Page 1 of 24

BRIEF FACTS OF THE CASE

M/s Corrtech International Pvt. Ltd., situated at 22, Second Floor, Dhara Centre, Vijay Char Rasta, Navrangpura, Ahmedabad [hereinafter referred to as ‘the said assessee’] are holding Service Tax Registration No. AAACC0134GST001 under the category of Erection, Commissioning and Installation, Works Contract Service, Consulting Engineer, Commercial or Industrial Construction Service, Maintenance or Repair Service and Transport of Goods by Road.

2. During the course of reconciliation of the figures declared by the said assessee in their ST-3 returns vis-à-vis the figures appeared in their audited balance sheet and books of account for the year 2006-07, while conducting an audit by the service tax officers, it appeared that the figures declared by them in them in ST-3 returns was on a lower side, indicating non/short-payment of service tax of Rs. 7,28,258/-. However, the said assessee did not agree with the audit objection and contended that the department has not considered the net effect of closing and opening balances of retention money and security deposit, which is held back by the customers from their bill. Further scrutiny of records indicated that the said assessee was providing complete service of drawing, design, supply, erection and commissioning, and had bifurcated the composite contracts into supply portion and service portion for restricting service tax payment on service portion. Therefore, an inquiry was initiated by the jurisdictional service tax officers for which relevant documents and information were requisitioned. Statements of Shri Pankaj Kanhaiyalal Maheshwari, Accounts Manager of the said assessee were recorded on 03.10.2011 and 10.10.2011 wherein he explained the nature and details of business activities carried out by them.

3. On verification of the contracts, records and other relevant documents and details given by Shri Pankaj Maheshwari in his statements, it appeared that the contracts entered into by the said assessee with their clients were composite and indivisible in nature which involved design, detail engineering, supply, installation, testing and commissioning of pipelines with cathodic protection system, etc. Scrutiny of some sample contracts revealed that the contract amounts were mentioned in lump sum without any bifurcation for supply portion or service portion, etc. However, the said assessee bifurcated the amount artificially into service portion and supply portion and paid service tax only on service amount. It was also observed that the said assessee had availed the benefits of Notification No. 12/2003-ST dated 20.06.2003 for payment of service tax on service portion only. Although the said notification categorically prohibited availment of Cenvat credit of duty paid on the goods and materials sold by the service provider while rendering taxable services, the inquiry revealed that the said assessee had either availed Cenvat credit of goods and materials utilized/consumed by them during the rendition of taxable services or facilitated their service recipients to avail such Cenvat credit by getting the manufacturers’ Cenvat invoices endorsed in their name as consignee of the goods. It was noticed that one single contract executed by the said assessee with M/s. GSPL alone involved such facilitation of Cenvat credit availment for Rs. 2,49,54,315/- by the said service recipient and that too for only one item of inputs. Therefore, it appeared that the said assessee has wrongly availed benefit of exemption as per Notification No. 12/2003.

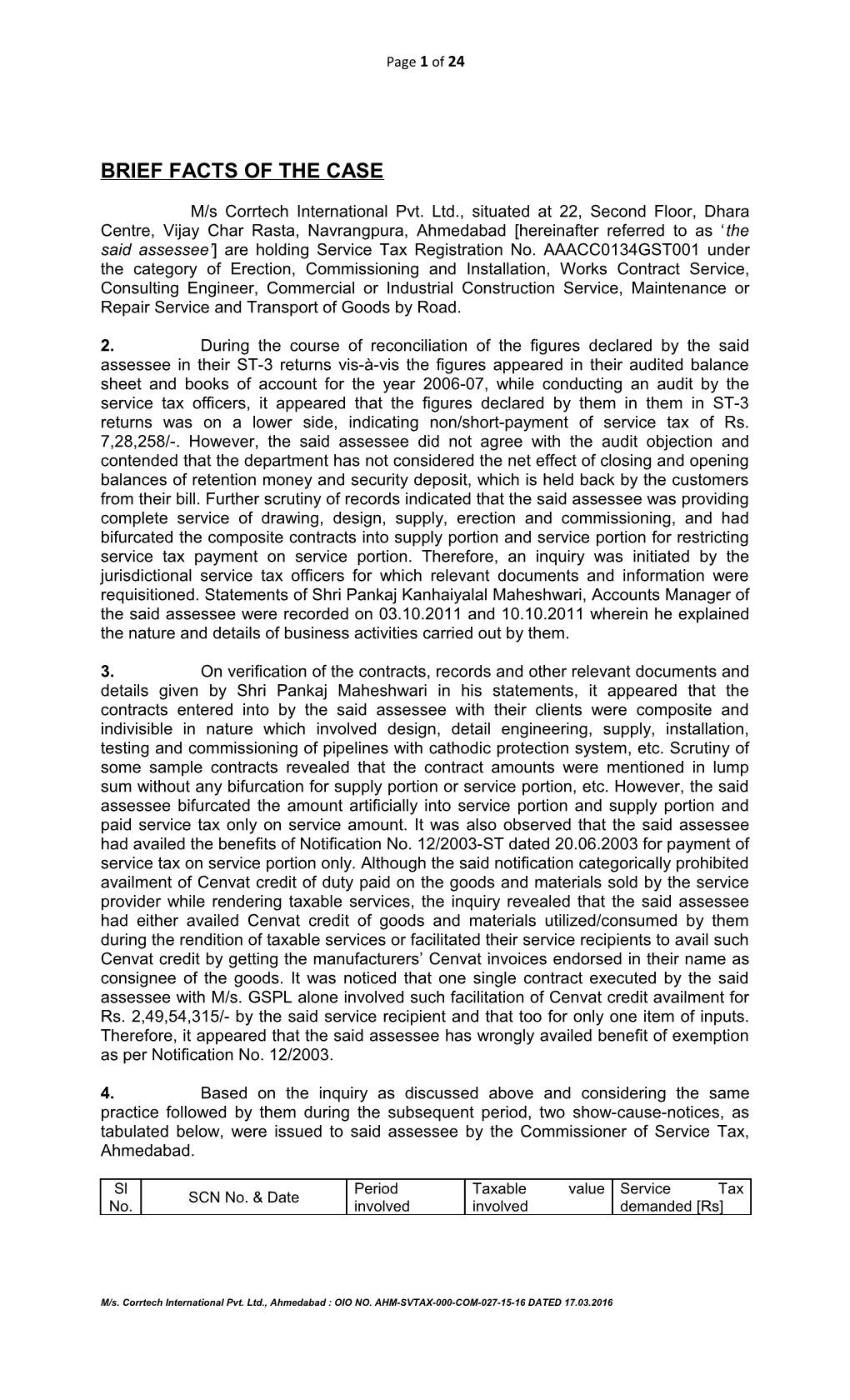

4. Based on the inquiry as discussed above and considering the same practice followed by them during the subsequent period, two show-cause-notices, as tabulated below, were issued to said assessee by the Commissioner of Service Tax, Ahmedabad.

Sl Period Taxable value Service Tax SCN No. & Date No. involved involved demanded [Rs]

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 2 of 24

STC/04-86/O&A/11-12 dtd. 2006-07 to 01 Rs. 70,16,81,697/- Rs. 8,27,00,775/- 21.10.2011 2010-11 STC/04-94/O&A/10-11 dtd. 02 2011-12 Rs. 7,96,58,569/- Rs. 82,04,833/- 20.10.2012

5. Both the aforesaid SCNs have been adjudicated by Commissioner of Service Tax, Ahmedabad vide Order-in-Original No. STC/09 to 10/COMMR/AHD/2013 dated 07.03.2013 under which the demand of service tax was confirmed along with applicable interest, besides imposed penalty under sections 76, 77 and 78, as applicable.

6. Thereafter, on inquiry, it was observed that the said assessee adopted the same practice of assessment during the subsequent period, whereupon the quantum of service tax not paid was worked out as tabulated below:

Value of goods/materials Rate of ST Amount of ST Period sold/traded as per details given [inclusive of cess] payable 2012-13 Rs. 14,52,85,432/- 12.36% 1,79,57,279/- 2013-14 [upto Rs. 3,81,70,577/- 12.36% 47,17,883/- 30.09.2013] TOTAL Rs. 18,34,56,009/- 2,26,75,162/-

7. Accordingly, another periodical SCN No. STC/04-60/O&A/2013-14 dated 19.09.2014 was issued to the said assessee by the Commissioner of Service Tax, Ahmedabad calling upon them to show cause as to why:

(i) the amount shown towards trading of goods and materials during the period from 01.04.2012 to 30.06.2012 as discussed above, should not be considered as taxable income under the category of “commercial or industrial construction service” as per section 65(25b) read with definition given under section 65(105)(zzq)and why the benefit of Notification No. 12/2003-ST should not be disallowed for this period;

(ii) such activities should not be considered as ‘service’ in terms of section 65B(44) for the period from 01.07.2012 to 30.09.2013 and why the amount shown towards goods and materials sold/traded should not be considered as taxable value as they have availed Cenvat credit on the inputs;

(iii) service tax amounting to Rs. 2,26,75,162/- not paid by them as shown above should not be demanded and recovered from them under section 73(1);

(iv) Interest at the applicable rate should not be charged from them under section 75;

(v) Penalty should not be imposed upon them under section 76 for failure to make payment of service tax within prescribed limit; and

(vi) Penalty should not be imposed upon them under section 77 for their failure to assess correct tax liability and for not filing ST-3 returns within the prescribed time limit.

PERSONAL HEARING

8. The SCN was served upon the said assessee on 23.09.2014 and they have not filed their defence reply within the stipulated time limit. Therefore, an

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 3 of 24

opportunity for personal hearing was offered on 11.02.2016 which was attended on their behalf by Ms. Madhu Jain, Associate of M/s. Lakshikumaran & Sridharan, Attorneys. During the personal hearing, she filed a defence reply dated 09.02.2016 along with a compilation of case laws, besides undertook to file a further written submission within ten days indicating invoices showing material portion and service portion separately along with payment of service tax only on service portion. Thereafter, the said assessee submitted another submission dated 19.02.2016, details of which are discussed in the following paras.

DEFENCE REPLY

9.1. Vide their defence reply dated 09.02.2016 filed during the personal hearing, the said assessee, inter alia, stated that they are engaged in pipeline construction business for various soil companies and have carried out such work in pursuance of works contract executed for design, survey, supply, installation, testing, commissioning and construction of pipeline and cathodic protection; that the bifurcation of works contract into supply portion and service portion are done as per the norms and standards of the clients, like ONGC, GAIL, PSUs, etc.; that for an example, the agreement dated 04.08.2006 with Punj Lloyd involved a lump sum amount of Rs. 1.62 Crores, which was bifurcated as 5% towards design and engineering, 65% against supply of material, 20% against installation and 10% against testing and commissioning; that the materials which are supplied under the contract include pipes, cables, anodes, warning mats, transformer rectifiers, coke breeze, termite welding materials, HDPE pipes, HDPE ducts, paints for coating, valves, etc.; that such goods are procured by the said assessee and delivered to the site, with the invoices carrying their name as buyer and the name of service recipient as consignee whereupon the consignee take Cenvat credit; and that other consumables are consumed during the course of installation of pipeline, and once the project is completed they obtain a certificate in this regard from the service recipient. They clarified that while cenvat credit in respect of materials and goods are transferred to the service recipients in the above manner, they themselves avail cenvat credit in respect of the consumables which they purchase and use/consume while rendering taxable services. They further stated that they were availing the benefit of Notification No. 12/2003 and with effect from 01.07.2012, they were classifying the services under works contract services and continued the same practice as earlier

9.2. The said assessee further submitted that the subject SCN is vague and beyond comprehension as it wrongly states that they have undervalued the services provided by them by not including the value of material supplied/ sold by them; and that the notice was wrongly issued without verifying the facts regarding payment of VAT/CST on the goods sold by them and cited the case law of Amrit Foods -2005 (190) ELT 433 (SC), wherein the Hon’ble Supreme Court has held that the assessee has to be put on notice as to the exact nature of contravention for which he is liable, and also cited a similar case in respect of Brindavan Beverages – 2007 (213) ELT 487 (SC).

9.3. As regards the period upto 30.06.2012, they submitted that in construing the contracts, the intention between the parties is the determining factor as to the nature of the contracts and this intention is of paramount importance in interpreting contracts; that the object of the construction of the terms of a contract is to discover therefrom the intention of the parties to the contract; that the cardinal presumption is that the parties have intended what they have in fact said, so that their words must be construed as they stand; that it is a well settled principle that the meaning of the document in the form of a written contract, has to be sought in the document itself, and cited the case law of Variety Body builders - (1976) 3 SCC 500. The claimed that a contract must be interpreted in a way which is permitted by its language and which will best effectuate the

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 4 of 24

intention of the parties as emanating from the whole of the contract. They also relied upon the decisions in respect Associated Hotels of India Ltd. - 1972 (29) STC 474, Walchandnagar Industries - (1985) 58 STC 89 (Bom), Gannon Dunkerley & Co. - 9 STC 353.

9.4. They also stated to have correctly availed exemption Notification No. 12/2003-ST; that the intention of the Govt. was to levy service tax only on the service portion and not on the value of goods and materials that are transferred to the customers; that it is settled law that a contract that provides for supply of goods as well as labour would be a works contract and to the extent the property in goods actually passes from the contractor to the principal, the transaction would come within the purview of the extended definition of sale viz., transfer of property in goods whether as goods or in some other form, which is the position after the Constitution (Forty-sixth Amendment) Act, 1982 by which the Legislatures of the States were empowered to levy sales tax on certain transactions described in clause (29-A) of Article 366 of the Constitution, besides cited the case law of Bharat Sanchar Nigam - 2006-(3)-SCC 1, and Gujarat Ambuja Cements Ltd. -(2005) 4 SCC 214, besides mentioned that the Larger Bench of the Hon’ble Supreme Court in the case of BSNL - 2006 (2) STR 161 (S.C.) relied upon the aforesaid observation and held that the Centre cannot include the value of the SIM cards under service tax if they are found ultimately to be goods; and that Hon’ble CESTAT in the case of Idea Mobile Communications Ltd. - 2006-TIOL- 857-CESTAT-BANG held a similar view.

9.5. They further deposed that they were raising invoices for consumables and hence the same were eligible for exemption under Notification No. 12/2003 and cited the case law in re Modi Xerox Ltd. - 1999 (114) STC 424 (KAR); that CBEC vide letter dated 07.04.2001 addressed to M/s. Punjab Colour Lab Association had clarified that maintenance of proper records for the goods/material will make the service providers eligible for the benefit of Notification No. 12/2003 and cited the Shilpa Colour Lab - 2007 (5) S.T.R. 423 (Tri. - Bang.) which has also been maintained by Supreme Court as per 2009 (14) S.T.R. J 163 (S.C.). As regards the meaning of the term consumption, they relied on the Hon’ble Supreme Court’s decision in the case of V.M. Salgaoncar & Bros. (P) Ltd. - 1998 (99) E.L.T. 3 (S.C.) besides citing the case laws of Wipro GE Medical Systems Pvt. Ltd. - 2009 (14) S.T.R. 43 (Tri. - Bang.), Ge Nuova Pignone - 2012 (27) S.T.R. 380 (Tri. - Ahmd.), LSG Sky Chief India Pvt. Ltd. - 2012 (27) S.T.R. 5 (Kar.)

9.6. The said assessee further mentioned that this notification was issued by the Government without making any change to section 67 of the Act, and was available to all service providers including those who have been specifically mentioned under section 67; that the Service Tax (Determination of Value) Rules 2006 (Valuation Rules) was enacted by the Government and came in to effect from 01.06.2006, whcih prescribed certain methods and procedures for determination of value of service rendered by an assessee; and that even after the enactment of the Valuation Rules, Notification 12/2003 continued to be in force.

9.7. Without prejudice to the above, the said assessee submitted that section 65(121) states that “words” and “expressions” used but not defined in this chapter but defined in the Central Excise Act, 1944 or the rules made thereunder shall apply, so far as may be in relation to service tax as they apply in relation to duty of excise; that the term “sale” has been defined in the Central Excise Act, 1944 under section 2(h); that the transfer of possession even without transfer of property is to be considered as sale in the case of Central Excise as has been settled in Rado Tyres Ltd - 2004 (174) ELT 218, Video Master - 1996 (88) ELT 117, Moldtek Plastics Ltd.- 2002 (50) RLT 944), Partap Steel Rolling Mills (P) Ltd – 2001 (137) ELT 741 and Imex Engineering

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 5 of 24

Co. Pvt. Ltd. - 1990 (47) ELT 32; that it is not the case of the department that the contracts entered into by them are not works contract; and that in the case of Asian Techs Ltd., - 2005 (189) ELT 420 (Tri-LB), Hon’ble Tribunal held that even under execution of works contract, there is a transfer of property in the goods used in the works contract. They also stated that Notification No. 12/2003-ST only requires that documentary evidence is required to show the value of goods sold in the course of providing the service.

9.8. As regards the period after 01.07.2012, the said assessee stated that during this period negative list of services was introduced; that the SCN proposed to classify their activity under the taxable category of “works contract services” as enlisted in Section 66E(h) according to which the value of service portion would only be liable for service tax; that with effect from 01.07.2012, rule 2A of Valuation Rules deals with valuation of works contract; that there are basically two methods available to evaluate the value of services in rule 2A of valuation rules; that if the assessee is able to provide actual value of material then that value can be deducted from the gross amount charged for the services rendered and rest (i.e. value of services) can be treated as value of services and the assessee is liable to pay service tax at the applicable rates which is prescribed in rule 2A(i) of the Valuation Rules; that alternatively, the service provider can go by the deemed percentage method i.e. the value of services in any contract will be deemed depending on the nature of activity carried out by the assesse i.e. 40% or 70% of the total amount charged etc.; that in the present case, undisputed fact is that the said assessee have not paid service tax on the value of materials which is separately sold by them under the cover of the invoice; that it is also undisputed fact that they have paid VAT/CST as the case may be on such sales; and that therefore, even if the allegation in the show cause notice is believed to be true that the activity carried out by them is works contract then also in terms of rule 2A(i) of Valuation Rules service tax is to be discharged only on value of services, which they have correctly discharged.

9.9. They also stated that the statute never permits charging service tax on material part and cited the case law in re Godfrey Phillips India Ltd. - 2005 (139) STC 537 and BSNL (supra); that goods supplied (in whatever form) can never be subject matter of levy of service tax; that even if the goods in question be considered as consumables then also service tax cannot be levied on the same; that Board’s Circular No. 87/05/2006-ST dated 06.11.2006 issued from F.No.137/128/2006-CX-4 shows that benefit of exemption Notification 12/2003-ST can be extended to consumables consumed during the process of providing the service as the same are not available for sale; that the said Circular clarifies that if documentary proof for the sale of material is produced, levy of service tax is exempted to the extent value of the goods and materials sold by the service provider to the service recipient, and cited the case laws of J. P. Transformers - 2014 (36) STR 961 (All), Goverdhan Transformer - 2015 (37) STR 161 (All), Balaji Tirupati Enterprises - 2013 (32) STR 530 (All). They have also cited excerpts from the Budget Speech of Hon’ble Finance Minister along with legislative history of service tax statute to pursue that no service tax would ever be leviable on the materials and goods sold during the course of rendition of taxable services.

9.10. The said assessee further contended that service tax is leviable on the gross amount charged for the services provided and such gross amount would not comprise value of materials and consumables involved in the service, and cited CBEC Circular no. 65/14/2003-ST dated 05.11.2003 and the case laws of E. V Mathai - 2003 (157) ELT 101 (T), Rolex Logistics Private Limited- 2009 (13) STR 147. They further stated that the material consumed is also materials supplied, and cited the case law of Builder’s Association of India - (1989) 2 SCC 645, Gannon Durnkerley (supra), Matoshri Textile Limited - 2003 (132) STC 539 (Bom.), Livetole - 2001 (122) STC 115 (Gau),

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 6 of 24

Modi Corporation Limited - 2005 (7) SCC 380). They have also cited the case laws of Shilpa Colour - 2007 (5) STR 423, BSNL - 2006 (2) STR 161 (SC), Roopchhaya Colour Studio - 2008 (11) STR 125, Sood Studios Private Limited - 2009 (15) STR 93.

9.11. The said assessee also stated that they have not availed Cenvat credit on the material sold by them for which benefit under Notification 12/2003-ST was claimed by them, and hence there is no contravention of any of the conditions stipulated under Notification No. 12/2003-ST; that the term “passing of the credit” cannot be equated with “taking of the credit” as alleged in the show cause notice; and that they have availed credit on inputs which are consumed during providing installation service on which already service tax liability is discharged on the gross value which is inclusive of service charge and material consumed in support of which copies of invoices are already placed on record, and cited the case laws of N J Devani Builders Pvt Ltd - 2010 (17) STR 437 (T). They also cited, without prejudice, that they are liable to pay service tax on the value of all the contracts under Rule 2A of the said Valuation Rules which provide for levy of service tax only on the service portion.

9.12. They further contended that the SCN dated 19.09.2014 covers the period from 01.04.2012 to 30.09.2013 and has not alleged any suppression wilful misstatement on their part and hence the notice is time barred. They also submitted that penalty under section 76 is not imposable since there is no short payment of service tax; that for imposing penalty, there should be an intention to evade payment of service tax on the part of the assessee, and cited the case law of Hindustan Steel Ltd. - AIR 1970 (SC) 253, Kellner Pharmaceuticals Ltd. - 1985 (20) ELT 80, Pushpam Pharmaceuticals Company - 1995 (78) ELT 401 (SC), Chemphar Drugs and Liniments - 1989 (40) ELT 276 (SC), (Supra). They also submitted that no penalty under section 77 is imposable as the SCN does not specify the violations involved; and that the issue involved in their case is only a bonafide interpretation of law, and cited the case laws of Ispat Industries Ltd. - 2006 (199) ELT 509 (Tri.-Mum), Town Hall Committee - 2007 (8) S.T.R. 170 (Tri.- Bang.), Sikar Ex-serviceman Welfare Coop. Society Ltd. - 2006 (4) S.T.R. 213 (Tri. - Del.), Haldia Petrochemicals Ltd. - 2006 (197) E.L.T. 97 (Tri. - Del.), Siyaram Silk Mills Ltd. - 2006 (195) E.L.T. 284 (Tri. - Mumbai), Fibre Foils Ltd. - 2005 (190) E.L.T. 352 (Tri. - Mumbai), ITEL Industries Pvt. Ltd. -2004 (163) E.L.T. 219 (Tri. - Bang.). They also claimed that the provisions of section 80 are in favour of the noticees for not imposing any penalty and cited the case laws of ETA Engineering Ltd. - 2004 (174) E.L.T 19 (T- LB), Flyingman Air Courier Pvt. Ltd. - 2004 (170) ELT 417 (T), Star Neon Singh -, 2002 (141) ELT 770 (T).

10.1. As per their statement during the PH on 11.02.2016, the said assessee filed another written submission dated 22.02.2016 wherein, they inter alia, stated that the present show cause notice dated 19.09.2014 was issued upon them for demanding service tax amounting to Rs.2,26,75,162/- involved during the period from 01.04.2012 to 30.09.2013; that they are engaged in pipeline construction business for oil/gas pipeline projects in the range of 4”-48” diameter which includes: route survey/site clearing & grading, stringing, welding, NDT testing, joint coating, excavation, lowering/laying, hydro testing, pre commissioning and commissioning of pipeline system along with associated works such as execution of critical crossings by augur boring, horizontal directional drilling methods and civil work; that they also provide temporary/permanent cathodic protection system for cross country pipelines, tank bottoms, petro chemical plants, refineries, power plants, fertilizer plants, jetties and other offshore structures; that they have rightly not discharged service tax on material portion; and that the details of payments made by them during the disputed period of 01.04.2012 to 31.03.2013 are tabulated as follows:

Name of Company Value of VAT/ CST Value of Service Tax

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 7 of 24

material paid Service paid supplied Bharat Petroleum 204,734 27,331 Only supply bill raised in this Construction Ltd period for these projects Cairn Energy India Pvt Ltd 726,750 109,013 CLP India Private Ltd. 3,382,177 286,555 994,173 122,880

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 8 of 24

Control Plus Oil & Gas 10,920 1,638 982,258 121,407 Solutions Pvt. Ltd. Delhi Cathodic Only supply bill raised in this 24,000 3,600 Consultancy Services period for these projects Hindustan Petroleum 495,000 71,775 368,635 45,563 Corporation Ltd Jaihind Projects Ltd. 50,510 990 M/s. Essar Projects Only supply bill raised in this 7,661,049 Singapore Pte L period for these projects NTPC Limited 459,000 9,000 Reliance Industries Ltd 50,459,492 1,626,726 26,72,898 330,370 Tata Projects Limited. Only supply bill raised in this 1,660,000 33,200 period for these projects Essar Oil Limited 550,000 82,500 127,291 15,733 Essar Projects (India) Ltd. 3,189,331 63,787 87,371 10,799 Gail India Ltd. 242,235 12,111 1,520,153 187,891 GSPC Gas Company Ltd. 3,404,380 183,002 35,888,447 4,023,679 Gujarat Chemical Port 5,969,392 715,389 902,576 111,558 Terminal Co. Hyundai Heavy Industries 149,895 22,484 427,535 52,843 Co. Ltd Indian Oil Corporation 62,479,127 1,249,583 1,476,832 182,536 Limited IOT Anwesha Eng. & Construction ltd 1,029,000 20,580 421,000 52,036

L&T Hydrocarbon Construction & PL 688,056 103,208 2,453,209 161,274

M/S. Corrtech Trenchless 33,372 619,020 12,380 270,000 Pvt Ltd. Prashanth Project Ltd. 41,420 828 2,186,258 270,222 Reliance Utilities and Only supply bill raised in this 1,789,944 179,772 Power Pvt Lt period for these projects Total 145,285,432 4,803,341 50,778,636 5,722,163

10.2. Similarly, they have also furnished details for the subsequent period from 01.04.2013 to 30.09.2013 as follows:

Name of Company Value of VAT/CST Value of Service Tax material paid Service paid supplied Indian Oil Corporation Limited 7,540,288 192,439 IOT Anwesha Eng. & Construction Ltd 1,312,500 26,250 Only supply bill raised in this Kanak Metal & Alloys period for these projects M/S. Corrtech Trenchless 125,000 2,500 Pvt Ltd.

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 9 of 24

M/S. Corrtech Trenchless Pvt Ltd. 1,725,405 34,508 Reliance Gas Only supply bill raised in this transportation 135,000 20,250 period for these projects Tata Projects Limited. 715,000 14,300 Bharat Oman Refineries 438,421 8,768 411,880 49,425 Limited CLP India Private Ltd. 390,131 56,169 43,400 5,364 Essar Oil Limited 1,070,010 114,994 261,020 32,262 Essar Projects (India) Ltd. 2,674,472 53,489 1,253,149 154,889 Gail India Ltd 1,135,268 3,967 2,117,443 261,716 GSPC Gas Company Ltd. 116,728 5,836 536,440 66,304 Larsen & Toubro Limited 210,435 31,565 350,150 43,279 Gujarat Chemical Port 220,962 18,548 113,841 14,071 Terminal Co Reliance industrial 3,982,091 343,325 11,315,307 1,398,572 Infrastructure Reliance Industries Ltd 14,655,455 280,501 1,255,781 155,215 Reliance Utilities and 1,723,410 60,677 67,500 8,343 Power Pvt Lt Total 38,170,576 1,268,086 17,725,911 2,189,440

10.3. The said assessee further contended that the clear bifurcation of supply and material portion is provided hereinabove as asked at the time of hearing with illustrative documents as evidence.

DISCUSSION AND FINDINGS

11. I have carefully gone through the case records, contents of the show cause notice, defence reply dated 09.02.2016 and further submission dated 22.02.2016 filed by the said assessee, and the record of personal hearing. Further, in the light of the references contained in the SCN and the defence reply with regard to the earlier two SCNs dated 21.10.2011 and 20.10.2012 both of which already stands adjudicated vide OIO No. STC/09 to 10/COMMR/AHD/2013 dated 07.03.2013, I have also examined the records pertaining to the said proceedings.

12. The issues which warrants determination in the present case are recapitulated as follows:

(i) Whether the value of goods and materials shown to have been traded/sold by the said assessee while providing taxable services to their clients during the period from 01.04.2012 to 30.06.2012 could be considered as taxable income under the category of “commercial or industrial construction service” as per section 65(25b) read with definition given under section 65(105)(zzq);

(ii) Whether the benefit of Notification No. 12/2003-CE could be disallowed to them for the said period from 01.04.2012 to 30.06.2012 on the ground of artificial bifurcation of composite value of works contracts into supply portion and service portion, and facilitating availment of Cenvat credit by their service recipients on the goods and materials utilized/consumed while providing taxable service;

(iii) Whether the aforesaid activities carried out by the said assessee during the period from 01.07.2012 to 30.09.2013 could be considered as a “service” in

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 10 of 24

terms of section 65B(44) and whether the amount shown towards goods and materials sold/traded could be considered as taxable value as they have availed Cenvat credit on the inputs;

(iv) Whether service tax amounting to Rs. 2,26,75,162/- not paid by them on the taxable income during the period from 01.04.2012 to 30.09.2013 could be demanded and recovered from them on the above grounds;

(v) Whether the said assessee is liable to pay interest for delayed payment of service tax, besides liable for penalty under section 76 and section 77, or otherwise.

13. I find that the undisputed facts of the case are that the said assessee was carrying out commercial or industrial construction services (pipeline construction) pursuant to the works contracts entered into with their clients; that these works contracts were composite in nature wherein value of the contract was shown in lump sum; that the said assessee was procuring goods and materials required for execution of works contract directly from the manufacturers or suppliers; that they got cenvatable invoices issued by such manufacturers/suppliers by showing the name of service recipients as ‘consignee’ and their name as ‘buyer’ and thus facilitated the recipients to avail Cenvat credit on such goods and materials; and that the said assessee has utilized/consumed various consumable items during the execution of works contract whereupon they have taken Cenvat credit. Thus, while the manner and method of rendering taxable services, accountal of income realized, procurement of goods and materials required for provision of taxable services, availment of Cenvat credit etc. remained unchanged during the entire period of demand from 01.04.2012 to 30.09.2013, the aforesaid categorization of the subject matter of dispute was necessitated due to the change in service tax statute with effect from 01.07.2012, whereupon service tax levy was shifted from service based method to negative list based mechanism.

14. The issues covered in Points (i) to (iii) of Para 12 supra are identical, except for the period involved, and hence I would discuss the same together. Again, there are two dimensions involved in this same issue which requires to be deliberated separately; first, eligibility of Cenvat credit by the service recipients for the duty paid on inputs used or consumed during the provision of taxable service; and secondly, includability of material value towards the taxable value for the purpose of service tax levy on the alleged ground of artificial bifurcation of the contract value.

15.1. However, before taking up all the aforesaid aspects of the main dispute, I find it pertinent to settle on the appropriate classification of service as per the statute exists before and after 01.07.2012. Although a change in the classification would not affect the leviability or rate of service tax, this question is relevant for determining eligibility for exemption notification, abatement, etc. In this regard, I find that services in relation to execution of “works contract” was brought under service tax levy with effect from 01.06.2007 as defined under section 65(105)(zzzza) which reads as ‘taxable services’ means any services provided or to be provided:

“ (zzzza) to any person, by any other person in relation to the execution of a works contract, excluding works contract in respect of roads, airports, railways, transport terminals, bridges, tunnels and dams.

Explanation.—For the purposes of this sub-clause, “works contract” means a contract wherein,— (i) transfer of property in goods involved in the execution of such contract is leviable to tax as sale of goods, and (ii) such contract is for the purposes of carrying out,—

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 11 of 24

(a) erection, commissioning or installation of plant, machinery, equipment or structures, whether pre-fabricated or otherwise, installation of electrical and electronic devices, plumbing, drain laying or other installations for transport of fluids, heating, ventilation or air conditioning including related pipe work, duct work and sheet metal work, thermal insulation, sound insulation, fire proofing or water proofing, lift and escalator, fire escape staircases or elevators; or (b) construction of a new building or a civil structure or a part thereof, or of a pipeline or conduit, primarily for the purposes of commerce or industry; or (c) construction of a new residential complex or a part thereof; or (d) completion and finishing services, repair, alteration, renovation or restoration of, or similar services, in relation to (b) and (c); or (e) turnkey projects including engineering, procurement and construction or commissioning (EPC) projects;”

15.2. Prior to 01.06.2007, services of the type specified under sub-clauses (a) to (e) of the aforesaid explanation-(ii) to section 65(105)(zzzza) were individually classified under different categories, e.g. Erection, Commissioning or Installation Service, Commercial or Industrial Construction Service, Construction of Complex Service, etc. The constitutional provisions of taxability under works contract service for the period before and after 01.06.2007 has been examined in detail by the Larger Bench of Hon’ble Tribunal in re Larson & Toubro Ltd. – 2015-TIOL-527-CESTAT-DEL-LB. It is, thus, a settled principle of law that the aforesaid type of services (Erection, Commissioning or Installation Service, Commercial or Industrial Construction Service, Construction of Complex Service, etc.), albeit form part of a composite works contract, would be leviable to service tax under the respective clauses of section 65(105) even for the period prior to 01.06.2007. After levy of service tax on ‘works contract services’ by virtue of section 65(105)(zzzza), if such services are executed in pursuance of a works contract and if it involves transfer of property in goods which is leviable to VAT/sales Tax, then such services would merit specific classification under the said section 65(105)(zzzza), irrespective of individual classifications elsewhere in section 65(105). This is evident from Para 6.4 of Board’s Circular Letter DOF No. 334/1/2007- TRU dated 28.02.2007 which states as follows:

“6.4. VAT/sales tax is leviable on transfer of property in goods involved in the execution of a works contract. The proposed taxable service is to levy service tax on services involved in the execution of a works contract. It may be noted that under this service only the following works contracts wherein transfer of property in goods involved in execution of such works contract is leviable to VAT/sales tax, are covered, namely:-

(i) works contract for carrying out erection, commissioning or installation (ii) works contract for commercial or industrial construction (iii) works contract for construction of complex (iv) works contract for turnkey projects including Engineering Procurement and Construction or Commissioning (EPC) projects.

6.4.1 Works contract in respect of specified infrastructure projects namely roads, airports, railways, transport terminals, bridges, tunnels and dams are specifically excluded from the scope of the levy.”

15.3. Board has issued two circulars No. 96/7/2007-ST dated 23.08.2007 and No. 128/10/2010-ST dated 24.08.2010 wherein it has been broadly stated that wherever works is involved, it would be a works contract, however, composition scheme under works contract could not be availed if a person had paid service tax under the individual category (e.g. erection, commissioning and installation service). This further suggests that the construction and erection service categories would include only labour intensive services where property in material is not passed on to the service recipient. The principles of classification as provided under section 65A as it stood during the period prior to 01.07.2012 also requires that where for any reason, a taxable service is, prima facie, classifiable under two or more sub-clauses of clause (105) of section 65,

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 12 of 24

classification shall be effected under the sub-clause which provides the most specific description, which if the service was rendered in pursuance of a works contract and if transfer of property of material is involved, is indisputably the ‘works contract service’.

15.4. I find that the ratio of the decision of Hon’ble Tribunal in re SPL Developers (P) Ltd. – 2015 (39) STR 455 (Tri.Bang) is squarely applicable in this case, which states that: “after introduction of ‘works contract’ as an independent and distinct taxable service with effect from 1-6-2007 any service provided which involve rendition of service such as those amounting to erection, commissioning or installation of plant, machinery, equipments or structure; construction of a new building or a civil structure or a part thereof; construction of a new residential complex or a part thereof and other enumerated activities falling within the defined ambit of works contract under Section 65(105)(zzzza) of the Act would necessarily have to be classified as a works contract service irrespective of whether these services answer the description of or were earlier classifiable as other pre-existing taxable services.” I also place reliance on the case laws of ABL Infrastructure Pvt. Ltd. – 2015 (38) STR 1185 (Tri.Mum) to support my view.

15.5. The aforesaid factual and legal position make it abundantly clear that classification of service under ‘works contract service’ or ‘commercial or industrial construction service’ cannot be left to the choice, or likes or dislikes of their clients nor could it be done as per their whims and fancies. Thus, if a particular service has been rendered by the said assessee pursuant to a works contract executed with the service recipient and if such service involved transfer of materials or property, then the same would be classified as ‘works contract service’. Similarly, even if rendition of a particular service was in pursuance of a works contract, if such service involved only labour charges or service portion, then the same would be classified as ‘commercial or industrial construction service’, as the case may be. As already mentioned above, these legal provisions which govern appropriate classification of services would find way while deciding the disputes regarding eligibility of Cenvat credit by the service recipients and includability of material value towards taxable value, etc. as involved in this case. However, I find that the said assessee has all along been arguing that their services are classifiable as ‘works contract services’, and hence I find no dispute with regard to the actual classification of services.

16.1. It is the arguments by the said assessee that the benefits of Notification No. 12/2003-ST dated 20.06.203 were correctly availed by them with a bonafide belief; and that the notification does not bar availment of Cenvat credit of inputs by the service recipients nor it prohibits availment of Cenvat credit on consumable items, etc. In this connection, I find that Notification No. 12/2003-ST dated 20.06.2003 as amended by No. 12/2004-ST dated 10.09.2004 is a general notification which exempts material portion involved in any taxable services specified under section 65(105), which I reproduce below for ease of reference:

“ In exercise of the powers conferred by section 93 of the Finance Act, 1994 (32 of 1994), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts so much of the value of all the taxable services, as is equal to the value of goods and materials sold by the service provider to the recipient of service, from the service tax leviable thereon under section (66) of the said Act, subject to condition that there is documentary proof specifically indicating the value of the said goods and materials.

Provided that the said exemption shall apply only in such cases where- (a) no credit of duty paid on such goods and materials sold, has been taken under the provisions of the Cenvat Credit Rules, 2004; or

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 13 of 24

(b) where such credit has been taken by the service provider on such goods and materials, such service provider has paid the amount equal to such credit availed before the sale of such goods and materials.

2. This notification shall come into force on the 1st day of July, 2003.”

16.2. The above notification is applicable for exemption from service tax for the cost of materials involved in the taxable services of any type as specified under section 65(105) which are either rendered in pursuance of works contracts or even otherwise. Another Notification No. 1/2006-ST dated 01.03.2006 was in force during the same time which provided certain percentage of abatement from the ‘gross amount’, where the gross amount includes the value of materials supplied during the rendition of such service, and was applicable for certain specified services such as ‘commercial or industrial construction service’, ‘erection, commissioning or installation services’, construction of complex services’, etc. Thus, service providers of these specified services were having option to avail either of these notifications, i.e. 12/2003 or 01/2006. While Notification No. 1/2006 provided a condition that no Cenvat credit of duty paid on inputs, capital goods, or input services would be available, the other Notification No. 12/2003 prescribed for non-availment of Cenvat credit of duty paid on goods transferred during the provision of service.

16.3. At the same time, ‘works contract services’ were governed by an optional set of provisions such as section 2A of the Service Tax (Determination of Value) Rules, 2006 [hereinafter referred as ‘Valuation Rules’ for brevity]; Works Contract (Composition Scheme for Payment of Service Tax) Rules, 2007 [hereinafter referred as ‘Composition Rules’ for brevity]; and the aforesaid Notification No. 12/2003-ST. For easy comparison of the provisions, I reproduce the section 2A of the said Valuation Rules as it existed during the period prior to 01.07.2012:

“2A. Determination of value of services involved in the execution of a works contract. –(1) Subject to the provisions of Section 67, the value of taxable service in relation to services involved in the execution of a works contract (hereinafter referred to as works contract service), referred to in sub-clause (zzzza) of clause 105 of Section 65 of the Act, shall be determined by the service provider in the following manner:-

(i) Value of works contract service determined shall be equivalent to the gross amount charged for the works contract less the value of transfer of property in goods involved in the execution of the said works contract.

Explanation. –For the purpose of this rule, -

(a) gross amount charged for the works contract shall not include Value Added Tax (VAT) or sales tax, as the case may be, paid, if any, on transfer of property in goods involved in the execution of the said works contract;

(b) vale of works contract shall include,-

(i) labour charges for execution of the works; (ii) amount paid to a sub-contractor for labour and services; (iii) charges for planning, designing and architect’s fees; (iv) charges for obtaining on hire or otherwise, machinery and tools used for the execution of the works contract; (v) cost of consumables such as water, electricity, fuel, used in the execution of the works contract; (vi) cost of establishment of the contractor relatable to supply of labour and services; (vii) other similar expenses relatable to supply of labour and services; and (viii) profit earned by the service provider relatable to supply of labour and services;

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 14 of 24

(ii) Where Value Added Tax or sales tax, as the case may be, has been paid on the actual value of transfer of property in goods involved in the execution of the works contract, then such value adopted for the purpose of payment of Value Added Tax or sales tax, as the case may be, shall be taken as the value of transfer of property in goods involved in the execution of the said works contract for determining the value of works contract service under clause (i).”

16.4. As per the above provisions, an assessee providing works contract services can pay service tax on the gross amount charged for the works contract less the value of transfer of property in goods involved in the execution thereof, and where VAT/sales tax has been paid on transfer of property, then the value adopted for such payment of VAT/ST is to be considered for deduction towards value of property transferred.

16.5. However, the said rule 2A was substituted with effect from 01.07.2012. The said new rules continued the same provisions as it existed during the earlier period, except for introduction of an optional scheme vide clause (ii) thereto, which reads as under:

“(ii) Where the value has not been determined under clause (i), the person liable to pay tax on the service portion involved in the execution of the works contract shall determine the service tax payable in the following manner, namely :-

(A) in case of works contracts entered into for execution of original works, service tax shall be payable on forty per cent of the total amount charged for the works contract;

(B) in case of other works contracts entered into for maintenance or repair or reconditioning or restoration or servicing of any goods, service tax shall be payable on seventy per cent of the total amount charged for the works contract;

(C) in case of other works contract, not covered under sub-clauses (A) and (B), including maintenance, repair, completion and finishing services such as glazing, plastering, floor and wall tiling, installation or electrical fittings of an immovable property, service tax shall be payable on sixty percent of a total amount charged for the works contract.

Explanation 1. - For the purposes of this rule,- (a) “original works” means- (i) all new constructions; (ii) all types of additions and alterations to abandoned or damaged structures on land that are required to make them workable; (iii) erection, commissioning or installation of plant, machinery or equipment or structures, whether pre-fabricated or otherwise; (b) “total amount” means the sum total of the gross amount charged for the works contract and the fair market value of all goods and services supplied in or in relation to the execution of the works contract, whether or not supplied under the same contract or any other contract, after deducting- (i) the amount charged for such goods or services, if any; and (ii) the value added tax or sales tax, if any, levied thereon :

Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally accepted accounting principles.

Explanation 2. - For the removal of doubts, it is clarified that the provider of taxable service shall not take CENVAT credit of duties or cess paid on any inputs, used in or in relation to the said works contract, under the provisions of CENVAT Credit Rules, 2004.”

16.6. A simple reading of the provisions of rule 2A as it existed before and after 01.07.2012 would reveal that except for the manner and method of payment of service tax, conditions which make an assessee eligible for the said provisions remained unchanged. Even the insertion of explanation-2 with regard to availment of Cenvat

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 15 of 24

credit did not make material change in the construction of legal provisions, which I would discuss separately later.

16.7. Similarly, the said Composition Rules provided an option to the assessee to discharge service tax liability on the works contract service provided or to be provided, instead of paying service tax at the rate specified in Section 66 of the Act, by paying an amount of equivalent to 4% of the gross amount charged for the works contract. The term ‘gross amount’ included the value of all goods used in or in relation to the execution of works contract, whether supplied under any other contract for a consideration or otherwise, and the value of all services that are required to be provided for execution of the works contract, however, subject to the condition that the service provider shall not take Cenvat credit of duties or cess paid on any inputs used in or in relation to the said works contract. Accordingly, an assessee who was providing ‘works contract service’ was having following three options to pay service tax:

(i) At the normal rate specified under section 66 on the service portion of the contract by deducting the actual value of property transferred during the execution of the contract (whereupon VAT/ST has been discharged) as per section 2A of Valuation Rules;

(ii) At 4% on the gross value charged for the execution of contract including the value of all goods and services used in or relation thereto as per the said Composition Rules; or

(iii) At the normal rate on the service portion, i.e. value of works contract less the value of goods and materials sold to the service recipient as per Notification No. 12/2003

16.8. Similarly, an assessee who was providing taxable services under the category ‘commercial or industrial construction service’ was having following options to pay service tax:

(i) At the normal rate on the service portion, i.e. value of works contract less the value of goods and materials sold to the service recipient as per Notification No. 12/2003; or

(ii) At the normal rate on the gross amount charged for the service contract including the value of materials less the abatement at the specified rate as per Notification No. 1/2006.

16.9. Since service tax liability has been worked out in the subject SCN on the basis of the value of goods traded during the provision of service, it evidently appears that the services rendered by the said assessee were ‘works contract services’. The said assessee has also confirmed this fact. Although the said assessee has thus, got various options for discharging their service tax liability, they ought to have fulfilled certain conditions as prescribed under each of these options. For example, if they wanted to operate under the said Composition Rules and to pay concessional rate of service tax of 4%, then the value adopted for the purpose of the said rule shall include the value of all goods and services used in or in relation to the execution of the works contract whether supplied under any other contract for a consideration or otherwise, the facts of which, including the actual cost of free issue materials supplied or actual value of consumable items used during the rendition of service, etc. if any, by the said assessee etc., are not ascertainable at this stage. Further, the said rule is not applicable for the contracts execution commenced or any payments received by the service provider before 07.07.2009; service provider should not have taken any Cenvat credit of

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 16 of 24

inputs; such Cenvat credit on specified input services was limited to 40%; and the declared value should not be less than the gross amount charged for the works contract, none of which could be verified or ascertained at this stage of the proceedings. Above all, sub-rule (3) of the said rules specifically provide that the service provider who opts for the said rules should exercise such option in respect of a works contract prior to payment of service tax in respect of the said works contract and the option so exercised should be applicable for the entire works contract and shall not be withdrawn until the completion of the said works contract. These provisions of the said rules make it abundantly clear that the said assessee cannot exercise their option to avail such benefits at this stage, and therefore, present cases cannot be considered in the light of the said Composition Rules.

16.10. Similarly, clause (i) of rule 2A(1) of the said Valuation Rules as it stood during the period prior to 01.07.2012 clearly specifies that the value of works contract service for the purpose of the said rule shall be equivalent to the gross amount charged for the works contract less the value of transfer of property of goods involved in the execution of the said works contract, sans the element of VAT/sales tax involved therein. Further, clause (ii) of rule 2A(1) states that if VAT/ST has been paid on the actual value of goods, then such value adopted for payment of VAT/ST is to be considered as the value for deduction under clause (i). Although rule 2A of the said Valuation Rules was substituted w.e.f. 01.07.2012 vide Notification No. 24/2012-ST dated 06.06.2012 as discussed supra, the provisions of the substituted rule 2A and the erstwhile rule 2A(1) remain pari materia except for renumbering of earlier clause (ii) as sub-clause (c) in the new rules. Explanation-2 given under the new rule 2(A) provides that: “for removal of doubts, it is clarified that the service provider shall not take Cenvat credit of duties or cess paid on any inputs used in or in relation to the said works contract.” Further, similar restrictions for availment of Cenvat credit on inputs also exist in the said Composition Rules as well as in the Notifications No. 12/2003 and No. 01/2006 which are the other options available under the law for levy of service tax on the same taxable service. Therefore, I am of the considered view that Explanation-2 as it exists in the present rule 2A of the Valuation Rules is merely a clarificatory one in nature and hence the same clarification would hold good so far as the provisions of erstwhile rule 2A(1) also are concerned. Had this not been the intention of the legislature, there would not have been any reason for such restriction on Cenvat to be given in Notification Nos. 12/2003 when both the other optional routes available in the law exclude the value of supply portion of the works contract. Therefore, I am not inclined to accept the argument made by the said assessee that the Valuation Rules do not provide restrictions for Cenvat availment during the earlier period. To draw my conclusion on this score, I place reliance on the case law in re Martin Lottery Agencies Ltd. - 2009 (14) S.T.R. 593 (S.C.) in which the case of Sonia Bhatia v. State of U.P. [(1981) 2 SCC 585 at 598 was discussed wherein it was observed that an Explanation to a statutory provision may fulfill the purpose of clearing up an ambiguity in the main provision or an Explanation can add to and widen the scope of the main. If it is in its nature clarificatory then the Explanation must be read into the main provision with effect from the time that the main provision came into force (See: Shyam Sunder v. Ram Kumar [(2001) 8 SCC 24 (para 44)]; Brij Mohan Laxman Das v. CIT [(1997) 1 SCC 352 at 354], CIT v. Podar Cement [(1997) 5 SCC 482 at 506]. Therefore, I am fully convinced that all the aforesaid provisions, i.e. Section 2A of Valuation Rules, Notification No. 12/2003, Notification No. 1/96 as well as Rule 2 of Composition Rules provide a common condition that no Cenvat credit would be available for the duty paid on the inputs used for providing the taxable services.

16.11. The above facts and legal provisions make it clear that the services rendered by the said assessee and are in dispute under the present proceedings are of the type of “works contract services”, for which they have three optional routes for

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 17 of 24

discharging service tax liability, i.e.: (i) Rule 2A of the Valuation Rules; (ii) Composition Rules; or (iii) Notification No. 12/2003. While availment of Composition Rules is not a question which could be examined at this stage for the reasons discussed in the foregoing paras, all these three optional routes provide for non-availment of Cenvat credit on inputs or input services as explained above. And without prejudice to the classification of the subject services as works contract services, I must say that even Notification No. 01/2006 also carry the same condition for non-availment of Cenvat credit and the following discussion would also hold good for ‘commercial or industrial construction service’.

17.1. Now, coming to the present case, the said assessee has been admittedly following a practice wherein they procured various inputs/goods by placing orders to different manufacturers. Such manufacturers supply their goods under the cover of cenvatable invoices by indicating the name of the said assessee as the ‘buyer’ and the name of the service recipient or the main contractor (with whom they executed the works contract for rendition of taxable service) as the ‘consignee’. Based on these invoices, service recipients (or main contractors) were availing Cenvat credit of duty paid on the goods. Para 14 of the original SCN dated 21.10.2011, in fact, contains an illustrative list showing the details of Cenvat credit involving several crores of rupees passed on by the said assessee to some of their service recipients besides, discussing similar practice for another service recipients . The said assessee argued that the law does not prohibit the service recipients from availing Cenvat credit nor could the said assessee could be held responsible for the same. Therefore, it is their argument that they would be eligible for the benefits as provided under Notification No. 12/2003 or Rule 2A of the Valuation Rules, as the case may be. I have examined this aspect in the light of legal provisions as discussed in the following paras.

17.2. Rule 3 of Cenvat Credit Rules, 2004 contains provisions regarding the eligibility of Cenvat credit by the manufacturers and output service providers. Sub-rule (1) of the said rule 3 specifies the duties, taxes and cesses which have been paid on any input, input services or capital goods which are received in the factory of manufacturer or received by the output service provider, which are available as Cenvat credit. As per the conditions for availing Cenvat credit as specified under rule 4, Cenvat credit on inputs may be taken immediately on receipt of inputs in the factory of the manufacturer or in the premises of the output service provider, or by the job worker in case goods are directly dispatched from the manufacturer to the job worker on behalf of the recipient manufacturer. It is needless to say that the said assessee would not be considered as the job worker for the purpose of this rule as they are admittedly working under a works contract executed with the service recipients. As per second proviso to the said rule 4, Cenvat credit on inputs may be taken by the output service provider when the inputs are delivered to such provider, subject to maintenance of documentary evidence of delivery and location of the inputs. Thus, the crucial aspect of Cenvat availment, as a mandatory condition precedent, is the physical receipt of inputs, input services or capital goods within the factory of the manufacturer or by the output service provider, as the case may be. In the case of output service provider, it is all the more important that they maintain documentary evidence showing the physical receipt of inputs in their premises along with its physical location. In case of the said assessee, inputs were admittedly physically received by them at their premises where taxable service is rendered, whereas the service recipients (M/s. JPL, M/s. Corrtech, etc.) have received only Cenvat invoices carrying their respective names as ‘consignee’. No goods were physically delivered to their premises, which is otherwise a mandatory precondition for availment of Cenvat credit. Thus, these buyers have not fulfilled the basic conditions for eligibility of Cenvat credit. Even otherwise, these buyers or service recipients cannot be considered as ‘output service providers’ for the purpose of the aforesaid rule 3 and 4 of Cenvat Rules, until the said assessee completes the event of

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 18 of 24

taxable services (i.e. completion of works contract services) and hands them over the completed service along with the inputs and input services used in relation to the execution of the same (if at all such inputs or input services retains the name and nature in which it was originally purchased and received by the said assessee). Then only they can be considered as recipient of inputs and input services or output service providers (and that too only if they are to provide the same service to another third party), contained in the said taxable service. In other words, I have no doubt that the constitutional provisions on “deemed sales” would cover transfer of property involved in the provision of taxable service whereupon VAT would be leviable. But, this could never be the ground for the service receivers to avail Cenvat credit of central excise duty involved on such goods which were actually utilized/consumed by the service providers during the course of providing taxable services. In such cases, none of the conditions as provided under the Cenvat Rules as discussed supra are satisfied, nor does the service receiver physically receive any goods in the condition in which it is mentioned in the manufacturer’s invoice. What the service recipient receives in such case is a composite taxable service which may or may not contain various inputs, goods, materials, consumables, etc. which were originally purchased by the service provider and utilized during the course of taxable event. Admittedly, in the present case, service receivers receive physical possession of taxable services in completed condition only when they issue a completion certificate for the works contract, whereas they have availed Cenvat credit much earlier.

17.3. Further, the term ‘consignee’ has not been defined under service tax statute or Cenvat rules. In common parlance, a consignee is the person to whom goods are shipped and is assigned to accept or receive such goods. A consignee is also a person who is assigned to hold goods for delivery or sale by another agent or party. A buyer is any person who contracts to acquire an asset in return for some form of consideration. A buyer or merchandiser is a person who purchases finished goods, typically for resale, for a firm, government, or organization. The same meaning of the term ‘consignee’ emerges from Board’s Circular No. 579/16/2001-CX dated 26.06.20014, although the circular was issued in a different context. In the present case, the said assessee places orders to the manufacturers, and receive physical custody and possession of inputs/goods and utilizes/consumes the same during the provision of taxable services. No input or goods physically reach the premises of the service recipients at this stage of the taxable service. What these service recipients receive is only the cenvatable invoices issued by the original manufacturer/supplier by showing their name as the consignee. When the goods are not physically shipped to these service recipients nor are they assigned to accept or receive such goods or hold the goods for delivery or sale, they can never be considered as a consignee of such goods. In other words, what transpires in the transaction is only a manipulated trail of documentation wherein the service recipients are wrongly anointed as ‘consignees’ or ‘output service providers’ with intent to wrongly enrich them with Cenvat benefits by circumventing the law.

17.4. Notwithstanding the above, I find that the provisions for issuance of invoice with dual names of ‘buyer’ and ‘consignee’ are provided as an additional facility for the manufacturers as per rule 11 of the Central Excise Rules, 2002 for direct transport of goods from the manufacturer or the importer to the consignee where the consignee avails Cenvat credit on the basis of cenvatable invoices issued by the registered dealer or the registered importer. This facility obviates the need for the goods to be first brought to the premises of the registered importer or the registered dealer for subsequent transport of goods to the consignee and thereby to improve ease of doing business and to save transportation cost, etc., a fact which finds clarification in Board’s Circular No. 1003/10/2015-CX dated 05.05.2015. It is a settled point that this facility was provided to facilitate registered dealers who are issuing Cenvatable invoices for

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 19 of 24

reselling or re-trading goods. The said assessee admittedly does not hold any registered dealership nor issue Cenvatable invoices and hence these provisions are not applicable to them. More importantly, the provisions of Central Excise Rules, 2002 are not applicable for service tax matters as the same does not find a place in the list of service tax statutes as specified by DGST’s Circular dated 01.12.2008 titled FAQ on Service Tax. Although Cenvat Credit Rules, 2004 form part of service tax statute, the fact remains that no corresponding amendments have been made in rule 9 thereof to recognize such invoices carrying dual names as duty paying documents for the purpose of availing Cenvat by service tax assessees.

17.5. In the present case, the said assessee has placed the orders and physically received the inputs/goods in their custody and control before utilizing or consuming the same as part of execution of works contract service. Although they do not avail Cenvat credit on such inputs/goods, they pass on such Cenvat credit to their service recipients by getting the invoices endorsed with the name of such service recipients as consignee. I have no doubt that such practice followed by the said assessee is not recognized under the law as discussed above for the reasons, such as: (i)service recipients of the said assessee cannot be considered as ‘output service provider’ for the purpose of availment of Cenvat credit as per rule 3 of Cenvat Rules; (ii) service recipients avail Cenvat credit without physical receipt of goods/inputs which is otherwise a mandatory pre-condition for such availment; (iii) goods are physically received by the said assessee and are consumed or utilized for executing works contract, and even if the service recipients are further providing finished services to another client or third party, they do not get these goods in the form in which it is mentioned in the Cenvat invoices; (iv) rules provide for availment of Cenvat credit immediately on receipt of goods in their premises whereas in these case, service recipients would receive finished services containing the inputs in utilized/consumed form a long time after availment of Cenvat credit by them; and (v) if at all the service recipients wanted to avail Cenvat credit, they could have taken the same only on the basis of taxable invoices issued by the said assessee which would amount to an input service (unless otherwise eligible as manufacturer or provider of output service), on the service tax paid by the said assessee on provision of their taxable services which would indirectly cover the cost of materials utilized or consumed by them during the execution of works contract, and not on the goods which the service recipients never received in the form in which it was procured by the said assessee.

17.6. One of the arguments advanced by the said assessee is that Notification No. 12/2003 does not prohibit availment of Cenvat credit by the service recipients, but it only prevents the service providers from such availment. In this regard, I find that Notification No. 12/2003 and its parallel provisions such as the said Valuation Rules, Composition Rules, Notification No. 01/2006 etc. place total restriction on availment of Cenvat credit on the inputs or input services, as the case may be. The persons meant for such restrictions are to be understood from the normal course of any transaction. In the present case, there is no recognized way of transaction in the service tax statute for issuance of dual named invoices as discussed supra. Specific provisions for registered dealers as given under rule 11 of Central Excise Rules, 2002 are not applicable for service tax statute. Therefore, if an assessee conspires with their principal contractor or service recipients to manipulate taxable value by reverse enrichment in the form of Cenvat credit, as has been done in the instant cases, such transaction cannot be said to have been made as a normal course of trade or transaction, and hence cannot be placed under the shelter of statute.

17.7. Again, transfer of property involved in the execution of a works contract as specified under the said Valuation Rules, Composition Rules or the aforesaid notifications are not to be understood as normal sale of goods. Such transfer of property

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 20 of 24

has been termed as “deemed sale” and made liable for payment of VAT/sales tax by way of specific Constitutional provisions. However, such ‘deemed sales’ cannot per se be considered as eligible for Cenvat credit. In the instant case, inputs which are consumed during the execution of works contract are not sold to the service recipients, but are subsumed to be part of the works contract service. In other words, consumption of such inputs is a part of executing works contract. Once the works contract is considered as executed, there remains no separate identity on the goods in the form which it has been originally purchased by the said assessee. Therefore, when the service recipients received the finished works contract service, they do not receive the goods in the form in which it is identified in the Cenvat invoices got endorsed in their name and based on which he availed Cenvat credit. This fact further negates their eligibility for Cenvat credit on such invoices. In such cases, options are available to the service recipients to either purchase/procure goods in their name and avail Cenvat credit before passing on the service providers as free issue materials and to issue work orders only for service portion, or to avail Cenvat credit of service tax paid on the gross value of taxable services which evidently include the value of materials consumed.

17.8. Notwithstanding all these factors, I find that the aforesaid practice of facilitating Cenvat credit by their service recipients would amount to manipulation of ‘gross amount charged for the taxable services’ and consequent artificial depreciation of taxable value. It is evidently clear that while working out the cost of works contract, both the parties executing the same would consider this factor which would obviously lower the value of works contract to the extent of reverse enrichment of Cenvat component. In other words, had the Cenvat component not passed on by the said assessee to their service recipients, actual gross value and the resultant taxable value would have been higher by at least the quantum of such Cenvat component. Thus, I am of the strong view that the aforesaid manner and method of reverse enrichment of Cenvat component is a modus operandi and clever mechanism devised by the said assessee with their service recipient as interested parties, with the sole purpose of dodging and circumventing statutory provisions. Therefore, I hold the said assessee has wrongly passed on Cenvat credit to their service recipients by getting the manufacturer’s invoice endorsed with their name as consignee, and such Cenvat availment would amount to breach of the restrictions provided in this regard under rule 2A of the Valuation Rules, rule 3 of Composition Rules, Notification No. 12/2003 and/or Notification No. 01/2006, as the case may be.

17.9. As regards the consumables utilized/consumed by the said assessee during the provision of taxable services, I find no dispute as they have admitted of availment of Cenvat credit. Their only defence is that such consumables cannot be considered as inputs for the purpose of Cenvat Rules, which I am unable to accept in the light of specific definition of the term ‘input’ as provided under rule 2(k) of Cenvat Credit Rules, 2004 would include all goods used for providing any output service as well as any goods used for construction or execution of works contract.

17.10. The aforesaid facts and legal provisions would by itself stand in full support of the entire demand of service tax made in the subject SCN, as non-eligibility of the benefits of the said Valuation Rules, Composition Rules, Notifications No. 12/2003 or No. 01/2006 would warrant the said assessee to include the entire ‘considerations’ received by them towards execution of the works contract into the ‘gross amount’ for the purpose of computation of taxable value, as provided under section 67 of the Finance Act.

18.1. Notwithstanding the aforesaid facts and their resultant ineligibility for exclusion of the value of supply materials for the purpose of service tax levy, I would now examine the charges made in the SCN with regard to the includability of material

M/s. Corrtech International Pvt. Ltd., Ahmedabad : OIO NO. AHM-SVTAX-000-COM-027-15-16 DATED 17.03.2016 Page 21 of 24

value towards the taxable value for the purpose of service tax levy on the alleged ground of ‘artificial bifurcation’ of the contract value, as mentioned in Para 12 supra. In this regard, I find that there is no dispute that the works contracts received by the said assessee from various clients covered the scope of project as “design, survey, supply, installation, testing, commissioning and construction of pipeline and cathodic protection” and the cost of such project included the value of materials utilized for execution of the works contract as well as labour charges for erection, commissioning and installation of the same, which for the sake of brevity, shall be called as supply portion and service portion. The SCN alleges that the contract value is actually indivisible for the actual cost of supply portion and service portion and that the total value has been artificially bifurcated by the said assessee to somehow fulfill compliance under service tax statute. In fact, I find no dispute from the said assessee in this regard, as the defence reply itself states that the contract value is mentioned in lump sum which they have bifurcated as 5% towards design and engineering, 65% against supply of material, 20% against installation and 10% against testing and commissioning, etc. I find no reason to accept such proportionate bifurcation of the contract value, and the said assessee has never attempted to substantiate that the ratio adopted by them as above are actual and foolproof. In order to ensure this fact, I have also test checked the contracts available on record, none of which indicate the actual value involved in the supply portion and service portion, etc.

18.2. Moreover, none of the aforesaid legal provisions, i.e. Notifications No. 12/2003, No. 01/2006, Valuation Rules, Composition Rules or section 67 of the Act does not recognize splitting the contract value on proportionate basis for the purpose of availing exemption of the value of supply portion from the gross value of taxable services. In fact, clause (ii) of rule 2A of the said Valuation Rule as it existed before 01.07.2012 [explanation-(c) given under clause (i) after 01.07.2012], categorically provides that the VAT/ST should have been paid on the actual value of property transferred during the provision of taxable services.