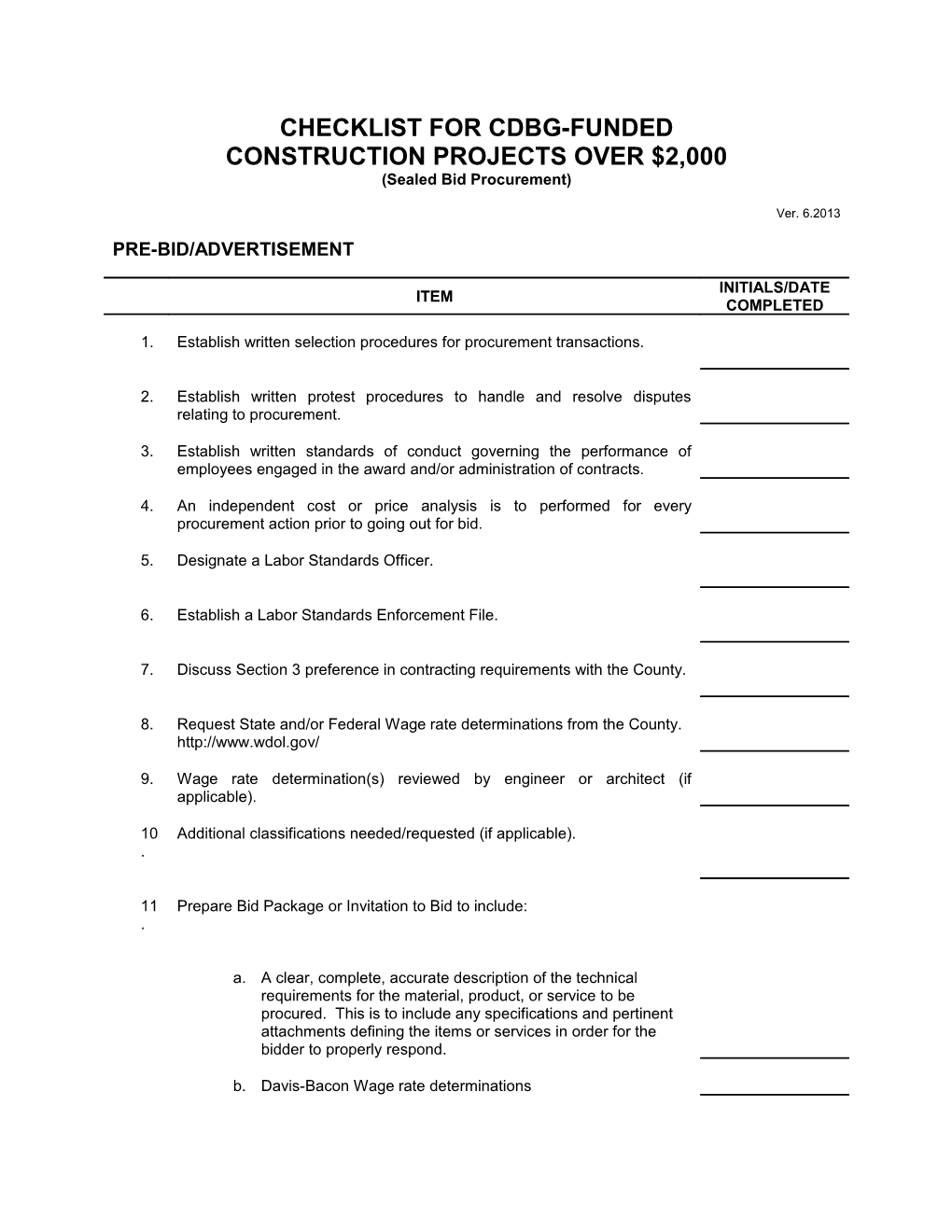

CHECKLIST FOR CDBG-FUNDED CONSTRUCTION PROJECTS OVER $2,000 (Sealed Bid Procurement)

Ver. 6.2013

PRE-BID/ADVERTISEMENT

INITIALS/DATE ITEM COMPLETED

1. Establish written selection procedures for procurement transactions.

2. Establish written protest procedures to handle and resolve disputes relating to procurement.

3. Establish written standards of conduct governing the performance of employees engaged in the award and/or administration of contracts.

4. An independent cost or price analysis is to performed for every procurement action prior to going out for bid.

5. Designate a Labor Standards Officer.

6. Establish a Labor Standards Enforcement File.

7. Discuss Section 3 preference in contracting requirements with the County.

8. Request State and/or Federal Wage rate determinations from the County. http://www.wdol.gov/

9. Wage rate determination(s) reviewed by engineer or architect (if applicable).

10 Additional classifications needed/requested (if applicable). .

11 Prepare Bid Package or Invitation to Bid to include: .

a. A clear, complete, accurate description of the technical requirements for the material, product, or service to be procured. This is to include any specifications and pertinent attachments defining the items or services in order for the bidder to properly respond.

b. Davis-Bacon Wage rate determinations PRE-BID/ADVERTISEMENT

INITIALS/DATE ITEM COMPLETED

c. Federal Labor Standards Provisions included in their entirety – may not just be linked. These are found at: http://www.hud.gov/offices/adm/hudclips/forms/files/4010.pdf

d. Requirement for bid guarantee equivalent to five (5) percent of the bid price (for construction or facility improvements exceeding $100,000).

e. Equal Opportunity Clause (Executive Order 11246, as amended)

f. Notice of Requirement for Affirmative Action (Executive Order 11246, as amended for contracts over $10,000)

g. Copeland Anti-Kickback Clause

h. Section 3 Clause (over $100,000)

i. Contract Work Hours and Safety Standards Act Clauses as supplemented by Department of Labor regulations

j. Disclosure of Ownership form

k. Conflict of Interest Form (or else inquire as part of bid opening)

12 Have attorney review bids and contracts (recommended). .

13 Advertise the Bid/Invitation to Bid in publications of general circulation – . obtain proof of publication. Municipalities should be sure to comply with the State Statutes for the Class of notice required.

14 Document outreach efforts to MBE/WBE. .

15 Document outreach efforts to Section 3 business concerns. .

16 Maintain list of businesses to which bids were sent/picked up. .

17 Ten (10) days prior to bid opening ensure the wage decisions are still in . effect. If they have been replaced or modified, notify prospective bidders so they can modify their bids. Wage rates change every Friday at 10 a.m., PRE-BID/ADVERTISEMENT

INITIALS/DATE ITEM COMPLETED

the subrecipient is responsible for using the current wage rate(s) for the project being bid. Failure to use the most current wage rates means the subrecipient will be responsible for all back wages due to employees.

18 Provide County with copies of all documents (procurement policies; . independent cost estimates; labor standards officer; bid package; proof of publication of bid advertisement; outreach efforts to MBE/WBE, Section 3 concerns; list of businesses obtaining bid packages)

19 Retain copies of all documents in the Labor Standards file. .

BID OPENING & AWARD

INITIALS/DATE ITEM COMPLETED

20 Open bid packages at public place and time specified in bid advertisement .

21 Tabulate (tally) bids. .

22 Record minutes of bid opening .

23 Verify eligibility of prime contractor and all subcontractors. Eligibility can . be verified on-line at https://www.sam.gov/portal/public/SAM/ . Be certain to document this verification in the contract file. Contact the County to verify.

24 Make recommendation for award .

25 Retain minutes from City Council, Village or Town Board or other Board . minutes (such as for non-profit Boards) awarding bid. Be sure to inquire if there are any conflicts of interest.

26 Take photos of site/work needing to be done. BID OPENING & AWARD

INITIALS/DATE ITEM COMPLETED

27 Provide County with copies of all documents (bid tally, minutes of bid . opening, eligibility of prime contractor and all subcontractors, minutes awarding bid, copies of photos).

28 Retain copies of all documents in Labor Standards file. .

PRE-CONSTRUCTION

INITIALS/DATE ITEM COMPLETED

29 Send notice of award to selected Contractor. .

30 Obtain a performance bond and a payment bond from the selected . Contractor consistent with 24 CFR 85.36(h).

31 For any project where CDBG has awarded $200,000 or more, the Section . 3 requirements are applicable. Meet with the County and selected Contractor to develop a Section 3 Plan. The Section 3 requirements may extend to subcontracts. The County may impose Section 3 goals for smaller contracts.

32 Execute contract with required provisions: .

a. Administrative, contractual, or legal remedies for violation or breach of contract

b. Termination for cause and for convenience including the manner by which it will be effected and the basis for settlement (contracts over $10,000)

c. Equal Opportunity Clause

d. Notice of Requirement for Affirmative Action

e. Copeland Anti-Kickback Clause

f. Federal Labor Standards Provisions: http://www.hud.gov/offices/adm/hudclips/forms/files/4010.pdf PRE-CONSTRUCTION

INITIALS/DATE ITEM COMPLETED g. Wage rate determinations

NOTE: If the contract is awarded 90 days or more after the bid opening, check with the County to see if the wage decision has been modified or superseded. If it has, the modified wage decision must be used in the construction project.

h. Contract Work Hours and Safety Standards Act Clauses as supplemented by Department of Labor regulations

i. Section 3 Clause (contracts over $100,000 or as applicable)

j. Reporting requirements

k. Notice of requirements and regulations pertaining to patent rights with respect to discovery or invention that arises or is developed in the course of or under such contract.

l. Requirements and regulations pertaining to copyrights and rights in data.

m. Access by the County, HUD, subrecipient, the Comptroller General of the United States, or any of their duly authorized representatives to any books, documents, papers, and records of the contractor which are directly pertinent to that specific contract for the purpose of making audit, examination, excerpts, and transcriptions.

n. Retention of all required records for three years after final payments and all other pending matters are closed.

o. Compliance with all applicable standards, orders, or requirements issued under section 306 of the Clear Air Act, section 508 of the Clean Water Act, Executive Order 11738, and Environmental Protection Agency regulations (40 CFR part 15). (Contracts, subcontracts in excess of $100,000).

p. Mandatory standards and policies relating to energy efficiency which are contained in the state energy conservation plan issued in compliance with the Energy Policy and Conservation Act.

3 Ensure Prime Contractor and all subs sign Lobbying Certification for 3. Contracts, Grants, Loans, and Cooperative Agreements

3 Obtain information from prime contractor and all subs regarding: 4.

a. FEIN numbers PRE-CONSTRUCTION

INITIALS/DATE ITEM COMPLETED

b. MBE/WBE status

c. Section 3 status

d. Demographics of owner

e. Amount of contract/subcontract

35 If apprentices are to be used, obtain copy of certification of the apprentice . program from the Wisconsin Bureau of Apprenticeship and Training (recognized by USBAT).1

36 If trainees are to be used, obtain copy of program certification from . USBAT.

37 If new hires will be necessary to complete the project (at any tier, for any . position), identify how preference will be given to persons who are Section 3 qualified, (if not a part of a Section 3 Plan).

38 If new sub-contactors will be necessary to complete the project (at any . tier), identify how preference will be given to Section 3 business concerns (if not a part of a Section 3 Plan).

39 Hold Pre-construction conference (not mandatory, but strongly . recommended). Invite County if holding. Retain minutes.

40 Labor Standards Officer is to provide Contractor with a copy of the . Employee Rights Under the Davis Bacon Act poster, Form WH-1321, with the name and contact information for the agency’s contracting officer.

41 Labor Standards Officer is to provide Contractor with a Project Wage . Rate Sheet – HUD Form 4720.

42 Labor Standards Officer is to provide Contractor with copies of all . required posters for the Job Site. Federal posters may be found at: http://www.dol.gov/elaws/posters.htm

43 Obtain copies of all executed Subcontracts. .

44 Obtain all necessary permits. .

1 Note: Apprentice or trainee rates can not be paid unless the apprentice or training program is certified by the Wisconsin Bureau of Apprenticeship and Training. PRE-CONSTRUCTION

INITIALS/DATE ITEM COMPLETED

45 Provide County with copies of all documents (notice of award to prime . contractor, contracts, subcontracts, lobbying certification form(s), pre- construction conference meeting minutes, Section 3 Plan, permits, etc.).

CONSTRUCTION

INITIALS/DATE ITEM COMPLETED

46 Receive notice to proceed from County. .

47 Issue notice to proceed to Prime Contractor. The Notice to Proceed . establishes the construction start date and the scheduled completion date, and provides the basis for assessing liquidated damages. The construction period and basis for assessing liquidated damages must be consistent with those sections of the contract documents.

48 Project Manager is to conduct on-site monitoring to assure posting of . permits and posters; job progress; delivery of materials; presence of contractors and workers; completion of inspections by code officials, engineers, and architects; compliance with federal rules; risk management; and processing of payment requests and change orders. Retain notes and associated photos of site inspections.

49 The Prime/General Contractor is to complete a weekly payroll report for its . employees on the covered job and sign the Statement of Compliance. The Prime/General Contractor must also obtain weekly payrolls (including signed Statements of Compliance) from all subcontractors as they work on the project.

50 The Prime/General Contractor is to submit certified payroll reports to the . Labor Standards Officer, typically no more than 10 working days following the end of the payroll period.

51 The Labor Standards Officer is to review every payroll to ensure workers . are being paid no less than the prevailing Davis-Bacon wages and that there are no other discrepancies.

52 If discrepancies are found, the Labor Standards Officer is to report them to . the County along with the steps being taken to resolve the discrepancies.

53 The Labor Standards Officer is to conduct periodic on-site interviews with . workers. Interviews should occur throughout the course of construction and include a sufficient sample of job classifications represented on the job, as well as, workers from various companies to allow for a reasonable CONSTRUCTION

INITIALS/DATE ITEM COMPLETED judgment of compliance. Information gathered during each interview is to be recorded on the Record of Employee Interview form (HUD-11).

54 Submit requests for payment during construction to the County. Be sure . to attach the bills/invoices/contractor (AIA forms) payment requests; weekly payrolls and Statements of compliance; employee interview forms and Federal Labor Standards Complaint Intake Form (HUD Form 4731) if needed.

55 Labor Standards Officer is to submit the Semi-Annual Labor Standards . Report to the County. This is due by April 5 and October 5 of each year.

56 Submit the Section 3 report to the County. .

57 Provide County with copies of all documents, including but not limited to: . bid and contract documents; Payroll forms from the contractor and subcontractors, including signed statements of compliance; Documentation of on-site job interviews and review of the corresponding payroll to detect any discrepancies; Documentation of investigations and resolutions to issues that may have arisen; Enforcement reports.

58 Retain copies of all documents in Labor Standards file. .

FINAL INSPECTION AND CLOSE-OUT

INITIALS/DATE ITEM COMPLETED

59 Notice of substantial completion is issued by the architect/engineer. The . notice of substantial completion verifies that the structure is able to be used for its intended purpose. The notice may be issued either before or after punch list items have been completed depending on the nature of the items.

60 Inspect punch list items as they are completed. .

61 Notify County of substantial completion. If this is a handicapped . accessibility project, County will have the County ADA Coordinator perform an inspection. FINAL INSPECTION AND CLOSE-OUT

INITIALS/DATE ITEM COMPLETED 62 Contractor is to provide cost certifications, warranties, as-built drawings, . operations manuals, guarantees, and release of liens. The information submitted by the Contractor is to cover all subcontractors and material supplies.

63 Submit final request for payment to the County. Include the notice of . substantial completion, lien releases, certificate of occupancy, or other proof that the project is completed as designed. Be sure to attach the bills/invoices/contractor (AIA forms) payment requests; weekly payrolls and Statements of compliance; employee interview forms and Federal Labor Standards Complaint Intake Form (HUD Form 4731) if needed.

64 Retain copies of all documents in the Labor Standards file. . SELECTION PROCEDURES FOR PROCUREMENT TRANSACTIONS

BACKGROUND

The federal requirements for contracting may be found at: 24 CFR 85.36 for governmental agencies and in 24 CFR 84.40-48 for subrecipients that are non-profit organizations.

§85.44 Rules (Non-profit Organizations) (a) All recipients shall establish written procurement procedures. These procedures shall provide for, at a minimum, that paragraphs (a)(1), (a)(2) and (a)(3) of this section apply. (1) Recipients avoid purchasing unnecessary items. (2) Where appropriate, an analysis is made of lease and purchase alternatives to determine which would be the most economical and practical procurement for the Federal Government. (3) Solicitations for goods and services provide for all of the following. (i) A clear and accurate description of the technical requirements for the material, product or service to be procured. In competitive procurements, such a description shall not contain features which unduly restrict competition. (ii) Requirements which the bidder/offeror must fulfill and all other factors to be used in evaluating bids or proposals. (iii) A description, whenever practicable, of technical requirements in terms of functions to be performed or performance required, including the range of acceptable characteristics or minimum acceptable standards. (iv) The specific features of “brand name or equal” descriptions that bidders are required to meet when such items are included in the solicitation. (v) The acceptance, to the extent practicable and economically feasible, of products and services dimensioned in the metric system of measurement. (vi) Preference, to the extent practicable and economically feasible, for products and services that conserve natural resources and protect the environment and are energy efficient.

§85.36 Rules (Governmental Agencies) (b) Grantees and subgrantees will use their own procurement procedures which reflect applicable State and local laws and regulations, provided that the procurements conform to applicable Federal law and the standards identified in this section. Details may be found at: http://ecfr.gpoaccess.gov/cgi/t/text/text-idx? c=ecfr;sid=47ada8bb95ba62e69adc914243800722;rgn=div5;view=text;node=24%3A1.1.1.1.39;idno=24;c c=ecfr#24:1.1.1.1.39.3.87.14 Town procurement policies and solicitations for public contracts must comply with Wis. Stat. §60.47 and §66.0901. Village procurement policies must comply with Wis. Stat. § 61.54, §62.15 and §66.0901. City procurement policies must comply with Wis. Stat. § 62.15 and §66.0901.

(3) Grantees will have written selection procedures for procurement transactions. These procedures will ensure that all solicitations: (i) Incorporate a clear and accurate description of the technical requirements for the material, product, or service to be procured. Such description shall not, in competitive procurements, contain features which unduly restrict competition. The description may include a statement of the qualitative nature of the material, product or service to be procured, and when necessary, shall set forth those minimum essential characteristics and standards to which it must conform if it is to satisfy its intended use. Detailed product specifications should be avoided if at all possible. When it is impractical or uneconomical to make a clear and accurate description of the technical requirements, a brand name or equal description may be used as a means to define the performance or other salient requirements of a procurement. The specific features of the named brand which must be met by offerors shall be clearly stated; and (ii) Identify all requirements which the offerors must fulfill and all other factors to be used in evaluating bids or proposals. Wisconsin §60 (Towns) § 61 (Villages) and §62 (Cities) The above cited Statutes should be consulted for the applicable Wisconsin State rules governing procurement by Towns, Villages, and Cities.

EXAMPLES

DANE COUNTY

The Dane County Purchasing Regulations may be found at: http://danedocs.countyofdane.com/webdocs/pdf/ordinances/ord025.pdf

TOWN TOWN of ______PROCUREMENT POLICIES

All public improvements constructed with municipal funds are carried out through contract awarded to the lowest responsible bid according to the requirements of Wisconsin Statutes. Major equipment purchases are made from the lowest responsible bidder following public advertisement and distribution of specifications.

Major materials and supplies: are purchased from the most price-advantageous source following bids or price quotations usually secured through unpublicized solicitation of more than two sources.

Purchases of $500 or less can be approved by authorized employees provided that the amount has been appropriated in a previous budget. All purchases over $500 require prior approval of the majority of the Council. Purchase of materials that cost more than $1 000 requires quotes or bids prior to the approval of the purchase. Public works contracts should be let as provided under section 62.15 of the Wisconsin Statutes.

1. Supplies required for operation of municipal offices and departments shall be purchased, as required, in accord with purchase order issued by the respective department head. It is required that purchases be made from suppliers located in the community unless price is not competitive or comparable to that of non-local suppliers.

2. Purchase of outlay items, such as vehicles and other equipment, shall be subject to competitive bidding. The purchase of these items shall be based on specifications. The town equipment committee will determine which bid will be most advantageous to the community and make recommendation thereon to the town board. Bids may be invited by letter or by advertisement in the local newspaper.

1. Public Works Projects exceeding the Wisconsin Statutory amount will be bid in accord with Wisconsin State Statutes. Specifications, and/or plans and bid documents, will be furnished to all requesting same. Notice of bid taking shall be published in the local newspaper, Western Builder and Builders Exchange releases. All bids timely received will be opened and read at a pre- specified time and place open to the public. Bids will be received and recommendation thereon will be made to the town board. Contract will be awarded to the responsible bidder submitting lowest bid. Force account projects are exempt from this policy.

Signature:______Date:______, 20___ PROTEST PROCEDURES/DISPUTE RESOLUTION

BACKGROUND

§85.36 (b)(12) Rules (Governmental Agencies)

Grantees and subgrantees will have protest procedures to handle and resolve disputes relating to their procurements and shall in all instances disclose information regarding the protest to the awarding agency. A protestor must exhaust all administrative remedies with the grantee and subgrantee before pursuing a protest with the Federal agency.

EXAMPLE

TOWN

The Town of ______Board will function as arbitrator for dispute resolutions arising from the awarding of any contracts. An appeal from the awarding of a contract must be filled with the _____ Town Clerk in writing within fourteen (14) days of the award of contract and specify in writing the grounds for the appeal. The Town Clerk shall schedule the appeal for consideration at a public meeting before the Board of Appeals (Town Board) within a period of time not exceeding 45 days after such filing. The Town Clerk shall mail notice of the appeal and of the scheduled meeting thereon at least ten (10) days prior to the time of such meeting to the applicant. The award of contract shall be final unless the Board of Appeals (Town Board) reverses or modifies the award of contract.

I hereby certify that the above Resolution was adopted by the Town Board of the Town of ____ at a regular Town of ______Board meeting on the ___ day of _____, 20___

Dated: ______

______Name/ Town of ______Clerk STANDARDS OF CONDUCT

BACKGROUND

Municipalities should ensure any procurement policy used by the municipality is compliant with Wis. Stat. 946.13 which prohibits a private interest in a public contract and makes a violation of that requirement a class 1 felony.

In the procurement of supplies, equipment, construction, and services by recipients and by subrecipients, the conflict of interest provisions in 24 CFR 85.36 and 24 CFR 84.42, respectively apply. In all cases not governed by 24 CFR 85.36 and 24 84.42, the provisions of this section apply.

No covered persons who exercise of have exercised any functions or responsibilities with respect to activities assisted with HOME and/or CDBG funds or who are in a position to participate in a decisionmaking process or gain inside information with regard to these activities, may obtain a financial interest or benefit from a HOME and/or CDBG-assisted activity, or have an interest in any contract, subcontract or agreement with respect thereto, or the proceeds thereunder, either for themselves or those with whom they have a business or immediate family ties, during their tenure or for one year thereafter.

Covered Persons The conflict of interest provisions apply to any person who is any employee, agent, consultant, officer, elected official, or appointed official of the County, designated public agencies, or of subrecipients that receive funds.

Immediate Family Ties Immediate family ties includes spouse (including fiancée/finace), parent (including step parents), child (including step-children), siblings (including step-brothers and step-sisters), grandparent, grandchild, and in-laws of a covered person.

Exceptions Upon written request by the County, HUD may grant an exception to the conflict of interest provisions on a case-by-case basis when certain thresholds are met.

§84.42 Rules (Non-Profit Agencies) The recipient shall maintain written standards of conduct governing the performance of its employees engaged in the award and administration of contracts. No employee, officer, or agent shall participate in the selection, award, or administration of a contract supported by Federal funds if a real or apparent conflict of interest would be involved. Such a conflict would arise when the employee, officer, or agent, any member of his or her immediate family, his or her partner, or an organization which employs or is about to employ any of the parties indicated herein, has a financial or other interest in the firm selected for an award. The officers, employees, and agents of the recipient shall neither solicit nor accept gratuities, favors, or anything of monetary value from contractors, or parties to subagreements. However, recipients may set standards for situations in which the financial interest is not substantial or the gift is an unsolicited item of nominal value. The standards of conduct shall provide for disciplinary actions to be applied for violations of such standards by officers, employees, or agents of the recipient.

§85.36 Rules (Governmental Agencies) Grantees and subgrantees will maintain a written code of standards of conduct governing the performance of their employees engaged in the award and administration of contracts. No employee, officer or agent of the grantee or subgrantee shall participate in selection, or in the award or administration of a contract supported by Federal funds if a conflict of interest, real or apparent, would be involved. Such a conflict would arise when: (i) The employee, officer or agent,

(ii) Any member of his immediate family,

(iii) His or her partner, or

(iv) An organization which employs, or is about to employ, any of the above, has a financial or other interest in the firm selected for award. The grantee's or subgrantee's officers, employees or agents will neither solicit nor accept gratuities, favors or anything of monetary value from contractors, potential contractors, or parties to subagreements. Grantee and subgrantees may set minimum rules where the financial interest is not substantial or the gift is an unsolicited item of nominal intrinsic value. To the extent permitted by State or local law or regulations, such standards or conduct will provide for penalties, sanctions, or other disciplinary actions for violations of such standards by the grantee's and subgrantee's officers, employees, or agents, or by contractors or their agents. The awarding agency may in regulation provide additional prohibitions relative to real, apparent, or potential conflicts of interest.

Wisconsin State Statutes § 946.13

Municipalities and public officials should also be aware of the conflict of interest provisions under Wisconsin Statutes § 946.13 which prohibit a private interest in a public contract. More information may be found at: http://docs.legis.wi.gov/statutes/statutes/946/II/13 .

STANDARDS OF CONDUCT EXAMPLES

DANE COUNTY:

9.38 CONDUCT REGULATED; DISCLOSURE BY COUNTY OFFICIALS. A county official or employee who has a substantial financial interest in a matter pending before the body of which he or she is a member shall disclose the nature of the interest. The disclosure shall be made on the record before the body or, if there is no formal record, in writing to the body. The official or employee shall not participate in any vote in which he or she or an immediate family member has a substantial financial interest.

25.13 FINANCIAL INTEREST PROHIBITED. (1) Employees engaged in the act of procurement shall not be personally or financially interested in, or in any manner connected directly or indirectly with, any bidder or proposer. Such employees shall not solicit, accept or receive, directly or indirectly, from any bidder or proposer, by rebate, gift or otherwise, any money or other thing of value, nor receive any promise or obligation for future reward or compensation from any bidder or proposer, nor financially profit in any manner from their employment with Dane County, other than the wages and benefits furnished directly by the county.

LABOR STANDARDS OFFICER DESIGNEE

DIRECTIONS: Type or print clearly. Then mail, fax, or e-mail to the Dane County CDBG Program.

NAME OF SUBRECIPIENT:

CONTRACT NUMBER:

LABOR STANDARDS OFFICER:

STREET ADDRESS:

CITY:

STATE:

ZIP CODE:

PHONE:

FAX:

E-MAIL:

Send a copy of this form to:

Dane County CDBG Program 1202 Northport DR/2nd FL Madison, WI 53704 Fax: (608) 242-6293 E-mail: [email protected] State of Wisconsin Department of Workforce Development Equal Rights Division Disclosure of Ownership Labor Standards Bureau

The statutory authority for the use of this form is prescribed in Sections 66.0903(12)(d) and 103.49(7)(d), Wisconsin Statutes. The use of this form is mandatory. The penalty for failing to complete this form is prescribed in Section 103.005(12), Wisconsin Statutes. Personal information you provide may be used for secondary purposes [Privacy Law, s. 15.04(1) (m), Wisconsin Statutes] (1) On the date a contractor submits a bid to or completes negotiations with a state agency or local governmental unit, on a project subject to Section 66.0903 or 103.49, Wisconsin Statutes, the contractor shall disclose to such state agency or local governmental unit the name of any “other construction business”, which the contractor, or a shareholder, officer or partner of the contractor, owns or has owned within the preceding three (3) years. (2) The term “other construction business” means any business engaged in the erection, construction, remodeling, repairing, demolition, altering or painting and decorating of buildings, structures or facilities. It also means any business engaged in supplying mineral aggregate, or hauling excavated material or spoil as provided by Sections 66.0903(3), 103.49(2) and 103.50(2), Wisconsin Statutes. (3) This form must ONLY be filed, with the state agency or local governmental unit that will be awarding the contract, if both (A) and (B) are met. (A) The contractor, or a shareholder, officer or partner of the contractor: (1) Owns at least a 25% interest in the “other construction business”, indicated below, on the date the contractor submits a bid or completes negotiations. (2) Or has owned at least a 25% interest in the “other construction business” at any time within the preceding three (3) years. (B) The Wisconsin Department of Workforce Development (DWD) has determined that the “other construction business” has failed to pay the prevailing wage rate or time and one-half the required hourly basic rate of pay, for hours worked in excess of the prevailing hours of labor, to any employee at any time within the preceding three (3) years. Other Construction Business Name of Business

Street Address or P O Box City State Zip Code

Name of Business

Street Address or P O Box City State Zip Code

Name of Business

Street Address or P O Box City State Zip Code

Name of Business

Street Address or P O Box City State Zip Code

I hereby state under penalty of perjury that the information, contained in this document, is true and accurate according to my knowledge and belief. Print the Name of Authorized Officer

Signature of Authorized Officer Date Signed

Name of Corporation, Partnership or Sole Proprietorship

Street Address or P O Box City State Zip Code

If you have any questions call (608) ______ERD-7777-E (R. 02/2009) CONTRACT WORK HOURS AND SAFETY STANDARDS ACT ((40 USC §3701 et seq.;(http://www.dol.gov/whd/regs/statutes/safe01.pdf) 29 CFR Part 5(http://www.dol.gov/dol/allcfr/Title_29/Part_5/toc.htm))

WHO IS COVERED

The Contract Work Hours and Safety Standards Act (CWHSSA) is administered by the Wage and Hour Division (WHD). The Act applies to contractors and subcontractors with federal service contracts and federally funded and assisted construction contracts over $100,000. Covered contracts include those entered into by the U.S., any agency or instrumentality of the U.S., any territory of the U.S., or the District of Columbia. The CWHSSA also extends to federally assisted construction contracts subject to Davis- Bacon and Related Acts wage standards where the federal government is not a direct party, except those contracts where the federal assistance takes the form only of a loan guarantee or insurance.

BASIC REQUIREMENT

The CWHSSA requires contractors and subcontractors with covered contracts to pay laborers and mechanics employed in the performance of the contracts one and one-half times their basic rate of pay for all hours worked over 40 in a workweek.

NOTICES AND POSTERS

A Poster is required to be posted on all contracts to which CWHSSA applies. The notice to be posted depends is the Notice to all Employees Working on Federal or Federally Financed Construction Projects (PDF)(http://www.dol.gov/whd/regs/compliance/posters/fedprojc.pdf) for Davis-Bacon contracts. The appropriate poster must be posted at the site of the work in a prominent and accessible place where it may be easily seen by employees. There is no size requirement for this poster but it must be easily readable.

RECORDKEEPING

The recordkeeping requirements of the Davis-Bacon and Related Acts apply to contracts subject to the CWHSSA. The recordkeeping requirement includes maintaining payroll records that provide the following information for each covered employee: Name Address Social Security number Correct classifications Hourly rates of wages paid Daily and weekly number of hours worked Deductions made Actual wages paid

Records must be maintained during the course of the work and for a period of three years from the completion of the contract, and be made available to the contracting agency and the Department of Labor.

REPORTING

Weekly payroll statement. On contracts to which the labor standards provisions of the Davis-Bacon and Related Acts apply, each contractor and subcontractor is required to provide the federal agency a weekly statement of the wages paid to each of its employees engaged in covered work. Each payroll submitted shall be accompanied by a Statement of Compliance using page 2 of Form WH-347 Payroll (For Contractors Optional Use)(http://www.dol.gov/whd/forms/wh347instr.htm), or any form with identical wording, certifying compliance with applicable requirements. The statement is to be signed by the contractor or subcontractor, or by an authorized officer or employee of the contractor or subcontractor who supervises the payment of wages, and delivered to a representative of the federal or state agency in charge. This must be submitted within seven days after the regular pay date for the pay period.

PENALTIES/SANCTIONS

Contractors or subcontractors who violate the CWHSSA may be subject to fines, imprisonment, or both. EQUAL EMPLOYMENT PROVISIONS

INTRODUCTION

The Civil Rights Laws and related laws and regulations are designed to protect individuals from discrimination on the basis of race, national origin, religion, color, sex, age, handicap, and familial status. As applied to the CDBG Program, they protect individuals from discrimination in housing, employment, business opportunities, and benefits created by CDBG projects.

RELEVANT LAWS

A. Title VI and Title VIII of the Civil Rights Act, which provides that no person shall be excluded from participation, denied the benefits, or subjected to discrimination on the basis of race, color, familial status, or national origin under any program receiving federal financial assistance.

B. Section 109 of the Housing and Urban Development Act of 1992, as amended, provides that no person shall be excluded from participation (including employment), denied benefits or subjected to discrimination on the basis of race, color, sex, national origin, age or qualified handicapped, under any program or activity, funded in whole or in part under the CDBG program.

C. Executive Order 11246, as amended, provides that no person shall be discriminated against, on the basis of race, color, religion, sex, or national origin in any place of employment during the performance of federally-assisted construction contracts.

D. Section 3 of the Housing and Urban Development Act of 1968, as amended, provides that employment and other economic opportunities generated by Federal financial assistance for housing and community development programs shall, to the greatest extent feasible, be directed to low-and- very-low income persons. EQUAL OPPORTUNITY CLAUSE (EO 11246) [Section 202]

During the performance of this contract, the contractor agrees as follows:

1. The contractor will not discriminate against any employee or applicant for employment because of race, color, religion, sex, or national origin. The contractor will take affirmative action to ensure that applicants are employed, and that employees are treated during employment, without regard to their race, color, religion, sex or national origin. Such action shall include, but not be limited to the following: employment, upgrading, demotion, or transfer; recruitment or recruitment advertising; layoff or termination; rates of pay or other forms of compensation; and selection for training, including apprenticeship. The contractor agrees to post in conspicuous places, available to employees and applicants for employment, notices to be provided by the contracting officer setting forth the provisions of this nondiscrimination clause.

2. The contractor will, in all solicitations or advertisements for employees placed by or on behalf of the contractor, state that all qualified applicants will receive consideration for employment without regard to race, color, religion, sex or national origin.

3. The contractor will send to each labor union or representative of workers with which he has a collective bargaining agreement or other contract or understanding, a notice, to be provided by the agency contracting officer, advising the labor union or workers' representative of the contractor's commitments under Section 202 of Executive Order 11246 of Sept. 24, 1965, and shall post copies of the notice in conspicuous places available to employees and applicants for employment.

4. The contractor will comply with all provisions of Executive Order 11246 of September 24, 1965, as amended by Executive Order 11375 of October 13, 1967 and with the rules, regulations, and relevant orders of the Secretary of Labor.

5. The contractor will furnish all information and reports required by Executive Order 11246 of September 24, 1965 as amended, and by the rules, regulations, and orders of the Secretary of Labor, or pursuant thereto, and will permit access to his/her books, records, and accounts by the contracting agency, County of Dane, HUD, and the Secretary of Labor for purposes of investigation to ascertain compliance with such rules, regulations, and orders.

6. In the event of the contractor’s noncompliance with the nondiscrimination clauses of this contract or with any of such rules, regulations, or orders, the contract may be cancelled, terminated, or suspended in whole or in part and the contract may be declared ineligible for further government contracts in accordance with procedures authorized in Executive Order 11246 of September 24, 1965 as amended, and such other sanctions may be imposed or remedies invoked as provided in Executive Order No. 11246 of September 24, 1965 as amended, or by rule, regulation, or order of the Secretary of Labor, or as otherwise provided by law.

7. The contractor will include the provisions of paragraphs 1 through 7 in every subcontract or purchase order unless exempted by rules, regulations, or orders of the Secretary of Labor issued pursuant to section 204 of Executive Order 11246 of September 24, 1965 as amended, so that such provisions will be binding upon each subcontract or vendor. The contractor will take such action with respect to any subcontract or purchase order as the contracting agency and/or County of Dane may direct as a means of enforcing such provisions, including sanctions for noncompliance.

NOTICE OF REQUIREMENT FOR AFFIRMATIVE ACTION TO ENSURE EQUAL EMPLOYMENT OPPORTUNITY (EO 11246) (Applicable to construction contracts/subcontracts exceeding $10,000)

1. The Offeror's or Bidder's attention is called to the "Equal Opportunity Clause" and the "Standard Federal Equal Employment Opportunity Construction Contract Specifications" set forth herein.

2. The goals and timetables for minority and female participation, expressed in percentage terms for the contractor's aggregate workforce in each trade on all construction work in the covered area, are as follows:

Goals for Women = 6.9 percent (this goal applies nationwide)

Goals for minority participation = 2.2 percent (this goal applies county-wide)

These goals are applicable to all the contractor's construction work (whether or not it is federal or federally assisted) performed in the covered area. If the contractor performs construction work in a geographic are located outside of the covered area, it shall apply the goals established for such geographic area where the work is actually performed. The contractor is also subject to the goals for both its federal and nonfederal construction.

3. The contractor's compliance with the Executive Order and the regulations in 41 CFR Part 60-4 shall be based on its implementation of the Equal Opportunity Clause, specific affirmative action obligations required by the specifications set forth in 41 CFR 60-4.3 (a), and its efforts to meet the goals established for the geographical area where the contract resulting from this solicitation is to be performed. The hours of minority and female employment and training must be substantially uniform throughout the length of the contract and in each trade, and the contractor shall make a good faith effort to employ minorities and women evenly on each of its projects. The transfer of minority or female employees or trainees from contractor to contractor or from project to project for the sole purpose of meeting the contractor's goals shall be a violation of the contract, the Executive Order, and the regulations in 41 CFR Part 60-4. Compliance with the goals will be measured against the total work hours performed.

4. The contractor shall provide written notification to the awarding agency and the County of Dane within 10 working days of award of any construction subcontract in excess of $10,000 at any tier for construction work under the contract resulting from this solicitation. The notification shall list the name, address, and telephone number of the subcontractor; employer identification number; estimated dollar amount of the subcontract; estimated starting and completion dates of the subcontract; and the geographical area in which the contract is to be performed.

As used in this notice, and in the contract resulting from this solicitation, the "covered area" is ______(a description of the geographical areas where the contract is to be performed indicating the state, county and city, if any). SECTION 3 CLAUSE Reference 24 CFR 135.38 (Applicable to all contracts exceeding $100,000)

Include the following language in all bid documents, contracts, and subcontracts.

All Section 3 covered contracts (contracts to direct recipients in excess of $200,000, for Section 3 covered projects, and subcontracts excess of $100,000) shall include the following clause (referred to as the Section 3 clause):

A. The work to be performed under this contract is subject to the requirements of Section 3 of the Housing and Urban Development Act of 1968, as amended, 12 U.S.C. 1701u (section 3). The purpose of Section 3 is to ensure that employment and other economic opportunities generated by HUD assistance or HUD-assisted projects covered by Section 3, shall, to the greatest extent feasible, be directed to low- and very low-income persons, particularly persons who are recipients of HUD assistance for housing.

B. The parties to this contract agree to comply with HUD’s regulations in 24 CFR part 135, which implement Section 3. As evidenced by their execution of this contract, the parties to this contract certify that they are under no contractual or other impediment that would prevent them from complying with the part 135 regulations.

C. The contractor agrees to send to each labor organization or representative of workers with which the contractor has a collective bargaining agreement or other understanding, if any, a notice advising the labor organization or workers’ representative of the contractor’s commitments under this Section 3 clause, and will post copies of the notice in conspicuous places at the work site where both employees and applicants for training and employment positions can see the notice. The notice shall describe the Section 3 preference, shall set forth minimum number and job titles subject to hire, availability of apprenticeship and training positions, the qualifications for each; and the name and location of the person(s) taking applications for each of the positions; and the anticipated date the work shall begin.

D. The contractor agrees to include this Section 3 clause in every subcontract subject to compliance with regulations in 24 CFR part 135, and agrees to take appropriate action, as provided in an applicable provision of the subcontract or in this Section 3 clause, upon a finding that the subcontractor is in violation of the regulations in 24 CFR part 135. The contractor will not subcontract with any subcontractor where the contractor has notice or knowledge that the subcontractor has been found in violation of the regulations in 24 CFR part 135.

E. The contractor will certify that any vacant employment positions, including training positions, that are filled (1) after the contractor is selected but before the contract is executed, and (2) with persons other than those to whom the regulations of 24 CFR part 135 require employment opportunities to be directed, were not filled to circumvent the contractor’s obligations under 24 CFR part 135.

F. Noncompliance with HUD’s regulations in 24 CFR part 135 may result in sanctions, termination of this contract for default, and debarment or suspension from future HUD assisted contracts.

G. With respect to work performed in connection with Section 3 covered Indian housing assistance, section 7(b) of the Indian Self-Determination and Education Assistance Act (25 U.S.C. 450e) also applies to the work to be performed under this contract. Section 7(b) requires that to the greatest extent feasible (i) preference and opportunities for training and employment shall be given to Indians, and (ii) preference in the award of contracts and subcontracts shall be given to Indian organizations and Indian-owned Economic Enterprises. Parties to this contract that are subject to the provisions of Section 3 and section 7(b) agree to comply with Section 3 to the maximum extent feasible, but not in derogation of compliance with section7(b). COPELAND “ANTI-KICKBACK” ACT

(18 USC §874(http://www.dol.gov/whd/regs/statutes/copeland.htm) and 40 USC §3145(http://www.dol.gov/whd/regs/statutes/copeland.htm); 29 CFR Part 3(http://www.dol.gov/dol/allcfr/ESA/Title_29/Part_3/toc.htm))

Who is Covered

The Copeland Act is administered by the Wage and Hour Division (WHD). The "Anti-Kickback" section of the Copeland Act applies to all contractors and subcontractors performing on any federally funded or assisted contract for the construction, prosecution, completion, or repair of any public building or public work, except contracts for which the only federal assistance is a loan guarantee. This provision applies even where no labor standards statute covers the contract.

The regulations pertaining to Copeland Act payroll deductions and submittal of the weekly statement of compliance apply only to contractors and subcontractors performing on federally funded contracts in excess of $2,000 and federally assisted contracts in excess of $2,000 that are subject to federal wage standards.

Basic Provisions/Requirements

The "Anti-Kickback" section of the Act precludes a contractor or subcontractor from in any way inducing an employee to give up any part of the compensation to which he or she is entitled under his or her contract of employment. The Act and implementing regulations require a contractor and subcontractor to submit a weekly statement of the wages paid to each employee performing on covered work during the preceding payroll period. The regulations also list payroll deductions that are permissible without the approval of the Secretary of Labor and those deductions that require consent of the Secretary of Labor. LOBBYING CERTIFICATION FOR CONTRACTS, GRANTS, LOANS, AND COOPERATIVE AGREEMENTS

The undersigned certifies, to the best of his/her knowledge and belief, that:

1. No federally appropriated funds have been paid, or will be paid, by or on behalf of the undersigned, to any person for influencing or attempting to influence an officer or employee of an agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with the awarding of any federal contract, the making of any federal contract, the making of any federal loan, the entering into of any cooperative agreement, and the extension, continuation, renewal, amendment, or modification of any federal contract, grant, loan, or cooperative agreement.

2. If any funds other than federally appropriated funds have been paid or will be paid to any person for influencing or attempting to influence an officer or employee of any agency , a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with this federal contract, grant, loan, or cooperative agreement, the undersigned shall complete Standard Form-LLL, “Disclosure Form to Report Lobbying,” in accordance with its instructions.

3. The undersigned shall require that the language of this CERTIFICATION be included in the award documents for all sub-awards at all tiers (including subcontractors, sub-grants, and contracts under grants, loans, and cooperative agreements) and that all sub-recipients shall certify and disclose accordingly.

This CERTIFICATION is a material representation of fact upon which reliance was placed when this transaction was made or entered into. Submission of this CERTIFICATION is a prerequisite for making and entering into this transaction imposed by Section 1352, Title 31, U.S. Code. Any person who fails to file the required CERTIFICATION shall be subject to a civil penalty of not less than $10,000 and not more than $100,000 for each such failure.

(Signature of Chief Executive Officer) (Date)

(Name of Business/Firm) COPYRIGHTS

Per 85.34, the U.S. Department of Housing and Urban Development (HUD) reserves a royalty-free, nonexclusive, and irrevocable license to reproduce, publish, or otherwise use, and to authorize others to use, for Federal Government purposes: (a) The copyright in any work developed under a grant, subgrant, or contract under a grant or subcontract; and (b) Any rights of copyright to which a grantee, subgrantee, or a contractor purchases ownership with grant support. PRIME CONTRACTOR AND SUBCONTRACTORS

Submit this form to the contracting agency and to: Dane County CDBG; 1202 Northport DR/2 nd FL; Madison, WI 53704. Information requested on this form may be provided in an alternate format. A good faith effort to use WBEs, MBEs and Section 3 Businesses must be made. The Dane County Targeted Business Directory provides listings of certified MBE/WBE businesses: http://www.countyofdane.com/oeo/pdf/targeted_business_directory.pdf

PROJECT INFORMATION Project Name: Project Location: Contract No: Information Prepared by: (Name and Phone):

CONTRACTS Required Information Prime Contractor Sub 1 Sub 2 a. Name of Firm b. Contact Name c. Phone No. d. Firm Type MBE WBE Sec. 3 MBE WBE Sec. 3 MBE WBE Sec. 3 e. Is firm self certified or agency-certified Self Self Self as an MBE/WBE/Section 3 business? Agency (Provide Agency Name): Agency (Provide Agency Name): Agency(Provide Agency Name)

f. Verification that vendor is not on the Yes No Yes No Yes No HUD debarred/suspended list found at https://www.sam.gov/portal/public/SAM/ 2 g. Date Contracted h. Street Address i. City, State, Zip j. FEIN k. Business Racial/Ethnic Code (See Below) l. Amount of Contract

Enter the numeric code that indicates the racial/ethnic character of the owner(s) of 51% of the business. Racial/Ethnic Codes: 1 = White American 4 = Hispanic American 2 = Black American 5 = Asian/Pacific American 3 = Native American

2 No contracts may be awarded at any tier to any party that is debarred or suspended or is otherwise excluded from participation on federal assistance programs. Project Name:

CONTRACTS Required Information Sub 3 Sub 4 Sub 5 a. Name of Firm b. Contact Name c. Phone No. d. Firm Type MBE WBE Sec. 3 MBE WBE Sec. 3 MBE WBE Sec. 3 e. Is firm self certified or agency-certified? Self Self Self Agency (Provide Agency Name): Agency (Provide Agency Name): Agency(Provide Agency Name)

f. Results of check on Yes No Yes No Yes No https://www.sam.gov/portal/public/SAM/ 3 g. Date Contracted h. Street Address i. City, State, Zip j. FEIN k. Business Racial/Ethnic Code (See Below) l. Amount of Contract

Enter the numeric code that indicates the racial/ethnic character of the owner(s) of 51% of the business. Racial/Ethnic Codes: 1 = White American 4 = Hispanic American 2 = Black American 5 = Asian/Pacific American 3 = Native American

3 No contracts may be awarded at any tier to any party that is debarred or suspended or is otherwise excluded from participation on federal assistance programs. Project Name:

CONTRACTS Required Information Sub 6 Sub 7 Sub 8 a. Name of Firm b. Contact Name c. Phone No. d. Firm Type MBE WBE Sec. 3 MBE WBE Sec. 3 MBE WBE Sec. 3 e. Is firm self certified or agency-certified? Self Self Self Agency (Provide Agency Name): Agency (Provide Agency Name): Agency(Provide Agency Name)

f. Results of check on Yes No Yes No Yes No https://www.sam.gov/portal/public/SAM/ 4 g. Date Contracted h. Street Address i. City, State, Zip j. FEIN k. Business Racial/Ethnic Code (See Below) l. Amount of Contract

Enter the numeric code that indicates the racial/ethnic character of the owner(s) of 51% of the business. Racial/Ethnic Codes: 1 = White American 4 = Hispanic American 2 = Black American 5 = Asian/Pacific American 3 = Native American

4 No contracts may be awarded at any tier to any party that is debarred or suspended or is otherwise excluded from participation on federal assistance programs. Preconstruction Conference Items To Be Discussed

A) Requirements and penalties of the Davis-Bacon Act.

B) Requirements and penalties of the Contract Work Hours and Safety Standards Act.

C) Requirements and penalties of the Copeland Anti-Kickback Act.

D) Minority Business Enterprises (MBE's) and Women's Business Enterprises (WBE's) Participation.

E) Section 3 goals for hiring and subcontracting.

F) Discussion of the Wage Decision.

1. Trade classifications.

2. Missing classifications.

3. Missing classifications that can be conformed.

4. Employment of Apprentices.

a. Proper papers from state or U.S. Department of Labor required. b. Allowable ratio of Apprentices to Journeymen. c. Apprentice supervision by Journeymen required at all times.

5. Truck drivers, employed by the contractor, delivering materials, and spending more than an incidental amount (more than 20 percent) of their time on the job site, are covered.

6. Requesting additional classifications--procedures and information required.

G) Proper Certification.

1. Each subcontractor is covered, regardless of the amount of the subcontract.

2. Each subcontractor must have a written contract.

3. Requirements governing owner-operators. Questionnaire required for subs without IRS Employer identification number.

4. Prime Contractor is responsible for ensuring that subcontractors are not debarred from working on federal projects.

H) Collect IRS Employer identification numbers for all contractors.

I) Discuss the requirement to post the wage rate, additional classifications, and Davis-Bacon posters on the project site. They must be protected from the weather and visible to the public.

J) Weekly Payroll Submission.

1. Payrolls must be submitted weekly to the prime contractor, who must submit them to the grantee's labor standards officer within seven working days of the end of the payroll period. 2. Statement of Compliance (back of WH 347 OR WH 348) must be completed and submitted with each payroll.

3. Payroll Completion.

a. Recommend form WH-347. Alternate forms are allowed but must be cleared with the labor standards officer. The form must contain the contractor's name and IRS I.D. number.

b. Each weekly payroll must be numbered in sequential order. Each week from beginning to end of the contractor's time on the job must be accounted for by either a payroll or a "no work" letter.

c. Project and location must be identified on the payroll.

d. Each employee's address and social security number must appear on the payroll for the first week that they work.

e. Completion of the withholding exemptions column is not required.

f. Work classification must conform to the trades listed on the wage rate or Additional Classification.

g. Apprentice indenture papers should be attached to the first payroll that he/she appears.

h. Employees working split classifications--hours and wages for each classification must be identified on the payroll plus the employee must sign the payroll form or submit a signed copy of the time card. Average pay of the two classes is NOT acceptable.

i. The work classification of "helper" is not accepted unless it is listed on the original wage rate.

j. Straight and overtime hours worked each day must be reported. Emphasize again the penalties for violation of CWHSS Act. Only overtime on the CDBG job needs to be reported.

k. Rates of Pay.

1. Not less than the minimum wage for each classification and must include base rate plus fringe benefits.

2. Overtime rate is one and one-half times the base rate actually paid plus the straight time value of fringe benefits (if paid in cash) for all hours over 40 in a work week.

3. Apprentice wage rate will be established by the step level of the apprentice based on the journeymen rate in the wage rate.

4. Apprentices must receive the fringe benefits specified in their indenture. If the indenture does not specify, then they must receive the full value states in the wage rate.

5. Piece work--must be stated as an hourly rate and a copy of signed time card showing piece rate and number of units must be submitted. l. Gross amount earned--must be shown as HUD Gross/Total earnings for the week. m. Deductions.

1. Must be specified on the payroll.

2. Written permission must be submitted for "other" deductions.

3. Proper documentation of a II deductions must be submitted. n. Net wages--enter the amount of the employee's net check. o. Fringe Benefits.

1. Check box 4(a) if benefits are paid to approved funds and submit evidence of the value of the fringe benefits.

2. Check box 4(b) if fringe benefits are paid in cash.

3. List any exceptions to whichever box is checked. p. Signature--payrolls must be manually signed by the employer or an official of the employer who is authorized to sign. q. Time cards, signed by the employees, must be retained for four (4) years. r. Payrolls must be retained for four (4) years. s. Employer must inform each employee that they are subject to being interviewed on the job by the subrecipient, County, State, HUD, or the USDOL concerning wages, hours and duties. t. Review the process to be used to secure payments for work. u. Failure to comply with aforementioned items will cause a delay in payouts by the municipality and/or County. Federal Labor Standards Provisions U.S. Department of Housing and Urban Development Office of Labor Relations