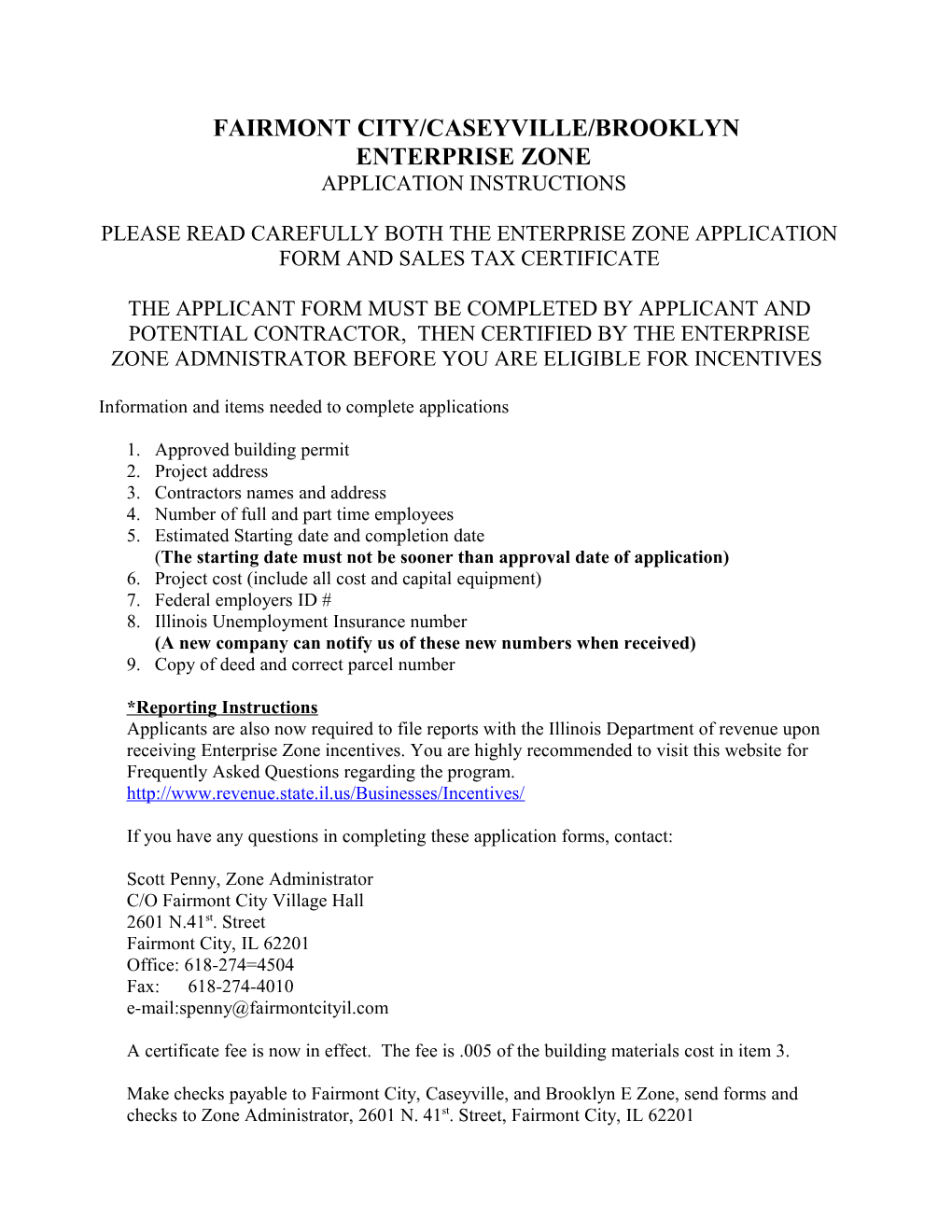

FAIRMONT CITY/CASEYVILLE/BROOKLYN ENTERPRISE ZONE APPLICATION INSTRUCTIONS

PLEASE READ CAREFULLY BOTH THE ENTERPRISE ZONE APPLICATION FORM AND SALES TAX CERTIFICATE

THE APPLICANT FORM MUST BE COMPLETED BY APPLICANT AND POTENTIAL CONTRACTOR, THEN CERTIFIED BY THE ENTERPRISE ZONE ADMNISTRATOR BEFORE YOU ARE ELIGIBLE FOR INCENTIVES

Information and items needed to complete applications

1. Approved building permit 2. Project address 3. Contractors names and address 4. Number of full and part time employees 5. Estimated Starting date and completion date (The starting date must not be sooner than approval date of application) 6. Project cost (include all cost and capital equipment) 7. Federal employers ID # 8. Illinois Unemployment Insurance number (A new company can notify us of these new numbers when received) 9. Copy of deed and correct parcel number

*Reporting Instructions Applicants are also now required to file reports with the Illinois Department of revenue upon receiving Enterprise Zone incentives. You are highly recommended to visit this website for Frequently Asked Questions regarding the program. http://www.revenue.state.il.us/Businesses/Incentives/

If you have any questions in completing these application forms, contact:

Scott Penny, Zone Administrator C/O Fairmont City Village Hall 2601 N.41st. Street Fairmont City, IL 62201 Office: 618-274=4504 Fax: 618-274-4010 e-mail:[email protected]

A certificate fee is now in effect. The fee is .005 of the building materials cost in item 3.

Make checks payable to Fairmont City, Caseyville, and Brooklyn E Zone, send forms and checks to Zone Administrator, 2601 N. 41st. Street, Fairmont City, IL 62201 FAIRMONT CITY/CASEYVILLE/BROOKLYN ENTERPRISE ZONE PROJECT INFORMATION

Name of Business applying for Enterprise Zone designation:

______

E-Zone project address: ______

Owner or Contact Person: ______

Address: ______

Phone: ______

Email address: ______Fax Number: ______

Tax Bill Mailing Address: ______

Business owner (if different than Contact) Name of Individual or Company: ______

Address: ______Phone: ______

Type of Business: ______Commercial ______Industrial

Product(s) or Service: ______

Permanent (full-time) employees: ______Temporary (full-time) employees: ______

Estimated Date of Project Start: ______Completion: ______

Estimated Cost of Project: (Amounts for 1 and/or 2 must coincide with building permit.) (Abatement of sales tax exemption will not be given over amounts declared.)

1) Remodeling $______2) New Construction Cost $______3) Building Materials Cost $______4) Capital Equipment $______5) Site (purchase and preparation) $______

JOBS: Number of full-time Equivalent Jobs- (Total hours worked by fill-time and part-time employees divided by 40.)

Retained due to project: ______Created within one year due to project: ______Description of project: ______

Federal Employer Identification Number: ______

IL Unemployment Insurance Number: ______

NAICS Code Number: ______

Does this project involve a move from another location: ______

If yes, indicate city and state of previous location: ______

______Signature of Project Representative Title Date

NOTE: A COPY OF THE APPROVED BUILDING PERMIT, PARCEL NUMBER OR COPY OF DEED MUST BE SUBMITTED BEFORE PROJECT WILL BR APPROVED. ************************************************************* (To be filled in by Enterprise Zone Administrator.)

Township: ______Tax Code: ______

Building Permit # ______

Grantor: ______

Number: ______

Date: ______

(Dollar Amount of Building Materials from #3 on front):______

X .005 = ______Enterprise Zone

Project is Accepted ______Rejected______Place E-Zone Approval Stamp Below Comments:

Signature of Enterprise Zone Administrator

______