Review packet for Chapters 29, 30 & 31

Multiple Choice Identify the letter of the choice that best completes the statement or answers the question.

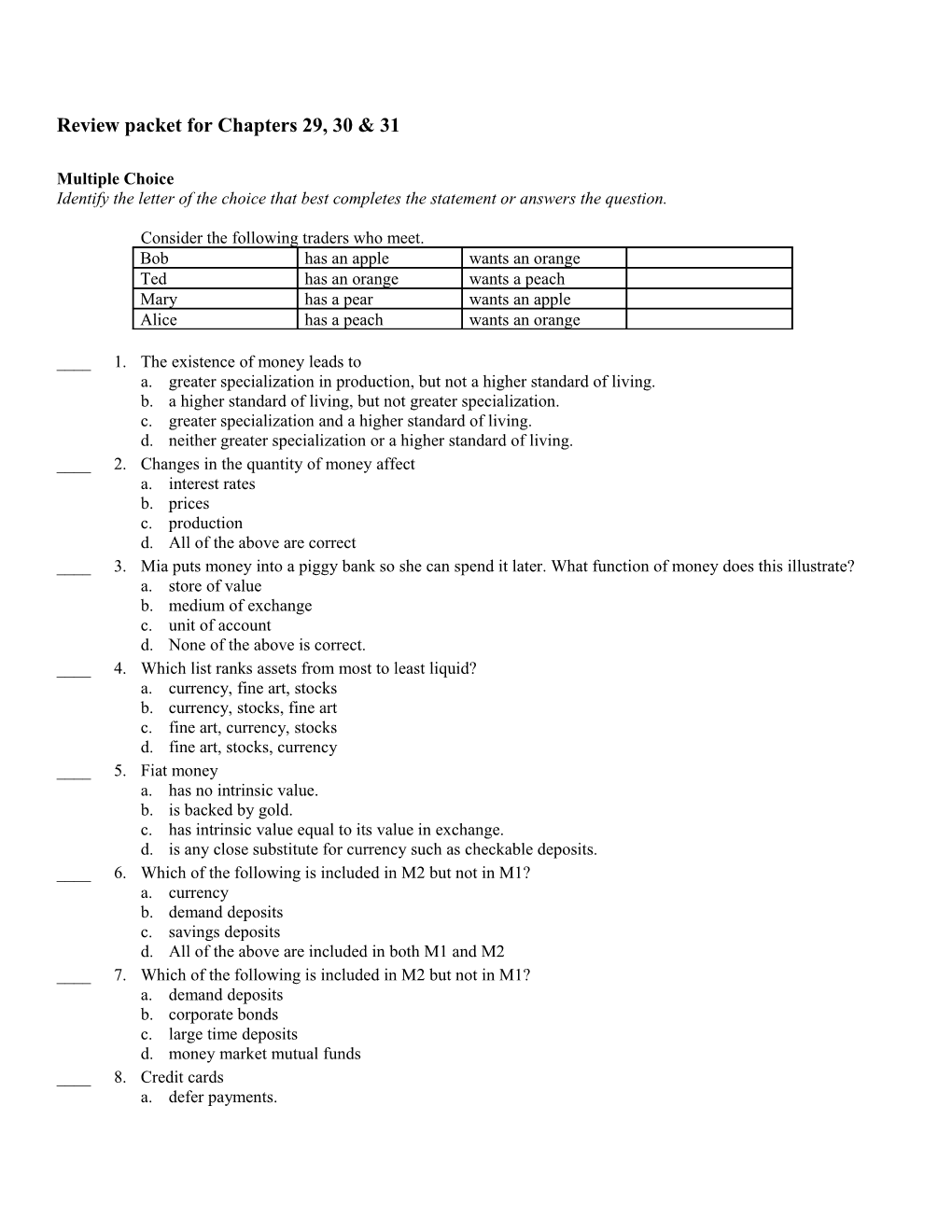

Consider the following traders who meet. Bob has an apple wants an orange Ted has an orange wants a peach Mary has a pear wants an apple Alice has a peach wants an orange

____ 1. The existence of money leads to a. greater specialization in production, but not a higher standard of living. b. a higher standard of living, but not greater specialization. c. greater specialization and a higher standard of living. d. neither greater specialization or a higher standard of living. ____ 2. Changes in the quantity of money affect a. interest rates b. prices c. production d. All of the above are correct ____ 3. Mia puts money into a piggy bank so she can spend it later. What function of money does this illustrate? a. store of value b. medium of exchange c. unit of account d. None of the above is correct. ____ 4. Which list ranks assets from most to least liquid? a. currency, fine art, stocks b. currency, stocks, fine art c. fine art, currency, stocks d. fine art, stocks, currency ____ 5. Fiat money a. has no intrinsic value. b. is backed by gold. c. has intrinsic value equal to its value in exchange. d. is any close substitute for currency such as checkable deposits. ____ 6. Which of the following is included in M2 but not in M1? a. currency b. demand deposits c. savings deposits d. All of the above are included in both M1 and M2 ____ 7. Which of the following is included in M2 but not in M1? a. demand deposits b. corporate bonds c. large time deposits d. money market mutual funds ____ 8. Credit cards a. defer payments. b. are a store of value. c. have led to wider use of currency. d. are part of the money supply. ____ 9. Credit cards a. are included in M1 but not M2. b. are included in M1 and M2. c. are included in M2 but not M1 d. are not included in any measure of the money supply. ____ 10. Which of the following defer payments? a. credit cards and debit cards b. neither credit cards or debit cards c. credit cards but not debit cards d. debit cards but not credit cards

Use the (hypothetical) information in the following table to answer the following Questions.

Table 29-1 Type of Money Amount Large time deposits $80 billion Small time deposits $75 billion Demand deposits $75 billion Other checkable deposits $40 billion Savings deposits $10 billion Travelers' checks $1 billion Money market mutual funds $15 billion Currency $100 billion SDRs $10 billion Miscellaneous categories of M2 $25 billion

____ 11. Refer to Table 29-1. What is the M2 money supply? a. $125 billion b. $341 billion c. $421 billion d. $431 billion ____ 12. Which of the following might explain why the United States has so much currency per person? a. U.S. citizens are holding a lot of foreign currency. b. Currency may be a preferable store of wealth for criminals. c. People use credit and debit cards more frequently. d. All of the above help explain the abundance of currency. ____ 13. One puzzle about the U.S. money stock is that a. banks hold so much currency relative to the public. b. the public holds so much currency relative to banks. c. there is so little currency per person. d. there is so much currency per person. ____ 14. Which of the following executes open-market operations? a. Board of Governors b. New York Federal Reserve Bank c. The FOMC d. None of the above is correct. ____ 15. The Board of Governors a. is currently chaired by Paul Volcker. b. are appointed by the president and confirmed by the Senate. c. has twelve members. d. All of the above are correct. ____ 16. The Federal Open Market Committee is made up of a. 5 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors. b. 5 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors. c. 12 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors. d. 12 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors. ____ 17. When the Fed conducts open-market sales, a. it sells Treasury securities, which increases the money supply. b. it sells Treasury securities, which decreases the money supply. c. it borrows from member banks, which increases the money supply. d. it lends money to member banks, which decreases the money supply. ____ 18. When the Fed conducts open-market purchases, a. it buys Treasury securities, which increases the money supply. b. it buys Treasury securities, which decreases the money supply. c. banks buy Treasury securities from Fed, which increases the money supply. d. banks buy Treasury securities from the Fed, which decreases the money supply. ____ 19. The Fed can increase the price level by conducting open market a. sales and raising the discount rate. b. sales and lowering the discount rate. c. purchases and raising the discount rate. d. purchases and lowering the discount rate. ____ 20. There is a a. short-run tradeoff between inflation and unemployment. b. short-run tradeoff between an increase in the money supply and inflation. c. long-run tradeoff between inflation and unemployment. d. long-run tradeoff between an increase in the money supply and inflation. ____ 21. A bank’s assets include a. both its reserves and the deposits of its customers. b. neither its reserves nor the deposits of its customers. c. its reserves, but not the deposits of its customers. d. the deposits of its customers, but not its reserves. ____ 22. Suppose a bank has $200,000 in deposits and $190,000 in loans. It has loaned out all it can. It has a reserve ratio of a. 2.5 percent. b. 5 percent. c. 9.5 percent. d. 10 percent. ____ 23. When a bank loans out $1,000, the money supply a. does not change. b. decreases. c. increases. d. may do any of the above. ____ 24. Under a fractional reserve banking system, banks a. hold more reserves than deposits. b. generally lend out a majority of the funds deposited. c. cause the money supply to fall by lending out reserves. d. All of the above are correct. ____ 25. Suppose the Fed requires banks to hold 10% of their deposits as reserves. A bank has $20,000 of excess reserves and then sells the Fed a Treasury bill for $9,000. How much does this bank now have to lend out if it decides to hold only required reserves? a. $29,000 b. $28,100 c. $19,100 d. $11,000

Use the balance sheet for the following questions.

Table 29-3 Last Bank of Cedar Bend Assets Liabilities Reserves $25,000 Deposits $150,000 Loans $125,000

____ 26. Refer to Table 29-3. If the reserve requirement is 20 percent, this bank a. has $10,000 of excess reserves. b. needs $10,000 more reserves to meet its reserve requirements. c. needs $5,000 more reserves to meet its reserve requirements. d. just meets its reserve requirement.

Table 29-4 Bank of Tampa Assets Liabilities Reserves $100 Deposits $1,000 Loans $900

____ 27. Refer to Table 29-4. If the Bank of Tampa has loaned out all the money it wants given its deposits, then its reserve ratio is a. 1% b. 5% c. 10% d. 20% ____ 28. Refer to Table 29-4. Assume that all other banks hold only the required 5 percent of deposits as reserves and that people hold only deposits and no currency. If the Bank of Tampa decides to hold exactly 5% reserves, by how much would the economy's money supply increase? a. $500 b. $1,000 c. $1,500 d. $2,000 ____ 29. If the reserve ratio is 12.5 percent, the money multiplier is a. 6.25. b. 8. c. 12.5. d. 25. Tazian Banking Statistics The Monetary Policy of Tazi is controlled by the country’s central bank known as the Bank of Tazi. The local unit of currency is the Taz. Aggregate banking statistics show that collectively the banks of Tazi hold 300 million Tazes of required reserves, 75 million Tazes of excess reserves, have issued 7,500 million Tazes of deposits, and hold 225 million Tazes of Tazian Treasury bonds. Tazians prefer to use only demand deposits and so all currency is on deposit at the bank.

____ 30. Refer to Tazian Banking Statistics. Assuming the only other thing Tazian banks have on their balance sheets is loans, what is the value of existing loans made by Tazian banks? a. 6,900 million Tazes b. 7,125 million Tazes c. 7,350 million Tazes d. None of the above is correct. ____ 31. If the Fed wanted to increase the money supply, it would make open market a. purchases and lower the discount rate. b. sales and lower the discount rate. c. purchases and raise the discount rate. d. sales and raise the discount rate. ____ 32. Which of the following lists two things that both increase the money supply? a. make open market purchases, raise the reserve requirement ratio b. make open market purchases, lower the reserve requirement ratio c. make open market sales, raise the reserve requirement ratio d. make open market sales, lower the reserve requirement ratio ____ 33. Which of the following lists two things that both decrease the money supply? a. raise the discount rate, make open market purchases b. raise the discount rate, make open market sales c. lower the discount rate, make open market purchases d. lower the discount rate, make open market sales ____ 34. When the Fed conducts open market purchases, bank reserves a. increase and banks can increase lending. b. increase and banks must decrease lending. c. decrease and banks can increase lending. d. decrease and banks must decrease lending. ____ 35. In a fractional reserve banking system, an increase in reserve requirements a. increases both the money multiplier and the money supply. b. decreases both the money multiplier and the money supply. c. increases the money multiplier, but decreases the money supply. d. decreases the money multiplier, but increases the money supply. ____ 36. If the reserve ratio is 10 percent, banks do not hold excess reserves and people hold only deposits and not currency, when the Fed sells $10 million dollars of bonds to the public, bank reserves a. increase by $1 million and the money supply eventually increases by $10 million. b. increase by $10 million and the money supply eventually increases by $100 million. c. decrease by $1 million and the money supply eventually increases by $10 million. d. decrease by $10 million and the money supply eventually decreases by $100 million. ____ 37. The interest rate the Fed charges on loans it makes to banks is called a. the prime rate. b. the federal funds rate. c. the discount rate. d. the LIBOR. ____ 38. If the discount rate is lowered, banks choose to borrow a. less from the Fed so reserves increase. b. less from the Fed so reserves decrease. c. more from the Fed so reserves increase. d. more from the Fed so reserves decrease. ____ 39. When the Fed decreases the discount rate, banks will a. borrow more from the Fed and lend more to the public. The money supply increases. b. borrow more from the Fed and lend less to the public. The money supply decreases. c. borrow less from the Fed and lend more to the public. The money supply increases. d. borrow less from the Fed and lend less to the public. The money supply decreases. ____ 40. During the stock market crash of October 1987, the Fed a. nearly created a financial panic by not acting as a lender of last resort. b. nearly created a financial panic by raising the discount rate. c. prevented a financial panic by raising reserve requirements. d. prevented a financial panic by providing liquidity to the financial system. ____ 41. The banking system currently has $10 billion of reserves, none of which are excess. People hold only deposits and no currency, and the reserve requirement is 10%. If the Fed raises the reserve requirement ratio to 20% and at the same time buys $1 billion dollars of bonds, then by how much does the money supply change? a. It falls by $45 billion. b. It falls by $52 billion. c. It falls by $55 billion. d. None of the above is correct. ____ 42. During wars the public tends to hold relatively more currency and relatively fewer deposits. This decision makes reserves a. and the money supply increase. b. and the money supply decrease. c. increase, but leaves the money supply unchanged. d. decrease, but leaves the money supply unchanged. ____ 43. Imagine that the Federal Funds rate was below the level the Federal Reserve had targeted. To move the rate back towards it’s target the Federal Reserve could a. buy bonds. This buying would increase the money supply. b. buy bonds. This buying would reduce the money supply. c. sell bonds. This selling would increase the money supply. d. sell bonds. This selling would reduce the money supply. ____ 44. The price level rises from 120 to 126. What is the inflation rate? a. 3% b. 5% c. 6% d. None of the above is correct. ____ 45. If the price index in some country were falling over time, economists would say that country had a. disinflation. b. deflation. c. a contraction. d. an inverted inflation. ____ 46. Which of the following is correct? a. hyperinflation is a period of extraordinarily high inflation. b. deflation is negative inflation, not just a decrease in the inflation rate. c. during the 1990s US inflation averaged 2% per year. d. All of the above are correct. ____ 47. Economists all agree that a. neither high inflation nor moderate inflation is very costly. b. both high and moderate inflation are quite costly. c. high inflation is costly, but disagree about the costs of moderate inflation. d. moderate inflation is as costly as high inflation. ____ 48. When the price level falls, the number of dollars needed to buy a representative basket of goods a. increases, so the value of money rises. b. increases, so the value of money falls. c. decreases, so the value of money rises. d. decreases, so the value of money falls. ____ 49. The supply of money increases when a. the value of money increases. b. the interest rate increases. c. the Fed makes open-market purchases. d. None of the above is correct. ____ 50. If the Fed raises the money supply, then 1/P a. falls, so the value of money falls. b. falls, so the value of money rises. c. rises, so the value of money falls. d. rises, so the value of money rises. ____ 51. When the money market is drawn with the value of money on the vertical axis, an increase in the money supply causes the equilibrium value of money a. and equilibrium quantity of money to increase. b. and equilibrium quantity of money to decrease. c. to increase, while the equilibrium quantity of money decreases. d. to decrease, while the equilibrium quantity of money increases. ____ 52. Open-market purchases by the Fed make the money supply a. increase, which makes the value of money increase. b. increase, which makes the value of money decrease. c. decrease, which makes the value of money decrease. d. decrease, which makes the value of money increase. ____ 53. When the money market is drawn with the value of money on the vertical axis, an increase in the money supply creates an excess a. supply of money causing people to spend more. b. supply of money causing people to spend less. c. demand for money causing people to spend more. d. demand for money causing people to spend less. ____ 54. The price of a Honda Accord a. and the price of a Honda Accord divided by the price of a Honda Civic are both real variables. b. and the price of a Honda Accord divided by the price of Honda Civic are both nominal variables. c. is a real variable, and the price of a Honda Accord divided by a Honda Civic is a nominal variable. d. is a nominal variable and the price of a Honda Accord divided by the price of a Honda Civic is a real variable. ____ 55. According to the classical dichotomy, which of the following is influenced by monetary factors? a. the real wage b. the real interest rate c. the nominal wage d. All of the above are correct. ____ 56. Changes in nominal variables are determined mostly by the quantity of money and the monetary system according to a. both the classical dichotomy and the quantity theory of money. b. the classical dichotomy, but not the quantity theory of money. c. the quantity theory of money, but not the classical dichotomy. d. neither the classical dichotomy nor the quantity theory of money. ____ 57. According to the quantity equation if P = 4 and Y= 800, which of the following pairs could M and V be? a. 800, 4 b. 600, 3 c. 400, 2 d. 200, 1 ____ 58. If Y and V are constant, and M doubles, the quantity equation implies that the price level a. more than doubles. b. changes but less than doubles. c. doubles. d. does not change ____ 59. Suppose that over some period the money supply tripled, velocity fell by half, and real GDP doubled. According to the quantity equation the price level is now a. 6 times its old value. b. 3 times its old value. c. 1.5 times its old value. d. .75 times its old value ____ 60. Suppose that over some period the money supply tripled, velocity was unchanged, and real GDP doubled. According to the quantity equation the price level is now a. 6 times its old value. b. 3 times its old value. c. 1.5 times its old value. d. .75 times its old value ____ 61. If real output in an economy is 1000 goods per year, the money supply is $300, and each dollar is spent an average of 3 times per year, then according to the quantity equation, the average price of goods is a. $0.90. b. $1.00. c. $1.11. d. $1.33. ____ 62. From the early 1980s through the early 1990s a. both inflation and nominal interest rates rose. b. both inflation and nominal interest rates fell. c. the inflation rate fell and the nominal interest rate rose. d. the inflation rate rose and the nominal interest rate fell. ____ 63. The shoeleather cost of inflation refers to a. the redistributional effects of unexpected inflation. b. the time spent searching for low prices when inflation rises. c. the waste of resources used to maintain lower money holdings. d. the increased cost to the government of printing more money. ____ 64. Menu costs refers to a. resources used by people to maintain lower money holdings when inflation is high. b. resources used to price shop during times of high inflation. c. the distortion in incentives created by inflation when taxes do not adjust for inflation. d. the cost of more frequent price changes induced by higher inflation. ____ 65. For a given real interest rate, an increase in inflation makes the after-tax real interest rate a. decrease, which encourages savings. b. decrease, which discourages savings. c. increase, which encourages savings. d. increase, which discourages savings. ____ 66. You put money in an account and earn a real interest rate of 6 percent, inflation is 2 percent, and your marginal tax rate is 20 percent. What is your after-tax real rate of interest? a. 4.8 percent b. 3.2 percent c. 2.8 percent d. None of the above is correct. ____ 67. Indexing the tax system to take into account the effects of inflation would by itself a. mean that only real interest earnings are taxed. b. mean an end to taxing capital gains. c. mean an increase in average tax rates. d. All of the above are correct. ____ 68. Marta lends money at a fixed interest rate and then inflation rises more than expected. The real interest rate she earns is a. higher than she’d expected, and the real value of the loan rises. b. higher than she’d expected, and the real value of the loan falls. c. lower than she’d expected, and the real value of the loan rises. d. lower then she’d expected, and the real value of the loan falls. ____ 69. High and unexpected inflation has a greater cost a. for those who borrow than those who save. b. for those who hold a little money than for those who hold a lot of money. c. for those whose wages increase by as much as inflation, than those who are paid a fixed nominal wage. d. for savers in high income tax brackets than for savers in low income tax brackets. ____ 70. Between 1880 and 1886 prices that were a. lower than expected transferred wealth from creditors to debtors. b. lower than expected transferred wealth from debtors to creditors. c. higher than expected transferred wealth from creditors to debtors. d. higher than expected transferred wealth from debtors to creditors. ____ 71. Juan lives in Ecuador and purchases a motorcycle manufactured in the United States. The motorcycle is a. both a U.S. and Ecuadorian export. b. both a U.S. and Ecuadorian import. c. a U.S. import and an Ecuadorian export. d. a U.S. export and an Ecuadorian import. ____ 72. Suppose a country had net exports of $8.3 billion and sold $52.4 billion of goods and services abroad. This country had a. $60.7 billion of imports and $52.4 billion of imports. b. $60.7 billion of exports and $52.4 of imports. c. $52.4 billion of imports and $44.1 billion of exports. d. $52.4 billion of exports and $44.1 billion of imports. ____ 73. Mike, a U.S. citizen, buys $1,000 worth of cheese from France. His action alone a. increases U.S. imports by $1,000 and increases U.S. net exports by $1,000. b. increases U.S. imports by $1,000 and decreases U.S. net exports by $1,000. c. increases U.S. exports by $1,000 and increases U.S. net exports by $1,000. d. increases U.S. exports by $1,000 and decreases U.S. net exports by $1,000. ____ 74. About what percentage of GDP are U.S. imports? a. less than 1 percent b. about 4 percent c. about 7 percent d. over 10 percent ____ 75. An Italian citizen opens and operates a spaghetti factory in the United States. This is Italian a. foreign direct investment that increases Italian net capital outflow. b. foreign direct investment that decreases Italian net capital outflow. c. foreign portfolio investment that increases Italian net capital outflow. d. foreign portfolio investment that decreases Italian net capital outflow. ____ 76. Greg, a U.S. citizen, opens an ice cream store in Bermuda. His expenditures are U.S. a. foreign portfolio investment that increase U.S. net capital outflow. b. foreign portfolio investment that decrease U.S. net capital outflow. c. foreign direct investment that increase U.S. net capital outflow. d. foreign direct investment that decrease U.S. net capital outflow. ____ 77. Net capital outflow equals the difference between a country's a. income and expenditure. b. investment and saving. c. buying of foreign goods and services and sales of goods and services abroad. d. purchases of foreign assets and sales of domestic assets abroad. ____ 78. When a French vineyard establishes a distribution center in the U.S., U.S. net capital outflow a. increases because the foreign company makes a portfolio investment in the U.S. b. declines because the foreign company makes a portfolio investment in the U.S. c. increases because the foreign company makes a direct investment in capital in the U.S. d. declines because the foreign company makes a direct investment in capital in the U.S. ____ 79. If a U.S. shirt maker purchases cotton from Egypt, U.S. net exports a. increase, and U.S. net capital outflow increases. b. increase, and U.S. net capital outflow decreases. c. decrease, and U.S. net capital outflow increases. d. decrease, and U.S. net capital outflow decreases. ____ 80. Jill uses some euros to purchase a bond issued by a French vineyard. This exchange a. increases U.S. net capital outflow by more than the value of the bond. b. increases U.S. net capital outflow by the value of the bond. c. does not change U.S. net capital outflow. d. decreases U.S. net capital outflow. ____ 81. Tony, a U.S. citizen, uses some previously obtained Portuguese currency (escudo) to purchase a bond issued by a Portuguese company. This transaction a. increases U.S. net capital outflow by more than the value of the bond. b. increases U.S. net capital outflow by the value of the bond. c. does not change U.S. net capital outflow. d. decreases U.S. net capital outflow. ____ 82. A U.S. firm buys apples from New Zealand with U.S. currency. The New Zealand firm than uses this money to buy packaging equipment from a U.S. firm. Which of the following increases? a. New Zealand net capital outflow and New Zealand net exports b. only New Zealand net exports c. only New Zealand net capital outflow d. neither New Zealand net exports nor New Zealand capital outflow ____ 83. If a country has a trade surplus a. it has positive net exports and positive net capital outflow. b. it has positive net exports and negative net capital outflow. c. it has negative net exports and positive net capital outflow. d. it has negative net exports and negative net capital outflow. ____ 84. If there is a trade surplus then a. saving is greater than domestic investment and Y > C + I + G. b. saving is greater than domestic investment and Y < C + I + G. c. saving is less than domestic investment and Y > C +I + G. d. saving is less than domestic investment and Y < C + I + G. ____ 85. A country has $60 million of saving and domestic investment of $40 million. Net exports are a. $20 million. b. -$20 million. c. $100 million. d. -$100 million. ____ 86. All saving in the U.S. economy shows up as a. investment in the U.S. economy. b. U.S. net capital outflow. c. either investment in the U.S. economy or U.S. net capital outflow. d. None of the above is correct. ____ 87. From 1980 to 1987 a. foreigners were buying more capital assets from the United States than Americans were buying abroad. The United States was going into debt. b. Americans were buying more capital assets abroad than foreigners were buying from the United States. The United States was going into debt. c. foreigners were buying more capital assets from the United States than Americans were buying abroad. The United States was moving into surplus. d. Americans were buying more capital assets abroad than foreigners were buying from the United States. The United States was moving into surplus. ____ 88. From 1980-1987, U.S. net capital outflow as a percent of GDP became a a. larger positive number. b. smaller positive number. c. larger negative number. d. smaller negative number. ____ 89. From 2000-2004 net capital outflow as a percent of GDP became a a. larger positive number. b. smaller positive number. c. larger negative number. d. smaller negative number ____ 90. You are the CEO of a firm considering opening a factory in Peru. If the dollar appreciated relative to the Peruvian peso, then other things the same a. you'd find it took fewer dollars to build the factory. The building of the factory increases U.S. net capital outflow. b. you'd find it took fewer dollars to build the factory. The building of the factory decreases U.S. net capital outflow. c. you'd find it took more dollars to build the factory. If you still build the factory anyway, it will increase U.S. net capital outflow. d. you'd find it took more dollars to build the factory. If you still build the factory anyway, it will decrease U.S. net capital outflow. ____ 91. In the United States, a cup of hot chocolate costs $5. In Australia, the same hot chocolate costs $6.5 Australian dollars. If the exchange rate is $1.3 Australian dollars per U.S. dollar, what is the real exchange rate? a. 1/2 cup of Australian hot chocolate per cup of U.S. hot chocolate b. 1 cup of Australian hot chocolate per cup of U.S. hot chocolate c. 2 cups of Australian hot chocolate per cup of U.S. hot chocolate d. None of the above is correct. ____ 92. The nominal exchange rate is about 1.8 Aruban florin per dollar. If a basket of goods in the United States costs $40, how many florins must a basket of goods in Aruba cost for purchasing power parity to hold? a. 18 florin b. 36 florin c. 72 florin d. 90 florin ____ 93. If US goods cost 1/5 of one dollar for every Markka Finnish goods cost, the real exchange rate would be computed as how many Finnish goods per U.S. goods? a. five b. one fifth the price of the U.S. goods c. the amount of Markka that can be bought with 1/5 of one dollar. d. None of the above is correct. ____ 94. Suppose that the real exchange rate between the United States and Vietnam is defined in terms of baskets of goods. Other things the same, which of the following will increase the real exchange rate (that is increase the number of baskets of Vietnamese goods a basket of U.S. goods buys)? a. an increase in the quantity of Vietnamese currency that can be purchased with a dollar b. an increase in the price of U.S. baskets of goods c. a decrease in the price in Vietnamese currency of Vietnamese goods d. All of the above are correct. ____ 95. If the U.S. real exchange rate appreciates, U.S. exports a. increase and U.S. imports decrease. b. decrease and U.S. imports increase. c. and U.S. imports both increase. d. and U.S. imports both decrease.

Use the (hypothetical) information in the following table to answer the following questions.

Table 31-1 Currency per U.S. Price Country Price Country Currency U.S. Dollar Index Index Bolivia boloviano 8.00 200 1600 Japan yen 125.00 200 50,000 Morocco dinar 10.00 200 2,000 Norwegian kroner 6.5 200 1,500 Thailand baht 40.00 200 7,000

____ 96. Refer to Table 31-1. Which currency(ies) is(are) more valuable than predicted by the doctrine of purchasing- power parity? a. boloviano and dinar b. yen, kroner, and baht c. yen and kroner d. baht ____ 97. Refer to Table 31-1. In real terms, U.S. goods are less expensive than goods in which country(ies)? a. Bolivia and Morocco b. Japan, Norway, and Thailand c. Japan and Norway d. Thailand ____ 98. If inflation is higher in the United States over the next few months than in foreign countries and exchange rates are given in terms of how much foreign currency a dollar buys or how many foreign goods U.S. goods buy, then according to purchasing-power parity we should expect to see a. only the nominal exchange rate depreciate. b. both the real and nominal exchange rate appreciate. c. both the real and nominal exchange rate depreciate. d. only the real exchange rate appreciate. ____ 99. From 1970 to 1998 the U.S. dollar a. gained value compared to the German mark because inflation was higher in Germany. b. gained value compared to the German mark because inflation was lower in Germany. c. lost value compared to the German mark because inflation was higher in Germany. d. lost value compared to the German mark because inflation was lower in Germany. ____ 100. Purchasing-power parity theory does not hold at all times because a. many goods are not easily transported. b. the same goods produced in different countries may be imperfect substitutes for each other. c. Both a and b are correct. d. prices are different across countries.

Short Answer

101. Economists argue that the move from barter to money increased trade and production. How is this possible? 102. Which of the three functions of money are commonly met by each of the following assets in the U.S. economy? a. paper dollar b. precious metals c. collectibles such as baseball cards, stamps, and antiques 103. What makes the New York Federal Reserve regional bank so important? 104. Explain how each of the following changes the money supply. a. the Fed buys bonds b. the Fed raises the discount rate c. the Fed raises the reserve requirement 105. Describe the two things that limit the precision of the Fed's control of the money supply and explain how each limits that control. 106. During the early 1930s there were a number of bank failures in the United States. What did this do to the money supply? The New York Federal Reserve Bank advocated open market purchases. Would these purchases have reversed the change in the money supply and helped banks? Explain. 107. Why did farmers in the late 1800s dislike deflation? 108. Explain the adjustment process in the money market that creates a change in the price level when the money supply increases. 109. Using separate graphs, demonstrate what happens to the money supply, money demand, the value of money, and the price level if: a. the Fed increases the money supply. b. people decide to demand less money at each value of money. 110. According to the classical dichotomy, what changes nominal variables? What changes real variables? 111. Identify each of the following as nominal or real variables. a. the physical output of goods and services b. the overall price level c. the dollar price of apples d. the price of apples relative to the price of oranges e. the unemployment rate f. the amount that shows up on your paycheck after taxes g. the amount of goods you can purchase with the wage you get each hour h. the taxes that you pay the government 112. List and define any two of the costs of high inflation. 113. Inflation distorts relative prices. What does this mean and why does it impose a cost on society? 114. List the factors that might influence a country's exports, imports, and trade balance. 115. Why are net exports and net capital outflow always equal? 116. Colonial America had little industry and so had mostly raw materials to export. At the same time, there were many opportunities to purchase capital goods and earn a high rate of return because there was little existing capital so that the marginal product of capital was relatively high. What does this suggest about net exports and net capital outflow in colonial America? 117. Derive the relation between savings, domestic investment, and net capital outflow using the national income accounting identity. 118. How do we find the real exchange rate from the nominal exchange rate? 119. According to purchasing-power parity, what is the relationship between changes in price levels between two countries and changes in nominal exchange rates? 120. Suppose a lobster supper in Maine costs fewer dollars than a Lobster supper in Paris, France. Explain why this is inconsistent with purchasing-power parity and explain why the inconsistency may exist. Review packet for Chapters 29, 30 & 31 Answer Section

MULTIPLE CHOICE

1. ANS: C DIF: 1 REF: 29-1 TOP: Money MSC: Definitional 2. ANS: D DIF: 1 REF: 29-1 TOP: Monetary policy MSC: Definitional 3. ANS: A DIF: 1 REF: 29-1 TOP: Store of value MSC: Interpretive 4. ANS: B DIF: 1 REF: 29-1 TOP: Liquidity MSC: Definitional 5. ANS: A DIF: 1 REF: 29-1 TOP: Fiat money MSC: Definitional 6. ANS: C DIF: 1 REF: 29-1 TOP: M2, M1 MSC: Definitional 7. ANS: D DIF: 2 REF: 29-1 TOP: M2, M1 MSC: Definitional 8. ANS: A DIF: 1 REF: 29-1 TOP: Credit cards MSC: Definitional 9. ANS: D DIF: 1 REF: 29-1 TOP: Credit cards MSC: Definitional 10. ANS: C DIF: 1 REF: 29-1 TOP: Credit cards, Debit cards MSC: Definitional 11. ANS: B DIF: 2 REF: 29-1 TOP: M2 MSC: Applicative 12. ANS: B DIF: 1 REF: 29-1 TOP: Currency holdings MSC: Definitional 13. ANS: D DIF: 1 REF: 29-1 TOP: Currency holdings MSC: Definitional 14. ANS: B DIF: 1 REF: 29-2 TOP: Federal Reserve MSC: Definitional 15. ANS: B DIF: 1 REF: 29-2 TOP: Federal Reserve MSC: Definitional 16. ANS: A DIF: 2 REF: 29-2 TOP: Federal Open Market Committee MSC: Definitional 17. ANS: B DIF: 1 REF: 29-1 TOP: Open-market operations MSC: Definitional 18. ANS: A DIF: 1 REF: 29-1 TOP: Open-market operations MSC: Definitional 19. ANS: D DIF: 3 REF: 29-2 TOP: Open-market operations MSC: Definitional 20. ANS: A DIF: 1 REF: 29-2 TOP: Inflation, Unemployment MSC: Definitional 21. ANS: C DIF: 1 REF: 29-3 TOP: Bank balance sheet MSC: Definitional 22. ANS: B DIF: 1 REF: 29-3 TOP: Reserves MSC: Applicative 23. ANS: C DIF: 2 REF: 29-3 TOP: Money creation MSC: Definitional 24. ANS: B DIF: 1 REF: 29-3 TOP: Money creation MSC: Definitional 25. ANS: A DIF: 3 REF: 29-2 TOP: Reserves MSC: Applicative 26. ANS: C DIF: 1 REF: 29-3 TOP: Reserves MSC: Applicative 27. ANS: C DIF: 2 REF: 29-2 TOP: Reserve ratio MSC: Applicative 28. ANS: B DIF: 2 REF: 29-2 TOP: Money multiplier MSC: Analytical 29. ANS: B DIF: 1 REF: 29-3 TOP: Money multiplier MSC: Applicative 30. ANS: A DIF: 2 REF: 29-3 TOP: Reserve ratio MSC: Applicative 31. ANS: A DIF: 2 REF: 29-3 TOP: Monetary tools MSC: Definitional 32. ANS: B DIF: 2 REF: 29-3 TOP: Monetary tools MSC: Definitional 33. ANS: B DIF: 2 REF: 29-3 TOP: Monetary tools MSC: Definitional 34. ANS: A DIF: 2 REF: 29-3 TOP: Monetary tools MSC: Interpretive 35. ANS: B DIF: 2 REF: 29-3 TOP: Reserve requirement MSC: Interpretive 36. ANS: D DIF: 3 REF: 29-3 TOP: Open-market operations, Money multiplier MSC: Applicative 37. ANS: C DIF: 1 REF: 29-3 TOP: Federal funds rate MSC: Definitional 38. ANS: C DIF: 1 REF: 29-3 TOP: Discount rate MSC: Definitional 39. ANS: A DIF: 2 REF: 29-3 TOP: Discount rate MSC: Interpretive 40. ANS: D DIF: 1 REF: 29-3 TOP: Stock market crash of 1987 MSC: Definitional 41. ANS: A DIF: 3 REF: 29-3 TOP: Money multiplier, Open-market operations MSC: Analytical 42. ANS: B DIF: 2 REF: 29-3 TOP: Money multiplier and currency holdings MSC: Applicative 43. ANS: D DIF: 3 REF: 29-3 TOP: Federal funds rate market MSC: Analytical 44. ANS: B DIF: 1 REF: 30-1 TOP: Inflation MSC: Applicative 45. ANS: B DIF: 1 REF: 30-1 TOP: Deflation MSC: Applicative 46. ANS: D DIF: 1 REF: 30-1 TOP: Inflation MSC: Definitional 47. ANS: C DIF: 1 REF: 30-1 TOP: Inflation costs MSC: Definitional 48. ANS: C DIF: 1 REF: 30-1 TOP: Value of money MSC: Definitional 49. ANS: C DIF: 2 REF: 30-1 TOP: Money supply MSC: Definitional 50. ANS: A DIF: 1 REF: 30-1 TOP: Deflation, Inflation MSC: Interpretive 51. ANS: D DIF: 2 REF: 30-1 TOP: Money market MSC: Applicative 52. ANS: B DIF: 2 REF: 30-1 TOP: Money market MSC: Applicative 53. ANS: A DIF: 2 REF: 30-1 TOP: Money market MSC: Analytical 54. ANS: D DIF: 1 REF: 30-1 TOP: Nominal variables, Real variables MSC: Interpretive 55. ANS: C DIF: 1 REF: 30-1 TOP: Classical dichotomy MSC: Definitional 56. ANS: A DIF: 2 REF: 30-1 TOP: Classical dichotomy, Quantity theory MSC: Definitional 57. ANS: A DIF: 2 REF: 30-1 TOP: Velocity MSC: Applicative 58. ANS: C DIF: 1 REF: 30-1 TOP: Quantity equation MSC: Analytical 59. ANS: D DIF: 2 REF: 30-1 TOP: Quantity equation MSC: Analytical 60. ANS: C DIF: 2 REF: 30-1 TOP: Quantity equation MSC: Analytical 61. ANS: A DIF: 1 REF: 30-1 TOP: Quantity equation MSC: Applicative 62. ANS: B DIF: 2 REF: 30-1 TOP: Nominal interest rate, Inflation MSC: Definitional 63. ANS: C DIF: 1 REF: 30-2 TOP: Shoeleather costs MSC: Definitional 64. ANS: D DIF: 1 REF: 30-2 TOP: Menu costs MSC: Definitional 65. ANS: B DIF: 2 REF: 30-2 TOP: After-tax real interest rate MSC: Analytical 66. ANS: D DIF: 2 REF: 30-2 TOP: After-tax real interest rate MSC: Applicative 67. ANS: A DIF: 1 REF: 30-2 TOP: Inflation-induced tax distortions MSC: Definitional 68. ANS: D DIF: 1 REF: 30-2 TOP: Redistributional effects of unexpected inflation MSC: Analytical 69. ANS: D DIF: 2 REF: 30-2 TOP: Redistributional effects of unexpected inflation MSC: Interpretive 70. ANS: B DIF: 2 REF: 30-2 TOP: Redistributional effects of unexpected inflation MSC: Interpretive 71. ANS: D DIF: 1 REF: 31-1 TOP: Exports, Imports MSC: Definitional 72. ANS: D DIF: 2 REF: 31-1 TOP: Net exports MSC: Analytical 73. ANS: B DIF: 1 REF: 31-1 TOP: Net exports MSC: Applicative 74. ANS: D DIF: 2 REF: 31-1 TOP: U.S. trade MSC: Definitional 75. ANS: A DIF: 1 REF: 31-1 TOP: Foreign direct investment, Net capital outflow MSC: Interpretive 76. ANS: C DIF: 1 REF: 31-1 TOP: Foreign direct investment, Net capital outflow MSC: Interpretive 77. ANS: D DIF: 1 REF: 31-1 TOP: Net capital outflow MSC: Definitional 78. ANS: D DIF: 3 REF: 31-1 TOP: Net capital outflow, Foreign investment MSC: Applicative 79. ANS: D DIF: 2 REF: 31-1 TOP: Net capital outflow, Net exports MSC: Applicative 80. ANS: C DIF: 3 REF: 31-1 TOP: Net capital outflow MSC: Applicative 81. ANS: C DIF: 3 REF: 31-1 TOP: Net capital outflow MSC: Applicative 82. ANS: D DIF: 3 REF: 31-1 TOP: Net exports, Net capital outflow MSC: Applicative 83. ANS: A DIF: 2 REF: 31-2 TOP: Trade balance MSC: Applicative 84. ANS: A DIF: 1 REF: 31-1 TOP: National accounts MSC: Definitional 85. ANS: A DIF: 2 REF: 31-1 TOP: National accounts MSC: Analytical 86. ANS: C DIF: 1 REF: 31-1 TOP: Saving MSC: Definitional 87. ANS: A DIF: 2 REF: 31-3 TOP: U.S. trade MSC: Definitional 88. ANS: C DIF: 2 REF: 31-1 TOP: U.S. trade MSC: Definitional 89. ANS: C DIF: 2 REF: 31-1 TOP: U.S. trade MSC: Definitional 90. ANS: A DIF: 2 REF: 31-2 TOP: Nominal exchange rate, Net capital outflow MSC: Interpretive 91. ANS: B DIF: 2 REF: 31-2 TOP: Real exchange rate MSC: Analytical 92. ANS: C DIF: 1 REF: 31-3 TOP: Purchasing-power parity MSC: Applicative 93. ANS: C DIF: 2 REF: 31-2 TOP: Real exchange rate MSC: Analytical 94. ANS: D DIF: 2 REF: 31-2 TOP: Real exchange rate MSC: Analytical 95. ANS: B DIF: 1 REF: 31-2 TOP: Appreciation, Real exchange rate MSC: Applicative 96. ANS: C DIF: 3 REF: 31-3 TOP: Purchasing-power parity MSC: Analytical 97. ANS: C DIF: 3 REF: 31-3 TOP: Purchasing-power parity MSC: Analytical 98. ANS: A DIF: 2 REF: 31-3 TOP: Purchasing-power parity MSC: Analytical 99. ANS: D DIF: 2 REF: 31-3 TOP: U.S. exchange rates, Purchasing-power parity MSC: Definitional 100. ANS: C DIF: 1 REF: 31-3 TOP: Purchasing-power parity MSC: Interpretive

SHORT ANSWER

101. ANS: The use of money allows people to trade more easily. When it is easier to trade specialization increases. Increased specialization increases production and the standard of living.

DIF: 2 REF: 29-1 TOP: Efficiency of money MSC: Interpretive 102. ANS: a. medium of exchange, store of value, unit of account b. store of value c. store of value

DIF: 1 REF: 29-1 TOP: Functions of money MSC: Interpretive 103. ANS: The president of the New York Federal Reserve regional bank is the only regional bank president who is always a voting member of the FOMC, the committee that determines monetary policy. New York is the traditional financial center of the U.S. economy and the New York Federal Reserve Bank conducts all open- market transactions.

DIF: 1 REF: 29-2 TOP: Federal Reserve MSC: Definitional 104. ANS: a. If the Fed buys bonds, it pays for them with reserves so banks will have more reserves and can lend more which will create more deposits and so more money. b. If the Fed raises the discount rate banks will borrow less from the Fed, and so have fewer reserves, which decreases the money supply. c. If the Fed raises the reserve requirement, banks will have to hold more of their deposits as reserves and so will have less to lend out. With less to lend out, deposits and the money supply decrease.

DIF: 2 REF: 29-3 TOP: Monetary tools MSC: Interpretive 105. ANS: First, the Fed does not control the amount of currency that households choose to hold relative to deposits. If households decide to hold relatively more currency, banks have fewer reserves and the money supply decreases. Second, the Fed cannot control the amount banks choose to hold as excess reserves. If bankers decide to lend out less of their deposits, the money supply will decrease.

DIF: 3 REF: 29-3 TOP: Monetary tools MSC: Interpretive 106. ANS: Bank failures cause people to lose confidence in the banking system so that deposits fall and banks have less to lend. Further, under these circumstances banks are probably more cautious about lending. Both of these reactions would tend to decrease the money supply. Open market purchases increase bank reserves and so would have at least made the decrease smaller. The increase in reserves would also have provided banks with greater liquidity to meet the demands of customers who wanted to make withdrawals. In short, while the actions of depositors and banks lowered the money supply, the Fed could have increased it by buying bonds.

DIF: 3 REF: 29-3 TOP: Monetary policy, Open-market operations MSC: Analytical 107. ANS: Most had large nominal debts. The decrease in the price level meant that they received less for what they produced and so made it harder to pay off the debts whose real value rose as prices fell.

DIF: 2 REF: 30-1 TOP: Deflation MSC: Analytical 108. ANS: When the money supply increases, there is an excess supply of money at the original value of money. After the money supply increases, people have more money than they want to hold in their purses, wallets and checking accounts. They use this excess money to buy goods and services or lend it out to other people to buy goods and services. The increase in expenditures causes prices to rise and the value of money to fall. As the value of money falls, the quantity of money people want to hold increases so that the excess supply is eliminated. At the end of this process the money market is in equilibrium at a higher price level and a lower value of money.

DIF: 2 REF: 30-1 TOP: Money market MSC: Analytical 109. ANS:

a. The Fed increases the money supply. When the Fed increases the money supply, the money

supply curve shifts right from MS1 to MS2. This shift causes the value of money to fall, so the price level rises. b. People decide to demand less money at each value of money. Since people want to hold less at each value of money, it follows that the money demand curve will shift to the left from MD1 to MD2. The decrease in money demand results in a lower value of money and so a higher price level.

DIF: 2 REF: 30-1 TOP: Money market MSC: Analytical 110. ANS: The classical dichotomy argues that nominal variables are determined primarily by developments in the monetary system such as changes in money demand and supply. Real variables are largely independent of the monetary system and are determined by productivity and real changes in the factor and loanable funds markets.

DIF: 1 REF: 30-1 TOP: Classical dichotomy MSC: Definitional 111. ANS: a. real variable b. nominal variable c. nominal variable d. real variable e. real variable f. nominal variable g. real variable h. nominal variable

DIF: 1 REF: 30-1 TOP: Nominal variables, Real variables MSC: Interpretive 112. ANS: The costs include: Shoeleather costs: the resources wasted when inflation induces people to reduce their money holdings.

Menu costs: the cost of more frequent price changes at higher inflation rates.

Relative Price Variability: because prices change infrequently, higher inflation causes relative prices to vary more. Decisions based on relative prices are then distorted so that resources may not be allocated efficiently.

Inflation Induced Tax Distortions: the income tax is not completely indexed for inflation; an increase in nominal income created by inflation results in higher real tax rates that discourage savings.

Confusion and Inconvenience: inflation decreases the reliability of the unit of account making it more complicated to differentiate successful and unsuccessful firms thereby impeding the efficient allocation of funds to alternative investments.

Unexpected Inflation: inflation decreases the real value of debt thereby transferring wealth from creditors to debtors.

DIF: 1 REF: 30-2 TOP: Inflation costs MSC: Definitional 113. ANS: Relative prices are the value of one good in terms of other goods. Relative prices ordinarily provide signals concerning the relative scarcity of goods so the goods may be allocated efficiently. Some prices change infrequently, so that when inflation rises, there is greater variation in relative prices. However, changes in relative prices created by inflation do not signal changes in the scarcity of goods and so lead to an inefficient allocation of goods and resources.

DIF: 1 REF: 30-2 TOP: Relative price variability MSC: Interpretive 114. ANS: a. the tastes of consumers for domestic and foreign goods b. the prices of goods at home and abroad c. the exchange rates at which people can use domestic currency to buy foreign currencies d. the costs of importing goods from country to country e. the policies of the government toward international trade

DIF: 2 REF: 31-1 TOP: Trade balance MSC: Applicative 115. ANS: Net exports and net capital outflow are always equal because every international transaction is an exchange. When a seller country transfers a good or service to a buyer country, the buyer country gives up some asset to pay for this good or service. The value of that asset equals the value of goods and services sold. Hence, the net value of goods and services sold by a country (NX) must equal the net value of assets acquired (NCO).

DIF: 3 REF: 31-1 TOP: Net capital outflow, Net exports MSC: Analytical 116. ANS: Net exports were negative because the value of exports was low, and the colonies imported capital goods. If net exports were negative, net capital outflow must also have been negative. Net capital outflow would have been negative because the colonies sold stocks, bonds, and other domestic assets to buy capital goods from abroad.

DIF: 2 REF: 31-1 TOP: Net capital outflow, Net exports MSC: Applicative 117. ANS: Start from the national income accounting identity, (1) Y = C + I + G + NX. Recall from Chapter 25 that national saving is the income that is left after paying for current consumption and government expenditure, (2) S = Y - C - G. Rearranging, (1) we obtain Y - C - G = I + NX, and substituting in (2) (3) S = I + NX. Because net exports also equal net capital outflow, we can also write this equation as (4) S = I + NCO.

DIF: 3 REF: 31-1 TOP: National income accounts MSC: Analytical 118. ANS: Real Exchange Rate = Nominal Exchange Rate x Domestic Price Index/Foreign Price Index

DIF: 2 REF: 31-2 TOP: Nominal exchange rate, Real exchange rate MSC: Definitional 119. ANS: Purchasing-power parity asserts that the nominal exchange rate is equal to the foreign price level divided by the domestic price level. If the domestic price level rises more than the foreign price level, domestic currency depreciates. If the foreign price level rises more than the domestic price level, domestic currency appreciates.

DIF: 2 REF: 31-3 TOP: Purchasing-power parity MSC: Analytical 120. ANS: According to purchasing-power parity, a dollar should buy the same amount of goods everywhere in the world. The inconsistency may exist because lobsters have to be transported to Paris. Price differences can also persist because goods are not perfect substitutes. While eating lobster gazing at the Maine coastline may be a pleasurable experience, eating well-prepared lobster in a fancy French restaurant may be an experience people would be willing to pay more for.

DIF: 2 REF: 31-3 TOP: Purchasing-power parity MSC: Interpretive