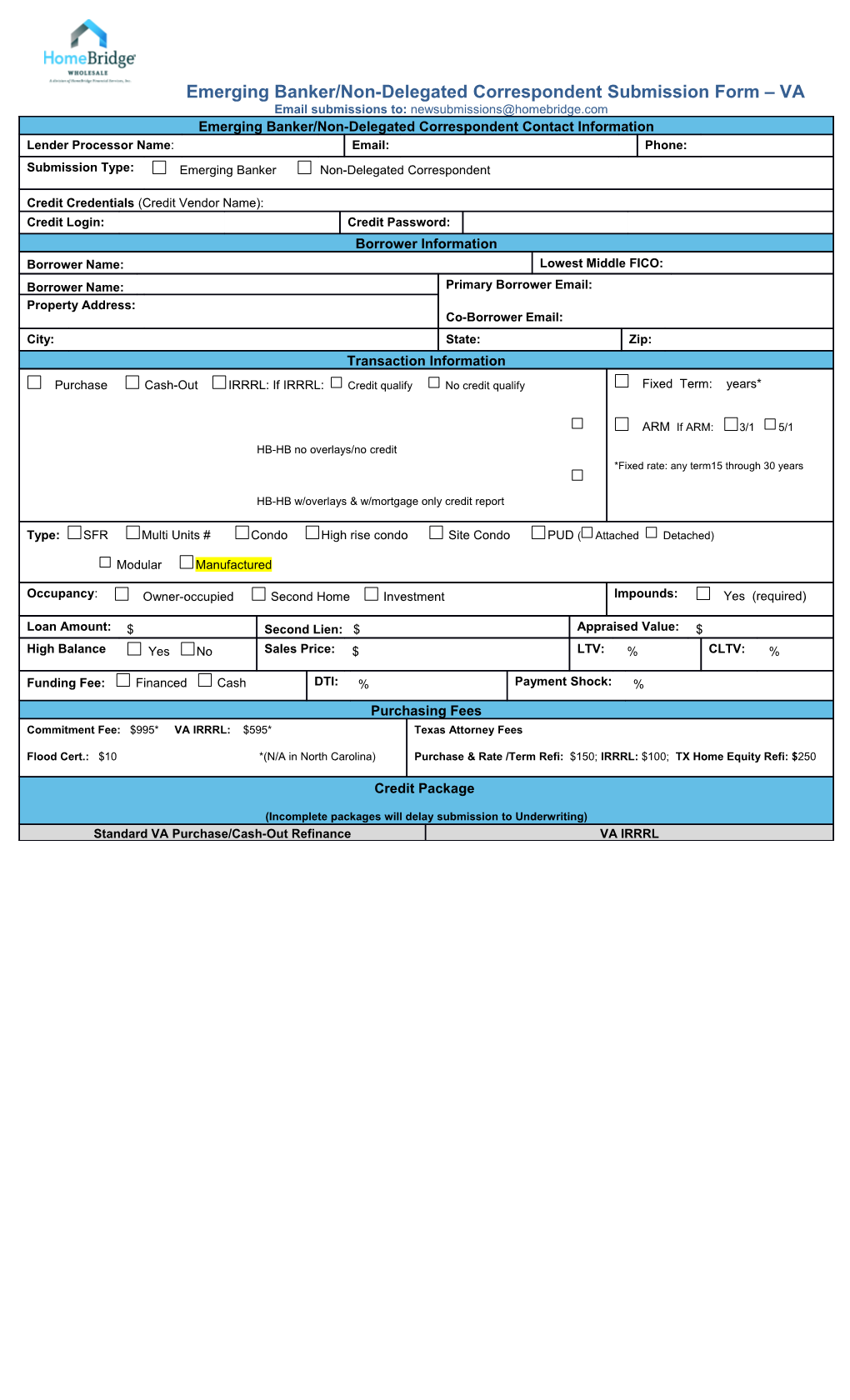

Emerging Banker/Non-Delegated Correspondent Submission Form – VA Email submissions to: [email protected] Emerging Banker/Non-Delegated Correspondent Contact Information Lender Processor Name: Email: Phone: Submission Type: Emerging Banker Non-Delegated Correspondent

Credit Credentials (Credit Vendor Name): Credit Login: Credit Password: Borrower Information Borrower Name: Lowest Middle FICO: Borrower Name: Primary Borrower Email: Property Address: Co-Borrower Email: City: State: Zip: Transaction Information

Purchase Cash-Out IRRRL: If IRRRL: Credit qualify No credit qualify Fixed Term: years*

ARM If ARM: 3/1 5/1 HB-HB no overlays/no credit *Fixed rate: any term15 through 30 years

HB-HB w/overlays & w/mortgage only credit report

Type: SFR Multi Units # Condo High rise condo Site Condo PUD ( Attached Detached)

Modular Manufactured

Occupancy: Owner-occupied Second Home Investment Impounds: Yes (required)

Loan Amount: $ Second Lien: $ Appraised Value: $ High Balance Yes No Sales Price: $ LTV: % CLTV: %

Funding Fee: Financed Cash DTI: % Payment Shock: % Purchasing Fees Commitment Fee: $995* VA IRRRL: $595* Texas Attorney Fees

Flood Cert.: $10 *(N/A in North Carolina) Purchase & Rate /Term Refi: $150; IRRRL: $100; TX Home Equity Refi: $250

Credit Package

(Incomplete packages will delay submission to Underwriting) Standard VA Purchase/Cash-Out Refinance VA IRRRL Emerging Banker/Non-Delegated Correspondent Submission Form – VA Email submissions to: [email protected] Required at Submission: Required at Submission: HomeBridge Emerging Banker/NDC Submission Form HomeBridge Emerging Banker/NDC Submission Form

1003 w/ NMLS ID signed by Emerging Banker/NDC 1003 w/ NMLS ID signed by Emerging Banker/NDC

- Credit Qualifying requires complete 1003 HUD/VA Addendum to Uniform Residential Loan Application (26-1802a) - NCQ Assets, Employment and Liabilities not required to be completed. Income should never be included. Credit report (must be < 90 days old)

HUD/VA Addendum to Uniform Residential Loan Application (26-1802a) Signed Borrower Credit Authorization required when 1003 provided is not signed by veteran and broker/NDC. Pages 1 and 2 only. signed by borrower(s) Credit Report (must be < 90 days old) Paystubs (30 days earnings and YTD) -Credit Qual: Full tri-merged credit report; NCQ: Mortgage only for subject. W-2s for 2 years Signed Borrower Credit Authorization required only if 1003 provided is not

Tax Returns/ all Schedules - 2 years signed by borrowers

Paystubs with 30 days & YTD earnings (credit qual. only) Purchase Contract w/ Addendums (if applicable)

W-2s for 2 years (credit qual. only) VA Amendatory Clause (if purchase)

Tax Returns/ all Schedules – 2 years (credit qual. only) Bank Statements (if purchase)

Service Provider List AUS Findings

Loan Estimate 3.2 file required if submitted outside of HomeBridge portal

Loan Estimate/Fee Worksheet VA Certification of Eligibility (COE)

Notice of Intent to Proceed VA Indebtedness Questionnaire (HomeBridge form avail. on website)

Change of Circumstance Form(s) (if applicable) Service Provider List

Recommended at Submission not Required (to avoid closing delays): Loan Estimate (signed if the LE includes a signature line; if not, signature Current Note not required)

Notice of Intent to Proceed Copy of recorded Manufactured Rider to deed/mortgage for the loan

being refinanced (manufactured home only) Change of Circumstance Form(s) (if applicable) CoreLogic GeoAVM™ or 2055 (2055 rqrd if AVM deviation > 18%)

Recommended at Submission Not Required (to avoid closing delays): Affiliated Service Provider Fee Certification (if applicable) State Specific Disclosures

Signed Notice of Homeownership Counseling Disclosure Safe Harbor Certification

Safe Harbor Certification VA Case Number

Proof of appraisal delivery to borrower (if appraisal available at Proof of appraisal delivery to borrower (if appraisal available at submission) submission) Business Purpose Use of Investment Property Borrower Certification (if Signed Homeownership Counseling Disclosure applicable)

Affiliated Service Provider Fee Certification (if applicable) State Specific Disclosures

Completed & signed 4506-T (if business income used for qualifying a VA IRRRL Lin Number

completed/signed 4506-T for business returns also required) One month bank statement if funds needed to close (credit qual. only) Recommended at Submission VA Forms Not Required (avail. on HB Emerging Banker/Non-Delegated Correspondent Submission Form – VA Email submissions to: [email protected] website) Completed & signed 4506-T (credit qual only) (if business income used

VA Debt Questionnaire (26-0551) for qualifying a completed/signed 4506-T for business returns also required)

Recommended at Submission VA Forms Not Required (avail. on HB VA Loan Summary Sheet (26-0286) website)

VA Debt Questionnaire (26-0551) (credit qual. only) Counseling Checklist for Military Homebuyers (26-0592) Active duty only

Counseling Checklist for Military Homebuyers (26-0592) Active duty only Federal Collection Policy Notice (26-0503)

Federal Collection Policy Notice (26-0503) Recommended at Submission Non-VA Forms (samples on website)

Nearest Living Relative Statement Recommended at Submission Non-VA Forms (samples on website)

Nearest Living Relative Statement Child Care Certification/Statement

Child Care Certification/Statement (credit qual. only) VA Lender Certification

VA Lender Certification

Refer to the VA IRRRL Quick Reference Guide for additional information regarding forms

.

NOTE: Manufactured housing recommended not required: Refer to the Manufactured Housing: Required Documentation topic in the VA guidelines for a complete list of documentation 2/21/17