2018 年 4 月 6 日 星期五

Department of Finance Canada 14th Floor 90 Elgin Street Ottawa, Ontario K1A 0G5

Via e-mail: [email protected]

Good afternoon,

I am writing in response to the discussion paper titled “Tax Planning Using Private Corporations” which was released on July 18, 2017.

I believe the complex changes that have been proposed will:

Reduce the number of small businesses in Canada,

Increase the cost of tax compliance for small businesses,

Diminish Canada’s competitiveness on the global stage,

Reduce long-term economic growth and innovation,

Limit Canada’s ability to attract and retain professionals,

Disproportionately negatively affect women in Canada, and

Negatively impact Canadian society and lifestyle.

I request that this submission not be disclosed or published in any form.

Disadvantage for Transfer of Family Farms

The proposed legislation as drafted provides a disincentive for farmers to transfer their farm business to their children or other family members. Transferring the family farm to the next generation is a common scenario for many farmers. The proposed legislation as drafted will provide adverse tax consequences for the sale of the farm to a related person or group. It will also provide adverse tax consequences where a farm company’s value is frozen to allow a new common shareholder to be introduced. These changes will provide a significant monetary incentive for farmers to sell their farm business to an unrelated third-party. This benefits large businesses in Canada, private equity firms, and hurts farmers and their families.

Business Risk

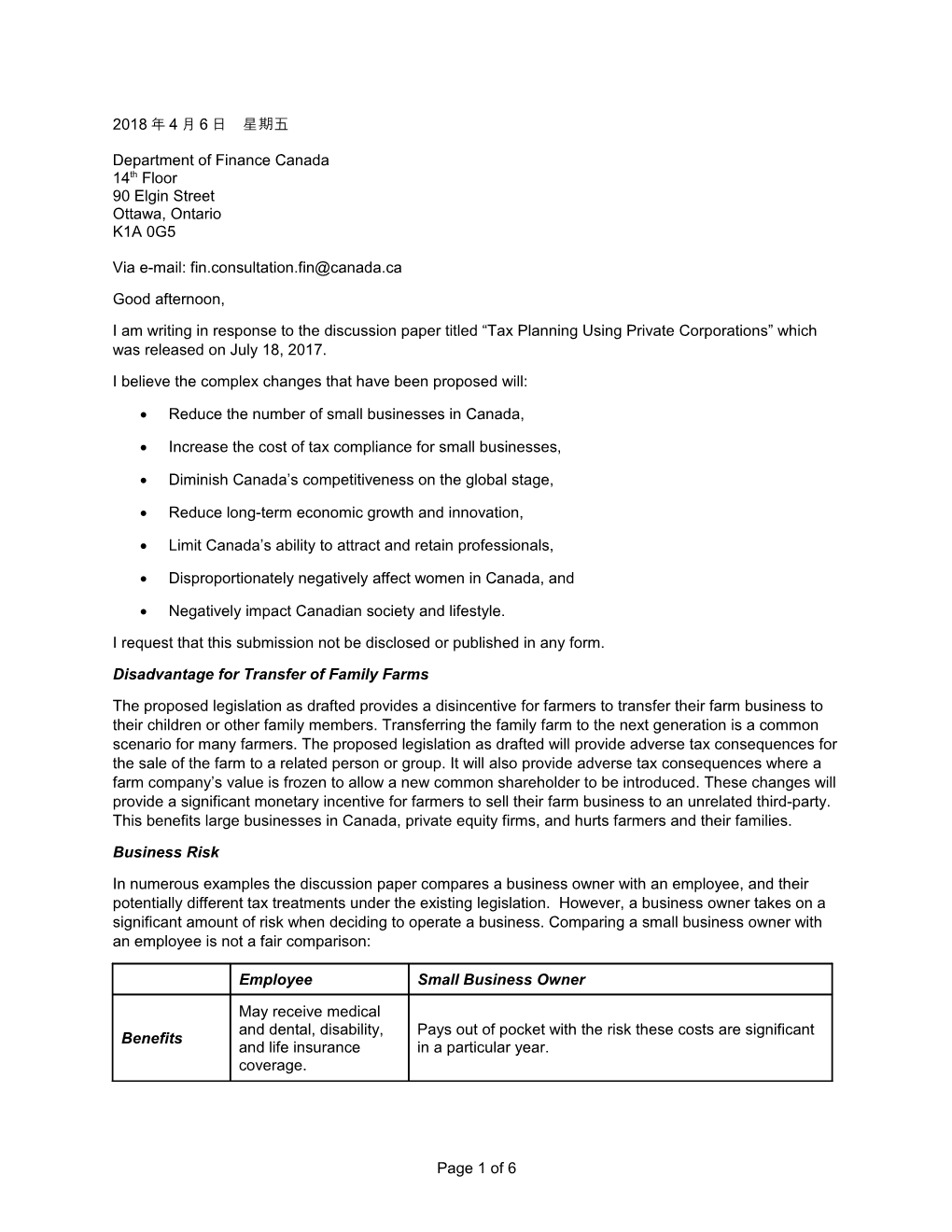

In numerous examples the discussion paper compares a business owner with an employee, and their potentially different tax treatments under the existing legislation. However, a business owner takes on a significant amount of risk when deciding to operate a business. Comparing a small business owner with an employee is not a fair comparison:

Employee Small Business Owner

May receive medical and dental, disability, Pays out of pocket with the risk these costs are significant Benefits and life insurance in a particular year. coverage.

Page 1 of 6 Vacation and Minimum entitlement None. Does not earn income while away and as such does sick leave by law. not take as much time off.

Page 2 of 6 CONTINUED Employee Small Business Owner

Works longer, unpaid hours, and has a higher level of Entitled to additional Overtime stress, taking care of the accounting records, billing clients, pay or time off by law. human resources, and managing client relationships.

May receive pension Pension plan funded by Wholly responsible for own retirement. employer.

May receive top-up of Parental salary while away, and Less secure, as clients and customers may leave. leave access to Employment Insurance benefits.

Entitled to severance Loss of job / and Employment No benefits available. clients Insurance benefits.

Investment in Invests savings or takes on debt to start and grow the None. the business business. If the business fails, this is lost.

No similar contribution Employs Canadians in their business, providing livelihood Employment to Canadian economy. and benefits outlined above.

Obtaining Employment earnings More difficulty obtaining financing for home and vehicles financing more secure for banks. due to less trust placed on business earnings by banks.

Small business owners deserve to have a preferential tax treatment as compared to an employee to compensate for this additional risk, stress, and time.

The proposed changes will provide a disincentive for Canadians to pursue small business and instead stay in the relative safety of employment. With fewer people willing and able to take the risks associated with small business, there will be less small businesses in Canada. This harms Canada’s long-term economic growth, innovation in the economy, and overall competitiveness of business within Canada. This will also reduce employment opportunities for the rest of Canadians, which is discussed in more detail below.

Increased Cost of Tax Compliance

The proposed legislation will dramatically increase the cost of corporate tax compliance to small businesses and make sound tax and business advice more difficult for small businesses to obtain. Finance Minister Morneau made the comment that Canadians expect the government to reduce people using “fancy accounting schemes”1, however the introduction of these changes will increase, rather than decrease, the cost of tax compliance for small business owners, and create more incentive for taxpayers to pursue more complex structures.

1 Tasker, John Paul. “Liberals Propose Tax Changes to Close Loopholes for Wealthy.”CBCnews, CBC/Radio Canada, 18 July 2017, www.cbc.ca/news/politics/morneau-tax-changes-wealthy-consultations-tuesday-1.4210201. Accessed 30 July 2017.

Page 3 of 6 First, analyzing the “reasonability test” proposed to address income splitting is fact specific, time- consuming, and subjective. Small-business owners will not be able to navigate these extremely complex and fact-specific rules without the advice of a qualified, competent professional accountant.

Second, the proposed reasonability test penalizes families that make a different home-life choice than other families. Another example illustrates the taxation difference for two families that have made different choices for home upkeep and childcare. One couple may make the choice to share the home and childcare duties, and as a result share some of the small business duties as well. However, another couple may choose to separate the home and business duties. The second couple would be penalized for this choice. Canadian courts have been reluctant to approach a reasonability test because of the subjectivity, and massive administrative burden that it would apply on taxpayers. There appears to be unreconcilable issues with the current proposed legislative attempt at this reasonability test, and a different taxation outcome for families that make different home-life choices.

Third, the proposals to adjust the taxation of passive investment income all involve a significant administrative burden to track the eventual source of after-tax funds, or track and tax different types of passive income received and paid out. This will significantly increase the cost of tax compliance for corporations, as they will be relying on professional accountants to do this.

The increased accounting cost to small businesses to analyze these measures each year and track the information necessary to comply with the laws would be significant. If the cost was conservatively $500 per corporation for even half of the 1.8 million Canadian-Controlled Private Corporations (CCPCs) in Canada, this is $450 million of reduced collective business investment per year by these CCPCs. In addition, the subjectivity in the rules will require the Federal Government to invest in resources to assess compliance with the new rules, enforce the legislation, and pursue cases in the courts. These same costs would also be incurred by small businesses to support their own filing position. This is money taken out of growing their businesses and saving for retirement, and will ultimately slow economic growth. This will also increase the barrier to entry for small businesses, and reduce overall competitiveness in Canada.

Reduced Employment Opportunities

The proposed changes will provide a disincentive for individuals to pursue a small business, and will reduce the overall number of small businesses in Canada. As of 2015, small businesses (defined as 1-99 paid employees) employed over 8.2 million Canadians, or 70.5% of the private labour workforce2. A reduction in business spending and long-term reduction in the number of small businesses in Canada will have a significant impact on the ability for Canadians to find employment. The discussion paper makes continued references to the taxation of the small business owner compared to his employed neighbour, but the reality of the proposed changes may be that his neighbour would be unemployed.

Funding Students’ Education

Currently small business owners make use of family trusts to fund post-secondary education costs for their children. Chart 6 on Page 21 of the discussion paper outlines the dividends reported collectively by all taxpayers, with a particular focus on those under the age of 25. The proposed rules would all but eliminate the ability to split dividends with adult children under the age of 25.

The impact of this change will be two-fold. Some small business owners will choose to continue to fund their children’s post-secondary education, and will be forced to withdraw more funds from their corporations to do so. As outlined above, this will leave less funds available for business investment, which will slow business growth, job growth, and disproportionately hurts smaller businesses compared to larger, more established ones.

2 "Key Small Business Statistics - June 2016." Government of Canada, Innovation, Science and Economic Development Canada, Office of the Deputy Minister, Small Business, Tourism and Marketplace Services. Innovation, Science and Economic Development Canada, 17 Nov. 2016. http://www.ic.gc.ca/eic/site/061.nsf/eng/h_03018.html. 25 July 2017.

Page 4 of 6 Alternatively, other small business owners will choose to not help their children with funding their post- secondary education. Some students will then choose not to pursue post-secondary education, or may choose to pursue a different level of education. Long-term this reduced education of the next generation will reduce Canada’s innovation, slow economic growth, and have unforeseen societal impacts.

For those students that continue to pursue post-secondary education, they will be forced to make use of Federal and Provincial student loan programs, and obtain bank loans or student lines of credit. This puts more pressure on existing student loan programs. Increased household debt once students have completed their education will reduce home ownership, reduce spending in the economy, and ultimately further reduces the chance the next generation pursues small business ownership.

Disproportionate Negative Impact on Women

The proposed changes will negatively impact women disproportionately compared to the impact on men. The majority of small business owners are men3. If the proposed changes are implemented, a female spouse would be unable to receive dividends from a corporation if she is not actively involved in the business. With no tax advantage to having a spouse or family members as a shareholder of a corporation, small business owners will establish their small business corporation with themselves as the sole shareholder.

However, share ownership carries certain legal rights to financial and tax information. In a separation or divorce situation, this financial and tax information could be very relevant in determining a fair allocation of property, or fair access to support payments. If a woman isn’t given access to this information over time, without a good accountant and lawyer, there could be extremely negative consequences for her. The proposed changes will result in negative outcomes for women without access to funds to engage an accountant and lawyer.

Women will also have less control over their own retirement savings and will be more reliant on their spouse for their financial security. With the proposed changes, a female spouse not actively involved in the business will result in all of the couple’s retirement savings in the name of the male spouse. Women will be reliant on their spouse without income of their own from the corporation that would otherwise form savings in their own name. This becomes pronounced in a separation or divorce situation, where the female spouse may not have immediate access to funds, or may not have access to the full assets and incomes in the name of her spouse. The proposed changes will again result in negative outcomes for women without access to funds to engage an accountant and lawyer.

Women also disproportionately take the majority of parental leave in the first year of their children’s life4, and perform 61% of the household work5. These already serve as disincentives for women to pursue small business; the proposed changes will simply add to that list. In 2015, 38.8% of self-employed people were women (61.2% were men), and just 34.2% of these women utilized a corporation, compared to 53.2% of self-employed men6. With the proposed changes, women, along with men, will be less likely to pursue small business, but women will be disproportionately affected due to the other existing conditions in Canadian society holding them back from self-employment.

3 “Women in Canada: A Gender-Based Statistical Report - Women and Paid Work Women and Paid Work.” Government of Canada, Statistics Canada, Government of Canada, 9 Mar. 2017, www.statcan.gc.ca/pub/89- 503-x/2015001/article/14694-eng.htm. Accessed 24 July 2017. 4 “Leave Practices of Parents after the Birth or Adoption of Young Children.” Government of Canada, Statistics Canada, Government of Canada, 27 Nov. 2015, www.statcan.gc.ca/pub/11-008-x/2012002/article/11697-eng.htm. Accessed 24 July 2017. 5 “Spotlight on Canadians: Results from the General Social Survey Changes in Parents' Participation in Domestic Tasks and Care for Children from 1986 to 2015.” Government of Canada, Statistics Canada, Government of Canada, 7 June 2017, www.statcan.gc.ca/pub/89-652-x/89-652-x2017001-eng.htm. Accessed 24 July 2017. 6 “Women in Canada: A Gender-Based Statistical Report - Women and Paid Work Women and Paid Work.” Government of Canada, Statistics Canada, Government of Canada, 9 Mar. 2017, www.statcan.gc.ca/pub/89- 503-x/2015001/article/14694-eng.htm. Accessed 24 July 2017.

Page 5 of 6 Lower Tax Revenue on Investment Income

Under the current legislation for small businesses, they have been able to accumulate passive investments in private corporations. These investments generated $27 billion of income in 2015 according to Page 16 of the discussion paper. The proposed changes to limit the ability to split income and apply additional taxation to passive investments will reduce the income tax revenue collected on passive investments for two reasons.

First, small business owners will make increased use of RRSPs and TFSAs for their retirement savings. Currently, if a small business owner is taking dividend income from their company and saving for retirement within their company, they may not be utilizing RRSPs or TFSAs at all. These proposed changes to tax small business owners like employees will result in increased usage of RRSPs and TFSAs by small business owners. As well, with less small businesses overall in Canada, and more potential small business owners remaining as employees in the future, the use of these retirement savings vehicles will increase. This will significantly reduce the income tax revenue collected each year on passive investments as more dollars are sheltered inside these tax-free vehicles.

Second, with less money available for small business owners to put towards their retirement savings each year, either within or outside their company, it will slow the growth of their unregistered passive investments. Long-term, this reduces the income tax that is collected annually on these investments.

While there may be some increased taxation revenue to be collected from limited income splitting for small business owners and increasing the initial taxation of passive investments, the long-term reduction in taxation revenue must be considered.

Provide Sufficient Time for Consultation

The proposed changes are significant and far-reaching, and the 75-day consultation period is too short for Canadians to provide meaningful feedback. Give Canadians more time to respond and engage small business owners and other Canadians in meaningful discussions to determine if changes are needed, and if so, what potential alternatives could be. This engagement may be in the form of another Royal Commission on Taxation to study the current income tax system and look at ways to modernize and simplify it, rather than making it significantly more complicated.

Conclusion

I hope that you carefully consider my concerns, and study them on behalf of all Canadians. The proposed changes are the biggest taxation changes since 1972 which took six years to properly establish, and should not be implemented lightly.

Sincerely,

Page 6 of 6