Understanding Import Export Procedure under GST

-CA Navya Malhotra [B. Com(H), ACA, DISA]

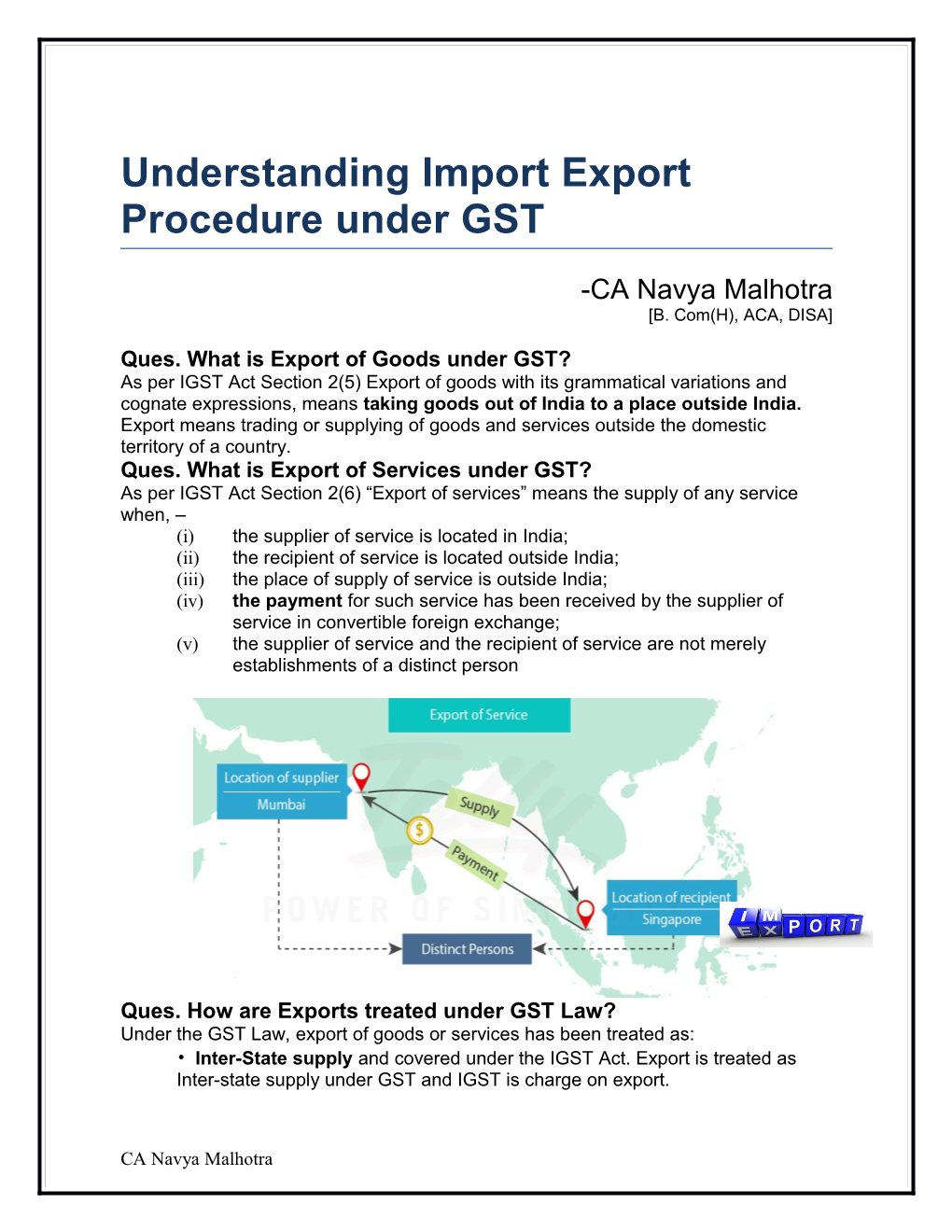

Ques. What is Export of Goods under GST? As per IGST Act Section 2(5) Export of goods with its grammatical variations and cognate expressions, means taking goods out of India to a place outside India. Export means trading or supplying of goods and services outside the domestic territory of a country. Ques. What is Export of Services under GST? As per IGST Act Section 2(6) “Export of services” means the supply of any service when, – (i) the supplier of service is located in India; (ii) the recipient of service is located outside India; (iii) the place of supply of service is outside India; (iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; (v) the supplier of service and the recipient of service are not merely establishments of a distinct person

Ques. How are Exports treated under GST Law? Under the GST Law, export of goods or services has been treated as: • Inter-State supply and covered under the IGST Act. Export is treated as Inter-state supply under GST and IGST is charge on export.

CA Navya Malhotra • ‘zero rated supply’ i.e. the goods or services exported shall be relieved of GST levied upon them either at the input stage or at the final product stage. GST will not be levied in any Kind of Exports of Goods or Services. Note: Zero rated supply means no tax would be payable on such supplies, the exporter will be eligible to claim the corresponding input tax credits. The input tax credits would be available to an exporter even if supplies were exempt supplies. The exporter may utilize such credits for discharge of other output taxes or alternatively, the exporter may claim a refund of such taxes. A guidance note relating was released by the Indian government which has helped in clearing doubts regarding the claim of input tax credit on zero-rated exports. An exporter dealing in zero-rated goods under GST can claim a refund for zero-rated supplies as per the following options: (a) He may export the services under a Letter of Undertaking, without payment of IGST and claim refund of unutilized input tax credit; or As per Rule 96A of CGST Rules (1) Any registered person availing the option to supply goods or services for export without payment of integrated tax shall furnish, prior to export, a bond or a Letter of Undertaking in FORM GST RFD-11 Bond and LUT Format to the jurisdictional Commissioner, binding himself to pay the tax due along with the interest specified under sub-section (1) of section 50 within a period of —

(a) fifteen days after the expiry of three months from the date of issue of the invoice for export, if the goods are not exported out of India; or

(b) fifteen days after the expiry of one year, or such further period as may be allowed by the Commissioner, from the date of issue of the invoice for export, if the payment of such services is not received by the exporter in convertible foreign exchange.

(2) The details of the export invoices contained in FORM GSTR-1 furnished on the common portal shall be electronically transmitted to the system designated by Customs and a confirmation that the goods covered by the said invoices have been exported out of India shall be electronically transmitted to the common portal from the said system.

(3) Where the goods are not exported within the time specified in sub-rule (1) and the registered person fails to pay the amount mentioned in the said sub-rule, the export as allowed under bond or Letter of Undertaking shall be withdrawn forthwith and the said amount shall be recovered from the registered person in accordance with the provisions of section 79.

LUT needs to be submitted with jurisdictional Deputy/ Assistant Commissioner having jurisdiction over the principal place of business of the exporter. Until a specific

CA Navya Malhotra administrative officer is assigned, the exporter can furnish bond/ LUT before any officer (Centre or State).

Considering the difficulties faced by exporters, the Government has issued Notification no. 16/2017-Central Tax and circular no. 4/4/2007-GST, both dated 07 July, 2017 to clarify certain aspects relating to bond/ LUT. The clarifications are summarized below: Submission of LUT in place of a Bond (Format for submission of LUT)

1. The following persons would be eligible to provide a LUT instead of a bond:

. Status holder as per Para 5 of Foreign Trade Policy 2015-2020; or . A person who has received foreign inward remittances equal to minimum of 10% of the export turnover, which should not be less than INR 10 million, in the preceding financial year. 2. Such a person should not have been prosecuted for any offence under the CGST Act or any existing law where the amount of tax evaded exceeds INR 25 million.

3. The LUT should be furnished in duplicate for a financial year in the prescribed format. The LUT should be executed by the working partner, the Managing Director, the Company Secretary, the proprietor or by a person duly authorized by such working partner or Board of Directors of such company or proprietor on the letter head of the registered person.

4. The LUT would be valid for 12 months.

5. If the exporter fails to comply with the conditions of LUT, he may be asked to provide a bond. CONDITION FOR LUT OR BONDS

Procedure of filing Letter of undertaking (LUT)/BOND Under GST for Exports

Rule 96A of CGST Rules: Refund of integrated tax paid on export of goods or services under bond or Letter of Undertaking.-

As per Rule 96A of CGST Rules (1) Any registered person availing the option to supply goods or services for export without payment of integrated tax shall furnish, prior to export, a bond or a Letter of Undertaking in FORM GST RFD-11 Bond and LUT Format to the jurisdictional Commissioner, binding himself to pay the tax due along with the interest specified under sub-section (1) of section 50 within a period of —

(a) fifteen days after the expiry of three months from the date of issue of the invoice for export, if the goods are not exported out of India; or

CA Navya Malhotra (b) fifteen days after the expiry of one year, or such further period as may be allowed by the Commissioner, from the date of issue of the invoice for export, if the payment of such services is not received by the exporter in convertible foreign exchange.

(2) The details of the export invoices contained in FORM GSTR-1 furnished on the common portal shall be electronically transmitted to the system designated by Customs and a confirmation that the goods covered by the said invoices have been exported out of India shall be electronically transmitted to the common portal from the said system.

(3) Where the goods are not exported within the time specified in sub-rule (1) and the registered person fails to pay the amount mentioned in the said sub-rule, the export as allowed under bond or Letter of Undertaking shall be withdrawn forthwith and the said amount shall be recovered from the registered person in accordance with the provisions of section 79.

(4) The export as allowed under bond or Letter of Undertaking withdrawn in terms of subrule (3) shall be restored immediately when the registered person pays the amount due.

(5) The Board, by way of notification, may specify the conditions and safeguards under which a Letter of Undertaking may be furnished in place of a bond.

(6) The provisions of sub rule (1) shall apply, mutatis mutandis, in respect of zero-rated supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit without payment of integrated tax.”;

Export procedure for Submission of LUT

The procedure for Submission of LUT is very simple. LUT needs to be submitted with jurisdictional Deputy/ Assistant Commissioner having jurisdiction over the principal place of business of the exporter. Until a specific administrative officer is assigned, the exporter can furnish bond/ LUT before any officer (Centre or State). Under LUT an exporter need not to pay advance taxes, he just have to submit LUT. LUT is only be given after checking the ratings given to exporters, higher the ratings higher the chances of getting LUT.

Considering the difficulties faced by exporters, the Government has issued Notification no. 16/2017-Central Tax and circular no. 4/4/2007-GST, both dated 07 July, 2017 to clarify certain aspects relating to bond/ LUT.

CA Navya Malhotra The clarifications are summarized below:

Exports would be allowed under existing bonds/ LUTs by 31 July 2017. New LUT/ bonds need to be submitted in the revised format by 31 July 2017.

Submission of LUT in place of a Bond (Format for submission of LUT)

When a person fails to submit a LUT or by any chances not able to get LUT then he has a option to fill a bond in place of LUT.

1. The following persons would be eligible to provide a LUT instead of a bond: Status holder as per Para 5 of Foreign Trade Policy 2015-2020; or A person who has received foreign inward remittances equal to minimum of 10% of the export turnover, which should not be less than INR 10 million, in the preceding fiscal year.

2. Such a person should not have been prosecuted for any offence under the CGST Act or any existing law where the amount of tax evaded exceeds INR 25 million.

3. The LUT should be furnished in duplicate for a financial year in the prescribed format. The LUT should be executed by the working partner, the Managing Director, the Company Secretary, the proprietor or by a person duly authorized by such working partner or Board of Directors of such company or proprietor on the letter head of the registered person.

4. The LUT would be valid for 12 months.

5. If the exporter fails to comply with the conditions of LUT, he may be asked to provide a bond. Submission of bond (Format of Submission of Bond)

With regards to submission of bond, circular no. 4/4/2017-GST provides as follows:

All persons not eligible to issue LUT would need to submit a bond.

A running bond will be submitted and the bond amount should cover the amount of tax involved in the export based on estimated tax liability as assessed by the exporter. A fresh bond is to be submitted if the amount in the bond is less than the outstanding tax liability on exports.

The amount of bank guarantee would be decided by the jurisdictional Commissioner and it should not exceed 15% of bond amount. The Commissioner has the power to accept the bond without any bank guarantee in case of assessee with good track record.

The bond shall be furnished on non-judicial stamp paper of the value as applicable in the State in which the bond is being furnished.

(b) He may export the services upon payment of IGST and claim refund of such tax paid. For the option (b), the shipping bill filed by an exporter shall be deemed to be an application for refund of integrated tax paid on the goods exported out of India and such application shall be deemed to have been filed only when the person in charge of the

CA Navya Malhotra conveyance carrying the export goods duly files an export manifest or an export report covering the number and the date of shipping bills or bills of export and the applicant has furnished a valid return.

For both option (a) and (b) exporters have to provide details of GST invoice in the Shipping bill. ARE-1 which is being submitted presently shall be dispensed with except in respect of commodities to which provisions of Central Excise Act would continue to be applicable.

Conclusion With GST in place, the export industry in India would be able to have internationally competitive prices due to the smooth process of claiming input tax credit and the availability of input tax credit on services.

Quest: What will be the impact of GST on zero rating of export of goods? This will make Indian exports competitive in the international market. The procedures relating to export have been simplified so as to do away with the paper work and intervention of the department at various stages of export.

BENEFITS TO THE EXPORTERS MANUFACTURES UNDER GST REGIME

The goods and services can be exported either on payment of IGST which can be claimed as refund after the goods have been exported, or under bond or Letter of Undertaking (LUT) without payment of IGST.

In case of goods and services exported under bond or LUT, the exporter can claim refund of accumulated ITC on account of export.

In case of goods the shipping bill is the only document required to be filed with the Customs for making exports. Requirement of filing the ARE 1/ARE 2 has been done away with.

The supplies made for export are to be made under self-sealing and self- certification without any intervention of the departmental officer.

The shipping bill filed with the Customs is treated as an application for refund of IGST and shall be deemed to have been filed after submission of export

CA Navya Malhotra general manifest and furnishing of a valid return in Form GSTR- 3 by the applicant.

CA Navya Malhotra INVOICING FOR EXPORTS The contents in Export Invoice remain same except inclusion of the following information. The invoice rules clearly stipulates that in case of exports, the invoice shall carry an endorsement SUPPLY MEANT FOR EXPORT ON PAYMENT OF IGST or SUPPLY MEANT FOR EXPORT UNDER BOND WITHOUT PAYMENT OF IGST and among other details shall also contain:- (i) Name and address of the recipient,

(ii) Address of Delivery,

(iii) Name of the Country of Destination, and

(iv) Number and date of application for removal of goods for export [ARE-1]

Quest: What is deemed export under GST Law? Whether any supply has been categorized as deemed export by the Government? Section 147 of the Central Goods and Services Tax Act, 2017 empowers the Government to notify, on the recommendation of the GST Council, certain supplies of goods as deemed exports, where goods supplied do not leave India, and payment for such supplies is received either in Indian rupees or in convertible foreign exchange, if such goods are manufactured in India. The benefit will be available only on supply of goods and not services. Moreover explanation 2(b) to section 54 while defining relevant date for the purpose of refund claim for deemed exports talks about goods only. However section 55(1) empowers the Government to notify class of persons who will be entitled to claim refund of taxes paid on notified supplies of goods or services. Thus irrespective of section 147, the Government may extend deemed export benefits to provision of services. No goods have yet been notified under section 147. However, it is expected that some of the existing deemed exports under FTP may be notified under this section.

CA Navya Malhotra IMPORTS

Ques. What is Import under GST? ‘‘Import of goods” with its grammatical variations and cognate expressions, means bringing goods into India from a place outside India. Import means bring in the goods and services in India from other countries. Import of goods into India would be treated as supply of goods in the course of inter- State trade/ commerce and would be liable to integrated tax under this Act. The incidence of tax will follow the destination principle and the tax revenue in case of SGST will accrue to the State where the imported goods and services are consumed. Full and complete set-off will be available on the GST paid on import on goods and services. The integrated tax on goods shall be in addition to the applicable Basic Customs Duty (BCD) which is levied as per the Customs Tariff Act. In addition, GST compensation cess, may also be leviable on certain luxury and demerit goods under the Goods and Services Tax (Compensation to States) Cess Act, 2017. The Customs Tariff Act, 1975 has accordingly been amended to provide for levy of integrated tax and the compensation cess on imported goods. Accordingly, goods which are imported into India shall, in addition to the Basic Customs duty, be liable to integrated tax at such rate as is leviable under the IGST Act, 2017 on a similar article on its supply in India.

CA Navya Malhotra Let’s take an example: Suppose the assessable value of an article imported into India is Rs. 100/-. Basic Customs Duty is 10% ad-valorem. Integrated tax rate is 18%. The taxes will be calculated as under: • Assessable Value= Rs. 100/- • Basic Customs Duty (BCD) = Rs. 10/- • Value for the purpose of levying integrated tax= Rs. 100/- + Rs.10/-= Rs. 110/- • Integrated Tax = 18% of Rs.110/- =Rs. 19.80 • Total taxes = Rs. 29.80 Ques. What is import of services under GST? ‘‘Import of services” means the supply of any service, where the supplier of service is located outside India; the recipient of service is located in India; and the place of supply of service is in India; The phrase “import of service” is very broad and covers all such supplies where: (a) The supplier is located outside India, (b) The recipient is located in India (c) Place of supply is in India. The following aspects need to be noted: Supplies, where the supplier and recipient are mere establishments of a person, would also qualify as “import of service”. The importer will be liable to pay integrated tax on a reverse charge basis and the same will have to be discharged by cash only and credit cannot be utilized for discharging such a liability; Import of service made for a consideration alone would be taxable, whether or not in the course of business. Therefore, import of service for personal consumption for a consideration would qualify as ‘supply’ and would be liable to integrated tax. However, the recipient will not be required to obtain a registration for that purpose; The threshold limits for registration would not apply and the importer would be required to obtain registration irrespective of his turnover; Import of services from related persons or establishments located outside India without consideration also would be liable to integrated tax.

CHANGE IN IMPORT PROCEDURE

Importer Exporter Code (IEC): In GST regime, GSTIN would be used for credit flow of IGST paid on import of goods. Therefore, GSTIN would be the key identifier. PAN would be the Import Export code (IEC). However, while PAN is identifier at the entity level, GSTIN would be used as identifier at the transaction level for every import and export. Further, in scenarios where GSTIN is not applicable, UIN or PAN would be accepted as IEC. It is advised that all importers need to quote GSTIN in their Bills of Entry in addition to IEC. In due course of time IEC would be replaced by PAN / GSTIN.

Bill of Entry Regulations and Format: To capture additional details in the Bill of entry such as GSTIN, IGST rate and amount, GST Compensation Cess and amount, the electronic as well

CA Navya Malhotra as manual formats of Bill of entry including Courier Bill of entry are being amended. For the benefit of the trade, modified Forms have been hosted on the departmental website, www.cbec.gov.in. Further, suitable notifications shall be issued to amend the relevant regulations and introduce modified Forms.

Import under Export Promotion Schemes and duty payment through EXIM scrips . Under the GST regime, Customs duties will be exempted on imports made under export promotion schemes namely EPCG, DEEC (Advance License) and DFIA. IGST and Compensation Cess will have to be paid on such imports.

. The EXIM scrips under the export incentive schemes of chapter 3 of FTP (for example MEIS and SEIS) can be utilized only for payment of Customs duties or additional duties of Customs, on items not covered by GST, at the time of import. The scrips cannot be utilized for payment Of Integrated Tax and Compensation Cess. Similarly, scrips cannot be used for payment of CGST, SGST or IGST for domestic procurement.

Baggage

. Full exemption from IGST has been provided on passenger baggage.

. However, basic customs duty shall be leviable at the rate of 35% and education cess as applicable on the value which is in excess of the duty free allowances provided under the Baggage Rules, 2016. Input Tax Credit (ITC) under Import:

. In GST regime, input tax credit of the integrated tax (IGST) and GST Compensation Cess shall be available to the importer and later to the recipients in the supply chain, however the credit of basic customs duty (BCD) would not be available. In order to avail ITC of IGST and GST Compensation Cess, an importer has to mandatorily declare GST Registration number (GSTIN) in the Bill of Entry. Provisional IDs issued by GSTN can be declared during the transition period. However, importers are advised to complete their registration process for GSTIN as ITC of IGST would be available based on GSTIN declared in the Bill of Entry. Input tax credit shall be availed by a registered person only if all the applicable as prescribed in the Invoice Rules are contained in the said document, and the relevant information, as contained in the said document, is furnished in FORM GSTR-2 by such person.

. Customs EDI system would be interconnected with GSTN for validation of ITC. Further, Bill of Entry data in non-EDI locations would be digitized and used for validation of input tax credit provided by GSTN.

CA Navya Malhotra PLACE OF SUPPLY IN CASE OF IMPORTS AND EXPORTS

CA Navya Malhotra SEZ

Ques. What is SEZ?

SEZ is an area identified within the Country which is designated as such through a Notification issued by the Central State Government. Proposals for setting up a SEZ are to be submitted to the ‘Board of Approval’ constituted under section 8(1) of the SEZ Act, 2005. However, the Central Government can suo motu set up and notifies a Special Economic Zone. The term special economic zone can further include:

Free trade zones (FTZ) Export processing zones (EPZ) Free zones/ Free economic zones (FZ/ FEZ) Industrial parks/ industrial estates (IE) Free ports Bonded logistics parks (BLP Urban enterprise zones

Ques. Who is SEZ Developer? SEZ Developer means a person who, or a State Government which, has been granted by the Central Government a letter of approval under sub-section (10) of section 3 and includes an Authority and a Co-Developer The Developer or Co-Developer shall have at least twenty-six percent of the equity in the entity proposing to create business, residential or recreational facilities in a Special Economic Zone in case such development is proposed to be carried out through a separate entity or a special purpose vehicle being a company formed and registered under the Companies Act, 1956 (1 of 1956).

CA Navya Malhotra Purpose of SEZ

To provide an internationally competitive environment of exports. The objectives of Special Economic Zones include making available goods and services free of taxes and duties supported by integrated infrastructure for export production, expeditious and single window approval mechanism and a package of incentives to attract foreign and domestic investments for promoting export led growth.

Some of their key objectives include:

Increase in Foreign Trade by promotion of exports of goods and services Increased Foreign Investment Domestic Job creation and; Effective Administration and Compliance Procedures. Better Infrastructure Facilities GST Registrations by SEZ Units Scheme of registration of tax payers under GST envisage a single registration number in a State or Union territory. However a person having multiple business verticals in a State or Union territory is permitted to have separate registration for each business vertical [Section 25(2) of the CGST Act, 2017]. Revised draft of registration rules released on March 31, 2017 make it mandatory for a SEZ unit or SEZ developer to apply for registration as a business vertical distinct from its other units located outside the SEZ. A separate registration each would be required to be taken in case a single legal entity has more than one unit in same SEZ or the entity is also a developer and has a unit in the same SEZ. If there are more than one SEZ within a State of the same entity they may also require separate registrations. Treatment of SEZ under GST law Section 7(5)(b) of the Integrated Goods and Services Tax Act, 2017 (IGST Act) provides that supply of goods or services or both to or by a Special Economic Zone Developer or a Special Economic Zone unit shall be treated to be a supply of goods or services or both in the course of inter-State trade or commerce. Proviso (i) to Sub- section (1) of Section 8 of the IGST Act aims to reiterate this arrangement. Example 1: A supplier in DTA in the State of Gujarat supplies goods or services to a SEZ unit in Gujarat. The supply will be treated as inter-State supply despite the fact that goods did not move inter-State. Example 2: A supplier in SEZ in the State of Gujarat supplies goods or services to a DTA unit in Gujarat. The supply will be treated as inter-State supply despite the fact that goods did not move inter-State. Example 3: A supplier in SEZ in the State of Gujarat supplies goods or services to a SEZ unit in Gujarat. The supply will be treated as inter-State supply despite the fact that goods did not move inter-State.

CA Navya Malhotra Section 16 of the IGST Act provides for special treatment to Special Economic Zone Developer or a Special Economic Zone unit. Supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit is treated as Zero rated supply. Suppliers of goods and services to these recipients can avail of one of the following: a) Make their supplies under bond or LUT without payment of IGST and claim credit of ITCs; b) May supplies on payment of IGST and claim refund of taxes paid. Suppliers to SEZ unit or developers under either of the above will be subjected to such conditions, safeguards and procedure as may be prescribed in this regard. Other than special treatment in terms of nature of supply and zero rating, SEZ unit or developer will be subject to all other concepts and procedures such as conditions & restrictions for availment of input tax credit, time and place of supply, filing of returns, audit, assessment, invoicing, maintenance & retention of records & documents and so on.

Invoices for supplies by SEZs No separate format or content is prescribed for invoices issued by SEZs. Invoice rules applicable to exports will apply to invoices issued by SEZ for export out of India and with suitable modification to supplies to DTA. Ques. Will import of services by SEZ be liable to IGST on reverse charge basis? Import of services is included in the definition of supply. In case of import of services, suppliers remains in non-taxable territory. For collecting tax on services provided by persons located in non-taxable territory, the Government will notify the recipient of services in India to be the person liable for payment of tax on reverse charge basis. As SEZ is the person located in India, it will be liable for payment of tax on import of services and eligible to claim credit of tax so paid if it fulfills eligibility criteria. Ques. Will SEZ unit be liable to GST on receipt of supplies from unregistered persons? Section 5(4) of the IGST Act provides that the integrated tax in respect of supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis. Like any other registered tax payer, SEZ unit being a person registered under GST Act will be required to comply this requirement. It will be liable for payment of tax on receipt of supplies from unregistered persons eligible to claim credit of tax so paid if it fulfills eligibility criteria.

CA Navya Malhotra INPUT TAX MECHANISM UNDER EXPORT AND IMPORT

Conclusion

On the basis of above discussion one can conclude that all the supplies of goods or services or both to SEZ developer or SEZ unit shall be zero rated. IGST shall be payable on supplies made by SEZ developer or units. In the context of supply of goods by SEZ developer or SEZ unit author urge the Government to levy IGST under Sec. 30 of SEZ Act, 2005 itself and not under IGST Act, 2017. This will save applying two different set of valuation rules for same transaction.

CA Navya Malhotra Summary of Notifications, Circulars and Press Releases.

CA Navya Malhotra S.no. Date Reference No. Subject

1 1st July 26/2017 (C) Export Procedure and Sealing of Containerized Cargo Regarding

2 4th July 2/2/2017-GST (C) Issues related to furnishing of Bond/ Letter of Undertaking for Exports

3 5th July 18/2017 exempts services imported by a unit or a developer in the Special Economic Zone for authorized operations, from the whole of the integrated tax leviable 4 6th July 28/2017 Revised rates of Rebate of State Levies on Export of Garments and textile made-up articles w.e.f. 01.07.2017

5 7th July 16/2017 LUT Conditions

6 7th July 4/4/2017 ( C ) Issues related to Bond/Letter of Undertaking for exports without payment of integrated tax

7 10th July 66/2017 Seeks to increase import duty on sugar [Raw sugar, Refined or White sugar, Raw sugar if imported by bulk consumer under tariff head 1701, from the present 40% to 50% with immediate effect and without an end date 8 10th July PRESS Press Release on GST rate for Sanitary Napkins RELEASE (imports) 9 13th July 35 /2017 Seeks to Impose provisional anti-dumping duty on imports of 'O-Acid" originating in exported from China PR 10 13th July 34/2017 Seeks to extend levy of anti- dumping duty on imports of ' Grinding Media Balls' (excluding Forged Grinding media Balls), originating in, or exported from, Thailand and people's Republic of China 11 17th July 29/2017 (c) Operational problems being faced by EOU in GST regime consequent to amendment in Notification no. 52/2003-Customs dated 31-3-2003 12 20th July 72/2017 Rate of exchange of conversion of the foreign currency ( for import and export)

13 25th July 31/2017 (C) Extending the Single Window Interface for Facilitation of Trade (SWIFT) in Exports with WCCB to all EDI locations- reg

CA Navya Malhotra 14 26th July 73/2017 Regarding amendment in Notification no. 131/2016-Customs (N.T.) dated 31.10.2016 relating to AIRs of duty drawback

15 27th July 32/2017 (c ) Clarification regarding exports under claim for drawback in the GST scenario

16 28th July 36/2017 Seeks to continue anti-dumping inforce concerning imports of 'polytetraflouroethylene or PTFE' originating in exported from China PR.

17 1ST 33/2017 (c) Leviability of Integrated Goods and Services Tax August (IGST) on High Sea Sales of imported goods and point of collection

About the Author:

CA Navya Malhotra, is an associate member of the Institute of Chartered Accountants of India since 2016. He has also done his graduation from University of Delhi. As a post qualification course, he has also completed his Diploma in Information Systems Audit (D.I.S.A) from the Institute of Chartered Accountants of India.

Navya is a regular writer to VIPCA JOURNAL, published by VIP ROAD CHARTERED ACCOUNTANTS’ ASSOCIATION, KOLKATA. He is also a regular writer and author to many discussion forums, magazines and portals for GST related articles. He is one of the author to Taxguru.com and Professional Times Magazine and editor to GST Samadhan portal. Navya is a regular speaker at various respected forums and platforms on GST including the Institute of Chartered Accountants of India (ICAI), Institute of Cost and Works Accountants of India (CMA) for its members and the faculty for the NIRC of the ICAI for students on GST. He has also deliberated the seminars, workshops and open discussions on GST in various educational institutions such as the University of Delhi.

CA Navya Malhotra CONCLUSION In this article, the author has tried to summarize the meaning and scope of Import- Export under GST. However, author is of the view that being a new statute, legislature will make necessary amendments once the practical difficulties in implementation of statute are experienced. For any clarification or discussion on this article, the author may be contacted at E- mail: [email protected] author is working in the GST Consulting domain and currently providing services related to GST Transition, Impact and Migration support on various clients. His mobile number is +91 84471 37367. Disclaimer: The views in this article are author’s point of view. This article is not intended to substitute the legal advice. No portion of this article may be copied, retransmitted, reposted, duplicated or otherwise used, without the express written approval of the author.

CA Navya Malhotra CA Navya Malhotra