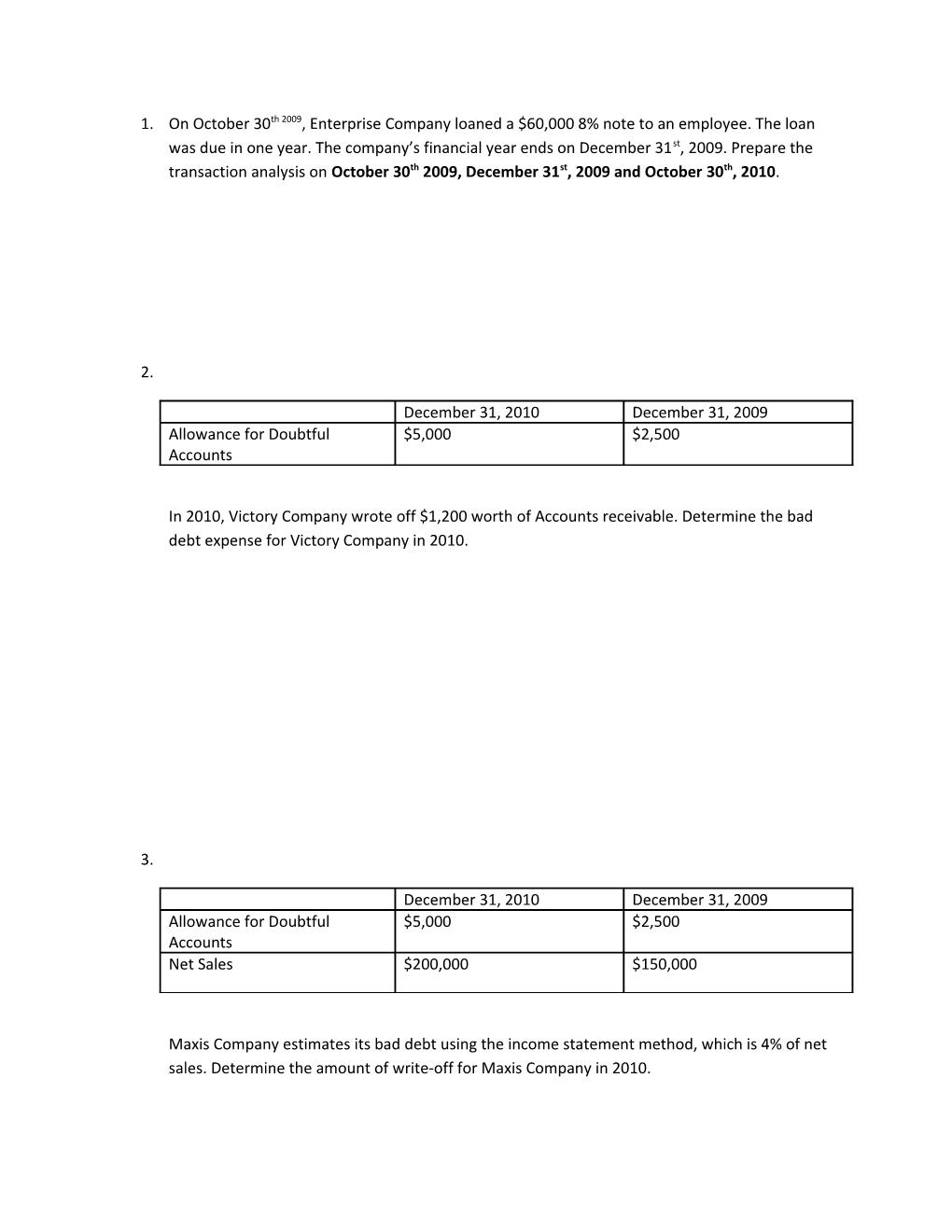

1. On October 30th 2009, Enterprise Company loaned a $60,000 8% note to an employee. The loan was due in one year. The company’s financial year ends on December 31st, 2009. Prepare the transaction analysis on October 30th 2009, December 31st, 2009 and October 30th, 2010.

2.

December 31, 2010 December 31, 2009 Allowance for Doubtful $5,000 $2,500 Accounts

In 2010, Victory Company wrote off $1,200 worth of Accounts receivable. Determine the bad debt expense for Victory Company in 2010.

3.

December 31, 2010 December 31, 2009 Allowance for Doubtful $5,000 $2,500 Accounts Net Sales $200,000 $150,000

Maxis Company estimates its bad debt using the income statement method, which is 4% of net sales. Determine the amount of write-off for Maxis Company in 2010. 4. Jan 1, 2009 Celcom Company sold merchandise amounting to $55,000 and received a 5% note on the sale that is due in one year.

May 1, 2009 Celcom Company’s fiscal year ends on this date. It thus accrues the interest on the note.

Jan 1, 2010 Celcom receives payment on the note plus interest.

Record the transactions for all the three dates above. What is the net effect on assets for each of the three dates? 5. Calculate the interest rate on a note that pays $2,000 interest ever year, with a $50,000 principal.

6. Nokia uses the aging approach to estimate bad debt expense. The balances of the A/R are aged and the estimated default are listed as follows: (i) 1-30 days old $10,000...... estimate 2% default. (ii) 30-60 days old $25,000...... estimate 5% default. (iii) 60 days and more $80,000...... estimate 8% default.

The balance in the allowance for doubtful accounts is $1,500 (debit)

Estimate the bad debt expense of Nokia assuming a write off of $2,000.