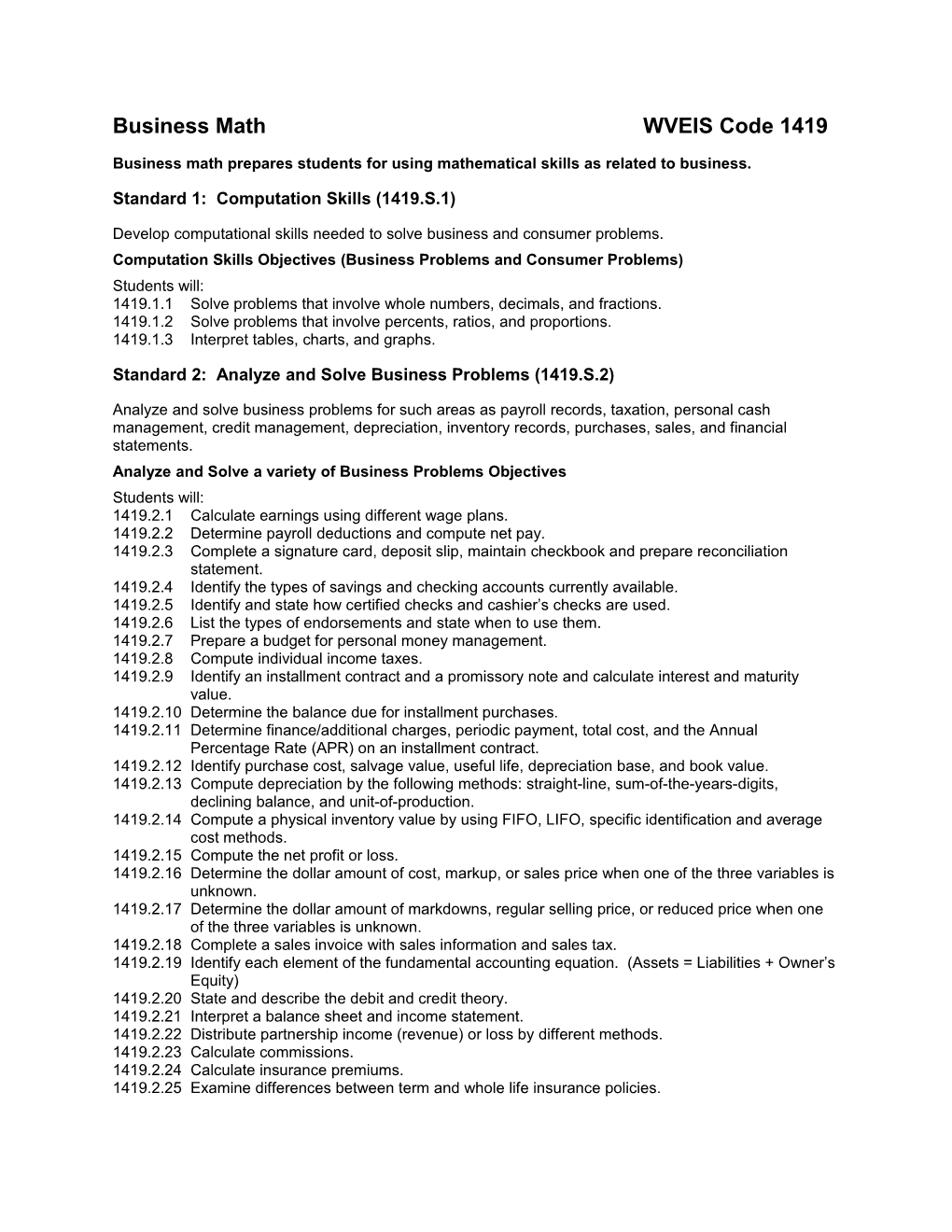

Business Math WVEIS Code 1419

Business math prepares students for using mathematical skills as related to business.

Standard 1: Computation Skills (1419.S.1)

Develop computational skills needed to solve business and consumer problems. Computation Skills Objectives (Business Problems and Consumer Problems) Students will: 1419.1.1 Solve problems that involve whole numbers, decimals, and fractions. 1419.1.2 Solve problems that involve percents, ratios, and proportions. 1419.1.3 Interpret tables, charts, and graphs.

Standard 2: Analyze and Solve Business Problems (1419.S.2)

Analyze and solve business problems for such areas as payroll records, taxation, personal cash management, credit management, depreciation, inventory records, purchases, sales, and financial statements. Analyze and Solve a variety of Business Problems Objectives Students will: 1419.2.1 Calculate earnings using different wage plans. 1419.2.2 Determine payroll deductions and compute net pay. 1419.2.3 Complete a signature card, deposit slip, maintain checkbook and prepare reconciliation statement. 1419.2.4 Identify the types of savings and checking accounts currently available. 1419.2.5 Identify and state how certified checks and cashier’s checks are used. 1419.2.6 List the types of endorsements and state when to use them. 1419.2.7 Prepare a budget for personal money management. 1419.2.8 Compute individual income taxes. 1419.2.9 Identify an installment contract and a promissory note and calculate interest and maturity value. 1419.2.10 Determine the balance due for installment purchases. 1419.2.11 Determine finance/additional charges, periodic payment, total cost, and the Annual Percentage Rate (APR) on an installment contract. 1419.2.12 Identify purchase cost, salvage value, useful life, depreciation base, and book value. 1419.2.13 Compute depreciation by the following methods: straight-line, sum-of-the-years-digits, declining balance, and unit-of-production. 1419.2.14 Compute a physical inventory value by using FIFO, LIFO, specific identification and average cost methods. 1419.2.15 Compute the net profit or loss. 1419.2.16 Determine the dollar amount of cost, markup, or sales price when one of the three variables is unknown. 1419.2.17 Determine the dollar amount of markdowns, regular selling price, or reduced price when one of the three variables is unknown. 1419.2.18 Complete a sales invoice with sales information and sales tax. 1419.2.19 Identify each element of the fundamental accounting equation. (Assets = Liabilities + Owner’s Equity) 1419.2.20 State and describe the debit and credit theory. 1419.2.21 Interpret a balance sheet and income statement. 1419.2.22 Distribute partnership income (revenue) or loss by different methods. 1419.2.23 Calculate commissions. 1419.2.24 Calculate insurance premiums. 1419.2.25 Examine differences between term and whole life insurance policies.