Student ID#: ______Name: ______

2016-2017 Household Resources Verification for Dependent Students

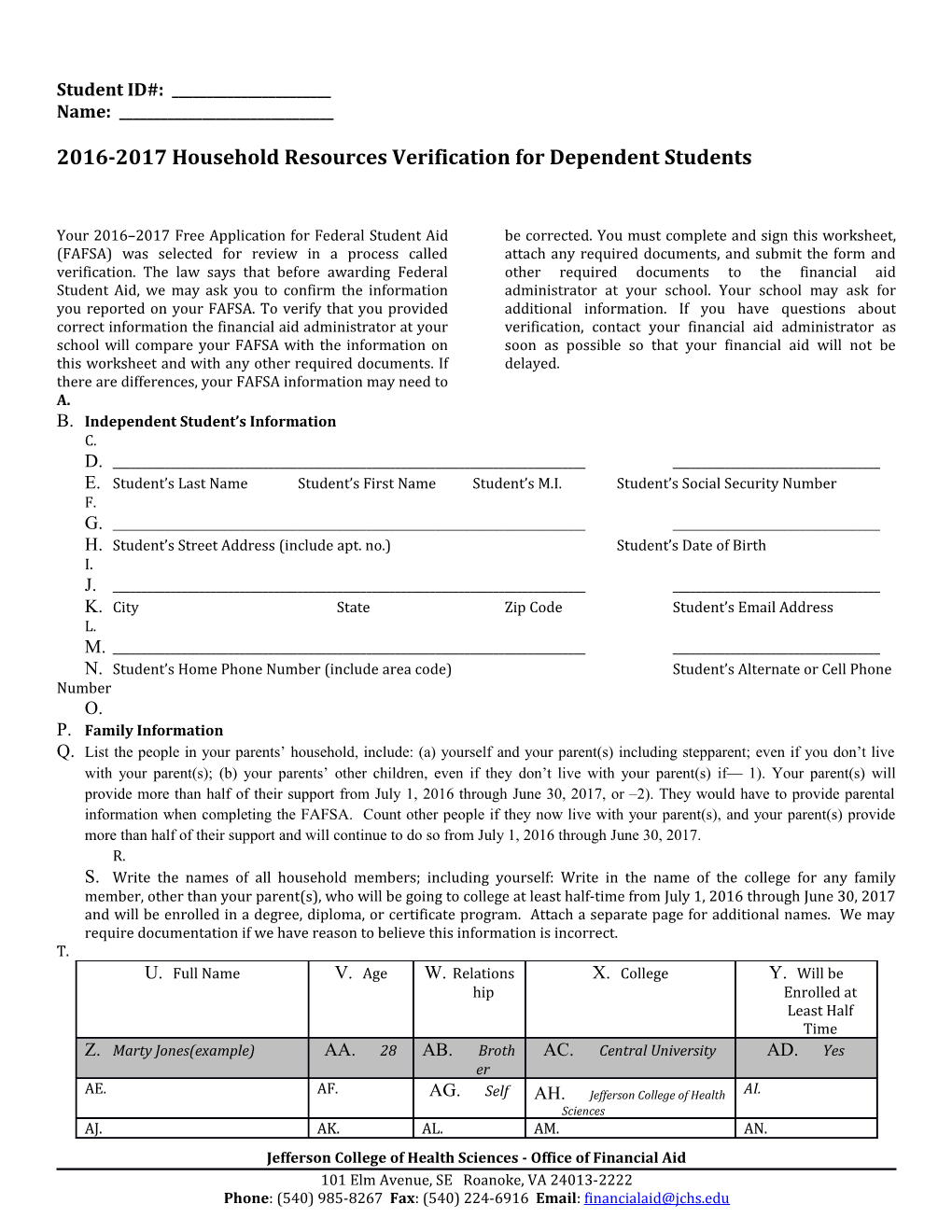

Your 2016–2017 Free Application for Federal Student Aid be corrected. You must complete and sign this worksheet, (FAFSA) was selected for review in a process called attach any required documents, and submit the form and verification. The law says that before awarding Federal other required documents to the financial aid Student Aid, we may ask you to confirm the information administrator at your school. Your school may ask for you reported on your FAFSA. To verify that you provided additional information. If you have questions about correct information the financial aid administrator at your verification, contact your financial aid administrator as school will compare your FAFSA with the information on soon as possible so that your financial aid will not be this worksheet and with any other required documents. If delayed. there are differences, your FAFSA information may need to A. B. Independent Student’s Information C. D. ______E. Student’s Last Name Student’s First Name Student’s M.I. Student’s Social Security Number F. G. ______H. Student’s Street Address (include apt. no.) Student’s Date of Birth I. J. ______K. City State Zip Code Student’s Email Address L. M. ______N. Student’s Home Phone Number (include area code) Student’s Alternate or Cell Phone Number O. P. Family Information Q. List the people in your parents’ household, include: (a) yourself and your parent(s) including stepparent; even if you don’t live with your parent(s); (b) your parents’ other children, even if they don’t live with your parent(s) if— 1). Your parent(s) will provide more than half of their support from July 1, 2016 through June 30, 2017, or –2). They would have to provide parental information when completing the FAFSA. Count other people if they now live with your parent(s), and your parent(s) provide more than half of their support and will continue to do so from July 1, 2016 through June 30, 2017. R. S. Write the names of all household members; including yourself: Write in the name of the college for any family member, other than your parent(s), who will be going to college at least half-time from July 1, 2016 through June 30, 2017 and will be enrolled in a degree, diploma, or certificate program. Attach a separate page for additional names. We may require documentation if we have reason to believe this information is incorrect. T. U. Full Name V. Age W. Relations X. College Y. Will be hip Enrolled at Least Half Time Z. Marty Jones(example) AA. 28 AB. Broth AC. Central University AD. Yes er AE. AF. AG. Self AH. Jefferson College of Health AI. Sciences AJ. AK. AL. AM. AN. Jefferson College of Health Sciences - Office of Financial Aid 101 Elm Avenue, SE Roanoke, VA 24013-2222 Phone: (540) 985-8267 Fax: (540) 224-6916 Email: [email protected] AO. AP. AQ. AR. AS. AT. AU. AV. AW. AX. AY. AZ. BA. BB. BC. BD. BE. BF. BG. BH. BI. BJ. BK. BL. BM. BN. BO. SNAP and CHILD SUPPORT Information to Be Verified BP. 1. Complete this section if someone in the student’s household (listed in Section B) received benefits from the Supplemental Nutrition Assistance Program or SNAP (formerly known as food stamps) any time during the 2014 or 2015 calendar years. BQ. BR. Check here if one of the people listed in section B received SNAP benefits in 2014-2015. BS. BT. Check here if NO ONE in section B received SNAP benefits in 2014-2015. BU. 2. Complete this section if you or your spouse, if married, paid child support in 2015. BV. BW. Check here if student, if married, my spouse who is listed in Section B of this worksheet, paid child support in 2015. BX. BY. Who Paid Child BZ. Person to Whom Child CA. Name of Child for CB. Amount Support Support was Paid Whom Support Was of Child Paid Support Paid in 2015 CC. Marty CD. Chris Smith CE. Terry Jones CF.$6,000.00 Jones(example) CG. CH. CI. CJ. CK. CL. CM. CN. CO. CP. CQ. CR. CS. CT. Verification of 2015 IRS Income Tax Return Information for Student Filers CU. CV. Important Note: The instructions below apply to the student and spouse, if the student is married. Notify the financial aid office if the student or spouse filed separate IRS income tax returns for 2015 or had a change in marital status after the end of the 2015 tax year on December 31, 2015. CW. CX. Instructions: Complete this section if the student and spouse filed or will file a 2015 IRS income tax return(s). The best way to verify income is by using the IRS Data Retrieval Tool (IRS DRT) that is part of FAFSA on the Web at FAFSA.gov. In most cases, no further documentation is needed to verify 2015 income information that was transferred into the student’s FAFSA using the IRS DRT if that information was not changed. CY. CZ. In most cases, for electronic tax return filers, 2015 IRS income tax return information for the IRS DRT is available within 2–3 weeks after the 2015 electronic IRS income tax return has been accepted by the IRS. Generally, for filers of 2015 paper IRS income tax returns, the 2015 IRS income tax return information is available for the IRS DRT within 8–11 weeks after the 2015 paper IRS income tax return has been received by the IRS. Contact the financial aid office if more information is needed about using the IRS DRT. DA. DB. Check the box that applies: DC. DD. The student has used the IRS DRT in FAFSA on the Web to transfer 2015 IRS income tax return information into the student’s FAFSA. DE. DF. The student has not yet used the IRS DRT in FAFSA on the Web, but will use the tool to transfer 2015 IRS income tax return information into the student’s FAFSA once the 2015 IRS income tax return has been filed. DG. Name: ______Student ID: ______Page 3 of 6 DH. The student is unable or chooses not to use the IRS DRT in FAFSA on the Web, and instead will provide the school a 2015 IRS Tax Return Transcript(s). DI. DJ. To obtain a 2015 IRS Tax Return Transcript, go to www.IRS.gov and click on the “Order a Return or Account Transcript” link. Make sure to request the “IRS Tax Return Transcript” and not the “IRS Tax Account Transcript.” Use the Social Security Number (or the IRS individual taxpayer identification number) and the date of birth of the first person listed on the 2015 IRS income tax return, and the address on file with the IRS (normally this will be the address used on the 2015 IRS income tax return). In most cases, for electronic filers, a 2015 IRS Tax Return Transcript may be requested from the IRS within 2–3 weeks after the 2015 IRS income tax return has been accepted by the IRS. Generally, for filers of 2015 paper IRS income tax returns, the 2015 IRS Tax Return Transcript may be requested within 8–11 weeks after the 2015 paper IRS income tax return has been received by the IRS. DK. DL. If the student and spouse filed separate 2015 IRS income tax returns, 2015 IRS Tax Return Transcripts must be provided for both. DM. DN. ____ Check here if a 2015 IRS Tax Return Transcript(s) is provided. DO. ____ Check here if a 2015 IRS Tax Return Transcript(s) will be provided later. DP. DQ. Verification of Other Untaxed Income for 2015 DR. DS. If any item does not apply, enter “N/A” for Not Applicable where a response is requested, or enter 0 in an area where an amount is requested. Answer each question below as it applies to the student and the student’s parent(s) whose information is on the FAFSA. DT. DU. To determine the correct annual amount for each item: If you paid or received the same dollar amount every month in 2015, multiply that amount by the number of months in 2015 you paid or received it. If you did not pay or receive the same amount each month in 2015, add together the amounts you paid or received each month. DV. DW. If more space is needed, provide a separate page with the student’s name and ID number at the top. DX. DY. 1. Payments to tax-deferred pension and retirement savings DZ. List any payments (direct or withheld from earnings) to tax-deferred pension and retirement savings plans (e.g.401(k) or 403(b) plans), including, but not limited to, amounts reported on W-2 forms in Boxes 12a through 12d with codes D, E, F, G, H, and S. EA. EB. Name of Person Who Made the Payment EC. Total Amount Paid in 2015 ED. EE. EF. EG. EH. EI. EJ. EK. 2. Child Support Received EL. List the actual amount of any child support received in 2015 for the children in your household. EM. EN. Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually paid. EO. EP.Name of Adult Who ER. Name of Child For Whom ET.Amount of Child Support EQ. Received the Support ES.Support was Received EU. Received in 2015 EV. EW. EX. EY. EZ. FA. FB. FC. FD. FE. FF. FG. FH. FI. FJ. FK.

Jefferson College of Health Sciences - Office of Financial Aid 101 Elm Avenue, SE Roanoke, VA 24013-2222 Phone: (540) 985-8267 Fax: (540) 224-6916 Email: [email protected] FL. 3. Housing, food, and other living allowances paid to members of the military, clergy, and others FM. Include cash payments and/or the cash value of benefits received. FN. FO. Do not include the value of on-base military housing or the value of a basic military allowance for housing. FP. FQ. Name of FR. Type of FS. Amount of Recipient Benefit Received Benefit FT. Received in 2015 FU. FV. FW. FX. FY. FZ. GA. GB. 4. Veterans non-education benefits GC. List the total amount of veterans non-education benefits received in 2015. Include Disability, Death Pension, Dependency and Indemnity Compensation (DIC), and/or VA Educational Work-Study allowances. GD. GE. Do not include federal veterans educational benefits such as: Montgomery GI Bill, Dependents Education Assistance Program, VEAP Benefits, Post-9/11 GI Bill GF. GH. Type of Veterans GJ. Amount of Benefit GG. Name of Recipient GI. Non-education Benefit GK. Received in 2015 GL. GM. GN. GO. GP. GQ. GR. GS. GT. GU. GV. 5. Other untaxed income GW. List the amount of other untaxed income not reported and not excluded elsewhere on this form. Include untaxed income such as workers’ compensation, disability, Black Lung Benefits, untaxed portions of health savings accounts from IRS Form 1040 Line 25, Railroad Retirement Benefits, etc. GX. GY. Do not include any items reported or excluded in A – D above. In addition, do not include student aid, Earned Income Credit, Additional Child Tax Credit, Temporary Assistance to Needy Families (TANF), untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion, or credit for federal tax on special fuels. GZ. HD. Amount of Other HB. Type of Other Untaxed HA. Name of Recipient HC. Untaxed Income HE. Income Received in 2015 HF. HG. HH. HI. HJ. HK. HL. HM. HN. HO. HP. 6. Money received or paid on the student’s behalf HQ. List any money received or paid on the student’s behalf (e.g., payment of student’s bills) and not reported elsewhere on this form. Enter the total amount of cash support the student received in 2015. Include support from a parent whose information was not reported on the student’s 2016–2017 FAFSA, but do not include support from a parent whose information was reported. For example, if someone is paying rent, utility bills, etc., for the student or gives cash, gift cards, etc., include the amount of that person's contributions unless the person is the student’s parent whose information is reported on the student’s 2016–2017 FAFSA. Amounts paid on the student’s behalf also include any distributions to the student from a 529 plan owned by someone other than the student or the student’s parents, such as grandparents, aunts, and uncles of the student. HR. HS. Purpose: e.g. Cash, Rent, HT. Amount Received in HU. Source Books 2015 HV. HW. HX. Name: ______Student ID: ______Page 5 of 6 HY. HZ. IA. IB. IC. ID. IE. IF. 7. Attach copies of all 2015 IRS W-2 forms for each source of employment income received in 2015 IG. ____ Check here if copies of all 2015 IRS W-2 forms are attached to this form. IH. II. ____ Check here if copies of all 2015 IRS W-2 forms will be provided later. IJ. IK. ____ Check here if you are unable to provide copies of all/some 2015 IRS W-2 forms and provide an explanation in the box below. IL. IM. IN. IO. IP. IQ. Additional Information IR. IS. So that we can fully understand the student’s family's financial situation, please provide below information about any other resources, benefits, and other amounts received by the student and any members of the student’s household. This may include items that were not required to be reported on the FAFSA or other forms submitted to the financial aid office, and include such things as federal veterans education benefits, military housing, SNAP, TANF, etc. IT. IU. If more space is needed, provide a separate page with the student’s name and ID number at the top. IV. IY. Amount of Financial Support IW. Name of Recipient IX. Type of Financial Support IZ. Received in 2015 JA. JB. JC. JD. JE. JF. JG. JH. JI. JJ. JK. JL. JM. JN. JO. JP. JQ. Comments: JR. JS. JT. JU. JV. JW. JX. JY. JZ. KA. KB. KC. KD. KE. KF. Certification and Signature KG. KH. By signing this form, I certify that all the information attested to is accurate and correct. Because this information may affect federal aid eligibility, intentionally giving false or misleading information may cause you to be fined up to $20,000.00, sent to prison, or both. KI. KJ.

Jefferson College of Health Sciences - Office of Financial Aid 101 Elm Avenue, SE Roanoke, VA 24013-2222 Phone: (540) 985-8267 Fax: (540) 224-6916 Email: [email protected] KK. I certify that all of the information reported on this worksheet is complete and correct. The student must sign this worksheet. If married, the spouse’s signature is optional. KL. KM.

KN. ______KO. Student’s Signature Date Parent’s Signature Date