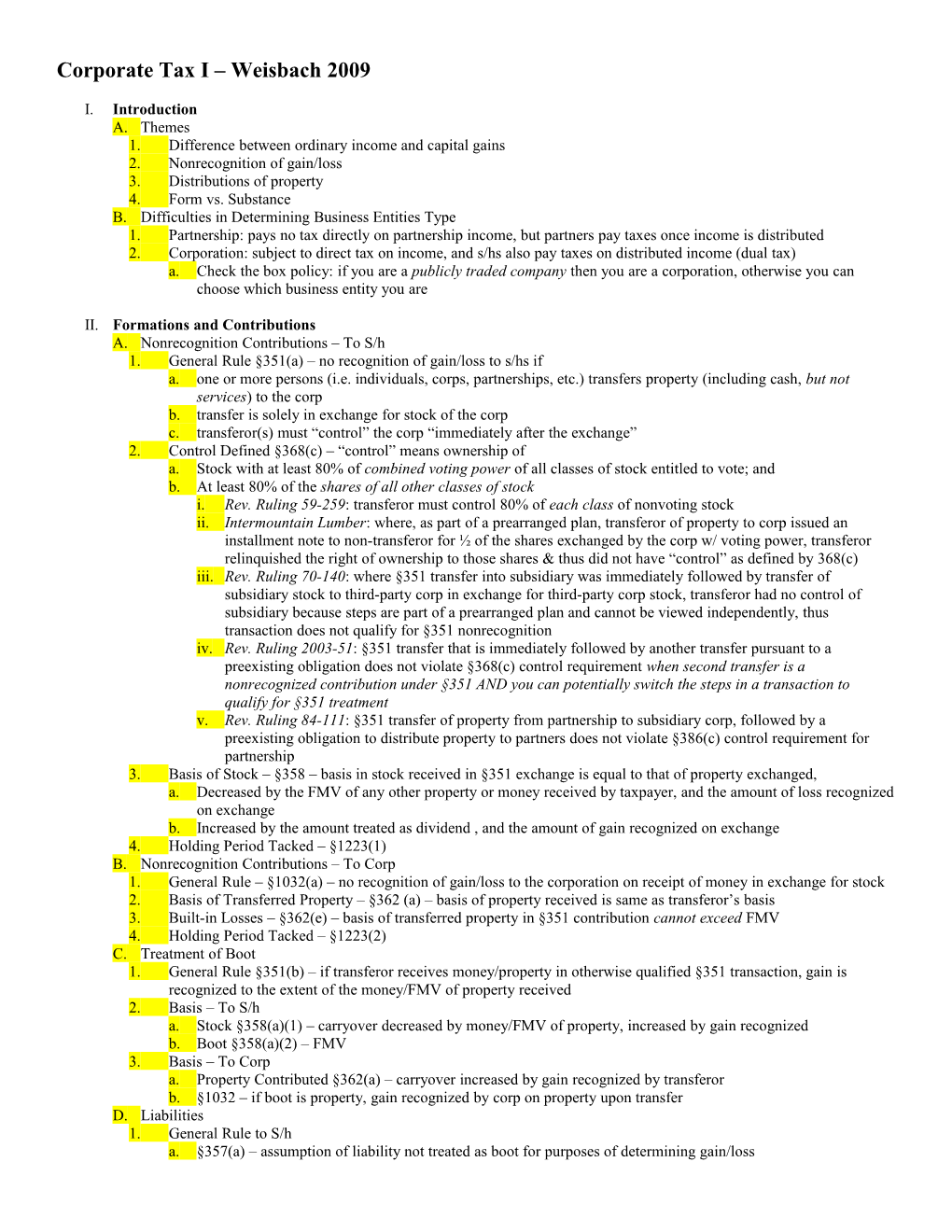

Corporate Tax I – Weisbach 2009

I. Introduction A. Themes 1. Difference between ordinary income and capital gains 2. Nonrecognition of gain/loss 3. Distributions of property 4. Form vs. Substance B. Difficulties in Determining Business Entities Type 1. Partnership: pays no tax directly on partnership income, but partners pay taxes once income is distributed 2. Corporation: subject to direct tax on income, and s/hs also pay taxes on distributed income (dual tax) a. Check the box policy: if you are a publicly traded company then you are a corporation, otherwise you can choose which business entity you are

II. Formations and Contributions A. Nonrecognition Contributions – To S/h 1. General Rule §351(a) – no recognition of gain/loss to s/hs if a. one or more persons (i.e. individuals, corps, partnerships, etc.) transfers property (including cash, but not services) to the corp b. transfer is solely in exchange for stock of the corp c. transferor(s) must “control” the corp “immediately after the exchange” 2. Control Defined §368(c) – “control” means ownership of a. Stock with at least 80% of combined voting power of all classes of stock entitled to vote; and b. At least 80% of the shares of all other classes of stock i. Rev. Ruling 59-259: transferor must control 80% of each class of nonvoting stock ii. Intermountain Lumber: where, as part of a prearranged plan, transferor of property to corp issued an installment note to non-transferor for ½ of the shares exchanged by the corp w/ voting power, transferor relinquished the right of ownership to those shares & thus did not have “control” as defined by 368(c) iii. Rev. Ruling 70-140: where §351 transfer into subsidiary was immediately followed by transfer of subsidiary stock to third-party corp in exchange for third-party corp stock, transferor had no control of subsidiary because steps are part of a prearranged plan and cannot be viewed independently, thus transaction does not qualify for §351 nonrecognition iv. Rev. Ruling 2003-51: §351 transfer that is immediately followed by another transfer pursuant to a preexisting obligation does not violate §368(c) control requirement when second transfer is a nonrecognized contribution under §351 AND you can potentially switch the steps in a transaction to qualify for §351 treatment v. Rev. Ruling 84-111: §351 transfer of property from partnership to subsidiary corp, followed by a preexisting obligation to distribute property to partners does not violate §386(c) control requirement for partnership 3. Basis of Stock – §358 – basis in stock received in §351 exchange is equal to that of property exchanged, a. Decreased by the FMV of any other property or money received by taxpayer, and the amount of loss recognized on exchange b. Increased by the amount treated as dividend , and the amount of gain recognized on exchange 4. Holding Period Tacked – §1223(1) B. Nonrecognition Contributions – To Corp 1. General Rule – §1032(a) – no recognition of gain/loss to the corporation on receipt of money in exchange for stock 2. Basis of Transferred Property – §362 (a) – basis of property received is same as transferor’s basis 3. Built-in Losses – §362(e) – basis of transferred property in §351 contribution cannot exceed FMV 4. Holding Period Tacked – §1223(2) C. Treatment of Boot 1. General Rule §351(b) – if transferor receives money/property in otherwise qualified §351 transaction, gain is recognized to the extent of the money/FMV of property received 2. Basis – To S/h a. Stock §358(a)(1) – carryover decreased by money/FMV of property, increased by gain recognized b. Boot §358(a)(2) – FMV 3. Basis – To Corp a. Property Contributed §362(a) – carryover increased by gain recognized by transferor b. §1032 – if boot is property, gain recognized by corp on property upon transfer D. Liabilities 1. General Rule to S/h a. §357(a) – assumption of liability not treated as boot for purposes of determining gain/loss b. §358(d) – assumption of liabilities treated as money received by contributors c. §357(c)(1) – gain realized to extent that sum of liabilities exceed basis in transferred property i. Peracchi: where taxpayer transferred unsecured note to corp in order to increase basis to avoid §357(c)(1) recognition of gain where liabilities exceeded basis in property contributed in §351 contribution, note had basis equal to its face value b/c creditors in bankruptcy could enforce the note 2. General Rule to Corp – follow general rules under §362 3. Incorporating an Ongoing Business a. Hempt Bros: where partnership transferred accounts receivable to corporation in §351 contribution, such receivables constituted property in the broad sense and did not run afoul of the assignment of income doctrine b/c Congress’ intent in creating §351 was to make such contributions untaxable b. Insert notes for 1/15 on Brown & §482 4. Contingent Liabilities a. §357(c)(3) – deductible liabilities do not count for purposes of computing gain or calculating basis i. Rev. Ruling 95-74: a. Issue 1: where corporation created subsidiary in §351 transaction and contributed property subject to contingent environmental liabilities, and subsidiary incurs §162 deductible expenses and §263 capital expenditures for remediation of liabilities, both types of expenses are deductible liabilities under §357(c)(3) and excluded for the purposes of determining liabilities transferred under §357(c)(1) b. Issue 2: contingent environmental liabilities assumed by subsidiary are deductible as business expenses under §162 and can be capitalized under §263 and are NOT built into the cost of acquiring the predecessors property (negates holding in Holdcroft) i. Problem: get around this ruling & Holdcroft by contributing property encumbered by liabilities in exchange for part-stock and part-cash – this is a situation in b/w Holdcroft and 95-74 5. Contingent Liability Shelters a. Black & Decker: where corp contributed $561 mil. in cash and $560 mil. in contingent liabilities (deductible and thus excluded from 357(c)(1) liabilities under 357(c)(3)) to subsidiary in exchange for stock valued at 1 mil. (liabilities minus cash), and claimed stock had basis of $561 mil. and thus realized a loss of $560 upon sale of stock, court remanded for determination on whether transaction has reasonable opportunity for profit i. §358(h) – if basis of property exceeds FMV of property under 358(a)(1), basis of such property is reduced by amount of liability which is assumed by another person during the exchange and with respect to which subsection (d)(1) does not apply to the assumption

III. Capital Structure of a Corporation A. Debt vs. Equity 1. General Rule §385 – gives treasury power to determine debt or equity based on certain factors a. Debt is promise to pay on fixed day at fixed interest rate b. Subordination – deep subordination indicates equity, minimal subordination indicates debt c. Debt to equity ratio – high leverage indicates some equity instead of purported debt d. Proportionality – ? e. Convertibility – debt convertible to equity likely to be equity 2. Rev. Ruling 94-47: reissuance of §385 factors a. Promise to pay at fixed date w/ maturity b. Subordination c. Participation in management – more participation indicates equity d. Debt/Equity ratio e. Labels f. Proportionality g. Nontax treatment – accountants/bankers treat instrument as equity for certain purposes, and debt for tax purposes h. Payable in stock – restricting payment to creditors in stock is equity-like feature

IV. Nonliquidating Distributions A. General Rules 1. Dividends §316 – dividend is a distribution out of current and accumulated earnings and profits a. Current e&p – e&p for the current taxable year (counted first) b. Accumulated e&p – all e&p earned in the past 2. Distribution Scheme §301(c) a. Part of distribution which is dividend is taxed as gross income b. Part of distribution which is not dividend first reduces basis c. Part of distribution in excess of basis is taxed as gain 3. Qualified Dividens §1(h)(11) – qualified dividends (from domestic or certain qualified corps) currently taxed at capital gains rates, not as ordinary income, until 2010 B. Distributions of Property – to Corp 1. 311(a)(2) – no loss recognized on distribution of property a. Incentivizes corp not to distribute loss property to s/h, but can be circumvented by selling to third party, realizing loss, then distributing proceeds to s/h 2. 311(b) – gain recognized on distribution of appreciated property to the extent FMV exceeds basis 3. 311(b)(3) – anti-stuffing rule C. Distributions of Property – to S/hs 1. §301(b) – amount of distribution of property is FMV reduced by liabilities assumed by s/h 2. 301(d) – basis of distributed property is FMV D. E&P 1. §312(a) – corp reduces e&p after dividend by amount of money or basis of property distributed 2. §312(b) – increase corp e&p by gain on distribution of property E. Constructive Dividends 1. Nicholls, North, Buse Co: taxpayer who purchased yacht w/ company money, but got personal use out of yacht 75% of the time charged with a constructive distribution for the rental value of the yacht during the period of personal use b/c personal expenditure by corp made for the benefit of the s/hs qualifies as a constructive dividend 2. Rev. Ruling 69-630: where s/h who controlled two corps caused one corp to sell property to the other corp at less than arms-length price to avoid realization of gain, §482 authorizes a recharacterization of the transaction as a distribution in the difference b/w the bargain and arms-length price to the controlling s/h, and an increase in the basis to prevent the evasion of taxes F. Dividends Received by Corporations 1. Dividends Received Deduction §243 – if s/h is a corporation, portion of dividend is deducted a. If 80% ownership, 100% deduction b. If b/w 20% and 80% ownership, 80% deduction c. If 20% ownership, 70% deduction i. Problem: corporations can act opportunistically by buying stock of corps who have highly appreciated e&p right before distribution, and deduct taxes via the DRD – dividend capture 2. Dividend Capture Rules a. §246(c) – must hold stock for 46 days to get DRD for common stock, 91 days for preferred b. Extraordinary Dividends §1059 – extraordinary dividend exists if it is greater than 10% of s/h basis i. 2 year holding period to get DRD ii. If holding period not met, reduce basis by untaxed portion of dividend iii. If untaxed portion exceeds basis, it is taxed as gain 3. Dividends in Bootstrap Sales a. TSN Liquidating: where parent caused subsidiary to issue dividend of unwanted assets protected by DRD b/f sale of subsidiary and injection of new assets by buyer, such transaction was valid because assets injected were of a different nature from the assets issued via dividend to parent thus there was valid business purpose b. Waterman Steamship: where appreciated subsidiary issued dividend note to parent, then sold at no gain to buyer, then note was paid off with funds borrowed by buyer, transaction was recast as sale of appreciated subsidiary to buyer with note dividend to buyer because no valid business purpose c. Litton: where subsidiary issued note dividend to parent 5 moths b/f sale of subsidiary and satisfaction of note by buyer, transaction was valid because at time of dividend no formal action taken by parent to initiate sale and substantial amount of time b/w dividend and sale. d. Step Transaction Doctrine i.

V. Redemptions A. General Rule §302(a) – redemption is treated as sale/exchange if it meets at least one of the tests in §302(b) 1. §302(b) – sale/exchange treatment if redemption is a. Not essentially equivalent to a dividend b. Substantially disproportionate c. Complete termination 2. §302(d) – if redemption does not fulfill 302(a) it is treated as distribution to which §301 applies B. Constructive Ownership 1. Attribution Categories a. Family Attribution – you own stock owned by your i. Spouse ii. Children iii. Grandchildren iv. Parents v. BUT, NO ATTRIBUTION b/w siblings, in-laws, or from grandparents to grandchild b. Upstream Attribution – stock owned by partners, estates, and trusts owned by partners, heirs and beneficiaries respectively – stock owned by corp is owned by s/h w/ 50%< ownership in proportion to their percentage ownership c. Downstream Attribution – stock owned by partners, heirs, and beneficiaries owned by the partnership, estate, or trust respectively – corp owns stock owned by 50% < owner (no proportionality) – no attribution for remote contingent interests in trusts d. Option Attribution – person holding an option to buy stock is treated as owning actual stock in the amount of the option 2. Applying Attribution Rules §318(a)(5) a. Chain attribution (link different categories of attribution to ownership possibilities, EXCEPT NO CHAIN ATTRIBUTION IN FAMILIES) b. No sidewise attribution (i.e. upstream then downstream, or vice versa – only attribute in one direction) c. Option trumps family C. Not Essentially Equivalent to a Dividend 1. U.S. v Davis: four rules a. Attribution rules apply to §302(b)(1) b. Redemption of a sole s/h is always a §301 distribution and never a §302 redemption c. Business purpose is irrelevant d. Standard is “meaningful reduction in ownership of the corp” 2. Rev. Ruling 85-106: where taxpayer could exercise control of the corp in concert w/ two other s/hs, a redemption of part of the taxpayer’s nonvoting preferred stock was not a “meaningful reduction” in the taxpayers interest in the corporation and thus did not qualify for §302(b)(1) treatment a. To determine whether reduction is “meaningful” look to rights inherent in corp ownership i. Right to vote/control (most important and applicable in 85-106) ii. Right to share in e&p & surplus iii. Right to share assets on liquidation 3. Rev. Ruling 75-502: where taxpayer reduced his interest in corp through redemption from 57% to 50%, reduction was “meaningful” for purposes of §301(b)(1) if remaining stock is owned by single unrelated s/h b/c taxpayer no longer has “dominant voting rights” 4. Rev. Ruling 75-512: where corp is subject to control of dominant s/h, and unrelated taxpayer is minority s/h, reduction in taxpayer’s interest in corp through redemption from 30% to 24.3% (just misses substantially disproportionate) is a “meaningful reduction” b/c s/h cannot exercise control in concert w/ other minority s/hs D. Redemptions in Bootstrap Acquisitions 1. Zenz: where taxpayer sold part of her stock to buyer, and then had corp redeem the balance of the stock, such transaction was not essentially equivalent to a dividend b/c taxpayer sought to completely terminate her interest in the corp through the transaction 2. Rev. Ruling 75-447: in determining whether a specific redemption coupled with a sale of stock in accordance with an overall plan qualifies as substantially disproportionate under §302(b)(2), proper treatment is to look at the circumstances before the plan is initiated, and the overall result of the plan, NOT the steps in between E. Constructive Dividend Issues 1. Rev. Ruling 69-608: if corporation assumes unconditional obligation on behalf of s/h to purchase stock of another s/h, the corps assumption of the unconditional obligation counts as a constructive dividend to the assigning s/h in the amount necessary to purchase the redeemed shares; if there are other remaining s/hs, corp then redeems the purchased shares from assigning s/h to give his the proper proportional interest in the corp F. Substantially Disproportionate 1. §302(b)(2) – a redemption is substantially disproportionate if after the redemption ALL of the following requirements are fulfilled a. S/h owns less than 50% of total stock in corp b. S/h owns less than 80% of pre-redemption voting stock c. S/h owns less than 80% of pre-redemption common stock i. If multiple classes of common stock, then less than 80% of FMV 2. 302(b)(2)(D) – a substantially disproportionate redemption made pursuant to a plan which in the aggregate does not result in a substantially disproportionate redemption with respect to the s/h does not qualify for §302(b)(2) safe harbor a. Rev. Ruling 85-14: where taxpayer knew of future redemption by another s/h and redeemed his stock to get temporary substantially disproportionate treatment under §302(b)(2), only flunk §302(b)(2) after second s/hs redemption, that single taxpayer initiated a “plan” under §302(b)(2)(D) and thus flunked §302(b)(2) G. Complete Termination 1. §302(b)(3) – complete termination of all stock qualifies as a sale/exchange a. Applies when (1) complete redemptions of non-voting stock, & (2) cases where family attribution is waived 2. §302(c)(2) – waiver of family attribution a. Must agree not to acquire any interest in the corp (other than creditor) for 10 years and waive statute of limitations b. Must state that no acquisition of stock from §318 relative for the purpose of avoiding tax in previous 10 years H. Basis to S/h 1. Reg. §1.302-2(c) – for redemptions treated as dividends, “proper adjustment” made for basis of remaining shares a. Remaining shares get all basis, and if s/h has no remaining shares then basis shifts to §318 attributed parties 2. Proposed Elimination of Basis Shifting a. Proposed Reg. §1.302-5(a)(3) – if all of taxpayers shares are redeemed and the redemption is treated as a distribution, the distribution is split pro-rata according to the total amount of shares redeemed and I. Shelters 1. Seagrams 2. OPIS J. Consequences to the Distributing Corporation

VI. Stock Dividends A. General Rule §305(a) – gross income does not include stock dividends B. Exceptions §305(b) - stock dividend is taxable distribution to ALL s/hs if 1. S/h can elect to take either stock or property 2. Distribution or series of distributions results in receipt of stock by some s/hs, and increase in proportionate interests of other s/h in assets or e&p of corp 3. Distribution or series of distributions results in receipt of preferred stock by some s/h and common stock by other s/h 4. Distribution is of convertible preferred stock C. Reg. §1.305-3(b)(3) – “isolated” redemptions do not trigger §305(b) exceptions D. Basis §307(a) – if distribution is nontaxable stock dividend basis in old stock is allocated among both old and new stock in proportion to relative FMV on date of distribution E. Preferred Stock Bailouts 1. §306(c) - §306 stock is defined as any stock other than common on common (i.e. preferred) 2. §306(a) – sale of §306 stock to a third party is taxed as ordinary income to the extent of e&p on the date of distribution a. Amount in excess of e&p reduces basis b. Amount in excess of basis is gain c. No loss on sale of §306 stock d. Redeemed §306 stock is ordinary income to the extent of e&p on the date of redemption 3. §306(b) – §306(a) n/a if s/h completely terminates interest in corp and does not pass stock to §318 attributed party

VII. Liquidations A. Nonparent Liquidations 1. General Rule To S/h a. §331(a) – s/h recognizes gain/loss in complete liquidation as if s/h had sold stock in exchange for property i. House Ways and Means Committee Report on General Utilities Repeal: two reasons for repealing GU doctrine a. Basis step-up on acquisition of property from liquidating distributions makes property than property from nonliquidating distributions, thus GU distorts business behavior by encouraging companies w/ appreciated assets to liquidate to effect transfers of property b. Basis step-up on liquidating distributions undermines the corp income tax b/c it eliminates the usual rule that transferees inherit the transferor’s basis, thus granting a permanent exemption from the corporate income tax b. §334(a) – basis of property exchanged for stock is FMV c. §346(a) – complete liquidation includes a series of distributions over a period of time if they are pursuant to a plan of complete liquidation 2. General Rule to Corp a. §336 – corp recognizes gain/loss on complete liquidation as if stock were sold to corp at FMV i. Problem: this is hard to square w/ §311 which denies loss to corp on non-liquidating distributions 3. Limitations on Loss Recognition a. §336(d)(1) – no recognition of loss on property is distributed to §267 related party (50%< owner) if i. Distribution is not pro-rata ii. Distributed property is acquired by corp in §351 contribution w/in five year period ending on distribution date a. Problem: this rule is moot b/c §362(e) eliminates double losses at corp level in §351 contributions b. §336(d)(2) - B. Parent-Subsidiary Liquidations 1. General Rule to Parent a. §332(a) – no gain/loss to parent corp in subsidiary liquidation if parent meets control & timing requirements i. Control §1504(a)(2) – parent must own 80% of vote & 80% of value upon date liquidation is adopted NOT counting plain preferred (i.e. pref stock w/o voting rights) a. Riggs: plan of liquidation is adopted when s/h formally adopt a plan to liquidate; this effectively allows corp to go out and purchase/redeem shares from minority interests to attain 80% ownership b/f adopting liquidation plan and avoid taxes ii. Timing – parent corp must complete liquidation in one-year, or w/in three years, otherwise retroactively disqualified b. §334(b) – parent takes carryover basis in distributed property and parent’s basis in stock disappears c. §336(d)(3) – minority s/hs recognize gain in subsidiary liquidations BUT do not recognize loss 2. General Rule to Subsidiary a. §337(a) – no gain/loss to liquidated subsidiary in §332 liquidation