have it anyway. The students and teacher can add to this list to accommodate the range of thinking amongst the students. 6. The class discuss their findings around the level of ‘financial thinking’ that is occuring before they buy things. 7. Students complete a set of guidelines that would support their financial thinking before they spend their limited income. 8. Students reflect on their personal spending examples and provide a view on whether their decisions reflect ‘financial responsibility’. 9. Students may wish to devise a set of ‘finanical personalities’ that desribe the spending patterns of people in their sample.

Reflective questions/discussion 1. Given your recent purchases, which ones would you classify as needs, and which ones as wants? 2. How did you ‘earn’ the income you were using to buy the goods, or was it a gift? Did you have to ‘work hard’ for that income? 3. Did you consider the choice of saving your money? 4. Did you consider the future consequences when your spent your money? 5. Did your spending involve you getting into debt, or further into debt? 6. What do we mean by the term ‘impulse buying’.? What might be the consequences of too much impulse buying? 7. Who do you think is ‘financially responsible’ with their money? What might you learn from their behaviour? 8. When we look at our class’s view point, are we all in agreement here? Or are we seeing key financial message No 3 in our classroom? i.e. We may make different financial decisions from those made by someone else because we have dfferent preferences or cicumstances. 9. Are there any other key financial messages that are relevant to our discussion here?