Disability Housing Network Fall Conference Workshop Notes

Session 6: Capital Replacement Planning Presenters: Pat Rafter, CEO, Creative Housing, Inc. Dianne DePasquale-Hagerty, Executive Director, Medina Creative Housing Marti Goetz, General manager, Miami Valley Inn-Ovations December 1, 2010

The presenters spoke from Powerpoint presentations. Given below, in black and red, are the notes from their slides. In blue is additional information from notes taken by DHN Technical Assistance Consultant. A Q&A appears at the end.

Capital Replacement Planning - Pat Rafter

Reserve Funds Who pays for the new roof? Have a bake sale?

Does your revenue equal your expense? When we first started doing this a number of years ago, we didn't know what we were doing. These are things you learn as you go. But having revenue that is more than or equal to expenses is fundamental - and very difficult.

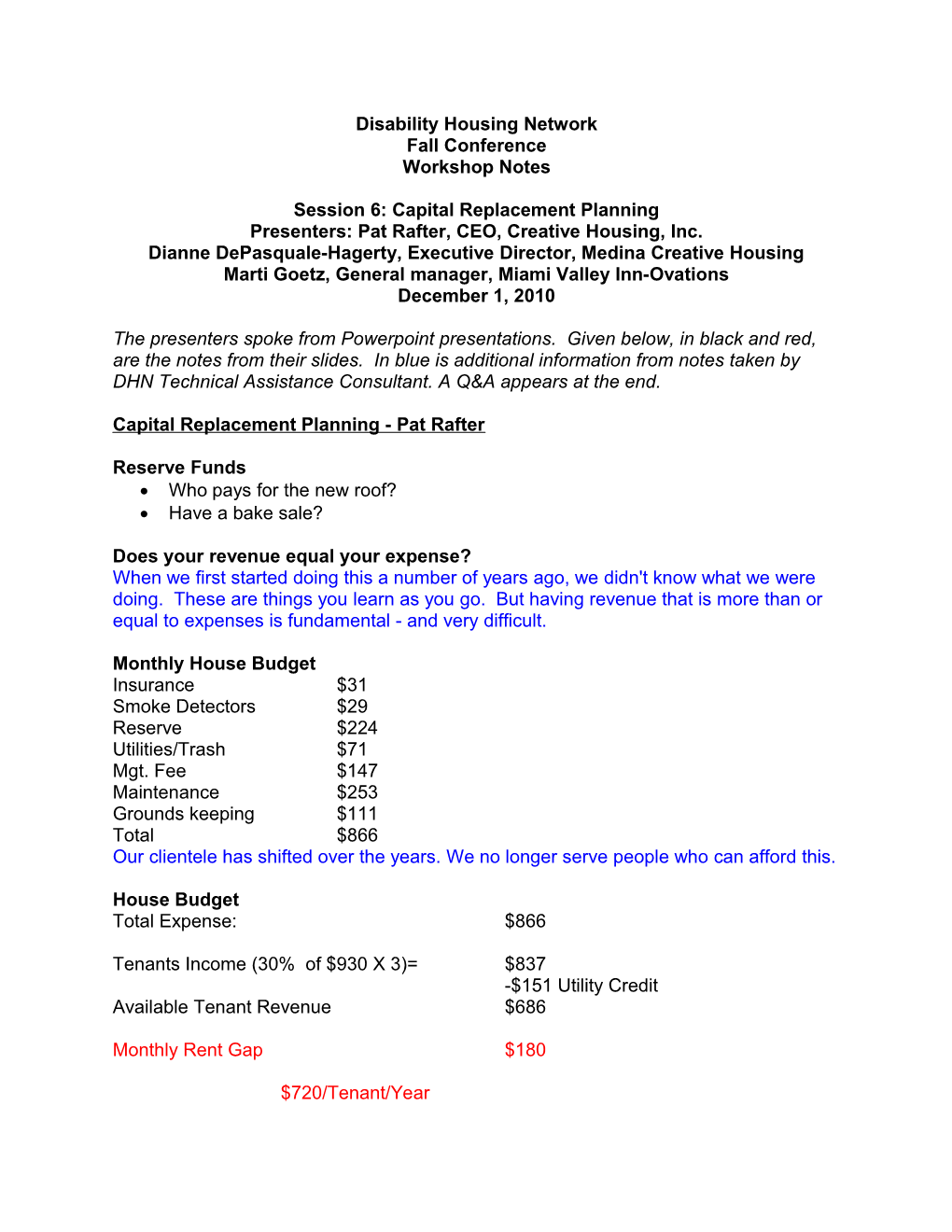

Monthly House Budget Insurance $31 Smoke Detectors $29 Reserve $224 Utilities/Trash $71 Mgt. Fee $147 Maintenance $253 Grounds keeping $111 Total $866 Our clientele has shifted over the years. We no longer serve people who can afford this.

House Budget Total Expense: $866

Tenants Income (30% of $930 X 3)= $837 -$151 Utility Credit Available Tenant Revenue $686

Monthly Rent Gap $180

$720/Tenant/Year Other Major Expenses? Property Taxes? Snow Removal? Mortgage? Etc.? Some of our housing corporations still pay taxes. These items also affect the monthly expenses for the house.

Repeat After Me We Can't Afford Debt We Can't Afford Debt We Can't Afford Debt We Can't Afford Debt We Can't Afford Debt We Can't Afford Debt We Can't Afford Debt The Technical Assistance Collaborative (TAC) has put out a report on this, and they showed that providing affordable housing for people with disabilities is next to impossible if there is debt on the properties. And, not only do we need no debt, we also need deep subsidies.

Revenue Variables Number of Tenants Level of Income % of Income for Rent Available Subsidies If we cannot do this much, we can't even start talking about capital reserve.

House Budget Revisited Total Expense: $866

Tenants Income (30% of $930 X 3)= $837 -$151 Utility Credit Available Tenant Revenue $686

Monthly Rent Gap $180

$720/Tenant/Year The rent gap can keep getting bigger. This is the problem that must be solved first. Monthly Reserve Formula ITEM REPLACEMENT AVERAGE PER YEAR COST LIFE SET ASIDE

Furnace $2,700 20 $135 Air Conditioning $2,300 20 $115 Driveways $5,000 20 $250 Appliances $2,400 10 $240 Cabinets $2,000 15 $133 Bathtubs/Surrounds $2,200 15 $147 Carpet $2,400 7 $343 Laminate $5,600 20 $280 Ceramic $1,200 20 $60 Roofs $7,600 35 $217 Windows $3,000 15 $200 Ramps $8,500 15 $567

Annual Set Aside $2,687

Monthly Set Aside $224 These are conservative figures. The best we can do is to continuously work on educating the county board concerning the actual costs we face.

Capital Replacement Reserves - Two Different Approaches: Dianne DePasquale- Hagerty

Medina Creative Housing Functions in Two Worlds HUD and CCAP have different rules

HUD 811 Supportive Living for Individuals with Disabilities HUD Formula for Replacement Reserves: • Agreed subsidy HUD budget includes operation & capital replacement • Allows diverting funds from monthly funding stream of rental revenues to fund long term repairs • Owner funds capital reserves for excess amenities This is an asset management technique.

Planning Vs. Crisis Management • Important to maintain financial viability of organization. • Provide continuous upkeep of property • Safeguard investment • Maintain health and safety On the following page is a chart which others should feel free to use as a template. It can be modified to fit your organization. It helps us know when certain items will need to be replaced, so we can plan accordingly.

CCAP Funded Housing • Minimal County Board support via Capital Housing Contract. We do not get rental subsidies or any cash flow for capital reserve purposes from our county board. • Insufficient funds/revenues to set aside dollars to fund capital replacement needs. We can do preventive maintenance according to our schedule, but we have very little available for major events.

Approach: • Wait until it breaks vs. preventative upkeep and replacement when there is access to state dollars • State has been flexible and looked at replacement requests on a case-by-case basis, not sure if this will continue We rely on grantwriting and fundraising for repairing or replacing capital items. State funds are limited. We all need to build up capital reserves and to come up with a plan.

Recommendations: • Analysis of current housing stock and capital replacement needs • Educate local Board on need for subsidy • Establish an agreed budget with local Board • Open and maintain capital reserve escrow account Everyone should do an analysis of current housing stock. Identify needs, dialogue with the county board for a subsidy to fund long-term capital needs. We should do a budget for the CCAP similar to the HUD budget.

Property Maintenance Schedule - Marti Goetz Marti presented the Miami Valley In-Ovations procedure/process for capital planning which involves creative use of a spreadsheet. Below are the component parts of the spreadsheet, making use of the colors that help them see at a glance where they are from year to year. Attached in pdf format is a blank copy of the chart which others may feel free to use as a template.

Marti indicated MVIO does its planning in conjunction with the County Board, which provides a maintenance subsidy as part of its contract. The planning cycle is three years. The county board pitches in from their capital fund. The chart below also serves as a reference tool for the maintenance staff.

MVIO Home Maintenance Schedule

11/15/2011 D C R I O W E S F S W G S H O W S D W F O N S U H I O D Y A A N E P A T R T R E A D R W A F S O R V S A D E O I P O I Y T T I R T N T D E H A A T T O N O T E V E N R E - A E N G S G E I E E I R O W E R R R E C M C H R R E R E

N R

S E E

R E R

Property Address A R M M A A M M M D J N D O O a u u a a e a o a a e c c n r y c r g g r y c v t t ------0 0 0 0 0 2 0 0 2 0 0 0 0 1 1 8 2 0 7 0 0 7 0 1 1 6 Estim ated Cost

COST TO REPLACE IN THE NEXT 3 YEARS COST TO REPLACE IN THE NEXT 4-7 YEARS COST TO REPLACE IN THE NEXT 7-10YEARS COST TO REPLACE IN THE NEXT 10-15 YEARS

AMITY RD. 13212, BROOKVILLE, OHIO Jul-0945309 Jan-11 Jul -09 Jul-09 Jul-09 Jul-09 Oct-09 Oct-09 2005 June-2010 1995+ 2000+ Jun/09

ASHVIEW CT. 5072, HUBER HEIGHTS,Jan 2011 OH 4542410+ 1996 1996 Jan 2009 2008 Jan 2008 2001 1996 10+ N/A 10+ 1998

BENCHWOOD RD. 3088, DAYTON,2003 OHIO 454142003 10 10 Dec 2008 Dec 2008 4-10 N/A Sept 2008 Sept 2008 N/A N/A Nov/09

BENCHWOOD RD.3086, DAYTON,July OHIO 2009 45414 2003 10+ 10+ 0-3 0-3 4-10 N/A 0-3 0-3 N/A N/A 11/09

BRITTON AVE. 699, DAYTON, OHIO 45429Aug-10 Aug 2008 10+ 10+ Jul 2002 Jul 2002 10+ N/A Jun 2007 10+ N/A 8-15 0-7

BURCHDALE ST. 4233, KETTERING,Aug-10 OHIO 45429Mar 2007 4-10 4-10 May 2010 Aug 2010 4-10 N/A 10+ 10+ N/A 8-15 7

BURMAN AVE. 610, TROTWOOD,N/A OHIO 45426 Mar 2011 Mar 2007 Mar 2007 4-10 4-10 10+ N/A Oct 2002 Sept 2006 N/A N/A 6-10

BURMAN AVE. 612, TROTWOOD,N/A OHIO 45426 Sep 2009 Mar 10 Mar 10 Feb 2002 Feb 2002 10+ N/A Sept 2008 Sept 2006 N/A N/A 6-10

CEDAR BLUFF CR. 4179, DAYTONJan OH 2010 45415 10+ 7-10 7-10 Nov-11 Apr 2008 n/a Jul 2004 Jul 2004 n/a 8-15 Nov 2003

CEDARCLIFF CR. 3000, DAYTON,Oct OHIO 2010 45414 10+ 10+ 10+ 0-3 4-10 10 N/A 4-10 10 N/A N/A Mar 2011

CEDARCLIFF CR. 3002, DAYTON,Oct OHIO 2010 45414 June 2009 Mar 2011 Mar 2011 Jan 2007 Jan 2007 10+ N/A 4-10 10 N/A N/A Nov 2009

CLIFFWOOD PLACE 6911, HUBER0-3 HEIGHTS 0-3 0-3 0-3 Oct 2010 Oct 2010 0-3 4-10 4-10 n/a 0-7

CONCEPT CT. 297 May 2011 0-3 0-3 0-3 Dec 2010 Dec 2010 Apr 2010 x2 n/a 4-10 4-10 n/a 8-15 4-10 SCHEDULE TO REPLACE IN 0-3 YEARS 27 22 32 32 6 8 29 SCHEDULE TO REPLACE IN 4-6 YEARS 17 28 23 22 22 21 12 SCHEDULE TO REPALCE IN 7-10 YEARS 27 23 19 19 39 36 30

COST TO REPLACE IN THE NEXT 3 YEARS Nov-25 Mar-45 Apr-26 Apr-26 Dec-04 Nov-09 Aug-47 Jul-11 Oct-95 Jun-72

COST TO REPLACE IN THE NEXT 4-7 YEARS Apr-16 Jun-57 Nov-18 Jan-18 Jan-18 Nov-25 Sep-19 Jan-00 Apr-64 Dec-14

COST TO REPLACE IN THE NEXT 7-10YEARS Nov-25 Mar-47 Aug-15 Aug-15 Jan-32 May-44 Dec-36 Jul-11 Sep-32 Dec-92

3 Year Budget - $1,359,150

4-7 Year Budget - $1,873,200 7-10 Year Budget - $1,701,150