ML Investment Banking Institute

August 2006 International Finance Sessions Professor Gordon Bodnar Problem Set #2

1. The Dole Company (US) has just agreed to purchase a Canadian food distributor for CAD150M. They will close on the deal in six months (180 days). Dole’s rates for borrowing and lending in each currency in the eurocurrency markets are shown below. Also shown are the current quotes in the market for exchange rates and OTC (over the counter) exchange rate options: Exchange rates: Spot: CAD/USD = 1.1350 180 day Month Forward: CAD/USD = 1.1325 180 day eurocurrency rates: USD 3.85 / 3.65 % p.a CAD 3.40 / 3.20 % p.a. [Note: ask then bid] 180 day call option on CAD with exercise of USD 0.90 / CAD, premium is 2.5% 180 day put option on CAD with exercise of USD 0.90 / CAD, premium is 6% a. What kind of exposure does Dole face from this transaction? (How big and for how long?) b. Describe the forward hedge Dole would use for this exposure and determine the FV of the payment in USD if Dole hedges the purchase using a forward contract. c. Describe the money market hedge Dole would use for this exposure and determine the FV of the payment if Dole pays for the transaction now out of cash reserves it holds in a deposit. d. Describe the option hedge that Dole would use for this exposure and determine following values: i. the most (in FV terms) that Dole will pay in the transaction with the option hedge assuming it pays for the premium out of its cash reserves on deposit. ii. the range of settlement date spot rates for which the option hedge provides a lower net cost for Dole than being unhedged? iii. The range of settlement date spot rates for which the option hedge provides a lower net cost for Dole than the forward hedge? e. How would you suggest they decide among hedging choices? f. Why is the CAD put option more expensive that the CAD call option?

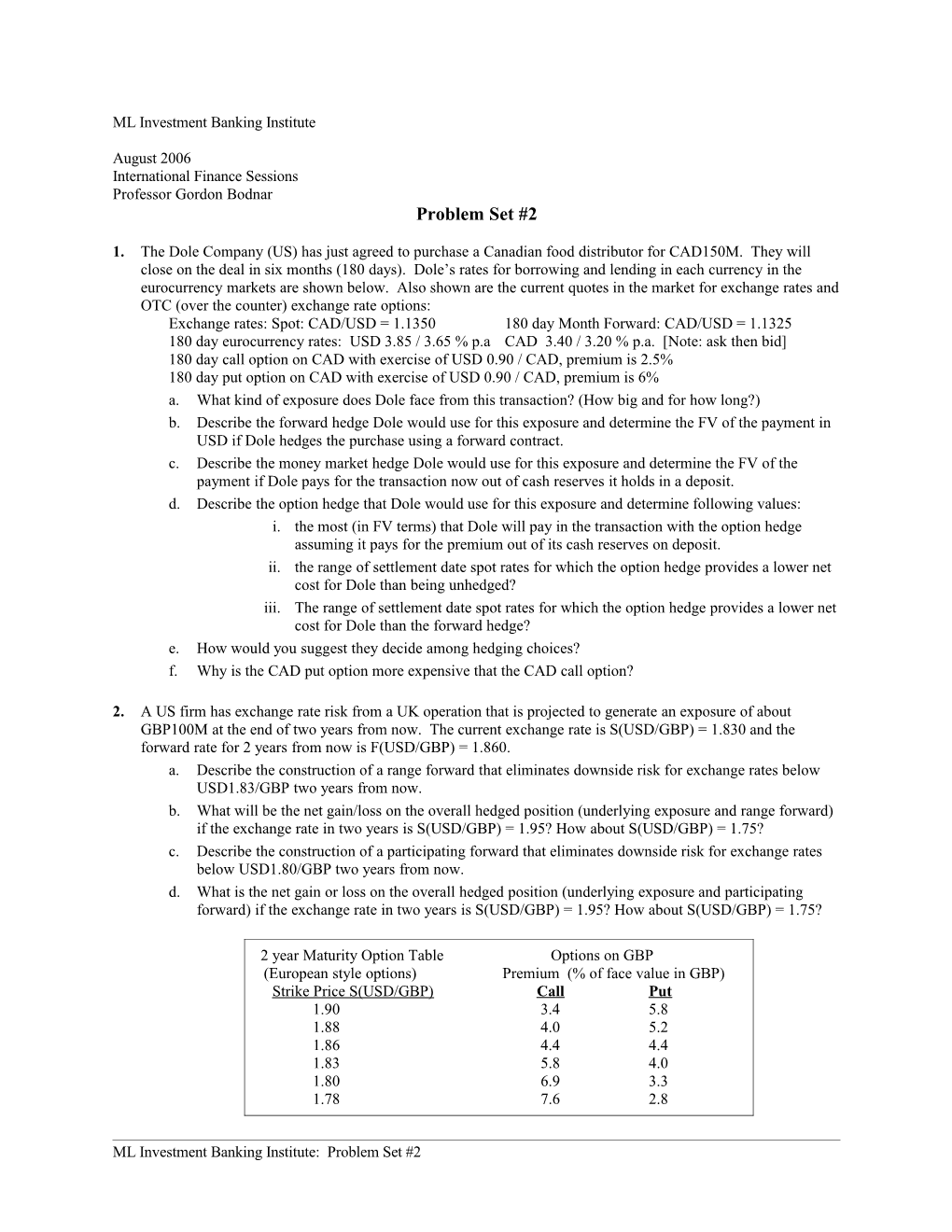

2. A US firm has exchange rate risk from a UK operation that is projected to generate an exposure of about GBP100M at the end of two years from now. The current exchange rate is S(USD/GBP) = 1.830 and the forward rate for 2 years from now is F(USD/GBP) = 1.860. a. Describe the construction of a range forward that eliminates downside risk for exchange rates below USD1.83/GBP two years from now. b. What will be the net gain/loss on the overall hedged position (underlying exposure and range forward) if the exchange rate in two years is S(USD/GBP) = 1.95? How about S(USD/GBP) = 1.75? c. Describe the construction of a participating forward that eliminates downside risk for exchange rates below USD1.80/GBP two years from now. d. What is the net gain or loss on the overall hedged position (underlying exposure and participating forward) if the exchange rate in two years is S(USD/GBP) = 1.95? How about S(USD/GBP) = 1.75?

2 year Maturity Option Table Options on GBP (European style options) Premium (% of face value in GBP) Strike Price S(USD/GBP) Call Put 1.90 3.4 5.8 1.88 4.0 5.2 1.86 4.4 4.4 1.83 5.8 4.0 1.80 6.9 3.3 1.78 7.6 2.8

ML Investment Banking Institute: Problem Set #2 4. SAIS is a U.S. corporation with a wholly owned foreign subsidiary in Bologna Italy and a 50-50 joint venture with a local partner in Nanjing China. Italy and the US are world-wide tax principle countries while China is a territorial tax principle country. The foreign subsidiary in Italy earns $100 before taxes. Italy has a 30% corporate tax rate and a 5% withholding tax on all non-wage transfers to nonresidents. The JV in China earns a total of $50 before taxes. China has a 45% corporate tax rate and a 10% withholding tax on all non-wage transfers to nonresidents The U.S. has a 35% corporate tax rate and a foreign tax credit system and currently SAIS Inc. has no surplus FTCs.

a. Under the condition that the Bologna subsidiary pays a dividend of 50% of its net income and the Chinese JV pays out a full dividend to both owners, determine the dividend payments received by SAIS (US) after any and all U.S. tax liabilities for that year are paid..

b. If SAIS bought out its Chinese partner so that it fully owned the Chinese operation, determine the dividend payments received by SAIS after any and all U.S. tax liabilities for that year are paid. Assume the same payout policy as above and that SAIS has no surplus FTCs in any basket.

c. SAIS acquires a wholly owned operation in Brunei, where the local corporate tax rate is 10% and there is no withholding tax. If the income from this operation is expected to be 25 per period and the operation will pay a full dividend, what is the effective tax rate on this investment given the situation from part (b)?

ML Investment Banking Institute: Problem Set #2