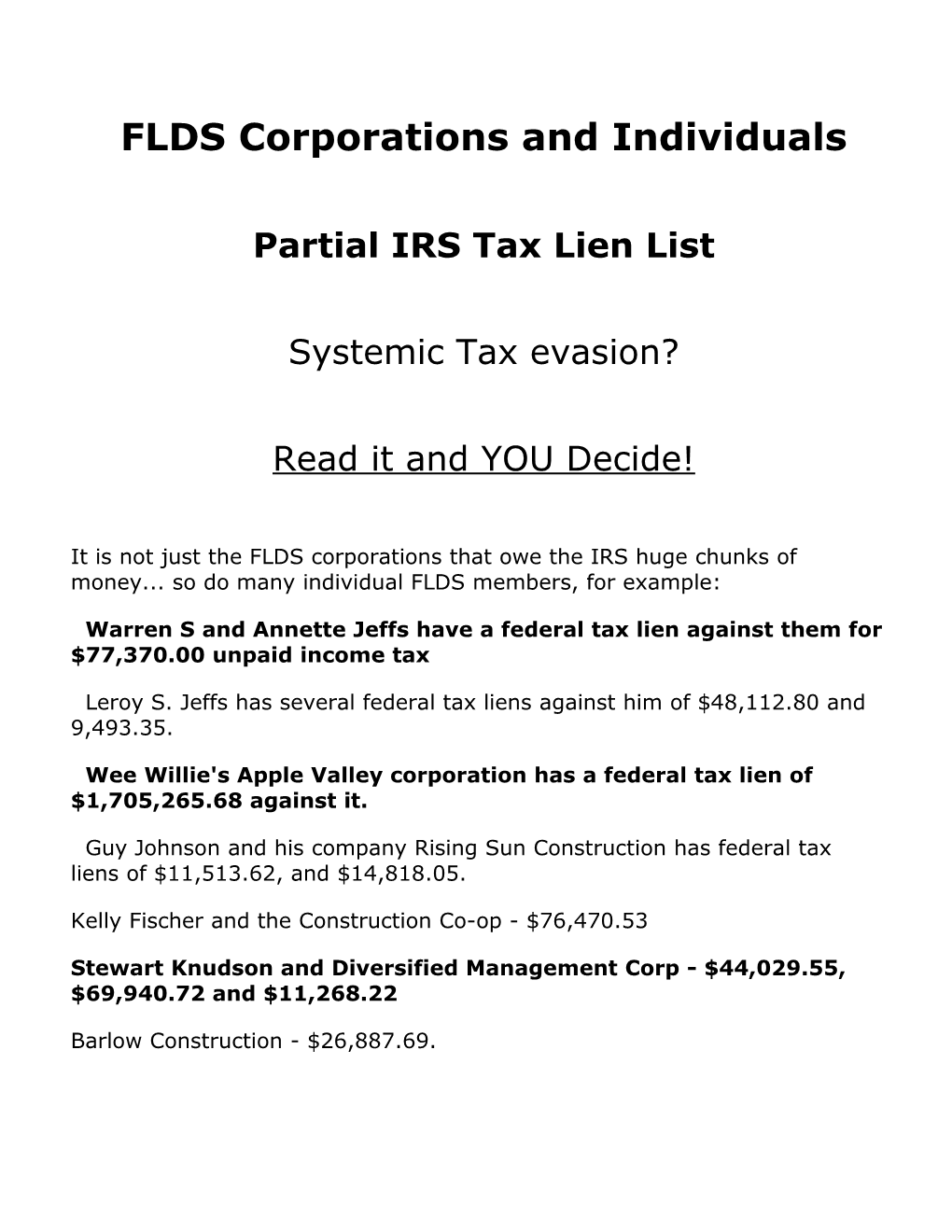

FLDS Corporations and Individuals

Partial IRS Tax Lien List

Systemic Tax evasion?

Read it and YOU Decide!

It is not just the FLDS corporations that owe the IRS huge chunks of money... so do many individual FLDS members, for example:

Warren S and Annette Jeffs have a federal tax lien against them for $77,370.00 unpaid income tax

Leroy S. Jeffs has several federal tax liens against him of $48,112.80 and 9,493.35.

Wee Willie's Apple Valley corporation has a federal tax lien of $1,705,265.68 against it.

Guy Johnson and his company Rising Sun Construction has federal tax liens of $11,513.62, and $14,818.05.

Kelly Fischer and the Construction Co-op - $76,470.53

Stewart Knudson and Diversified Management Corp - $44,029.55, $69,940.72 and $11,268.22

Barlow Construction - $26,887.69.

Ronald O. Barlow - $111,584.64.

Allco, Inc. $151,877.94, $255,050.57 and $12,360.55

Metal Tech - $15,334.59

Intermountain Skyline Stove Works - $43,473.07 and $45,604.55

Steeds, Inc - $955,069.15 and $17,442.02

Hildale Automotive Center Inc - $8,350.18

Regency West Management Group - $36,538.10.

Nephi Barlow - $12,030.69

SAMCOR, Inc - $95,573.14

True Square Construction, Inc - $9,799.78

Allen W. Steed - $455,877.30

Eda Jessop - $71,477.89

HY-TEST Builders, Inc - $35,506.31

Virginia B. Barlow - $444,598.50.

Which adds up to almost $5,000,000.00 in unpaid taxes that are captured in IRS LIENS!

Was Warren the beneficiary of these funds?

Or rather, his attorneys? The IRS may have to move swiftly to avoid losing these funds due them.