Attachment B. Questionnaire

The following questionnaire will assist City of Roanoke in evaluating the quality of care and benefits being offered to members as well as to assist in the evaluation of the financial and contractual information requested of the offeror. Review of an offeror’s proposal will not be adversely impacted if a specific question does not apply to that offeror’s proposal. Offeror’s are requested to indicate “not applicable” as a response to those items that do not apply.

A. INSTRUCTIONS

C.1.Answer each question fully, clearly and concisely.

C.2.Each response must immediately follow the respective question. The question as well as the answer should be typed. All questions and responses should be numbered / labeled exactly as in this Questionnaire.

C.3.If the offeror is unable to answer a question or the question does not apply, the offeror should indicate why.

C.4.If the offeror is unwilling to disclose particular information asked in a question, the offeror should indicate why.

C.5.Samples of documents requested in the Questionnaire should be labeled with the corresponding question number and submitted as specified in Section 6 of the RFP.

C.6.Responses to the Questionnaire should be submitted in hard copy in Tab IV of your proposal.

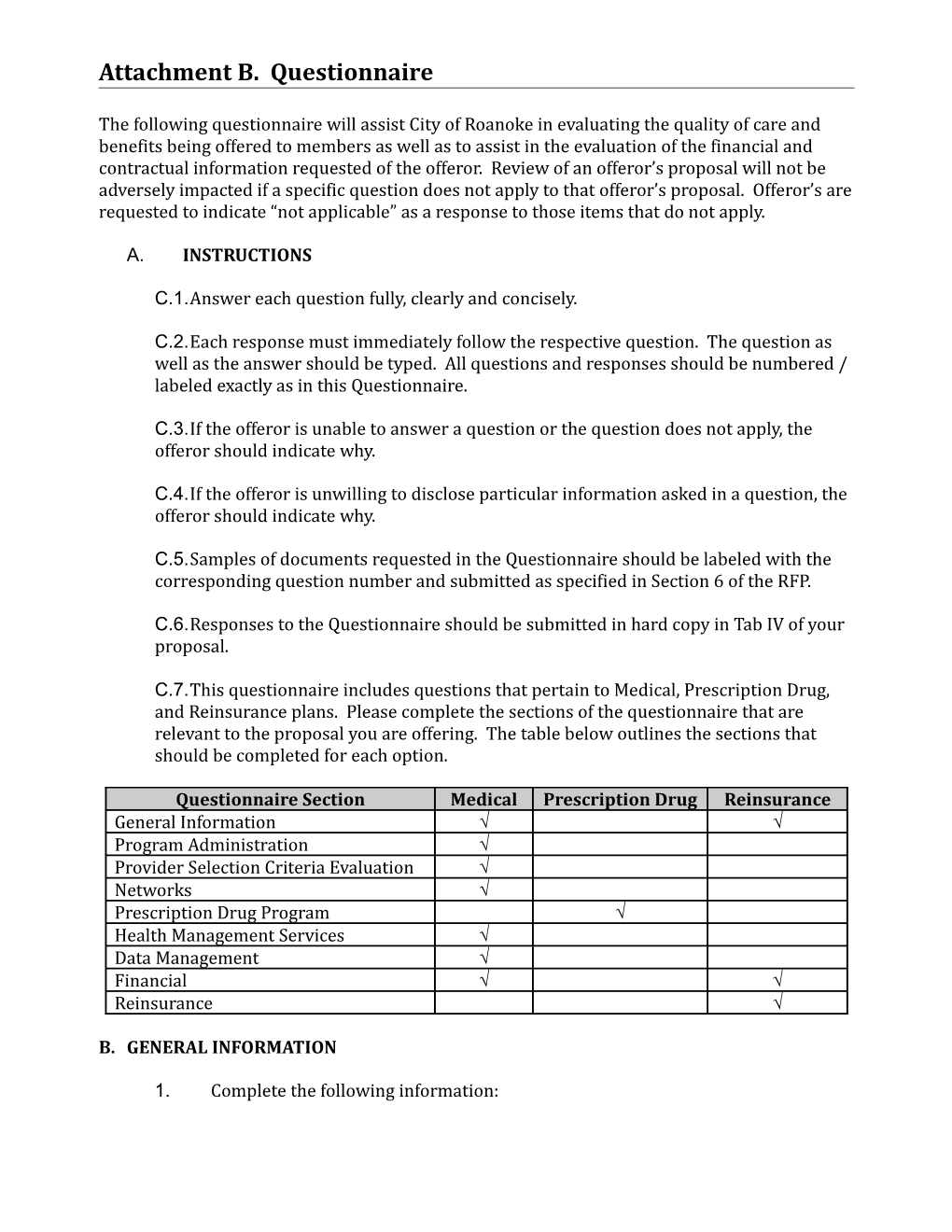

C.7.This questionnaire includes questions that pertain to Medical, Prescription Drug, and Reinsurance plans. Please complete the sections of the questionnaire that are relevant to the proposal you are offering. The table below outlines the sections that should be completed for each option.

Questionnaire Section Medical Prescription Drug Reinsurance General Information √ √ Program Administration √ Provider Selection Criteria Evaluation √ Networks √ Prescription Drug Program √ Health Management Services √ Data Management √ Financial √ √ Reinsurance √

B. GENERAL INFORMATION

1. Complete the following information: Attachment B. Questionnaire

Point of Contact: Title: Company: Address: Telephone: E-Mail:

2. Have the proposal requirements been fully met as requested in this RFP? ______Yes ______No. If not, please summarize all deviations and include that summary in Tab II of your proposal.

3. Identify all subcontractors (including consultants, advisors, network managers and suppliers) to be used and describe specific responsibilities, qualifications, and background experience of all key personnel. Identify the specific function(s) that each subcontractor performs for your company. Also identify the location of the subcontractor’s employees who perform these functions. Include financial stability for each major subcontractor, consultant, or advisor.

4. Provide pertinent financial data which demonstrates your firm’s ability to successfully perform required services. Provide your most recent ratings by each of the following rating agencies (include date of rating):

Rating Date of Legal Name of Company to Which Rating Rating Applies A.M. Best Fitch Moody’s Standard & Poors

5. Is your organization currently compliant with the HIPAA legislation as it pertains to Private Health Information and Electronic Data Interchange (EDI) Standards? Yes No [If No, please explain.]

C. PROGRAM ADMINISTRATION

6. What is the location of the claims office that will be processing claims and providing general administration for this account? Indicate if locations are different for medical, prescription drug, and managed mental health. Also indicate any differences based on product. Identify service center locations for each of the following functions: Attachment B. Questionnaire

Function Service Center Location Claims Processing Eligibility Billing Claims Management & Reporting Accounting Underwriting Account Management Contract Generation ID Card Generation

7. Provide an implementation schedule (in Tab III of your proposal)

Detail specific activities, target dates, data requirements, and responsibilities for completion. Detail any expenses involved and whether these expenses are included in your pricing.

8. Describe your ongoing enrollment procedures and annual open enrollment assistance.

Indicate the services you would be willing to provide, such as on-site assistance with employees, etc. Identify any services that would require a separate fee to be paid outside the administrative fees included in the pricing. Will you provide open enrollment communication materials in hard copy and PDF for Internet and intranet posting as part of your price? Provide samples of communication materials you have available.

9. Please indicate whether you are providing members with uniform explanation of coverage documents, or Summary of Benefits Coverage (SBC).

Please indicate the processes in which they will be provided to clients, and The timeline required for generating the documents.

10. Will you issue ID cards directly to plan members? Yes No

11. Please list the administrative services that are provided as part of your “standard fees”.

12. Describe your billing process.

13. Explain your on-line enrollment and eligibility capabilities, as well as any other on-line services, such as reporting, network directories, etc. Attachment B. Questionnaire

Identify on-line services available specifically to benefits administrators Identify any additional costs associated with these on-line services.

14. Explain your on-line services available to members.

15. Please explain the process the City must follow to add and delete employees to and from your eligibility system.

How long does it normally take for your billing department to make requested changes to the bill or monthly accounting statement (additions/deletions) and How long does it normally take for the proper adjustments in fees or premium?

16. How long will you allow retroactive changes to be made to the bill?

17. Do you provide automated, interactive telephone service? Yes No

Is there always an option to default to a customer service representative? Yes No During what hours is a customer service representative available to take calls?

18. Do the customer service representatives have the authority to resolve problems immediately?

What is the percentage of problems that are resolved during the initial call?

19. What percentage of claims do you routinely audit for turnaround time, coding accuracy, and payment accuracy? How frequently do you conduct these audits? Attachment B. Questionnaire

20. Please provide your performance standards and quarterly results for 2015 and 2016 in the chart below. The results should include the performance of the service team, which would be responsible for City of Roanoke. If different units would be responsible for the different plans, provide standards and results separately for each unit. Input your standard on each measure.

Product(s): Results The results below include the following 2015 2016 service units: Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Timeliness of claims processing: Standard: Results: Claims processing accuracy: Standard: Results: Telephone inquiry/wait time: Standard: Results: Telephone inquiry/ abandonment rate: Standard: Results:

21. Will there be any additional cost to City of Roanoke for you to prepare and print employee membership materials?

22. Confirm that you will allow City of Roanoke to review and approve all communication pieces before they are sent to their employees.

23. To what extent will the City of Roanoke be allowed to customize the enrollment and communication materials that will be provided to members?

What additional costs will be associated with customization?

24. Provide resumes for the members of your proposed account team.

25. Describe how your proposed account team will interface on an ongoing basis with the City of Roanoke’s HR and benefits staff on administrative issues (including billing, claims issues, etc.) and describe your process for resolving administrative problems.

26. What HSA and administrator and custodial bank do you currently use? Please provide an overview of their capabilities.

27. What on-line HSA services do you offer to the City of Roanoke? To account holders?

28. What HSA reporting do you provide to the City of Roanoke? Discuss frequency Attachment B. Questionnaire

and purpose of report. Provide samples of all reports in Tab VII.

29. Do you notify HSA account holders if their contribution in a calendar year exceeds the limit allowed by law? How does an account holder withdraw any such amounts?

30. How do HSA participants request and receive reimbursements if they are not using their debit card?

31. How many debit cards do you provide per HSA accountholder?

32. Provide an overview of investment options provided to HSA accountholders.

33. What educational support do you provide to accountholders? Discuss your strategy for assisting City of Roanoke in providing financial education with regard to HSAs.

D. PROVIDER SELECTION/CRITERIA EVALUATION

34. Answer for each of your networks included in quotation. Label your response clearly for each network, if applicable. Specifically address the following criteria:

NETWORK: PPO HMO/POS Yes No Yes No Do you require Board Certification? Do you require Physicians to be Board Eligible? Do you require a degree from a U.S. Medical School? Do you check with the Federation of State Medical Boards? Do you check the status of the narcotics license, both federal/state? Is the level of the physician’s fees considered in the selection process? Do you perform pre-contracting on-site reviews? Do you check credentials by practicing physicians in the community? Do you check hospital admitting procedures? Do you require malpractice insurance? What amounts? $ ______

35. List the 5 largest physician practices in the City of Roanoke’s service area that have terminated from one or all of your networks in the most recent 24 months. Indicate the reason for these terminations. Attachment B. Questionnaire

36. How much advance notice must the provider give you if they wish to cancel their contract with you?

37. What is your process for notifying members when a physician leaves the network?

38. What is your process for on-going evaluation of physicians? What steps are taken when a physician does not meet the performance standards? How many physicians were terminated for performance standards in 2016?

39. Please describe the quality assessment tools you currently use with each of your networks. Indicate how often you perform quality assessments, and how the results are reported. How is information about malpractice or complaints used? Will you be willing to share data with City of Roanoke to identify high quality cost effective providers used by the membership?

40. Indicate the most prevalent method of contractual reimbursement by network/plan for your:

Physicians Specialists Hospitals Laboratory Skilled Nursing Care Home Health Care Durable Medical Equipment Rehabilitation Services Other Ancillary Providers (identify)

41. If a physician or hospital cancels or fails to renew their network contract, how would transition of care be handled for an inpatient or critical/chronic case or a maternity case? Confirm your compliance with Commonwealth of Virginia continuity of care mandates.

42. How are member grievances against providers handled?

43. Do you offer to members an online quality and cost comparison tool on physicians and facilities? Please describe how you assess and measure quality? Is cost based on actual cost of a procedure or average cost? Attachment B. Questionnaire

E. NETWORKS

46. Complete the chart below for the following zip codes within the City of Roanoke service area: 240 and 241.

% Board % Accepting New HMO # In-Network Certified Patients Family Practitioners General Practitioners Internists Orthopedics Pediatricians OB/GYNs Cardiologists Surgeons Dermatologists Allergists Radiologists Anesthesiologists Psychiatrists Psychologists MSWs Psych RNs Chiropractors Urgent Care Facilities

47. For each network/product, please list your laboratory providers for lab services not provided in a physician’s office (City of Roanoke service area only).

48. For each network/product, please list your home health providers (City of Roanoke service area only).

49. Please provide a geographic access report for each network using the zip code listing provided in the census data. Access is defined as: 2 PCPs within 10 miles, 2 specialists within 10 miles and 1 hospital within 15 miles. Please include reports for detailing zip codes that do not meet access criteria. (Include this report in Tab V of your proposal.)

50. Confirm that you will negotiate to add specific providers to the network at the request of City of Roanoke?

51. Can members designate a practice or an Urgent Care Center as a PCP?

52. Do you have Centers of Excellence for specific specialty care, surgery, etc.? If Attachment B. Questionnaire

yes, list the facilities by specialty. Please describe your program, including how centers are selected and details on services offered to family members when travel and overnight stays are involved. Is your Centers of Excellence program voluntary?

53. Complete the table below and explain in detail the coverage options available and how benefits are paid for each of the following members (discuss for each product if different). Indicate how the member would be covered for ongoing treatment for a chronic illness.

Members Routine Emergency/Urgent Chronic Care Illness COBRA enrollee outside the service area Retiree living permanently outside the service area Retiree living three to six months outside the service area Dependent spouse and/or child of an active employee living permanently outside the service area Dependent attending college outside the service area

54. Is your PPO Utilization Review Accreditation Commission (URAC) accredited? Yes No a. If accredited, at what level? b. If no, have you applied for accreditation?

55. For all networks included in your price, do you own the network? a. If yes, how long have you owned the network? b. If no, who owns the network? c. Explain your responsibility and accountability

56. Please complete the Hospital, Provider, and Prescription Drug Checklists (Attachment C and D) as instructed and include the completed lists in Tab V of your proposal.

F. HEALTH MANAGEMENT SERVICES Attachment B. Questionnaire

57. Which programs are accredited with URAC (American Accreditation HealthCare/ Commission)?

58. Who approves medical procedures and services before they are performed?

59. What tools are used to determine medical necessity?

60. Indicate what health management services you provide as part of your coverage including:

• Disease Management (defined as proactive telephonic/home based contact to reduce risk, improve adherence to prescribed therapies, improve outcomes and health status, and reduce inappropriate utilization)

• Maternity Management (defined as proactive, telephonic/home based contact to reduce risk, per-term birth rate, low and very low birth weight rates, and infant mortality)

• Demand Management (24-hour nurse triage line)

• Member health risk and/or health status assessment

• Health promotion/wellness programs (define)

• Lifestyle management (defined as smoking cessation, weight management, fitness activities, stress, injury prevention)

• Newsletter

• Other (define)

61. Are you willing to guarantee utilization rates/return on investment on your disease management programs in total?

a. Discuss how you would structure the guarantee?

62. How involved are your network physicians in accountability for compliance with wellness, disease management, and pharmacy initiatives to improve quality and cost management?

63. Do you offer coverage for gastric bypass surgery and other related surgeries? If so, is this covered by a rider or included in plans normally? Please explain. If this is an option, how will it impact pricing?

64. Please describe health promotion or wellness programs that you can offer the Attachment B. Questionnaire

City of Roanoke at no cost (attach program descriptions or other literature to illustrate your program offerings). Do you have the ability to conduct on site wellness seminars, clinical screenings or health risk assessments? Are there additional programs that could be purchased by the City of Roanoke?

65. What mobile applications do you offer to assist with wellness program and overall health management? Is there an additional cost? Please explain.

66. What capabilities do you offer to track wellness programs in order to administer an incentive? Please explain and provide details about pricing if it is at an additional cost.

67. Are you willing to provide City of Roanoke $50,000 wellness dollars to be used to fund wellness programs for City of Roanoke’s members? If so, please provide the dollar amount and for the number of years wellness dollars would be available.

68. The City has an on-site clinic. How will you partner with the clinic to share data and to institute programing that will ultimately impact member’s outcomes and ongoing health?

69. How have you worked effectively with other on-site clinics to impact outcomes, cost and trends?

G. DATA MANAGEMENT

65. Please provide a sample of your standard management reports for medical and drug coverages and the frequency of distribution. (Include in Tab VII of your proposal.)

66. Do you offer on-line access to your database, which would allow the City of Roanoke to access certain management reports? If so, please explain your system, the cost to access and run reports, and an outline of what kinds of reports are available. Indicate how frequently the database is updated with real time information. Is this database available to City of Roanoke benefits consultants provided approval is granted by City of Roanoke?

H. FINANCIAL

67. Indicate your trend factors both rating and actual observed. Label accordingly for your PPO and POS plans for the last three years for medical and drug. Specify the location/region on which these trend factors are based. If available, provide trends for the Roanoke region.

PPO POS Pharmacy Attachment B. Questionnaire

Observed Trend 2015 Observed Trend 2016 Rating Trend 2016 Rating Trend 1Q 2017

68. Please describe your proposed funding arrangement.

Indicate how fees are charged (calculations and timing), monthly cash flow arrangements, escrow requirements, settlement process, terminal liability, etc. Explain the billing process for claims and administrative fees.

69. Is your administrative fee developed on a paid claim or incurred claim basis?

a. If it is based on a paid claim basis, explain how the fee will change in year 2 of the contract and what will happen upon termination of the contract.

70. Do you retain any negotiated provider discounts as a source of administrative fees? If so, please explain.

71. Confirm that your organization will accept fiduciary responsibility for claim payments. Outline any fees that would apply.

72. Explain how your contract addresses coverage for claims expense for any individual in the hospital (1) on the day your contract becomes effective and (2) on the day your contract is terminated.

73. Provide a sample Administrative Services Only (ASO) contract. (Include in Tab IX of your proposal.)

74. What are your notification requirements for changes in eligibility?

75. What is your enrollment fluctuation threshold?

76. In the event of termination on the contract anniversary date, are you willing to process claims runout?

a. For how long? b. What is the cost for this service? c. How is this cost determined?

77. Are you willing to provide a guarantee on the percentage of discount to be achieved through your negotiated agreements?

a. Outline your proposed guarantee and explain thoroughly how it would be Attachment B. Questionnaire

measured.

78. Outline any financial guarantees offered to City of Roanoke.

79. Are you willing to guarantee a maximum percent or dollar increase in administrative fees and/or reinsurance fees for the second, third, fourth, or fifth year?

80. What guarantees will you offer for overall program performance (i.e., guaranteed trend factors within a certain range, guaranteed utilization targets, network performance and managed care performance)?

a. Identify and describe any conditions and potential cost implications.

81. What is the value of your HMO network as compared to the PPO network in the Roanoke Valley area?

82. If you are providing a bundled (medical, prescription drug, reinsurance) response to this RFP, identify clearly any changes to your proposal response (pricing, guarantees, etc.) should coverages be unbundled and awarded to separate vendors.

I. REINSURANCE

83. Are you willing to provide “Run-In” specific reinsurance liability protection in the event the contract is terminated? If so, what terms are you willing to provide. Please explain.

84. Is premium accounting done on a self-bill or insurer-generated bill basis?

85. How long has your company been in the stop-loss marketplace?

86. Does your company hold all the specific risk, or do you have outside reinsurance? Please explain. If you have outside reinsurance, then please provide dollar amount limit, which your company retains. If applicable, provide the financial ratings for each reinsurer or partner.

87. What audits, if any, will be required?

88. Within what period of time will any reimbursement be made under the contract? Is specific stop loss (SSL) reimbursement immediate? If not, explain.

89. Will you guarantee a maximum first year renewal increase?

90. Assuming you are awarded the contract, will you require any additional claims experience beyond what is provided in this RFP in order to provide final renewal Attachment B. Questionnaire

rates? Please explain.

91. Will you work with different medical administrator and pharmacy vendors? If so, is an approval process required?

92. What kind of notification by the medical administrator and pharmacy vendor, or the client is required for a claim to be paid? Please explain the process.

93. Are there any additional costs/fees to interface with the medical administrator or pharmacy vendor?

94. Please explain your reconciliation process when the client has separate medical and prescription drug administrators and there is no coordination of claims between the two?

95. Is there underwriting or lasering on individual claims in your price or upon renewal?

96. Are you willing to offer an unlimited maximum on the specific limits?

97. Are you willing to offer an unlimited maximum on the aggregate limit?

98. Will you guarantee that future renewals will be released at least 90 days in advance of the renewal date? Will renewal prices released in advance be contingent upon any additional claims and/or enrollment information? Please explain.

99. Provide a sample stop loss contract. (Include in Tab IX of your proposal.)

100. Please provide all underwriting assumptions and caveats.

101. Outline any claims/expenses NOT included in your specific reinsurance.

102. Outline your renewal methodology for SSL charge calculations.

PRESCRIPTION DRUG PROGRAM – A separate section to this RFP is dedicated to the Prescription Drug Program

Complete Attachment B2. This section should be completed if prescription drug is priced as a carve-out pharmacy solution or if bundled with medical coverage.