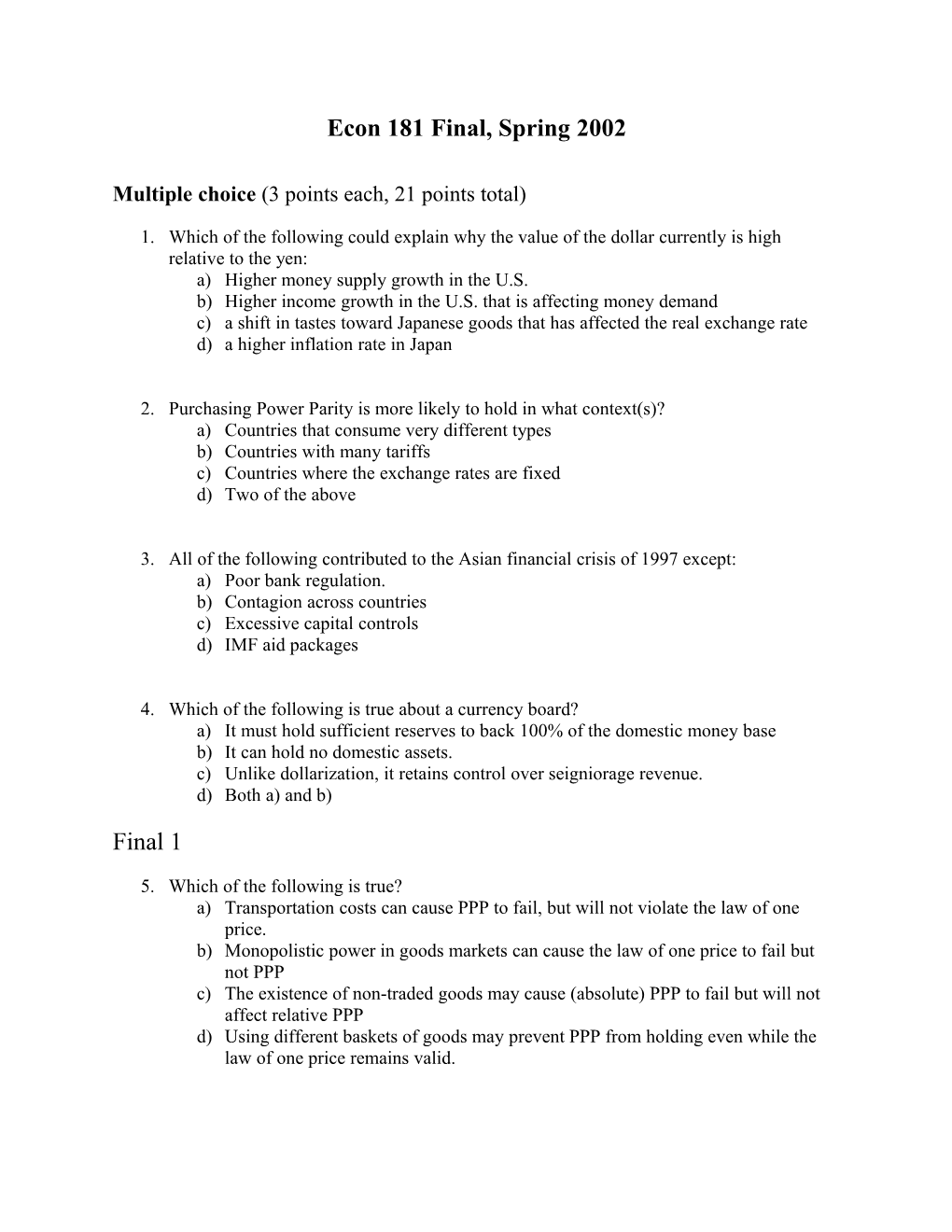

Econ 181 Final, Spring 2002

Multiple choice (3 points each, 21 points total)

1. Which of the following could explain why the value of the dollar currently is high relative to the yen: a) Higher money supply growth in the U.S. b) Higher income growth in the U.S. that is affecting money demand c) a shift in tastes toward Japanese goods that has affected the real exchange rate d) a higher inflation rate in Japan

2. Purchasing Power Parity is more likely to hold in what context(s)? a) Countries that consume very different types b) Countries with many tariffs c) Countries where the exchange rates are fixed d) Two of the above

3. All of the following contributed to the Asian financial crisis of 1997 except: a) Poor bank regulation. b) Contagion across countries c) Excessive capital controls d) IMF aid packages

4. Which of the following is true about a currency board? a) It must hold sufficient reserves to back 100% of the domestic money base b) It can hold no domestic assets. c) Unlike dollarization, it retains control over seigniorage revenue. d) Both a) and b)

Final 1

5. Which of the following is true? a) Transportation costs can cause PPP to fail, but will not violate the law of one price. b) Monopolistic power in goods markets can cause the law of one price to fail but not PPP c) The existence of non-traded goods may cause (absolute) PPP to fail but will not affect relative PPP d) Using different baskets of goods may prevent PPP from holding even while the law of one price remains valid. 6. The monetary approach to exchange rate determination a) applies best in the short run because money can only have real effects in the short run b) predicts the exchange rate well in normal cases, but is wildly inaccurate in hyperinflations c) assumes that national price levels are determined only by the nominal supply of money d) assumes that the real exchange rate never changes

7. Which of the following statements in regards to the European Monetary System are false? a) A major crisis was created in part because Germany prioritized internal goals over its obligations for the joint maintenance of its exchange rates b) Exchange rates were not strictly fixed but were permitted to vary between pre- assigned margins c) The French central bank’s inattention to its obligations led to its early exit from the system and was a portent of future strains that resulted in the eventual downfall of the system. d) The de-facto operation of the EMS can be traced in part to the German experience with hyperinflation during the interwar years.

b) exchange rates are sticky in the short run c) interest rates are sticky in the short run d) output is sticky in the short run.

Problems (65 points total)

1. (20 points) List and explain the various benefits and costs of allowing capital mobility in the international capital market. Make an argument for how these costs and benefits apply to the case of typical developing countries, and whether these countries should allow capital mobility or should restrict capital flows.

2. (20 points) List and explain the criteria for an optimal currency area. Discuss how this applies to Europe and the euro. What are some of the political issues that are involved here? What do you think will happen with the European Union in the future? Defend your view.

3. Suppose that Chile relies upon copper mining for most of its exports. Suppose further that there is a large discovery of copper in Brazil, and demand for Chilean copper falls. a) (9 points) Using the AA-DD-XX apparatus, what effects will this have on Chile’s output, exchange rate (peso/dollar) and the current account (rise, fall, no change, ambiguous)? (Assume the shock is temporary) Explain briefly.

b) (8 points) If Chile tries to use fiscal expansion (government purchases) to restore the initial value of output, how will the current account compare to its initial value before the foreign demand shock (higher, lower, same, ambiguous)?

c) (8 points) Alternatively, suppose that Chile uses monetary policy to engineer a currency depreciation and restore output to its former value. What will be the current account value relative to its initial value (higher, lower, same, ambiguous)?

Figures (64 points total)

1. Figure 14-9 (11 points) Explain how fiscal policies and monetary policies could be used to maintain full employment after a domestic money-demand increase. Describe the assumptions involved, and discuss how the various lines might shift and the meaning of points 1, 2, and 3.

2. Figure 16-6 (11 points) Describe what is going on here, after a permanent increase in the U.S. money supply. Discuss the relevant assumptions, describe the shifts (both immediate and over time) and their causes, and say what each of points 1, 2, 4, 1’, 2’, 3’, and 4’ mean.

3. Figure 17-1 (11 points)

4. Figure 19-5 (11 points)

5. Figures 19-A-1 and 19-A-2 (20 points)