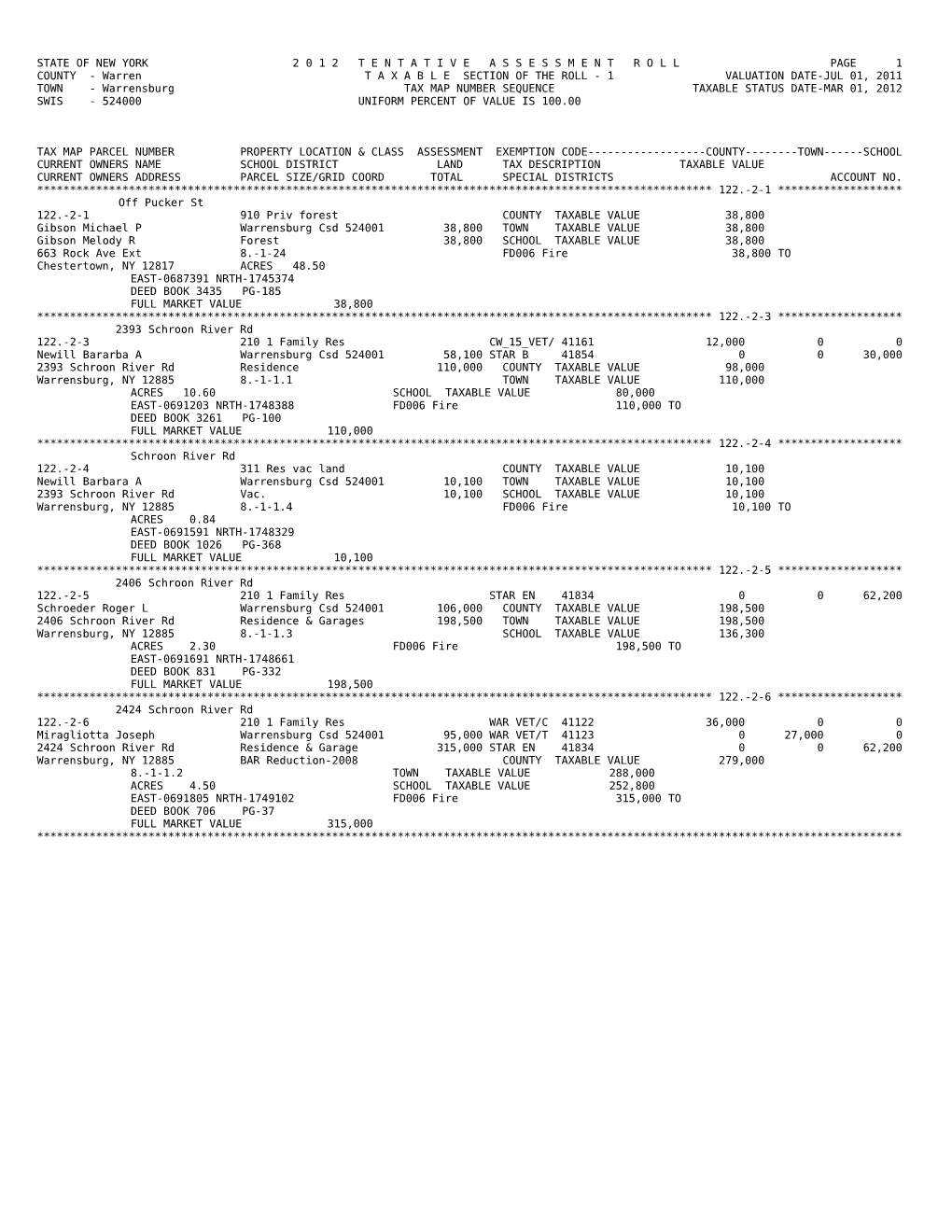

STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 1 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.-2-1 ******************* Off Pucker St 122.-2-1 910 Priv forest COUNTY TAXABLE VALUE 38,800 Gibson Michael P Warrensburg Csd 524001 38,800 TOWN TAXABLE VALUE 38,800 Gibson Melody R Forest 38,800 SCHOOL TAXABLE VALUE 38,800 663 Rock Ave Ext 8.-1-24 FD006 Fire 38,800 TO Chestertown, NY 12817 ACRES 48.50 EAST-0687391 NRTH-1745374 DEED BOOK 3435 PG-185 FULL MARKET VALUE 38,800 ******************************************************************************************************* 122.-2-3 ******************* 2393 Schroon River Rd 122.-2-3 210 1 Family Res CW_15_VET/ 41161 12,000 0 0 Newill Bararba A Warrensburg Csd 524001 58,100 STAR B 41854 0 0 30,000 2393 Schroon River Rd Residence 110,000 COUNTY TAXABLE VALUE 98,000 Warrensburg, NY 12885 8.-1-1.1 TOWN TAXABLE VALUE 110,000 ACRES 10.60 SCHOOL TAXABLE VALUE 80,000 EAST-0691203 NRTH-1748388 FD006 Fire 110,000 TO DEED BOOK 3261 PG-100 FULL MARKET VALUE 110,000 ******************************************************************************************************* 122.-2-4 ******************* Schroon River Rd 122.-2-4 311 Res vac land COUNTY TAXABLE VALUE 10,100 Newill Barbara A Warrensburg Csd 524001 10,100 TOWN TAXABLE VALUE 10,100 2393 Schroon River Rd Vac. 10,100 SCHOOL TAXABLE VALUE 10,100 Warrensburg, NY 12885 8.-1-1.4 FD006 Fire 10,100 TO ACRES 0.84 EAST-0691591 NRTH-1748329 DEED BOOK 1026 PG-368 FULL MARKET VALUE 10,100 ******************************************************************************************************* 122.-2-5 ******************* 2406 Schroon River Rd 122.-2-5 210 1 Family Res STAR EN 41834 0 0 62,200 Schroeder Roger L Warrensburg Csd 524001 106,000 COUNTY TAXABLE VALUE 198,500 2406 Schroon River Rd Residence & Garages 198,500 TOWN TAXABLE VALUE 198,500 Warrensburg, NY 12885 8.-1-1.3 SCHOOL TAXABLE VALUE 136,300 ACRES 2.30 FD006 Fire 198,500 TO EAST-0691691 NRTH-1748661 DEED BOOK 831 PG-332 FULL MARKET VALUE 198,500 ******************************************************************************************************* 122.-2-6 ******************* 2424 Schroon River Rd 122.-2-6 210 1 Family Res WAR VET/C 41122 36,000 0 0 Miragliotta Joseph Warrensburg Csd 524001 95,000 WAR VET/T 41123 0 27,000 0 2424 Schroon River Rd Residence & Garage 315,000 STAR EN 41834 0 0 62,200 Warrensburg, NY 12885 BAR Reduction-2008 COUNTY TAXABLE VALUE 279,000 8.-1-1.2 TOWN TAXABLE VALUE 288,000 ACRES 4.50 SCHOOL TAXABLE VALUE 252,800 EAST-0691805 NRTH-1749102 FD006 Fire 315,000 TO DEED BOOK 706 PG-37 FULL MARKET VALUE 315,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 2 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.-2-9 ******************* Northway,off 122.-2-9 910 Priv forest COUNTY TAXABLE VALUE 37,800 Stork Francis Warrensburg Csd 524001 37,800 TOWN TAXABLE VALUE 37,800 Stork Deborah Small Log Cabin (was DR-1 37,800 SCHOOL TAXABLE VALUE 37,800 215 Gannon Rd Forrest Land w/Small Pond FD006 Fire 37,800 TO Eagle Bridge, NY 12057 8.-1-25 ACRES 146.67 EAST-0689701 NRTH-1746034 DEED BOOK 1411 PG-247 FULL MARKET VALUE 37,800 ******************************************************************************************************* 122.-2-10 ****************** Northway,off 122.-2-10 910 Priv forest FISHER ACT 47450 24,573 24,573 24,573 Gibson Michael P Warrensburg Csd 524001 55,000 COUNTY TAXABLE VALUE 30,427 Gibson Melody R Forest 55,000 TOWN TAXABLE VALUE 30,427 663 Rock Ave Ext 8.-1-23 SCHOOL TAXABLE VALUE 30,427 Chestertown, NY 12817 ACRES 54.00 FD006 Fire 55,000 TO EAST-0687641 NRTH-1744068 DEED BOOK 3435 PG-185 FULL MARKET VALUE 55,000 ******************************************************************************************************* 122.14-1-2 ***************** Northway,off 122.14-1-2 323 Vacant rural COUNTY TAXABLE VALUE 1,000 Russell Bernard Warrensburg Csd 524001 1,000 TOWN TAXABLE VALUE 1,000 Russell Shirley Vac. 1,000 SCHOOL TAXABLE VALUE 1,000 Federal Hill Rd 9.-1-2 FD006 Fire 1,000 TO Bolton Landing, NY 12814 FRNT 40.00 DPTH 100.00 ACRES 0.09 EAST-0689239 NRTH-1746042 DEED BOOK 700 PG-78 FULL MARKET VALUE 1,000 ******************************************************************************************************* 122.14-1-3 ***************** Northway,off 122.14-1-3 323 Vacant rural COUNTY TAXABLE VALUE 1,300 Russell Bernard Warrensburg Csd 524001 1,300 TOWN TAXABLE VALUE 1,300 Russell Shirley Vac. 1,300 SCHOOL TAXABLE VALUE 1,300 Federal Hill Rd 9.-1-3 FD006 Fire 1,300 TO Bolton Landing, NY 12814 FRNT 60.00 DPTH 100.00 ACRES 0.14 EAST-0689296 NRTH-1746084 DEED BOOK 700 PG-78 FULL MARKET VALUE 1,300 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 3 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.14-1-4 ***************** Northway,off 122.14-1-4 311 Res vac land COUNTY TAXABLE VALUE 1,400 Maguire Sheryl Warrensburg Csd 524001 1,400 TOWN TAXABLE VALUE 1,400 3645 Burgoyne Vac. 1,400 SCHOOL TAXABLE VALUE 1,400 Hudson Falls, NY 12839 9.-1-6 FD006 Fire 1,400 TO FRNT 100.00 DPTH 100.00 ACRES 0.23 EAST-0689490 NRTH-1746035 DEED BOOK 674 PG-475 FULL MARKET VALUE 1,400 ******************************************************************************************************* 122.14-1-5 ***************** Northway,off 122.14-1-5 311 Res vac land COUNTY TAXABLE VALUE 1,000 Maguire Sheryl Warrensburg Csd 524001 1,000 TOWN TAXABLE VALUE 1,000 3645 Burgoyne Ave Vac. 1,000 SCHOOL TAXABLE VALUE 1,000 Hudson Falls, NY 12839 9.-1-8 FD006 Fire 1,000 TO FRNT 40.00 DPTH 100.00 ACRES 0.09 EAST-0689459 NRTH-1745913 DEED BOOK 674 PG-475 FULL MARKET VALUE 1,000 ******************************************************************************************************* 122.14-1-6 ***************** Northway,off 122.14-1-6 311 Res vac land COUNTY TAXABLE VALUE 500 Maguire Sheryl Warrensburg Csd 524001 500 TOWN TAXABLE VALUE 500 3645 Burgoyne Ave Vac. 500 SCHOOL TAXABLE VALUE 500 Hudson Falls, NY 12839 9.-1-7 FD006 Fire 500 TO FRNT 40.00 DPTH 100.00 ACRES 0.09 EAST-0689450 NRTH-1745931 DEED BOOK 674 PG-475 FULL MARKET VALUE 500 ******************************************************************************************************* 122.14-1-7 ***************** Northway,off 122.14-1-7 311 Res vac land COUNTY TAXABLE VALUE 1,000 Maguire Sheryl Warrensburg Csd 524001 1,000 TOWN TAXABLE VALUE 1,000 3645 Burgoyne Ave Vac. 1,000 SCHOOL TAXABLE VALUE 1,000 Hudson Falls, NY 12839 9.-1-5 FD006 Fire 1,000 TO FRNT 60.00 DPTH 100.00 ACRES 0.14 EAST-0689396 NRTH-1745961 DEED BOOK 674 PG-475 FULL MARKET VALUE 1,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 4 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.14-1-8 ***************** Northway,off 122.14-1-8 311 Res vac land COUNTY TAXABLE VALUE 1,000 Maguire Sheryl Warrensburg Csd 524001 1,000 TOWN TAXABLE VALUE 1,000 3645 Burgoyne Ave Vac. 1,000 SCHOOL TAXABLE VALUE 1,000 Hudson Falls, NY 12839 9.-1-4 FD006 Fire 1,000 TO FRNT 60.00 DPTH 100.00 ACRES 0.14 EAST-0689334 NRTH-1745910 DEED BOOK 674 PG-475 FULL MARKET VALUE 1,000 ******************************************************************************************************* 122.15-1-1 ***************** 2365 Schroon River Rd 122.15-1-1 210 1 Family Res COUNTY TAXABLE VALUE 191,100 Deneen Douglas P Warrensburg Csd 524001 37,500 TOWN TAXABLE VALUE 191,100 210 E 73Rd St Residence & Small Cabin 191,100 SCHOOL TAXABLE VALUE 191,100 New York, NY 10021 9.-1-9.3 FD006 Fire 191,100 TO ACRES 2.49 EAST-0691148 NRTH-1747904 DEED BOOK 1241 PG-162 FULL MARKET VALUE 191,100 ******************************************************************************************************* 122.15-1-2 ***************** 2357 Schroon River Rd 122.15-1-2 210 1 Family Res STAR B 41854 0 0 30,000 Czuba Michael D Warrensburg Csd 524001 30,700 COUNTY TAXABLE VALUE 140,100 Putnam Kelly A Res.&barn 140,100 TOWN TAXABLE VALUE 140,100 2357 Schroon River Rd 9.-1-9.2 SCHOOL TAXABLE VALUE 110,100 Warrensburg, NY 12885 ACRES 1.14 FD006 Fire 140,100 TO EAST-0691120 NRTH-1747642 DEED BOOK 689 PG-144 FULL MARKET VALUE 140,100 ******************************************************************************************************* 122.15-1-3 ***************** Schroon River Rd 122.15-1-3 311 Res vac land - WTRFNT COUNTY TAXABLE VALUE 40,600 Kreckman David A Warrensburg Csd 524001 40,600 TOWN TAXABLE VALUE 40,600 PO Box 1201 Vacant Waterfront Land 40,600 SCHOOL TAXABLE VALUE 40,600 Bolton Landing, NY 12814 9.-1-9.1 FD006 Fire 40,600 TO ACRES 7.46 EAST-0691514 NRTH-1747672 DEED BOOK 1241 PG-165 FULL MARKET VALUE 40,600 ******************************************************************************************************* 122.15-1-4 ***************** Schroon River Rd 122.15-1-4 311 Res vac land COUNTY TAXABLE VALUE 16,200 Keegan William C Warrensburg Csd 524001 16,200 TOWN TAXABLE VALUE 16,200 Keegan Madelyn Vac. 16,200 SCHOOL TAXABLE VALUE 16,200 32 Hampton Pl 9.-1-10 FD006 Fire 16,200 TO Freeport, NY 11520 FRNT 100.00 DPTH 489.00 ACRES 1.12 EAST-0691118 NRTH-1747176 DEED BOOK 875 PG-69 FULL MARKET VALUE 16,200 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 5 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.15-1-5 ***************** Schroon River Rd 122.15-1-5 311 Res vac land COUNTY TAXABLE VALUE 12,100 Keegan William C Warrensburg Csd 524001 12,100 TOWN TAXABLE VALUE 12,100 Keegan Madelyn Vac. 12,100 SCHOOL TAXABLE VALUE 12,100 32 Hampton Pl 9.-1-11 FD006 Fire 12,100 TO Freeport, NY 11520 FRNT 100.00 DPTH 433.00 ACRES 1.01 EAST-0691117 NRTH-1747069 DEED BOOK 875 PG-72 FULL MARKET VALUE 12,100 ******************************************************************************************************* 122.15-1-6 ***************** 2327 Schroon River Rd 122.15-1-6 210 1 Family Res COUNTY TAXABLE VALUE 176,000 Keegan William C Warrensburg Csd 524001 26,400 TOWN TAXABLE VALUE 176,000 Keegan Madelyn Unfinished 176,000 SCHOOL TAXABLE VALUE 176,000 32 Hampton Pl 8.-1-28 FD006 Fire 176,000 TO Freeport, NY 11520 FRNT 124.40 DPTH 365.00 ACRES 0.88 EAST-0691136 NRTH-1746961 DEED BOOK 695 PG-789 FULL MARKET VALUE 176,000 ******************************************************************************************************* 122.15-1-7 ***************** 2340 Schroon River Rd 122.15-1-7 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 217,500 Winterroll Christopher Warrensburg Csd 524001 63,600 TOWN TAXABLE VALUE 217,500 9 Wyndham Rd Res 217,500 SCHOOL TAXABLE VALUE 217,500 Scardale, NY 10583-3633 BAR Reduction (2008) FD006 Fire 217,500 TO 8.-1-4 FRNT 170.00 DPTH 135.00 EAST-0691446 NRTH-1747176 DEED BOOK 736 PG-75 FULL MARKET VALUE 217,500 ******************************************************************************************************* 122.15-1-8 ***************** Schroon River Rd 122.15-1-8 311 Res vac land - WTRFNT COUNTY TAXABLE VALUE 7,500 Roden William M Warrensburg Csd 524001 7,500 TOWN TAXABLE VALUE 7,500 Roden Hilda Island 7,500 SCHOOL TAXABLE VALUE 7,500 R R 1 8.-1-29 FD006 Fire 7,500 TO Diamond Point, NY 12824 FRNT 1080.00 DPTH 200.00 ACRES 1.90 EAST-0691646 NRTH-1747202 DEED BOOK 649 PG-790 FULL MARKET VALUE 7,500 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 6 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.15-1-9 ***************** Schroon River Rd 122.15-1-9 311 Res vac land - WTRFNT COUNTY TAXABLE VALUE 38,000 Winterroll Christopher Warrensburg Csd 524001 38,000 TOWN TAXABLE VALUE 38,000 9 Wyndham Rd Vac. 38,000 SCHOOL TAXABLE VALUE 38,000 Scardale, NY 10583 8.-1-5.3 FD006 Fire 38,000 TO FRNT 134.00 DPTH 174.00 EAST-0691462 NRTH-1746975 DEED BOOK 736 PG-75 FULL MARKET VALUE 38,000 ******************************************************************************************************* 122.15-1-10 **************** 2326 Schroon River Rd 122.15-1-10 260 Seasonal res - WTRFNT COUNTY TAXABLE VALUE 245,000 Carlstrom Ed Warrensburg Csd 524001 131,400 TOWN TAXABLE VALUE 245,000 Carlstrom Linda Residence 245,000 SCHOOL TAXABLE VALUE 245,000 8571 Woodbriar Dr 8.-1-5.2 FD006 Fire 245,000 TO Sarasota, FL 34238 FRNT 200.00 DPTH 300.00 EAST-0691526 NRTH-1746869 DEED BOOK 1470 PG-139 FULL MARKET VALUE 245,000 ******************************************************************************************************* 122.15-1-11 **************** 2324 Schroon River Rd 122.15-1-11 270 Mfg housing - WTRFNT COUNTY TAXABLE VALUE 119,900 Burke Timothy Warrensburg Csd 524001 114,000 TOWN TAXABLE VALUE 119,900 466 Gansvoort Blvd Cottage 119,900 SCHOOL TAXABLE VALUE 119,900 Staten Island, NY 10314 8.-1-5.1 FD006 Fire 119,900 TO FRNT 100.00 DPTH 414.00 EAST-0691539 NRTH-1746769 DEED BOOK 3926 PG-1 FULL MARKET VALUE 119,900 ******************************************************************************************************* 122.15-1-12 **************** 2318 Schroon River Rd 122.15-1-12 210 1 Family Res - WTRFNT STAR EN 41834 0 0 62,200 Genier Richard Warrensburg Csd 524001 126,000 COUNTY TAXABLE VALUE 218,000 Genier Patricia Residence & Garage 218,000 TOWN TAXABLE VALUE 218,000 2318 Schroon River Rd 8.-1-6.1 SCHOOL TAXABLE VALUE 155,800 Warrensburg, NY 12885 FRNT 126.00 DPTH 415.00 FD006 Fire 218,000 TO ACRES 1.20 EAST-0691540 NRTH-1746664 DEED BOOK 1461 PG-247 FULL MARKET VALUE 218,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 7 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.15-1-13 **************** 2312 Schroon River Rd 122.15-1-13 210 1 Family Res - WTRFNT STAR B 41854 0 0 30,000 Showers Stephen J Warrensburg Csd 524001 123,900 COUNTY TAXABLE VALUE 216,200 Larkin Katherine Residence 216,200 TOWN TAXABLE VALUE 216,200 2312 Schroon River Rd 8.-1-7.2 SCHOOL TAXABLE VALUE 186,200 Warrensburg, NY 12885 FRNT 131.00 DPTH 375.00 FD006 Fire 216,200 TO BANK 139 EAST-0691537 NRTH-1746559 DEED BOOK 1043 PG-164 FULL MARKET VALUE 216,200 ******************************************************************************************************* 122.15-1-14 **************** 2310 Schroon River Rd 122.15-1-14 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 193,100 Gonzalez Emilio Warrensburg Csd 524001 97,200 TOWN TAXABLE VALUE 193,100 Gonzalez Carmen G Residence, Garage, Pool 193,100 SCHOOL TAXABLE VALUE 193,100 Villa 12-16 Granada Cresc 8.-1-7.1 FD006 Fire 193,100 TO White Plains, NY 10603-1241 FRNT 107.00 DPTH 330.00 EAST-0691515 NRTH-1746460 DEED BOOK 641 PG-897 FULL MARKET VALUE 193,100 ******************************************************************************************************* 122.15-1-15 **************** 2306 Schroon River Rd 122.15-1-15 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 201,600 Mehl Adrienne & Philip Warrensburg Csd 524001 87,600 TOWN TAXABLE VALUE 201,600 Mehl Gary & Evelyn Camp 201,600 SCHOOL TAXABLE VALUE 201,600 53-62 66th St 8.-1-7.4 FD006 Fire 201,600 TO Maspeth, NY 11378 FRNT 115.00 DPTH 275.00 EAST-0691494 NRTH-1746368 DEED BOOK 1497 PG-166 FULL MARKET VALUE 201,600 ******************************************************************************************************* 122.15-1-16 **************** 2304 Schroon River Rd 122.15-1-16 270 Mfg housing - WTRFNT COUNTY TAXABLE VALUE 75,700 Roulier Robert E Warrensburg Csd 524001 62,400 TOWN TAXABLE VALUE 75,700 Roulier Carol Trailer & Storage Bldg 75,700 SCHOOL TAXABLE VALUE 75,700 190 Menands Rd 8.-1-7.5 FD006 Fire 75,700 TO Loudonville, NY 12211 FRNT 140.00 DPTH 196.00 ACRES 0.52 EAST-0691471 NRTH-1746263 DEED BOOK 797 PG-56 FULL MARKET VALUE 75,700 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 8 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.15-1-17 **************** Schroon River Rd 122.15-1-17 323 Vacant rural - WTRFNT COUNTY TAXABLE VALUE 2,400 Roulier Robert Warrensburg Csd 524001 2,400 TOWN TAXABLE VALUE 2,400 Roulier Carol Island 2,400 SCHOOL TAXABLE VALUE 2,400 190 Menands Rd 8.-1-30 FD006 Fire 2,400 TO Loudonville, NY 12211 FRNT 200.00 DPTH 101.00 ACRES 0.30 EAST-0691700 NRTH-1746187 DEED BOOK 1020 PG-213 FULL MARKET VALUE 2,400 ******************************************************************************************************* 122.19-1-1 ***************** Schroon River Rd 122.19-1-1 312 Vac w/imprv COUNTY TAXABLE VALUE 34,500 Keegan William C Warrensburg Csd 524001 29,400 TOWN TAXABLE VALUE 34,500 Keegan Madelyn Vac. 34,500 SCHOOL TAXABLE VALUE 34,500 32 Hampton Pl 8.-1-6.2 FD006 Fire 34,500 TO Freeport, NY 11520 ACRES 3.90 EAST-0691159 NRTH-1746415 DEED BOOK 695 PG-789 FULL MARKET VALUE 34,500 ******************************************************************************************************* 122.19-1-2 ***************** 2296 Schroon River Rd 122.19-1-2 270 Mfg housing - WTRFNT STAR B 41854 0 0 30,000 Schwindt Frank J Warrensburg Csd 524001 27,600 COUNTY TAXABLE VALUE 99,600 Schwindt Theresa Mobile Home 99,600 TOWN TAXABLE VALUE 99,600 2296 Schroon River Rd 8.-1-7.3 SCHOOL TAXABLE VALUE 69,600 Warrensburg, NY 12885 FRNT 116.00 DPTH 85.00 FD006 Fire 99,600 TO EAST-0691439 NRTH-1746132 DEED BOOK 1019 PG-12 FULL MARKET VALUE 99,600 ******************************************************************************************************* 122.19-1-3 ***************** 2270 Schroon River Rd 122.19-1-3 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 157,000 Wagner Thomas A Warrensburg Csd 524001 125,000 TOWN TAXABLE VALUE 157,000 66 Weyrick Rd Camp 157,000 SCHOOL TAXABLE VALUE 157,000 Troy, NY 12180 8.-1-8.2 FD006 Fire 157,000 TO ACRES 3.63 BANK 82 EAST-0691447 NRTH-1745316 DEED BOOK 828 PG-256 FULL MARKET VALUE 157,000 ******************************************************************************************************* 122.19-1-4 ***************** 2244 Schroon River Rd 122.19-1-4 270 Mfg housing - WTRFNT COUNTY TAXABLE VALUE 110,000 Lobo Denzil C Warrensburg Csd 524001 102,000 TOWN TAXABLE VALUE 110,000 Lobo Yon S Trailer 110,000 SCHOOL TAXABLE VALUE 110,000 423 Shannon St 8.-1-9 FD006 Fire 110,000 TO Schenectady, NY 12306 ACRES 1.50 EAST-0691531 NRTH-1744833 DEED BOOK 986 PG-150 FULL MARKET VALUE 110,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 9 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 122.19-1-6 ***************** 2236 Schroon River Rd 122.19-1-6 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 357,700 De Amelia Eric Warrensburg Csd 524001 189,600 TOWN TAXABLE VALUE 357,700 De Amelia Laura Residence 357,700 SCHOOL TAXABLE VALUE 357,700 PO Box 176 8.-1-12 FD006 Fire 357,700 TO Warrensburg, NY 12885 ACRES 9.90 EAST-0691762 NRTH-1744391 DEED BOOK 1067 PG-6 FULL MARKET VALUE 357,700 ******************************************************************************************************* 122.19-1-7 ***************** 2219 Schroon River Rd 122.19-1-7 270 Mfg housing COUNTY TAXABLE VALUE 40,000 Cavanaugh Ronald Warrensburg Csd 524001 29,100 TOWN TAXABLE VALUE 40,000 PO Box 766 Mobile Home 40,000 SCHOOL TAXABLE VALUE 40,000 South Royalton, VT 05068 8.-1-11 FD006 Fire 40,000 TO FRNT 200.00 DPTH 220.00 ACRES 0.97 EAST-0691245 NRTH-1744189 DEED BOOK 4024 PG-62 FULL MARKET VALUE 40,000 ******************************************************************************************************* 122.19-1-8 ***************** Schroon River Rd 122.19-1-8 311 Res vac land COUNTY TAXABLE VALUE 28,500 Cavanaugh Ronald Warrensburg Csd 524001 28,500 TOWN TAXABLE VALUE 28,500 Schroon River Rd Vac. 28,500 SCHOOL TAXABLE VALUE 28,500 PO Box 766 8.-1-10 FD006 Fire 28,500 TO South Royalton, VT 05068 FRNT 150.00 DPTH 205.00 ACRES 0.95 EAST-0691184 NRTH-1744404 DEED BOOK 4024 PG-65 FULL MARKET VALUE 28,500 ******************************************************************************************************* 122.19-1-9 ***************** Schroon River Rd 122.19-1-9 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 32,500 Roberts Cindy A Warrensburg Csd 524001 32,500 TOWN TAXABLE VALUE 32,500 408 Upper Sherman Ave Vac. 32,500 SCHOOL TAXABLE VALUE 32,500 Queensbury, NY 12804 8.-1-8.1 FD006 Fire 32,500 TO ACRES 7.74 EAST-0691242 NRTH-1745270 DEED BOOK 3477 PG-45 FULL MARKET VALUE 32,500 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 10 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-1 ******************* 15 Lake Dr 137.-2-1 210 1 Family Res - WTRFNT STAR EN 41834 0 0 62,200 Burke Milton T Sr North Warren Cs 522402 185,600 COUNTY TAXABLE VALUE 269,200 15 Lake Dr Res. 269,200 TOWN TAXABLE VALUE 269,200 Chestertown, NY 12817 6.-1-4.1 SCHOOL TAXABLE VALUE 207,000 ACRES 3.52 FD006 Fire 269,200 TO EAST-0678684 NRTH-1738021 DEED BOOK 3486 PG-285 FULL MARKET VALUE 269,200 ******************************************************************************************************* 137.-2-4.1 ***************** Pucker St 137.-2-4.1 322 Rural vac>10 COUNTY TAXABLE VALUE 27,600 Pavlik Martin North Warren Cs 522402 27,600 TOWN TAXABLE VALUE 27,600 172 Red Robin Rd Vac 27,600 SCHOOL TAXABLE VALUE 27,600 Naugatuck, CT 06770 7.-1-9.31 FD006 Fire 27,600 TO FRNT 385.13 DPTH ACRES 12.13 EAST-0682762 NRTH-1739136 DEED BOOK 1229 PG-205 FULL MARKET VALUE 27,600 ******************************************************************************************************* 137.-2-4.2 ***************** Pucker St 137.-2-4.2 314 Rural vac<10 COUNTY TAXABLE VALUE 21,800 Pavlik Martin North Warren Cs 522402 21,800 TOWN TAXABLE VALUE 21,800 172 Red Robin Rd Vac 21,800 SCHOOL TAXABLE VALUE 21,800 Naugatuck, CT 06770 7.-1-9.32 FD006 Fire 21,800 TO ACRES 7.51 EAST-0682845 NRTH-1738867 DEED BOOK 1229 PG-205 FULL MARKET VALUE 21,800 ******************************************************************************************************* 137.-2-4.3 ***************** Pucker St 137.-2-4.3 314 Rural vac<10 COUNTY TAXABLE VALUE 21,800 Pavlik Martin North Warren Cs 522402 21,800 TOWN TAXABLE VALUE 21,800 172 Red Robin Rd Vac 21,800 SCHOOL TAXABLE VALUE 21,800 Naugatuck, CT 06770 7.-1-9.33 FD006 Fire 21,800 TO ACRES 7.51 EAST-0682956 NRTH-1738651 DEED BOOK 1229 PG-205 FULL MARKET VALUE 21,800 ******************************************************************************************************* 137.-2-4.4 ***************** Pucker St 137.-2-4.4 314 Rural vac<10 COUNTY TAXABLE VALUE 21,800 Pavlik Martin North Warren Cs 522402 21,800 TOWN TAXABLE VALUE 21,800 172 Red Robin Rd Vac 21,800 SCHOOL TAXABLE VALUE 21,800 Naugatuck, CT 06770 7.-1-9.34 FD006 Fire 21,800 TO ACRES 7.50 EAST-0683073 NRTH-1738426 DEED BOOK 1229 PG-205 FULL MARKET VALUE 21,800 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 11 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-5 ******************* Off Pucker St 137.-2-5 323 Vacant rural COUNTY TAXABLE VALUE 7,400 Bruce Bethany A North Warren Cs 522402 7,400 TOWN TAXABLE VALUE 7,400 6 Pasco Ave Vac. 7,400 SCHOOL TAXABLE VALUE 7,400 Warrensburg, NY 12885 7.-1-10 FD006 Fire 7,400 TO ACRES 1.46 EAST-0683755 NRTH-1739772 DEED BOOK 1238 PG-54 FULL MARKET VALUE 7,400 ******************************************************************************************************* 137.-2-6 ******************* 824 Pucker St 137.-2-6 210 1 Family Res COM VET/C 41132 26,500 0 0 Phillips George W North Warren Cs 522402 45,900 COM VET/T 41133 0 26,500 0 824 Pucker St Cabin no electric 106,000 AGED T 41803 0 31,800 0 PO Box 359 7.-1-9.1 AGED C&S 41805 39,750 0 53,000 Chestertown, NY 12817 ACRES 23.38 STAR EN 41834 0 0 53,000 EAST-0684054 NRTH-1739080 COUNTY TAXABLE VALUE 39,750 DEED BOOK 869 PG-295 TOWN TAXABLE VALUE 47,700 FULL MARKET VALUE 106,000 SCHOOL TAXABLE VALUE 0 FD006 Fire 106,000 TO ******************************************************************************************************* 137.-2-7 ******************* 813 Pucker St 137.-2-7 260 Seasonal res COUNTY TAXABLE VALUE 97,300 Joule Erik North Warren Cs 522402 30,700 TOWN TAXABLE VALUE 97,300 Joule Roseann Log Cabin 97,300 SCHOOL TAXABLE VALUE 97,300 950 67th St 7.-1-9.2 FD006 Fire 97,300 TO Brooklyn, NY 11219 ACRES 8.77 EAST-0683222 NRTH-1738173 DEED BOOK 3556 PG-42 FULL MARKET VALUE 97,300 ******************************************************************************************************* 137.-2-8 ******************* Pucker St 137.-2-8 314 Rural vac<10 COUNTY TAXABLE VALUE 16,800 Forde John M Warrensburg Csd 524001 16,800 TOWN TAXABLE VALUE 16,800 39 Hemlock Ln Vac. 16,800 SCHOOL TAXABLE VALUE 16,800 Bay Shore, NY 11706 12.-1-19.2 FD006 Fire 16,800 TO ACRES 4.60 EAST-0684189 NRTH-1738499 DEED BOOK 659 PG-200 FULL MARKET VALUE 16,800 ******************************************************************************************************* 137.-2-9 ******************* Pucker St 137.-2-9 322 Rural vac>10 COUNTY TAXABLE VALUE 25,800 McPhee Giselle,Dari & Tony North Warren Cs 522402 25,800 TOWN TAXABLE VALUE 25,800 33 Long Acre Ln Vac. 25,800 SCHOOL TAXABLE VALUE 25,800 Dix Hills, NY 11746 12.-1-3.2 FD006 Fire 25,800 TO ACRES 10.30 EAST-0683427 NRTH-1737850 DEED BOOK 1479 PG-116 FULL MARKET VALUE 25,800 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 12 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-10 ****************** Pucker St 137.-2-10 312 Vac w/imprv COUNTY TAXABLE VALUE 24,700 Hill Bernard Warrensburg Csd 524001 24,300 TOWN TAXABLE VALUE 24,700 Attn: Robert James Hill Shed 24,700 SCHOOL TAXABLE VALUE 24,700 PO Box 375 12.-1-19.1 FD006 Fire 24,700 TO Brant Lake, NY 12815 ACRES 12.44 EAST-0684385 NRTH-1738333 DEED BOOK 912 PG-253 FULL MARKET VALUE 24,700 ******************************************************************************************************* 137.-2-11 ****************** Pucker St 137.-2-11 311 Res vac land COUNTY TAXABLE VALUE 16,900 Messina Daniel North Warren Cs 522402 16,900 TOWN TAXABLE VALUE 16,900 139 Halsey Manor Rd Vac. 16,900 SCHOOL TAXABLE VALUE 16,900 Manorville, NY 11949 12.-1-3.1 FD006 Fire 16,900 TO ACRES 9.87 EAST-0683769 NRTH-1737475 DEED BOOK 2984 PG-70 FULL MARKET VALUE 16,900 ******************************************************************************************************* 137.-2-12 ****************** 815 Pucker St 137.-2-12 312 Vac w/imprv COUNTY TAXABLE VALUE 12,500 Moffitt James North Warren Cs 522402 10,500 TOWN TAXABLE VALUE 12,500 Moffitt Laura 12.-1-18.2 12,500 SCHOOL TAXABLE VALUE 12,500 36 Vern Tennyson Rd ACRES 2.49 FD006 Fire 12,500 TO Chestertown, NY 12817 EAST-0684961 NRTH-1736674 DEED BOOK 3918 PG-219 FULL MARKET VALUE 12,500 ******************************************************************************************************* 137.-2-13 ****************** 757 Pucker St 137.-2-13 270 Mfg housing COUNTY TAXABLE VALUE 54,000 Hill Bernard North Warren Cs 522402 50,700 TOWN TAXABLE VALUE 54,000 Robert James Older Single Wide 54,000 SCHOOL TAXABLE VALUE 54,000 PO Box 375 12.-1-18.1 FD006 Fire 54,000 TO Brant Lake, NY 12815 ACRES 29.04 EAST-0684414 NRTH-1736782 DEED BOOK 912 PG-253 FULL MARKET VALUE 54,000 ******************************************************************************************************* 137.-2-14 ****************** Off Pucker St 137.-2-14 910 Priv forest COUNTY TAXABLE VALUE 50,000 Denton Clara North Warren Cs 522402 50,000 TOWN TAXABLE VALUE 50,000 Denton Larry Wood Lot 50,000 SCHOOL TAXABLE VALUE 50,000 28 Darrowsville Rd 12.-1-2.1 FD006 Fire 50,000 TO Chestertown, NY 12817 ACRES 47.47 EAST-0683620 NRTH-1736104 DEED BOOK 662 PG-319 FULL MARKET VALUE 50,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 13 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-15 ****************** Off Pucker St 137.-2-15 322 Rural vac>10 COUNTY TAXABLE VALUE 60,500 Moffitt Robert North Warren Cs 522402 60,500 TOWN TAXABLE VALUE 60,500 Moffitt Helen Vac. 60,500 SCHOOL TAXABLE VALUE 60,500 89 Rob Moffitt Rd 12.-1-1.1 FD006 Fire 60,500 TO Chestertown, NY 12817 ACRES 60.00 EAST-0682510 NRTH-1735187 DEED BOOK 335 PG-158 FULL MARKET VALUE 60,500 ******************************************************************************************************* 137.-2-17.1 **************** Green Mansions Rd 137.-2-17.1 311 Res vac land COUNTY TAXABLE VALUE 45,800 Becher Cynthia North Warren Cs 522402 45,800 TOWN TAXABLE VALUE 45,800 9 East Pl Vac 45,800 SCHOOL TAXABLE VALUE 45,800 Suffern, NY 10901 12.-2-1 FD006 Fire 45,800 TO FRNT 213.24 DPTH ACRES 2.80 EAST-0681322 NRTH-1735728 DEED BOOK 1477 PG-29 FULL MARKET VALUE 45,800 ******************************************************************************************************* 137.-2-17.2 **************** 102 Balsam Crest Rd 137.-2-17.2 210 1 Family Res COUNTY TAXABLE VALUE 260,000 McKinnon Murdoch William IV North Warren Cs 522402 58,900 TOWN TAXABLE VALUE 260,000 McKinnon Christina Residence 260,000 SCHOOL TAXABLE VALUE 260,000 7 Fieldcrest Ct Log Style Chalet W/O bsm FD006 Fire 260,000 TO Bayville, NJ 08721 12.-2-2 ACRES 2.78 EAST-0681581 NRTH-1735852 DEED BOOK 1477 PG-33 FULL MARKET VALUE 260,000 ******************************************************************************************************* 137.-2-17.3 **************** Green Mansions Rd 137.-2-17.3 311 Res vac land COUNTY TAXABLE VALUE 60,700 Lane Garrett North Warren Cs 522402 60,700 TOWN TAXABLE VALUE 60,700 Lane Marklyn Vac 60,700 SCHOOL TAXABLE VALUE 60,700 112 Green Mansions Rd 26C 12.-2-3 FD006 Fire 60,700 TO Chestertown, NY 12817 ACRES 6.15 EAST-0681840 NRTH-1736047 DEED BOOK 1481 PG-311 FULL MARKET VALUE 60,700 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 14 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-17.4 **************** Green Mansions Rd 137.-2-17.4 311 Res vac land COUNTY TAXABLE VALUE 69,700 Draffen Steven & Sally North Warren Cs 522402 69,700 TOWN TAXABLE VALUE 69,700 Murcott Robert & Sherry Vac 69,700 SCHOOL TAXABLE VALUE 69,700 228 Porter St 12.-2-4 FD006 Fire 69,700 TO Easton, PA 18042 ACRES 13.22 EAST-0682674 NRTH-1736514 DEED BOOK 1479 PG-53 FULL MARKET VALUE 69,700 ******************************************************************************************************* 137.-2-17.5 **************** Green Mansions Rd 137.-2-17.5 311 Res vac land COUNTY TAXABLE VALUE 77,900 Kim Yong Sook Hahn North Warren Cs 522402 77,900 TOWN TAXABLE VALUE 77,900 Kim Myung H Vac 77,900 SCHOOL TAXABLE VALUE 77,900 14 Cobble Hill Rd 12.-2-5 FD006 Fire 77,900 TO Loudonville, NY 12211 ACRES 21.39 EAST-0682548 NRTH-1737102 DEED BOOK 942 PG-25 FULL MARKET VALUE 77,900 ******************************************************************************************************* 137.-2-17.6 **************** Green Mansions Rd 137.-2-17.6 311 Res vac land COUNTY TAXABLE VALUE 88,600 Stoecker Henry & Terri North Warren Cs 522402 88,600 TOWN TAXABLE VALUE 88,600 7111 South Flagler Dr Vac 88,600 SCHOOL TAXABLE VALUE 88,600 West Palm Beach, FL 33405 12.-2-6 FD006 Fire 88,600 TO ACRES 32.11 EAST-0682091 NRTH-1737550 DEED BOOK 1479 PG-61 FULL MARKET VALUE 88,600 ******************************************************************************************************* 137.-2-17.7 **************** Green Mansions Rd 137.-2-17.7 311 Res vac land COUNTY TAXABLE VALUE 60,300 Berzon Howard A North Warren Cs 522402 60,300 TOWN TAXABLE VALUE 60,300 Klein Rhona Vac 60,300 SCHOOL TAXABLE VALUE 60,300 15 Ridings Way 12.-2-7 FD006 Fire 60,300 TO Chadds Ford, PA 19317 ACRES 5.85 EAST-0681314 NRTH-1737331 DEED BOOK 1477 PG-33 FULL MARKET VALUE 60,300 ******************************************************************************************************* 137.-2-17.8 **************** Green Mansions Rd 137.-2-17.8 311 Res vac land COUNTY TAXABLE VALUE 61,900 Molinary Charles T North Warren Cs 522402 61,900 TOWN TAXABLE VALUE 61,900 Molinary Eleanor Vac 61,900 SCHOOL TAXABLE VALUE 61,900 29 Wellington Dr 12.-2-8 FD006 Fire 61,900 TO Basking Ridge, NJ 07920 ACRES 6.95 EAST-0681020 NRTH-1737118 DEED BOOK 1485 PG-141 FULL MARKET VALUE 61,900 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 15 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-17.9 **************** Green Mansions Rd 137.-2-17.9 311 Res vac land COUNTY TAXABLE VALUE 69,000 Juliano Rev. Liv. Trust Peter, North Warren Cs 522402 69,000 TOWN TAXABLE VALUE 69,000 Juliano Rev. Liv. Trust Sara, Vac 69,000 SCHOOL TAXABLE VALUE 69,000 5210 W Desert Poppy Ln 12.-2-9 FD006 Fire 69,000 TO Marana, AZ 85658 FRNT 125.00 DPTH ACRES 12.47 EAST-0680891 NRTH-1736794 DEED BOOK 4302 PG-279 FULL MARKET VALUE 69,000 ******************************************************************************************************* 137.-2-17.10 *************** 105 Balsam Crest Rd 137.-2-17.10 240 Rural res COUNTY TAXABLE VALUE 224,200 Levine Jeffrey North Warren Cs 522402 96,300 TOWN TAXABLE VALUE 224,200 Levine Barbara Residence 224,200 SCHOOL TAXABLE VALUE 224,200 2544 W Pumpkin Ridge 12.-2-10 FD006 Fire 224,200 TO Anthem, AZ 85086 ACRES 4.25 EAST-0681361 NRTH-1736319 DEED BOOK 1002 PG-44 FULL MARKET VALUE 224,200 ******************************************************************************************************* 137.-2-17.11 *************** 93 Balsam Crest Rd 137.-2-17.11 210 1 Family Res COUNTY TAXABLE VALUE 249,600 Sardoni Frank R Jr North Warren Cs 522402 90,500 TOWN TAXABLE VALUE 249,600 422 Aynsley Ct Log Cabin Style 249,600 SCHOOL TAXABLE VALUE 249,600 Morganville, NJ 07751 Walk out Basement FD006 Fire 249,600 TO 12.-2-11 ACRES 3.09 EAST-0681086 NRTH-1736201 DEED BOOK 1421 PG-29 FULL MARKET VALUE 249,600 ******************************************************************************************************* 137.-2-19 ****************** 21 Evergreen Rd 137.-2-19 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 421,100 Echt Evelyne North Warren Cs 522402 189,100 TOWN TAXABLE VALUE 421,100 East Road Brunswick Hls Residence 421,100 SCHOOL TAXABLE VALUE 421,100 Troy, NY 12180 6.-1-5.9 FD006 Fire 421,100 TO ACRES 9.10 BANK 26 EAST-0679754 NRTH-1736778 DEED BOOK 1041 PG-68 FULL MARKET VALUE 421,100 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 16 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-20 ****************** 21 B Balsam Crest Rd 137.-2-20 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 266,500 Clarke William H North Warren Cs 522402 100,000 TOWN TAXABLE VALUE 266,500 Clarke Margaret P End Townhouse 266,500 SCHOOL TAXABLE VALUE 266,500 500 North Broadway 6.-8-1.1 FD006 Fire 266,500 TO Upper Nyack, NY 10960 ACRES 0.03 EAST-0680134 NRTH-1735742 DEED BOOK 889 PG-295 FULL MARKET VALUE 266,500 ******************************************************************************************************* 137.-2-21 ****************** 21 A Balsam Crest Rd 137.-2-21 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 266,500 Sheehy-Bulriss Kathleen M North Warren Cs 522402 100,000 TOWN TAXABLE VALUE 266,500 12355 Bayside Ct End Townhouse 266,500 SCHOOL TAXABLE VALUE 266,500 Indianapolis, IN 42656 6.-8-1.2 FD006 Fire 266,500 TO ACRES 0.04 EAST-0680147 NRTH-1735780 DEED BOOK 1466 PG-215 FULL MARKET VALUE 266,500 ******************************************************************************************************* 137.-2-22 ****************** 22 D Balsam Crest Ct 137.-2-22 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 215,000 O'keefe Joan (Life Est) C North Warren Cs 522402 50,000 TOWN TAXABLE VALUE 215,000 O'keefe Thomas D End Townhouse 215,000 SCHOOL TAXABLE VALUE 215,000 4007 Deer Path 6.-8-3.1 FD006 Fire 215,000 TO Poughkeepsie, NY 12603 ACRES 0.03 BANK 82 EAST-0680564 NRTH-1736221 DEED BOOK 1225 PG-245 FULL MARKET VALUE 215,000 ******************************************************************************************************* 137.-2-23 ****************** 22 C Balsam Crest Ct 137.-2-23 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 183,500 Vellutino Frank North Warren Cs 522402 30,000 TOWN TAXABLE VALUE 183,500 Vellutino Joyce Attached Townhouse 183,500 SCHOOL TAXABLE VALUE 183,500 1203 Oakleaf Hl 6.-8-3.2 FD006 Fire 183,500 TO Schenectady, NY 12303 ACRES 0.02 EAST-0680554 NRTH-1736246 DEED BOOK 908 PG-113 FULL MARKET VALUE 183,500 ******************************************************************************************************* 137.-2-24 ****************** 22 B Balsam Crest Ct 137.-2-24 210 1 Family Res - ASSOC STAR B 41854 0 0 30,000 VanBuren Richard North Warren Cs 522402 30,000 COUNTY TAXABLE VALUE 183,500 VanBuren Beverly Attached Townhouse 183,500 TOWN TAXABLE VALUE 183,500 22-B Balsam Crst Ct 6.-8-3.3 SCHOOL TAXABLE VALUE 153,500 Chestertown, NY 12817 ACRES 0.02 BANK 137 FD006 Fire 183,500 TO EAST-0680547 NRTH-1736263 DEED BOOK 1363 PG-292 FULL MARKET VALUE 183,500 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 17 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-25 ****************** 22 A Balsam Crest Ct 137.-2-25 210 1 Family Res - ASSOC STAR EN 41834 0 0 62,200 Klein Florence North Warren Cs 522402 50,000 COUNTY TAXABLE VALUE 217,500 22 A Balsam Crest Ct End Townhouse 217,500 TOWN TAXABLE VALUE 217,500 Chestertown, NY 12817 6.-8-3.4 SCHOOL TAXABLE VALUE 155,300 ACRES 0.04 FD006 Fire 217,500 TO EAST-0680537 NRTH-1736289 DEED BOOK 888 PG-298 FULL MARKET VALUE 217,500 ******************************************************************************************************* 137.-2-26 ****************** 23 B Balsam Crest Ct 137.-2-26 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 277,000 Stuto Peter F North Warren Cs 522402 100,000 TOWN TAXABLE VALUE 277,000 Stuto Diane D End Townhouse 277,000 SCHOOL TAXABLE VALUE 277,000 19 Newell Ct 6.-8-2.1 FD006 Fire 277,000 TO Menands, NY 12204 ACRES 0.03 EAST-0680638 NRTH-1736096 DEED BOOK 3520 PG-86 FULL MARKET VALUE 277,000 ******************************************************************************************************* 137.-2-27 ****************** 23 A Balsam Crest Ct 137.-2-27 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 277,000 Barry Kevin B North Warren Cs 522402 100,000 TOWN TAXABLE VALUE 277,000 Barry Lorraine J End Townhouse 277,000 SCHOOL TAXABLE VALUE 277,000 186 Pennsylvania Ave 6.-8-2.2 FD006 Fire 277,000 TO Freeport, NY 11520 ACRES 0.03 EAST-0680638 NRTH-1736147 DEED BOOK 1420 PG-244 FULL MARKET VALUE 277,000 ******************************************************************************************************* 137.-2-28 ****************** Green Mansions Rd 137.-2-28 591 Playground - WTRFNT COUNTY TAXABLE VALUE 0 Balsam Crest Homeowners Associ North Warren Cs 522402 0 TOWN TAXABLE VALUE 0 C/O CBH Business Services Balsam Crest Common Area 0 SCHOOL TAXABLE VALUE 0 119 Dix Ave common area FD006 Fire 0 TO Glens Falls, NY 12801 6.-8-10 ACRES 39.24 BANK 82 EAST-0680379 NRTH-1736100 DEED BOOK 3341 PG-78 FULL MARKET VALUE 0 ******************************************************************************************************* 137.-2-29.23 *************** 24 D Balsam Crest Path 137.-2-29.23 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 239,500 Dimeglio James North Warren Cs 522402 50,000 TOWN TAXABLE VALUE 239,500 Dimeglio Christine End Townhouse 239,500 SCHOOL TAXABLE VALUE 239,500 1018 Southern Dr ACRES 0.06 BANK 82 FD006 Fire 239,500 TO Franklin Square, NY 11010 EAST-0680670 NRTH-1735325 DEED BOOK 4407 PG-16 FULL MARKET VALUE 239,500 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 18 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-29.24 *************** 24 C Balsam Crest Path 137.-2-29.24 210 1 Family Res - ASSOC STAR EN 41834 0 0 62,200 Rives Meribeth V North Warren Cs 522402 30,000 COUNTY TAXABLE VALUE 202,000 24C Balsam Crest Path Attached Townhouse 202,000 TOWN TAXABLE VALUE 202,000 Chestertown, NY 12817 ACRES 0.03 BANK 82 SCHOOL TAXABLE VALUE 139,800 EAST-0680654 NRTH-1735300 FD006 Fire 202,000 TO DEED BOOK 1323 PG-142 FULL MARKET VALUE 202,000 ******************************************************************************************************* 137.-2-29.25 *************** 24 B Balsam Crest Path 137.-2-29.25 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 190,000 Ingrassia Anthony North Warren Cs 522402 30,000 TOWN TAXABLE VALUE 190,000 Ingrassia Shanon Attached Townhouse 190,000 SCHOOL TAXABLE VALUE 190,000 5 Van Alst Rd ACRES 0.03 FD006 Fire 190,000 TO Montgomery, NY 12549 EAST-0680644 NRTH-1735284 DEED BOOK 3976 PG-247 FULL MARKET VALUE 190,000 ******************************************************************************************************* 137.-2-29.26 *************** 24 A Balsam Crest Path 137.-2-29.26 210 1 Family Res - ASSOC COUNTY TAXABLE VALUE 237,000 Kay Arthur & Betty North Warren Cs 522402 50,000 TOWN TAXABLE VALUE 237,000 Kay Martin & Marilyn End Townhouse 237,000 SCHOOL TAXABLE VALUE 237,000 573 Warwick Ave ACRES 0.06 FD006 Fire 237,000 TO Teaneck, NJ 07666 EAST-0680629 NRTH-1735259 DEED BOOK 1339 PG-20 FULL MARKET VALUE 237,000 ******************************************************************************************************* 137.-2-31 ****************** Tripp Lake Rd 137.-2-31 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 150,000 Tripp Point LLC North Warren Cs 522402 150,000 TOWN TAXABLE VALUE 150,000 PO Box 717 New Subdivided Lot 7/09 150,000 SCHOOL TAXABLE VALUE 150,000 Chestertown, NY 12817 6.-1-4.2 FD006 Fire 150,000 TO ACRES 5.23 EAST-0678906 NRTH-1738020 DEED BOOK 3612 PG-1 FULL MARKET VALUE 150,000 ******************************************************************************************************* 137.-2-32 ****************** Tripp Lake Rd 137.-2-32 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 550,000 Lehv David G North Warren Cs 522402 186,000 TOWN TAXABLE VALUE 550,000 Lehv Hilary Z Residence & Garage 550,000 SCHOOL TAXABLE VALUE 550,000 6 Little John Pl New Construction 2011-12 FD006 Fire 550,000 TO White Plains, NY 10605 Original Parcel: 137.-2-2 ACRES 11.49 EAST-0679144 NRTH-1738087 DEED BOOK 4055 PG-73 FULL MARKET VALUE 550,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 19 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-33 ****************** Tripp Lake Rd 137.-2-33 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 150,000 Tripp Point LLC North Warren Cs 522402 150,000 TOWN TAXABLE VALUE 150,000 PO Box 717 New Subdivided Lot 7/09 150,000 SCHOOL TAXABLE VALUE 150,000 Chestertown, NY 12817 Original Parcel: 137.-2-2 FD006 Fire 150,000 TO ACRES 3.07 EAST-0678986 NRTH-1737369 FULL MARKET VALUE 150,000 ******************************************************************************************************* 137.-2-34 ****************** Tripp Lake Rd 137.-2-34 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 110,400 Sheehy-Bulriss Kathleen M. North Warren Cs 522402 110,400 TOWN TAXABLE VALUE 110,400 12355 Bayside Ct New Subdivided Lot 7/09 110,400 SCHOOL TAXABLE VALUE 110,400 Indianapolis, IN 46256 Original Parcel: 137.-2-2 FD006 Fire 110,400 TO ACRES 3.49 EAST-0678949 NRTH-1737194 DEED BOOK 4120 PG-63 FULL MARKET VALUE 110,400 ******************************************************************************************************* 137.-2-35 ****************** Tripp Lake Rd 137.-2-35 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 157,400 Doberman Yvonne North Warren Cs 522402 157,400 TOWN TAXABLE VALUE 157,400 Jetter Amy New Subdivided Lot 7/09 157,400 SCHOOL TAXABLE VALUE 157,400 3024 Williamsburg Dr Original Parcel: 137.-2-2 FD006 Fire 157,400 TO Schenectady, NY 12303 ACRES 6.49 EAST-0679187 NRTH-1737196 DEED BOOK 4256 PG-173 FULL MARKET VALUE 157,400 ******************************************************************************************************* 137.-2-36 ****************** Tripp Lake Rd 137.-2-36 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 150,000 Rugge John North Warren Cs 522402 150,000 TOWN TAXABLE VALUE 150,000 Palermo Victoria New Subdivided Lot 7/09 150,000 SCHOOL TAXABLE VALUE 150,000 44 Garrison Rd Original Parcel: 137.-2-2 FD006 Fire 150,000 TO Queensbury, NY 12804 ACRES 4.53 EAST-0679223 NRTH-1737067 DEED BOOK 4256 PG-181 FULL MARKET VALUE 150,000 ******************************************************************************************************* 137.-2-37 ****************** Tripp Lake Rd 137.-2-37 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 150,000 Chalson Barbara A North Warren Cs 522402 150,000 TOWN TAXABLE VALUE 150,000 14827 Leopard Creek Pl New Subdivided Lot 7/09 150,000 SCHOOL TAXABLE VALUE 150,000 Lakewood Ranch, FL 34202 Original Parcel: 137.-2-2 FD006 Fire 150,000 TO ACRES 3.53 EAST-0679383 NRTH-1737030 DEED BOOK 4256 PG-189 FULL MARKET VALUE 150,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 20 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.-2-38 ****************** Tripp Lake Rd 137.-2-38 314 Rural vac<10 - WTRFNT COUNTY TAXABLE VALUE 150,000 Tripp Point LLC North Warren Cs 522402 150,000 TOWN TAXABLE VALUE 150,000 PO Box 717 New Subdivided Lot 7/09 150,000 SCHOOL TAXABLE VALUE 150,000 Chestertown, NY 12817 Original Parcel: 137.-2-2 FD006 Fire 150,000 TO ACRES 5.08 EAST-0679529 NRTH-1736919 FULL MARKET VALUE 150,000 ******************************************************************************************************* 137.-2-39 ****************** Tripp Lake Rd 137.-2-39 911 Forest s480 FISHER ACT 47450 12,582 12,582 12,582 Tripp Point LLC North Warren Cs 522402 69,900 COUNTY TAXABLE VALUE 57,318 PO Box 717 New Subdivided Lot 7/09 69,900 TOWN TAXABLE VALUE 57,318 Chestertown, NY 12817 Fisher Act Exemption Appl SCHOOL TAXABLE VALUE 57,318 ACRES 43.20 FD006 Fire 69,900 TO EAST-0680693 NRTH-1737893 FULL MARKET VALUE 69,900 ******************************************************************************************************* 137.-2-40 ****************** Tripp Lake Rd 137.-2-40 911 Forest s480 FISHER ACT 47450 14,670 14,670 14,670 Tripp Point LLC North Warren Cs 522402 81,500 COUNTY TAXABLE VALUE 66,830 PO Box 717 New Subdivided Lot 7/09 81,500 TOWN TAXABLE VALUE 66,830 Chestertown, NY 12817 Fisher Act Exemption Appl SCHOOL TAXABLE VALUE 66,830 ACRES 63.91 FD006 Fire 81,500 TO EAST-0680775 NRTH-1738999 FULL MARKET VALUE 81,500 ******************************************************************************************************* 137.-2-41 ****************** Tripp Lake Rd 137.-2-41 911 Forest s480 FISHER ACT 47450 12,924 12,924 12,924 Tripp Point LLC North Warren Cs 522402 71,800 COUNTY TAXABLE VALUE 58,876 PO Box 717 New Subdivided Lot 7/09 71,800 TOWN TAXABLE VALUE 58,876 Chestertown, NY 12817 Fisher Act Exemption Appl SCHOOL TAXABLE VALUE 58,876 ACRES 46.34 FD006 Fire 71,800 TO EAST-0679612 NRTH-1739198 FULL MARKET VALUE 71,800 ******************************************************************************************************* 137.-2-42 ****************** Pucker St 137.-2-42 911 Forest s480 FISHER ACT 47450 15,102 15,102 15,102 Tripp Point LLC North Warren Cs 522402 83,900 COUNTY TAXABLE VALUE 68,798 PO Box 717 New Subdivided Lot 7/09 83,900 TOWN TAXABLE VALUE 68,798 Chestertown, NY 12817 Fisher Act Exemption Tran SCHOOL TAXABLE VALUE 68,798 ACRES 106.82 FD006 Fire 83,900 TO EAST-0682140 NRTH-1740338 FULL MARKET VALUE 83,900 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 21 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.15-2-1 ***************** Tripp Lake Rd 137.15-2-1 314 Rural vac<10 COUNTY TAXABLE VALUE 35,400 Klaritch Thomas M North Warren Cs 522402 35,400 TOWN TAXABLE VALUE 35,400 1255 Morning Glory Ct Vac 35,400 SCHOOL TAXABLE VALUE 35,400 Brentwood, TN 37027 5.-1-20 FD006 Fire 35,400 TO ACRES 1.07 EAST-0678507 NRTH-1738967 DEED BOOK 1435 PG-37 FULL MARKET VALUE 35,400 ******************************************************************************************************* 137.15-2-2 ***************** 47 Grove St 137.15-2-2 240 Rural res COUNTY TAXABLE VALUE 290,100 Purcell Thomas I North Warren Cs 522402 82,800 TOWN TAXABLE VALUE 290,100 Purcell Clare C Residence 290,100 SCHOOL TAXABLE VALUE 290,100 60 Acre View Dr 5.-1-9.3 FD006 Fire 290,100 TO Stamford, CT 06903 ACRES 1.55 EAST-0678474 NRTH-1738752 DEED BOOK 1454 PG-159 FULL MARKET VALUE 290,100 ******************************************************************************************************* 137.15-2-3 ***************** 53 Grove St 137.15-2-3 210 1 Family Res COUNTY TAXABLE VALUE 203,100 Dorn Adam D North Warren Cs 522402 57,600 TOWN TAXABLE VALUE 203,100 Dorn Suzanne L Res. 203,100 SCHOOL TAXABLE VALUE 203,100 21 Bethea Dr 5.-1-9.2 FD006 Fire 203,100 TO Osining, NY 10562 FRNT 73.00 DPTH 270.00 ACRES 0.72 BANK 82 EAST-0678426 NRTH-1738565 DEED BOOK 1438 PG-167 FULL MARKET VALUE 203,100 ******************************************************************************************************* 137.15-2-4 ***************** 11 Mountain Ln 137.15-2-4 210 1 Family Res COUNTY TAXABLE VALUE 251,000 Philippone Deborah A North Warren Cs 522402 44,400 TOWN TAXABLE VALUE 251,000 36 Long Park Dr Res. 251,000 SCHOOL TAXABLE VALUE 251,000 Rochester, NY 14612 5.-1-10 FD006 Fire 251,000 TO FRNT 91.00 DPTH 159.00 ACRES 0.37 BANK 17 EAST-0678460 NRTH-1738428 DEED BOOK 1267 PG-134 FULL MARKET VALUE 251,000 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 22 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.15-2-5 ***************** Mountain Ln 137.15-2-5 311 Res vac land COUNTY TAXABLE VALUE 26,600 Philippone Deborah A North Warren Cs 522402 26,600 TOWN TAXABLE VALUE 26,600 Philippone James J Vac. 26,600 SCHOOL TAXABLE VALUE 26,600 36 Long Park Dr 5.-1-11 FD006 Fire 26,600 TO Rochester, NY 14612 FRNT 104.00 DPTH 170.00 ACRES 0.38 EAST-0678356 NRTH-1738459 DEED BOOK 4189 PG-43 FULL MARKET VALUE 26,600 ******************************************************************************************************* 137.15-2-6 ***************** 5 Mountain Ln 137.15-2-6 210 1 Family Res COUNTY TAXABLE VALUE 170,500 Hohn Linda L North Warren Cs 522402 48,000 TOWN TAXABLE VALUE 170,500 106 Brockley Dr Res. 170,500 SCHOOL TAXABLE VALUE 170,500 Delmar, NY 12054 5.-1-12 FD006 Fire 170,500 TO FRNT 78.00 DPTH 175.00 ACRES 0.40 EAST-0678251 NRTH-1738461 DEED BOOK 1472 PG-220 FULL MARKET VALUE 170,500 ******************************************************************************************************* 137.15-2-7 ***************** 30 Park Ln 137.15-2-7 210 1 Family Res COUNTY TAXABLE VALUE 185,800 Hall Revocable Trust Howard North Warren Cs 522402 43,200 TOWN TAXABLE VALUE 185,800 Hall Arosa Res.& Gar. 185,800 SCHOOL TAXABLE VALUE 185,800 108 Penny Creek Dr 5.-1-13 FD006 Fire 185,800 TO Bluffton, SC 29909 FRNT 144.00 DPTH 160.00 ACRES 0.36 EAST-0678161 NRTH-1738423 DEED BOOK 1486 PG-284 FULL MARKET VALUE 185,800 ******************************************************************************************************* 137.15-2-8 ***************** Lake Dr 137.15-2-8 591 Playground COUNTY TAXABLE VALUE 0 Jovic Development Inc North Warren Cs 522402 0 TOWN TAXABLE VALUE 0 PO Box 717 Common Beach 0 SCHOOL TAXABLE VALUE 0 Chestertown, NY 12817 Easement FD006 Fire 0 TO 5.-1-9.1 FRNT 678.00 DPTH 165.00 ACRES 0.99 BANK 82 EAST-0678318 NRTH-1738246 FULL MARKET VALUE 0 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 23 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.15-2-9 ***************** 6 Park Ln 137.15-2-9 210 1 Family Res STAR B 41854 0 0 30,000 Bernat James North Warren Cs 522402 32,000 COUNTY TAXABLE VALUE 179,000 Bernat Dina Res. 179,000 TOWN TAXABLE VALUE 179,000 6 Park Ln 5.-1-8.2 SCHOOL TAXABLE VALUE 149,000 Chestertown, NY 12817 FRNT 85.00 DPTH 110.00 FD006 Fire 179,000 TO ACRES 0.20 BANK 82 EAST-0678080 NRTH-1737906 DEED BOOK 954 PG-309 FULL MARKET VALUE 179,000 ******************************************************************************************************* 137.15-2-11 **************** 276 Tripp Lake Rd 137.15-2-11 210 1 Family Res COUNTY TAXABLE VALUE 255,000 Schulz Barbara J North Warren Cs 522402 145,600 TOWN TAXABLE VALUE 255,000 Facemire Victoria Lee Schulz Residence 255,000 SCHOOL TAXABLE VALUE 255,000 PO Box 1502 5.-1-6 FD006 Fire 255,000 TO Oneco, FL 34264 FRNT 249.28 DPTH 186.00 ACRES 0.91 BANK 102 EAST-0678096 NRTH-1738090 DEED BOOK 97 PG-133 FULL MARKET VALUE 255,000 ******************************************************************************************************* 137.15-2-13 **************** Tripp Lake Rd 137.15-2-13 311 Res vac land COUNTY TAXABLE VALUE 18,900 The Annig A Agopian Revocabl T North Warren Cs 522402 18,900 TOWN TAXABLE VALUE 18,900 1455 SW Silver Pine Way Vac. 18,900 SCHOOL TAXABLE VALUE 18,900 Palm City, FL 34990 5.-1-4 FD006 Fire 18,900 TO FRNT 76.00 DPTH 161.00 ACRES 0.27 EAST-0678065 NRTH-1738245 DEED BOOK 1256 PG-96 FULL MARKET VALUE 18,900 ******************************************************************************************************* 137.15-2-14 **************** 282 Darrowsville Rd 137.15-2-14 210 1 Family Res STAR B 41854 0 0 30,000 Morelli Albert J North Warren Cs 522402 32,400 COUNTY TAXABLE VALUE 180,800 Morelli Elizabeth J Residence & Garage 180,800 TOWN TAXABLE VALUE 180,800 282 Darrowsville Rd 5.-1-3 SCHOOL TAXABLE VALUE 150,800 Chestertown, NY 12817 FRNT 75.00 DPTH 156.00 FD006 Fire 180,800 TO ACRES 0.27 BANK 167 EAST-0678035 NRTH-1738316 DEED BOOK 3225 PG-161 FULL MARKET VALUE 180,800 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 24 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.15-2-15 **************** 29 Park Ln 137.15-2-15 210 1 Family Res STAR B 41854 0 0 30,000 Wood Mechylle North Warren Cs 522402 21,600 COUNTY TAXABLE VALUE 160,000 29 Park Ln Residence 160,000 TOWN TAXABLE VALUE 160,000 Chestertown, NY 12817 5.-1-9.4 SCHOOL TAXABLE VALUE 130,000 FRNT 75.00 DPTH 164.00 FD006 Fire 160,000 TO ACRES 0.27 EAST-0678003 NRTH-1738385 DEED BOOK 1341 PG-250 FULL MARKET VALUE 160,000 ******************************************************************************************************* 137.15-2-16 **************** N Tripp Rd 137.15-2-16 311 Res vac land COUNTY TAXABLE VALUE 10,500 Smith Timothy J North Warren Cs 522402 10,500 TOWN TAXABLE VALUE 10,500 226 West 17th St Apt 2C Vac 10,500 SCHOOL TAXABLE VALUE 10,500 New York, NY 10011 5.-1-9.1 FD006 Fire 10,500 TO FRNT 76.00 DPTH 180.00 ACRES 0.30 EAST-0677977 NRTH-1738452 DEED BOOK 3138 PG-209 FULL MARKET VALUE 10,500 ******************************************************************************************************* 137.15-2-17 **************** 37 Park Ln 137.15-2-17 210 1 Family Res COUNTY TAXABLE VALUE 161,200 Smith Gregory North Warren Cs 522402 20,000 TOWN TAXABLE VALUE 161,200 Smith Loretta Residence 161,200 SCHOOL TAXABLE VALUE 161,200 14 Sterling Pl 5.-1-15 FD006 Fire 161,200 TO Blauvelt, NY 10913 FRNT 75.00 DPTH 180.00 ACRES 0.25 EAST-0677937 NRTH-1738519 FULL MARKET VALUE 161,200 ******************************************************************************************************* 137.15-2-18 **************** Tripp Lake Rd 137.15-2-18 311 Res vac land COUNTY TAXABLE VALUE 0 O`Dwyer Carole North Warren Cs 522402 0 TOWN TAXABLE VALUE 0 PO Box 605 5.-1-16 0 SCHOOL TAXABLE VALUE 0 Chestertown, NY 12817 FRNT 10.00 DPTH 34.00 FD006 Fire 0 TO ACRES 0.03 EAST-0677985 NRTH-1738585 DEED BOOK 3584 PG-243 FULL MARKET VALUE 0 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 25 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.15-2-19 **************** 58 Grove St 137.15-2-19 210 1 Family Res COUNTY TAXABLE VALUE 225,000 Jones Frank North Warren Cs 522402 64,000 TOWN TAXABLE VALUE 225,000 Jones Patrice Residence 225,000 SCHOOL TAXABLE VALUE 225,000 10 Benedict Pl 5.-1-17 FD006 Fire 225,000 TO Huntington, NY 11743 FRNT 124.00 DPTH 122.00 ACRES 0.40 EAST-0678107 NRTH-1738602 FULL MARKET VALUE 225,000 ******************************************************************************************************* 137.15-2-20 **************** Tripp Lake Rd 137.15-2-20 311 Res vac land COUNTY TAXABLE VALUE 15,100 Jones Frank North Warren Cs 522402 15,100 TOWN TAXABLE VALUE 15,100 Jones Patrice Vac 15,100 SCHOOL TAXABLE VALUE 15,100 10 Benedict Pl 5.-1-18 FD006 Fire 15,100 TO Huntington, NY 11743 FRNT 251.00 DPTH 150.00 ACRES 0.43 EAST-0678202 NRTH-1738659 DEED BOOK 1215 PG-245 FULL MARKET VALUE 15,100 ******************************************************************************************************* 137.15-2-21 **************** Tripp Lake Rd 137.15-2-21 311 Res vac land COUNTY TAXABLE VALUE 0 Fowler Jesse North Warren Cs 522402 0 TOWN TAXABLE VALUE 0 Fowler Ann 5.-1-19 0 SCHOOL TAXABLE VALUE 0 4 Van Alst St FRNT 39.00 DPTH 116.00 FD006 Fire 0 TO New Paltz, NY 12561 ACRES 0.06 EAST-0678208 NRTH-1738758 DEED BOOK 1248 PG-170 FULL MARKET VALUE 0 ******************************************************************************************************* 137.15-2-22 **************** N Tripp Rd 137.15-2-22 311 Res vac land COUNTY TAXABLE VALUE 2,500 Jovic Development North Warren Cs 522402 2,500 TOWN TAXABLE VALUE 2,500 PO Box 717 Vac road 2,500 SCHOOL TAXABLE VALUE 2,500 Chestertown, NY 12817 FRNT 33.00 DPTH 514.00 FD006 Fire 2,500 TO ACRES 1.64 EAST-0678153 NRTH-1738305 FULL MARKET VALUE 2,500 ******************************************************************************************************* 137.18-1-1 ***************** 203 Tripp Lake Rd 137.18-1-1 552 Golf course COUNTY TAXABLE VALUE 673,100 Wanaroma Inc. North Warren Cs 522402 75,900 TOWN TAXABLE VALUE 673,100 Ronald Walker Pres Golf Course & 4 Buildings 673,100 SCHOOL TAXABLE VALUE 673,100 207 Darrowsville Dr 6.-1-2 FD006 Fire 673,100 TO Chestertown, NY 12817 FRNT 2930.00 DPTH ACRES 50.22 EAST-0677654 NRTH-1737274 DEED BOOK 1007 PG-289 FULL MARKET VALUE 673,100 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 26 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------COUNTY------TOWN------SCHOOL CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO. ******************************************************************************************************* 137.18-1-2 ***************** 268 Tripp Lake Rd 137.18-1-2 210 1 Family Res - WTRFNT COM VET/C 41132 60,000 0 0 Orluk William F North Warren Cs 522402 164,900 COM VET/T 41133 0 45,000 0 268 Darrowsville Rd Residence 403,500 STAR B 41854 0 0 30,000 Chestertown, NY 12817 4.-1-1 COUNTY TAXABLE VALUE 343,500 FRNT 320.00 DPTH 130.00 TOWN TAXABLE VALUE 358,500 ACRES 0.97 BANK 135 SCHOOL TAXABLE VALUE 373,500 EAST-0678129 NRTH-1737645 FD006 Fire 403,500 TO DEED BOOK 99999 PG-100 FULL MARKET VALUE 403,500 ******************************************************************************************************* 137.18-1-3 ***************** 258 Tripp Lake Rd 137.18-1-3 210 1 Family Res - WTRFNT STAR B 41854 0 0 30,000 Lamm Carl North Warren Cs 522402 90,100 COUNTY TAXABLE VALUE 258,600 Lamm Judith Residence 258,600 TOWN TAXABLE VALUE 258,600 PO Box 691 4.-1-2 SCHOOL TAXABLE VALUE 228,600 Chestertown, NY 12817 FRNT 150.00 DPTH 148.00 FD006 Fire 258,600 TO ACRES 0.53 BANK 139 EAST-0678175 NRTH-1737410 DEED BOOK 1015 PG-287 FULL MARKET VALUE 258,600 ******************************************************************************************************* 137.18-1-4 ***************** 276 Tripp Lake Rd 137.18-1-4 210 1 Family Res - WTRFNT COUNTY TAXABLE VALUE 244,900 Ptak Diane Snyder North Warren Cs 522402 107,100 TOWN TAXABLE VALUE 244,900 12 Tice Rd Residence 244,900 SCHOOL TAXABLE VALUE 244,900 Albany, NY 12203 4.-1-3.6 FD006 Fire 244,900 TO FRNT 150.00 DPTH 182.00 EAST-0678200 NRTH-1737267 DEED BOOK 2987 PG-29 FULL MARKET VALUE 244,900 ******************************************************************************************************* 137.18-1-5 ***************** 252 Tripp Lake Rd 137.18-1-5 210 1 Family Res - WTRFNT COM VET/C 41132 60,000 0 0 Brust Kenneth R North Warren Cs 522402 117,300 COM VET/T 41133 0 45,000 0 PO Box 512 Residence 352,500 STAR EN 41834 0 0 62,200 Chestertown, NY 12817 4.-1-3.1 COUNTY TAXABLE VALUE 292,500 FRNT 150.00 DPTH 220.00 TOWN TAXABLE VALUE 307,500 ACRES 0.69 SCHOOL TAXABLE VALUE 290,300 EAST-0678202 NRTH-1737128 FD006 Fire 352,500 TO DEED BOOK 1180 PG-46 FULL MARKET VALUE 352,500 ************************************************************************************************************************************ STATE OF NEW YORK 2 0 1 2 T E N T A T I V E A S S E S S M E N T R O L L PAGE 27 COUNTY - Warren T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011 TOWN - Warrensburg TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012 SWIS - 524000 UNIFORM PERCENT OF VALUE IS 100.00