An Example of a Dollar Cost Averaging Plan

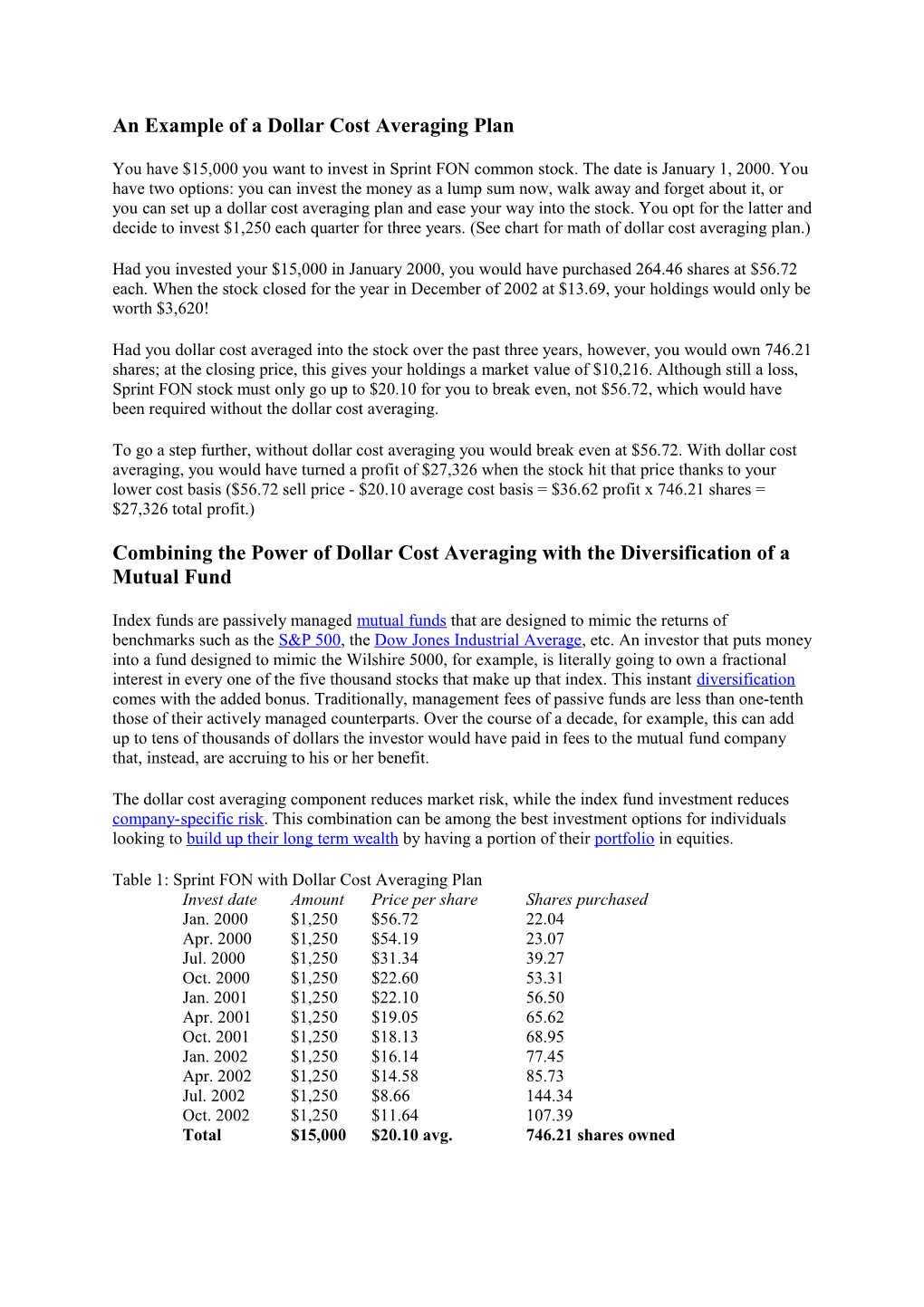

You have $15,000 you want to invest in Sprint FON common stock. The date is January 1, 2000. You have two options: you can invest the money as a lump sum now, walk away and forget about it, or you can set up a dollar cost averaging plan and ease your way into the stock. You opt for the latter and decide to invest $1,250 each quarter for three years. (See chart for math of dollar cost averaging plan.)

Had you invested your $15,000 in January 2000, you would have purchased 264.46 shares at $56.72 each. When the stock closed for the year in December of 2002 at $13.69, your holdings would only be worth $3,620!

Had you dollar cost averaged into the stock over the past three years, however, you would own 746.21 shares; at the closing price, this gives your holdings a market value of $10,216. Although still a loss, Sprint FON stock must only go up to $20.10 for you to break even, not $56.72, which would have been required without the dollar cost averaging.

To go a step further, without dollar cost averaging you would break even at $56.72. With dollar cost averaging, you would have turned a profit of $27,326 when the stock hit that price thanks to your lower cost basis ($56.72 sell price - $20.10 average cost basis = $36.62 profit x 746.21 shares = $27,326 total profit.)

Combining the Power of Dollar Cost Averaging with the Diversification of a Mutual Fund

Index funds are passively managed mutual funds that are designed to mimic the returns of benchmarks such as the S&P 500, the Dow Jones Industrial Average, etc. An investor that puts money into a fund designed to mimic the Wilshire 5000, for example, is literally going to own a fractional interest in every one of the five thousand stocks that make up that index. This instant diversification comes with the added bonus. Traditionally, management fees of passive funds are less than one-tenth those of their actively managed counterparts. Over the course of a decade, for example, this can add up to tens of thousands of dollars the investor would have paid in fees to the mutual fund company that, instead, are accruing to his or her benefit.

The dollar cost averaging component reduces market risk, while the index fund investment reduces company-specific risk. This combination can be among the best investment options for individuals looking to build up their long term wealth by having a portion of their portfolio in equities.

Table 1: Sprint FON with Dollar Cost Averaging Plan Invest date Amount Price per share Shares purchased Jan. 2000 $1,250 $56.72 22.04 Apr. 2000 $1,250 $54.19 23.07 Jul. 2000 $1,250 $31.34 39.27 Oct. 2000 $1,250 $22.60 53.31 Jan. 2001 $1,250 $22.10 56.50 Apr. 2001 $1,250 $19.05 65.62 Oct. 2001 $1,250 $18.13 68.95 Jan. 2002 $1,250 $16.14 77.45 Apr. 2002 $1,250 $14.58 85.73 Jul. 2002 $1,250 $8.66 144.34 Oct. 2002 $1,250 $11.64 107.39 Total $15,000 $20.10 avg. 746.21 shares owned